Good morning from Paul & Graham!

Very quiet for news today, so we'll leave it there.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

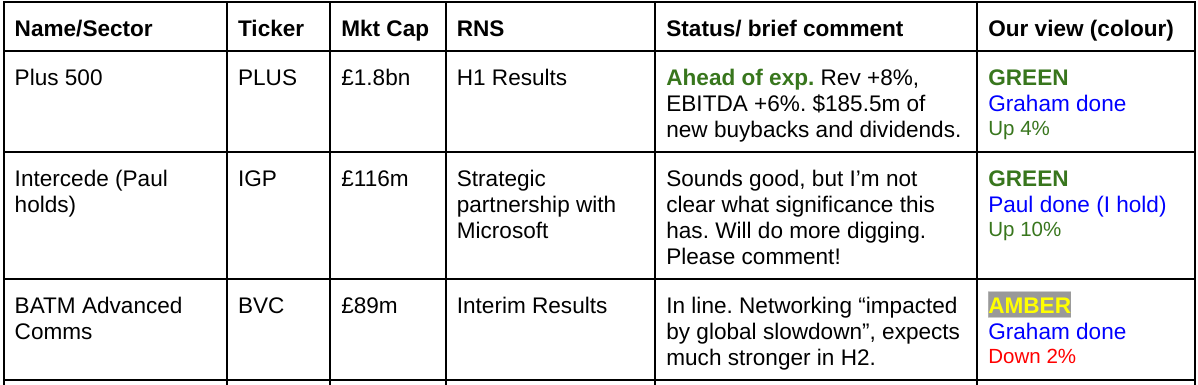

Companies Reporting

Summaries

Intercede (LON:IGP) (Paul holds) - up 14% to 197p (£116m) - Strategic partnership with Microsoft - Paul - GREEN

Today's partnership with Microsoft sounds impressive, but doesn't alter the broker forecasts. Hence at this stage I don't know what the financial significance or structure of this deal is likely to be. I've reached out to the company asking for more colour, so at this stage all we can do is discuss amongst ourselves in the comments below - sector experts please help guide us!

Plus500 (LON:PLUS) - up 5% to £25.52 (£1.93 billion / $2.5 billion) - Interim Results - Graham - GREEN

This CFD provider issues an ahead of expectations update. Perhaps it could have already done this in July (at the H1 trading trading) but there is no harm in delaying the good news for a month. I’m staying positive on this one. There are still some important risk factors to be aware of - in particular around customer churn and profits on customer losses - but the track record of excellent profitability stretches over several years now, and I think it needs to be respected.

Batm Advanced Communications (LON:BVC) - down 4% to 19.75p (£86m / $111m) - Interim Results - Graham - AMBER

BATM says it is on track to deliver full-year results in line with expectations, but this is predicated on a recovery in the Networking division (whose performance collapsed in H1) and a large H2 weighting for group revenues. This is a stock I would treat with caution as it seems much more complex than other small companies we analyse and its market cap already prices in a step-change in profitability.

Paul’s Section:

Intercede (LON:IGP) (Paul holds)

Uup 14% to 197p (£116m) - Strategic partnership with Microsoft - Paul - GREEN

Intercede and Microsoft Join Forces to Streamline FIDO Passkey Management for the Enterprise

Intercede, the leading cybersecurity software company specialising in digital identities and strong authentication, announces a strategic partnership between Microsoft and the Company that will bring cutting-edge FIDO Passkey management to the Enterprise.

This sounds exciting, but I’m left scratching my head after reading this announcement several times. It doesn’t give any indication of the likely financial benefit from this “strategic partnership”.

Broker update - house broker Cavendish helps us out with a brief update today, with the key bit saying -

“ While there are no changes to forecasts, the partnership reiterates the world-class quality and reach of Intercede’s technology”

What does this deal actually entail? It’s not clear to me, but this bit below seems to suggest IGP’s software is somehow to be used in conjunction with Microsoft’s Entra ID cloud-based identity & access software -

“This collaboration combines Intercede's expertise in Credential Management Systems with Microsoft Entra ID to allow administrators to create and register FIDO Passkeys on behalf of users on devices such as the Yubikey family of devices or smart phones. This development allows FIDO Passkeys to be managed in a similar way to PKI based devices through MyID CMS and then passed to Microsoft Entra ID for use during user authentication. Importantly, this enables organisations to comply with US federal government security legislation including FIPS 201/SP 800-63 at the highest levels of assurance.”

That’s quite intriguing. Perhaps naively, I would have expected a software giant like Microsoft just to write its own code, and not have any need to involve Intercede.

