Good morning from Paul & Graham!

USA interest rate cut is expected later today.

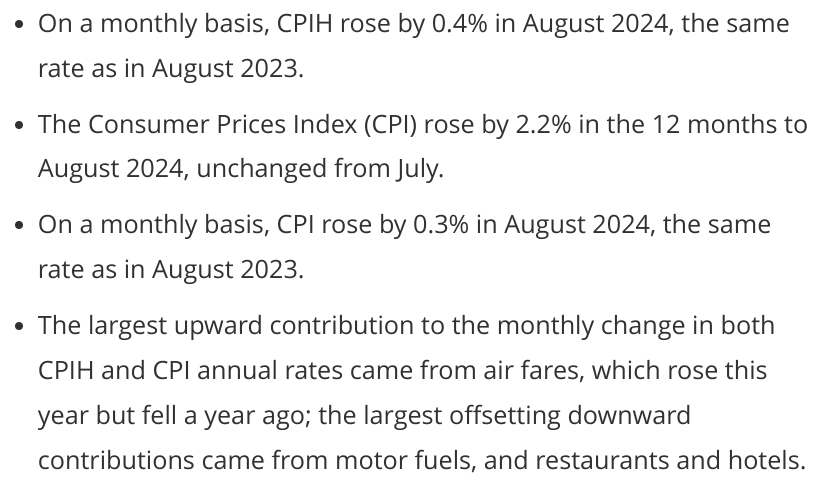

Aug 2024 UK inflation report - snippets of interest -

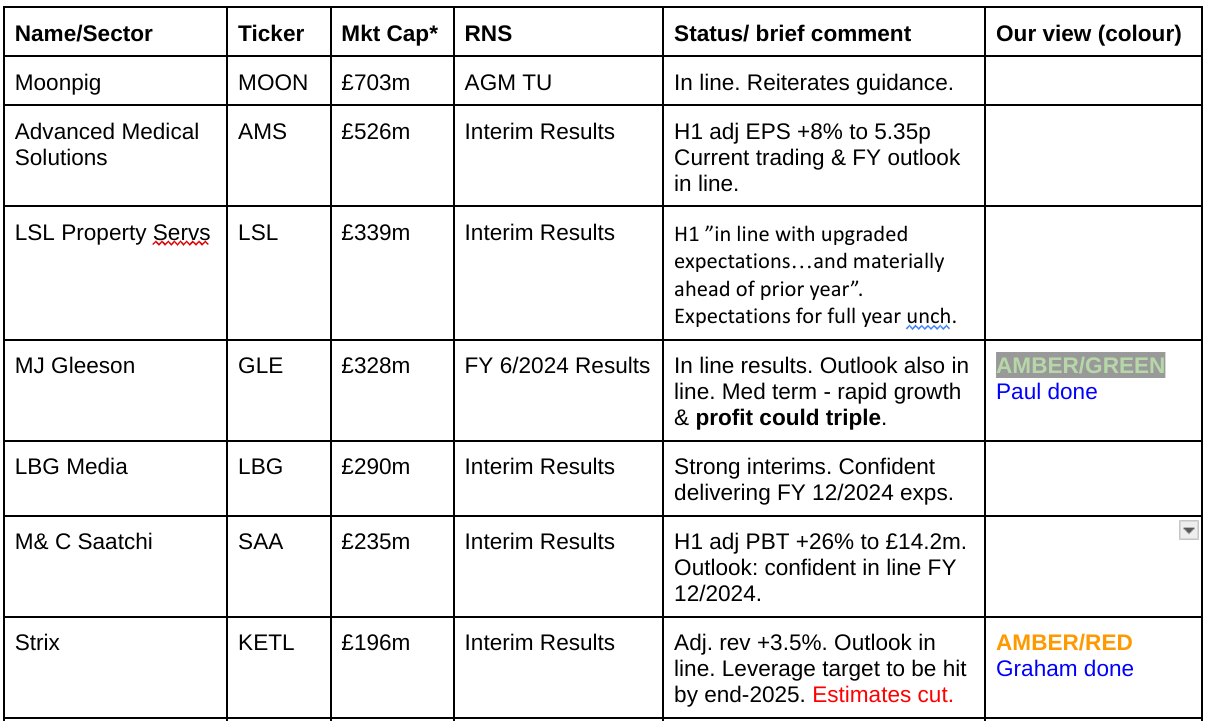

It's getting very busy now, with a deluge of June half year results coming through. So we'll keep flagging (almost) everything, with in-depth reviews for some of the more interesting items, eg. overs & unders (trading vs expectations), and the companies that you're collectively looking at (as disclosed by the home page "most viewed" widget). To keep expectations grounded, please remember that we can't cover everything in detail.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Summaries

MJ GLEESON (LON:GLE) - unch 573p (£328m) - Audited Results FY 6/2024 - Paul - AMBER/GREEN

In line results for FY 6/2024. Outlook sounds upbeat for FY 6/2025, with some signs of customer demand improving. More interesting is the longer term growth planned, with it claiming to be able to triple profits (sounds intriguing). Superb balance sheet too. Political risk:reward not currently clear. I like it overall.

