Good morning from Paul & Graham!

We've run out of time today, so that has to be it.

"Profitable growth" survey

A bugbear of mine, we're seeing this arguably meaningless phrase appearing in many results & trading updates. I wanted to survey your opinions on this, so we can give some feedback to the PRs and brokers I talk to. Unfortunately, my survey last week went wrong, as I didn't realise Survey Monkey start charging extortionate fees once 25 people have replied, so I had to bin that.

This weekend I set up a new survey through google forms. So I invite you to give your views on the increasing use of the vague phrase "profitable growth". Even if you replied to the old survey, please do reply again, as this is a new survey. It doesn't capture any of your personal information, or have any commercial angle on it at all. I'm just interested to hear your views. Thanks in advance.

Click here to reply to my survey

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

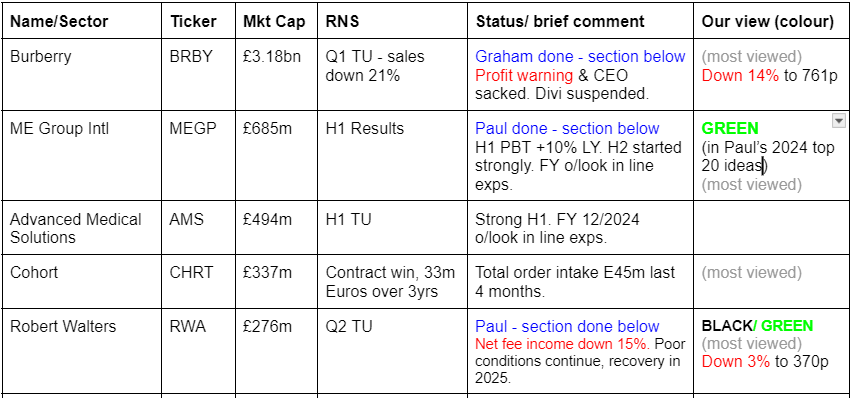

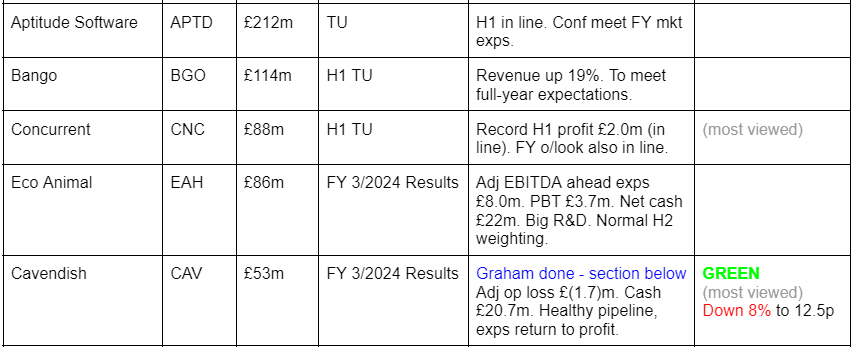

Companies Reporting

Other mid-morning movers (with news)

Silver Bullet Data Services (LON:SBDS) - up 27% to 95p (£17m) - Contract Wins & Working Capital Facility- Paul - AMBER/RED

“Silverbullet (AIM: SBDS), a leading provider of AI-driven digital transformation services and products, is pleased to announce significant new contract wins and a new working capital facility.”

20 contract wins, but totalling only £1.2m total. Says it now has c.70% visibility for (not stated) FY 12/2024 revenue target. Mentions “worldwide mandate for its data strategy” with global confectionery company - presumably Mars, which it has previously mentioned a contract renewal for FY 12/2024 of $2.3m, on 27 Feb 2024 - I’m assuming the £1.2m new contract wins are additional to that Mars contract?

New borrowing facility of $1m is a receivables discounting facility. Again, very small, and reminds us how tight cash must be.

Outlook - confident it can meet FY 12/2024 expectations. Reckons it can achieve positive EBITDA & cashflow in H2.

Paul’s view - I’m surprised punters have chased this share up 27% on relatively minor news today.

I should remind readers that SBDS has a weak balance sheet, and 2023 results contained a material uncertainty going concern. So you’re going to get diluted sooner or later, on unknown terms, is my view. That’s why I have to flag the risk with a continuing AMBER/RED - but NB some riskier shares go on to do very well, so don’t let this necessarily put you off - it’s just a risk flag, so you can weigh up the options armed with the full facts.

