Good morning from Paul!

Phew, that's me done! Have a lovely weekend, and enjoy the weather - at last it's arrived!

As the RNS is broken, due to a global IT problem apparently, I'll look at some backlog stuff instead. Mine & Stockopedia's IT seems to be working. EDIT at 10:39 - we're off! RNSs just started coming through.

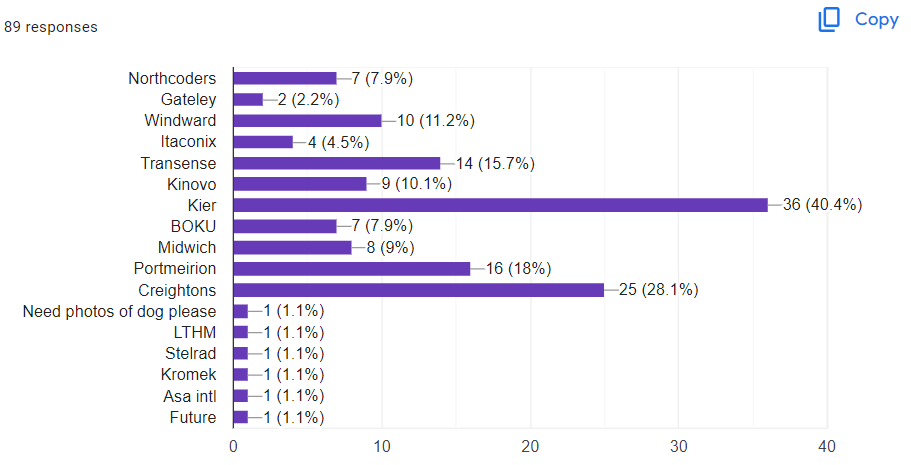

Subscriber vote! Click here to vote (voting now closed, thanks for your interest) for which backlog item you would like me to write about today. I've done the 3 items that got the most votes!

Voting update - no need to call Jon Snow, I have the data in hand (the dog request made me chuckle!) -

On the back of your votes, I've done sections on Kier (LON:KIE) , Creightons (LON:CRL) , and Portmeirion (LON:PMP)

This is great, I think we'll do polls more regularly, so we can focus on what subscribers most want.

