Good morning from Paul & Graham!

That's all we have time for today, see you tomorrow.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 26/8/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

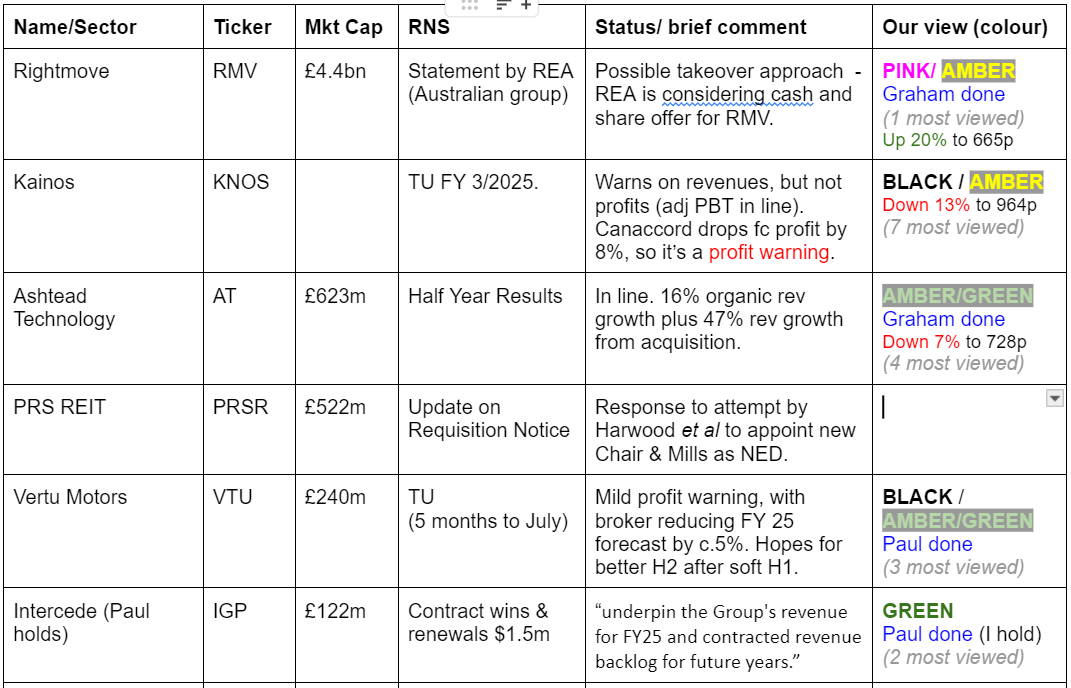

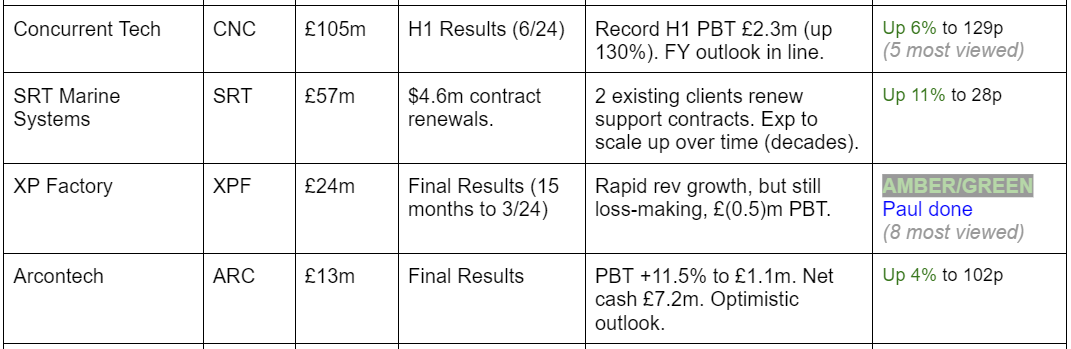

Companies Reporting

Summaries

Intercede (LON:IGP) (Paul holds) - 208p pre-market (£122m) - Contract Orders & Subscription Renewals - Paul - GREEN

Several contract wins totalling $1.5m. "Underpins" existing forecasts, which are unchanged, per Cavendish. I explain more why I see IGP as an exciting opportunity, even though shares have already soared. It's certainly not cheap on a forward PER of 51x!

