Good morning from Paul!

Friday markets/macro summary

I started doing this last Friday, and people seemed to like it, so let's continue.

I’m not an expert, more a moderately educated layman, in economics, but I like to keep abreast of what’s going on, and the broad trends, to help inform my investing.

Halifax reported that UK house prices were up 4.7% year-on-year (the best rise since Nov 2022) - increasing evidence that the residential property market in the UK is recovering (although some mortgage rates went up, due to increased Gilt yields).

Florida hurricane sounds bad, but not as bad as initially feared. Seems to have had little effect on markets. Obviously hoping people will be OK (“stuff” can be replaced, but people cant), but I don’t think it’s something that UK investors need to be overly concerned with.

Moan of the week (potentially developing into a podcast rant for the coming weekend) - increasing numbers of companies are not stating if they are trading above/in line/below market expectations. That’s the whole point of trading updates, so filling them with other information, but omitting the key info is both annoying and counter-productive (as it makes investors suspicious that the PRs are trying to hide something, and undermines my trust in the company's management). That is a disgrace!

CityAM headline on Thu told us to prepare for a possible AIM sell-off (Peel Hunt reckons a 20-30% across the board sell-off is possible), as fears mount that the Budget might include an attack on AIM’s Inheritance Tax benefits, with £6bn in IHT funds potentially at risk of redemptions. We’re certainly seeing signs of strange price drops in some AIM shares, handing us some attractive buying opportunities in my view. Irrational market events like this are a great opportunity to put cash to work, in my view. It’s a question of being bold, selective, but also keeping some powder dry in my view, as most of us are not skilled traders who can time purchases at the exact low! So I’m holding my nerve but also have some cash ready to deploy if the market does go haywire. The best purchases are often the most uncomfortable!

Anecdotal evidence that some holders of SIPPs are selling shares in order to grab their 25% tax-free lump sum, following speculation that this might also be curtailed in the forthcoming budget. All speculation, but the way all this has been mishandled has done real (hopefully only temporary) damage.

ONS report out today says GDP is estimated to have grown +0.2% in Aug 2024, slightly better than 0% in June & July. Such small numbers that I don’t think we can yet ascertain a trend, and they are only estimates, which often get revised up or down. At least it’s positive anyway.

Interesting blogs from Neil Woodford, the most recent 3 are worth reading. This one mentions that the UK’s finances are getting a boost from lower interest rates, because the UK has a large amount of index-linked Gilts in issue. Also he thinks that necessary revisions to OBR forecasts could result in the Chancellor having more wiggle room than anticipated, hence a possibility the Budget may not be as bad as we fear. Thank goodness we’ll soon be put out of our misery on 30 October. As usual I’m planning on writing my thoughts about the Budget here in that day’s SCVR and maybe the next day.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