Strix (LON:KETL) - down 3.5% to 80.7p (£186m) - Interim Results - Graham - AMBER/RED

Today’s outlook statement says that the company is on track to report results for FY24 in line with expectations, but if you dig a little deeper you find that forecasts have been cut due to currency and commodity price movements. That’s just one layer of the confusion faced by investors as they try to make sense of KETL’s numbers. I’ll give this one a miss now.

Xaar (LON:XAR) - down 1% to 98.5p (£78m) - Interim Results - Graham - AMBER/RED

Forecasts are unchanged at this printhead manufacturer and the cash balance has slightly improved. But there’s little else tangible good news to be found in today’s release. Profitability is currently very weak and maybe it can improve, but the company itself doesn’t know when this might happen. I’ve been disappointed by this stock too many times and for too long, so I think a mildly negative stance is reasonable.

Eagle Eye Solutions (LON:EYE) - down 4% to 455p (£135m) - Results FY 6/2024 - Paul - GREEN

A wide variety of profit measures for us to choose from! I remain of the view that this seems one of the best growth companies on AIM. As always valuation is tricky, but it seems to have a successful niche service, with an impressive client list. Continuing good organic growth. I like it. Notes also below from a chat with management today.

Paul’s Section:

Eagle Eye Solutions (LON:EYE)

Down 4% to 455p (£135m) - Results FY 6/2024 - Paul - GREEN

One of my favourite UK growth companies, EYE is a global SaaS company, primarily serving retailers (especially large grocery chains) with complicated customer personalised reward schemes. So think in terms of the loyalty apps for ASDA, Morrisons, Waitrose in the UK, and Leclerc in France, Woolworths in the US, etc. Offers and rewards are targeted to individual customers, using machine learning - eg it won’t offer you promotions on cat food or alcohol, if your previous spending shows that you’re a teetotal dog owner.

Very impressive clients, and sticky too - with almost no churn, and recurring revenues (which tend to grow as customers expand their use of the EYE platform). I had another catchup today with the CEO & CFO, and think I understand the business model a bit better now. Clients that use the EYE service are able to increase customer basket sizes, and frequency of shops, using personalised promotions. This gives a payback of about 7x for grocery retailers, and 4x for brands. Hence it’s clear why customers like the service, and keep using it. EYE has demonstrated impressive growth in recent years (mostly organic), as it wins new clients all over the world. Hence why I like this share. The difficult bit is how to value it, as mentioned before.

Earlier this year our SCVR reviews have been -

19/3/2024 - GREEN (Paul) at 570p - good H1 results, but valuation tricky. Cashflow not great.

29/4/2024 - GREEN (Paul) at 470p - Tesco has signed up for 1-2 year contract (Clubcard challenges) - impressive win. Shares are expensive, but could be worth it.

23/7/2024 - AMBER/GREEN (Roland) at 482p - FY TU - adj EBITDA ahead, buy revenue behind. Strong recent contract wins.

FY 6/2024 Results

Eagle Eye, (LSE: "EYE"), a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing, is pleased to announce its audited results for the financial year ended 30 June 2024 (the "Year").

“Strong growth in ARR and EBITDA, exiting the year with increasing win momentum”

Revenue up 11% to £47.7m

79% of revenues are recurring (very good)

Annualised recurring revenue at year end is £39.7m (up an impressive 19%, as recent contract wins start contributing)

Adj EBITDA up 28% to £11.3m, but this is not a real number, as a large element of the payroll is capitalised.

Adj PBT is much lower at £4.5m, and this is only up 4%

Note that a large £2.8m (£2.4m last year) shares based payment is adjusted out.

Statutory PBT is much lower again at only £0.7m

A big tax credit of £5.0m (recognising previous tax losses as usable) boosts PAT to £5.7m, and heavily skews EPS to a meaningless 19.5p, so we need to ignore EPS at this stage, or recalculate it to normalise the tax charge.