Rightmove (LON:RMV) - up 21% to 672p (£5.3bn) - Statement - Graham holds - AMBER

A Murdoch-controlled Australian real estate group is considering a cash and shares offer for the UK’s #1 property portal. It’s a dramatic response to the US acquisition of OTMP, demonstrating that Rightmove itself may receive foreign assistance to keep its commanding market position. I’m moving to AMBER but personally I’d require over 800p before I willingly handed over my RMV shares.

Vertu Motors (LON:VTU) - down 3% to 69.3p (£232m) - Trading Update [mild profit warning] - Paul - BLACK (PW), AMBER/GREEN on fundamentals.

A mild profit warning today, dressed up as "broadly in line", but FY 2/2025 forecast profit & EPS are reduced nearly 5%. Mixed comments on its various activities, with a lot of useful detail. Shares are cheap, and strongly asset-backed too, so I remain moderately positive, despite a less than stellar H1 being indicated.

XP Factory (LON:XPF) - up 3% to 14.2p (£25m) - Audited Results (15 months to 31 March 2024) - Paul - AMBER/GREEN

15-month results show a breakeven PBT result in the last 3 months (after 12 month figures were released in March). The big news is a new £10m RCF agreed with Barclays, with removes worries over financing & dilution. Overall I take a moderately positive view of the opportunity here, with highly leveraged upside to any consumer recovery possible, due to exceptionally high gross margins from games revenues.

Ashtead Technology Holdings (LON:AT.) - down 13% to 678p (£545m) - Unaudited Half Year Results - Graham - AMBER/GREEN

AT says that its expectations for the year are unchanged, which makes today’s 13% share price fall perplexing. I speculate as to what may have caused the sellers to dump the stock this morning, but also explain why I have a generally positive impression of this stock. Paul was AMBER/GREEN on this one in April and I’m happy to do the same.

Paul’s Section:

XP Factory (LON:XPF)

Up 3% to 14.2p (£25m) - Audited Results (15 months to 31 March 2024) - Paul - AMBER/GREEN

This is a growing experiential leisure group, with two brands - Escape Hunt (escape rooms), and Boom Battle Bars competitive socialising bars (BBB).

I like the format a lot, so we’ve discussed it here in the past probably more than was justified. I think management has done well to expand considerably, with lots of new sites (owned and franchised), but it’s fallen short of achieving the profitability that was originally forecast. Maybe we can forgive that, because of covid, and the large cost increases (particularly wages and energy) in the last couple of years. It’s an incredibly tough sector, where none of the smaller listed bar operators make any money, and of course Revolution Bars (LON:RBG) has been a disaster, as indeed was Nightcap (which has delisted).

XPF issued its FY 12/2023 results back on 19/3/2024, which we didn’t cover because there were over 20 other companies reporting that day, and its figures were unremarkable, producing a modest loss before tax of £(535)k.

A year end change means that today it puts out 15-month results for the new year end of 31 March.

Nothing much has changed, in terms of profitability, producing a 15-month PBT almost identical at £(539)k, so it’s traded at breakeven in the last 3 months.

Revenue (15 months) was £57.3m. It was £44.8m for the more meaningful y/e Dec 2023 (up £22.8m in FY 12/2022), so you can see the rapid growth from a splurge of new sites opened in late 2022. The new openings have been slower this year, due to financial constraints only allowing it to self-fund about 6 new sites per year.

Strong like for like (LfL) revenues, up 22.4% at BBB in the 65 weeks to 31/3/2024, and up 16.9% for Escape Hunt, as new sites matured.

Recent LfL revenue growth is only modest at +1.9% for Boom (20 weeks to 18/8/2024) and +1.5% same period for Escape Hunt.

Outlook - not madly exciting -

“Whilst the summer uplift in sales in July and August has been modest, forward bookings for the end of year are well ahead in comparison to previous years providing confidence for the coming months and leaving the Board's expectations for the full year unchanged.”

