Good morning from Paul & Graham!

That's us done for today - we've covered nearly everything on the long list today, with at least a brief comment, or a full section.

Renold (LON:RNO) update - re share options, etc. I spent a bit of time last night going through the accounts again for Renold (LON:RNO, in particular trying to unravel the accounting treatment of share options and employee benefit trust, dilution, etc that we were discussing yesterday. I've figured it out now. What they've done is buy shares in the open market for the employee benefit trust, to meet share option awards. I flagged this in the cashflow statement in yesterday's results, as a £4.5m cash outflow in FY 3/2024. There was nothing in FY 3/2023, however another £4.9m cash outflow called "Own shares purchased" in the FY 3/2022 cashflow statement. I would have just glanced at that, and thought good, they're doing buybacks for cancellation. But the shares are not cancelled, instead they are gifted to the employee benefit trust, which seems to be mainly share options reward schemes for Directors. That's £9.4m cash spent on buying shares to be given away (at nil cost) to Directors in the last 3 years. That seems excessive to me.

Note that the way this is accounted for, the cost completely by-passes the P&L. It took a while to track down the double entry, but it goes like this: credit cash on the balance sheet (ie cash going out, as double entry is the opposite of how we see it on our bank statements), and there where has the debit gone? It should be showing as either a cost (debit) on the P&L, or an asset on the balance sheet. Actually it's neither. The debit goes through reserves, and is shown in the reserves section of the balance sheet (below share capital) as "Other reserves". Nicely hidden! Therefore this entry lowers NAV, to reflect that RNO has spent £9.4m in cash on buying shares to give away to Directors.

The diluted EPS figure therefore seems a red herring, since the company apparently confirmed in the webinar last night (I missed it, due to being asleep in the sun) that there would not be any dilution. So I'm happy to go back to using the higher EPS figure that strips out dilution which should not happen.

Bottom line though, is by a roundabout route, a big chunk of Renold's cash has been syphoned off by management, to pay for a load of free shares for them. I'm not happy about this - the amount looks really excessive. That's cash which could have paid shareholders pleasant divis. We've had nothing over the last 3 years, whilst Directors filled their boots with £9.4m of free shares, bought by the company for them. For whose benefit is this company being run, and why did shareholders agree such a generous scheme?

To balance that, I remain very pleased & impressed with the turnaround in trading, and of course the share price, so probably shouldn't grumble too much.

I'll scrutinise employee benefit schemes more closely in the future at other companies, as it seems to me this is an effective way to hide substantial rewards for Directors in ways that wouldn't be obvious to a casual observer.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

