Good morning from Paul, and with Graham making a Friday guest appearance too, thanks Graham!

(placeholder is up early because I'll be travelling early in the morning, disrupting my usual routine here a little)

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

SThree (LON:STEM) - Notes from Graham's management meeting this week are available in a section below.

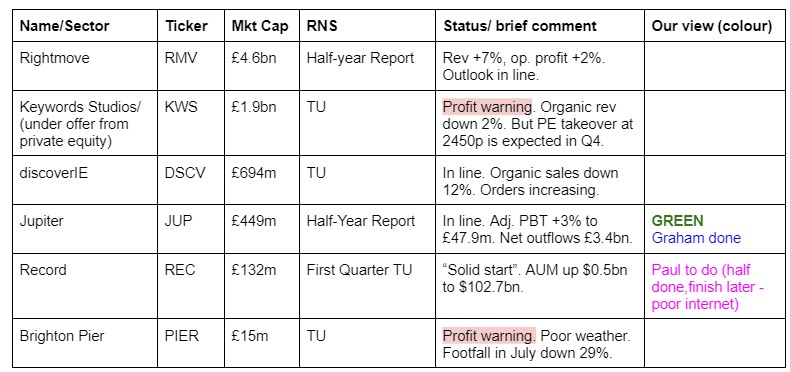

Summaries

Jupiter Fund Management (LON:JUP) - up 9% to 89.8p (£489m) - Half-Year Report - Graham - GREEN

H1 results are “in line with or, in some cases, ahead of our expectations”. Revenue declined, but cost control and higher interest income helped generate an improvement in PBT. I think management has achieved a lot over the past year, and this remains one of my favourite “value” financial stocks.

Jupiter Fund Management (LON:JUP)

Up 9% to 89.8p (£489m) - Half-Year Report - Graham - GREEN

A solid first half with reasons for cautious optimism

We last covered this stock in April, for the Q1 update, when I kept my positive stance on it.

Here are the key bullet points from today’s half-year report.

The financial results are “in line with or, in some cases, ahead of our expectations”.

AuM £51.3bn (June 2024), down slightly from £52.2bn (Dec 2023).

Net outflows £3.4bn.

H1 net revenue £173.7m (H1 last year: £181m)

H1 PBT £38.7m (H1 last year: £34.8m)

The last line sticks out to me: despite falling revenues, Jupiter has nevertheless posted an increase in pre-tax profits.

Jupiter’s CEO (appointed in late 2022) was one of the catalysts that I hoped would lead to positive change here. So far, so good. Here are some of his comments on the half-year results:

"Jupiter delivered a solid financial performance during the first half of the year… Our underlying profit before tax increased by 3%, supported by a continuous focus on cost management which saw total operating costs continue to fall. I believe we have a business and a structure which positions us well for success given our work to date to right-size our business, invest in strategic growth drivers, and bring in highly regarded investment talent.

There are reasons to be cautiously optimistic. Our underlying outflows were small at just £0.2bn and we saw an increase in gross flows to £7.5bn…

As we look forward, like other market participants, we are beginning to see early signs of client sentiment shifting more favourably in the UK…

Flows: the company is eager to point out that “underlying” net outflows were only £0.2bn, if you look past two major sources of outflows. One of these involves Jupiter staff leaving to set up their own fund management company. The other saw the management of an investment trust changing hands.

While I agree that these events are one-off and lumpy in nature, the staff departures are arguably a symptom of Jupiter’s overall malaise.So I wouldn’t be too quick to treat the £0.2bn outflow figure for H1 as being representative of Jupiter’s “real” net outflow.

I also think it’s worth pointing out that the trend isn’t currently positive. Underlying inflows in Q1 were followed by underlying outflows in Q2. But it wouldn’t require a huge change in sentiment for this to turn positive again (I think underlying outflows were £0.5 billion in Q2).

Cost control: administrative expenses reduced by £3m to £129m. Staff compensation increased but other costs decreased. And in another example of positive change from CEO Matthew Beesley, I see that the total number of Jupiter funds is going to reduce further by the end of the year.

Interest income: another boost to profits came from finance income, which shot up from £1m to £4m.

Exceptional items: reduced from £12m to £9m. The only exceptional item is the amortisation of an acquisition. The results are clean.