[Paul: Singers has FY 3/2025: £6.4m adj EBITDA pre IFRS 16 = £0.7m adj PBT, 0.3p adj EPS]

New bank facility - the big news I think is credit approval being recently gained for a £10m RCF from Barclays, to fund new site openings. I had a quick call with CEO Richard Harpham (RH) earlier today, and I homed in on this point as being important. He agreed, and said it’s a “vanilla” borrowing facility, and will help them accelerate new site openings from c.6, to c.10 pa, and provides flexibility, eg if a really good site is offered to them, they can grab it, instead of turning it down due to financial constraints previously. This is really good news I think, if you can tolerate the company taking on more debt, which personally I can. This should remove the risk of a dilutive equity fundraise, all being well.

EBITDA numbers I tend to ignore mostly, but as there’s a big depreciation charge on existing sites (a sunk cost) then there’s no denying it does generate positive cashflow on a standstill basis. New site openings are discretionary of course.

New sites - I asked if good deals are still available, eg with capital contributions from landlords, and long rent-free periods, which RH confirmed is indeed still the case. I imagine landlords would much prefer an established, and stock market listed tenant like XPF, and offer it better terms, than any numbers of small private competitors.

Competition - there are plenty of other experiential leisure operators expanding, but RH said he quite likes locating new BBB sites where there is competition, as it’s where the customers are already going, and there’s room for several operators. He reckons it’s the traditional bar operators that are losing the market share, and struggle to adapt, whereas XPF is a specialist and know what works.

Franchises - I recall there being some concern at the inadequate quality of some franchisees, and XPF has bought back some sites, including my local one, Bournemouth, so that gives me an excuse to mystery shop it again in the autumn, when the turnaround has had time to be implemented.

Customer satisfaction scores remain excellent - see eg TripAdvisor.

Cost inflation - XPF took the pain, and has not raised prices, in order to attract more volume growth, and be more competitive. Energy costs have dropped back now.

Broker update - thanks to Singers for a note today, as always incredibly helpful. It echoes the company’s comments that results are ahead of expectations on EBITDA. I can’t get excited about that, as it’s really just trading at or around breakeven when all costs including depreciation are taken into account.

Singers has quite modest forecasts, of adj PBT at £0.7m FY 3/2025, £1.1m FY 3/2026, and £1.4m FY 3/2027. I don’t think that’s going to excite any value investors here, rightly so. Hopefully though, with a consumer recovery and real incomes now rising, there might be scope for out-performance in future? The interesting bit is that more than half XPF’s revenue is almost 100% gross margin from games. Its overall gross margin (incl drinks & food) is a strong 64.6%, but note 6 shows that this includes over half its staff costs, so if we strip that out, the gross margin including only the cost of food & drinks, is much higher at c.84% (my calculations). So in other words, if customers spend more, then the drop through to profit could be spectacular from the super high margin gaming revenues. Hence why I think this share is more interesting than traditional bar operators, with greater potential upside in a consumer recovery maybe?

That translates into EPS of 0.3p, 0.5p, and 0.6p, which means PERs of 45x, 30x, and 25x (3/25, 3/26, and 3/27 respectively). So definitely not cheap on the existing forecasts.

I can quite understand why some readers just won’t be interested in a company that is only forecast to eke out a tiny profit margin despite continued expansion.

However, lots of market participants, banks, and takeovers, value shares using EBITDA multiples. So maybe we’re missing a trick with our old school PER figures here?!

Going concern statement is clean.

Balance sheet - is thin, with only £1.4m NTAV (after eliminating intangible assets), so there’s essentially no asset backing here.

Share price upside will all have to come from earnings and cashflows, not from assets.

However, with the new £10m Barclays facility lined up, then I see a lot more financial flexibility, and hence little risk of a dilutive equity fundraise, which worried a lot of investors I recall when we have previously looked at XPF. Although RF didn’t give me an emphatic no when I asked about potential future equity raises, it was something like "hopefully not".

Paul’s opinion - I think this is looking more interesting now that Barclays has provided a decent facility for expansion.