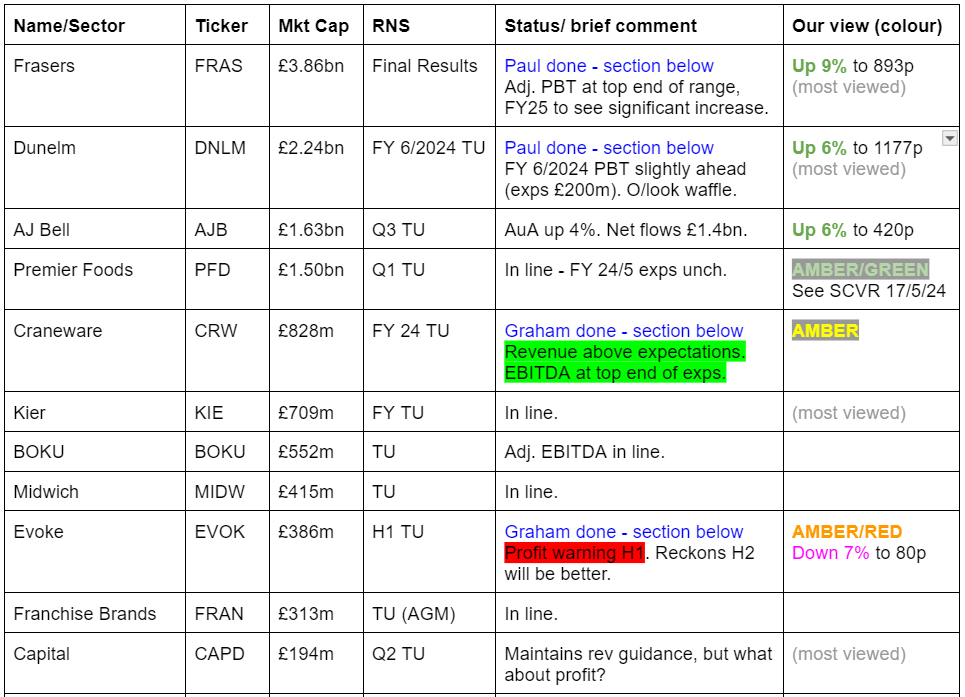

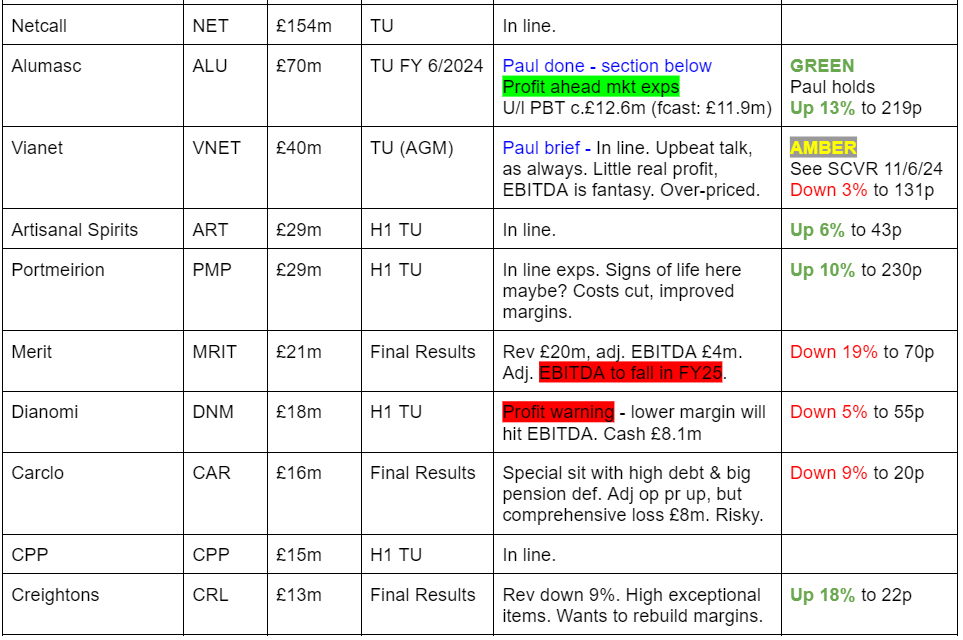

Companies Reporting

A busy day!

Other mid-morning movers (with news)

Intelligent Ultrasound (LON:IUG) - up 48% to 10.75p (£35m) - Proposed sale of clinical AI business for £40.5m - Paul - AMBER

This looks a sensible move. H1 trading update shows lower revenues, and almost out of cash. So selling its main (cash burning) division to GE Healthcare for a premium price (above its market cap) makes a lot of sense. Says it will consider returning some cash to shareholders. This will leave the listed company with its small NeedleTrainer product. Paul’s opinion - probably too small to be listed. I don’t see any further upside on the share price after today’s 48% rally, so won’t be getting involved. Probably a lucky escape for shareholders overall. It just shows though, that private buyers can sometimes see more value than the stock market, we’re seeing a lot of that at present with takeover deals. The stock market is the wrong place for small, cash burning, development companies.

Summaries

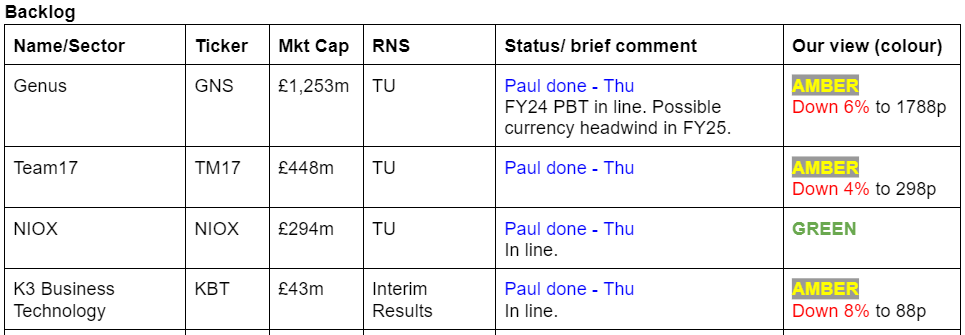

The first 4 items below are catch-up news from yesterday -

K3 Business Technology (LON:KBT) - down 8% to 88p y’day (£39m) - H1 Results - Paul - AMBER

Loss-making in H1, but it says seasonality is heavily H2-weighted each year from year end contract renewals, so still expects adj PBT to double to £1.6m for FY 12/2024. This strikes me as a declining business, propping up (small) profits through cost-cutting. With a tiny free float, and 5 large shareholders, I would expect this to de-list at some stage, hence probably best avoided. AMBER is probably being generous. Why get involved?