It’s an interesting-sounding company, demonstrating good revenue growth. Key question - what does it have that’s special, compared with any number of similar consultancies talking about AI? The repeat business with Mars looks intriguing though. Very volatile share, is telling us the market doesn’t know how to value it.

I’ll move up to amber once it gets proper financing. The existing balance sheet is clearly stretched, and badly needs a proper equity injection. Losses in 2023 greatly reduced, and if it does achieve positive cashflow in H2 this year, then investors could get lucky here, who knows?!

I recall there was a fair bit of reader interest in this share previously, so what do you think?

Destiny Pharma (LON:DEST) - down 74% to 2.25p (£2m) - Proposed De-listing - Paul - GREY (delisting)

AIM is not the right place for zero revenues, serial loss-makers, so I’m pleased to see another one is departing.

This has been listed since 2017, and burned through a lot of cash. We’ve never reported on it here at the SCVR, because there’s nothing we can say on zero revenues speculative shares. They’re just punts, and they nearly all fail. I’m flagging it to try to keep track of delistings for my spreadsheet.

Summaries

Robert Walters (LON:RWA) - down 3% to 370p (08:48) £268m - Q2 Trading Update (profit warning) - Paul - BLACK (pw) - GREEN (on fundamentals)

RWA follows larger sector peers, PAGE and HAS, saying that current trading is depressed, with fee income down c.15%, and no sign of green shoots yet, now expected in 2025. Crunching the numbers, I still view RWA as fundamentally attractive, safe (strong balance sheet), generous divis, and a cyclical recovery to come in 2025 probably. It's GREEN for me.

Cavendish Financial (LON:CAV) - down 5% to 12.99p (£50m) - 2024 Full Year Results - Graham - GREEN

These results aren’t too exciting when you look at the numbers. Despite much higher revenues on a combined basis, and post-merger cost synergies delivered as planned, the company failed to avoid posting a loss for the year. It has paid out generous staff bonuses which I think can be justified in these special circumstances, but it must tighten up its FY 2025 payments if market conditions don’t improve.

ME International (LON:MEGP) - Up 1% to 183p (£692m) -H1 Results - Paul - GREEN

Pleasing H1 results, and a confident (in line) outlook. Everything looks good to me, including balance sheet and cashflow. The self-funded roll-out of more laundry machines continues at a record pace, together with next generation replacement photo booths. Despite rising c.46% in 2024 YTD, this top 20 share idea of mine still looks attractive value, so I'm sticking at GREEN. High StockRank too.

Burberry (LON:BRBY) - down 16% to 747p (£2.7 billion) - First Quarter trading update - Graham holds BRBY - BLACK (PW) - AMBER on fundamentals

Tough news for BRBY shareholders (myself included) as the company reports a very poor quarter with a 20% decline in revenues at constant exchange rates. The CEO leaves and is immediately replaced. Due to the inherent leverage of retailing, the company is now loss-making and the stock is a risky recovery play. Solvency seems ok for now but I can’t take a positive stance on this in the short or medium term.

Paul’s Section:

Robert Walters (LON:RWA)

Down 3% to 370p (08:48) £268m - Q2 Trading Update (profit warning) - Paul - BLACK (pw) - GREEN (on fundamentals)

Focused on being optimally positioned amidst muted client and candidate confidence

This is now the third international recruitment group which has told us that trading is difficult. We covered Pagegroup (LON:PAGE) profit warning here last week, and similar news from Hays (LON:HAS) here last week. Both said that conditions are tough in nearly all geographies, so this is not a UK-specific problem. Both have similar market caps at £1.4bn to £1.5bn, and in both cases there was little impact on their share prices, which had already seemingly anticipated slower trading, with the rally in May completely reversing in June/July.

Hence it shouldn’t have come as a surprise to anyone that smaller rival RWA is also today announcing slow trading. We’ve only so far seen a very modest 3% drop in RWA’s share price today, indicating the bad news was expected, and already factored into its valuation. I find it encouraging when share prices barely budge on a profit warning, as that’s telling me we could be at or near a bottom.

RWA reports today that Q2 (Apr, May, June 2024) Net Fee Income was down 15%. That’s exactly the same figure that PAGE gave us last week for Q2.

The trend seems to be worsening within Q2, with June down 18%. Definitely no green shoots in the staffing sector, yet.

RWA’s own staff headcount has fallen 15% Y-on-Y, so it’s scaling down staff overheads at the same rate as revenue falls.

Net cash of £49m (excl lease liabilities) at end June 2024 is healthy.