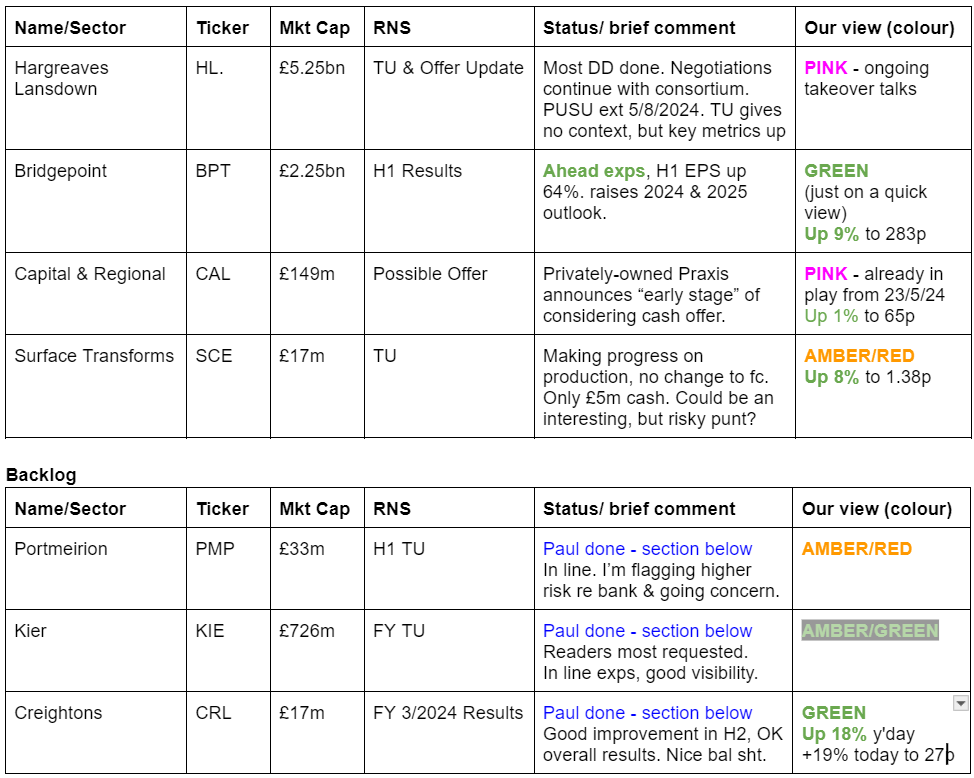

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

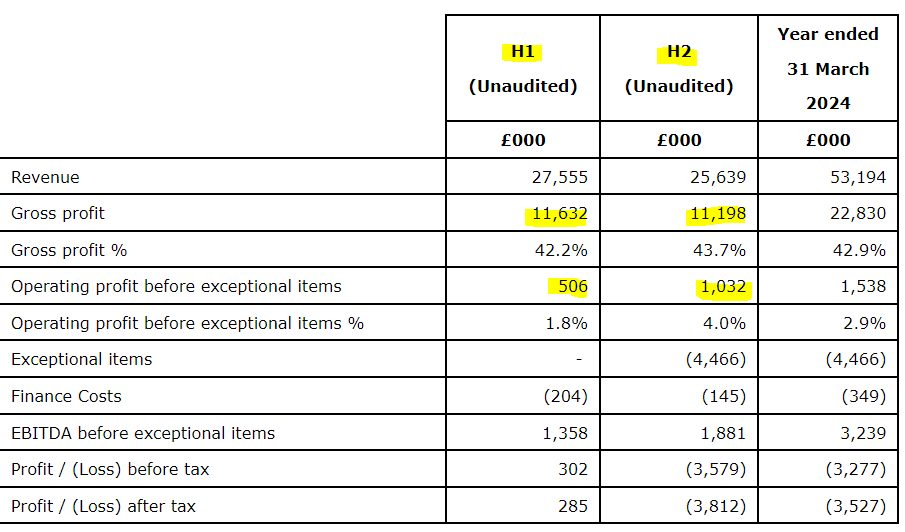

Companies Reporting

Summaries

Portmeirion (LON:PMP) - up 12% y’day to 235p (£33m) - H1 Trading Update - Paul - AMBER/RED

In line update for H1 (the much weaker half), despite a 60% plunge in sales in the important S. Korean market, blamed on destocking. Other markets are OK though. Cost cutting done, as planned. Nothing said on most important issue, the bank renewal due in Sept 2024. I flag the last "material uncertainty" going concern statement. I'd rather wait for confirmation of bank facilities renewing, and the upturn in H2 trading actually happening. Until then, it's high risk in my view, but that's why the shares are low.

Kier (LON:KIE) - up 3% to 161p y’day (£729m) - FY 6/2024 Trading Update - Paul - AMBER/GREEN

Top of my poll of reader requests. An interesting situation - it's traded in line, and has good visibility thanks to a giant order book of public infrastructure projects. Shares have already re-rated significantly from a PER of 3.1x to 7.3x, and could possibly have further to go? I've shifted up a notch from amber to AMBER/GREEN.

Creightons (LON:CRL) - up 19% today, plus 18% y’day, now 27p (£18m) - FY 3/2024 Results - Paul - GREEN

I'm moving on up, as Heather Small would sing, from amber to GREEN. Good progression upwards in profit from H1 to H2, although achieved from cost-cutting. Very decent balance sheet has been de-geared from good cashflows. New management seem more commercial. I see the decks as cleared now for management to have a good stab at getting a recovery underway here, with potential to return to higher historical profit levels. So risk:reward seems quite good to me.

Paul’s Section:

Portmeirion (LON:PMP)

Up 12% y’day to 235p (£33m) - H1 Trading Update - Paul - AMBER/RED

Portmeirion Group PLC, the owner, designer, manufacturer and omni-channel retailer of leading homeware brands in global markets, provides an update on its trading for the six months to 30 June 2024.

This (mostly) ceramics maker used to be a wonder stock, let’s pretend we’re back in late 2018, and see its 12-bagging performance from the 2009 lows to 2018 high -

Unfortunately, since then, performance has disappointed, and series of acquisitions do not seem to have added value, but did weaken the finances. Plus of course the pandemic, energy and supply chain problems more recently. So it’s had a tough time for sure. Although as mentioned before, I can’t shake off the feeling that something structural is going wrong - ie that demand just isn’t as high as it used to be for PMP’s core products, and diversification hasn’t worked.

Note the share count has gone up from c.11m to c.14m in the last 6 years too. I wonder if it will need another equity fundraise, if the bank don't play ball - more on that below.

