Good morning, Paul & Graham here!

All done for today.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

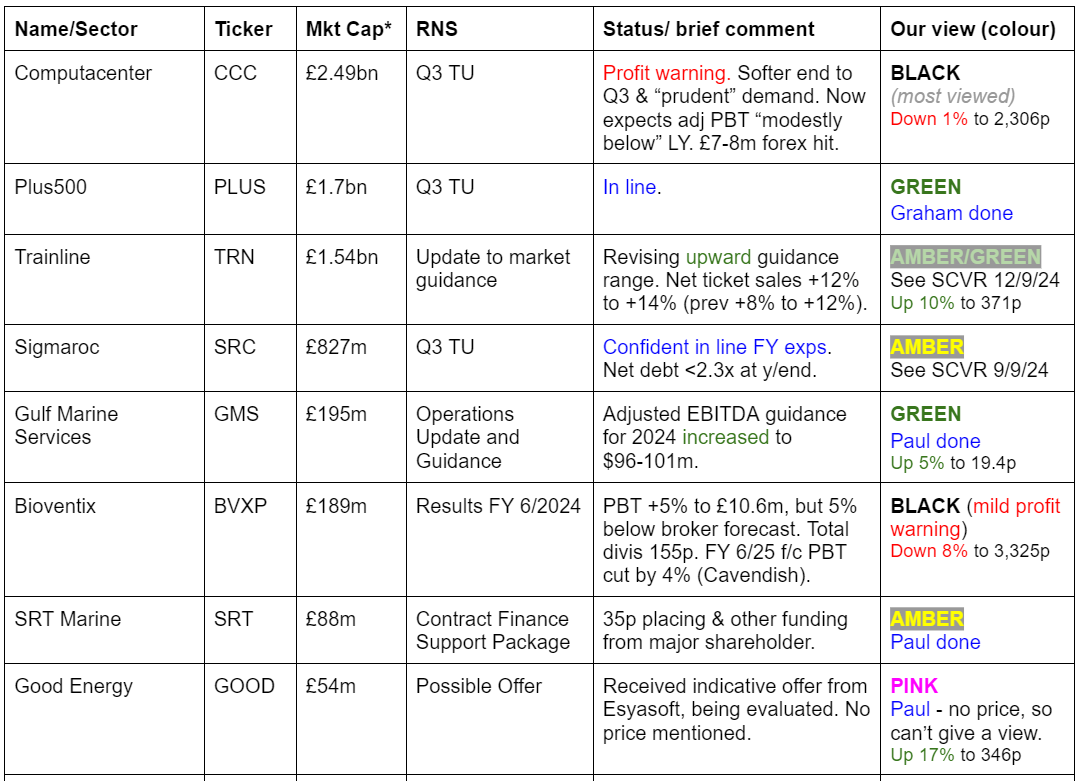

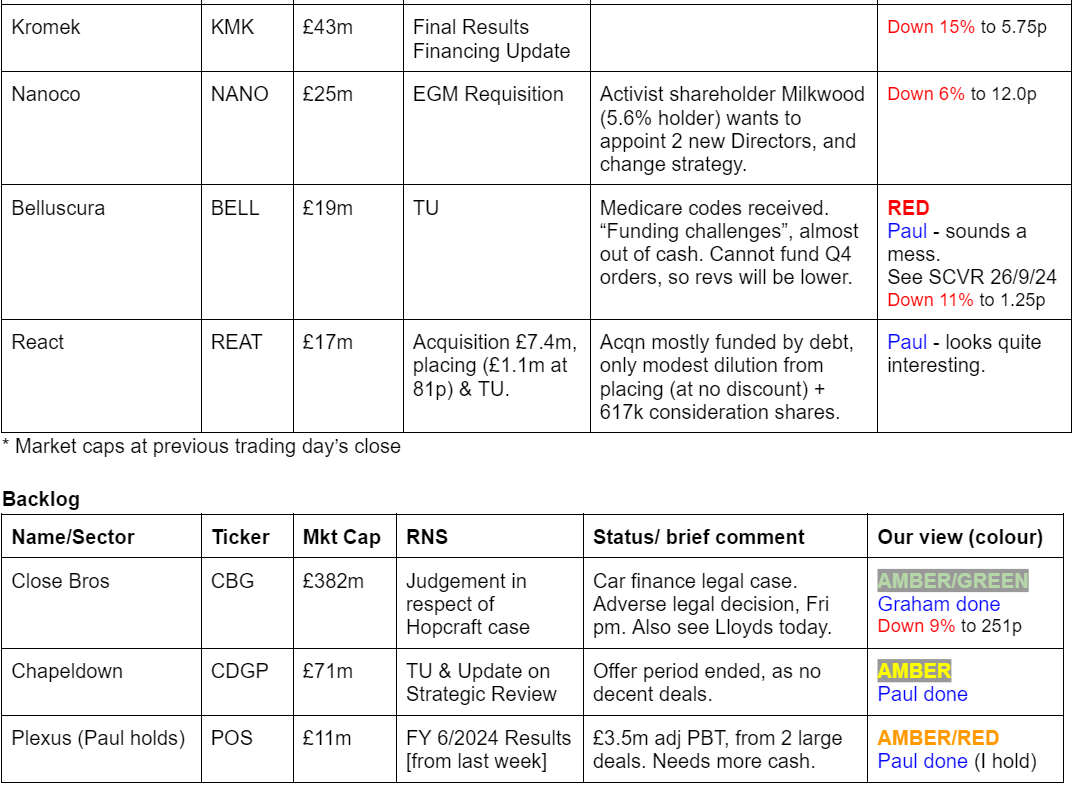

Companies Reporting

Summaries

Plus500 (LON:PLUS) - up 1% to £24.36 (£1.8 billion) - Q3 2024 Trading Update - Graham - GREEN

This trading platform provider upgraded expectations in June. Customer churn remains elevated and EBITDA margin has reduced to 44%. But at a mid-single digit PER (after adjusting for the company’s enormous cash balance of nearly $1 billion), I remain positive.

Gulf Marine Services (LON:GMS) [Paul holds] - Up 3% to 18.9p (at 09:31) £203m - Q3 Trading Update & revised guidance - Paul (I hold) - GREEN

It's a slight upgrade to FY 12/2024 guidance, with FY 12/2025 also looking increasingly likely to be upgraded. This is an excellent deleveraging story, very reasonably priced still I think, one of my current favourite shares. It's fully listed (not AIM) which helps at the moment. Today's update reinforces that everything is on track.

Plexus Holdings (LON:POS) [Paul holds] - 10.25p (£11m) - Results FY 6/2024 & Loans Update - Paul [I hold] - AMBER/RED

Sparkling, profitable results last week, driven by a one-off licensing deal, and a single large contract (not necessarily a one-off). Plenty of positive things in the commentary for the bulls like myself, but very much overshadowed by a need for another fundraise - that's the big issue right now, and I can only hope this will be resolved satisfactorily without excessive dilution - I'm encouraged that founder management own 60% and have largely avoided dilution despite multi-year losses. High risk, so it has to be AMBER/RED.

Close Brothers (LON:CBG) - down 23% on Friday and down 9% today to 252p (£382m) - Judgement in respect of Hopcraft case - Graham - AMBER/GREEN

