Good morning! Apologies for the delay.

I'll hang up the pen there. See you tomorrow! Cheers.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

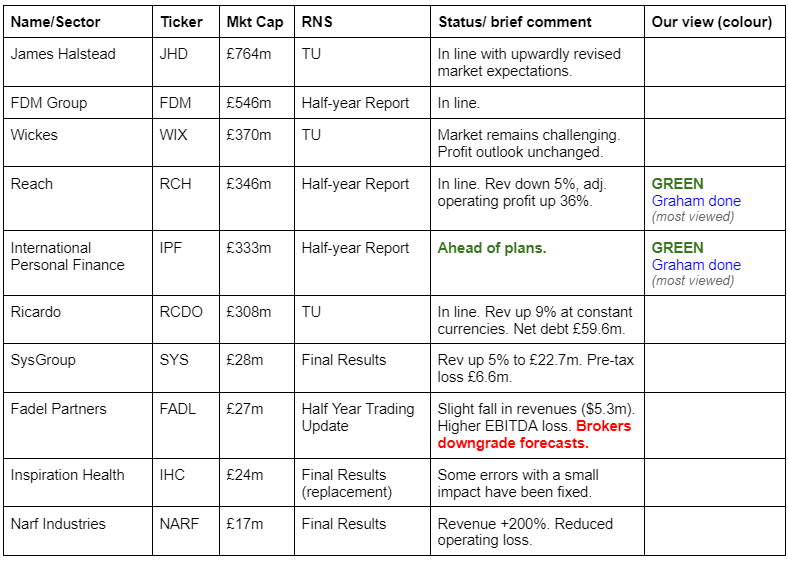

Companies Reporting

Summaries

International Personal Finance (LON:IPF) - up 8% to 149p (£338m) - Half-year Report - Graham - GREEN

Excellent H1 results with profits setting up to be ahead of expectations for the full year. The dividend is increased and the company initiates a £15m buyback, ensuring that its balance sheet will remain efficient so that it can keep earning decent ROE for investors. I had the chance to speak with management this morning and my notes have been typed up below.

Reach (LON:RCH) - up 1% to 105.3p (£335m) - Half-year Report - Graham - GREEN

A very good half-year report from Reach with a strong outlook statement. The main thing is that the company remains on track to deliver full-year expectations of adj. operating profit. As profits remain stubbornly high and as the obligations to Reach's pension schemes continue to reduce, I'm happy to maintain my sunny disposition here.

Graham's Section

International Personal Finance (LON:IPF)

Up 8% to 149p (£338m) - Half-year Report - Graham - GREEN

I was up early this morning for a conference call with IPF’s management and investor relations teams - an exciting opportunity as this is a company I’ve been covering for Stockopedia for several years.

Before typing up the notes to my Q&A, here is an overview of the first-half results.

Pre-exceptional profit before tax up 25% to £47.3m, ahead of IPF’s internal plans.

Interim dividend up 9.7%, in line with the policy to pay 33% of prior year full dividend per share as the following year’s interim.

£15m buyback announced to return excess capital to shareholders.

Operationally, a summary of the company’s achievements is as follows.

Customer lending up 7% excluding Poland.

Receivables up 12% excluding Poland.

Receivables in Poland are stabilising. 180,000 credit cards issued there.

Impairment rate of 10.5% (H1 last year: 11.4%) thanks to “exceptional customer repayment performance and excellent credit quality”.

Outlook is ahead of expectations.

Confidence in delivering an acceleration in growth through the remainder of the year.

Expect full year pre-exceptional profit before tax of between £78m and £82m for 2024, ahead of current market expectations.

Market expectations were pre-exceptional profit before tax of £71.4m. So this is heading for a significant beat of at least 9%.

CEO comment excerpt:

"I am delighted to announce very strong financial and operational progress for IPF in the first half of the year. Executing on our Next Gen strategy has delivered good growth momentum, exceptional customer repayment performance and pre-exceptional profit before tax…. The successful refinancing of our €341m Eurobond, which attracted very good demand and over 150 investors, ensures that we have a strong funding position to support our ambitious growth plans…

We continue to see substantial demand for our broadening portfolio of credit and insurance services from underserved consumers and we are confident that there are further attractive growth opportunities as we continue to execute on our strategy. I would like to say thank you to all my hard-working colleagues whose commitment ensures we continue to increase financial inclusion for our customers in all our markets."