Reviewing our previous comments here in the last year, to remind me of the background (which anyone can do quickly using my summary spreadsheet here, then doing CTRL-F for the PMP ticker) -

20/7/2023 - AMBER - 285p - Profit warning hidden in seemingly mild update. Broker slashed profit forecast by 68%! Blamed on US de-stocking.

2/2/2024 - AMBER - 217p - In line 12/2023 TU. Paul - shares could go either way, not clear.

28/3/2024 - AMBER/RED - 244p - FY 12/2023 results. Still profitable, but down on LY. Main issue = “material uncertainty” going concern, re bank facilities.

Remember that if we go AMBER/RED or RED, it’s a high risk warning. It’s not a prediction of what will happen next for any particular company. Some of these companies recover, a few even multi-bag, but on average these categories go on to under-perform our more positive colour-coded shares. Here's the latest data re our colour-coding. Take out outliers MCB and HOTC, and the rest of amber/red is about zero -

In practice, very few listed companies go bust, or have bank facilities withdrawn. Although plenty are forced into highly dilutive, discounted placings, which I’ve been hit with in the past, hence why I avoid any company that obviously needs to raise fresh equity (especially in a bear market). Everyone has their own risk tolerance, so armed with the facts, we can make up our own minds for each individual share.

Right, back to PMP, this is the latest news - which sounds reassuring -

“H1 2024 Trading update

Improved demand across US/UK, tough macroeconomic backdrop remains in South Korea

Remain on track to meet Full Year market expectations”

Remember PMP has a big seasonality towards H2, as that includes bumper Xmas sales.

Last year FY 12/2023 it made £3.0m adj PBT (down 63% on 2022), but adjustments were large (mostly non-cash impairments), leading to a £(8.5)m statutory LBT.

Singers leaves forecasts unchanged, anticipating a 50% rise in adj PBT to £4.5m (24.5p adj EPS) for FY 12/2024. I’m not sure how realistic that is, given that PMP has just said H1 revenues are down 17% (all caused by a plunge in S. Korean sales. Other major markets are OK, the US and UK). Although it says this sharp drop in S. Korea was expected, and was previously flagged in March - which I’ve just confirmed (although it wasn’t quantified, and this 17% drop in total H1 revenues is a lot more than I imagined).

Sales elsewhere were up 5%, so this implies sales in S. Korea must have absolutely collapsed, to take the overall group revenue to -17%. Ah yes, here we are, it says H1 S. Korea sales were down an enormous -60% - that’s a big worry. De-stocking means the products are not in demand, so there’s clearly a problem here, and I’m worried it might not just resolve itself in H2. Although this bit reassures it might only be temporary -

“In South Korea, following a significant stock refill in 2022 and first half 2023, the more recent consumer slowdown has resulted in distributors and retailers needing to reduce high stock levels. This has impacted short term orders for this market however we are confident that our Portmeirion brand remains ever popular with the end consumer as evidenced by healthy, growing online channel sales in the market.”

Hence H1 results are likely to look grim when they’re published (revenues down 17% on a previous H1 only at breakeven last year).

Wax Lyrical, its home fragrances business, is doing well, with UK sales up 25% from new product lines achieving good orders.

Outlook - remember H2, and Xmas orders, are crucial to overall performance. Some comfort here -

“We expect FY24 profit to be up on the prior year with improved operating margins and we remain on track to meet FY market expectations.

We expect sales in the second half in our South Korean market to be back to broadly in line with the prior year and we have healthy order books for Christmas across the US and UK…

…We are also encouraged by our advance US orders for Christmas which remain significantly ahead of last year.”

Cost-cutting done, and a mention of shipping costs/disruption doesn’t sound alarming -

“The actions we have taken to reduce our overhead cost base by 10% leaves us better placed to navigate any continuing macro pressures as trading conditions around our key markets across the world continue to be unpredictable. We also continue to manage the increasing disruption to global container freight shipping together with rising rates.”

What’s missing? Nothing is said about by far the most important issue at PMP - its cash/debt position, and banking relationship.

This is what caused the “material uncertainty” in the last going concern statement. Going through that again, it said a £3m loan repayment is due to Lloyds on 31/1/2025. A decision on extending the bank facilities was said to be expected in Sept 2024. The downside scenario in the FY 12/2023 going concern note forecast 10% downturn in revenues. H1 is actually down more than that, at -17%, admittedly the seasonally quieter half, but even so it’s a worry. It says if they promptly took additional cost savings action, then “sales could reduce by 18% before we breached facility limits or any covenants”. -17% actual in H1 is dangerously close to that figure, so it’s now vital that sales do recover in H2, or PMP would be in a pickle. “we do not consider the likelihood of an 18% sales reduction to be plausible. “ - yet it’s (almost) happened in H1. I suppose they are talking about the full year though. An H2 recovery in sales is clearly vital.