Nudging my stance lower to AMBER/GREEN as the Court of Appeals has found against CBG and other lenders in a judgement with industry-wide ramifications. The FCA was the main focus but with courts already siding against the industry, a highly negative outcome (of unknown size) seems locked in.

Chapel Down (LON:CDGP) - 41.4p (£71m) - Update on Strategic Review, Harvest & Trading - Paul - AMBER

I review its latest update below, and come away distinctly underwhelmed - much like when tasting its wines (apart from its acceptable fizz). Various factors mean it will now report a loss for 2024. Lending facilities look adequate though. I can't see any justification for trading at a premium to NAV, given its volatile harvests, mildew, and lack of sustained profitability. Hence no appeal at all to this share, it's a grudging AMBER.

SRT Marine Systems (LON:SRT) - unch. 39.5p (£88m) - System Contract Finance Support Package - Paul - AMBER

A complicated funding package is announced, involving c.20% dilution from yet another placing. But big support from shareholder OI on terms that look fair to me, gives a lot of credibility to the bull case. Good luck, but for me, the >£100m market cap post placing & warrants means too much is already priced in. Broker forecasts are still suspended from Cavendish until there's more clarity.

Paul’s Section:

Gulf Marine Services (LON:GMS)

Up 3% to 18.9p (at 09:31) £203m - Q3 Trading Update & revised guidance - Paul (I hold) - GREEN

GMS, a leading provider of advanced self-propelled, self-elevating support vessels serving the offshore oil, gas and renewables industries, is pleased to share highlights on its unaudited operational management results for the nine months period ended 30 September 2024 (9M 2024) as well as to provide a revised adjusted EBITDA guidance for 2024.

