Good morning! There are lots of updates to keep us occupied today. Hanging up the pen for today - hopefully we will have a chance for some catch-ups later in the week. Thanks!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

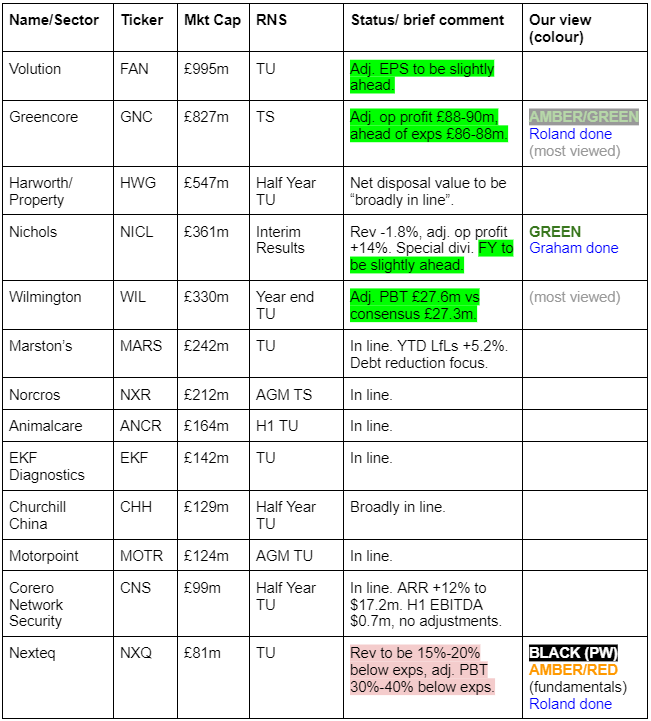

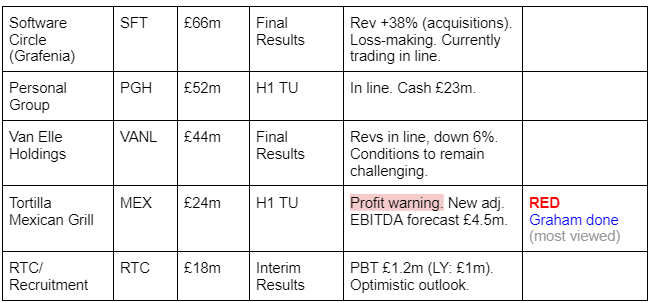

Companies Reporting

Graham's Section (No Summaries today due to time constraints)

Nichols (LON:NICL)

Up 7% to £10.68p (£390m) - Interim Results - Graham - GREEN

Soft drinks group Nichols has published a huge table of “key financials”, here are the best bits:

Revenue down 1.8% to £84m

Adj. PBT +18% to £14.5m

PBT +5.8% to £11.8m

Cash £70m (last year: £56m)

Given the strength of trading, and the growing cash pile, the company announces a one-off special dividend worth £20m, or 54.8p per share.

On top of regular dividends of about 30p p.a., that means a payout of c. 85p for shareholders this year.

This amount is not fully covered by this year’s earnings but it’s affordable in the circumstances and for me is a fresh indication of the company’s shareholder orientation. Nichols still very much looks and acts like a family business, even if times have moved on.

CEO comment:

Positive trading momentum in our UK Packaged business reflected further market share gains in squash and carbonates, driven by increased marketing investment, growth from innovation, and distribution gains. Our biggest ever UK promotional campaign was launched towards the end of the Period, and we are confident this will support the continued growth of the Vimto brand over the summer.

Whilst mindful of continued pressure on consumer spending, despite levels of inflation stabilising, our diversified business model and the enduring strength of the Vimto brand have enabled us to deliver a strong performance. As a result, we now expect full-year profitability to be slightly ahead of current market expectations and we remain confident that Nichols is well placed to deliver its strategic growth ambitions."