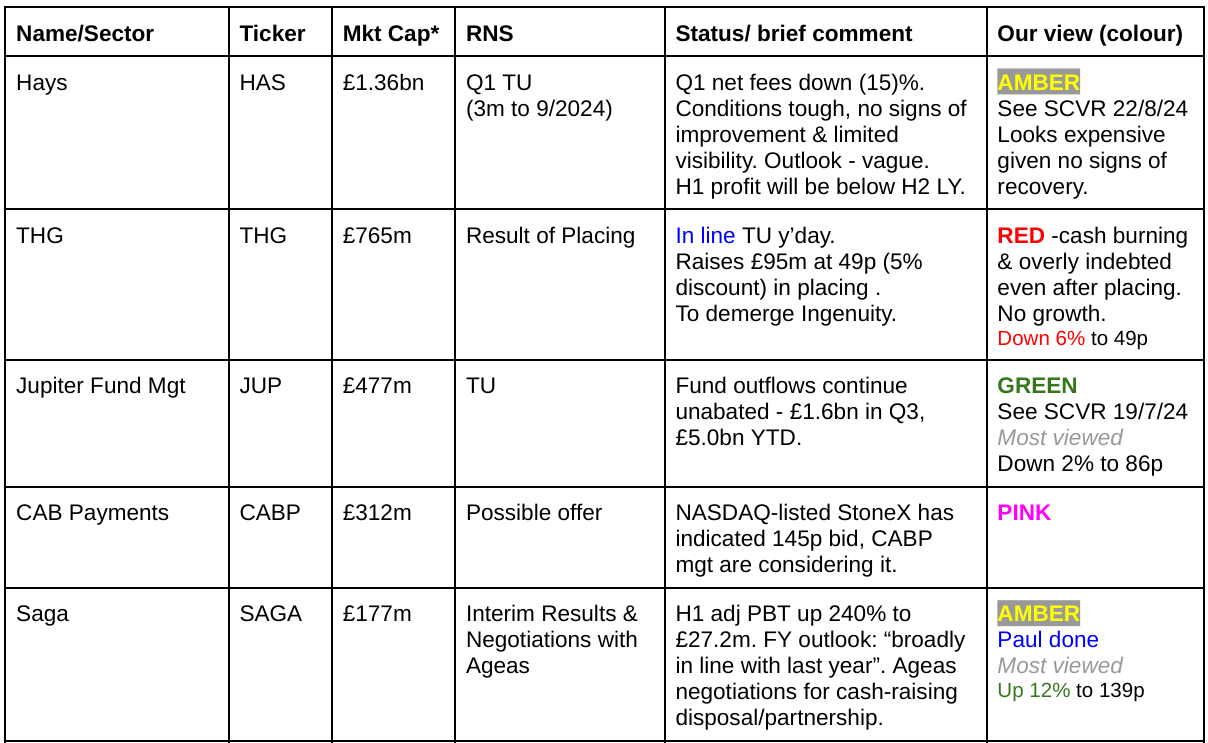

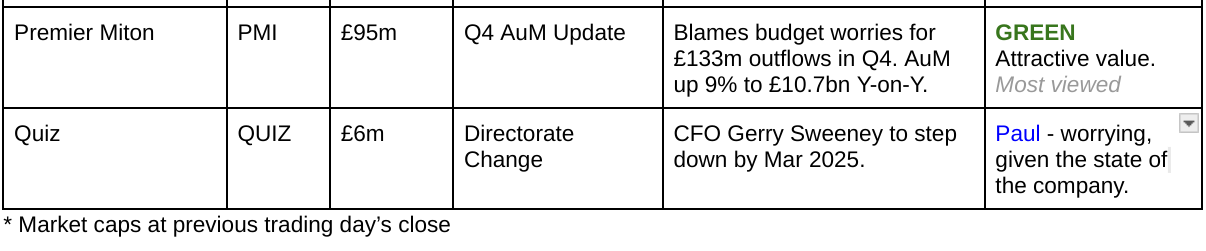

Companies Reporting

Summaries

Saga (LON:SAGA) - up 9% to 136p (£193m) - Interim Results & Exclusive talks with Ageas - Paul - AMBER (possible FY PW?)

Interim results look good, with a 240% increase in adj PBT to £27.2m. That's spoiled a bit by a vague outlook statement that seems to be saying H2 will not make much profit, resulting in FY 1/2025 profit slightly below last year. Insurance broking is struggling, with profits halved, but ocean cruising is going very well, so this is now looking more like a travel business, than an insurance company. More so as it announces what seems an advanced deal with Ageas to sell underwriting, and get £80m up-front for a partnership in broking. All looks intriguing, and I suspect this share could head higher, although I don't have enough info to be sure about that, hence AMBER again.

Paul’s Section:

Saga (LON:SAGA)

Up 9% to 136p (£193m) - Interim Results & Exclusive talks with Ageas - Paul - AMBER

Saga plc (Saga or the Group), the UK's specialist in products and services for people over 50, announces its interim results for the six-month period ended 31 July 2024.

The company’s headlines sound positive -

Strong underlying profit growth, alongside significant deleveraging

Continued momentum across Cruise and Travel, while market conditions impacted Insurance

This has been the same story for a while, with travel doing well, and insurance struggling.

I was amber/green earlier in 2024, 30 Jan & 19 April, but moderated to AMBER in May, June & early Oct. We’ve been following the story here quite closely for years now, with my view consistently being that when you dig into the detail, the debt isn’t as bad as it looks, with the 2 owned cruise ships being a substantial asset (£577m book value) that covers most of the debt. I’m not saying the debt is comfortable, because it’s not, but also not likely to result in anything bad happening (e.g. another placing, which I don’t think is necessary).

There’s a decent jump in revenues, and adj PBT for the latest half year. Although note the (once again) large statutory loss, so very large costs adjusted out. These adjustments are almost all goodwill write-offs, so that’s OK. Also a useful reduction in net debt -

Outlook - on my initial skim of the results, I couldn’t find a clear statement of whether or not it expects to achieve full year market expectations. As mentioned above, this is not good enough. Companies need to be crystal clear on this. Using some other form of wording strikes me as deceptive, and makes me less likely to want to buy the shares.

It says this today -

“The Group remains on track to deliver a full year Underlying Profit Before Tax3 that is broadly consistent with the prior year.”

I haven’t got any detailed broker forecasts. Going back to the FY 1/2024 results, it posted an underlying PBT of £38.2m. So deducing from the statement above, it only expects to produce about £10m adj PBT in H2 this year, which doesn’t sound very good.