Balance sheet overall is very good, with NTAV of £130m, almost half the market cap. So you get proportionately more balance sheet support with RWA than with the larger staffing groups. Plus a lower PER, and a higher dividend yield, so I think RWA looks more attractive than PAGE and HAYS in terms of the valuation numbers.

UK - interesting to note that London is performing better (-6%) than elsewhere (-21%).

CEO comments below (in full, as they’re interesting) -

"Fee income for the first half of 2024 continued to reflect the rebasing in market conditions relative to the post-pandemic peak. This period of market adjustment is now longer in duration than previously expected, with macroeconomic turbulence and political uncertainty restraining client and candidate confidence in certain geographies.

Our near-term planning now assumes that any material improvement in confidence levels will be gradual, and likely not occur before 2025. In this environment, we remain focused on being positioned to deliver the best outcomes for our clients and candidates, whilst maintaining tight cost discipline. These actions do not fully offset the first-half fee income reduction, but they position us well going into the second half of the year.

Though current market conditions suggest a wider range of potential outcomes for the full-year than seen historically, I have high confidence in our experienced leadership team, which has successfully navigated many challenging market cycles. We are committed to our medium-term plan to further strengthen the business, details of which will be shared at our capital markets event in September."

Broker updates - I don’t have access to anything as yet. Given the tone of the above, I imagine brokers are likely to trim their estimates for FY 12/2024 and FY 12/2025, which is what has already happened with PAGE and HAYS. Not drastic cuts, but significant - eg broker consensus estimate for FY 12/2025 at PAGE has just dropped from 29.5p to 25.7p after last week’s profit warning. Hence I imagine something similar might happen with the existing consensus for 2025 at RWA, currently 30.1p. Let’s assume that also drops by 13%, then we get to c.26p for 2025.

Valuation - at 370p I make that a 2025 PER of 14.2x - not exactly a bargain, but the hope would be that 2025 forecasts are beaten once recovery begins.

The question is how much are earnings likely to recover in future? I’m starting to wonder if the bumper profits immediately after the pandemic in this sector might not necessarily be the normal level we’re likely to return to. As hinted at by RWA above, maybe that was a temporary boom? So perhaps we should be adjusting down our expectations of a cyclical recovery, which RWA says will only be gradual, and in 2025 (not this year)?

Paul’s opinion - I see better value at RWA than its larger rivals, and I particularly like its balance sheet strength with net cash, and only about 2x NTAV. It seems to me that dividend expectations might be too high, so I wouldn’t be surprised to see brokers trim not only profit, but also dividend forecasts. That said, RWA clearly has the financial strength (hefty net cash) to continue paying good divis.

Looking at the 5-year chart below, RWA shares are at a low, not much above the initial pandemic panic sell-off. Note also there’s been no dilution, in fact the share count has shrunk a bit over this 5-year period, from c.78m to c.72m, so buybacks, on top of generous divis which have totalled 98p in the last 5 years - during the chaos of the pandemic & energy crisis. That’s impressive.

Is today’s update actually a profit warning? It doesn’t specifically say that expectations have been lowered, but it dances around the issue talking about a “wider range of potential outcomes”, and it does say fee income is lower than expected. So I think this is effectively a profit warning (trading slower than expected) and I bet broker forecasts will be reduced. So that’s close enough to a profit warning to have a BLACK flag on my spreadsheet. Incidentally, this is not a negative view on any share. It’s just flagging that a profit warning has happened.

As I recently posted, the BLACK shares on my spreadsheet have in many cases subsequently recovered, and quite a lot have attracted takeover bids. So I challenge the idea that companies which warn on profits should be avoided. My data shows that, in the last year anyway, many profit warnings have actually been decent buying opportunities. But mainly for previously good quality companies, not the tiny market cap junk ones, which tend to keep warning on profits time & time again. So let’s keep an open mind.

I see RWA as a fundamentally good company, and hence for me this delay to recovery is disappointing, but expected. If there’s another lurch down in share price later this year, it would become too attractive to resist. Good fundamentals mean I’m ignoring this recent soft patch of trading, which is sector-wide, and remaining at GREEN for the inevitable trading recovery (seemingly now in 2025). That seems to be the market’s view too, with sector prices holding firm despite soft current trading.

ME International (LON:MEGP)

Up 1% to 183p (£692m) - H1 Results - Paul - GREEN

ME Group International plc (LSE: MEGP), the instant-service equipment group, announces its results for the six months ended 30 April 2024 (the "Period" or "H1 2024").