Niox (LON:NIOX) - unch 68p (£291m) - Trading Update - Paul - GREEN

I think this looks an interesting growth company, profitable, soundly financed, and its shares have been >3-bagger in the last 5 years, so I think there’s something good here. It's not cheap though, and the shareholder register is very interesting (see below).

Team17 (LON:TM17) - down 3% y’day to 300p (£438m) - Trading Update - Paul - AMBER

I last looked at this video games group a year ago, when it warned on profits. Since then, the share price has recovered very well, doubling from the lows. It now looks reasonably priced, on a reasonable PER, with a good balance sheet and cash pile. Trading is in line with expectations. Could be worth a look, if you invest in this sector, which I tend not to.

Genus (LON:GNS) - down 11% to 1698p y’day (£1.12bn) - Trading Update (y’day) - Paul - AMBER

In line trading for FY 6/2024, but it lowers FY 6/2025 profit expectations by 13.5%. I can’t see any attraction to this share based on these numbers. It looks expensive, has quite a highly indebted balance sheet, and performance is lacklustre. So why pay a premium PER for it? I’m being generous with AMBER.

Alumasc (LON:ALU) (Paul holds) - up 13% to 221p (£79m) - Trading Update (FY 6/2024) [ahead exps] - Paul - GREEN

The value seems obvious here, for a decent quality niche building products supplier, making good & improving margins. Today's update says it's traded ahead of expectations for FY 6/2024, and management sound confident there's more to come. Well worth you taking a closer look, I see potentially c.50% upside here, if we're patient, and we get paid generous divis whilst we wait.

Craneware (LON:CRW) - up 2% to £24.60 (£869m / $1,130m) - FY24 Trading Update - Graham - AMBER

An excellent full-year update from this healthcare software company, with revenue beating expectations. I’d like to take a more positive stance on this stock as I’m a big fan of the story and the management team, but it seems fully priced to me with the PER in excess of 30x and the price to sales ratio over 6x.

Frasers (LON:FRAS) - up 9% to 894p (£4.03bn) - FY 4/2024 Results - Paul - GREEN

Mike Ashley's sprawling retail empire, that he still owns 73% of, but is supposedly not involved in managing any more. Yeah, right! These numbers look great, and with a confident outlook and clear guidance too, sound balance sheet, good cashflows, and a PER of only about 9x, there's a lot to like here. It has to be GREEN.

Dunelm (LON:DNLM) - up 7% to 1,179p (£2.39bn) - Q4 & FY 6/2024 Trading Update - Paul - AMBER/GREEN

Homewares retailer ended the FY 6/2024 year with a pleasing surge, leading to it reporting today profit will be slightly ahead of expectations. I think it's an excellent business, and pays decent divis of almost 5%. With the share price looking up with events, I've moderated a little to a still positive AMBER/GREEN. Freight costs rising worries me. Although a consumer recovery gives potential upside. A stronger pound could also be a buying tailwind helping margins, after a time lag.

Evoke (LON:EVOK) - down 8% to 79.15 (£387m) - H1 2024 Trading Update - Graham holds - AMBER/RED

This remains a complex situation. Bondholders are relaxed, the share price has been stable, and management still insists that leverage is going to reduce by 2026. However, they have made precious little progress on that front so far, and H1 has been poor with adj. EBITDA up to £40m below target. But they leave FY25 expectations unchanged, and so shareholders can continue to dream of recovery.

Paul’s Section:

K3 Business Technology (LON:KBT)

Down 8% to 88p y’day (£39m) - H1 Results - Paul - AMBER

Provider of business-critical software solutions focused on fashion and apparel brands.

Poor H1 results here, with a marked fall in revenues, and a hefty loss -

Outlook - suggests we shouldn’t judge it on the seasonally softer H1 figures -

"The second half of the financial year is typically our stronger half, with significant cash inflows from software licence and maintenance and support contract renewals. Our priority is to deliver shareholder value while maintaining strong financial discipline. The Group remains on track to perform in line with our expectations for the current financial year."

