Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

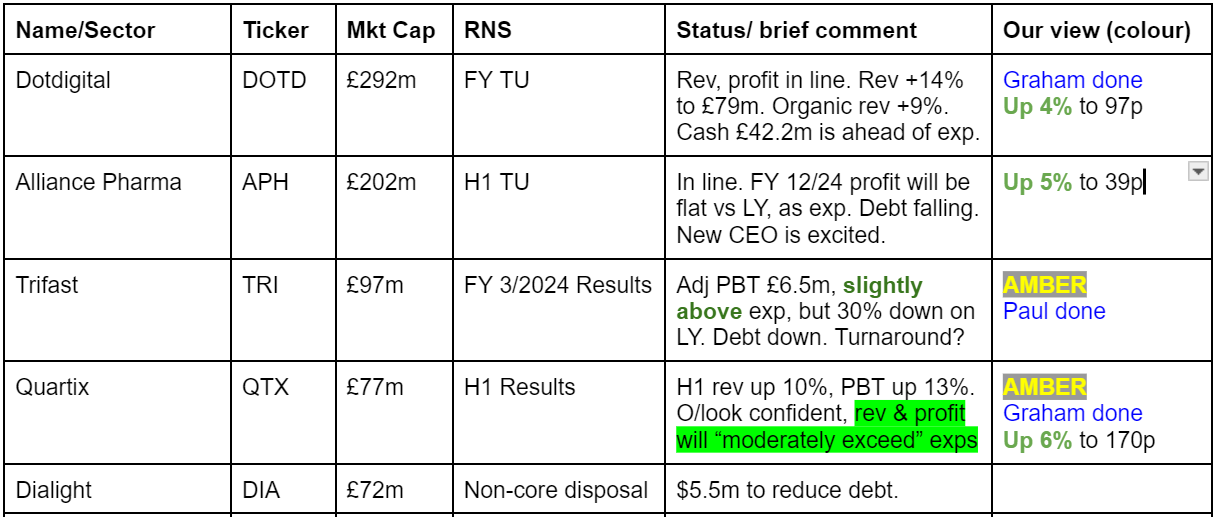

Companies Reporting

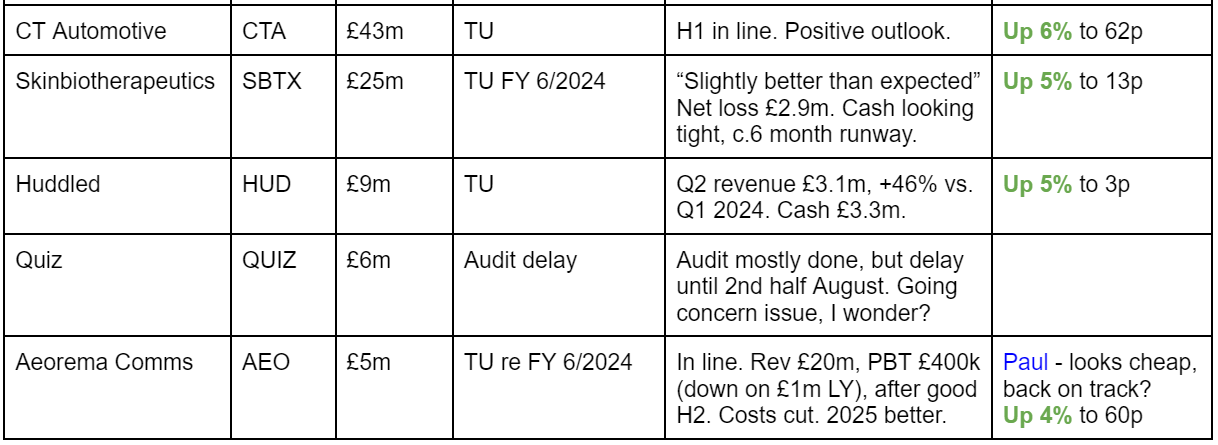

Other mid-morning movers (with news)

SIG (LON:SHI) - down 7% to 24.5p (£290m) - Sky News says this building materials group is lining up a substantial equity raise. Paul - AMBER/RED

We covered its profit warning here on 24/6/2024, concluding that with soft trading, a weak balance sheet, and no divis, the shares had little appeal. With the risk of discounted placing (on unknown terms) now added into the mix, I will definitely be avoiding this one for now.

Trakm8 Holdings (LON:TRAK) - down 12% to 7.5p (£4m) - FY 3/2024 Results - Paul - RED

Serial under-performing telematics minnow.

