Good morning and welcome to the Daily Stock Market Report! This is the new name for our daily report, previously known as the Small Cap Value Report. Don’t worry, we’ll still be covering all the small company stories that matter to you. But we’re also aiming to expand the breadth of our coverage - you can read more about the incoming upgrades to our content and analysis here.

This morning we have Graham, Megan and Roland helping to cover today’s news.

Graham writes: we're hanging up our collective pen now (2pm). Thanks for reading!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices).

My video explaining/reviewing it.My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

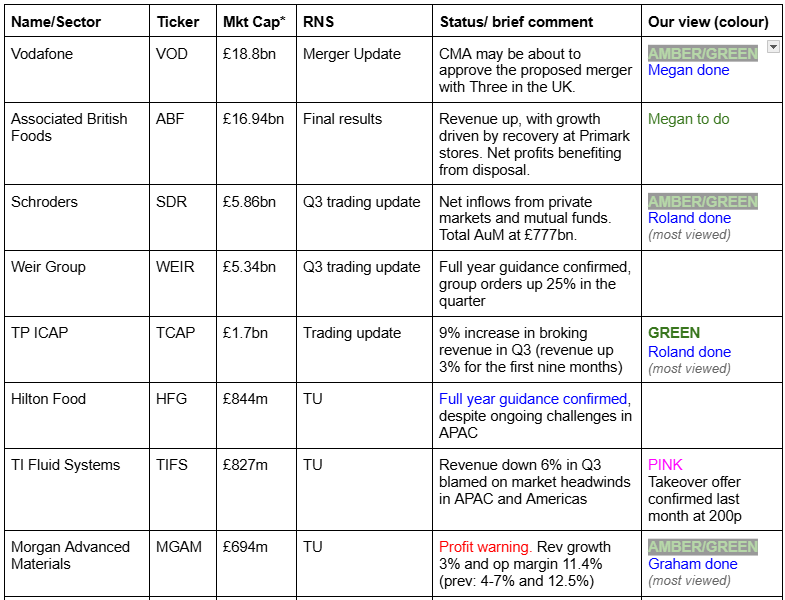

Companies Reporting

Summaries

Smiths News (LON:SNWS) - up 7% to 61p ( £151m) - Final Results - Graham - GREEN

Results come in ahead of expectations (we already knew that they would be “at least in line”). Operating profit is £39.1m and the company declares a special dividend of 2p due to being under-leveraged. The outlook for the new year is in line and I continue to like this one at a PER of only 5.4x.

Morgan Advanced Materials (LON:MGAM) - unch. at 245p (£699m) - Trading Update - Graham - AMBER/GREEN

Officially this is a profit warning but I think the market was expecting it after a woolly outlook statement a few months ago and given the declining share price since then. More interestingly, the company has announced a £40m buyback and an expanded cost-cutting programme. Could be worth a closer look.

Asos (LON:ASC) - down 8% to 346.7p (£414m) - Final Results - Megan - AMBER/RED

Sales are down 16% like-for-like, below expectations, and the company remains loss-making. It is now trying to increase order sizes by invoking a £40 threshold for free returns. I see little to like here from a quality perspective and it’s probably still too soon to make a value argument for the shares either.

Vodafone (LON:VOD) - up 1.4% to 73p (£18.8bn) - Merger Update - Megan - AMBER/GREEN

The Companies and Markets Authority (CMA) has revealed it might give the go-ahead to Vodafone’s plans to merge its UK operators with Three. The two telecoms companies announced their merger proposal in June last year, but the deal has been held up by concerns from the regulator that the two companies might drive up prices. News that the deal could get the green light when the CMA makes its final decision in December has been well received.

TP Icap (LON:TCAP) - up 3% to 234p ( £1.8bn) - Trading Statement - Roland (I hold) - GREEN

A solid Q3 update from this FTSE 250 broking and data group which suggests to me that the business remains on track after a strong Q2. The shares have risen this year but remain attractively valued, in my view.

Schroders (LON:SDR) - down 14% to 314p (£5.1bn) - Q3 2024 update - Roland - AMBER/GREEN

Assets under management rose thanks to positive market movements in Q3, but there were net outflows. Management have warned that Q4 could see further significant outflows before a more positive period in 2025. I argue that the company needs tighter control on its cost base and perhaps more focus, but could be attractively valued after a multi-year decline.