Note the last divi was paid in 2018, so this seems a business that is managing decline, and note it’s incurring hefty restructuring costs of £2.1m last year, and £1.25m in H1 this year.

Broker update - Cavendish helps us out with some numbers.

It’s left FY 11/2024 adj PBT at 1.6m, double the previous year. To achieve that would require a very heavy H2 weighting - with the risk being contracts don’t get renewed as expected. Although in this type of business, I would expect them to know in advance if a customer was not intending to renew. It would be useful to see the client list, to find out if any are at risk of going bust - clearly a risk in the fashion sector.

EPS forecast is 3.1p, for a PER of 28.4x, which clearly looks too high.

Balance sheet - is weak. NAV at 31/5/2024 was £24.3m, but intangible assets are £26.3m, giving NTAV of negative £(2.0)m.

That’s not great, but it’s probably adequate for a software company, since it has negligible fixed assets and inventories. Plus customers tend to pay up-front. Put that together, and a weak balance sheet can actually work OK.

Paul’s opinion - distinctly lacklustre. I cannot see any reason to get involved here, it looks like a business in decline, keeping itself going through cost-cutting.

Look how concentrated the shareholder register is, below. So there’s absolutely no point in having a stock market listing, which is an unnecessary cost & hassle, and is probably harming the potential to do deals in the private market, but attributing a low market cap of only £39m. So I would be very worried that the big 5 shareholders might decide to take it private - at an unknown price.

For those reasons, I’m tempted to raise a warning flag here.

Niox (LON:NIOX)

Unch 68p (£291m) - Trading Update - Paul - GREEN

Oxford, UK - 17 July 2024: NIOX Group plc (AIM: NIOX), a company engaged in the design, development and commercialisation of medical devices for asthma diagnosis and management, today announces a trading update for the six months ended 30 June 2024 ("H1 2024" prior period "H1 2023").

“Continued strong performance driven by Clinical Business”

This seems to be an in line update, so not price sensitive -

“Ian Johnson, NIOX's Executive Chairman, said: "I am pleased to report continued growth in revenues and profits in the first half of the current financial year, during which the group has traded in line with management expectations. Our core Clinical business, which continues to benefit from a high degree of recurring revenues, grew at 14% in constant currency terms.”

H1 revenues up 12% to £21m

Adj EBITDA up 14.5% to £7.1m

Forecast - Singer helps us with an update note. It leaves FY 12/2024 unchanged at £13.7m adj EBITDA = £10.7m adj PBT = 2.4p adj EPS (PER 28.3x)

That’s showing a nice uptrend, from 1.4p EPS in 2022, and 1.9p in 2023, to forecast 2.4p in 2024, then 2.9p and 3.5p in 2025 & 2026.

So this looks an interesting growth company, which was the same conclusion I reached when viewing it GREEN on 18/7/2023.

Balance sheet at end Dec 2023 looks very good to me, with ample capital, including £20m net cash. So I see little to no dilution or solvency risk. This healthy cash position also enables it to pay a divi yield of about 1.8%, twice covered. That’s modest because the shares are rated on a high PER.

Paul’s opinion - it’s obviously not a value share, on a PER of 28x, but I’m impressed by the growth track record, and high gross margin - thus providing leveraged upside as sales grow.

I know nothing about life sciences businesses, so cannot offer any view at all on the products, competition, etc, it’s your job to research all of that. My view is purely on the numbers, and I think this looks an interesting growth company, profitable, soundly financed, and its shares have been >3-bagger in the last 5 years, so I think there’s something good here. If you do have a deeper dig into things, then do let me know what you think!

Another way of looking at it, is to admire the top 3 shareholders, who arguably have done the due diligence for us already - although note the two largest have reduced their positions this year - picked up by Rathbones -

Team17 (LON:TM17)

Down 3% y’day to 300p (£438m) - Trading Update - Paul - AMBER

Team17, a leading global independent ("Indie") games label developer and publisher of premium video games and apps, provides the following trading update for the six months ended 30 June 2024 ("H1 2024").

Short and sweet! -

“The Group has traded in line with the Board's expectations during H1 2024 and management remains confident of delivering full year results in line with market expectations.

The Group's interim results will be announced in September, with full details to follow nearer the time.”

We’ve not looked at TM17 since its profit warning on 24/11/2023, when I wasn’t keen, due to complicated accounts and lack of broker notes.