Estimates:

Checking the latest broker note from Singers, they have upgraded their EPS estimates by 4% for each year from 2024 to 2026, and they note that Nichols is trading at a discounted earnings multiple against its own historic average and against the buyout multiple given to Britvic (LON:BVIC) by Carlsberg.

Graham’s view

We have a lot to look at today so I’ll keep this brief. I’m delighted to see the investment thesis playing out here, as this is a stock I’ve backed on multiple occasions. Please see my comments in April. There is still a long way to go if Nichols will ever achieve its historic operating margins, but it’s moving in the right direction.

Strategic decisions to exit unprofitable contracts (at the cost of lower revenues) are proving to be the right ones. The company’s assurances that weak trading in Q1 was caused by temporary timing issues have proven to be accurate. And now they are rewarding patient shareholders with a large dividend, instead of embarking on risky and expensive projects as many AIM-listed companies would be tempted to do.

Before finishing, I should admit that I engaged in a bit of self dealing while on my recent holiday in Mallorca. It wasn’t the drink that I wanted the most, but I really wanted to help Nichols produce a good H1 result. So I bought several cans of the purple stuff. And I didn’t regret it: it was wonderfully refreshing every time.

Tortilla Mexican Grill (LON:MEX)

Down 20% to 50.3p (£19m) -H1 2024 Trading Update - Graham - RED

It’s bad news from this restaurant group, I’m afraid.

Key bullet points:

LfL revenues down 5.9% (GN note: this is despite MEX raising prices vs. last year)

Adj. EBITDA £1.8m, same as H1 last year.

Outlook: full-year adj. EBITDA £4.5m. Previous forecast from Panmure Liberum was £5.1m.

Net debt was £3.3m at the end of H1 and is forecast to increase to £7.5m at year-end.

CEO comment:

We are now seeing the positive implementation of our strategy across all five pillars as we continue to strengthen Tortilla's offering and position the business to capitalise on the long-term significant opportunities in our market as the dominant European market leader in fast-casual Mexican cuisine.

In the first half of 2024, we have significantly improved the quality of our food and are driving exciting innovation with our new Food Director, James Garland now onboard. We have accelerated the deployment of kiosk-ordering technology and will be launching our new loyalty platform at the beginning of August. Whilst the timing of these initiatives has been slower than planned, the early signs are positive, and we look forward to updating shareholders on progress in September."

Graham’s view

I’ve quoted several paragraphs of the CEO comment because I would like readers to be able to read the bullish argument, too, in addition to what I’m going to say about it.

In general, I’m not a fan of restaurant shares. So it’s true that I’m already biased against MEX, even before I read its profit warning.

Firstly, this is a sector where EBITDA is useless - the depreciation charge “D” is real. Fixtures and fittings need to be replaced every few years, and shareholders will have to pay for it one way or another. Expansion capex is a separate category of spending, but of course there is also greater uncertainty around the ultimate payoff for that spending. The bottom line is that I give zero credit to any restaurant company for having positive EBITDA.

Secondly, this is a sector where there is inherent leverage from leases, legal liabilities which used to sit off the balance sheet but which modern accounting rules require to go on the balance sheet, where shareholders can see them more easily.

The last set of full-year results from MEX showed lease liabilities with a present value of £35m.

MEX has combined this with financial leverage in the form of bank loans.

It has embraced this risk by making an acquisition in France (!) for €4m before the UK company has succeeded.

In terms of how the business is trading, the recent fall in LfL revenue is attributed by the company to the decision to use a “dual delivery platform to improve profit conversion and increase focus on in store revenue”.

If I was to describe what happened in plain English and perhaps in a more cynical way, I would say that they simply dropped Deliveroo (their 3rd major delivery partner) because they couldn’t afford Deliveroo’s commissions. That decision, combined with fewer visitors in store, explains their falling sales.

Net assets? The Dec 2023 balance sheet showed no tangible asset backing here.

I’m afraid I do not see any attraction to this share, and I think it’s very risky, so I’m putting a RED on it.