Graham's Section

Smiths News (LON:SNWS)

Up 7% to 61p ( £151m) - Final Results - Graham - GREEN

We covered the full-year trading statement from SNWS here, when it confirmed that full-year adjusted operating profit would be “at least in line” with expectations of £38.2m.

That number comes in today at £39.1m (slightly higher than last year, and ahead of expectations) on revenues of £1.1 billion (up 1%).

Here are the headline numbers from the UK’s largest wholesaler of newspapers and magazines:

FY24 had 53 weeks, while FY23 only had 52 - something to bear in mind when there are only marginal differences between the two financial years.

Average net debt did see a meaningful reduction: it more than halved to less than £12m (from £25m).

The adjustments are minimal. In fact the statutory (what I call “actual”) operating profit of £40m is higher than the adjusted operating profit.

91% of revenues are set to renew under long-term agreements, either in the form of signed contracts or Heads of Terms, until 2029, suggesting excellent visibility (74% of revenues will repeat under signed contracts, with an additional 17% under Heads of Terms).

Outlook: in line with expectations, and there has been a start to the new financial year.

CEO comment snippet:

"Our performance over FY 2024 reflects the resilience of our news and magazines business and impact of our cost efficiency initiatives. The refinancing agreement announced in May removes restrictions on shareholder returns and also enables internal investment to support both our news and magazines business and our growth plans…

Smiths News is well placed to continue to deliver a resilient performance over the medium term.

Refinancing/dividend: back in May, SNWS received a new £40m RCF with better terms than the previous facility. The old facility only allowed a max of £10m to be paid to shareholders annually. With that cap out of the way, SNWS announces a 2p special dividend in addition to a final ordinary dividend of 3.4p.

Including an interim dividend that has already been paid, they are distributing an impressive £17m to shareholders for the year. They can afford to do this as their leverage ratio (net debt/EBITDA) ended the year at only 0.3x, far below their self-imposed limit of 1.0x (the bank will allow up to 2.5x).

Graham’s view

I see no reason to change my view from what I said in October: this is an interesting value stock that I'm happy to give the thumbs up.

It trades at a pitiful earnings multiple:

And it gets a perfect Value Rank of 99, while still offering some Quality according to the algorithms:

Probably in truth it is a melting ice cube, as newspapers and magazines are in long-term decline. But of course everyone knows this, and it has been true for many years.

According to the Press Gazette, the year-on-year decline in newspaper circulation is currently running up to 20% (Sunday People), with only a couple of the free newspapers (Metro and City AM) bucking the trend.

So when SNWS says that up to 91% of revenue is set to renew until 2029, maybe we should assume that this is a best-case scenario.

However, at a PER of a little over 5x, and with the company doing a great job of finding cost savings, perhaps the gloomy industry outlook is priced in?

Personally, I’m inclined to think that print circulations could stabilise at some point in the next few years - could there be a point where everyone who wants to read the news online is already doing so?

It might be a risky call but I continue to like the risk:reward here, and will keep giving it the thumbs up.

Morgan Advanced Materials (LON:MGAM)

Unch. at 245p (£699m) - Trading Update - Graham - AMBER/GREEN

Morgan Advanced Materials plc, the global manufacturer of advanced carbon and ceramic materials for technically demanding applications, announces today a trading update for the first nine months to 30 September 2024.

MGAM hasn’t made it into this report before. The stock has taken a dive in recent months:

Roland has covered it in his SIF Portfolio, most recently here when he noted a vague outlook statement at the interim results and declining earnings estimates.

Given that the share price has barely moved today, I think we can safely say that the market priced in the bad news the company has published.

Outlook/Profit warning:

Market conditions have weakened during the second half and we are now seeing a further deterioration in our outlook for the fourth quarter. Our outlook for constant currency revenue growth for the full financial year is now around 3%. Together with additional FX headwinds, we now expect an adjusted operating profit margin for the year of c.11.4%.

The half-year guidance was for full-year revenue growth towards the top end of the range of 4-7%, and an adj, operating profit margin of around 12.5%.

But sales for the first nine months are only up by 3.8%, and Q4 is shaping up poorly.

Simplification programme: the company is looking for even more cost reductions than it was before.

Previously: £10m of annualised savings were targeted, with a one-off cost of £20m.

