Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

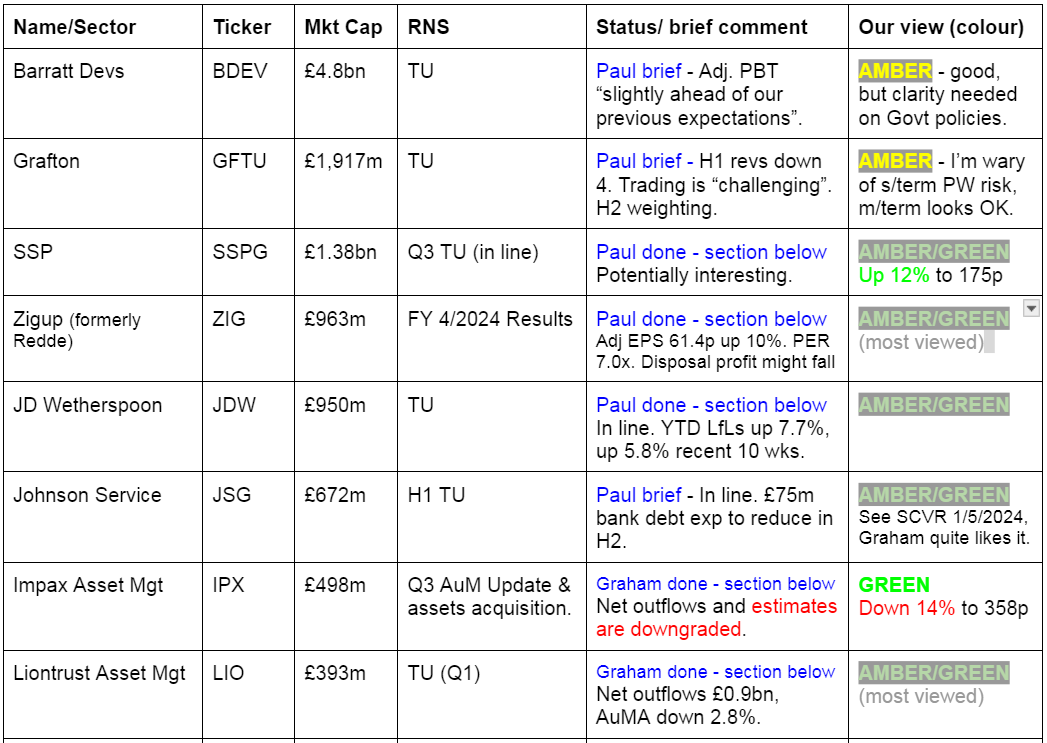

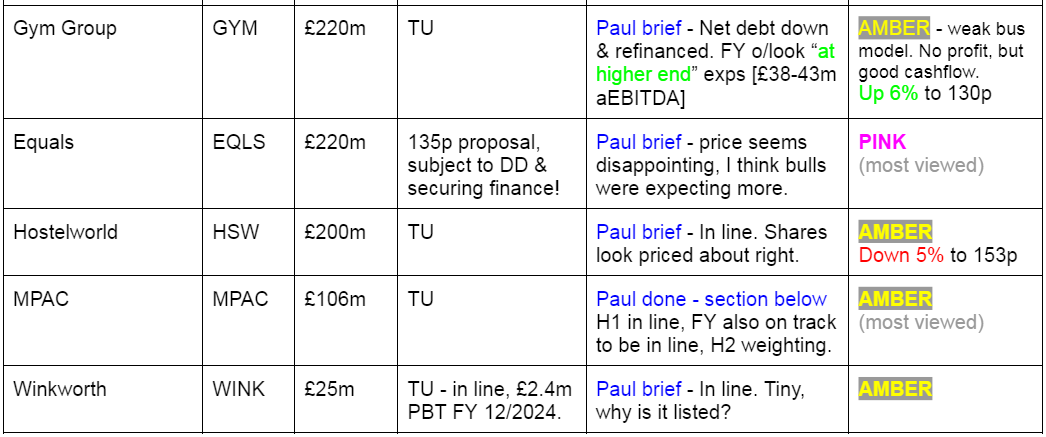

Companies Reporting

Summaries

Liontrust Asset Management (LON:LIO) - up 2% to 617.7p (£401m) - Trading Statement - Graham - AMBER/GREEN

This Q1 AuMA update shows net outflows of £0.9 billion, an improvement on Q4 and Q1 last year. The CEO sees positivity in the post-election political outlook and in macro conditions, which is reasonable, and LIO shares sit on a lowly valuation. Due to my previously expressed concerns, I remain AMBER/GREEN.

