Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

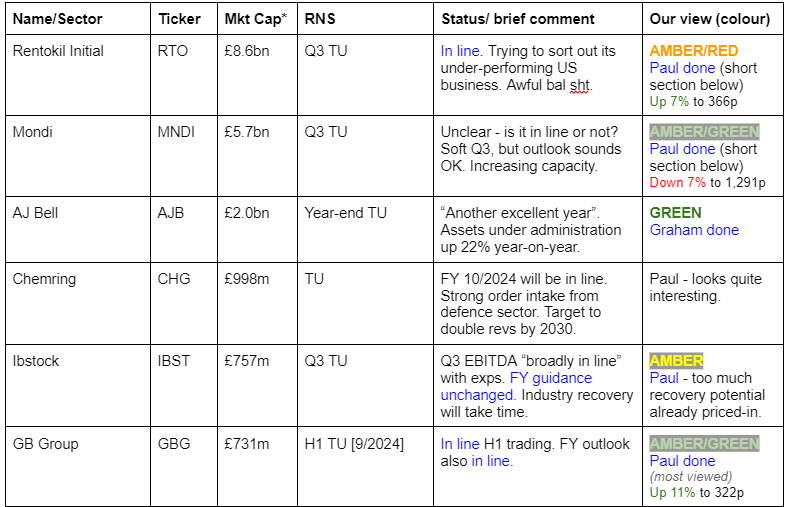

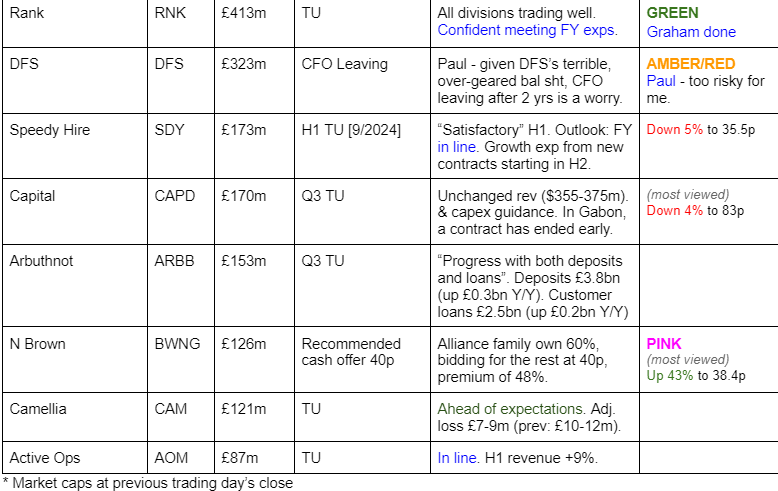

Companies Reporting

Summaries

Rank (LON:RNK) - down 1% to 87.1p (£408m) - Trading Statement - Graham - GREEN

This casino and bingo hall operator is confident of delivering profits in line with expectations, although it doesn’t provide readily available research notes or information re: estimates in the RNS. Even so, I’m a long-term fan and with revenue growth at 12% I’m excited about what it might achieve.

AJ Bell (LON:AJB) - down 1% to 476.5p (£1.97 billion) - Year-end trading update - Graham - GREEN

A confident update describing another “excellent” and “successful” year. Assets under administration rose 22% while in investment management, AUM rose 45%. At a PER of 23x it’s not cheap but I think it does deserve this rating so my stance is unchanged.

Paul's Section:

Other mid-morning movers (with news)

Mondi (LON:MNDI)

Down 7% to 1,291p (£5.71bn) - Q3 Trading Update - Paul - AMBER/GREEN

An adverse market reaction to a soft Q3 trading update from this paper/packaging group, which mentions “muted” market conditions. Annoyingly, it isn’t clear about performance or outlook vs market expectations.

“Underlying EBITDA for the quarter was, as expected, lower than the previous quarter, at €223 million (Q2 2024: €351 million). This was primarily due to more planned maintenance shuts and a forestry fair value loss, which together resulted in a difference between the third quarter and second quarter of approximately €90 million. This was in addition to softer seasonal demand and higher input costs.”

Outlook -

“In the fourth quarter there will be fewer planned maintenance shuts, and we expect the normal seasonal pick-up in demand.”

"Our expansionary projects remain on track... our organic growth investments are expected to deliver a meaningful EBITDA contribution from 2025.”

Paul’s view - just a quick review, I think MNDI shares look quite attractive for value investors. Reasonable PER of about 12x, good yield of c.4.4%, and solid asset backing. Profit margins seem to have been under pressure in recent years. Cyclical recovery possible? Not bad, so I’ll give it AMBER/GREEN.

Rentokil Initial (LON:RTO)

Up 7% to 366p (£8.6bn) - Q3 Trading Update - Paul - AMBER/RED

Guidance unchanged, so I’m struggling to see what justifies a 7% bounce today?