I see this share as a development project. Management has built a significant sized new leisure operator from scratch, in incredibly difficult macro circumstances in recent years, with pandemic, energy crisis, inflation, and the consumer squeeze. That's to be applauded, and shows they should be safe hands for further expansion. For them to be operating around breakeven now is no mean feat. They’ve done well just to survive, let alone rapidly expand. The bull case is that freer spending consumers could start giving XPF a highly leveraged boost to its bottom line, due to its exceptionally high gross margins.

So I can see a pretty good bull case for this share, if you’re prepared to punt on that upside scenario.

Equally, I can also understand why some more traditional value-style investors would see little to get excited about, given the current breakeven performance, competition, and it just being a horrible sector to make money from as younger people increasingly eschew alcohol.

Personally I think we’re at the concept proven stage, with potential upside if they can open more decent sites and squeeze more value from the largely fixed central overheads.

Note there’s a fair bit of dilution from options, etc, so do check that carefully.

Market cap of £24m looks quite reasonable to me, so I’m leaning towards a moderately positive view, let’s go with AMBER/GREEN.

Vertu Motors (LON:VTU)

Down 3% to 69.3p (£232m) - Trading Update [mild profit warning] - Paul - BLACK (PW), AMBER/GREEN on fundamentals.

Vertu Motors, a leading UK automotive retailer with a network of 192 sales and aftersales outlets, announces the following trading update with regards to the five-month period to 31 July 2024 (the 'Period') ahead of its interim results for the six-month period ended 31 August 2024.

Vertu’s headline -

“Trading Update: Strong performance in Used cars and Aftersales against soft new retail market. “

This looks to be a scheduled trading update, since a similar announcement was made at this time last year.

It’s a slight profit miss -

“ Full year FY25 adjusted1 profit before tax expected to be broadly in-line with current market consensus. H1 profits will be lower than prior year levels as anticipated. Performance in H2 is expected to improve over prior year levels due to a stronger used car market and enhanced used vehicle trade values.”

1 Adjusted for share based payments charges and amortisation.

My first port of call in these situations is to look up broker forecasts on Research Tree, to see how much brokers have reduced forecasts by.

Progressive has issued a (commissioned by the company) update, which reduces FY 3/2025 forecast adj PBT by 4.7% to £40.2m, and lowers adj dil EPS by 4.6% to 8.2p. So actually, this is a mild profit warning, so I’ll flag it as BLACK (that’s purely to flag profit warnings, it’s not necessarily a negative view on the company).

Vertu always puts plenty of useful detail in its updates, so I’ll summarise the ones that look more important -

Aftersales (warranty, repairs, servicing, etc) doing well.

Used vehicle sales showing %% volume growth, and higher gross margin of 7.2%.

Used vehicle supply “increasingly constrained”, which is good for margins.

New vehicle sales down 5.8% (industry average -12.1%) - some discounting & lower margins.

Soft retail demand means new car sales are prioritised for lower margin fleet & motability sales.

Small acquisitions, and more planned.

Gearing “below target levels”.

Higher costs of running demonstrator fleets, as more are high cost EVs, and bigger ranges.

Lower energy costs, and marketing spend reduced.

Higher finance costs now it has net debt (following multiple acquisitions) & higher interest rates (something I’ve flagged before, as now consuming a lot of operating profit).

Govt driven regulation towards battery electric cars is causing “market volatility and negative impacts” - is the time coming for us to grab a bargain EV I wonder? (some secondhand EVs are looking attractive value now, I see from a look through the ads) -

“New vehicle supply in the UK remains strong, particularly for BEVs, as Manufacturers aim to meet Government targets. This supply, coupled with weakening retail demand, has led to significant discounting and attractive financing offers, especially for electric models. Margins have been put under pressure and there has been a growth in the pipeline inventory of new vehicles held by Manufacturers and retailers.”

Inflationary cost pressures, especially wages :

“A significant factor contributing to the rise in salary costs was the increase in the national minimum wage on 1 April 2024. Approximately 25% of Group colleagues are now paid at or within 5% of the minimum wage. To retain skilled colleagues, such as parts advisors and vehicle administrators, the Group has recently further increased pay for such roles to increase the differential to the national minimum wage. Additionally, the Group is progressing with the automation of administrative and finance process tasks, with pilots underway which should deliver cost savings when rolled out in the coming months.”