Management Q&A

Before going any further, here are the notes from my meeting with management at 8am this morning. Answers were provided both by CEO Gerard Ryan and by CFO Gary Thompson.

Company intro by CEO Gerard Ryan

Our company has been around for decades and has a very clear purpose everyone is focused on - financial inclusion. Customers are those who are not welcomed by or who choose not to use high street banks. IPF treats them in a very fair and transparent way and unlike other lenders, IPF does not want to keep its customers in perpetual debt. Instead the loans are paid back in instalments, as IPF wants to help its customers to get back out of debt.

IPF is active in 9 countries. 16,000 customer representatives provide Home Credit, while IPF Digital provides loans through people’s phones or online. Circa 1.6 million customers.

The average loan size is €1,000 in Europe, €400 in Mexico.

Unusually, IPF doesn’t penalise late payments. Even if contractually loans are supposed to be paid back in 70 weeks, they know that the average time to repay will be 76 weeks, and customers aren’t charged for this.

Customer representatives are incentivised to earn commission by collecting loans, not by making loans. So the customer representatives are incentivised to arrange loans that customers can afford.

Financially the company is strong with 56% of the receivables balance backed up by IPF’s equity, and it seeks to earn a return on required equity of 15-20%. So it delivers for its customers while also providing its shareholders with a good return.

Q1. What would management say to potential investors who are nervous about investing abroad, e.g. in Eastern Europe?

A. IPF is spread over nine economies, and therefore its risk is balanced across these different countries. So arguably it is safer than purely domestic-focused stocks which have exposure to only one economy. A purely UK-focused bank, for example, could be impacted by national regulations or decisions that affected its entire business, which is not the case with IPF. So potential IPF investors could think of IPF as a fund containing a spread of different company and country exposures.

At the same time, IPF is a UK-listed entity with many UK-based employees, so it does benefit from the governance associated with being a UK company.

Q2. I noted that there were some exceptional charges, £5m associated with restructuring in Poland and another charge related to the refinancing of a bond. As these are classified as exceptional charges, can investors rest assured that these charges are finished for the time being?

A. No, the restructuring in Poland is not finished yet. The company has unfortunately had to make 215 redundancies. There has been 2-3 years of ongoing restructuring in that country and there is likely to be more restructuring in the current year. However the company is going to benefit from greater efficiencies thanks to its Next Gen strategy. The processes it uses in one country will be replicated in other countries.

With respect to the exceptional refinancing charge, the company had to pay up to exercise its call option to redeem its Eurobond in H1. The new bond which replaced it has a 5½ year maturity, including a six-month window during which it can be refinanced without paying up. So the company hopes to avoid a similar refinancing charge the next time it wishes to refinance.

Q3. Some investors may be unclear as to why your target impairment rate (14% to 16%) is so much higher than your current impairment rate (10.5%). Why would you want your impairment rate to rise from current levels?

A. One of the company’s key growth opportunities is in Mexico. However, the impairment rate in Mexico is around 30%. In Mexico, IPF can take more risk as there is no lending cap, and it can look for a faster growth rate of 10-15%. So growth in Mexico is a key reason why the impairment rate would rise.

More broadly, IPF wants to grow and to serve more customers. This mission will likely see a rise in the impairment rate towards the target rate.

Q4. On the subject of regulations, you’ve mentioned that you do not expect draft regulations in Romania to have a material impact on your business. Is IPF currently feeling comfortable with the regulatory backdrop in general and not expecting any major changes?

A. Companies such as ours can never feel “comfortable” as regulations are beyond our control. However, only one of our European countries doesn’t have a rate cap: the Czech Republic. We expect that it will eventually have one. For now, there does seem to be less planned activity in terms of new regulations. The only noteworthy change is the CCCD2 (Consumer Credit Directive 2) from the EU.

Q5. For those investors who may be interested in your retail bond, is your recent credit rating upgrade the main attraction?