Revenue down 20%, and moved from £0.3m adj PBT last year, to £(1.3)m this time. Outlook comments sound mixed. Board says they’re confident revenues & profits can improve. Good job, as they’re probably going bust if they don’t show an improvement. Balance sheet looks horrible, with NTAV negative c.£(6)m.

Paul’s view - is the equity worth anything? I’m struggling to value this above nil. Heavy dilution or insolvency look the most likely outcome, based on these lousy numbers.

Petrofac (LON:PFC) - down 18% to 18.2p (£95m) - Guarantees & loan forbearance - Paul - RED

Petrofac shot up 67% on Fri afternoon on news of deals with a big customer over guarantees, and extension of forbearance agreement with bondholders. We already knew PFC was dangling by a thread, in serious financial difficulties. So this is a high risk special situation, which could end up with a debt for equity swap, or even insolvency. Or the upside case could see equity multibag. One for specialists only, you really need to know what you’re doing with this type of share. I have to mark it RED due to the high risk, but I have no idea what the outcome is likely to be.

Reckitt Benckiser (LON:RKT) - down 8% to 4,109p (£28.6bn) - Legal action - Paul - No view.

Large cap consumer goods group. Shares are taking a battering this year, down a lot to a 10-year low apparently. The problem seems to be large numbers of legal claims in the US over problems caused by baby milk products, and an adverse judgement recently. I wonder if the 4.6% dividend yield might come under threat, if legal costs escalate? Let’s move on, I’m only briefly flagging a large % mover, not doing any analysis.

Summaries

Quartix Technologies (LON:QTX) - up 9% to 175p (£85m) - Interim Results - Graham - AMBER

This telematics company has achieved some upgrades to its earnings expectations for this year and next year, thanks to solid growth in annualised recurring revenue and good cost control. I can see bull and bear arguments here - can motivated, previously successful management justify a high earnings multiple?

Trifast (LON:TRI) - up 2% to 72.5p (£98m) - FY 3/2024 Results - Paul - AMBER

Some useful improvements here compared with my last review after a profit warning in January. A turnaround plan seems to have only stabilised things so far, with more progress expected medium term, hence nothing much of interest to grab my attention shorter term. Debt & inventories are usefully down. I've upped my view from amber/red to AMBER, given the progress so far. We'll keep an eye on it, but nothing has excited me as yet.

dotDigital (LON:DOTD) - unch. at 93.2p (£286m) - Trading Update - Graham - AMBER/GREEN

A solid update from this provider of online marketing tools to businesses. Last year’s acquisition has performed well, and the company continues to benefit from a large cash pile and repeat revenues from a wide variety of corporate customers. However, I’m inclined to think the attractions could be priced in here.

Paul’s Section:

Trifast (LON:TRI)

Up 2% to 72.5p (£98m) - FY 3/2024 Results - Paul - AMBER

I’m happy to look at this fastenings group with fresh eyes today. I took a dim view of its profit warning here on 22/1/2024, concluding amber/red, since forecast profit for FY 3/2024 was almost cut in half. I also noted that inventories seemed excessive, and the outlook weak. Although the balance sheet protected the downside, being quite strong. Let’s see if things have improved since?

Note from our archive here, that there are 4 fund manager interviews from Paul Hill which mention Trifast, including the effective turnaround specialists Harwood. I can remember walking around ASDA and listening to the podcast version of Richard Staveley, where he explained the turnaround potential. Although I’m still not clear what has actually gone wrong to begin with. Competitive pressures, presumably? I wouldn’t imagine that a fastenings maker has much pricing power, but could be wrong. The main reason for the profit warning seems to have just been reduced demand. The inventories were much too high, at £83m (as at 30/9/2023), c.6 months cost of sales, which could contain slow-moving or obsolete items possibly?

FY 3/2024 Results - which were delayed by the audit almost a month, something that seems fairly common these days.

This looks OK, in particular inventories coming down -

Outlook - I like the format of bullet points here, but there’s nothing particularly exciting here - it sounds more like sorting out basics that shouldn’t have deteriorated in the first place -

Medium term is usually code for nothing much good happening in the short term.

More outlook comments -

“Whilst the macroeconomic environment continues to present short-term challenges, current trading remains in line with management expectations. We continue to have a strong focus on cash generation to reduce net debt and working capital and are driving EBIT improvement through margin management, focused growth, organisational effectiveness and operational efficiency.

