Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

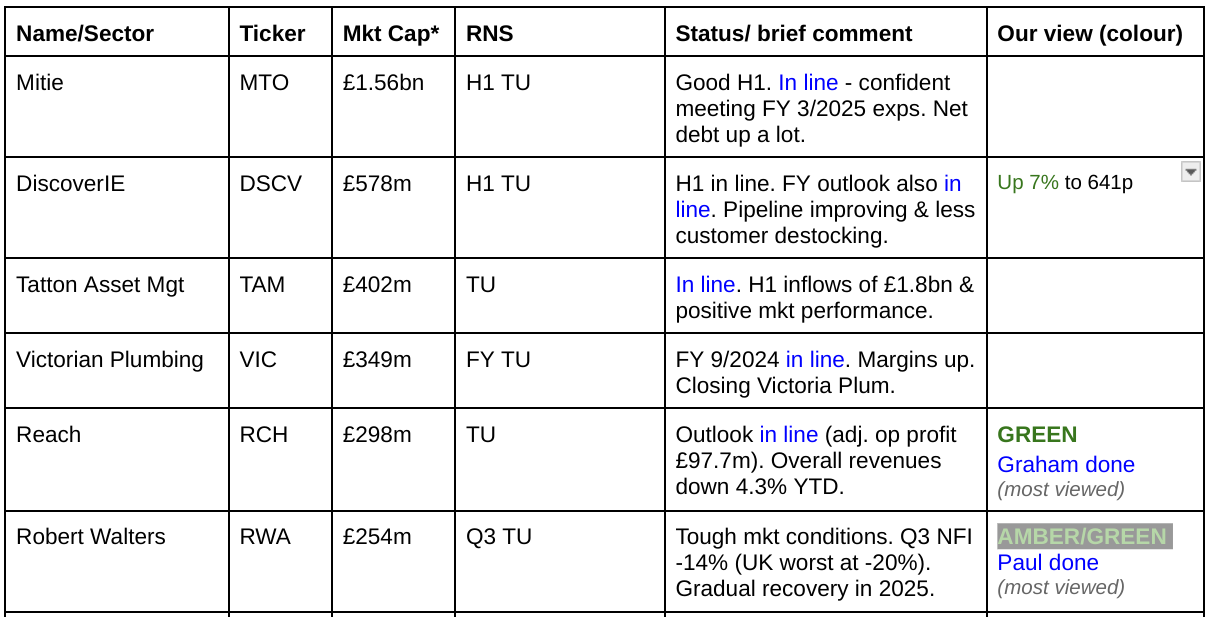

Companies Reporting

Summaries

Reach (LON:RCH) - up 3.5% to 97.1p (£309m) - Trading Update - Graham - GREEN

An in line update confirming full year expectations (adj. operating profit £97.7m consensus, slightly higher than 2023). This is despite a revenue decline in the region of 5%. Pension deficits and a shrinking core business continue to weigh on this, but I suspect the problems are more than fully priced in.

