Good morning from Paul & Graham!

All done for today!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Companies Reporting

Summaries

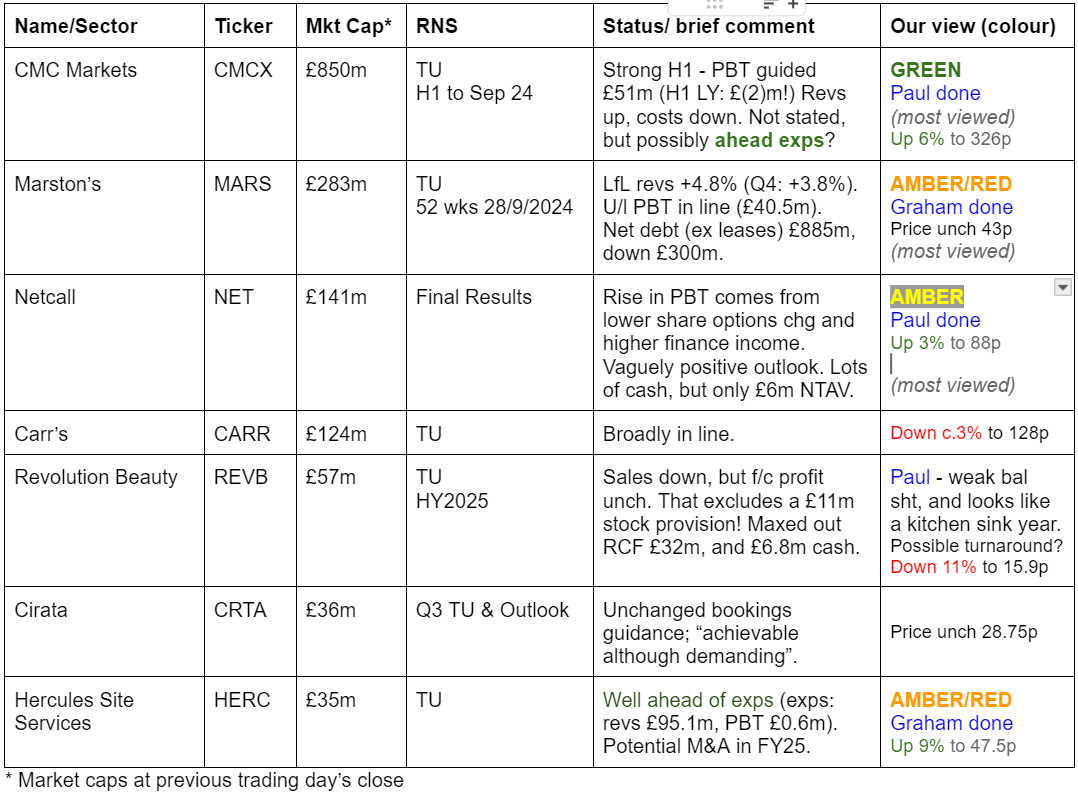

CMC Markets (LON:CMCX) - up 6% to 322p (£900m) - Trading Update - Paul - GREEN

This looks a strong update for H1, with guidance for £51m PBT, massively improved from a small loss in H1 LY. This is a combination of much stronger revenues, and a lower cost base. I reckon this share could still be decent value, if H2 delivers a likely seasonal uplift. Broker forecasts look too low for FY 3/2025 I think. Hence I'm happy to remain at our 6th GREEN this year for this high-performing share.

Hercules Site Services (LON:HERC) - up 11% to 48.3p (£38m) - Trading Statement - Graham - AMBER/RED

An excellent update from this supplier of labour to the construction/infrastructure industry. Forecasts are raised accordingly, with revenues trending c. 10% higher than prior expectations. The company is profitable and is owner-managed but I’m picky in this sector and the valuation worries me.

Marston's (LON:MARS) - up 1% to 43.3p (£275m) - Trading Update - Graham - AMBER/RED

A decent update with this pub group outperforming the broader market thanks to LfL sales growth of 4.8%. I’m leaving AMBER/RED unchanged as recent financial results from MARS have struggled under the weight of the company’s net debt (£885m) and I’d like to see confirmation that this has improved.

Netcall (LON:NET) - up 2% to 87p (£144m) - Final Results (FY 6/2024) - Paul - AMBER

OK results, with EBITDA up 5%. Big cash pile mainly comes from favourable timing of customer payments up-front. Valuation on c.23x PER looks about right to me, for a decent quality business that has established a good multi-year track record.

Paul’s Section:

Netcall (LON:NET)

Up 2% to 87p (£144m) - Final Results (FY 6/2024) - Paul - AMBER

Netcall plc (AIM: NET), a leading provider of intelligent automation and customer engagement software, today announces its audited results for the year ended 30 June 2024.