At the mercy of Lloyds (who I don’t trust to be supportive, having had bad experiences with them personally), PMP said this in the going concern note (26/3/2024) -

“The Directors recognise that the current bank facilities, which include both a committed revolving credit facility of £10 million available until September 2025 and an uncommitted facility element of £12.5 million available until September 2024, are all required under both a base case and downside scenario in order to provide the Group with sufficient liquidity to continue trading. Under an unlikely but plausible scenario by September 2024 Lloyds could decline their option to extend the committed revolving credit facility beyond September 2025 and therefore decide not to renew the uncommitted facilities at the same date. Under this scenario alternative third party funding would need to be secured in order for the Group to meet liabilities as they fall due and therefore continue as a going concern.”

The Group has a positive and long-standing relationship with our lenders however, if the Group could not secure alternative funding by this date, then the Directors acknowledge that this represents a material uncertainty which may cast significant doubt on the Group's ability to continue as a going concern.

The Board considers the likelihood of lenders removing facilities at this date and not being able to secure an alternative source of funding to be low, and therefore the Directors have a reasonable expectation that the Group has adequate resources to meet its liabilities over a period of at least twelve months from the date of signing the financial statements. Accordingly, they continue to adopt the going concern basis in preparing the annual report and accounts.

Paul’s opinion - I don’t like this bank risk hanging over PMP shares. So for me, risk:reward isn’t attractive at the moment. I’d rather pay a bit more for this share, once it has confirmed renewal of the bank facilities, and that trading in H2 is improving as expected.

Before that happens, it’s higher risk, so it has to be AMBER/RED again.

You can make up your own mind if the risk is worth taking, that’s entirely up to you. IF the bank renews, and trading shows signs of improvement in H2, then I wouldn’t be surprised to see PMP shares bounce strongly.

However, see below how much forecasts have already come down. Also PMP management have a tendency to gloss over bad news, and hence I don’t trust their optimism. The downside case here is another profit warning in the autumn, which I suspect could happen, saying they won’t recoup the necessary sales, and the bank could then tighten their grip with maybe smaller facilities, and a side agreement that PMP will raise more equity in a (probably discounted) placing. I don’t want to take that risk, so I’ll watch from the sidelines for now. Good luck to holders, I hope the upside case pans out for you, which it could well do, who knows?!

Kier (LON:KIE)

Up 3% to 161p y’day (£729m) - FY 6/2024 Trading Update - Paul - AMBER/GREEN

Kier Group plc ("Kier" or "the Group"), a leading infrastructure services, construction and property group issues a trading update for the year ended 30 June 2024, ahead of publishing Full Year 2024 ("FY24") results on 12 September 2024.

Kier shares bottomed out in late 2022 at c.60p, and have since been in a lovely uptrend rising c.168% to 161p as of now. A terrific outcome for shareholders, well done to people who spotted the value. We were a bit slow on the uptake here at the SCVR I’m afraid, but I caught up in Nov 2023. Here’s a recap -

16/11/2023 - GREEN - 104p - AGM TU - appealingly cheap, 5% yield, trading well, decent outlook, worth a closer look if you invest in low margin contractors.

19/01/2024 - AMBER/GREEN - 125p - In line TU - Low margins, weak balance sheet. Performance is OK, divis about to resume. Still quite good value, but given shares have doubled in the last year, I'm moderating my view.

07/03/2024 - AMBER - 139p - H1 results as expected, FY 6/2024 outlook in line (note that forecasts have been slightly reduced in the last 9 months). Balance sheet is large, complicated, and weak. Shares have had a great run, but look up with events to me now.

Those are all fair points I think, but the market disagrees, and has taken KIE shares up a further leg to 161p today.

Must admit, with the forward PER still only at 7.6x, I probably made a mistake becoming more cautious this year as the price rose.

This sector seems to be becoming more fashionable with investors, and ultra low PERs are now attracting buyers. We saw something similar with Galliford Try Holdings (LON:GFRD) recently, which has moved up sharply, now having a forward PER of 12.8x. It also has ambitious growth plans.

KIE is mainly a re-rating story (onto a higher PER), as the earnings forecasts have actually gone slightly down during the same period that shares rose by 168% -

We can look back in time, using the “PRINT” button on any StockReport (which brings up a menu of loads of historical StockReports), and sure enough, KIE shares were on an insanely low PER of 3.1x in Jan 2023 - a bargain hiding in plain sight!

