Good morning from Paul!

That's it for today, sorry SEE is only half-done, but I've run out of time, so that should appear on Monday. Have a lovely weekend! Podcast should be on Saturday.

Phew, am I glad it's Friday, this has been an exhausting time in recent weeks, with very volatile small caps markets, all the budget uncertainty, etc. We all deserve a thoroughly good rest this weekend!

I must thank everyone for the lovely reader comments yesterday - it's very much appreciated, and quite a thing to have retired fund managers patting us on the back. I was chuckling away, as everyone seemed to know each other! Maybe someone could organise an informal drinks evening at some point!? It would be great to put some names to faces and have a natter over a few pints. Although we have Mello Derby coming up shortly, where I shall be floating around both days & happy to talk shares with anyone & everyone :-)

I noticed that Evoke (LON:EVOK) has bounced strongly post budget, which reminded me that the media warnings of punitive budget measures targeting gambling companies didn't happen. I wonder if work is being done behind the scenes on more tax raising measures? After all, the Govt & civil service would only have had enough bandwidth to focus on a few key areas in this budget. So I suspect they might return to some issues next time.

I'll be writing to Rachel Reeves to urge her to give everyone some certainty - the big lesson she needs to learn is how negative messaging followed by a long delay causes actual, measurable economic damage - as we saw with consumer and business confidence surveys plunging in recent months. Confirming that corporation tax will not be changed in this parliament was an excellent move. We need the same thing on key issues for investors - eg assurances that they won't meddle with ISAs, or pensions tax relief, etc. Then people can plan ahead.

The IHT change, if implemented (it's only a consultation at present, I'm told) is a huge issue. Imagine how many billions there must be in defined contribution pensions? If that's all now going to be newly subject to Inheritance Tax, then I think we'll see a lot of people changing their behaviour - eg one friend has already told me that he's intending to move into drawdown, and just pay the income tax on it (up to the limit of the 20% band), then put £20k into an ISA every year, and gift the rest to his children (to avoid IHT under the 7-year rule), putting it into ISAs for them and managing the accounts for them. People are coming up with all sorts of ideas for how to avoid IHT in new ways, which is why I suspect these proposed tax changes may not raise anything like the amount budgeted. As mentioned yesterday, it is vital to take professional advice from authorised experts before doing anything that could potentially cause big problems down the line.

I'm curious to hear what the IHT portfolio fund managers think about the budget. Will bringing in effectively 20% IHT on most AIM shares (previously zero) kill their golden goose? I got an email from one yesterday, giving an initial response, which sounded quite positive - saying it could have been a lot worse, and well-chosen AIM shares still have considerable attractions - half the normal rate of IHT is still an attractive tax break. Naturally they have to sound positive to avoid redemptions! Although it's another area where Reeves should have given a commitment not to change the rate again this parliament. If it's just a stepping stone to full IHT on AIM shares, then it might cause people to move their money elsewhere possibly? Although this fund manager also commented that making pensions IHT liable could be a net positive for AIM, as people who thought their money was in an IHT shelter now realise that's ending, and they might move money into AIM shares. All interesting, and I enjoy reader discussions on these points, so keep them coming if you have any interesting insights.

Many eyes are now on UK gilt yields, which have risen to not far off the highs at Liz Truss's disastrous mini budget, and sterling has weakened a little. Let's hope things settle down. Ed Conway of Sky commented that things are "halfway to the danger zone" as defined by the OBR apparently. Although he mentioned that bond yields in other countries are also rising, but not as fast. Anyway there's nothing I can do about that, but it does raise the question of whether the increased borrowing Reeves has planned might end up keeping UK interest rates higher, who knows?

I'm keen to hear more from listed companies about how much the NIC increases will harm their profits, and how much can be saved with mitigating measures. To flag this article again from Sky, it sounds really bad actually - in particular the lowering of the threshold, plus the increased rate, combines to make costs much higher than expected for the many retail & hospitality companies which employ part-time workers in particular. This quote from one of the major supermarkets sounds as if the impact could be dreadful, and I think we could see widespread profit warnings (let's hope I'm wrong, but why take the risk - hence why I'm completely out of the retail & hospitality sectors until the dust settles) -

"An executive at one of the quartet said their immediate calculation was that they would have to pay "between double and treble" the additional sums they had modelled following pre-Budget reports in the media that the chancellor was preparing to increase the employer NICs rate by two percentage points."

