Good morning from Paul and Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

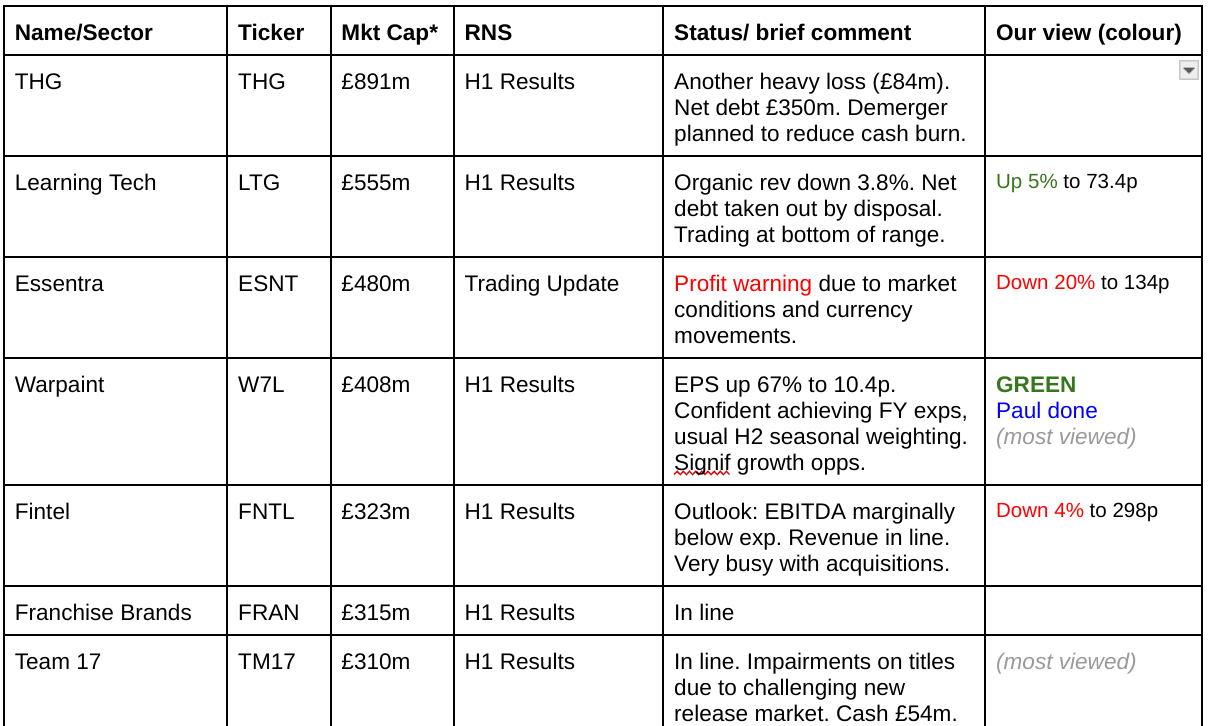

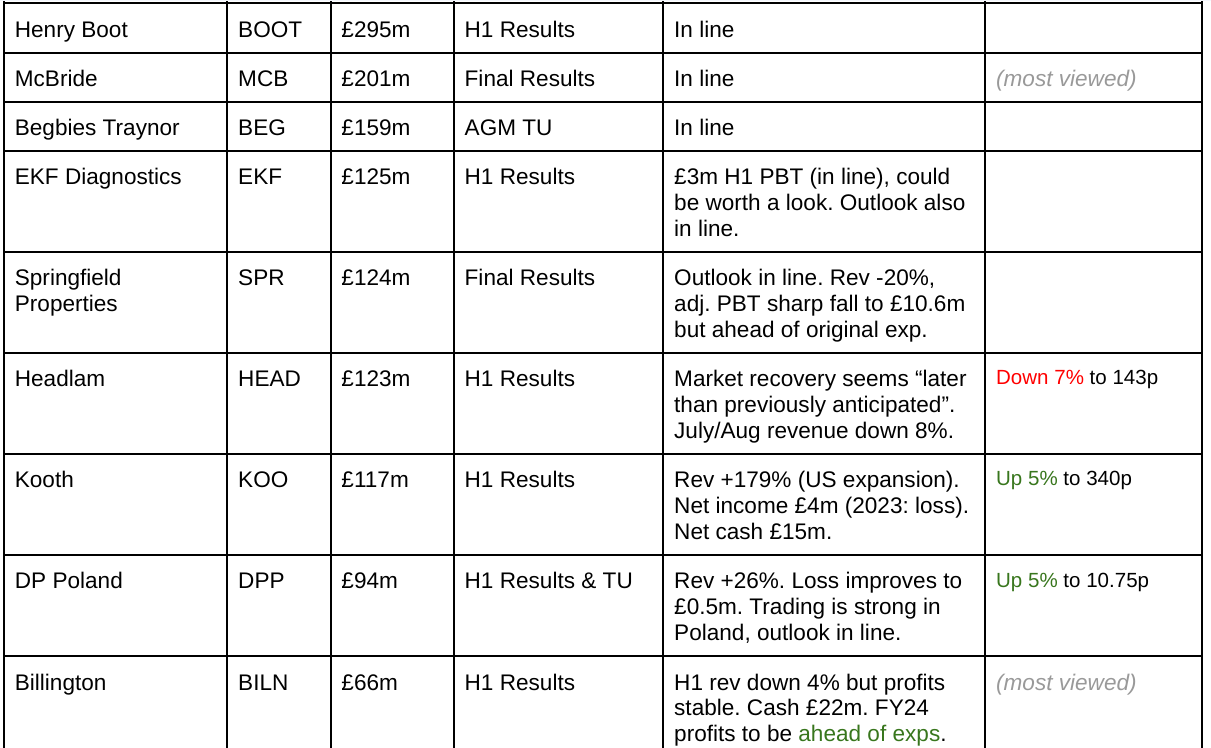

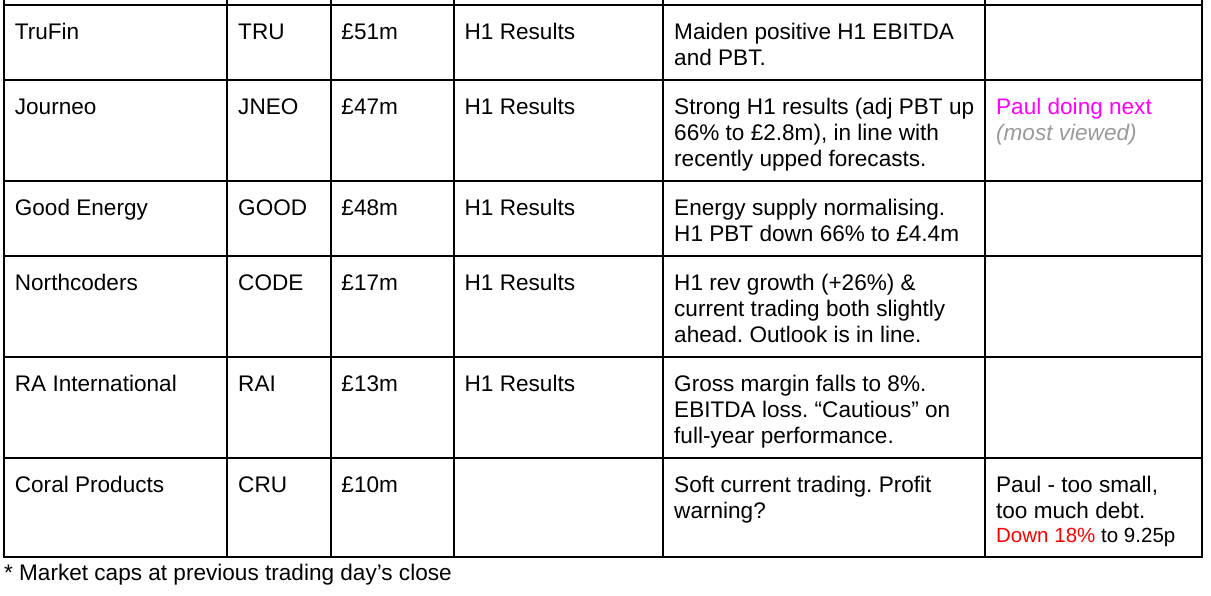

Companies Reporting

Summaries

Warpaint London (LON:W7L) - 516p (pre market) £401m - Interim Results [in line] - Paul - GREEN

Cracking H1 results, ahead of Shore's forecast, and a FY upgrade this morning (which looks way too conservative, given the heavy H2 seasonality). After the recent c.20% share price pullback, I'm much happier with valuation, so it's an enthusiastic GREEN from me today, the sixth green in a row from us here in 2024.