Strong performance driven by cloud demand and enhanced product proposition

To date this year we’ve not had a proper look at NET. Although we did note it announced in line trading on 23/1/2024 and 6/3/2024, with no further comments.

The long-term track record is mixed, but something seems to have started going well in 2020, with the shares having more than 3-bagged since those lows -

This looks to have been driven by the improving fundamentals, with much better profit growth kicking in from FY 6/2022 -

Broker consensus data also tells a positive story -

The StockRank nicely sums things up - very high quality, with good momentum, but not cheap -

The growth & value section tells the same story - good quality, but expensive on a PEG of 1.9, and PER of 23.1x, plus almost no asset backing, with P/TBV of 19.9x -

It takes about 30 seconds to review all the above items for any company, which gives me an almost instant rough idea of whether I want to pursue the stock idea any further. I can already tell you that I’m probably not interested in NET because it’s fully priced. So I’d want to see some catalyst (eg. big new contract wins, accelerating growth, blockbuster new products, etc), to get me excited about any further possible upside.

Performance in FY 6/2024 -

It splits out the faster growth rate in “Cloud services revenue” below, but I note they’re not showing the nil growth from the other part of the business, that row is missing below!

As mentioned in our snapshot posted first thing, I was struck by the large difference between Adj EBITDA +5%, but PBT +58%. The difference is explained below, where I’ve highlighted the 2 large items which boost PBT vs LY (last year), neither of which are related to the performance of the business. Hence I would say the +58% PBT is a bit of a red herring. Underlying performance is only slightly up on LY.

Still, those are good numbers, and this is a decently profitable business, making nice margins, whichever measure you prefer. It’s earning a lot of interest on the cash pile too, that’s material to overall profits.

Recurring revenues are 76% of the total, which investors like, and tend to pay highly for that visibility.

Acquisitions -

“Post-period end acquisitions of Govtech and Parble, both of which are expected to be immediately earnings enhancing with substantial potential for cross-selling”

The only acquisition I can find in FY 6/2024 was Skore Labs (£2m initial cash, plus £4.2m potential earn-out).

Dividends are negligible, yielding only just over 1%.

Outlook -

“Positive sales momentum continuing into the start of the new financial year which, together with the contracted revenue expected to be recognised in FY25, provides good revenue visibility.”

“Our robust pipeline and product roadmap, together with a growing base of recurring revenue and a healthy cash position, leaves us well-positioned to capitalise on the market opportunities ahead."

Balance sheet - the stand-out feature is a whopping £34m net cash pile. However, NTAV is only £6.9m, so this big cash pile has mostly come from customers paying up-front. So I would caution about imagining this is surplus cash, because it’s not. There is a £26m “contract liabilities” line in current liabilities, which shows that a lot of the cash will actually be used to provide the services that customers have paid up-front for. However, if NET can be sure that they can always get paid substantially up-front, then they could possibly use some of the cash pile eg for acquisitions. Canaccord forecasts that cash will drop about £8m in 2025, reinforcing my point that it's favourable timing this year, so don't get carried away re cash!

Cashflow statement - operating cashflow of £14.7m looks great, but benefits from a £5.2m favourable “Increase in contract liabilities” working capital movement. Personally I would adjust that out, as it could just be a one-off, and might even reverse in future.

Further down the statement, it spent £1.6m on payments for acquisitions, and £2.6m on capex, most of which £2.3m is capitalised development spend - almost double the amortisation charge, so profit is flattered by about £1m from this factor.

A further £1.3m was spent on divis.

Overall, the cash pile grew by £9.3m, with £5.2m of that coming from increased customer receipts, paid up-front. So underlying cash generation is less than half the total, but still looks reasonably good. So I don’t think there’s anything untoward in these numbers.

Broker forecasts - take your pick from Canaccord and Singers, both of whom kindly make their notes available on Research Tree, very helpful indeed.

Both have 3.7p adj EPS pencilled in for FY 6/2025, giving a PER of 23.5x

Paul’s opinion - NET has certainly established a good track record of growing profits. It’s not clear how much is organic, and how much has been bought in from acquisitions?

There are some interesting parts in the commentary, and I think this looks a fairly decent business. Cloud computing is obviously a growth area, and it also throws in a garnish - something about AI, almost obligatory these days.

Put it like this, I can’t see anything wrong with these numbers, but equally I don’t see anything exciting enough to make me want to buy any shares at this valuation.

My main software investments are BKS and IGP, which I think have more exciting growth than NET, hence why I’m prepared to pay a higher multiple for their current earnings.

Overall I think NET should be on AMBER - ie nothing wrong with it, and probably priced about right for now.