Now: it wants a total of £22m in annual savings with a one-off cost of £45m.

This cost-cutting programme is set to complete by mid-2026 and the money to pay for its implementation will be at the expense of spending on increased capacity. So there is no doubt that this is a very defensive move by the company, but should hopefully set it up to achieve a position of strength from 2026.

Share buyback programme: the announcement of a £40m buyback is not what you’d normally expect to hear from a company that is defensively cutting costs. But if you scroll back to the interim results, its leverage multiple as of June 2024 was only 1.3x (excluding leases), within its target range for quiet periods without any major M&A.

As it seems that there are no major M&A deals coming up in the short-term, the company is happy to plough cash flow into a buyback instead.

It’s a little unusual but it does make sense to me. I know that buybacks can be controversial, especially when it seems that companies are overpaying for their own shares. But the valuation on offer here doesn’t seem excessive, even if forecast earnings need to be adjusted slightly lower:

CEO comment:

"We are seeing a weaker trading environment in the near term and are expanding our simplification programme, continuing our track record of self-help. We remain focused on delivering enhanced returns to shareholders and are pleased to be able to support this in the near term with the additional cost savings and share buy-back programme, both announced today. Our business is well positioned with leading market positions, a strong balance sheet, and attractive opportunities in both faster growth and core markets as markets recover."

Graham’s view

I’m inclined to go AMBER/GREEN on this, as the combination of cost-cutting, share buybacks and a low-ish earnings multiple all appeal to me, even if the company is lowering expectations today.

The share price is down by about 25% from where it traded earlier this year, which at first glance seems harsh in comparison to declining EPS estimates (they are down, but not yet by 25%):

And if the company buys back £40m of stock, that could reduce the share count by over 5% and provide a nice little tailwind for future EPS.

So this one strikes me as being worthy of further research. It’s not high conviction for me but I’m satisfied with AMBER/GREEN.

Megan's Section

Asos (LON:ASC)

Down 8% to 346.7p (£414m) - Final Results - Megan - AMBER/RED

The recent share price spike which followed the news that Asos had secured additional financing following the part sale of its Top Shop family of brands, did not stick. The share price is back below 400p and has fallen further following this morning’s final results announcement.

Revenue continues to slide owing largely to a 16% decline in the number of active customers on the site (from 23.3m in the year to September 2023 to 19.6m in the 2024 financial year). A slight uptick in the average basket value (from £40.33 to £41.07) failed to offset the decline in customers and their frequency of orders.

Declining customer numbers is a problem that Asos will struggle to deal with. The market for online shopping has shifted in recent years, putting extreme pressure on the model that Asos pioneered in the UK in the early 2000s. Today, young shoppers are far more likely to buy cheap goods from Chinese competitors than they are from the UK. While a surge in environmental consciousness is turning yet more chunks of Asos’ former stalwart customers from their site.

Marketing costs rose from 5.5% of sales to 6.6% in these numbers, but marketing alone is not going to rescue the company’s dwindling sales.

Growth therefore must come from increased order sizes and Asos seems to be attempting to secure that by invoking a threshold for free returns. Now, customers will have to keep £40 worth of goods ordered to qualify for free returns.

I am dubious that this move will have the impact that Asos hopes it will. The company risks alienating its core customers even further. Sales this year were down 16% on a like-for-like basis (below expectations).

Gross margins have fallen further to 40%; they averaged over 50% before the pandemic.

Inventory levels have come down 50% over the last two years and are now at a more manageable £520m. Management says this improves “newness for customers” (not a great use of the English language), but more significantly for shareholders it improves the financial flexibility of the business. Fresher inventory should also help improve average selling prices and contribute to lower discounting (positive for margins in the long run).

Better balance sheet health has also had a positive impact on operating cash inflows in the 2024 financial year. The cash cost of payables (short-term debts owed by the company to its vendors) was almost £300m lower this year, allowing the company to report operating cash inflows of £217m.

These results don’t reflect the refinancing, completed after the period end, which should support the weakening balance sheet. But (as Paul commented in our last coverage of Asos), at what cost? Asos has ceded control of one of its higher quality brands and stomached a material loss on the investment it made in Top Man during the pandemic.

Megan’s view

Recent momentum, from the news of the joint venture, did not last long.

The company’s share price has underperformed the market by more than 14% in the last month and its momentum rank is now falling.