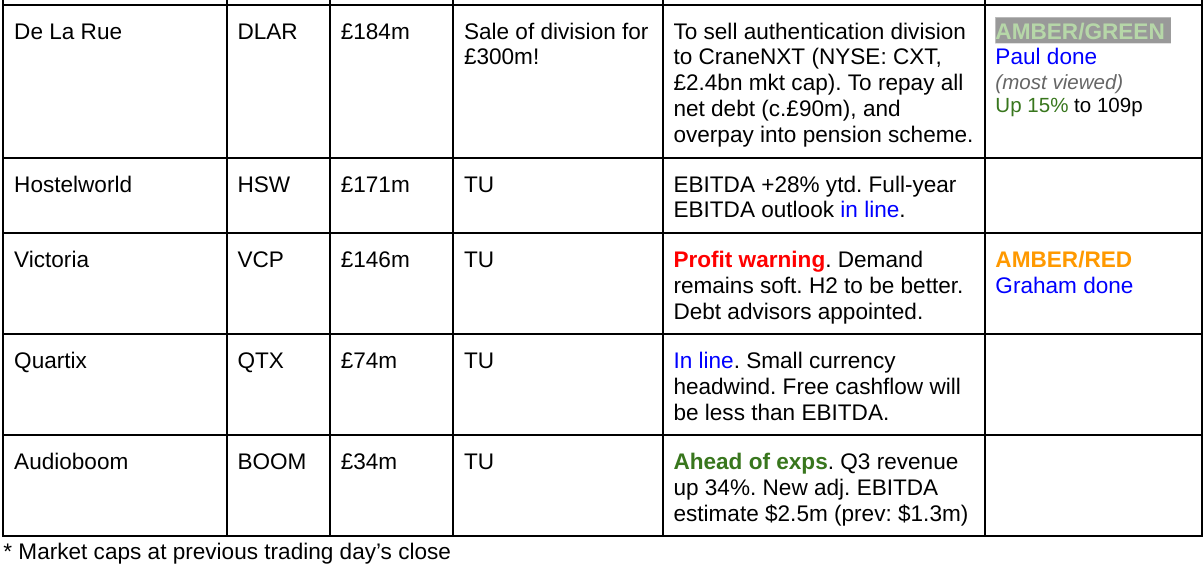

Victoria (LON:VCP) - down 7% to 118.4p (£135m) - Half-Year Trading Update - Graham - BLACK (PW) - AMBER/RED on fundamentals

This is a profit warning as VCP reveals ongoing soft demand for its flooring products. Debt advisors have been appointed to help with refinancing a large note that’s maturing in 2026. I am tempted to turn RED on this and would do so at the first sign of balance sheet trouble.

De La Rue (LON:DLAR) - Up 15% to 108p (£212m) - Proposed sale of authentication division for £300m - Paul - AMBER/GREEN

Achieves an impressive £300m deal to dispose of its authentication division. If it completes in H1 2025, then this deal would comfortably wipe out all net debt, allow DLAR to roughly halve its pension deficit (which isn't actually that large), and still have pots of net cash left over. Maybe I've missed something important, but my initial reaction was much more positive than Mr Market's.

Robert Walters (LON:RWA) - down 2% to 343p (£249m) - Q3 Trading Update - Paul - AMBER/GREEN

Another staffing company saying that revenues are still dropping, and it's only trading around breakeven. Recovery - no sign of it yet. Despite that, I mull over the recovery potential below, and think the strong cash position keeps it moderately positive looking through current dismal market conditions for a recovery in 2025 and beyond.

Paul’s Section:

Robert Walters (LON:RWA)

Down 2% to 343p (£249m) - Q3 Trading Update - Paul - AMBER/GREEN

“Trading update for the third quarter ended 30 September 2024”

“Continued focus on strengthening the business amidst challenging market conditions”

We had an excellent debate in yesterday’s report, with lots of interesting reader comments. Why is it that the expected recovery from staffing companies internationally, just isn’t happening?

We’ve had lacklustre reports from both Hays (LON:HAS) (late last week) and Pagegroup (LON:PAGE) (yesterday), both indicating no signs of recovery yet in their various regions.

As I would expect, RWA says very similar things today.

Q3 Net Fee Income (NFI) is down heavily vs LY at -14% - so it’s not even that this sector is bottoming out, it’s continuing to fall heavily.

The larger regions of Asia and Europe are both down -14%. The smaller UK operation is worse, down -19%.

Crumbs of comfort are the Q3 YTD is down -17%, so Q3 is a smaller reduction at -14%. There’s also the point that these weak 2024 figures should become 2025’s soft comparators. Also using constant currency reduces the -14% to -12%.

Company comments -

“Trading conditions were broadly unchanged from the first half, with client and candidate confidence levels yet to show signs of material improvement.”

RWA has slashed its own headcount by -17% compared with a year ago. It must be a horrible sector to work in at the moment, with the threat of redundancy & trying to meet targets being ever-present, I imagine.