SSP (LON:SSPG) - up 11% to 173p (£1.38bn) - Q3 Trading Update - Paul - AMBER/GREEN

This came up on the top risers list, so I diverted my attention onto it. Attractive numbers, and a lowish PER, but the stretched balance sheet is unpleasant. Overall though, I could see this possibly beating (lowered) expectations as consumers recover. Worth a look.

ZIGUP (LON:ZIG) - up 1% to 430p (£973m) - FY 4/2024 Results - Paul - AMBER/GREEN

Strong results from this attractive value mid-cap. Generous divis & buybacks from its prodigious cashflows are the main attraction. Substantial balance sheet supports 84% of the market cap. However, with a third of profits coming from (potentially temporary?) profit on disposal, should we strip out that element, which would bring its valuation into reasonable rather than cheap? I like it still, but have moderated a notch from green to AMBER/GREEN, to allow for the nice recent bull run.

Impax Asset Management (LON:IPX) - down 11% to 370p (£491m) - Q3 AUM Update & Acquisition - Graham - GREEN

It’s a large reduction in AuM for Q3, the combination of significant outflows and negative market movements. Impax is expanding into fixed income which to me is a logical progression, and announces another deal today. I remain positive on value despite negative AUM and share price momentum.

Paul's Section:

SSP (LON:SSPG)

Up 11% to 173p (£1.38bn) - Q3 Trading Update - Paul - AMBER/GREEN

SSP Group plc, a leading operator of restaurants, bars, cafes and other food and beverage outlets in travel locations across 37 countries, issues a Trading Update covering the third quarter ("Q3") of its 2024 financial year (1 April to 30 June 2024) and the nine-month period ended 30 June 2024.

It says Q3 has seen continued good trading, due to increased demand for leisure travel.

Revenue growth in all regions globally in Q3 of +16% - this is broken down as +6% LfL, +5% “net gains” (I assume this means new site openings), and +5% “Acquisitions” (of companies as opposed to individual sites, I assume).

But it’s only in line with expectations, so no change to guidance.

UK - regulatory threat recedes, with the ORR deciding not to refer SSPG to the CMA (enough abbreviations there?!)

Guidance - these look attractive numbers for a £1.38bn market cap company - maybe these shares are cheap?

“Our planning assumptions are for revenue to be within the range of £3.4-£3.5bn, for underlying EBITDA to be within the range of £345-£375m and underlying operating profit to be within the range of £210-£235m, all stated on a pre-IFRS 16 basis and at constant currency based on average rates for FY23.”

Paul’s opinion - a nice bounce in share price today, hence me flagging it here. It looks to be a seasonal business, with a big H2 (April-Sept) weighting to profits. H1 adj operating profit was only £38m, but it says above £210-235m for FY 9/2024.

Balance sheet looks stretched to me, with negative NTAV of £(390)m, and too much interest-bearing debt, and heavy trade creditors on top.

Hence although the PER seems cheap, you have to adjust for the substantial debt, so maybe not quite as cheap as I initially thought.

Still, when many other hospitality companies are struggling to make any money at all, this one stands out as a success. Although the arguably captive customers eg at railway stations and high prices, do make me uneasy.

Divis have resumed, but only at about a third of pre-pandemic levels.

Share price has (surprisingly) not recovered from the pandemic plunge, but note share count has risen from c.550m pre-pandemic, to c.798m now. Also I see broker consensus forecasts have been in a gentle downward trend this year -

Ten-year chart below - irreparable damage caused by covid? Or an opportunity for it to recover? I’m not sure, it would need more work, but I’m leaning slightly towards a positive view, since it could see a beat against expectations possibly, as consumer real incomes have now returned to growth ? (and based on a good uplift in revenues announced today, but keeping forecasts unchanged - sometimes a precursor to an ahead of expectations update).