What are FIDO passkeys? Details are on an industry website here. Briefly, it’s a secure method of logging into online services. An example would be when you’ve registered with internet banking, and subsequently login to your banking app using your fingerprint on your smartphone. It’s much more secure than ordinary passwords.

Quote from Microsoft in today’s RNS - it seems that Intercede is one of several vendors, so this isn’t an exclusive deal -

"Microsoft is committed to realising the full promise of passkeys to help accelerate adoption within enterprise organisations. Our new FIDO2 provisioning APIs, and our collaboration with leading vendors like Intercede, represent a big step forward in helping organisations create fast, easy and secure authentication journeys from day one," said Natee Pretikul, Principal Product Management Lead at Microsoft Security.”

Quote from Intercede -

“Until now, the lack of ability to integrate credential management systems with Entra ID for passkeys has been a barrier to adoption. I am delighted that by working with Microsoft this barrier has now been removed and organisations can benefit from stronger, managed authentication." added Allen Storey, CPO at Intercede.

What's Next: We're moving quickly to bring this partnership to life. A first version of the implementation will be ready for demonstration within the next two weeks.”

Paul’s opinion - with no indication of financial terms of this deal, I’m completely in the dark! Whilst obviously recognising that this sounds a very interesting development. Let’s see if we can draw out any industry experts within our community here to explain what this deal might mean, and help us understand its significance.

I’ve already reached out to Intercede this morning, asking for more colour. I’ll see if they want to do another CEO interview, where I can ask our questions, to hopefully better understand today’s deal.

I remain a bull on IGP shares, which is why I hold personally. It’s been a successful multi-year turnaround, and the company is now well-financed, following a bumper year boosted by a large one-off contract win in FY 3/2024. Now it has established successful routes to market through third party IT groups, and has an astonishing existing client list, I believe it has very considerable growth potential, and this isn’t blue sky - it’s an established (over 20 years) expert in an increasingly vital niche. It’s difficult to put numbers on it, so I tend not to focus very much on broker forecasts or conventional valuation metrics. My view is that there’s a genuine opportunity here, but I don’t know how large it is.

Shares now going exponential is both exciting and scary! Hence I'm expecting considerable volatility -

Graham’s Section:

Plus500 (LON:PLUS)

Up 5% to £25.52 (£1.93 billion / $2.5 billion) - Graham - GREEN

We have an ahead of expectations update from Plus500:

FY 2024 results expected to be ahead of current market expectations

Significant additional shareholder returns of $185.5m announced today

Strong financial and operational results for H1 2024

Existing full-year expectations for FY24, according to the company, were for revenue of $697.8m and EBITDA of $314.6m.

But the company has already achieved revenue of nearly $400m, and EBITDA of $180m+, in the first six months of the year:

Note that we covered this stock in July at the time of the H1 trading update. The market seemed to be disappointed with the “in line” outlook published that day, but I observed that PLUS still had a great chance of beating full-year expectations for FY 2024. So today’s “ahead of expectations” update does not come as a huge surprise.

Increasingly good news has been priced in:

Cash exceeds $1 billion for the first time.

Buybacks and dividends of $185.5m are announced, comprising share buybacks of $110m and dividends of $75.5m. This brings total buybacks and dividends year-to-date up to $360.5m.

Valuation multiples for PLUS tend to be cheap, making buybacks attractive:

The PER shown above is before making any adjustment for the company’s cash balance; deduct $1 billion from the market cap to adjust for this and the PER is reduced by about 40%, i.e. to less than 6x.

That would be an optimistic way of valuing the company, as the company’s cash balance is partly needed to insure PLUS against the risk of customers trading profitably as a collective. But still, PLUS evidently does not need $1 billion+ and some large portion of it is surplus.

Operational KPIs

Customer churn seems worse than before as nearly 57,000 customers joined in H1, vs 50,000 in H1 last year, and yet there is no increase in active customers. Active customers are unchanged year-on-year at c. 176,000.

The driver of revenue growth is therefore the 8% increase in average revenue per user, not growth in the user base. Combine that with zero growth in the cost of customer acquisition, and PLUS had the foundations for a very profitable H1.

Outlook is ahead of expectations:

Plus500 remains strategically well positioned to capitalise on both short-term market conditions and the medium to long-term growth trends in its end markets. In the short-term, its increasingly diversified offering and intuitive trading platforms allow customers to access a wide variety of products, services and features across multiple markets.