Outlook - as mentioned above, only “broadly in line” for FY 2/2025, which actually means profit almost 5% lower than previous broker forecast.

Retail demand for EVs is weak. The busy trading month of Sept will be soft -

“The Group's new vehicle order-take for the important plate change month of September is currently tracking at levels below prior year reflective of the weakening retail market in 2024. “

Expecting used car prices to “remain stable”, due to constrained supply.

Overall -

“The Group is delivering on its stated strategy and is well-positioned to take advantage of opportunities that arise whilst the market remains in an adjustment period, given the Group's track record of execution and strong financial position. The Board remains highly confident in the Group's long-term prospects.”

I read that as a bit wishy-washy, saying things are not great in the short term, but we're hoping it might improve.

Paul’s opinion - lots to take in here. It’s clearly not a good update, and forecasts for FY 2/2025 had already come down from 10.8p EPS to 8.8p, with another drop today to 8.2p. Car dealers don’t tend to attract high earnings multiples, I feel c.10x is about right here. That implies 82p/share, so actual price of c.69p at the time of writing, is below what I think this share is worth on fundamentals.

Note that VTU has a habit of doing buybacks, and the share count has usefully fallen from c.383m in 2019 pre-pandemic, to only c.335m today. Although net debt has increased a lot (forecast £122m at 2/2025), as it made acquisitions in recent years. That isn’t a particular worry, because the balance sheet remains sturdy, and packed with freehold property (valued at multiples of the net debt). However, the debt is expensive, eating up a lot of the wafer-thin margin operating profit.

We’ve also got all the uncertainty over the car industry as a whole, and considerable consumer reluctance to buy EVs (expensive, and poor ranges make them unsuitable for some higher mileage motorists).

Overall, I’ve been oscillating between green and amber/green this year. Considering today is actually a mild profit warning, and they’re relying on an H2 improvement just to hit trimmed forecasts, I can’t muster a great deal of enthusiasm. It is cheap on fundamentals though, so I’m still positive, but at AMBER/GREEN today, based on the facts, figures & forecasts as of today. We’re not time travellers from the future, so we don’t know what the future holds.

Intercede (LON:IGP) (Paul holds)

208p pre-market (£122m) - Contract Orders & Subscription Renewals - Paul - GREEN

Intercede, the leading cybersecurity software company specialising in digital identities, today announces further contract orders and subscription renewals, in excess of $1.5m in value.

$1.5m doesn’t sound a lot, but in the context of £15.9m forecast revenues for FY 3/2025, it’s c.7% of the total (after converting dollars into sterling), assuming that it’s all recognised in the current year, which may not necessarily be the case, as IGP says -

“These orders and renewals, received via our partners, underpin the Group's revenue for FY25 and contracted revenue backlog for future years.”.

The 4 contracts mentioned are mainly US Federal customers - the area where IGP seems to particularly excel in, and presumably helped by tougher cyber-security laws.

Cavendish issues a brief note this morning (many thanks) confirming that this announcement doesn’t change its forecasts, but today’s news “support expectations and derisk forecasts…”.

Paul’s opinion - I remain very positive on IGP, although obviously with much higher shares now, valuation comes in for closer scrutiny. My view is that £122m market cap doesn’t seem a lot for a small UK specialist in a huge market, with a client list to die for, and winning new business now due to having built up relationships with big systems integrators in the US. That is clearly paying off, so I think the sky could be the limit with this one. I particularly like scalable businesses like this, with no constraints on production capacity, or moving physical goods at all.

With a forward PER of 51.1x (although EV/EBITDA of 18.5x is more normal in this sector for growth companies), then it needs to beat rather than just meet expectations for the full year.

Remember that FY 3/2024 saw a one-off boost from a large single contract, hence why brokers are expecting lower profit in FY 3/2025. However, the £5.6m PBT in FY 3/2024 might have been one-off, but it does show the huge operational gearing here when big contracts are won. It’s also transformed the balance sheet. A few years ago we were worrying about the convertible loan (since paid off). Now though, the last balance sheet had a comfortable c.£17m in net cash. I like the fact that profit turns into cash at IGP, due to sensible & prudent accounting policies - it doesn’t rely on a multitude of adjustments to conjure up a theoretical profit, it is producing decent, cash profits in reality.