(Archived StockReport from 4/1/2023)

Although it’s also valid that KIE had big debt and pension liabilities back then, a poor track record, and dilution from quadrupling the share count during the pandemic. So perhaps investor caution made sense at the time. A strong recovery since, with forecast earnings recovery turning into actual recovery, has fuelled the big rise in share price.

So can the shares re-rate any further is the key question? And when/if will earnings start to improve? It needs either an earnings increase, or a further re-rating onto a higher PER, to keep the bull run going. Ideally, both would be great!

Kier has 2 main divisions of roughly equal size (revenues/profit) -

Infrastructure Services - H1 revs £944m, up 16% (boosted by HS2), operating margin rose from 4.1% to 4.7%.

Construction - H1 revs £915m, up 29%, operating margin fell sharply, from 4.6% to 3.6%.

These are the type of contracting projects Kier does -

Infrastructure - seems all-encompassing design/engineering/delivery/maintenance of roads, rail, ports, air, water, energy, nuclear, telecoms, etc.

Construction has national coverage delivering schools, hospitals, defence, custodial facilities and amenities centres for local authorities, councils and the private sector.

I’m assuming these will all be competitive tender & framework type arrangements, so it’s difficult to see there being much upside on margins in future. Although investors seem to like the story of margin upside in this sector. We also have to consider margin downside risk, when things (quite often) go wrong on major infrastructure projects. The UK seems remarkably bad at delivering infrastructure at anything like on time, and on budget. A key point is how the contracts are set up, and I don’t see how investors can judge that, seeing as we don’t get to see contract details. You just have to quiz management, and hope they know what they’re doing, in this sector.

Upside potential obviously comes from there being a large need for increased infrastructure spending in the UK, like many other countries, and a new Govt that seems amenable to pulling in more private sector funding to accelerate necessary improvements. So I think it’s safe to assume there should be a gigantic pie to share out between the big contracting groups, something that some investors have clearly (and cleverly) already cottoned on to.

Enough rambling, let’s get back to the point.

FY 6/2024 Trading Update - from yesterday.

Kier Group plc ("Kier" or "the Group"), a leading infrastructure services, construction and property group issues a trading update for the year ended 30 June 2024, ahead of publishing Full Year 2024 ("FY24") results on 12 September 2024.

Overall -

“The Group's full year FY24 results are anticipated to be above the prior year and in line with market expectations, reflecting a strong operational performance.”

Good visibility for FY 6/2025.

Year end spike in the cash position to £165m, average net debt of £(115)m is a more relevant measure, and has halved - very good.

“The year-end cash position was partly driven by a seasonal inflow of working capital, particularly in the Construction division.”

Dividends resuming, as expected.

Refinancing completed to 2029.

“In February 2024, the Group completed a refinancing of its principal debt facilities. This included the issuance of 5 Year £250m Senior Notes, maturing February 2029 and an extension of its Revolving Credit Facility, with a committed facility of £150m to March 2027.

With £400m of facilities, the Group has secured significant funding to support its medium-term value creation plan.”

“Strategic supplier” to the public sector - this looks important, with Google telling me -

“The UK government's 39 'Strategic Suppliers' are a group of companies who provide such vital services to the public sector that the Cabinet Office takes a more hands-on approach to managing the government's relationship with them.”

Outlook -

“Our core businesses are well-placed to benefit from investment in UK infrastructure, particularly in water, affordable homes and public housing maintenance. “

“During the year, Kier won new, high quality and profitable work in our markets reflecting the bidding discipline and risk management embedded in the business. The Group had a strong end to the year…”

The medium term growth targets show only modest growth on what it’s already achieving - this is much more modest growth than GFRD recently set out, and not at all exciting -

Paul’s opinion - I’m impressed. Could this share re-rate higher? Yes, I think that’s entirely possible.

I made a mistake dropping from amber/green to amber last time, so am happy to recognise that, and shift back up to a more positive view - AMBER/GREEN.

Although the shares have had such a good run, you could argue that the main % upside has probably already happened. However, I wouldn’t be surprised to see the PER rise to maybe 10x over time, and as the balance sheet improves, so upside to maybe 200-250p in due course? Not bad, if it happens, and of course assuming nothing goes wrong.