Quite a mixed bag there, with a very wide variation of profit measures, depending on which measure you prefer. I tend to favour adj PBT, whilst bearing in mind the management share schemes are very generous.

Outlook - more of the same, good growth in the pipeline -

“The Wins achieved at the end of FY24 and into FY25 mean we anticipate significant ARR growth in the year ahead. While this will naturally take time to flow through to revenue, the inherent operational leverage in the business means that over time the overall financial performance of the business should be very powerful.”

“Our ambition is to grow the business significantly, with our medium-term goal to achieve the next milestone of a £100m revenue and 25% adjusted EBITDA margin business and the timing couldn't be better - our exceptional offerings position us at the forefront of a global personalised marketing revolution."

Balance sheet - looks fine. It’s about £14m NTAV, including £10.6m net cash, improved by c.£1m from last year end. This looks financially stable to me, and I think EYE should not need to do any more equity raises.

Cashflow statement - isn’t great, as mentioned before, but it’s somewhat hampered by negative working capital movements vs last year. Most of its cash generation is absorbed into development spend & contract costs, so there’s not really much in the way of proper free cashflow at this stage, but I think that should come in future years as growth should see the benefit of operational gearing.

There are no divis, and it did repay about £1m of debt in the year, so work in progress I would say, not yet a big cash generator.

Q&A with management - very interesting, many thanks to the CEO/CFO for their time today. A few points I touched on (this is just my recollection of the gist of what was said, so don’t take this literally please!) -

Outlook comments - a bit unclear, I emphasised that I much prefer a crystal clear “in line with market expectations” statement, rather than waffling around the topic. Partly because it’s quick for us to CTRL+F search for “expectations” in the busy 7-8am hour, but also because more vague wording introduces doubt. They took my point on board I think.

Customer churn - have any customers left? No. Nectar was expected, and previously mentioned, which I recall. So is “land and expand” how things work? Yes, very much so.

Competition - who else is doing this? Plenty of competition from eg CRM companies, but nobody is doing loyalty schemes as a pure play, and nobody doing it as well as EYE.

Contracts take time to set up. Are those costs expensed? No, all new contract costs (and revenues) are deferred, capitalised onto balance sheet, then amortisation starts once the contract goes live (see £2.6m “contract fulfilment costs” in fixed assets).

SMS revenues are small and seem to be fizzling out. Yes, this is mainly JD Sports, and they are switching from SMS messages to other means of talking to customers, which are cheaper.

The slide deck talks about opportunities outside of grocery, in other retail chains. Yes, grocery is best as there’s so much more data, with customers shopping so frequently. Fashion, DIY stores, etc, is less frequent customer visits, but there’s lots of potential.

Given AIM shares are so much cheaper valuations than US & private equity, have you had any takeover approaches? You know we can’t answer that! But we wouldn’t sell out on the cheap.

Any further acquisitions? Always on the lookout, but nothing imminent.

AI is such a buzzword at present - but some people are saying it can be great, but also produce garbage. How do you avoid producing garbage? That’s true for generative AI (language models, although they're getting better), where it’s trying to answer questions. However, our AI is machine learning algorithms, which is very different. Our system builds a ring of products around each customer, based on what you buy. Then it looks for gaps where we can suggest products you might like, thus it allows grocers to increase basket size, and build loyalty. Great, proven payback for customers and brands.

Sales through partner channels is an interesting growth area.

UK small caps stock market still in the doldrums, is it dead in the water? We think it will recover, but don’t know when! Institutions are very supportive, and sometimes can’t buy in the size they want due to market illiquidity. Some private investors tend to drift away in subdued markets.

My overall impression - management seem straight-talking, giving direct answers to my questions. So all good I think!

Paul’s opinion - I remain of the view that EYE seems one of the best organic growth companies on AIM.

Shares have drifted sideways to slightly down in the last 3 years, despite very considerable growth having been delivered, so I think shareholders are now getting a lot more for your money than in 2021.

I would like to add some EYE to my personal portfolio when funds permit.

As mentioned before, it’s a tricky share to value at this stage. £140m market cap doesn’t seem excessive given its impressive growth, big name clients, sticky recurring revenues, and (modest) profitability. Could it become a bid target I wonder? Possibly, who knows. The Americans tend to value this type of business a lot higher than we do, it seems.

MJ GLEESON (LON:GLE)

Unch 573p (£328m) - Audited Results FY 6/2024 - Paul - AMBER/GREEN

We like Gleeson here at the SCVR. It builds low priced starter homes mostly in the Midlands & North.