CMC Markets (LON:CMCX)

Up 6% to 322p (£900m) - Trading Update - Paul - GREEN

CMC Markets Plc, a leading provider of online financial trading and B2B institutional solutions, today issues a trading update for the six months to 30 September 2024 ("H1 2025" or "the period").

Both Graham and I picked this share at c.100p as one of our top share ideas for 2024. The appeal then was turnaround potential, with an operationally geared recovery in profits possible, plus full cash & near-cash asset backing, so you basically got the business for free. Talk about favourable risk:reward! For some bizarre reason, I omitted to buy any personally, which is so annoying. Although I think it’s fair to say that we didn’t expect the profit recovery to be quite so spectacular, and so fast. Lesson learned for the future - when an excellent risk:reward situation arises, grab it fast, rather than dithering & waiting to see what happens.

In a brief update today, it gives us some guidance on H1 trading -

Net operating income up 45% to £180m

Costs down 7% to £113m (this exclude staff bonuses) - note that CMCX slashed its overheads earlier in 2024.

PBT c.£51m (implying £16m additional costs over the £113m mentioned above) - this is remarkable, as the LY H1 comparative is a £(2)m loss! A big turnaround was expected and in the forecasts, but I think this looks like a beat. I don’t have access to any broker notes, annoyingly, so can’t 100% confirm that it is an earnings beat, but the share price is up 6.2% at 08:40, so it’s been well received by the market - implying it probably is a beat.

Given that the summer period tends to be quietish for trading, then I imagine H2 might be a seasonally stronger half perhaps? So could we be looking at >£100m PBT for the full year? That seems likely to me. Looking back at previous years’ H1:H2 split, it’s so disrupted by the pandemic and market volatility, that I can’t draw any firm conclusions. Although it clearly makes sense to me that Oct-Mar would be busier in the markets than Apr-Sept most years, so it’s probably sensible to assume CMCX could report higher H2 than H1 profits.

Cost savings are kicking in now, as expected - we covered this here on 5/2/2024, when £21m of cost savings (200 staff cut) were announced.

Product range is broadening, although it’s not yet clear which (if any) of these are likely to be significant in the group’s future performance -

“From an operational standpoint, the Group has continued to enhance its service offering across platforms with the expansion of cash equities and options products, as well as the upcoming launch of cash ISAs in the UK underpinned by our treasury management division and proprietary technology.

The onboarding of Revolut clients has commenced following a soft launch, with the number of clients live and actively trading increasing steadily. The Group will continue to keep the market updated on the progress of this partnership.”

Valuation - I’ll have to wait to see what moves there are in the broker consensus numbers, probably another upgrade, on top of an already pleasing trend -

Making up my own numbers, if it achieves, say £120m PBT for FY 3/2025, take off 25% corporation tax, I get PAT of c.£90m. Divide by 280m shares in issue, that’s 32p EPS. The StockReport currently shows only 20.7p broker consensus for this year. So there could be good upside on forecasts, and a PER of about 10x on my guess for EPS. Not bad! Particularly as it has lovely liquid asset backing, and ample dividend-paying capacity.

Although we do have to bear in mind this sector is a bit feast or famine, with high fixed costs, and revenues that can suddenly be curtailed in bear markets.

Paul’s opinion - CMCX still looks decent value to me, despite the shares tripling this year. Performance has radically improved, so the company is worth a lot more. Valuation doesn’t look even remotely stretched to me, so I think there could be further upside here, maybe to 400-500p/share possibly (in the fullness of time [nice and vague!]).

So it’s a continuing GREEN from me. Both Graham and I have reviewed CMCX, this is now the 6th time in calendar 2024, and we’ve been unanimously GREEN on each occasion, as the facts justify the superb share price performance. So it’s not a case of us falling in love with a big winner for us, it still stacks up fully on fundamentals I think.

Note that the share count has actually dropped slightly over the 5-year period shown below. Note CMCX is controlled by founder Peter Cruddas, who controls c.60%, so he'll be zooming up in the rankings of the next Sunday Times rich list, given the share price performance here!

Graham’s Section:

Hercules Site Services (LON:HERC)

Up 11% to 48.3p (£38m) - Trading Statement - Graham - AMBER/RED

Hercules Site Services plc (AIM: HERC), a leading technology enabled labour supply company for the UK infrastructure and construction sectors, is pleased to provide a trading update for the year ended 30 September 2024 ("FY24").

Excellent news today: performance for FY24 is going to be well ahead of market expectations.

These prior expectations, helpfully provided in the RNS, are for revenues for £95.1, adj. EBITDA of £4.5m and PBT of £0.6m.

Revenues: the new revenue forecast is over £105m, up c. 24% on the prior year and 10% higher than the market consensus.