My hunch is that IGP is on the runway to considerably greater success, because its software just works, is being continuously improved, and is trusted by the biggest and most security conscious customers you could imagine, primarily in the USA. Building relationships with systems integrators looks to have been a very smart move, as it keeps overheads low, yet after successful implementations having been done, makes it increasingly likely that IGP will be chosen as the preferred partner for the niche of managing online credentials. Legislation requiring better IT security can only help too.

One sizeable US systems integrator actually flew in a US partner in the firm, who gave a ringing endorsement of IGP at its capital markets day in the UK earlier this year. I watched it live, but there’s no recording I’m afraid. I remember thinking at the time that this was such a strong endorsement of IGP from an important third-party.

Overall then, this is an unusually good opportunity in my view, and I won’t be quibbling over valuation. It’s more a question of letting my position run, I think, and not losing sight of the big picture due to over-analysing the detail.

Graham’s Section:

Rightmove (LON:RMV)

Up 21% to 672p (£5.3bn) - Statement - Graham holds - AMBER

(At the time of writing, Graham has a long position in RMV.)

It’s an exciting morning for Rightmove shareholders, as we have bid interest from an Australian real estate group, REA. REA is “a digital advertising company that operates Australia's leading property websites and real estate websites in Europe, Asia and the US”.

Here’s the news:

Further to press speculation… REA confirms that it is considering a possible cash and share offer for the entire issued and to be issued share capital of Rightmove. REA has not approached, nor had any discussions with, Rightmove regarding any potential offer, and makes this announcement in accordance with the requirements of the Code.

As you can see, things are still at an early stage with no discussions between the two companies yet.

The FT has just published an article with some background on REA, pointing out that it previously attempted to make inroads in the UK with the acquisition of the PropertyFinder website back in 2005.

REA is 61% owned by News Corporation.

Rationale

The first reasons given for the potential bid are:

The REA Board believes that there are clear similarities between REA and Rightmove in terms of their leading market positions in the core residential business, continued expansion and innovation of offerings across adjacent segments, leading audience share and strong brand awareness, as well as highly aligned cultural values.

REA sees a transformational opportunity to apply its globally leading capabilities and expertise to enhance customer and consumer value across the combined portfolio and to create a global and diversified digital property company, with number 1 positions in Australia and the UK.

Graham’s view

As a shareholder in Rightmove for several years, it’s natural for me to think that Rightmove is undervalued.

For a company with almost monopoly-like control over the lucrative industry of property search, I’ve grown accustomed to the multiples shown above, but didn’t fully agree with them. Yes, Rightmove has offered little in terms of short-term growth. But when it comes to quality (the ability to make money from a small asset base) and safety (a market position that is secure against competition), Rightmove is one of the most attractive shares that I’ve ever seen.

The safety argument did suffer a blow over the past year, when US-based CoStar picked up OnTheMarket (OTMP) for £100m, with ambitious plans to grow that business. These plans are currently in motion and CoStar recently claimed that visits to OnTheMarket in June 2024 were up 78% year-on-year. However, I’m not sure yet if this has made any inroads into Rightmove’s commanding market share of over 80% (OTMP’s market share gains, if any, could have come at the expense of Zoopla).

So in summary, I’ve continued to believe that RMV deserves an earnings multiple of at least 20x.

Today’s announcement has sent the shares to levels not seen since 2022:

The valuation here is now in the mid-20s in terms of PER, which to my shareholder eyes is a better reflection of underlying fair value than last night’s undisturbed price.

I’m therefore putting an AMBER colour on RMV today, as I could not argue with a straight face that the shares offer great value here. But I do believe that this is a “sleep-sound” type of stock (if such a thing exists). Therefore, with a long enough time horizon, I doubt that buyers at the current level will regret their investment, regardless of whether or not the Australians pick it up.

For what it’s worth, I’d want to receive a multiple of >30x, if I was going to happily give away my RMV shares, i.e. I’d be looking for in excess of 800p.

Ashtead Technology Holdings (LON:AT.)