Good H1 figures, with profit rising faster than revenues, net cash similar to last year, H1 divi up 16% -

Growth is coming from both the core photo booths, but also the increasingly important laundry machines, typically sited in car parks and filling station forecourts. I think the market has woken up to the roll-out potential of this high margin laundry business. We got there first here at the SCVR, spotting the valuation anomaly of this GARP share, which I included in my top 20 share ideas for 2024, which is now up a decent 46% from the 126p starting price.

Seasonality - note there is a usual H2 weighting, so the numbers above are consistent with full year forecast of c.14p

Outlook - sounds good, and is in line. What I like about this, is that we don’t have to worry about large, lumpy contract wins or the like. This is a self-funding roll-out of proven, successful, niche machines/services. Surely it should be rated on a PER that reflects these pretty dependable, recurring revenues, and the growth (but it isn't)?

This bit below appeals. It reminds us that MEGP is not standing still, and has deep expertise & experience in self-service booths of all kinds. Who knows what it might come up with next?!

"Additionally, the Group's R&D team has devised new production techniques to reduce the cost of the next-generation photobooths by 28% (effective immediately) and the Revolution laundry machine by 13% (effective FY 2025). A new generation solar panel, which delivers twice the power generation of the current model, is also in development and will be utilised by the Group's Revolution machines"

Key risk for the main photo booth business seems well-addressed in the risk section -

Valuation - the StockReport shows broker consensus of 14.1p FY 10/2024, and 15.4p FY 10/2025.

I would rate this share on a PER of 15-20x, to reflect its quality, recurring earnings, and self-funding expansion. So I get to a theoretical share price of 231p to 308p. The current price is 183p, so in my opinion this share remains undervalued. Although historically the market has tended to apply quite a low PER to MEGP, seeing it as old technology that is likely to decline sooner or later. That seems fundamentally wrong to me, but nobody can look into the future with certainty.

The quality of the business is shown by the fact that it can self-fund the roll-out of many new machines, at an accelerating pace with laundry, without using any net debt, and still throw off enough surplus cash to pay out a 4.6% dividend yield.

This is what a proper cash generating roll-out looks like! Compare the figures here with the weak numbers at GYM - there’s no comparison, MEGP is streets ahead.

Pizzas! - readers discussed this a while ago, and one subscriber even mystery shopped a pizza machine. We were then told by someone that MEGP had sold off the food/drink machines division. Today’s commentary seems to be saying this is still a live area, but maybe just selling the machines, rather than operating them? -

“In addition, the Group sells pizza vending equipment in Continental Europe and the UK, albeit on a small scale. The Group expects this will remain a small financial contributor to the Group going forward.”

As an aside, apparently Japan is the place to go for vending machines. I’ve never been (high on the wish list though) but saw a travel documentary recently, which said that Tokyo has vending machines everywhere, for all sorts of things, literally every few yards.

Balance sheet - absolutely fine, I don’t need to go into detail.

Cashflow statement - remarkable, the business throws off lots of cash, which it uses for capex and decent divis.

Paul’s opinion - I remain very positive on this share. It’s a high quality share, priced as a value share. That just doesn’t make sense to me, so I think with patience, it could & should do another leg up. And you're paid well whilst you wait, with those attractive divis.

Stockopedia likes it too, with a StockRank of 94.

So it's another GREEN from me.

Graham’s Section:

Cavendish Financial (LON:CAV)

Down 5% to 12.99p (£50m) - 2024 Full Year Results - Graham - GREEN

These are the first full-year results since the merger of Finncap and Cenkos.

Important to bear in mind that the merger didn’t take place until half-way through the financial year (FY March 2024).

Key bullet points:

H2 revenue +80% on a combined basis to £35m

£7m annualised cost synergies delivered on schedule

Net cash £20.7m at year end.

There is unfortunately a pre-tax loss of £4.3m. Normally I look for brokerages/investment banks to slash bonuses in the bad years, so that they never need to post a loss - their staff are very well paid in the good years, after all.

Cavendish explains the loss as follows:

The reported loss for the year reflects the decision we made to pay bonuses to reward and retain staff following a strong post-merger performance.

Balance sheet: there is tangible equity of £26m, including the cash figure mentioned above, and a large pile of receivables (£23m).

