Good morning from Paul!

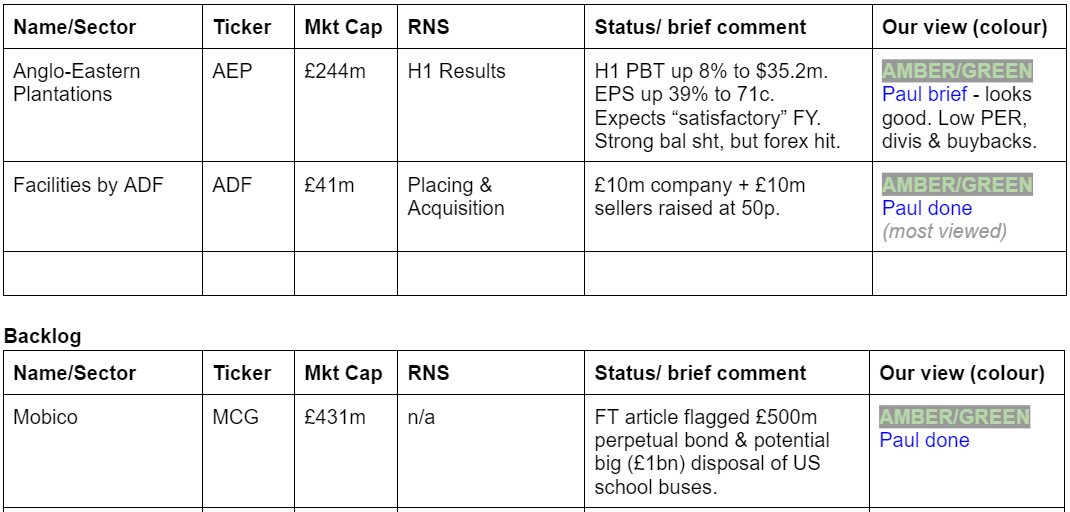

Very quiet for news today, so I spent most of the morning having a proper dig through the placings/acquisition for ADF, which is quite interesting. Sorry it took so long, but that's up now. Also some important new information (good and bad) from Mobico (LON:MCG) (I hold).

That's it for today, and the week. I hope you enjoy the long weekend :-)

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Summaries

Facilities by ADF (LON:ADF) - Unch at 51p (£41m - pre dilution) - Acquisition & Placings - Paul - AMBER/GREEN

I very much like this acquisition, it seems a great fit, reasonably priced, and funded prudently through a 50p equity raise, and self-funding earn-outs by the looks of it. A soft H1 in 2024 means there's a risk of another profit warning later this year, but despite that the 2025 upside looks good, so I'm upping my view from amber to AMBER/GREEN. It's possible I'm being too cautious here, this one was nearly green.

Mobico (LON:MCG) (Paul holds) - 71p (£431m) - Disposal & FT article re perpetual bond - Paul - AMBER/GREEN

A recent FT article flags that the US school bus division disposal underway could produce a blockbuster disposal up to £1bn. Bank of America thinks £400m is more realistic. So a wide range of outcomes here, but in either case it would greatly reduce, or even eliminate disclosed net debt. However the FT also flags that MCG has £500m of off balance sheet debt, in a perpetual bond, which is designed to be disclosed as equity. I try to explain it below.

Paul’s Section:

Mobico (LON:MCG) (Paul holds)

71p (£431m) - Disposal & FT article re perpetual bond - Paul - AMBER/GREEN

I covered international bus/coach group in some detail here on 21/8/2024.

Some more information has come to light, which I need to flag to you.

Firstly the good news. An important article in the FT flags that the US school bus division could be worth up to a staggering £1bn, and works through its rationale for that huge valuation, based on previous deals in the sector, where MCG is the no.2 player, and a good turnaround is underway. This seems to be based on a note from Jeffries, which of course we don’t have access to.

Now the bad news. The same FT article flags that MCG has a £500m perpetual bond in issue, which is a form of off-balance sheet debt. I was not aware of this previously, so am very grateful to the FT for flagging this important point. For the first time ever, I read a bond prospectus from start to finish, understanding most, but not all of it! This perpetual bond was issued in Nov 2020, bringing in £500m of cash, however it’s structured so that there are no repayments required, it’s perpetual. Plus the interest payments are optional, and called dividends. Hence apparently under accounting rules, this has been creatively structured so that it’s classified as equity, not debt, hence does not appear as a liability on the balance sheet. Instead the credit entry is shown in the separate reserves section of the balance sheet as equity (alongside share capital & share premium accounts) - a section that hardly anyone looks at.