The figures below clearly show just how impressive, and fast, deleveraging is happening - making this a very nice share for investors to just sit back and relax, ignoring market gyrations in share price - because the longer we wait, the better the fundamentals become -

As you can see above, adj EBITDA mostly turns into free cashflow, with $76.1m adj EBITDA (9 months) reducing net debt by $60m (over 12 months). The reasons for this are that maintenance capex is only small (since the fleet is relatively new), and finance charges are reducing as the net debt falls. Hence GMS is generating huge (and growing) amounts of cash when you consider its market cap is only £197m.

I think the table above verifies the bull case on GMS shares, not that it was really in doubt anyway.

However, we must not forget cyclicality, and the slide no.7 (below) from a recent slide deck (on GMS’s investor relations website here) vividly demonstrates how previous management let the debt spiral out of control when both utilisation and daily rates plunged in 2016 & 2017.

New management are very conscious of these risks, and determined not to make the same mistakes, when I asked them about this recently.

Also we can see above that whilst daily rates are rising steadily, they’re certainly nowhere near the boom rates that pertained in 2015 & 2016. Giving hope that the current gentle upward trend might continue - ie the numbers above don’t suggest to me that another boom & bust cycle is building, but who knows (I’m not a sector expert, so your guess could be better than mine).

The slight reduction in utilisation of 92% vs 94% LY is “largely attributed to necessary downtime for the maintenance and drydocking of various vessels”, which they’ve mentioned before. So I think we should probably be thinking of anything above 90% as being effectively full utilisation of the ships.

EBITDA margin flat at 60%, which is a big number. Obviously that doesn’t include the depreciation charge. The vessels are depreciated over 30 years, but management says the expected life is nearer 40-50 years. Average age is currently about 13 years, requiring modest maintenance capex. So all in all, it’s a good setup.

Finance charges - I like this bit too -

“Finance expenses decreased to US$ 17.9 million (9M 2023: US$ 24.6 million), driven by the lower level of gross debt, the cessation of 250 basis points (bps) Profit-In-Kind (PIK) interest and a reduction of the margin rate by 90 basis points (bps) when the Group's net leverage ratio dropped below 4:1 as of 31 March 2023, and a further reduction in the margin by 10 bps when the net leverage ratio passed below 3:1 as of 31 March 2024.”

Useful points here -

EBITDA guidance is slightly raised from $95-100m previously, to $96-101m today.

I’d like to see the paperwork signed off for the new financing facility, but given that GMS’s gearing is now at normal levels, I don’t see any reason to become alarmed at the time this is taking.

Dilution - 83m shares likely to be issued, as the remaining warrants (part of a refinancing in the past) are well in the money. That’s 7.8% dilution of the 1,070m shares currently in issue.

GMS is fully listed, so we don’t need to worry about AIM related uncertainty.

Broker update - many thanks to Zeus for a note this morning. Some simple maths leads me to believe that GMS is probably heading for a top end of expectations, or maybe even a slight beat for FY 12/2024.

Also 2025 guidance looks too low, and GMS has excellent visibility with a >$500m order book.

Paul’s opinion - Zeus points out that GMS’s EV of 4.8x EBITDA is similar to the sector average of c.5.0x, but the way I look at it is that rapid deleveraging at GMS means all we have to do is wait whilst the EV comes down (from rapid & large debt repayment), and EBITDA goes up (due to improving daily rates & high utilisation). All the upside flows to equity, so it’s just a do nothing share as the fundamentals continue to strengthen and risk:reward constantly improves.

Risk of being entirely tied to the cyclicality of the oil & gas sector is also reducing, as GMS’s ships can easily be converted to service burgeoning demand for maintenance of offshore wind farms.

Divis should start next year or 2026.

I really like this share, it’s so simple to understand, and today’s update confirms everything is on the right track.

Shares have done very well, although we’ve had some indigestion from major holder Seafox first dumping some shares at 15% below market price (17p vs 20p), and distributing some more of its GMS shares in specie to its own shareholders. To me that’s background noise, since selling overhangs at really good companies create potential buying opportunities. Although there’s always a background worry that Seafox might know something we don’t.

Anyway, so far so good.