I see that retail & hospitality shares are taking a battering, as this issue sinks in with investors.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

Companies Reporting

Hardly any news today, which is handy as I've got some backlog items I want to look at. Then it's a hard stop at 1pm for me, as Mum wants to go on a jaunt to buy a new vase, so chauffer duties beckon for me!

Summaries

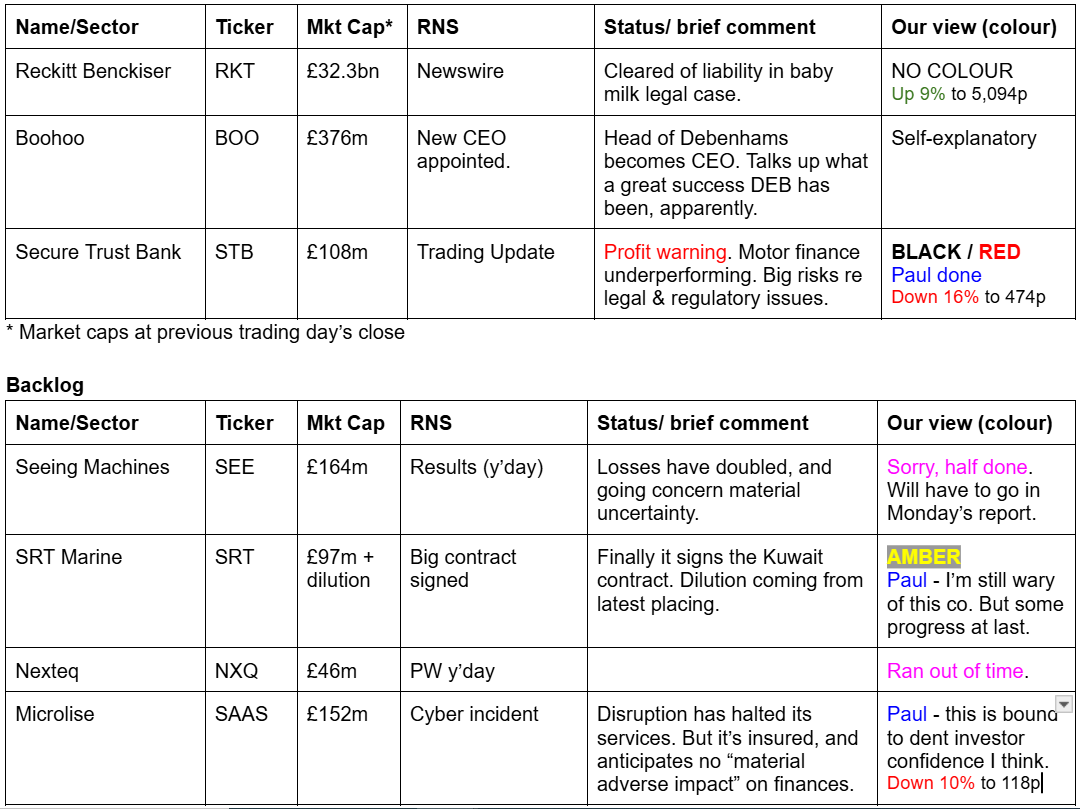

Secure Trust Bank (LON:STB) - down 12% to 500p (£95m) - Trading Update [Profit Warning] - Paul - BLACK / RED

Profit warning from this specialist lender sees broker forecast for FY 12/2024 slashed by 29%. The problem (putting it mildly!) division is the motor finance division. Elephant in the room are potential legal & redress costs, which could be huge, but are currently unknown. Therefore I see this share as GREEN for value, but RED for risk, so for me the high risk has to be prioritised in our overall view, so I'm reversing it from Graham's GREEN, to my RED. We'll have to have a negotiation over this next week!

Paul’s Section:

Secure Trust Bank (LON:STB)

Down 12% to 500p (£95m) - Trading Update [Profit Warning] - Paul - BLACK / RED

“Secure Trust Bank PLC ("STB" or the "Group"), a leading specialist lender, announces a trading update for the financial year ending 31 December 2024 (FY24) and details for the third quarter ended 30 September 2024 (Q3).”

This is one of Graham’s so don’t expect any particular insights from me, I’m just reporting on the news.

On 14/8/2024 Graham reviewed STB’s interim results, concluding GREEN at 836p, due to an extremely low PER of 3x supposedly pricing in the risks. He says it was a mild profit warning for 2024, combined with increased guidance for 2025.