I have never come across this type of perpetual bond financing before, so thought it was such an interesting situation, that I would flag it to you.

Here it is lurking in reserves, not within assets/liabilities in the main section of the balance sheet, because technically this £513m never has to be repaid, so it’s treated as a form of equity -

I didn’t spot this when doing my review on Weds. However, I did spot an item on the cashflow statement which perplexed me, namely a cash outflow in both 2023 and 2022 of £21.3m -

Therefore there are 2 ways of looking at this hybrid bond -

It’s disguised, undisclosed debt, which is what the FT is saying (and I’m leaning towards seeing it that way too), or

Not debt, as it never has to be repaid, but is instead an annual £21.3m cash outflow. I think MCG adjusts for this in its EPS calculations.

There are some circumstances which trigger repayment of the perpetual bond, eg insolvency or takeover I think, but let’s skip over that. In normal circumstances, all MCG has to do is pay the £21.3m pa divis, and the debt just sits there forever - just like equity receiving normal dividends, but never getting repaid. The perpetual bonds are traded on bond markets, so that’s how holders can cash out if they want, and currently trade at about 92, below par (hardly surprising give that base rates rose greatly after this bond was issued in the zero interest rate period).

Another complication here is that the interest rate payable (currently 4.25% pa coupon, despite the prospectus saying its a 5.25% coupon, and was issued at par). So there’s a query here on what is the actual interest rate? Moreover, another query is how the interest rate reset mechanism works? Maybe our resident bond specialists could clarify this? It did talk of a margin (over what? Base rates maybe, or the risk-free Govt bond rate?) and a consultant who is authorised to calculate and reset the bond's coupon interest rate every 5 years. Hence a key question is whether the attractively low coupon of 4.25% (costing £21.3m pa, making this a cheap form of financing for MCG) might see a sharp increase in the cash outflows when the rate is next reset upwards?

Call dates & terms. MCG has the option, but not any obligation, to repay (“call”) these perpetual loans once every five years. I’m thinking that if the annual finance cost remains at a low 4.25%, then it would make sense for MCG to not call (repay) this hybrid bond, but instead focus debt reduction on its other bonds & private placement, which are substantial.

Paul’s opinion - sorry I missed this very important point last time. Discovering £500m of (arguably) undisclosed debt at a £431m market cap company is a bombshell. There again, it’s more accurate to say that details were disclosed, it’s just that I didn’t spot it until flagged by the FT. So I wonder how many other investors here are aware of and understand the perpetual bond, and how many don’t? The big shareholders who have been in for a while will definitely be fully aware, but some PIs, like me, may not be aware of the perpetual bond, if we hadn’t gone all the way back through the RNS to almost 4 years ago when it was announced. Just shows doesn’t it, cutting corners on research can be dangerous. As I say though, I’ve never come across this issue before, in my 25+ years investing, I thought off balance sheet financing was a thing of the past, but clearly not.

Overall then, there could be unexpected, and maybe very large upside from a successful disposal of the US school buses division. If the disposal is anywhere near £1bn the FT quotes, then I think that would seriously put a rocket under this share, as that would wipe out all its disclosed net debt (but not the £500m hybrid bond of course, which never has to be repaid anyway, it’s just a cash drain for the interest costs, called divis).

However, the Times quotes a note from Bank of America, saying it expects the school bus disposal to raise a much smaller (but still very handy) £400m.

It’s more complicated than I previously realised, but I still like the turnaround potential, and the core Spanish business is trading really well. If a bumper price can be achieved for the US school buses, then that could be transformational. However, discovering £500m of off balance sheet debt has unnerved me. Hence I’m trimming back from green to AMBER/GREEN.

Facilities by ADF (LON:ADF)

Unch at 51p (£41m - pre dilution) - Acquisition & Placings - Paul - AMBER/GREEN

Quite a decent business this one, it hires out mobile facilities (e.g. production offices, makeup studios, etc) to the outside broadcasting industry, so films/TV. Obviously it was clobbered by the impact of the Hollywood strikes in 2023, and recovery has been somewhat hesitant since - reminding me of Zoo Digital (LON:ZOO) which has said similar things about the sector.