Outlook sounds more positive than negative, with a good start to FY March 2025:

The business is performing well in the new financial year, with deal flow balanced across ECM, Public and Private M&A, Debt Advisory and Private Growth Capital. As we look ahead, we see many reasons to be positive, including continued equity issuance, private and public M&A, further client wins and a number of emerging IPO opportunities as companies seek to join the UK markets. Clearly there remain uncertainties and macro issues which impact market sentiment, but with our well diversified offering and robust platform we look forward to returning to a profitable year as the merger synergies are fully realised and with that the compensation ratio returning to normal levels.

Graham’s view

As I’ve said, I normally want companies in this sector to slash bonuses in the bad years. If they do that, it shouldn’t be necessary for them to ever post a substantial loss.

But this is a special case: a transformational merger of equals has taken place. Many staff have had to change where they work and how they work. Others have been let go. In these circumstances, I think it’s reasonable for the company to maintain bonuses in the short-term, even if the financial results for the year don’t justify it.

In the long-term and starting straight away, shareholders will benefit from the £7m of annualised cost synergies that have been delivered.

Now if it turns out that FY March 2025 is another poor year and if the company fails to adjust its bonus payments sufficiently to avoid posting a loss, I’d certainly have to rethink my positive stance here.

Cavendish has announced a dividend of 0.25p, which I think has a gross value of less than £1m. Total employee costs, including bonuses, were £35m. For FY 2025, the company needs to try to get the balance right again between employee and shareholder rewards.

I am going to maintain my positive stance here for all the reasons I’ve described before. The enterprise value is £30m for a business that is going to deliver profits more efficiently (due to economies of scale) and more easily (due to less competition) whenever AIM conditions improve. For me, this still looks like an exciting way to bet on a market recovery. This is why it is on my list of best ideas for 2024.

Burberry (LON:BRBY)

Down 16% to 747p (£2.7 billion) - First Quarter trading update - Graham - AMBER

(Graham has a long position in BRBY at the time of writing.)

This is not a small-cap but seeing as I am a long-term (i.e. long-suffering) shareholder here, I thought I could add a few words on it.

Firstly, while today’s news is clearly very bad, the market has at least been attempting to price it in before today. Share price performance year-to-date:

Here are the numbers:

Q1 revenue down 20% at constant exchange rates.

Comparable store sales down 21%.

Comparable store sales: down 23% Asia Pacific, down 16% EMEIA (includes India, Africa), down 23% Americas.

Chair comment:

Our Q1 FY25 performance is disappointing. We moved quickly with our creative transition in a luxury market that is proving more challenging than expected. The weakness we highlighted coming into FY25 has deepened and if the current trend persists through our Q2, we expect to report an operating loss for our first half

Dividend payments are suspended as the company tries to “rebalance our offer to be more familiar to Burberry's core customers whilst delivering relevant newness”.

Various initiatives are underway, e.g. better functionality online with a website refresh, and a new outerwear campaign to be launched in October.

Outlook: profit warning for FY March 2025 based on current trends.

In addition to declining underlying revenues, the company is also suffering from currency movements and is forecasting a £20m hit to operating profit based on current exchange rates.

CEO replaced: the CEO unceremoniously leaves “with immediate effect by mutual agreement”, and is replaced straight away by the former CEO of Michael Kors and Coach. It’s a radical change without any transition period and with little warning. I suppose we can applaud the Board for their decisiveness.

Graham’s view

This stock has been part of my long-term portfolio for years. I’ve had many opportunities to cash in, but I always felt that it was worth holding on as the brand seemed to have an evergreen appeal to luxury consumers, especially in Asia, and I expected LMVH or someone else to eventually come knocking for it.

However, Burberry is currently suffering badly in a very tough market. Gucci (owned by Kering) provides a good comparison and in April it reported Q1 revenues down 21%, “attributed to a sharp decline in the Asia Pacific region”.

Given that Gucci had such a bad start to the year, I’m inclined to think it’s too soon to say that Burberry is doing much worse than its direct peers. Other luxury brands such as LVMH haven’t done as poorly, but they include brands which are not Burberry’s direct competitors.

As for my stance on this one? With the company now loss-making, I don’t think I can give this stock the thumbs up, as recovery plays are inherently risky. So I prefer to be neutral.

Personally, I don’t have any plans to sell my BRBY stock at this time, as I tend not to tinker with this portfolio - I know that some of the stocks in the portfolio will be losers, but I also expect that some of them will be big winners.

A note on solvency: the company reported net debt of £1.1 billion as of March 2024, but this included nearly £1.2 billion of leases. Excluding leases, the company still had a small net cash position. Cancelling the dividend will be a big help in maintaining solvency.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.