Graham’s view

Perhaps I got too positive on this one, too early (I’ve been positive on it for nearly two years). But I’m glad I’ve stuck with it recently, as management’s cost-cutting and simplification plans are bearing fruit.

Quantitatively it’s a dream stock, except for the lack of share price momentum:

It’s trading at a high single-digit earnings multiple, offering a good yield:

Investors currently get £105 of AuM per £1m invested in Jupiter stock (based on June 2024 AuM).

That’s not quite as depressed as it was in April (£120) but still very cheap compared to some of Jupiter’s peers and of course compared to historic levels.

Times have changed, and maybe the historic valuations given to active fund managers will never be seen again? After all, there is ongoing downward pressure on fee margins, and Jupiter can’t escape that (it will earn c. 66 basis points on AuM this year, vs. 70 basis points last year).

But I think companies such as these, if they are managed well, should still be able to pump out decent numbers and cash flow for their investors, for some time yet. Perhaps this is the financial equivalent of a tobacco stock?

SThree (LON:STEM)

410.5p (£554m) - Management Meeting - Graham - GREEN

I had the chance to speak with Timo Lehne, CEO and Andy Beach, CFO of the science-focused recruiter SThree, earlier this week.

We covered their interim results in this report on Tuesday.

With so many company announcements being made in the last few days, I didn’t get a chance to type up my notes for you. So here they are now.

1-year chart:

Value metrics:

Q1. How do developments in AI impact hiring currently?

A. There are a lot of conversations around AI. In the short-term, its impact may be overestimated. In the long-term, it may be underestimated. Many tech jobs make a reference to AI but they are not “real” AI roles, they just interact with AI in some way.

Q2. SThree’s net fees have declined 7% like-for-like, but the economies in which SThree operates (such as Germany, Netherlands, USA) are not particularly weak right now. What explains the disconnect between strong economies and weak net fees?

A. This is the most extreme disconnect we have seen in recent years between the economy and net fee growth. It’s the first time we’ve had both low unemployment and soft staffing. We think the reason is uncertainty about the future: companies may have been cautious about investing with several major elections coming up this year. Companies may also have been concerned about how the Ukraine conflict would impact them. Inflation has also been a problem. However, in countries such as Germany, Netherlands, UK and Japan, SThree’s decline in net fees has been softer than its peers. In the US, SThree’s decline in net fees was second-best, for the reason that SThree’s US business is more focused on Life Sciences.

Q3. Life Sciences has been declining ever since Covid. How important is this category to the future of SThree now that it’s a smaller percentage of net fees (17%) and why is it still declining several years after the Covid boom?

A. Life Sciences is still a sector that we back, it’s still very important to us. It has now returned to a level that is similar to where it was pre-Covid, so this is a normalisation after the boom. SThree is ready for it to rebound whenever it picks up again. Watch out for new activity from US pharmaceutical companies..

Q4. Has recent weakness in demand been purely corporate-driven, or is it also a factor that candidates have been reluctant to change jobs?

A. SThree’s focus on Contract recruitment means that this is not really a factor. But candidates are still willing to change jobs, SThree has not seen any change.

Q5. With the growth in net cash (£90m), is there a point at which the company has too much cash and is SThree approaching that point where it needs to reduce the cash balance?

A. While the company has a large cash balance, much of it is needed for business as usual. £15-20m is needed to fund growth in contractors. In total, the company needs about £60m for business as usual and to fund its growth. The company’s cash needs tend to be countercyclical. But yes, the company does consider what it might do with its excess cash. When the Technology Improvement Programme is completed, that could be a good time to look at M&A as acquired companies would benefit from the efficiencies delivered by that programme. The Board also considers the potential for a return of capital, either in the form of a buyback or special dividend.

Q6. SThree has an average market share of 3% (from 0.1% to 6%) across its regions and has suggested that it can increase market share. But the recruitment sector tends to be very fragmented. Is it realistic to grow market share and what is a realistic objective?

A. Absolutely, SThree can grow market share. We have plans with targets for 2029/2030 that we will discuss soon. And we do think we are undervalued. SThree is a uniquely positioned house of brands, offering flexible talent to employers, and with an automated back office and invoicing system in an outdated, analog industry.

Graham’s view - I appreciated the chance to speak with management here, and I hope that my notes do justice to the conversation. It certainly helped to improve my understanding of my favourite recruitment stock. I should try to cover the sector a little more frequently, so that we can compare and contrast SThree versus its listed peers.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.