However since then, shares have recovered in a steady trajectory, to double from the Dec 2023 low c.150p to c.300p now. It’s actually quite surprising how many smaller company shares have recovered well from profit warnings in the last year, including this one.

Forecasts for this year and next seem to have stabilised -

Looking back at its FY 12/2023 results, they showed adj PBT down 39% to a still respectable £28.7m, equivalent to 17.5p adj basic EPS (a current PER of 17.1x). Although the adjustments were large, making a statutory loss of £(1.1)m, due to a £32m impairment of intangible assets.

Balance sheet at Dec 2023 was healthy, with £42.8m net cash, and c.£37m NTAV.

It’s expected to do 21.9p EPS this year, so a PER of 13.7x seems reasonable.

Paul’s opinion - based on the reasonable valuation, and in line trading, this share looks worthy of further investigation, although personally I don’t get involved in the video games sector. I’m happy to sit on the fence at AMBER, but with a slight leaning towards a positive view, because trading has stabilised, and the balance sheet is robust, which has been reflected in a good recovery in share price. TM17 doesn’t pay divis, so seems to be growing by acquisition instead.

Genus (LON:GNS)

Down 11% to 1698p y’day (£1.12bn) - Trading Update (y’day) - Paul - AMBER

Genus (LSE: GNS), a leading global animal genetics company, publishes the following unaudited trading update for its fiscal year ended 30 June 2024 ("FY24").

An in line update yesterday for FY 6/2024 -

“Management expects Group FY24 adjusted profit before tax in actual currency to be in line with market expectations of between £58m and £61m.

Group Net Debt to EBITDA is expected to be circa 2.0x at year-end supported by strong cash conversion in the year.”

Panmure Liberum helpfully issued an update, it has 68.2p fully diluted EPS for FY 6/2024, a PER of a hefty 24.9x.

Forecast reductions - Panmure Liberum reduces FY 6/2025 forecast by 13.5% to 77.4p, due to weak demand and stronger sterling creating a headwind. So the PER is 21.9x on this revised forecast.

Paul’s opinion - I can’t see any attraction to this share based on these numbers. It looks expensive, has quite a highly indebted balance sheet, and performance is lacklustre. So why pay a premium PER for it? I’m being generous with AMBER. Looks like the downward trend in share price is justified, and could continue.

Alumasc (LON:ALU) (Paul holds)

Up 13% to 221p (£79m) - Trading Update (FY 6/2024) [ahead exps] - Paul - GREEN

Alumasc, the sustainable building products, systems and solutions group, provides a trading update for the year ended 30 June 2024, ahead of publishing its FY24 results on 3 September 2024.

Strong performance, with profit ahead of market expectations

Readers here flagged this share to me in Feb 2024, suggesting it was good and I should review it. Sure enough, my review of H1 results here on 9/2/2024 was very positive, GREEN at 179p. Given my positive view, I took up the offer of a briefing call with management, to better understand the business - which left me with a positive impression. More recently I picked up a small position in ALU shares personally, which we have to disclose here when writing about companies we hold personally, because it can create bias in what we write - although we try very hard to be objective with everything, whether we own it or not.

ALU shares seem to have oscillated in a sideways trend for the last 20 years, but that overlooks its generous divis. So the total shareholder return has been OK -

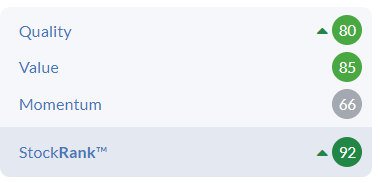

Margins have improved in recent years, and I think this is a much higher quality, niche products business than the market gives it credit for. So there’s a re-rating opportunity here, in my view. Stockopedia shows the forward PER as 7.3x, which seems too low to me. Surely a rating of 10-12x would be more appropriate, given its resilience during the tough macro in recent years?

It’s priced like a low quality, low margin building supplies company, but the quality scores are actually excellent -

StockRank is high, and the momentum score could rise, as more investors spot the attractive investing case here, and shares re-rate, possibly? I have about 300p+ in mind as my price target. Although from watching the shares, I suspect there might be an intermittent seller, so possibly an overhang, as with lots of small and mid caps - look at the series of secondary placings we’ve seen lately, eg at Gulf Marine Services (LON:GMS) (I hold), Trustpilot (LON:TRST), and something else. Still, for the patient investor, I think anomalies like that create opportunities, especially when you’re paid nice divis whilst you wait for the market in the shares to normalise & overhangs clear.