These initiatives are designed to position the Group for key growth opportunities, including new products, services and markets, the expansion of its OTC, futures and share dealing offerings and the deepening of its customer engagement and retention initiatives…

Over the medium to long-term, the opportunity to drive growth, scale and compounding value creation is significant. Plus500 has strong fundamentals underpinning its business and is attracting and retaining more customers while putting greater focus on customer longevity…

I’ve emphasised some parts of the outlook statement where I think PLUS is acknowledging that customer churn could be improved. Most of the bear arguments against this stock have been defeated by the passage of time but I think customer churn remains a point where the company could improve and where I think that even shareholders of the company might agree that it has a weakness.

Perhaps this will never change, but it is a fundamental challenge for PLUS that it needs to replace a huge portion of its active customer base every 12 months. This means that it is always vulnerable to customer acquisition costs, which are largely beyond its control.

Graham’s view

Despite the cautious tone that I’ve taken to PLUS over the years, I turned positive on it as its ability to generate cash has become undeniable, as its successful track record has lengthened, and as its product/geographic diversification has improved.

One of the points which worried me greatly before was the company’s hedging practices. I still think it’s worth worrying about them, but at least we have several years’ worth of data from the company now around how much of their revenue has been generated from customer losses as opposed to spreads and commissions.

Today, for example, we learned that customer trading performance (i.e. customer losses or wins) contributed $39.7m of revenue in H1. This is a little less than last year and is about 10% of total revenue. I still think it’s important to know that this is a source of risk and could be very volatile, but I no longer think that it defeats the bullish arguments in favour of PLUS.

So I’m happy to retain my positive stance on this one.

Batm Advanced Communications (LON:BVC)

Down 4% to 19.75p (£86m / $111m) - Interim Results - Graham - AMBER

We don’t cover this one too often. The last time was in August 2023

Profits tend to be unpredictable and usually seem too low compared to the market cap:

Here are the key points from today’s interim results, with the company on track to deliver full-year results in line with expectations.:

H1 revenue approximately unchanged at $60m

Gross margin falls and gross profit reduces by 11% to $18.7m.

Operating profit and EBITDA both increase, regardless of whether or not you include the company’s adjustments. Adj. operating up slightly to $2.3m.

Business review

This is more difficult to analyse than most stocks we cover because a) it’s based in Israel, and b) it has multiple divisions/activities.

These divisions are Cyber (hardware and software for government agencies), Networking (connectivity), Diagnostics (in vitro reagents and instruments) and “Secondary Activities” that generate nearly half of its revenues.

Few of the divisions stand out as being particularly profitable at this stage of their evolution, except for the Cyber division that generated $2.6m of EBITDA from $8.3m of revenue in H1.

The Networking division suffered a revenue collapse of nearly 50% (down to $6m) and was unprofitable in H1.

Outlook suggests that H2 will be much better in the Networking division, and mentions the potential for M&A:

BATM remains on track to deliver strong growth for FY 2024, in line with market expectations. In the Networking division, the Group expects performance in the second half to be much stronger than the first, with new orders expected for its carrier ethernet and Edgility solutions. The Cyber division continues to perform well as it delivers its large backlog as well as new orders. In the Diagnostics division, further growth is being driven by the continued expansion of the customer base.

Looking further ahead, the Group is eagerly anticipating the launch of its cyber solution into commercial markets, which represents a substantial increase in the addressable market. The Board is also continuing to actively pursue M&A and disposal opportunities that will enable the Group to accelerate execution on its growth strategy in its core divisions. As a result, the Board continues to look to the future with confidence.

Balance sheet: net assets are an impressive $117m, including only $21m of goodwill. So the market cap (c. $111m) is only a small premium to tangible net assets ($96m).

Cash and short-term investments finished the period at $32.6m. As noted previously by Paul, however, there isn’t any sign of dividend payments. While BATM has been publicly listed for a long time, large cash balances at foreign LSE-listed companies can arguably be viewed as a red flag - if the cash is real, what is it doing?

Graham’s view

I’m inclined to leave this stock in the “too difficult” tray. So I’ll take a neutral stance on it, as I wouldn’t have any conviction in a bearish or a bullish stance on it.

In the short-term (six months), I would worry that the expected H2 recovery in Networking may take longer to materialise than expected. A large H2 weighting is often the prelude to a profit warning, and the full-year group revenue forecast is $143m (vs. only $60m in H1).

Looking further ahead, there is clearly the potential for BATM to start converting incremental revenues into real profits, and for the large cash balance to provide optionality in the form of M&A or other opportunities.

However, I expect that a great deal of research would be needed to gain conviction in the bull case.

Stockopedia’s algorithms are neutral, too:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.