Results for FY 6/2024 are as expected -

“Results in line with expectations as Gleeson Homes delivers a strong performance”

Of the two divisions, Gleeson Homes is by far the more significant, with Gleeson Land providing rather erratic, smaller contributions to profit -

Market conditions have been more difficult for housebuilders, so it’s no surprise that profit is down 21% on the previous year.

As you can see below, forecasts were reduced multiple times as tough macro caused reduced demand, and higher costs -

The hope is obviously now that we could be at or near the bottom of the earnings cycle, which is backed up by macro factors moving in the right direction, such as improving consumer confidence, falling mortgage rates, and the long-term structural shortage of decent quality housing.

There are risks with this sector though. The new Govt wants more houses built (good), but is also keen to raise more tax revenues, and had been vocal on the cladding remediation issue, so lucrative housebuilding could come under the beady eye of the Chancellor, to see what additional taxes can be extracted maybe? The rights and wrongs of this are outside the scope of these reports, but personally I don’t want to hold any housebuilder shares until we have a clearer idea of what Govt policy overall will be, and what financial help or cost it all nets off to for this sector.

Outlook - no surprises for FY 6/2024 performance then, what about the future?

Things are starting to improve -

“Gleeson Homes' net reservation rates have been improving and in the 10 weeks to 6 September 2024 was 0.50 per site per week compared with 0.39 per site per week over the comparable period last year, an increase of 28%. Cancellation rates were 0.11 per site per week compared with 0.10 per site per week over the comparable period last year.

With a number of sites close to achieving planning and in sale processes, Gleeson Land is expected to deliver an improved performance in FY2025.”

Note that the last sentence specifically talks about the small Gleeson Land division.

This is the best bit -

“In an improving market environment, the Company is confident that Gleeson Homes will meet market expectations5 for the current year and, more importantly, fulfil an ambitious programme of site openings which, supplemented by a growing pipeline of partnership transactions, will drive the exciting growth planned for FY2026 and beyond.

In delivering our objective of 3,000 new homes per annum, the Company anticipates its profitability could broadly triple and the Company would resume its position as the fastest growing listed housebuilder in the UK.”

That is very interesting, the plan to almost double completions from 1,772 in FY 6/2024, to 3,000 pa in the medium term (presumably). By benefit of it being smaller, GLE has a bigger % growth opportunity vs the larger housebuilders, hence why this share could be a good pick maybe.

It already has a substantial and growing land bank too, so 3k plots pa looks feasible given that it already has over 6 years’ land at that higher sales run rate -

“Land pipeline up by 1,763 plots to 19,138 plots (2023: 17,375)”

Broker update - Singers helpfully updates us. It has FY 6/2024 as 33.0p, rising in subsequent years to: 36.0p, 43.4p, and 49.6p. Those seem modest forecasts, and I would hope to see GLE beat those numbers, given its ambitious growth plans (and talk of tripling profit, which suggests nearer 100p in future earnings - not clear on timing though).

At 573p/share the valuation stacks up on a PER basis, if we assume GLE might be heading towards 40-50p in the next year or two, which I think looks doable.

I also like to combine a PER valuation, with an NTAV valuation at property companies, so let’s look at assets -

Balance sheet - is fantastic, as always. £298m NAV, all tangible. Hardly any fixed assets, so it’s all just a big pile of land, and inventories, in the books at cost. So there’s upside on this number. Hence the price to tangible book is 328m (market cap) divided by £298m NTAV = P/TBV 1.10 - I prefer paying less than book value, but this is tolerable.

Paul’s opinion - GLE looks very interesting, due to its ambitious growth plans. If it does triple profit, then 100p EPS is possible, put that on a PER of say 10x and you’re at 1000p/share - nice upside from the current 573p share. Although that journey is likely to take several years, and things could go wrong along the way.

I want to wait until end October budget, to see if any punitive tax measures are taken by the new Govt. However, I do like the growth story here at GLE, plus the solid asset backing, and its focus on the more resilient low cost end of the market. So for now AMBER/GREEN feels about right, ucnhanged from our previous views on 16/2/2024 and 11/7/2024.

Graham’s Section:

Strix (LON:KETL)

Down 3.5% to 80.7p (£186m) - Interim Results - Graham - AMBER/RED

Impressive results this morning from Strix, if you’re happy to focus on the adjusted numbers.