Graham gave it a GREEN on 29/2/2024 despite a profit warning, as he prioritised eventual recovery.

I was a little more hesitant on 29/4/2024 (reviewing the FY 12/2023 numbers and future outlook) at AMBER, because it seemed to me that the hesitant recovery at that point made 2024 forecasts look unrealistically high. So I’m expecting a proper recovery in 2025, not 2024, implying another profit warning could be in the pipeline, if I’m correct.

Last night ADF announced this -

Proposed Acquisition, Primary & Secondary Placing

Acquisition of Autotrak Portable Roadways Ltd. - “one of the market-leading suppliers of portable roadway” - conditionally agreed to buy it for up to £21.3m. Initial consideration is £10m cash, plus 5.92m new ADF shares (worth £2.96m at 50p each, with a 2-year lock-in for half these shares).

Earn outs of up to £4.2m (£1.4m pa) in cash, if 2023-2027 performance is at least equal to 2024 forecast performance. An additional possible earnout of up to £4.0m payable in cash in 2028, based on profit growth. I like the way this deal has been structured, as the earn-outs look like they should be self-funding.

We’re told that in FY 12/2023 Autotrak generated £8.3m revenues, and £4.3m u/l adj EBITDA.

I’ve looked up its accounts at Companies House (co. no. 02999669 - created Dec 1994, so it’s been around for a long time, a good sign), but unfortunately they’re abbreviated accounts with only a balance sheet. NAV rose by £1.87m from Dec 2022 to Dec 2023 (ending at £6.6m, which includes £3.0m of tangible assets and £3.7m of cash). From that I Can deduce that it must have made £1.87m profit after tax and dividends in 2023, a very nice outcome. Renting out portable roadways is clearly a lucrative business, generating a very high return on capital - the NBV of its portable roadways is only £1.2m. It bought a freehold property for £946k in 2023). So based on the limited information available, this looks a good acquisition I’d say.

ADF says it has a good existing relationship with Autotrak, so they know what they’re buying - something I always look for when companies do acquisitions. It’s an obvious & logical fit with ADF, so I think this deal makes a lot of sense with cross-selling, co-ordinating contracts, etc.

“The Acquisition will be significantly earnings per share accretive following integration into the Group.”

I wonder why the vendors want to sell? That absurd phrase is included, to howls of derision from many people reading the RNS I'm sure -

"Sale of not less than 20,000,000 Sale Shares at the Issue Price on behalf of the Selling Shareholders in order to meet strong institutional demand."

Utter rubbish! They're selling because they want the money, and there just happens to be institutional demand which has allowed them to sell. I thought this misleading and inaccurate phrase had been consigned to the dustbin of financial history, but it sounds as if Cavendish didn't get that memo!

Strategy - I’m much happier with this approach below, than the previous strategy of trying to expand into Europe, which was a really bad idea in my view -

“The Acquisition is the next step in the delivery of the Group's vision for ADF as a one-stop shop for film and HETV production, operating across multiple businesses and run by talented local management and accelerates ADF's diversification of product offering and customer base, including across complementary industries.”

Placing - the first one is to raise money for ADF, to fund this acquisition. It’s raising £10.0m at 50p (6% discount is reasonable), so 20m new shares. Costs are an outrageous £0.9m. Surely of all the reforms needed to UK markets, ending this gravy train needs to be a priority? We need a quick, cheap, electronic way for existing listed companies to raise fresh equity, giving proper -re-emption rights to all existing holders. The current placing system is woefully outdated, expensive, and unfair. Leaving shares trading for weeks, whilst discounted fundraisings are secretly in progress is absurd, and an open invitation for insider dealing - rarely detected or punished.

This placing is cornerstoned by two institutions, putting in the bulk, of £7.6m. It’s great to see institutional appetite for small placings returning, let’s hope this is the start of the UK market resuming the key function of providing capital to decent growth companies. I’m very encouraged by this.

Retail Offer - at £0.5m is barely worth mentioning, but better than nothing I suppose.

Selling Shareholders - not good. Why do they want to sell, when there is apparently good upside on ADF shares? A secondary placing is happening to allow existing holders to dump 20m shares. Who are they? Details here -

It’s bound to raise questions when holders of 38% want to dump most of their shares.