Net cash is virtually unchanged at £50m. One of the reasons we’ve tended to view RWA positively is because of its strong, cash-rich balance sheet - meaning that there’s no solvency or dilution risk, and it is also adequately funded to scale up again once recovery gets underway (which can absorb cash when growth resumes).

Outlook - sounds rather hesitant on recovery, although as readers have mentioned here before, the staffing companies probably has little more idea than we do about what clients are going to do in future. Are things going to turn rapidly & strongly into recovery? It’s possible, but doesn’t sound imminent -

“As set out at our half-year results in August, our assumption continues to be that material improvement in client and candidate confidence levels will be gradual and not likely to commence until 2025.”

Setting the bar low here -

“Though market conditions mean second half fee income is unlikely to exceed that seen during the first half, the programme of actions underway mean we continue to aim for a profitable full-year outcome…”

I’m looking at its H1 numbers again (Graham reviewed here on 1/8/2024, concluding AMBER/GREEN), it generated a small PBT loss of £(2.3)m. It’s difficult to exaggerate how bad this sector is, the numbers are really quite dismal.

Forecasts are still falling too.

Paul’s opinion - I’m really torn here. It would be such a pity to give up on the sector right at the low point of earnings, when there could be a lovely recovery to come, even if it isn’t visible yet. We know that RWA is very strongly financed, so no issues there. RWA shares are quite near their 5-year, and pandemic lows, so is risk:reward now favourable enough to take the plunge? I honestly cannot decide. Buying at or near the bottom in any cyclical share tends to be deeply uncomfortable. I remain worried that something untoward may be happening with this whole sector, so am not convinced that a V-shaped recovery in earnings is necessarily going to happen. Who knows? Personally I’d be looking for a more distressed valuation, so I’ll sit this one out for now. Braver people could be rewarded in time though, but I think anyone buying this now just has to stick with it, and not panic if it keeps falling. Or maybe go in with a one-third standard size position, and keep buying if it continues falling? That’s the type of strategy I sometimes apply in situations like this.

Given that AIM in particular is throwing up some bizarre price moves at present, I’d rather keep some powder dry for better bargains elsewhere, then maybe revisit fully listed RWA later this year.

On balance I think Graham’s AMBER/GREEN from last time still looks reasonable.

De La Rue (LON:DLAR)

Up 15% to 108p (£212m) - Proposed sale of authentication division for £300m - Paul - AMBER/GREEN

As it stands, DLAR is 2 businesses (banknote printing, and authentication) on the asset side, with the liabilities side being c.£90m net debt, and a large pension scheme in deficit.

The group had big problems before, then was nearly finished off by the pandemic. It got a fundraise away though, and survived (although nearly doubling the share count), and has since achieved a somewhat hesitant & patchy turnaround.

It previously indicated that all parts of the business were up for sale, and that deal(s) would be concluded before its bank debt expires on 1/7/2025. It sounds as if the bank doesn’t want to extend the borrowings, so there could be deal risk here if the proposed sale of the authentication division falls through.

Key terms of the proposed disposal announced today -

Buyer: CraneNXT, which is clearly a credible buyer, NYSE listed (£2.4bn mkt cap, highly profitable).

Price: £300m on an enterprise value basis (presumably cash/debt neutral).

Escrow: 5% (£15m) to be held back for 18 months.

Subject to: regulatory approvals, and separating DLAR’s two divisions (cost £12m)

Timing: first half of 2025 (to allow time for the divisions to be separated).

Use of the £300m cash -

5% withheld for 18 months, so £15m.

Repayment of £89m net debt (at Mar 2024), so I’m assuming it’s likely to stay roughly the same.

Cash collateralisation of letters of credit & guarantees - not expected to exceed £10m.

Bankers fees £4.9m

Transaction costs £7.6m

Pension scheme overpayments £32.5m

Totalling that up, my best guess is that DLAR could have net cash of £141m (plus likely receipt later of the £15m escrow). That’s is clearly a very healthy position, and totally transformed & derisked its balance sheet & solvency.

Is the £300m price good?