Some recent turbulence, but the longer-term trend is still excellent - hardly surprising, since GMS's financial position has been absolutely transformed for the better over this period -

Plexus Holdings (LON:POS) [I hold]

10.25p (£11m) - Results FY 6/2024 & Loans Update - Paul [I hold] - AMBER/RED

Plexus Holdings plc, the AIM quoted oil and gas engineering services business and owner of the proprietary POS-GRIP® method of wellhead engineering, announces its Final Results for the year ending 30 June 2024.

Results are in line with expectations, producing a bumper £3.5m adj PBT, thanks to a one-off $5.2m licensing deal with SLB (announced in Jan 2024), and the company’s largest ever contract for a “special project” (something to do with plug & abandonment in the N.Sea). This special project was originally announced in March 2023 at £5m, then extended to £8m in Aug 2023 (when it caught my eye), and has now almost completed at £9m - projects from Plexus tend to grow from the original contract size. This was exceptional in size, but not necessarily one-off in nature - the commentary with the FY 6/2024 results suggests further opportunities might arise -

“The £8m major rental contract has been a highlight as it has combined Plexus' POS-GRIP Technology and "HG" Seals deployed in a subsea application for P&A work, whilst also heavily supported by its specialised engineering capability. Once this project is completed, it will free up resources to pursue other similar work.”

This project allowed POS to commission more rental equipment, which can be re-used -

“To meet demand and further support growth in the Jack-up rental wellhead market, Plexus is manufacturing additional sets of Exact™ wellhead equipment. The next four sets are scheduled for completion by the end of 2024, positioning them for deployment from the start of 2025. Plexus has also signed a new Master Services Agreement with a well management company.”

I thought there was lots of interesting stuff in the commentary. However, the main bugbear is that it confirmed the need for additional funding. For that reason, I have to stick with our risk warning system, and flag POS shares as AMBER/RED. That should not be swayed by my personal large holding in this share, I’m happy to be objective with the colour-coding.

I’ve pulled together my thoughts and list them below as bull & bear points.

BULL

- Great technology, proven over decades, and validated by licensing deals (SLB twice, and previously Technip).

- New family of patents, giving another 20 years IP protection.

- Stopping methane leaks is now a major environmental priority for Govts - Plexus has proven tech that prevents leaks happening.

- More focused strategy for shorter-term growth under new CEO.

- Successful £9m contract gives an idea of the scale of the opportunity, if more contracts are won (multibagger potential from big contract wins, as was demonstrated in 2023 when it roughly 15-bagged from the low, that’s what got me interested!)

- Rebuilding rental fleet capex done.

- Valuation - £11m market cap looks very cheap to me, given the opportunities, but obviously upside is speculative and cannot be guaranteed.

- Previously profitable growth company, with share price peaking at 317p in 2014 (when share count was c.85m), so £269m mkt cap. Share count is now c.105m, not much different. Market dried up in 2015, but £9m contract indicates it might now be returning maybe?

- Founder/CEO propped up the company with his own money in 2023, c.£3m in loans & asset purchases. Not entirely altruistic, but this demonstrated a lot of commitment, and belief in the company, and of course avoided dilution for other shareholders too.

- Stock market listing is considered essential by the company, as considerable benefits when dealing with major oil companies. Hence I think delisting risk is low here.

BEAR

- Main issue - it’s running out of cash again. This obviously puts a big dampener on the share price as investors worry about dilution. It sounds as if an equity fundraise is now being planned. If this is done well, it could be fine, if handled badly, could be a nightmare for existing holders.

- Lumpy large contracts, with often long gaps causing years of cash burn. Hence performance is impossible to predict accurately (although new forecasts from Cavendish look reasonable).

- Retiring Directors awarded themselves £0.7m in “compensation for loss of office” (not paid yet, but accrued). But they didn’t lose their office, these were planned retirements. Looks bad, I’ll be querying this with mgt.

- Great tech, but track record shows it has not been able to consistently commercialise it.

Paul’s opinion - obviously this is a speculative, high risk share, so definitely not for widows and orphans, as we’ve discussed before here.

What excited me is the multi-bagging potential which was driven by superb newsflow in 2023 and early 2024. Since then unfortunately the newsflow has largely dried up, with a crazily long gap of almost 7 months when the company told us literally nothing. That can’t happen again, we need much more frequent market updates, it’s a public company after all.