Current trading - sounds encouraging, but I don’t see any reference to performance vs market expectations -

“Following the end of the strikes in November 2023, and the continued growth in demand for ADF's services as evidenced by the current order book, the Company expects the financial performance in the six months ended 30 June 2024 ("H1-FY24") to be significantly ahead of the H2-FY23. [Paul: I should hope so, as H2-2023 was very weak, a £(2.1)m LBT]

Although the impact of the strikes on the film and HETV industry has carried on into the first few months of 2024, with producers having to reorganise the schedules of all relevant parties, ADF expects the situation will continue to normalise as the first half of the year progresses before returning to a full second half, more in line with pre-strike levels. Underlying market drivers still provide high confidence that the demand for ADF's services will continue to expand over the medium to long term. “

So I think that’s code for a weak H1, and an H2-weighting for 2024.

There’s H1 guidance here -

“the Company currently expects to report unaudited H1-FY24 revenues of approximately £15.2 million and H1-FY24 adjusted EBITDA of approximately £2.5 million.”

Last year FY 12/2023 adj EBITDA was £7.3m but adj PBT was only £0.9m. Hence the gap is about £3.2m per half year. So I can translate the H1 2024 guidance of adj EBITDA at £2.5m into an H1 loss before tax of c.£(0.7)m. Therefore expect weak H1 results when they are announced in mid to late Sept. Although the market may well look through the soft H1, if it sees evidence of the expected industry recovery in H2, who knows. Plus of course there should be some benefit from the Autotrak contribution towards the end of 2024.

Broker update - Cavendish helps us with revised forecasts, now expecting 5.8p adj EPS (which I think is likely to be missed), and a very nice jump to 8.8p in FY 12/2025 based on a full industry recovery, and a full year contribution from Autotrak. Maybe those figures are a bit too optimistic, but if it gets anywhere near the 2025 forecast, then the current share price of 52p would probably have moved up nicely, to maybe something like 75p? Cavendish has a target share price of 93p, which looks entirely possible if the forecasts are achieved.

More acquisitions - are in the pipeline, with surprisingly good details provided today. A disciplined approach of paying 46x maintainable EBITDA, and using a mix of cash & shares, with self-funding earn-outs, strikes me as spot-on.

Paul’s opinion - with 21m new shares being issued, the share count goes up from 80.9m to c.101.9m, a 26% increase. That looks fine, given that the acquisition is strongly profitable. I like the structure of the deal, with earn-outs probably being self-funding, and motivating the sellers who will remain in situ running Autotrak. I wonder why they decided to sell? It could possibly be something to do with potential tax changes maybe, who knows?

My main reservation here is that I think ADF has glossed over its weak H1-2024 trading. Hence hitting full year targets looks difficult, and I suspect it might be heading for another profit warning in late 2024. That could be a banana skin in the short term, although if markets are bullish they might well look through it, if the 2025 outlook points towards a full recovery after the lingering impact of Hollywood strikes. We don’t really know if the big spending by streaming companies was a one-off, or is likely to recover?

I’ve liked ADF since it floated, as a reasonably priced, decent business. Its achilles heel is gaps in utilisation. We’ve seen before that it’s nicely profitable when large, long contracts are won, but struggles a bit when projects are shorter, with down-time in between contracts. Hence it’s always going to be vulnerable to lumpiness and the occasional profit warning, in my view.

Finances are sound, with NTAV c.£19m at Dec 2023. Raising equity to fund this good quality acquisition looks prudent.

This is a situation where apparently Brexit might have been both a hindrance (ruling out European markets for its UK fleet), but also a benefit since this also closes off the UK market to European competition. Buying complementary UK businesses is a much better strategy than trying to compete in unfamiliar European markets, in my view.

Overall, I’d have gone green if it hadn’t been for the challenging H2-weighted forecast for 2024, so hoping to dodge a profit warning, I’m more comfortable at AMBER/GREEN for now (up from amber last time).

Share price has held up well since listing, if you allow for the fact that 2022-23 was a horrible bear market for UK small caps, and that ADF also had major industry disruption from the Hollywood strikes in 2023. Considering all of that, I think this performance is more than acceptable -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.