Journeo (LON:JNEO) - down 1% to 283p (£47m) - Interim Results - Paul - AMBER/GREEN

Very good H1 results, which are in line with expectations, as is the FY 12/2024 outlook. Maybe 12x PER is up with events, given that this type of business relies on a constant flow of (sometimes quite lumpy) contract wins? Track record since 2021 has been superb, and shares have more than 5-bagged.

Team17 (LON:TM17) - up 3.5% to 222.5p (£320m) - Half Year Results - Graham - AMBER/GREEN

This is a confident, positive statement with this indie games developer and publisher announcing that it expects to deliver market expectations (on the StockReport, this suggests adj. EPS of 21.8p). With over £50m of net cash and with a large back catalogue generating most of its revenues, I’ll take a mildly positive view on this one.

McBride (LON:MCB) - up 2.7% to 119.7p (£208m) - Final Results - Graham - AMBER/GREEN

This remarkable turnaround story sees this company generating profits far above anything it achieved before the recent inflation crisis. It’s not clear to me how long this situation will last but the company is using the opportunity to rapidly pay down its debts. The current net debt forecast is £111m (for June 2025). This looks like it could have further to run.

Paul’s Section:

Journeo (LON:JNEO)

Down 1% to 283p (£47m) - Interim Results - Paul - AMBER/GREEN

Journeo plc (AIM: JNEO) a leading provider of information systems and technical services to transport operators and local authorities, announces its interim results for the six months ended 30 June 2024 ("H1 2024").

I have a positive impression of Journeo, which started out as a sleepy minnow called 21st Century, selling CCTV systems for buses and trains. Some nifty acquisitions were done, and now it’s all looking a lot more impressive.

We’ve been GREEN here 5 times so far in 2024. There was a strange, irrational spike down to 209p on 16/7/2024, but we stayed at green here, so I hope nobody here panic sold? Stop losses can be a curse with volatile, illiquid shares. These erratic price movements in smaller caps are particularly irksome at present, with many of us suspecting that tax-driven selling ahead of the late October budget could be a contributory factor. I think that’s background noise, and is gifting us buying opportunities mostly, is my best reading of the situation.

H1 figures look healthy -

Revenue +17% to £25.6m in H1 (although only +6% sequentially on H2 2023), helped by acquisitions.

Profit before tax in H1 £2.78m (impressive growth of +67%)

Diluted EPS in H1: 14.76p (+69%)

Outlook comments -

“Strong sales pipeline”

“Record order intake during the period of £24m (H1 2023: £18m)”

“Journeo is evolving into a more capable and resilient business as we aim to become the market-leader for Intelligent Transport Systems. With a growing customer base and a strong sales opportunity pipeline, the Board looks to the future with confidence."

“The Board is pleased with this performance and is confident that we will meet our financial targets and trade in line with market expectations for the full year.”

Balance sheet - NAV £15.3m (growing nicely). This includes £6.8m intangible assets so NTAV is £8.5m.

Net cash is £12.7m (excl leases). Although note it has deferred revenue creditors totalling £9.7m, so the cash pile has mostly come from customers paying up-front before receiving services. I’m surprised at the size of deferred revenue creditors, as I thought JNEO was mainly a contract manufacturing type business. Big deferred revenue creditors suggest it has repeating, software income, which is a good thing. I can’t find a split to show what proportion of revenues are recurring, services type. If anyone knows, please add a comment. I can’t rely on the cash pile remaining in place, until it’s clearer what the nature of the deferred revenue is. If that were to unwind, than the cash pile could largely evaporate, hence why it matters.

Cashflow statement - looks good, and helped by a big reduction in receivables from the last year end. I vaguely recall that previously high receivables being something we queried at the time, so it’s good to see it unwind in H1 this year.

Broker update - thanks to Cavendish for a detailed note today. It has 23.5p EPS pencilled in for FY 12/2024, and notes that H1 results are as expected.

I don’t agree with its argument that the ex-cash valuation is even cheaper, because the cash is offset by deferred revenue creditors, and there isn’t an overall surplus NTAV position.

Hence I make the PER 12.0x, which seems about right to me.

Paul’s opinion - JNEO looks pretty good, and has established an excellent financial track record of growing EPS strongly since 2021. I like its strategy, and the commentary is interesting, with talk of innovative products, with features such as passenger number counting, clever wing mirror cameras to improve safety etc.