ZIGUP (LON:ZIG)

Up 1% to 430p (£973m) - FY 4/2024 Results - Paul - AMBER/GREEN

A daft new name, and a daft self-description too -

“ZIGUP plc (LSE:ZIG), the leading integrated mobility solutions platform providing services across the vehicle lifecycle, is pleased to announce its results for the full year ended 30 April 2024.”

This used to be called Redde Northgate (what was wrong with that name?!) after the two similar sized companies merged. It buys, then rents out vehicles. The old Northgate business was UK/Spain white van leasing. The Redde business was mainly providing courtesy cars on behalf of insurance companies, to no-fault car accident victims.

ZIG has a track record of being highly cash generative, which has enabled it to pay generous divis, and in recent years buybacks too (share count now c.226m, down from c.251m in 2022). So if you add up the divis, it’s paid out 93.9p in the last 5 years (from Aug 2019) to now. The share price has gone up from 355p in July 2019, to 430p now, so a 21% rise. Add in the 93.9p divis, and the total 5-year shareholder return has been +48% - not too shabby. Along the way you could have bought very much more cheaply during the pandemic, and it was an inspired purchase at the pandemic lows -

We are nearly always GREEN on this share, most recently -

26/9/2023 - 340p GREEN - “amazingly cheap” (that sounds like me!)

15/5/2024 - 420p GREEN - Graham - Good TU, upper end of forecast range.

Moving on to today’s FY 4/2024 results statement -

“Strong underlying results with positive pipeline, improving vehicle supply and growing footprint “

Highlights table shows some impressive numbers (I think the adjustments do seem reasonable) -

PER at 430p/share is a modest 7.0x

With low PER stocks, the key points to check are -

Is the balance sheet overloaded with debt? No, it’s absolutely fine. NTAV is very strong at £816m which is 84% of the market cap. The assets include a massive fleet of vehicles, which is worth far more than the borrowings that part-fund it.

Are profits sustainable? This is my key concern. Used vehicle values were heavily inflated during the pandemic, due to constrained supply, and car dealers have said values fell sharply in autumn 2023. Despite this, ZIG mentions another year of big profits on disposals -

“Disposal profits of £61.9m (2023: £51.5m); higher total sales volumes of 36,800 (2023: 18,200): LCV residual values moderating in line with our expectations, 7,000 cars and other non-fleet vehicles disposed at minimal PPUs”

(LCV is light commercial vehicles. PPU is profit per unit - note there’s a large table of definitions & abbreviations provided, helpfully).

So the key thing to research here is what’s likely to happen to secondhand vehicle values in future? Does ZIG benefit on an ongoing basis from profit on disposals (ie is the depreciation policy on vehicles conservative?), and does it make profits because it buys cheaply, in bulk? Or are these bumper disposal profits a one-off from the pandemic restricting new vehicle supply (hence temporarily boosting secondhand prices)? Now that supply is said to be normalising, then I presume ZIG’s profit on disposals would gradually fall, but no idea how much.

If we allow for the fact that £61.9m profit on disposals boosted overall adj PBT to £180.7m, that means disposals contributed 34% of total profits. Eliminate that, and EPS would drop to c.40p, pushing up the PER from 7.0x to 10.8x, which isn’t cheap any more - arguably that might be about the right price - as this sector doesn’t tend to command high valuations.

Cheap debt - whoever set up these 1.3% loan notes deserves a substantial bonus! An inspired move -

Remember debt is not a problem, and is only 41% of the value of the fleet - which are readily disposable assets.

Outlook - is too vague -

We have a healthy prospect pipeline across our businesses and demand for our services remains robust. LCV residual values have performed well as we had anticipated over the last few years and we expect they will moderate over the short term but remain elevated. We are confident that our proposition will continue to offer sustainable returns and that we will benefit from our differentiated position in the market, enabling the business to drive positive growth in underlying revenues, profitability and cashflow.