The stock has been on a recovery path:

Here are the highlights:

Adj. revenue +3.5%

Adj, operating profit +9.2% to £13m

PBT +15.9% to £8m

Unfortunately, the unadjusted figures paint a different picture.

At actual exchange rates, revenues increased by less than 2%, and all other growth rates are lower.

The “actual” (i.e. unadjusted) operating profit is a measly £1.1m (H1 last year: £10m) and the unadjusted pre-tax loss is £4m (H1 last year: £5m profit).

More positively, net debt has reduced and this number is not so easy to fudge. Net debt reduced to £69m (as of June 2024), down from £93m twelve months earlier.

The company did get a boost from a £9m placing, which was responsible for some of the debt reduction.

As a consequence, the leverage multiple has fallen to 1.76x, down from 2.66x twelve months earlier.

A leverage multiple of 2x is generally considered safe, although I have in recent years developed some doubts around the underlying quality of KETL. So I think we should probably apply stricter standards to this company than we would to others.

Bank facilities: an £80m RCF (corporate credit card) has been extended to October 2026.

Outlook

There’s a lengthy outlook statement; the punchline is that KETL is on track to report results in line with expectations, “notwithstanding the macro uncertainties”.

The target for the leverage multiple of 1.5x should be achieved “ahead of the end of FY25”.

Against that, there has been “relatively lower trading for parts of Q3”. The company says it is waiting for clarity on sales trends as it moves into peak season.

Estimates

I’m discouraged to see that forecasts have been revised lower by KETL’s brokers/commissioned researchers.

For example, the company’s Nomad has cut the revenue forecast for both this year and next year by c. £3m.

They have cut the adj. PBT forecast by 2.5% this year and by 5.6% next year (new estimates: £23.6m this year, £25.3m next year).

The cuts are blamed on currency and commodity price movements, not on the performance of Strix itself.

It’s another reminder that investors need to get their hands on these research notes if they want to be fully informed, as the RNS itself will not contain all the needed information.

Balance sheet - balance sheet equity is £43m but if you deduct intangibles (£68m) then this goes deep into the red.

Total bank loans add up to over £90m (down from £106m six months earlier). Headroom on the main lending facility is £9m which doesn’t seem particularly high to me.

Adjustments - a key adjustment in the results has been the classification of a subsidiary, “Halosource” as a discontinued operation. This means that losses associated with Halosource (nearly £3m) are removed from KETL’s headline numbers.

However, the decision to dispose of Halosource was only made privately by the Board of Directors in May and I have seen no indication that anyone is interested in buying it. So I don’t think that KETL could argue too loudly if investors wanted to include Halosource’s losses in the figures for H1.

More generally, there are nearly £12m of adjusting items to bridge the gap between actual PBT and adjusted PBT. This is a very large number, so here’s an example of what it includes:

Impairments amounting to £5.8m (HY23: £nil) including tooling/intangibles, inventories and licensing agreements associated with product lines in the Consumer Goods division where the group does not intend to place further commercial focus or allocate resources.

Graham’s view

I previously had a positive view on this stock, but was neutral on it when I covered it last year (in Sep 2023 I was AMBER with the share price at 54.5p).

Paul has been RED on it, primarily because of the poor balance sheet.

My main problem with KETL, apart from the debt load, has been the M&A strategy. If the kettle control business was so good, with long-lasting patents that laid the foundation for a quality business, why make it so much more complicated with acquisitions?

However, I was happy with a neutral stance on it last year, on the basis that management had agreed that debt reduction was the priority.

At this stage, with a market cap of nearly £200m and a share price of 80p, I am leaning more towards a negative view than a positive one, so I’m going AMBER/RED.

The company has been moving in the right direction in terms of deleveraging, and should be available to avoid financial distress, but it is reliant on the refinancing of its bank loans.

The more fundamental problem for me is that I no longer believe that it has a quality business. If it had kept things simple, then perhaps the kettle control business alone would have generated a fine return for investors. Instead we have an extremely complex situation where the level of adjustment to the numbers is beyond what I feel comfortable with. So I would be happy to avoid this one, even if it’s superficially cheap with a StockRank of 92.