It sets out actions being taken to sort out its under-performing US business, also integration of the large Terminix acquisition.

“FY 24 revenue and margin guidance unchanged”

“Year-end leverage expected to be unchanged at 2.8x”

Paul’s view - this looks a bit of a mess, and broker forecasts continue to be in a downward trend. Management have wrecked the balance sheet with too many acquisitions, too much debt, and as a result NTAV is negative £3 billion! So definitely not of interest to me. It’s striking how cavalier some mid to large companies are re their balance sheets, and debt. Surprisingly, we often have to look at smaller companies to find more secure balance sheets with net cash.

Paul’s Section:

GB (LON:GBG)

Up 11% to 322p (£814m) - H1 Trading Update [in line] - Paul - AMBER/GREEN

“Today, GBG, (AIM: GBG) the expert in global identity fraud and location software, provides an update on its performance for the six months to 30 September 2024.”

Strong 1H25 results: FY25 outlook reiterated

This update sounds clear, and confident -

“The Board is pleased with the strategic progress and financial performance that GBG has delivered in the period. This performance is in line with our expectations and underpins the Board's confidence in reiterating its FY25 outlook.”

It’s perhaps surprising that an in line update has triggered an 11% share price rise today, but the context is that there had been a declining share price trend (possibly Budget fears related, as GBG is one of the larger shares on AIM?) Hence I think today’s solid update reassures the market that there’s nothing wrong with the company fundamentals -

H1 revenue growth is modest, at +4.5% (constant currency) to £137m.

Cost-cutting has produced a good increase in profit margin -

“As a result of our revenue growth in the last six months and the continued benefit of our group-wide cost and simplification initiatives executed in the prior year, the first half adjusted operating profit¹ grew by approximately 21% to £29 million, representing a margin of 21.2%.”

Balance sheet -

“Our balance sheet remains strong…”

No it isn’t! Goodwill and other intangible assets total a huge £743m (at 3/2024). NAV is £625m, hence NTAV is negative £(118)m, a deficit that is funded by borrowings, with net debt at £80m (excl negligible lease liabilities) at 3/2024. It said with the full year results that debt reduction remains a priority, and it came down nicely in FY 3/2024 - demonstrating that GBG does generate good free cashflow to reduce debt.

Net debt has come down further now, so this issue is being dealt with and isn’t a deal-breaker for me, but it helps explain why the 1.6% yield is so modest -

“...with good progress in lowering net debt, which as at 30 September had reduced to around £72 million (31 March 2024: £80.9 million). This includes the FY24 final dividend payment of £10.6 million and a £5.0 million retranslation benefit given the relative strength of pound sterling since our FY24 results.”

It would be more accurate for the company to say we’ve got a weakish balance sheet, but it doesn’t matter because it's a capital-light business model, we get paid up-front by customers, and the debt is being paid down gradually, and is manageable at a fairly modest multiple of EBITDA. Hence my trust in the company & its commentary is lower-middle, due to this clumsy attempt to gloss over the balance sheet weakness.

Outlook - sounds OK, although the growth rate doesn’t excite. Is it realistic to expect higher growth in subdued macro conditions though? Maybe not. There could be a cyclical upturn in performance around the corner, in which case this share could be more attractive than it currently looks.

“With the strong progress achieved by the business in the last six months and positive momentum moving into the second half of the year, the Board reiterates its FY25 outlook. We expect to deliver mid-single-digit revenue growth on a constant currency basis, leading to high single-digit growth in adjusted operating profit.”

Valuation - no broker updates available today. Let’s go with the 17.1p broker consensus figure on the StockReport, which at 322p/shares gives us a PER of 18.8x. Given that net debt is c.10% of the market cap, I’m going to round that up to about 20x - which looks a fair price to me.

Historically GBG shares went crazy, and it became wildly overvalued after one of AIM’s best multibagging runs - indeed I can remember discussing this share over lunch with a friend called Mike, and we both thought it was quite good value at c.20p. But then nothing much happened for a couple of years, so I sold out of boredom. Another example of where a major multibagger wasn't at all obvious in advance of it multi-bagging (especially as a lot of the growth came from acquisitions).

Paul’s opinion - we can now buy at about a third of the 2021 peak of c.950p - is it a bargain then? Not really, I think it’s just reset from an unrealistic over-valuation to something more reasonable. The growth is quite modest now (remember c.20% earnings growth in H1 was driven mainly by cost-cutting, which only happens once). Hence I think a PER of about 20x is a sensible valuation for a modestly growing, but decent quality company.

Cashflows are quite good too, so as debt reduces it might be able to pay more generous divis. That’s assuming management doesn't once again go on the acquisition trail.