I would say yes. It looks an attractive disposal price given these numbers (although the outlook for authentication division sounds good, so profits likely to increase) -

“The Authentication Division generated revenue of £102.9m in the year to 30 March 2024 (FY24), an increase of 16.9% on the prior year. Divisional adjusted operating profit for FY24 was £14.6m (FY23: £14.2m) after the allocation of enabling function overheads (at a margin of 14.2%).”

I’m surprised DLAR shares are only up 14% at the time of writing (09:28), I would have expected a larger increase, given the attractive valuation achieved for the disposal, and that it totally de-risks the remaining business - clearing all the debt, and largely sorting out the pension schemes too.

Will the pension scheme gobble up the rest of the cash?

The numbers for the pension deficit are much smaller than I was expecting, and much higher figures have been bandied around by investors.

According to the last accounts, the accounting deficit was £50m. This would be mostly paid off under the above terms.

The actuarial deficit was £78m at Sept 2023. So the above arrangements would repay about half of it, leaving a relatively small balance more than covered, several times over, by DLAR’s net cash post deal completion.

What’s the remaining business worth?

Difficult to say. DLAR will become just a banknote printer, which isn’t likely to excite investors, who will probably see this as in long-term decline. Although as Spectra Systems (LON:SPSY) (I hold) has shown, there’s a lot of interest in the switch to polymer notes. There are not many companies in the world that can do this, and have the necessary security credentials.

There’s also the intriguing possibility that DLAR might also announce a sale of this remaining division, as we know it’s been in talks for that.

Taxation - I don’t know what, if any taxes would be payable on today’s proposed disposal deal.

The currency division was about two-thirds of group revenue last year of £207m. It only made adj operating profit of £6.4m in FY 3/2024, down by more than half LY, although it says that the order book substantially increased, so I would expect it to make higher profits in future.

There’s also talk in today’s announcement about spending on capex to make it more efficient.

We’ll have to wait for broker notes to do the detailed analysis and estimate what the smaller, currency-focused business might achieve in profits. It will certainly be well-funded though, with plenty of net cash, and a largely resolved pension deficit.

Paul’s opinion - given that a bumper price has been agreed for the authentication division, I was expecting a higher share price rise today.

The pension scheme numbers are not frightening at all, the deficits are actually quite small now. So maybe that’s a point investors have been unduly worried about?

There’s still some uncertainty, but this deal looks transformational for DLAR’s financial stability - if this deal completes, it takes DLAR from a riskier investment, to something that would be rock solid. I think there could be an opportunity here, but I need more information and pro forma P&L and balance sheets ideally. I’m going with AMBER/GREEN.

Graham's Section

Reach (LON:RCH)

Up 3.5% to 97.1p (£309m) - Trading Update - Graham - GREEN

This is an in line update but when you have a stock trading at a PER of 4x, in line updates can be very exciting!

The adjusted. operating profit consensus number is £97.7m, vs. a market cap of only about £300m.

That’s about the same as the company achieved in 2023 (£96.5m).

However, we do need to bear in mind that these adjusted results are inflated; there were £50m of adjustments last year. Hopefully the adjustments will be lower this time around?

Getting back to today’s Q3 update:

The market views this stock as a melting ice cube: the newspaper business is shrinking, perhaps towards total obsolescence, and digital revenues aren’t big enough to compensate for this.

The melting ice cube hypothesis does have some merit: year-to-date, we have another decline in total revenues.

Digital revenues, despite showing some year-on-year growth in Q3, are flat for the year as a whole.

In the print business, volumes are constantly declining: note that “circulation revenue” is down 3% despite the price of a printed publication going up. So volumes are certainly continuing on their downward trajectory.

But despite these challenges, the business is still being run for cash and profitability and I expect that we will get another decent full-year performance by these metrics. Revenues will be lower but adj. operating profit should be marginally higher.

Outlook: confident in delivering expectations for the year.

We continue to monitor the impact from the tech platforms' actions on referral volumes, and we expect further digital growth in Q4. We remain focused on costs and we are tracking slightly ahead of the 5-6% cost saving target we set at the start of the year.