A. We are strong from a capital perspective and strong from a funding perspective, always getting refinanced 6-9 months in advance. We also have a track record of cash generation: our profits are cash profits. And even in a worst case scenario, if we were forced to leave a country, we would still be able to convert our receivables into cash as we exited that country. Of course the equity would react differently in that scenario but even equity holders could see cash flow to them in that worst case scenario.

In the bigger picture we offer longevity and sustainability, and our products are not going to go out of fashion.

Graham’s view

It won’t come as a shock to readers that I’m going to be bullish on this stock today, as I’ve already been bullish on it. Today it announces that results are ahead of expectations, and a £15m share buyback due to holding excess capital. So this is hardly going to be the day that I change my mind on it!

The valuation metrics here have been cheap for quite some time, although of course many financial stocks are cheap in this environment:

Stockopedia gives it a near-perfect score:

Granted that it’s not as cheap as it was, but I thought that it was firmly in value territory before. And with an improved profit outlook, it’s only fair that the share price would increase:

Balance sheet net assets are £480m, still much higher than the current market cap. It’s reasonable if investors wish to discount the valuation for foreign currency risk, for regulatory risk, etc. But the return on equity numbers here are solid, from a company with a long track record. Even if future growth were to disappoint, I would see that possibility as being priced in here. If you disagree, feel free to let me know in the comments!

Reach (LON:RCH)

Up 1% to 105.3p (£335m) - Half-year Report - Graham - GREEN

It’s been a few months since we looked at Reach’s H1 trading update here.

The share price has been in a nice uptrend since then:

The company confirms again today that it is on track to deliver full-year expectations. These expectations are for an adj. operating profit of £97.8m.

It’s a remarkable level of profitability for a company whose total revenues are falling (down 5% in H1) and which many investors view as a legacy business.

Print: The company says that the volume decline in the print business is “in line with historical standards”. Revenue from the print business is declining, but is not falling as quickly as the decline in volumes.

Digital: Digital revenue has also declined in H1, but at a low rate of only 1%, and Q2 this year was positive against Q2 last year. Some major events (Euro Football Championships, UK general election etc.) boosted performance, so perhaps Q2 should be treated as exceptional?

The success story here is really all about cost control, as operating costs fell by 9% (on an adjusted basis) or 15% (on an unadjusted basis).

Outlook seems very positive:

We are trending slightly ahead of a full year reduction in operating costs of 5-6%. The phasing of cost initiatives and inflation during 2023 and 2024 means that operating profits will be more equally weighted between the first and second half of the year.

At the end of the period, we saw elevated levels of advertising spend supported by events such as the European Football Championships. July is trading in line with our expectations.

We continue to work against the backdrop of the dominant tech platforms and their impact on search and referral traffic. As we have seen, this dynamic can create some volatility across our distribution, however, we are building more resilience through our Customer Value Strategy and we remain on track to deliver market expectations.

Graham’s view

Remember that Reach is paying about £60m p.a. to fund its pension schemes, and needs to do so until 2027. From 2028, contributions will shrink.

The way I value Reach is by adding on the pension contributions until 2027 to the market cap, treating them as a form of debt and adding them to get a type of enterprise value figure.

Let’s check for news with respect to the pension schemes, as this issue is the main overhang on the stock.

Pension news:

Firstly, the accounting deficit has fallen (to £35m from £77m). I don’t care about this too much as it doesn't directly cause any fall in the required cash contributions.

Reach made pension contributions of £31m in H1, which makes sense as I previously calculated that the total cost would be about £60m p.a. The total cost this year is expected to be £61.1m.

With £31m having been paid off in H1, I can reduce my estimate of the outstanding “pension debt” owed by Reach.

I roughly estimate the outstanding pension contributions until the end of 2027 as £210m - let me emphasise that this is not an exact figure!

After 2027, contributions may still be required, but they should be much smaller.

There is also some financial net debt but it is only £12m (excluding lease liabilities), so shouldn’t be too important here.

Overall therefore I think the valuation here remains very interesting, even at a higher share price. You can add together pension contributions (until 2027) and net debt to the market cap and get a number in the region of £560m. With operating profit stubbornly high at close to £100m, it’s an interesting deleveraging story. I’m staying GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.