Overall, I think this is a creditable performance in tough macro, so I should probably see this share modestly positively, let’s up it a notch to AMBER/GREEN.

Graham’s Section:

Rank (LON:RNK)

Down 1% to 87.1p (£408m) - Trading Statement - Graham - GREEN

Let’s catch up on progress at this casino and bingo hall operator.

Its financial year ends in June, so this is a Q1 update to September:

I’m glad to see the bull thesis continue to play out.

In August, at the full-year results, we discussed Rank returning to the dividend list for the first time since before Covid. Net debt became net cash, and adjusted operating profit more than doubled year-on-year to an impressive £46.5m. The unadjusted figure was £29.4m.

With the new financial year well underway, the positive momentum seems to be continuing.

Grosvenor casinos: the 13% improvement in net gaming revenue is driven by a 2% increase in visits and an 11% increase in spend per visit, with better than expected profit margins.

This casino business, and Rank as a whole, suffered badly during the inflationary period immediately after Covid. Rank’s energy and other costs were up, while customer spending was down.

Now that some time has passed, costs have been able to stabilise while at the same time, there is apparently some greater willingness to spend.

Mecca bingo: NGR rose due to increased spend per visit, but visits were down 1% due to sunny weather and England’s run in the Euros.

Digital: while I like this stock for its physical venues, there is no harm in seeing the Digital segment making a strong contribution and growing NGR at a slightly faster pace than the rest of the group.

Outlook: confident of delivering operating profit in line with expectations.

CEO comment:

"We have continued to build on the momentum that we have generated over the past year and a half, and I am very pleased with our start to this financial year. With all business units performing well, the double-digit growth in our Grosvenor venues and UK digital business is particularly encouraging, with customers clearly enjoying the improvements we are making across our land-based estate and to our digital offering. Rank is now a stronger and more sustainable business, and we are looking forward to the land-based legislative reforms coming to fruition in 2025."

Graham’s view

There’s no need to change my positive view on this one. Rank’s NGR is growing at an impressive pace and inflation is no longer the major problem that it was before, although cost pressures may remain particularly when it comes to wages.

The threat of changing legislation might never go away, but that’s par for the course when it comes to this sector. Rank is enjoying terrific underlying momentum, and I’m intrigued to see how far this will take it. At a modest earnings multiple, I continue to like this one.

AJ Bell (LON:AJB)

Down 1% to 476.5p (£1.97 billion) - Year-end trading update - Graham - GREEN

AJ Bell plc ("AJ Bell" or the "Company"), one of the UK's largest investment platforms, today issues a trading update in respect of its financial year ended 30 September 2024.

It’s a wonderful update from AJB. However, the stock tends to be highly rated and the good news will have been priced in already:

ABJ stock enjoys unusually high (but in my view well-deserved) earnings multiples for the UK financial sector:

Let’s cover some of the key bullet points:

Customer numbers up 66k or 14% to 542k.

In the platform business (not the investment management business), we have:

Assets under administration up 22% to £86.5 billion.

This was achieved through net inflows of £6.1 billion combined with favourable market movements of £9.5 billion.

In the investment management business, assets under management grew by 45% to £6.8 billion. Market movements also helped to boost this result, but it was mainly driven by positive net inflows of £1.5 billion.

CEO comment excerpt:

Our strategy is centred on our dual-channel platform which serves both the advised and D2C platform markets using a single technology platform and single operating model... Platform net inflows of over £6 billion demonstrates the benefit of serving both markets, while our efficient model drives strong profitability, enabling continual reinvestment in the business to support our long-term growth ambitions.

He also says that the upcoming Budget has caused “unhelpful uncertainty”; there has been “a noticeable change in both customer contributions to pensions and tax-free cash withdrawals”, although this doesn’t have a material impact on AJB.

Graham’s view

AJB is up by nearly 20% since I covered it in May, when I had a positive stance on it.

I should briefly mention the competition. Hargreaves Lansdown (LON:HL.) . (in which I no longer have a position) was not valued correctly by the stock market, and is therefore leaving at a PER of about 16x. I think it’s probably worth more than that, and the buyer obviously agrees with me (it’s a private equity consortium led by CVC).

It seems to me that AJB has been valued much more accurately by the market; it has consistently traded at a very significant premium to HL and even today it trades at a PER of 23x.

Like HL, it is wonderfully profitable:

But not only is it wonderfully profitable, it also has the magic ingredient of rapid growth and (arguably) a best-in-class offering, with customers enjoying both competitive fees and a high level of service.

AJB stock passes 7 screens and they are not just momentum-based screens: the screens it passes are also based on quality, value and growth.

I could change my stance on this to AMBER/GREEN, given the valuation, but I’d rather stay GREEN until the rating starts to seriously overheat. A PER of >20x makes a lot of sense to me, given the attractions here, so I’m staying GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.