I can’t find anything about performance in the new financial year. There should be a comment about current trading vs market expectations, but that seems to be missing. All companies need to be strict about reporting this in every update, so it’s worrying what they duck out of saying this. Let me know if I’ve missed it, as I haven’t got time to read all the narrative, but have searched for “expectations” and “current” (trading), to no avail.

Dividends - and buybacks continue to be a key attraction of this share. The StockReport shows the yield at a very good 5.9%. Plus buybacks slowly enhance the share of the company you own, and drive up EPS and DPS.

Paul’s opinion - shares have had a good run up, and if I adjust out the disposal profits, now look possibly priced about right?

Main risks are probably used car/van prices lurching down again, as often (generally) when supply of anything has been restricted it can later over-compensate to the upside, creating a glut.

Also I recall years ago Redde shares halved in share price when a major customer was lost. So checking single client risk is important, although that’s a reduced risk since the Northgate merger, as it was more a Redde issue.

What else on the downside risks? A change in approach by insurance companies and regulators is something to consider.

Overall, I continue to like this share. Although if you look at the long-term share price, it hasn’t been particularly good, with the main attraction being an attractive (and growing) dividend yield.

Given all the above, I think it’s best to moderate a little from green to AMBER/GREEN - still positive, just not such an amazing bargain as it was, when you adjust out the (possibly unsustainable) profit on disposals.

Quickish Comments

MPAC (LON:MPAC)

Down 2% to 508p (£104m) - Trading Update [in line] - Paul - AMBER

Mpac Group plc, a global leader in high-speed packaging and automation solutions, issues a trading update ahead of the release of its unaudited results for the six months ended 30 June 2024.

There’s been a very strong bull run in MPAC shares in the last year, which largely escaped my notice, apart from here on 12/1/2024 with a very brief SCVR comment on an in line TU, flagging the positive order book & outlook comments, concluding: looks quite good. As it turns out my one line comment at 320p was not even halfway on a move up from 200p to >500p, so I should have given it more attention!

H1 update today is reassuring rather than price-moving -

“Trading in the first half was in line with the Board's expectations, with profits for the period substantially above the prior year and on track to meet market expectations for the full year.”

Other points - H2 weighting expected (prev flagged in May 2024 TU). Order intake same as H1 LY at £60m. Closing order book is £71m at June 2024. Good visibility over H2 revenues. H1 net debt £4.9m. Confident-sounding outlook comments about pipeline.

Paul’s view - the numbers here look good. Even after a big rise in share price, the fwd PER is only 12.4x. No divis since 2016 though. My only reservation with this company is that it has disappointed in the past - see the 5 year chart - due to lumpiness of orders.

The Dec 2023 balance sheet has £64m NAV, but half NAV is a pension surplus, and there’s £24m goodwill. Take those off, and there’s not much left. The pension scheme needs careful checking, as I recall it was previously a problem, which might have been resolved now, I’m not sure.

MPAC looks a good candidate for more detailed research into the products, competition, management, etc.

The bull run to date looks justified by the improved numbers. I’m happy with an AMBER view because the numbers have improved, which has already been reflected in a strong share price rise.

J D Wetherspoon (LON:JDW)

Down 1% to 761p (£941m) - Trading Update [in line] - Paul - AMBER/GREEN

I cooled a bit on the valuation of this cheap pubs chain, after an over-exuberant rally from 600p to 850p Oct 2023 to Jan 2024 took the PER up to about 20. However, it’s since eased down to 761p, whilst broker forecasts have been gently rising - taking the fwd PER down a more attractive 15.2x. At that level, I think it’s worth considering this unique value pubs group.

Today’s update contains some more detail, but the key point is this -

"The company continues to expect profits in the current financial year to be in line with market expectations."

Debt doesn’t worry me, as it is backed by plenty of freehold properties. A new 4-year facility “on attractive terms” was signed on 6/6/2024, further reassures.

Paul’s view - there could be more upside on forecasts I think, from a consumer recovery over the medium term. So this share seems moderately attractive to me again, and could be a reasonable performer over the next few years, so worth considering I’d say.