My view is that on the back of superb, profitable results for FY 6/2024, the company can & should be going to investors on the front foot, saying this is what we can do, and there’s lots more to come, but we need a cash top-up to get there. Founder/semi-retired management own c.60% of the company, and they have proven intensely resistant to dilution in the past. So that track record gives me hope that they’ll minimise dilution this time round too, and it’s key that other holders are able to participate in any equity fundraising. It should be done at market price, or hopefully even a premium. I reckon POS probably needs to raise about £3m, so maybe 30% dilution. Not the end of the world, but obviously not positive either - that’s why the share price has come down a long way.

Ideally I’d like to see a cornerstone industry investor come in, maybe SLB, with a stake in the placing.

I’ll be glad to get the fundraise out of the way, but I can only hope at this stage that I don’t get diluted too much. Other people can just sit on the sideline and wait for the refinancing to be done. That would avoid dilution, but would also mean missing out on potential upside from any contract win news, and possibly even a bid approach. Anyway, you can weigh up risk:reward for yourselves. Hopefully the above is a fair assessment of upside potential, and the undoubtedly considerable risks too.

Previous glories were striking -

Zooming in, the last 5 years saw it near-death in 2022-3, resuscitated with excellent newsflow in the summer of 2023, fizzling out as 2024 has progressed -

Chapel Down (LON:CDGP)

41.4p (£71m) - Update on Strategic Review, Harvest & Trading - Paul - AMBER

English winemaker - largest & best known brand, has 10% of UK planted acreage of vineyards.

Completed strategic review, with no better options than remaining AIM listed & independent.

Offer period has now ended.

Harvest for 2024 almost completed - below forecast, high quality, but lower yield than average due to mildew. Halved in tonnage vs exceptional 2023. Enough to make 1.7m bottles, mostly sparkling wine.

Revenue guidance - FY 12/2024 revenue expected to be slightly down on 2023.

Profit will be lower than in 2023 too.

Non-cash charge adjusting biological assets of c.£0.8m, due to lower harvest.

Overall expect 2024 to be a loss.

RCF extended long-term, increased to £20m, and lower interest charges, signed in Q3.

Paul’s view - this all reinforces my view that this is a deeply unattractive, and capital-intensive business model. It seems a lot of effort for no return.

Everyone I ask says the same thing - don’t like their still wines, but the sparkling is nice (but expensive for what it is). So it’s good to hear the company say it’s focusing on the fizz. Interesting that you’ve got Michael Spencer, Nigel Wray, and Lord Ashcroft all on the major shareholders list. Is this a rich man’s plaything then?

The bull case seems to rest on growing conditions, soil, etc in Kent now being favourable, and that champagne growers in France might take an interest in acquiring it. Nobody seems to have been interested in the strategic review, which rather undermines that argument.

Last reported NAV was c.£35m, and I cannot see any reason why the market cap should be double NAV. I’d struggle to justify even paying par with NAV, suggesting to me this share remains considerably overpriced, even after steep falls of late.

Overall then I can’t get above a distinctly unenthusiastic AMBER.

CDGP was previously listed on Aquis for a long time, but moved to AIM in Dec 2023 -

SRT Marine Systems (LON:SRT)

Unch. 39.5p (£88m) - System Contract Finance Support Package - Paul - AMBER

Nothing is ever straightforward with SRT!

Last time I looked at it on 7/10/2024, it had almost signed a $213m contract, hoping to get it actually signed by end Nov.

At 11:20 today quite a big announcement caused a brief spike up in price, but it now looks as if the market is trying to digest this latest news.

This news today sounds important -

“SRT Marine Systems plc ('SRT'), a global provider of maritime domain awareness systems and technologies for security, safety and environmental protection is pleased to announce that it has agreed a substantial investment and short-term finance bridge support package from existing shareholder Ocean Infinity (OI), together worth approximately £31 million.

This new financing allows SRT to immediately satisfy the need for the substantial performance bond required under the terms of the recently announced $213m contract, which is expected to be signed and commence on Thursday 31st October 2024, as well as providing a foundation to support simultaneous proceeding of three other contracts worth an additional $210m during the next quarter. All four contracts will have parallel implementation periods over the next two years, with follow on support phases of up to 10 years.”

That’s this Thursday for potential signing of the $213m contract.

As it’s so hugely material, then we really need some idea of what profit margin is being made on this, and the other deals. We can’t value the shares without that information, as there’s no consistent history of profitable trading in previous years - just occasional one-off profit years, but nothing approaching this scale of hundreds of millions of dollars.