Unfortunately, the 1-year chart below shows it making new all time lows today, and it’s obvious something has gone badly wrong here in the last week - STB shares began a big move down on 28/10/2024 - 2 days before the budget, so it doesn’t seem to be specifically related to that -

Ah yes, I remember now, it’s connected to the issue of motor finance, which hit several shares on the same day. STB issued this RNS, Vehicle Finance Update on 28/10/2024. Graham covered this issue here on 28/10/2024 in respect of Close Brothers (LON:CBG) which fell heavily too on a legal case called the Hopcraft case.

This is the second time motor finance companies have been hit with legal/regulatory problems, as the FCA had produced an adverse verdict in Feb 2024 - although looking at STB’s chart above, that didn’t seem to do much damage at the time.

Graham took the view earlier this week that motor finance looks as if it might become another PPI-style fiasco of unknown size and duration. He concluded that CBG looked a "bargain, but with the Sword of Damocles hanging over it".

On 28/10/2024, STB said that it noted the adverse verdict in Hopcroft, but that CBG intended to appeal the decision to the Supreme Court, concluding -

“This sets a higher bar in relation to commissions than had been understood to be required across the vehicle finance industry, before the Court of Appeal's decisions. These decisions relate to commission disclosure and consent obligations, which go beyond the scope of the current FCA discretionary motor commissions review.

STB is assessing the potential impact of the decisions, as well as any broader implications, pending the outcome of the appeal applications. The Company will update the market, if and as appropriate.”

Today’s update from STB -

Good news on arrears -

“As indicated in the Group's interim results announcement on 14 August 2024, the pausing of collections activity following the FCA's Borrowers in Financial Difficulty ('BIFD') review led to a higher volume of Vehicle Finance loans reaching default status. The Group has restored collections activity to normal levels and early arrears in Vehicle Finance are at the lowest level for three years.”

Although it says recoveries are taking longer than expected, which I’m struggling to reconcile with the quote above.

Overall though, it’s a profit warning, with a very helpful indication of the amount involved (why can’t all companies do this when they warn?) -

“As a result, the Board now expects the Group's underlying, continuing profit before tax for FY24 to fall materially below market expectations by between £10m and £15m. The reduced level of profit before tax is due to the performance of the Vehicle Finance business. The Group's other businesses are performing in line with management's expectations.”

Broker update - with thanks to Shore Capital, which downgrades EPS estimate for FY 12/2024 by 29% to 145p. That’s a PER of 3.4x.

Estimated EPS for FY 12/2025 comes down from 271p to 235p - a PER of 2.1x (based on 500p share price)!

So we have a staggeringly low PER (almost always a sign of big problems).

Very well covered dividends are forecast too, at 33.8p in 2024 (6.8% yield), and 35.5p in 2025 (7.1% yield).

Balance sheet - H1 results showed NTAV of 1836p, so at 500p in the market today you’re getting a huge discount. That’s a P/TBV of only 0.27x.

With 19.07m shares in issue, the discount to NTAV is £255m (£350m book value, less £95m market cap). So the key thing investors need to estimate, is the likely (or maybe a prudent) estimate for the legal costs & compensation to customers. If you think that total cost is more than £350m then these shares are probably worth little to nothing. If you think the cost is likely to be less than £255m, then the shares are worth more than the current 500p share price. How on earth are we meant to calculate if & how much compensation & legal costs might be? That's quite a narrow band as well between success and failure of this share.

The risk looks high that this could be another compensation gravy train, with TV ads cropping up for no win no fee type ambulance chasers, and often spurious claims. That could drag on for years and be hugely expensive for STB and others.

Overall though STB’s balance sheet looks quite simple -

Assets of £3.9bn are mainly loans to customers (£3.4bn), plus £0.4bn cash. £0.1bn other.

Liabilities of £3.5bn are mostly customer deposits of £3.04bn, and debt owed to banks £0.36bn. £0.1bn other.

Equity is £356m - just over 10% of the loan book.

However, Shore cautions on the unknown extent of the potential costs of redress over the legal/regulatory issues -

“However, this does not current include any potential legacy redress impact from the ongoing issues in the motor finance industry, which are currently too uncertain to quantify with any degree of confidence but could be significant. “

Paul’s opinion - this share is impossible to value. I would give it GREEN for value. But RED for risk! It’s totally unknowable for me to assess risk:reward here. But if there’s a significant risk of massive costs & compensation, I think it has to be properly flagged with our colour-coding, so overall I’m going RED.

Readers can now decide for yourselves if you think the high risk is worth taking or not. Remember that our colour-coding is not making predictions of future outcomes, it’s just flagging risk:reward as of today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.