Operationally, we have been setting ourselves up for growth when the market recovers by rightsizing the business through a restructuring programme, the completion of the Atlas Project and the consolidation of the NDC…

We believe there is significant scope for improvement in the mid-term and are confident we will be more profitable, effective and efficient in FY25.

The macroeconomic and geopolitical environment remains volatile, and we continue to be challenged by inflationary pressures. We are confident we have the right strategy to capture margin upside and deliver sustained growth. We believe there is significant opportunity to return performance to historic levels.

Trifast has made strong progress in managing working capital to reduce its net debt through working capital initiatives and remains focused on driving profit initiatives to improve our margins.”

A big fall in net debt by £17m to £21m should mean that finance costs reduce, as PBT dropped 30% mainly due to higher finance costs in FY 3/2024 vs LY. Assuming it’s a permanent step down, and not just year end window-dressing that quickly reverses.

Balance sheet - this is looking good. NAV £124m, less intangible assets of £36m, gives NTAV £88m, getting close to the £98m market cap.

Overall I think shareholders probably have little to worry about re dilution or insolvency. Although it would be worth checking the terms, covenants, etc of the bank facilities. I’ve just had a quick look in the Annual Report, and there’s quite a bit of detail about bank covenants, which look as if they’ve been amended, so there could be an issue here to at least check the detail properly and make sure you’re comfortable with downside risk if trading were to deteriorate further.

Going concern - you have to click through to the full Annual Report, on Trifast’s website, and I confirm it gives a clean going concern statement, which the auditors have signed off.

Paul’s opinion - I can’t shake off the view that this just doesn’t look a particularly good business, so why would I want to own part of it?

Turnaround efforts sound like they may have some potential, but why did it get into this position where turnaround efforts are needed? Is it a badly run business that’s slowly turning into a better run business? Getting back to previous higher profit margins isn’t likely to be easy - those margins have clearly fallen due to competitors squeezing TRI. What other explanation is there?

If I invest in industrials, I want something with pricing power, and something unique. There’s not any evidence of that with Trifast, so it has to execute perfectly, which doesn’t seem to have happened.

Harwood have bet big on it, with 14.1%, plus Slater (13.3%) and Schroders (9.8%) are also big holders. So who am I to disagree? Maybe there’s a trade here for a recovery, but I wouldn’t want to own this share long-term.

Zooming out to the 10 year chart below, a lot of shareholder value has been destroyed by TRI. Although it has paid decent divis along the way. It could be tougher than people think to turn this ship around, so for me, I’m not convinced at this stage. AMBER is the best I can get to, but that’s a notch up on last time, because trading hasn’t got any worse, it’s still profitable, and inventories/debt have both come down decently.

Just to remind everyone, I am not predicting what the future holds. My view is just an assessment of the facts, figures & forecasts, as of today. From today things start changing.

Notes from Zeus & Cavendish are available on Research Tree. Zeus leaves forecasts largely unchanged, just some minor tweaks.

Graham’s Section:

Quartix Technologies (LON:QTX)

Up 9% to 175p (£85m) - Interim Results - Graham - AMBER

Quartix Technologies plc (AIM:QTX), a leading supplier of subscription-based vehicle tracking systems, analytical software and services, is pleased to announce its unaudited results for the half year ended 30 June 2024.

It has been quite some time since I’ve covered this one, as Paul normally does it. He was “AMBER/GREEN” following the AGM update in March.

Its market cap has been demolished in recent years:

Today’s interim results show signs of progress:

Revenue +10% to £16.1m

Adj. EBITDA unch. at £2.7m

Operating profit +13% to £2.7m.

Annualised recurring revenue (ARR): often the key metric for subscription-based businesses, this is up 11% year-on-year to £30.94m.

Key performance indicators: aside from ARR, the other KPIs that stand out are the “fleet subscription base” (number of vehicle tracking units) up 12%, and the average subscription price down 1.3%.

I previously noted some softness in the pricing here, and was concerned that telematics products were getting cheaper so quickly that it negatively affected the investment case for companies in the sector. The average subscription price falling by 1.3% is hardly a good thing, but it fell by 4.6% a year ago!

According to the broker Cavendish, Quartix successfully implemented its first price increase across most of its customer base during H1. So while the average price charged did fall during the period, perhaps pricing has reached a bottom for now?