Roland's Section

Greencore (LON:GNC)

Up 4% to 187p (£850m) - Q3 trading update [ahead] - Roland - AMBER/GREEN

Upgrading FY24 outlook of £88-90m Adjusted Operating Profit, ahead of prior guidance and current market expectations

Sandwich and convenience food producer Greencore has issued a positive Q3 trading update today including an upgrade to full-year guidance and confirmation that the company will restart dividend payments this year.

This is a fairly modest upgrade – the company helpfully cites its previous guidance for an adjusted operating profit of £86m-£88m. This has now been upgraded to £88m-£90m.

However, an upgrade is an upgrade – and in fairness, there were some headwinds during the quarter. Wet weather affected sales in some categories and a major salad recall due to E coli concerns was a further challenge.

Q3 highlights: chief executive Dalton Philips is focusing on profitability as well as volume. During the last financial year, he sold the Trilby Trading vegetable oil business and exited some low-margin contracts.

Largely as a result of these changes, Greencore’s reported revenue is down this year. However, rising profits and like-for-like sales growth in most categories suggest to me that Philips’ strategy is delivering results:

The company says performance in the sandwich category was broadly flat against a 1% market decline. Meanwhile, there were positive LFL volumes in chilled ready meals, sauces and sushi.

Cash conversion from profits is also said to be improving due to operational and cost initiatives. The company has restructured its soup business and launched a number of new premium food offerings during the period.

A £30m share buyback is underway and a dividend will be declared for the year to 30 September 2024.

Updated forecasts: a note from house broker Shore Capital today (with thanks) suggests a payout of 3.5p per share for FY24, supported by (unchanged) adjusted earnings of 10.5p per share.

Those estimates price the shares on a FY24e P/E of 17 with a 1.9% dividend yield.

Roland’s view

Greencore was hit hard during the pandemic due to its heavy dependence on out-of-home sales. But it’s delivered a series of improving results since 2021 and operating profits have now risen above pre-pandemic levels.

Greencore’s long-term share price history suggests brutal cyclicality. But investors who have bought at the right times have done well.

Today’s update suggests to me that the current cycle may have plenty of distance to run.

While the forecast P/E of 17 is not obviously cheap for a low-margin business, I can see a couple of catalysts for further gains:

Having made changes to exit low-margin businesses, Greencore is now better-positioned to focus on growth from higher-margin categories, including new ranges

This improving profitability could drive operating leverage (when profits rise faster than sales)

I’m positive on the outlook here and believe the fundamentals are improving. But this is still a low-margin business, and I think it’s probably fair to say that some of the good news is already priced in.

On balance, I’m happy to maintain our previous view of AMBER/GREEN on Greencore.

Nexteq (LON:NXQ)

Down 35% to 80p (£53m) - Trading update [warning] & Board transition - Roland - BLACK (pw) / AMBER/RED (fundamentals)

It looks like something has gone wrong at technology firm Nexteq, which has issued a big profit warning and announced the departure of its chair, CEO and CFO.

This is a technology firm that produces software and hardware controls such as touchscreens. It has two core businesses, Densitron (industrial customers) and Quixant (casino/gaming). The company was renamed from Quixant to Nexteq in 2023.

H1 trading update/profit warning: the company says it has continued to see industry de-stocking during the first half of this year. In addition to this, some larger Quixant customers (gaming operators) have reported lower demand and have apparently decided to delay planned product launches/upgrades.

The impact on trading seems quite severe:

H1 revenue expected to be down 15% to $48.2m

Quixant H1 sales expected down 10% to $30.9m

Densitron H1 sales expected down 22% to $17.3m

There is some positive news on margins and cash generation:

Increased gross margin is expected to result in “double-digit adjusted profit before tax margins”

Net cash at 30 June 2024 of $36.9m (31 Dec 2023: $27.9m)

This net cash balance covers more than half the company’s market cap after today’s slump!

Full-year outlook: the company says its strategy is to diversify by targeting new customers in the Gaming and Broadcast sectors. An improvement in order intake was expected in H2, but this hasn’t happened yet.

Although we are still relatively early in the second half, it doesn’t sound like the company expects any recovery later during the period.