CEO comment:

"Our Customer Value Strategy continues to drive revenue diversification and has helped us navigate the dynamic media backdrop. We continue to make good progress with our investments including our US expansion, the re-platforming of our websites and our in-house ad tech platform, Mantis.”

Graham’s view

I’ve been positive on this one, most recently at 105p in July, when the half-year report was published.

Today, at 97p, I see no reason to change my view.

The stock has already made some progress from the lows around 60p at the start of the year:

The big question is whether investors can start to get excited about what might happen after the company finishes making large pension fund contributions. That is scheduled for around the end of 2027. Will a valuable business remain at that time, or will it be shrinking even more rapidly by then?

The pension fund issue might not be fully resolved until 2028, at a cost of over £200m. So it’s understandable that the market would continue to treat this one cautiously.

However, I’ve been impressed by management’s ability to squeeze profits out of a declining business, and the year-on-year revenue decline is only about 4-5% currently. So I continue to think that this is an interesting investment idea.

Victoria (LON:VCP)

Down 7% to 118.4p (£135m) - Half-Year Trading Update - Graham - AMBER/RED

Victoria PLC, (LSE: VCP) the international designers, manufacturers, and distributors of innovative flooring, provides a trading update for the six-month period ended 1 October 2024…

This acquisitive carpet company has filled up much space in this report over the years.

The last few years have not been kind to it:

We have shown a healthy degree of scepticism towards this one. Paul has been RED or AMBER/RED in coverage over the past year (July 2024, June 2024, March 2024).

Victoria’s market cap is now less than three times the estimated market value of Chairman Geoff Wilding’s superyacht.

Let’s get into today’s update, which is a profit warning. Key points:

Revenue: demand remains soft and H1 revenue is expected at c. £580m (down 10% from H1 last year: £643m). VCP is thought to have “generally outperformed” the wider market.

Profitability: underlying EBITDA for H1 of c. £50m (H1 last year: £96m), with negative operational leverage caused by falling revenues.

On the bright side, “pricing remains stable and management is taking actions to optimise the cost base”. The Board have noticed some positive signs in their key markets relating to the housing market (mortgage approvals, rising house prices, and lower interest rates) which they believe will lead to increased demand for flooring.

Management actions: Various brands have been merged, and operations have been consolidated. Production has been relocated from Belgium to Turkey. There is now a Group-wide procurement team. And the production of tiles in Spain is also being reorganised, with benefits to be seen from late 2025.

These actions will support “EBITDA margin expansion back towards the Group's historical levels of mid-high teens”. The EBITDA margin in the latest H1 period was only 8.6%, so I guess the company will want to double this.

Refinancing: Victoria’s use of debt has been a source of controversy, and net debt as of March 2024 was a remarkable £633m, with EURO €739m of senior secured notes outstanding. The larger of VCP’s two notes matures in August 2026. This note is currently trading at 87.5 cents on the euro, at a yield of 11.6%, according to Borse Frankfurt:

Fitch downgraded VCP’s credit rating to a lower grade of junk in March this year.

Today’s update lets us know that the company still has headroom of £200m and that Lazard have been appointed by the company as debt advisors, as the company makes plans to refinance this bond. The terms of this refinancing will be very interesting!

CEO comment:

"The flooring sector is experiencing the most severe and longest decline in demand in the last 30 years. During this period, we have focussed on optimising productivity and reducing operational costs whilst maintaining the same potential production capacity… Clearly the recovery continues to draw closer, although it is difficult to pinpoint precisely when it will begin. However, we remain prepared for growth when the time arrives, which will be delivered without any significant capex spend."

Graham’s view

This strikes me as a poor investment opportunity. A tough sector (flooring) cannot be made good with the use of leverage, and VCP has 22 months left before it must come up with an answer for its note holders.

Going RED on this might be a little premature, as the company is not currently distressed. But I see this as a high-risk play and it’s not a stock I’d want to own even if it was currently performing well. So AMBER/RED makes a lot of sense to me. But I would want to be RED on this at the first sign of any difficulty with the refinancing.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.