Down 13% to 678p (£545m) - Unaudited Half Year Results - Graham - AMBER/GREEN

Ashtead Technology Holdings plc (AIM: AT.), a leading subsea equipment rental and solutions provider for the global offshore energy sector, announces its unaudited results for the six months ended 30 June 2024 ("HY24" or "the period").

This has only been listed since 2021, and it has been a great success in share price terms. Paul covered it in April.

Until 2008, AT part of Ashtead (LON:AHT). It became an independent business in 2008, going private with a PE-backed MBO at a valuation of £96m.

Those who follow the big-cap market will know that the larger Ashtead has been a remarkable long-term success story in the wider equipment rental industry. So perhaps it shouldn’t be a big surprise that Ashtead Technology has been a success, given it has that Ashtead DNA.

Interim Results

The numbers published today are impressive: we have 16% organic revenue growth, plus 47% growth from a November 2023 acquisition, offset by a small FX headwind. Altogether, it adds up to 61% revenue growth (to £80.5m).

Adj. EBITDA increases by 49% (to £31.4m) and operating profit increases by 36% to £20.6m. It’s a nice conversion of revenue to profits, with a strong operating margin of about 25%.

The company calculates and reports its return on invested capital as 25.3%, about the same as last year, and a level that marks it as a high-quality business.

Stockopedia’s ROCE calculation doesn’t quite match it but it’s still coming up with a healthy reading:

Net debt has increased substantially to £72m. The leverage multiple is 1.2x which should still be manageable.

M&A: is still “a key element of the strategy”, and they want “medium term double digit organic revenue growth”.

Outlook: expectations are unchanged.

CEO comment:

"I am extremely pleased to deliver another record trading performance as we build on the strong momentum seen through 2023…

The outlook for our business remains positive given the strength of the global offshore energy market and our continued investment to support longer term growth. The Board is encouraged by the Group's performance in HY24 which gives us increased confidence on our full year 2024 outturn and our expectations remain unchanged."

Share price reaction?

It’s worth taking a moment to reflect on the double-digit decline in the share price today, despite the company saying that its full-year expectations are unchanged. This is a puzzle but I’ll try to explain it now, after the fact. Perhaps there has been a sneaky downgrade by a broker, but if so that hasn’t been made public, and it would conflict with the RNS.

Firstly, I would note that the share price was already up by c. 90% over the last 12 months, which says straight away that the market has been struggling to value it and that the market’s expectations (as opposed to the company’s expectations) have been rising rapidly. Therefore, some of today’s sellers may have been hoping for an “ahead-of” update.

Secondly, I note that last night’s valuation (based on forward estimates) was steep by some measures and was even more expensive than Ashtead (LON:AHT). The ValueRank was only 9. This makes it extra sensitive to any deterioration in sentiment:

Finally, looking at the results themselves, I note that there was a general decline in profit margins. Costs rose and gross margins declined due to the revenue mix. Headcount increased by 270 (to 559), of which 203 came from the acquisition. Even excluding the acquisition, therefore, AT has been a heavy spender. H1 administrative costs rose by £11.7m (to £30.5m), of which £8.4m were from the acquisition.

The decline in profitability could be seen as a disappointment by some, although the company would argue that it is investing for the future to meet expected customer demand.

On the income statement, unadjusted PBT came in at £17.6m, up by 33% with a very wide gap between that and the 61% revenue growth.

Without asking the sellers, we can’t know for sure why they sold out of AT today, but I would interpret it as profit-taking in light of all of the above

Graham’s view

AT’s customers are in the offshore energy market and this is not a market with which I have much familiarity. However, I can confidently say that in this sector, I would much prefer to take a “picks and shovels” approach rather than to invest directly in offshore energy producers themselves: oil/gas exploration and production, or wind turbines.

AT makes a predictable and good return by leasing equipment to these producers, while the producers take all of the risk associated with specific projects. So there is no question in my mind that AT is the type of company in which I’d prefer to invest in this sector.

I’m not convinced that it’s currently priced at bargain levels but I like the history of this one and have a positive impression of the company, so I’ll leave Paul’s AMBER/GREEN stance unchanged.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.