A very nice recovery in the last c.18 months -

However, a dismal story of shareholder value destruction over the long-term, with big dilution since - so you need to be very sure previous problems won't be repeated -

Creightons (LON:CRL)

Up 19% today, plus 18% y’day, now 27p (£18m) - FY 3/2024 Results - Paul - GREEN

Creightons Plc (the "Group" or "Creightons") brand owners and manufacturers of personal care, beauty, and fragrance products, is pleased to announce its preliminary results for the year ended 31 March 2024.

I’ve been sitting on the fence here, with only a couple of SCVR updates in the last year -

04/12/2023 - AMBER - 22.5p - H1 Results - modest profit, sound bal sht, CEO sacked last week. No strong view either way.

08/7/2024 - AMBER - 19p - AMBER - goodwill impairment looks storm in a teacup. H2 trading improved vs H1. Sound finances, nothing to worry about.

A reminder that amber is not negative, it’s me effectively giving the shares a clean bill of health, nothing for me to warn you about. It’s where we don’t have a particularly strong view either way. Things are nuanced of course, so it’s worth reading our summaries too, not just the colour. That’s for people who find our colour-coding useful, not everyone does, which is fine!

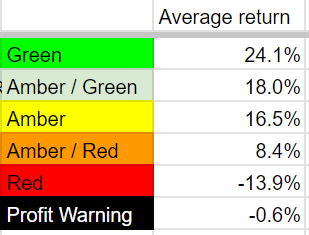

Key numbers for FY 3/2024 -

Revenue down 9% to £53.2m

Turnaround underway, to improve margins & reduce costs.

This useful table below splits out H1 & H2 performance. As you can see, gross profit fell £434k, so that should have led to £506k H1 operating profit almost disappearing in H2. Yet operating profit (pre exceptionals) actually doubled to £1,032k. This must have been achieved by stripping out a substantial c.£1m of costs in H2. Whilst that’s good, you can’t keep cutting costs, so it will need to drive both revenue & gross margin higher in future, to sustain further profit increases.

“Key cost reductions in administration and distribution also provided significant gains in operating performance overall.”

Balance sheet - is good, which I’ve flagged before. NAV is £22.1m, less intangibles (reduced after recent impairment) of £7.9m, and I’ll also take off deferred tax of £1.8m, giving my adj NTAV of £16.0m - that’s more than enough for the size of company, it’s well-capitalised. So dilution risk should be small, unless they decide to do a sizeable acquisition. Given mistakes made by previous management, let’s hope new management are either better at deals, or don’t do any at all for now.

I’ve previously been slightly concerned that too much capital was tied up in inventories & receivables. Both have come down usefully, by a larger % than the reduction in revenue, so that’s a positive thing, if they can maintain the new lower levels.

Cashflow statement - looks very good. Note that both this year and last year almost doubled cash generation from £3m to £6m due to favourable working capital movements, which may not continue, so don’t get carried away with £6m cash generation, it’s not likely to repeat. Capex is modest at £0.6m this year.

What happened to the cash generated? Mostly it’s paid down debt - reflected in a big improvement in net cash.

The headlines say it had £2.2m (vs LY negative £1.2m) but that doesn’t look right to me. The balance sheet shows £3.1m gross cash, and “borrowings” (excl. leases) of £620k + £2,315k. So I make that just £0.2m net cash. If anyone goes on the webinar due 11am, 24 July 2024, perhaps you could query this point? It’s not a deal-breaker, but I’m curious why CRL discloses net cash in what seems to be gross cash less leases, but ignores “borrowings”. It just looks wrong anyway, hence me querying it.

Paul’s opinion - I heard that Richard Crow’s followers have been piling in this week, hence the big surge in price.

It seems to me that they could be onto a winner. Although that depends on whether new management can drive good revenue & margin growth. The commentary seems to show a sharper commercial focus, whereas old management were addicted to doing deals as one investor friend put it. Which clearly they were no good at, as evidenced by the Emma Hardie debacle. That’s the past though, which is no longer relevant, as we’re buying the future, not the past when we buy a share, hence why I called the goodwill write-off a storm in a teacup recently.

With a nice sold balance sheet, net debt cleared, a better commercial strategy, and a good improvement from H1 to H2, I’m happy to move up two notches to GREEN.

CRL has a track record of making nice profits in the past, and hopefully can get back to previous £3-5m annual profit, which would justify a usefully higher share price, for sure. Can it do that though? No idea, we’ll just have to wait and see! I think an £18m market cap gives you pretty decent risk:reward.

The market got over-excited in 2021, but with not much dilution over this period, there's no reason why CRL shares couldn't recover some of this fall, if performance improves -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.