ALU also seems to have done some good acquisitions over the years.

Management say that ALU’s out-performance has been helped by new products selling well.

Today we get a lovely ahead of expectations update, with nice clear guidance, this is for FY 6/2024 -

“Underlying profit before tax ('UPBT')1 now expected to be at least £12.6m, ahead of current market forecasts2 and the prior year (£11.2m)

2 The Board understands current market UPBT forecasts for the year ending 30 June 2024 to be in the range of £11.7m to £12.1m, with a consensus of £11.9m.

That’s a c.6% beat against consensus.

Outlook comments - indicate further margin improvements are coming -

“Over the medium term, the Board believes that the Group can generate significant further value, which is reflected in its targets to generate organic revenue growth ahead of underlying UK construction markets and achieve operating margins of 15-20%.

FY24 represents a period of strong delivery against these objectives and the Group would expect to make further progress as market conditions improve.”

Net bank borrowings were a modest £7m at year end, only 0.5x EBITDA.

Latest acquisition of ARP has “performed very well”, reinforcing my view that management know what they’re doing with their acquisitions strategy.

Paul’s opinion - there’s plenty more detail in the update, which I don’t need to go into here.

Check out an update note from Cavendish this morning, forecasting 26.1p adj EPS for FY 12/2024, rising to 28.0p next year. With the building sector set for recovery in calendar 2025 onwards, there could be upside on these forecasts. Management sound confident.

Concluding then, I remain of the view that ALU seems an overlooked and under-priced, good quality business. Hence I’m happy to remain at GREEN.

Dunelm (LON:DNLM)

Up 7% to 1,179p (£2.39bn) - Q4 & FY 6/2024 Trading Update - Paul - AMBER/GREEN

Things are going well at this homewares retailer too.

This all sounds good -

Broker notes - nothing available. Stockopedia has consensus at 73.3p, so I’m guessing slightly ahead could mean 75p-ish?

That gives us a PER of 15.7x, which I’m struggling to justify having just looked at FRAS on 9.3x.

Outlook - I’m puzzled it doesn’t mention increasing freight costs -

"Going into FY25, we have a significant opportunity ahead of us. We are finding quality sites for new stores, and are increasingly confident in our smaller format stores. We are also continuing to invest in both our digital offer and wider operations to support further market share gains. However, we will need to maintain strong operational grip given ongoing wage inflation. Notwithstanding the continuing uncertainty in our markets, we're both excited and confident in our plans."

Paul’s opinion - I can see that a consumer recovery is likely, and that gives retailers an operationally geared upside. However the supply chain issues which are re-emerging, especially freight costs, could turn a tailwind into a headwind in the new financial year, who knows?

You do get a yield of close to 5% at Dunelm. It has very high quality scores, and is undoubtedly an excellent business. Balance sheet is adequate, with a small net cash position.

Overall, I think I should moderate to AMBER/GREEN (from green) because the share price looks up with events for now, but I still really like Dunelm as a proven business, resilient through the pandemic. Also I mystery shopped it for curtain poles & curtains, and found the products excellent quality for the price!

A strengthening pound is good for retailers' margins, after a time lag.

Frasers (LON:FRAS)

Up 9% to 894p (£4.03bn) - FY 4/2024 Results - Paul - GREEN

The sprawling sportswear & apparel group.

I’m not saying anything -

“ Profitable growth

· APBT (1) of £544.8m (+13.1%), at the top end of our guidance range (£500-£550m).

· Adjusted EPS (1) of 95.8p (+33.6%).

· Continued strong profitable growth - FY25 APBT expected to be £575m-£625m.”

Retail revenue was £5.35bn, so that’s a healthy 10.2% adj PBT margin.

PER is only 9.3x adj EPS of 95.8p.

Adjustments look reasonable, and are not excessive.

Share buybacks - note that there is an ongoing reduction in the number of shares in issue, down from 531m in 2018 to 450m today -

However, it doesn’t pay dividends.

Outlook - there’s so much going on at FRAS, but it seems to be working -

“Our successful Elevation Strategy is powering our strong financial performance, with strategic brand relationships giving us better access to product across the Frasers Group. As we move into FY25 and the Summer of Sport, we remain confident that our strategy will drive continued strong performance, and we expect significant synergies from both our automation programme and the integration of acquisitions. We continue to build a diverse business within retail, both in the UK and internationally, and also within financial services and property, that can deliver sustainable multi-year profitable growth. For FY25, we expect to achieve another strong increase in APBT in the range £575m-£625m.”