We also have to take into account that SRT has been a serial disappointer, numerous times, over many years. Although the current £88m market cap is not supported by any historical figures, so there must be plenty of bulls who believe it’s on the cusp of great things to have got the valuation up that high.

Current share count is 222.6m shares.

Placing announced today is for 21.5m new shares c.9.7% dilution, at 35p c.11% discount - not bad in the circumstances I’d say. Placing is fully underwritten by 8.9% existing shareholder Ocean Infinity (OI), which is taking 14m new shares minimum, with up to 7.5m reserved for other existing shareholders. Subject to usual things, hoping to complete placing in November.

Guarantee - from OI for $21.4m, enabling SRT to issue a contract performance bond re the big contract. Initially provided as a $21.4m cash loan, charged at 0.75% per month - which sounds a fair deal for bridging finance. This is expected to be repaid in a month and replaced with a bank guarantee funded by OI for 6 months. SRT will then repay this using proceeds from the contract presumably, and hopefully also a UK export guarantee facility. There’s obviously a fair bit of risk in all of that, that something could unravel.

OI will receive 20.0m warrants for new shares also at 35p. More dilution, but at least exercising the warrants would see SRT receive £7.0m fresh cash.

Sting in the tail - if SRT doesn’t repay OI within 8 months, then 4m additional warrants per month would be issued, at a 15% discount to the then prevailing share price.

OI says -

“Oliver Plunkett, Group CEO of Ocean Infinity, commented;

"This contract awarded to SRT in which Ocean Infinity will play a key supporting role is precisely the kind of opportunity to work together that we foresaw when we first invested in the Company. We strongly believe in the relationship, the wider market opportunity for maritime data and systems, and the long-term potential for both companies to continue working together for the benefit of our clients and each other.

That long term vision is why we have seized this opportunity to provide additional equity funding to SRT as well as help out in the short term with a bridge guarantee which will facilitate SRT providing the necessary up front contractual guarantees to their customer as they wait for UKEF to complete their processing."

Paul’s view - I’m tremendously impressed with the commitment from OI, which gives a lot of credibility to the bull case for SRT. I can’t find any financial information on OI, as it’s privately owned US company.

Dilution from this deal is not disastrous, at about 20% enlargement of the share capital, if the warrants are exercised.

How to colour code it? I’m instinctively sceptical about SRT, given the very many false dawns in the past, over so many years. However, if this deal proceeds without a hitch, then it could be very good for SRT and allow the fundamentals to catch up with the stretched valuation.

There’s still a lot of risk though, being dependent on a complicated financing package, not knowing what margins SRT will make, and single contract risk. Given how it always seems to run into big delays & uncertainties, why would I want to assume that everything is going to go smoothly this time around?

With this latest dilution, the latest market cap will be over £100m, which for me is much too high given the considerable uncertainty. At say £20-30m market cap I’d be tempted to have a punt, but >£100m is too much for me at this stage.

Good luck to holders! Let’s just go AMBER for now, as it’s impossible to value this share at this stage, and given the track record.

Has the lorry full of jam finally arrived, or is it another mirage?!

Graham’s Section:

Plus500 (LON:PLUS)

Up 1% to £24.36 (£1.8 billion) - Q3 2024 Trading Update - Graham - GREEN

Plus500, a global multi-asset fintech group operating proprietary technology-based trading platforms, today announces the following trading update for the three-month period ended 30 September 2024.

This update is in line with expectations that were already upgraded in June.

(Disclosure: at the time of writing, I remain a shareholder in IGG which is a competitor of PLUS.)

Key points:

Q3 revenue +11%, including “Customer Income” (spreads and charges and commissions) up 8%.

EBITDA growth of 2% doesn’t match the revenue growth, so the EBITDA margin falls to 44% (Q3 last year: 48%).

PLUS says that the decline in EBITDA margin reflects “the ongoing investment which the Group has made and will continue to make to enter new markets, develop new products”, etc.

New customers acquired during the quarter grew by 21% but the total number of active customers only grew by 2%. This hints at a criticism I’ve long had of this company: customer churn is extreme, so there is a constant need to recruit new customers as existing ones give up on trading.

The year-to-date numbers paint a similar picture: new customers acquired in the 9-month period are up by 15% (to nearly 82,000) but the total number of active customers is only up by 3% (to 211,000).