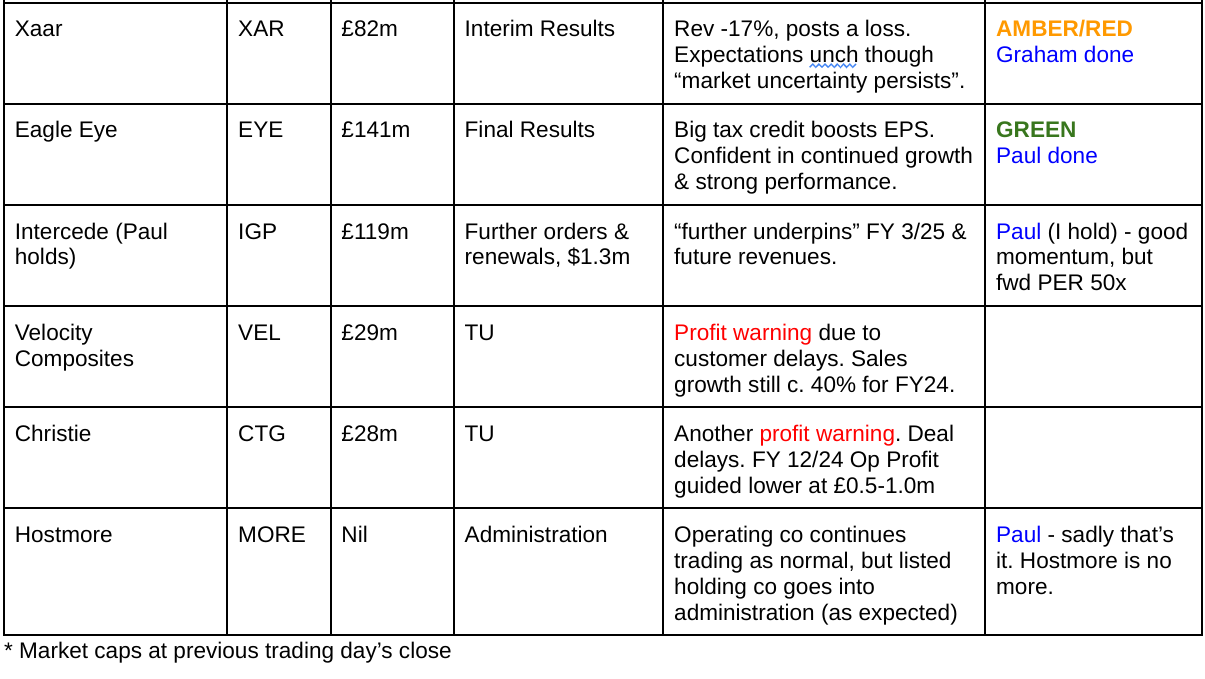

Xaar (LON:XAR)

Down 1% to 98.5p (£78m) - Interim Results - Graham - AMBER/RED

Xaar, “the leading inkjet technology group”, announces H1 results to June.

The company remains loss-making and nearly everything is moving in the wrong direction, except for a small increase in the cash balance:

Xaar’s ceramics business is now described as “legacy” (this was previously this biggest contributor of revenues and profits).

Outlook: “Market uncertainty persists although expectations for the full year remain unchanged”.

CEO comment puts on a brave face:

We remain confident in our strategy which is increasingly demonstrating the unique capabilities of our printhead technology. Our pipeline of opportunities has increased in quality in both existing and new application areas and increasing numbers of OEM's are engaged in, or actively planning, new product launches incorporating Xaar printhead…

We continue to focus on the elements of the business that are within our control, enhancing our technology, supporting customer adoption of our printheads, managing our cost base and strengthening our cash position demonstrating the benefits that Xaar's unique capabilities can deliver to customers. We remain convinced of our ability to maximise the substantial opportunity we have.

Graham's view

I was RED on this after its Nov 2023 profit warning (share price at the time: 132p).

Paul upgraded to AMBER in March 2024 with some signs of stabilisation.

1-year chart:

As with KETL, I’ll strike a balance today and go AMBER/RED.

It’s not all doom and gloom but Xaar has been around for a while and we’ve learned to expect volatile results due to uncertain demand, sensitivity to macro conditions and product cycles that come and go.

Here’s a classic example from today’s outlook statement:

As sales volumes improve and energy costs stabilise, we expect gross margins to improve in the medium term. We remain cautious on providing precise timing given the current market backdrop and uncertainty caused by economic and geopolitical effects.

In other words: the company itself cannot predict when profitability might improve. So it would be brave for anyone outside the company (such as myself) to make any predictions.

Estimates from Progressive suggest gently rising revenues this year with adj. PBT close to breakeven (£0.4m), improving to £1.6m next year.

But even those adjusted numbers would not be able to support the current market cap.

Perhaps this will work out well for investors, but to me these shares more closely resemble gambling tokens than sound investments.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.