CEO comment:

"We are thrilled to have delivered growth well ahead of the market's expectations for the year, once again reaching new record highs and adding to our proven track record of achieving significant year on year growth…

"We have a lot to look forward to in FY25. With a successful £8 million fundraise under our belt, we have the funds available to potentially acquire selected labour supply companies in the infrastructure sector, which is well-supported by the new government.

Further Estimates: a useful note out from Cavendish this morning provides fresh estimates and further explanation of HERC’s outperformance this year.

The adj. EBITDA forecast moves from £4.5m to £4.9m, and the adj. PBT forecast moves from £0.8m to £1.1m.

Cavendish point to the challenges in the water industry that require increased levels of investment, higher numbers of staff working on HS2, and the new nuclear power station Sizewell C.

In addition to the forecast changes for the current year, they also increase their revenue estimates for FY25 and FY26 by 10-11%. However, the adj. PBT estimates for each of those years increase by only £0.1m.

Fundraising/shareholder changes: the company raised £8m in a placing in September, so I guess we can treat it as having an enterprise value of about £30m (market cap minus cash raised). It previously had a small net cash position.

When that fundraising occurred, the founder-CEO of HERC sold 6 million shares, to a new “strategic” investor, Wasdell Packaging. Of course it can be disconcerting when a founder-CEO is selling, but he still has a very large stake and the corporate buyer should have some good reason for getting involved:

Graham’s view

I am very picky when it comes to staffing and recruitment firms and I’m afraid that I have my doubts about the merits of this one as an investment idea.

Additional revenues of over £10m this year (reality vs. prior expectations) are feeding through to perhaps a £0.3m increase in pre-tax profits.

At least there is some profit margin on the additional revenues, but it’s so thin that I would really struggle to get excited about owning this. This performance is probably perfectly normal for the sector - but this is a sector where I’m very picky.

I can only presume that the market is valuing this on the much larger EBITDA figure rather than on PBT.

Checking the interim results, EBITDA left out large depreciation and finance (presumably lease-related) costs. I would want to treat these as real costs, so I wouldn’t want to use EBITDA to value this stock.

Therefore I’m afraid this stock is not for me.

I’m nervous about taking an AMBER/RED stance on this because it is enjoying positive momentum in both its share price and its trading momentum, and it is profitable. However, the forward P/E multiple (using the latest adjusted EPS forecast) is nearly 50x. It’s risky to stand against momentum but I feel obliged to take a mildly negative view on this, at the current valuation.

Marston's (LON:MARS)

Up 1% to 43.3p (£275m) - Trading Update - Graham - AMBER/RED

Marston's, a leading UK operator of 1,339 pubs, today announces a trading update for the 52 weeks to 28 September 2024.

This is a brief full-year update. Key points:

Total retail sales +5.8% (including at franchised pubs).

Like-for-like sales of 4.8%, “outperforming the broader market”.

Like-for-like sales in Q4 (the 13 weeks to the end of September) were up 3.8%, “a strong result that comes despite the very wet weather towards the end of the period”.

Profits for FY24 are expected to be in line with an underlying PBT of £40.5m. This excludes any profits from its brewing business during the year, which has been sold to Carlsberg.

Net debt: the sale of the brewing company, along with other sources of cash, has enabled a reduction in net debt of c. £300m year-on-year. Net debt is still a staggering £885 million.

CEO comment:

'The strong revenue performance is very pleasing. This reflects the quality of the experiences we are providing for our guests as well as the continued focus and passion of our team. This performance, combined with our recent disposal of CMBC puts Marston's in a strong position to drive value for our shareholders as a focused pub business…

Graham’s view

As noted by Paul in January, this is a special situation where the company’s equity is a fraction of the value of the debt pile.

Interim results to March 2024 showed underlying pub operating profit of £53m only matching the company’s net finance costs of £53m, leaving zero profits for shareholders. The statutory (unadjusted) results were worse than this.

The company will confidently argue that it has a freehold estate with an asset value of £2.1 billion, and that it has borrowed against its assets at attractive rates. The most recent interim balance sheet helps the argument that the company has strong asset backing, as it showed a net asset value of £600m, almost entirely tangible.

Even if that’s true, however, the company still needs to generate enough cash profits to pay its interest bill and other obligations. Last year’s annual results contained a “going concern” warning as the company seemed to be in an uncomfortable situation. The subsequent interim results also included analysis along these lines but my interpretation is that there was more confidence in the company’s solvency by that point.

Overall, I am happy to leave Paul’s previous AMBER/RED stance unchanged on this, although I’d be open to upgrading when we get full-year results that show an improved income statement (in terms of both underlying and statutory numbers) and improved solvency. At this stage, there are too many unknowns for me to take a neutral stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.