More positively for PLUS, the average deposit per active customer is up 17% to $6,150. This is an area where I think the company has made progress: it has found higher-value customers who are willing to put larger deposits into their PLUS account.

Revenue per user and user acquisition costs are both up by 9% year-on-year.

Customer trading performance: the company has gained nearly $47m year-to-date from profits on customer trading positions, which is more than it had gained last year by this stage ($42m).

Cash is a traditional source of strength for PLUS. At the interim results to June, the company breached $1 billion in cash for the first time. This has reduced to $950m as of September but that’s after returning nearly $130m to shareholders in dividends and share buybacks.

Strategic update - talks about expanding its position in over 60 countries but specifically in the US. Also singles out the UAE and Japan as areas of focus.

Outlook - confirms in line.

Graham’s view

I’m going to stay positive on this one, as I have been for a while now.

Previously a bear and a sceptic on PLUS, I turned neutral on it in 2019 and went positive on it early last year at £17.30.

Here are some of the positives:

Diversified geographically and by product now (this wasn’t true before, it was a CFD broker concentrated in a few markets)

The enormous cash balance (much bigger than it was before) mitigates the risk of customer wins.

Brilliant track record of cash generation and shareholder returns - divis and buybacks. The share count has fallen by over a third since 2018.

I am therefore staying positive at the following valuation:

Remember that the PE Ratio does not make any adjustment for the cash balance. Deduct $950m from the market cap and you get a PER of only about 5x. This is probably too cheap, given its track record and momentum, in my view.

Close Brothers (LON:CBG)

Down 23% on Friday and down 9% today to 252p (£382m) - Judgement in respect of Hopcraft case - Graham - AMBER/GREEN

I went GREEN on this one in February (at 295p) after CBG acknowledged that there was “significant uncertainty” around the outcome of the FCA’s review of discretionary commissions for motor loans. That announcement wiped £150m off an already-low valuation.

The share price made a partial recovery since then, but has now hit a fresh low:

On Friday at 11:27am, CBG published an RNS noting that the Court of Appeal has sided with a claimant against Close Brothers and another lender:

The Court has determined that motor dealers acting as credit brokers owe both a disinterested duty and a duty of loyalty ("fiduciary duty") to their customers. This sets a higher bar for the disclosure of and consent to the existence, nature, and quantum of any commission paid than that required by current FCA rules, or regulatory requirements in force at the time of the case in question.

This will be appealed to the Supreme Court but it looks like it could be another PPI-type fiasco for the industry:

…the judgement may set a precedent for similar claims, which may (depending on the specific facts of those cases) result in significant liabilities for the Group. The range of outcomes in these circumstances is currently uncertain… It is therefore currently not possible to assess the timing, scope or quantum of any potential financial impact on the Group.

CBG points out that it has a CET1 capital ratio of 12.8% (a very strong capitalisation ratio) and that the agreed sale of Close Brothers Asset Management will strengthen this further.

They are “temporarily pausing” new motor loans while they review documentation and processes in light of the new requirements.

Graham’s view

The difficulty with this situation is that the outcome is unquantifiable and could drag on for years.

Perhaps I should take a neutral stance to reflect the reality that anything is possible, but I’m still leaning towards taking a positive view.

As of July 2024, CBG had equity of £1.8 billion (assets of £14.1 billion offset by liabilities of £12.2 billion), which is several multiples of the market cap.

It was very well capitalised and on track to sell its asset management business for up to £200m, further boosting its position.

It has ceased paying dividends.

The temporary pause on motor loans, while unwelcome, further reduces risk.

In passing I should note that Lloyds Banking (LON:LLOY) (down 2.5%) has also acknowledged the court judgement in an RNS today, although Lloyds is not one of the lenders directly involved in the case. According to Lloyds, the Court of Appeal’s stance on customer disclosure/consent goes “beyond the scope” of the FCA motor commissions review.

CBG said something similar, describing the Court of Appeal as having created an “extension of the existing case law”.

So while everyone was waiting for the FCA to bring a hammer down on lenders for historic motor commissions, it seems that the Court of Appeals is taking an even stricter stance. Perhaps the Supreme Court will see it differently?

To reflect the very high risk and the fact that the courts are now getting involved before the FCA has even finished its work, I’ll nudge my position on this share slightly lower, to AMBER/GREEN.

It’s a bargain, but with a regulatory Sword of Damocles hanging over it:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.