Cashflow - it generated c.£483m in cash (after tax, leases, and finance costs). This was spent mainly on capex (£211m), net purchases of listed shares (£249m), and buying its own shares (£126m). There were also £109m cash inflows relating to equity derivatives. So you can see this is not a vanilla retailer, it does a lot of wheeling & dealing too - where it has a patchy track record (eg losses on Debenhams, and Matches).

Balance sheet - NAV is £1,873m, with intangible assets being only £42m, so NTAV looks robust at £1,831m, which supports 45% of the market cap.

Net debt is not excessive at all, at £448m (includes securitisation borrowings, but not leases).

Paul’s opinion - just a quick skim of the numbers, and I have to say this does look a quirky, but interesting share!

It’s difficult to understand why the PER is only about 9x, so there could be upside from a re-rating at some point.

I always have a nagging feeling that FRAS could end up making some giant cock-up at some point, since its strategy has at times looked quite reckless - eg taking stakes in numerous other retailers, and sometimes with obviously not enough due diligence, eg Matches, where it was quickly put into administration after being bought. Mind you, it is encouraging that failure was recognised quickly, and acted upon, to stem the losses. I think its 20% stake in Asos could be problematic, although taking out a large online competitor has obvious attractions. It also has a sizeable stake in Boohoo, and others. The threat from Shein and other Chinese companies can't be ignored.

That said, its balance sheet is strong enough to be able to absorb mistakes.

I have to say, it can’t be anything other than GREEN, based on these good numbers, and confident outlook.

Graham’s Section:

Craneware (LON:CRW)

Up 2% to £24.60 (£869m / $1,130m) - FY24 Trading Update - Graham - AMBER

It’s an impressive full-year trading update from this provider of software to the US healthcare industry.

Key points:

Revenue up 8% to over $188m, above the upper end of market expectations.

Adj. EBITDA at least $58m, up 6%, towards the top end of market expectations.

Annualised recurring revenue is up by about 2% to $172m.

Net cash is still around zero (bank debt offsetting cash reserves). $13m was spent on dividends and $3m on share purchases, including shares bought for employees.

Outlook: says the company is well positioned for FY25:

The strong sales performance during the year demonstrates the strength of the Trisus platform, increasing partner success and the unique position the Group holds in its market.

The breadth of solutions the Craneware Group can provide though its Trisus platform, combined with the new market opportunities, accelerated innovation and exploration of new AI-based applications that will result from the recently announced alliance with Microsoft, give the Board confidence in the Group's ability to provide the insights its customers need to deliver greater value healthcare to their communities.

Alliance with Microsoft

We didn’t cover it at the time, but earlier this month Craneware announced a deepening of its relationship with Microsoft. This included “co-innovation with Microsoft's AI experts to accelerate the application of AI enhancements to existing Trisus offerings and the exploration of new AI-based applications”

Craneware’s Trisus will be available on Microsoft’s cloud software shop, the Azure Marketplace.

Graham’s view

I interviewed company management in March, publishing my notes here afterwards.

Unfortunately, I’ve not been bullish enough on Craneware stock:

My stumbling block has been the high rating vs. modest revenue growth:

Again today we have 8% revenue growth, ahead of expectations and a perfectly good growth rate for a large company, but not what I would consider to be “rapid” growth.

In March, I suggested that sustained double-digit growth could support Craneware’s valuation and generate upside for investors.

Perhaps the partnership with Microsoft will enable faster growth?

Besides earnings multiples, I’ve also tried using US-style price to sales or price to ARR multiples.

After recent share price gains, the price to trailing ARR multiple for Craneware is now about 6.5x. This could still be considered normal by US valuations standards, but US valuation standards are of course on a different level compared to the UK.

For further context, I should point out that Microsoft (MSFT), one of the Magnificent 7 stocks and Craneware’s partner, is currently trading at a price to sales multiple of 14x, with the following valuation multiples. It seems overpriced to me:

Overall, I still have a very positive impression of Craneware as a company, and its management, and I think its prospects are positive in the short and long term. Given the valuation, I’ll stick with my neutral stance.

Evoke (LON:EVOK)

Down 8% to 79.15 (£387m) - H1 2024 Trading Update - Graham - AMBER/RED

At the time of writing, Graham has a long position in Evoke.