No doubt there’s plenty of competition to consider, and this type of business has to constantly win new contracts just to stand still. Hence performance may not necessarily be easy to predict, with the ever present risk of a gap in the order book opening up and delivering a profit warning - as with all small caps that depend on relatively lumpy contract wins.

On balance the I think moderating a little to AMBER/GREEN feels about right, given that this share has already more than 5-bagged since this bull run began in Jan 2021. I don’t see anything wrong with shares needing to pause for breath after such a strong run. It might need an ahead of expectations update to break to new highs, but that’s guesswork obviously.

A more bullish view might be that the good order book and pipeline demonstrate there’s demand for its products, and hence more orders could flow in. I like the emphasis on R&D, in conjunction with customers, developing products that the customers want. So maybe I’m being too short-termist easing down from green to amber/green?

Warpaint London (LON:W7L)

516p (pre market) £401m - Interim Results [in line] - Paul - GREEN

Warpaint London plc (AIM: W7L; OTCQX: WPNTF), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands is pleased to announce its unaudited interim results for the six months ended 30 June 2024 ("H1").

Warpaint is one of our favourite growth companies here at the SCVR. I’ve covered it 5 times previously in 2024 all GREEN, although introducing a note of caution in more recent comments (eg 26/6/2024 at 588p) over the high valuation. Directors sold 7m shares at 450p in May, but retained a huge 43% combined.

On 26/6/2024 Warpaint told the market that H1 was going well, with faster than expected growth. H2 is the seasonally stronger half, due to Christmas gifting & party season boost to makeup sales.

As mentioned before, W7L shares have a wonderfully simple bull case. It sells reasonably priced makeup that end customers like, so the big retailers (internationally) buy more of it, and put it in more of their stores. So organic growth continues, with operational gearing helping profit, and plenty of scope to grow further, given the huge global market. That’s it, there’s nothing more to the business model!

Today’s news -

Interim Results

Revenue +25% to £45.8m (international +30%, now two-thirds of total)

Gross margin up 334bps to 42.5%

Shore Capital says H1 operating profit of £11.0m is ahead of its H1 estimate of £9.5m - good news!

Note that adj EBITDA, operating profit, and PBT are bunched quite close together, as there’s little in depreciation/amortisation, share based charges, or finance costs.

H1 profit before tax is £10.85m (up 76%)

Diluted EPS of 10.3p (up 66%) - and remember H2 is much stronger usually, eg last year H2 was c.double H1 PBT & EPS. If the same pattern holds this year, then maybe we could be looking at c.30p EPS? (Shore ups this year forecast to 23.7p, but says that might prove too conservative - I’d say it’s almost certainly too conservative!).

Put it on 20x my guess of 30p EPS, and I get to a price target of 600p. We’re currently at 530p in the market (08:16), so I think the bull case here looks good after the recent (and I’d say healthy) pullback in share price from the July 2024 peak of c.620-630p. Although I’m making quite ambitious assumptions there with my 600p valuation, that it continues trading its socks off in H2.

Shore reminds us that Warpaint could be just in the early stages of international growth.

Balance sheet & cashflow statement look fine to me, no issues there. It has a modest net cash position, with available bank facilities if needed. There’s no point in over-analysing the numbers, and negative cashflow in H1 is not an issue to me. A rapidly growing business will see cash absorbed into working capital (higher inventories & receivables), plus accelerated tax was another outflow. Also there was more capex (still small at only £1.3m in H1), which it says was due to buying display stands for some retailers, as part of deals to get W7L products into new stores.

Paul’s opinion - the lovely growth story continues. I’m happier with the share price now usefully lower than in the summer, making it a lot easier to justify valuation. So it’s a bright shiny GREEN from me again! The bull story is fully intact, and this looks one of the best long-term buy & hold investments that I’ve seen in the UK market. I’ve been trying to think of things that could go wrong, for balance. China supply issues maybe? Increased competition from Chinese direct-to-consumer companies? Although given the lamentable product quality of some TEMU items I’ve bought, I’m not convinced people would want to rub chemicals from TEMU into their skin! And customers clearly like the W7L brands, so brand value should be growing all the time.

Graham’s Section:

Team17 (LON:TM17)

Up 3.5% to 222.5p (£320m) - Half Year Results - Graham - AMBER/GREEN

Team17, a leading global independent ("Indie") games developer and publisher of premium video games and apps, is pleased to announce its unaudited results for the six months ended 30 June 2024 ("H1 2024" or the "period").

Paul covered the H1 update here.