Graham’s Section:

Liontrust Asset Management (LON:LIO)

Up 2% to 617.7p (£401m) - Trading Statement - Graham - AMBER/GREEN

We have a Q1 update from this fund manager. I recently covered its full-year results (here) switching my stance to AMBER/GREEN. I am GREEN on nearly all fund managers, but have more concerns with LIO than I do with others in the sector.

Today’s update is as follows:

Q1 net outflows £0.9 billion (Q1 last year: net outflows £1.6 billion. Q4: net outflows £1.2 billion).

AuMA (assets under management and administration) £27 billion, down £0.8 billion or 2.8%.

CEO comment: talks positively about the political and macroeconomic outlook.

Graham’s view: it’s a smaller outflow than Q1 last year, but doesn’t do anything to change my view on this stock. I agree that the outlook for the sector should be positive, especially in the context of beaten-down fund manager valuations.

The LIO share price has taken a dive recently, after it seemed to gain positive momentum:

My view is unchanged: I see this as very cheap, but due to my concerns as expressed last time I prefer not to have an outright positive stance. With positive flows I could think about going GREEN again.

Impax Asset Management (LON:IPX)

Down 11% to 370p (£491m) - Q3 AUM Update & Acquisition - Graham - GREEN

Sentiment around this fund manager has also been poor recently:

I took a look at it in May, when I thought its half-year report was robust (link).

Today we have both the Q3 AuM update and acquisition news.

AuM: net outflows £1.9 billion in Q3. For context, the net outflow across H1 was £2.7 billion. So things aren’t getting any better yet.

Market movements were also negative, so that AuM fell by 6.8% in just three months.

CEO comment is upbeat on prospects:

Aggregate net flows for the quarter to 30 June remained negative and dominated by our wholesale channel, despite a notable easing of outflows from key parts of our European distribution structure. Following a busy period for our direct sales team, our pipeline of potential new business is healthy.

Acquisition news

It’s another fixed income acquisition. As of the end of Q3, Impax only had £1.2 billion of fixed income AUM, or about 3% of total AuM. The vast majority of Impax funds are equity funds, and their strategy is to diversify beyond this asset class.

Today’s announced deal, which hasn’t closed yet, will add another c. $2.0bn (£1.6bn) of fixed income AuM.

The funds being acquired invest in “short-duration high yield and broad high yield ("HY") strategies”. They are “responsible” strategies, thereby aligning with the Impax ethos.

The seller is US-based SKY Harbor Capital Management.

This follows another recently announced deal which will acquire $0.5bn of fixed income AuM.

CEO comment on today’s acquisition announcement:

"This transaction marks an important milestone in our strategy to expand Impax's fixed income capabilities globally. Both founder-led specialist asset managers, SKY Harbor and Impax share a strong business culture and a complementary investment approach. The addition of SKY Harbor's deep expertise and track record in high yield investing and its team's experience in client service fit well with those brought by the Absalon team and will be a significant asset as we broaden our fixed income offering…

Graham’s view

When it comes to the acquisition, I think it makes perfect sense for Impax to expand its fixed income offering: fixed income is the much bigger asset class, and it often requires greater expertise to access. Bringing the Impax approach to fixed income is, for me, a logical next step.

No price is given for the deal, but there is little doubt that Impax can afford it. Checking the estimates from Paul Bryant at Equity Development this morning, I see that his new net cash estimate for FY Sep 2025 is £90.4m (previously: £111m).

Speaking of those estimates, the new net income forecast for the current year (FY Sep 2024) is £38.2m (previously £39.4m). At the latest share price, and given today’s downgrades, I estimate that the PER is about 12.5x.

With AuM of £36.9 billion, plus another c. £3.1 billion coming from the acquisitions, Impax has about £40 billion in pro forma AuM. So for every £1 invested in the stock, you get about £81 of AuM. This is a deeply distressed valuation by historic standards (i.e. compared to before the current bearish era in UK equity flows).

This is a fund manager with a strong position in its niche. It has, I believe, long-term growth prospects that are above-average in the sector. So I’m happy to remain positive at this valuation, although momentum is currently against me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.