Unfortunately, this is a profit warning from the company formerly known as 888.

This stock has a long history, please refer to Paul’s notes in April and my notes in March if you’d like to get up to speed.

With an almost completely new management team, and a new name, the company is trying to see itself as a new entity, and approach its business in new ways. But of course it still has to tackle the legacy of debt from the prior management team.

Some key points from today’s H1 update:

Q2 revenue £431m, “broadly stable” but below expectations..

Small gains in revenue from UK online and International divisions, but UK retail (William Hill) revenue down 8%.

Solutions to the decline in UK retail? Various initiatives planned, such as an improved self-service betting terminal product, along with a change of leadership.

Continuing with the financial news:

Adj. EBITDA margin 13-14%. The update doesn’t mention that this is down from 17.7% in H1 last year.

Cash £116m, total liquidity is “nearly” £300m, a little lower but not much change compared to last year.

Strategy: they have “fundamentally re-organised the Group’s operating model to streamline decision making and increase effectiveness”. £30m of cost efficiencies will be delivered by the end of this year.

Outlook: unfortunately the cost savings aren’t in time to help H1 adj. EBITDA, which is £35-40m behind plan.

By my sums, H1 adj. EBITDA is in the region of £110m-£120m (H1 last year: £156m).

The company insists that H2 will be much better. Marketing costs in H2 will be lower by up to £40m, revenue growth is expected to be 5-9% (in line with medium-term guidance), and the next round of cost efficiencies will be delivered.

So the adj. EBITDA margin is forecast to improve back to 21% in H2.

Importantly there is also no change to the company’s view of FY25 expectations.

And most critically, they are still targeting a leverage multiple of less than 3.5x by 2026. But is that realistic? I’m not sure.

In H1 last year, management guided that leverage would be “slightly below 5x” at year-end, i.e. by Dec 2023.

The actual leverage multiple at the end of the year was 5.6x, calculated on a net debt load of £1.7 billion. So they didn’t hit their forecast, and weren’t all that close. There was no improvement in the leverage multiple from Dec 2022 to Dec 2023.

CEO’s comment uses our favourite phrase “profitable growth” a couple of times.

He emphasises that the business is completely changing how it is run:

"We are focused on mid and long-term profitable growth and value creation and during the first half we have made bold, decisive changes to improve almost every area of the business. We are undertaking a complete reset and transformation of the business, and the scale of change is significant, but necessary. This transformation will take time but will enhance operational efficiency, leading to a bigger, more profitable and more cash generative business in the future…

Graham’s view

As I’ve noted above, I’m not sure if it’s realistic that the company might achieve a leverage multiple of 3.5x by the end of 2026.

Attempts to reduce the multiple haven’t worked thus far. But they do make a strong argument that H2 will be better. I guess it’s time for them to prove it now with a strong end to the year.

The annual interest charge on bank loans and bonds last year was £176m. With adj. EBITDA of over £300m, they were able to make those payments, but it wasn’t comfortable. After all charges, including large non-cash charges such as amortisation, they made a hefty loss for the year.

This year, I’m expecting another loss but I’m hopeful that the cash performance might be a little better.

I’ll be keeping an eye out again for excessive costs being thrown into the “exceptional” category, e.g. nearly £50m of “integration and transformation costs” were exceptional last year - I want this number to be very small in 2024!

Overall, this stock remains a can of worms - maybe we need a special colour for this category? I’ll stick with AMBER/RED. It’s a special situation where the bondholders and the banks are taking most of the risk, while the equity is just an option on the company being able to pay off its debts.

If, somehow, we got a leverage multiple of 3.5x, without any equity dilution, I’d be delighted and would expect an enormous re-rating of the equity. This is still a large business with well-known brands, and whose revenues should approach £2 billion in the years ahead. Good management could make a big difference and squeeze decent profits out of that sort of turnover. And we know that there has been takeover interest from the industry in the recent past.

For now, it’s a risky bet and one that I would think is inappropriate for most investors. Stale bulls like myself will hold on and go down with the ship if that’s what it comes to, but there is probably little reason for others to want to get involved, at least not without a great deal of conviction in the recovery potential.

Stockopedia’s algorithm is surprisingly risk tolerant, calling this a “Super Stock”. But I think there will be a big gap between the consensus earnings estimates (which are based on adjusted numbers) and the actual outturn.

The share price has been stable:

And bondholders remain relaxed:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.