Executive Chairman comment by co-founder Andrew Walters:

"The Company made very substantial progress in the first half of the year: new subscriptions increased by 13% compared to 2023 and this led to record growth in annualised recurring revenues ("ARR"), which increased by 11% to £30.9m over the past year. Two thirds of this increase in ARR was achieved since January 1st…

The issues faced by the Company in 2023 have now been put behind it, enabling it to refocus strongly on its core business and to structure for further growth.

The Board is confident in the outlook for the remainder of the year and now believes that both revenue and profit will moderately exceed market expectations*

Estimates: Cavendish have upgraded the revenue forecasts for 2024 and 2025 by 2%. They also nudge up the gross margin forecast to 69%. With costs expected to remain under control, the adj. EBITDA forecasts for 2024 and 2025 are raised by 7% and 6% respectively.

Graham’s view

It has been some time since I’ve studied this one, but familiar themes are apparent.

1. Pricing power - does Quartix have it? If it doesn’t, that makes the long-term investment case so much harder to make. There are mixed signals on this front, with ASP falling despite the implementation of a rare price increase. My impression is that there are few barriers to entry in the telematics space, and that competition does keep a lid on prices.

2. Valuation - Quartix tends to trade at a rich earnings multiple, and that can also makes it harder to have a rosy outlook on the prospects for investors.

Last night’s earnings multiples:

As readers will know, I am sometimes happy to look past earnings multiples and instead focus on cash-adjusted price to sales or price to ARR, depending on the circumstances.

For a true software-based business, I can use a cash-adjusted price/ARR multiple, instead of or in addition to the traditional earnings-based multiples.

Net cash at Quartix is modest at £2.7m, so the enterprise value is about the same as the market cap, £82m.

ARR is £31m, so the ARR multiple is less than 3x.

That would be considered very cheap in a US context for a subscription-based software business.

However, Quartix is both a hardware and a software provider. It does not earn close to 100% profits on incremental sales. For this reason, I’m not sure if I can apply NASDAQ-style valuation methods to it.

On traditional profit measures, it remains on the expensive end of the spectrum to my eyes. Stockopedia computers agree with me:

Hopefully there will be some operational leverage to boost profits in the years ahead - the company is doing its best on that front by controlling costs. Top-line revenue is growing at a good but not a rapid rate.

Management does win points for bulls here, as the company’s founder and largest shareholder is at the wheel again. The company is likely benefiting from highly motivated and passionate management at this time.

Overall, I’m more comfortable with a neutral stance here, as I think there are good arguments on both sides of the debate.

dotDigital (LON:DOTD)

Unch. at 93.2p (£286m) - Trading Update - Graham - AMBER/GREEN

This is a company providing online marketing tools, although it uses more impressive terminology than that:

Dotdigital Group plc (AIM: DOTD), the leading SaaS provider of an all-in-one customer experience and data platform (CXDP), announces a trading update for the year ended 30 June 2024 ("FY 2024"). The trading performance reported in this statement is based on unaudited management accounts.

Today’s full-year update is in line with expectations: here are some of the key points.

Revenue +14% to £79m

Organic revenue +9% at constant exchange rates.

Cash of £42m is ahead of expectations.

The adj. PBT estimate for the year is £16.4m (last year: adj. PBT of £15.4m)..

Last year, we covered the acquisition of a company called “Fresh Relevance” by Dotdigital (here), that provides complementary products to many of the same customers as Dotdigital. The integration of Fresh Relevance is “now complete and driving pipeline growth”.

Bigger clients are being attracted by the combined group, although the company notes that there have also been “elevated levels of churn” due to economic pressures on smaller customers.

Outlook is confident:

The Group enters the new financial year with continued positive momentum. Wider macro global conditions remain challenging, but due to the diversity of our revenue base and the low dependence we have on individual customers, the impact of this has been limited. We are seeing growing evidence that the investment we have made into our product offering is yielding results, particularly in respect of average new logo values and pricing power.

Graham’s view

I have generally taken a positive view on this one, citing its large net cash position, track record and quality.

It remains a company of exceptional quality, at least according to the numbers, although that is arguably priced in at these levels.

Admittedly, this sector does tend to trade at rich multiples:

Overall, not much has changed since I covered this one last time. It continues to execute its plans and make progress.

However, growth in adj. PBT is perhaps a little more muted than I would like at this valuation. It has only grown profits according to this measure by about 6% in FY 2024, despite the acquisition made and despite revenue growth at a double-digit rate.

For FY 2025, broker estimates suggest growth in adj. PBT of c. 10%.

Therefore, despite the company’s impressive cash pile, I think I need to adjust my stance on this stock down by a touch. I’m going AMBER/GREEN today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.