Today we have confirmation of the H1 numbers and they show continued improvement, i.e.:

Revenues +11% to £80.6m

PBT +53% to £12.4m

Adj. PBT +23% to £19.2m.

To top it off, the company’s cash balance increases from £45m (June 2023) to £54m (June 2024).

Revenue growth is all organic.

TM17’s own games are now responsible for 42% of total revenues (H1 2023: 37%).

The back catalogue is responsible for 92% of revenues (H1 2023: 79%).

Despite the company’s description of its games as being “premium”, these are lower-budget games whose sales tend to have a slow burn compared to the blockbuster titles released by larger studios.

Outlook: in line with market expectations.

New release revenues will be higher in H2. It sounds as though the back catalogue may struggle to match its results in H1, but is expected to give “another good performance”. EBITDA should be more evenly balanced between H1 and H2 than previous years.

CEO comment:

"Looking ahead, there is significant growth potential in our core markets - Indie, edutainment and working simulation games. Our focus on creating a portfolio of games and apps with evergreen longevity, and leveraging our excellent lifecycle management capabilities, ideally positions us to capitalise on this and build a lifetime of play within our growing portfolio and player base."

Graham’s view

TM17 seems to be running smoothly following the departure of long-term CEO Debbie Bestwick from the day-to-day operations (she is currently a NED, and the largest shareholder).

Costs and headcount have stabilised and combined with a stronger sales performance, the company’s profits are on a nice trajectory.

If you’re willing to look past the usual acquisition-related adjustments, especially amortisation, then these shares are cheap on an adjusted basis:

While personally I would be cautious with the adjusted numbers, I do think the valuation should take into account net cash of over £50m. Enterprise value (market cap minus net cash) is £270m.

I have known this company’s name for a very long time (since I was a child), and I’m inclined to take a positive view on it. Back in March 2023, at 405p, I thought the valuation was fair.

Since then, the valuation has been battered by a profit warning and some poor results for 2023, but the business now seems to be enjoying a turnaround. At around 220p, and backed up by a strong balance sheet, I’m happy to upgrade my view on this by one notch to AMBER/GREEN.

McBride (LON:MCB)

Up 2.7% to 119.7p (£208m) - Final Results - Graham - AMBER/GREEN

McBride, the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning/hygiene markets, announces its preliminary results for the year ended 30 June 2024.

Paul last looked at this in February when he said that excessive gearing was “no longer an emergency, but is a drag on valuation”.

We had been nervous about this one’s survival prospects, but here we are with another successful debt reduction announced by the company today.

Net debt falls from £166.6m (June 2023) to £146m (Dec 2023) and now again to £131.5m (June 2024).

The deleveraging has been associated with a big run-up in the share price, as insolvency has been taken off the table in the short-term::

In terms of profitability, we have:

Revenue +5.2% to £935m

Adj. op profit £67m (2023: £13.5m), slightly ahead of upgraded expectations.

PBT £46.5m (2023: loss of £15.1m).

A stunning return to form that proves the company has successfully passed on input cost inflation to its customers.

Dividends: are not allowed without the consent of the lending group, and are not proposed. Deleveraging should remain the priority for the time being.

Current trading/Outlook: sales volumes are currently in line with expectations for the new financial year (beginning July).

And the full year outlook is in line with expectations, those expectations being adj. operating profit £59.7m and net debt £111m.

In terms of inflation:

Input costs for the main raw materials remain steady, with costs of recycled materials and natural-based chemicals increasing in line with our expectations.

CEO comment:

"It has been an excellent financial and operational performance by the Group. While market dynamics have remained favourable, with a continued consumer trend towards private label across European household cleaning product markets, it is the effective execution of our strategy that has led McBride to capitalise on this environment. Our efforts to further develop our customer partnerships, together with improved consumer insights to support product range developments and innovation led by our specialist divisional teams, will continue to drive future growth.

Graham’s view

I must give credit where it is due: McBride has pulled through some trying times in spectacular fashion. It is now delivering spectacular levels of profitability and becoming a safer investment with every month that passes, as its debt load diminishes.

Is current profitability sustainable? It seems that market dynamics - which include very high demand for private label cleaning products during a cost-of-living crisis - are very much in McBride’s favour, and we should not presume that this will last forever. McBride itself acknowledges that current profitability is “significantly ahead of the historical average”.

Despite a StockRank of 98 and a single-digit PER, I’m not going to let myself get carried away with this one. For me, it remains an AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.