Is this actually a profit warning then? It might be, I haven’t got enough information about existing FY 1/2025 forecasts. If anyone manages to get hold of a broker note, perhaps you could post a comment to see if forecasts are now being reduced?

Doing some basic maths, I come up with c.20p adj EPS for FY 1/2024. That’s well below Stockopedia’s 26.6p broker consensus figure, so I suspect this might be a profit warning today that they seem to be trying to obscure perhaps?

Let’s keep an eye on the broker consensus figures in future, to see if another downgrade comes through in the coming days. The trend has been downwards of late - and SAGA has a long track record of missing its forecasts, hence why I place little value on them now - SAGA’s often incredibly low forward PER is because the forecasts are in-credible!

Ocean cruise - these numbers below look good. Although am I going mad here, with the last bullet point, how is £27.9m per ship “well in excess” of a £40.0m per ship target?? Ah of course, it’s half year figures, doh! Annualise these numbers below, and they’re impressive, assuming there’s not a huge H1:H2 seasonal weighting. It says its other travel business has an H2 profit weighting, but that may not necessarily apply to cruises, I’m not sure.

Insurance broking underlying PBT almost halved to £12.2m in H1, but it says this is as expected, and is due to competitive pressures. Maybe SAGA needs to automate things more, as it sounds to me as if profit per policy from broking is maybe under structural downward pressure?

This has driven another large goodwill write-off, which doesn’t really matter to me because I routinely write off all goodwill anyway. It is a reminder though that this part of the business is struggling, and maybe shouldn’t be valued at very much if profit is unlikely to recover?

Insurance underwriting - eked out a small H1 profit of £1.9m, vs a £3.6m in H1 LY. Hopefully they’ll get rid of this part of the business, which has always made me uncomfortable given its volatile performance.

Balance sheet - as before this is dominated by the large cruise ship assets (£577m) at the top, and net debt of £615m.

RCF doesn’t seem to be used, but has been extended by a year to Mar 2026. Covenants have been changed to include ship debt, and it’s within the key covenant of 6.0x, being 4.6x at end H1.

There’s also a loan facility from Sir Roger de Haan.

NAV is £116m, less intangible assets of £270m, gives a deficit on NTAV of £(154)m, which I would like to see repaired over time.

It would be interesting to see a pro forma balance sheet, to see what it would look like with the insurance underwriting division gone?

Dividends - are not possible, or likely to be possible for the time being, and the focus is on debt reduction.

This is, if anything the more important announcement today.

To have issued this announcement, I’m assuming that talks must be at an advanced stage -

“Saga and Ageas in exclusive negotiations over Insurance partnership and sale of Saga's Underwriting business”

The main points are -

Proposed sale of Saga’s underwriting division for £67.5m, expected completion Q2 2025.

“Affinity Partnership” between Saga’s insurance broking division and Ageas, with SAGA receiving £80m cash up-front, plus possible performance targets with £30m in 2026 and £30m in 2032. Target start in late 2025, running for 20 years.

Paul’s opinion - H1 results show quite a dramatic shift in profit away from the seemingly declining insurance businesses, and towards the much more profitable cruise ships. Together with the proposed deals to dispose of underwriting, and effectively sell the SAGA brand and some of the future broking profits in return for £80m cash up-front, then maybe we need to change how we value SAGA, and treat it as a travel company?

If the disposal & partnership deals complete, then that’s going to clear most of the non-ship remaining debt. EDIT - see this interesting reader comment below, which casts doubt on whether the £80m receipt would reduce debt, or just replace the negative working capital of the insurance underwriting business. So we definitely need more information to judge this properly. End of edit.

I don’t think we can really value this share now, because it’s going to fundamentally change shape, and we don’t have enough information about the insurance deals to ascertain what level of ongoing profits SAGA is likely to make from tying itself to Ageas.

Overall though, I like the sound of the deals, and that £80m could largely fix SAGA’s balance sheet, if it is booked as an exceptional profit, or it might have to be released over the 20 year period, I don’t know. Lots of questions, which make it almost impossible to value this share right now.

The core business will in future be the cruise ships, it appears. So maybe we could take a stab at valuation of that division alone, and assume everything else is worth only a little?

I would argue that the £193 mkt cap looks reasonable, for 2 owned & profitable cruise ships. The ships’ asset value is likely to more than cover the whole group’s net debt once the two deals above complete.

Given all the uncertainty here, I’m going to stick at AMBER, and watch with interest from the sidelines. My hunch is that there could be quite good upside on this share, but I can’t measure it at the moment unfortunately, due to so much uncertainty and lack of information.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.