Nexteq has now cut its guidance for full-year revenue by 15%-20%:

As a result, H2 2024 revenues are expected to be broadly in line with H1, which would result in FY24 revenues 15%-20% below market expectations

Despite the strong margin performance mentioned above, the company expects a big hit to profits due to the reverse operating leverage impact of reduced sales (my emphasis):

expects adjusted profit before tax to be 30%-40% below market expectations, primarily driven by the lower revenues.

According to todays’ update, previous consensus expectations were for revenue of $115.4m and adjusted profit before tax of $14.9m.

Using the mid-points of today’s guidance, my sums suggest revised revenue expectations of c.$95m, with adjusted pre-tax profit of perhaps $9.6m.

Helpfully we have an updated broker note from Canaccord Genuity today.

CG has cut FY24 eps estimates by 40% to $0.11 per share. FY25 earnings estimates have also been cut by 40% to $0.12 per share.

These estimates potentially price the shares on less than 10 times forecast earnings, after today’s 35% slump. But I would not rule out the risk of further downgrades at this early stage, perhaps when new management takes charge.

The company sounds bullish about the outlook for 2025, for what it’s worth:

The Board expects to see an improvement to order intake in 2025 as key customers' buying patterns normalise and the Group benefits from the healthy pipeline of new customers across both Quixant and Densitron. The Group benefits from a robust operating platform and diversified product portfolio, and the Board continues to have confidence in the Group's organic growth opportunities in the medium term.

However, with both top execs due to leave, I would not attach too much weight to this view without further evidence of a turnaround.

Board transition: Commenter AstonGirl says it sounds like a night of long swords at Nexteq. I can’t disagree with this!

The CEO, CFO and non-executive chair have all announced plans to leave over the coming months, once successors have been identified.

Founder and Deputy Chair Nick Jarmany (16.9% shareholder) is fulsome in his thanks to each, and says that their decisions to leave have been “carefully considered over some time”.

It’s an unusual situation, in my experience. These three directors are responsible for setting and executing strategy and control all investment decisions. Apparently they are not leaving in disgrace, but they have all decided to resign at the same time.

My best guess at what lies behind this change might be that the top team is no longer in agreement with founder Mr Jarmany about the future direction for the business.

The company says it expects to appoint a new independent non-executive chair shortly.

I wonder also whether Mr Jarmany might consider taking a more active role again, perhaps as interim CEO.

Roland’s view

With hindsight, Paul spotted the warning signs on trading here when we last covered this company in March 2024:

The wobbly, over-PR'd outlook statement spoils it for me though, with a soft H1 in 2024 now seeming likely, and it dodged the question of meeting 2024 profit expectations, instead only confirming revenues - which strikes me as deceptive, and introducing doubt. Very odd to be raising broker forecast at the same time as giving a wobbly-sounding outlook

Back in March, Nexteq said it had a “confirmed order book covering five months of revenue”. However, revenue was expected to be weighted to H2.

It seems that order intake has fallen far below expectations. Without further research into the company and the wider sector, it’s not clear to me whether this reflects external conditions or company performance. Or both.

However, given the uncertain outlook for the business and the expected change of management, I have no choice but to take a cautious and somewhat sceptical view at this point.

Nexteq’s performance was inconsistent, even before the disruption of the pandemic:

Perhaps the problems we’re seeing now are the culmination of decisions made a few years ago? I’m not sure.

The only saving grace of this situation is that Nexteq’s balance sheet appears to remain very strong, with net cash covering half the market cap and roughly one year’s operating expenses (based on FY23 results).

This pile gives the group breathing room and optionality – the benefits of this cannot be underestimated in a situation where things haven’t gone to plan.

The strong balance sheet means I’m not worried about an imminent collapse here. I think the equity looks safe for now. But the outlook is clearly uncertain, and in my view, today’s news raises questions over the group’s strategy and perhaps its product portfolio.

I’d need to do more in-depth research to understand these issues. For now, I’m going to adopt an AMBER/RED view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.