There is very little to like from a quality perspective. Margins are waning and the company has been loss-making at the operating level for three consecutive years.

Without profits, it’s hard to make a value argument either. Shares trade on just 0.14 times sales, but revenue continues to decline, meaning price/sales is not a great metric on which to base a valuation argument.

I have recently been familiarising myself with the deep value approach to investing (you can watch the webinar that Mark and I hosted recently here) and there could potentially be an argument to make about Asos heading towards deep value territory.

The company has a net current asset value of £95m (before the recent joint venture) so if the market cap keeps heading towards £100m, this might become one for the deep value investors. For now though, I am sticking with Paul’s Amber/Red rating.

Vodafone (LON:VOD)

Up 1.4% to 73p (£18.8bn) - Merger Update - Megan - AMBER/GREEN

For retail investors, the main draw of a holding in Vodafone is its dividend. In May, these shareholders were forced to stomach the disappointment of a major dividend cut (from 9¢ a share in 2023 to 4.5¢ a share this year) after the company revealed it could not afford to keep paying out such high amounts of cash to its shareholders given the volume of debt and anaemic growth.

It’s the second blow to Vodafone’s income investors in recent times. In 2019, the company slashed its final dividend to 3.7p (from 9.1p the previous year). For the last special payout, you’d have to look back to 2012.

But sometimes dividend cuts are the healthy thing to do and in Vodafone’s case, this is certainly true. The share price has dropped significantly since 2019 to reflect the cuts to the payout and shares are now yielding 6.07%. That’s certainly tempting, but the crucial question is: is the dividend safe at current levels?

The 2024 dividend, (the second chunk of which was paid in August) was not covered by earnings, but the dividend forecast to be paid in 2025 is covered by forecast earnings.

Today’s announcement that the UK business could be merged with Three will also be a relief to shareholders. Growth in the UK division of Vodafone has been sluggish as the company has struggled to invest in its domestic infrastructure. Merging with Three into a joint venture which would be 51% owned by Vodafone and 49% owned by Three’s UK owner, CK Hutchison Holdings, would allow for greater investment in a resilient 5G network.

Megan’s view

Vodafone has long been an income stalwart for UK investors and remains so, despite the major dividend cuts of the last few years.

The strategic direction of the company, which includes chopping out the cash draining chunks and implementing mergers (like the proposed merger with Three) to allow for more investment seems sensible.

This definitely isn’t a growth stock. But while the dividend looks safe and comes with a decent yield, I am pretty positive about Vodafone for income investors.

Roland's Section

TP Icap (LON:TCAP)

Up 3% to 234p ( £1.8bn) - Trading Statement - Roland (I hold) - GREEN

The Board is comfortable with FY 2024 market expectations for adjusted EBIT

I hold shares in this FTSE 250 interdealer broker group in the SIF model portfolio and my personal holdings. It’s also a stock that’s caught my eye for its high and apparently well covered dividend yield.

As I see it, the investment case has two core elements that could drive a re-rating from the current modest P/E:

Improved performance from the broking and exchange businesses after a period of reshaping and M&A

Potential for significant value to be released by a partial spinout of the high-margin Parameta Solutions data business

Today’s trading statement is fairly brief but seems broadly reassuring to me. Let’s take a look at the main points (all figures in constant currency):

Record Q3 group revenue up 10%to £557m - a new record for the business.

Global broking revenue up 9% - this division arranges transactions between financial institutions in areas such as FX and interest rates. Rates is the largest and most profitable asset class – Rates revenue rose by 14% in Q3, although I wonder if this masks weaker results in some other asset classes.

Liquidnet - this is an equity trading venue providing block trading and other liquidity services for institutional investors. Reports strong trading in Q3 with revenue up 28%.

Energy & Commodities broking revenue rose by 3% against a tough comparator in Q3 2023.

Parameta Solutions - revenue up 9%. This is a data analytics service specialising in OTC markets such as those served by TP ICAP’s other operating units. Parameta has an adjusted operating margin of c.40% and is seen by many investors as undervalued within TP ICAP, when compared to some rival data businesses.

I share this view, although I am struck by the relatively slow rate of revenue growth in this business. Nine-month revenue growth for Parameta is only 10% and FY23 revenue growth was only 8%. I wonder if this slow growth could act as a constraint on the value that can be released in a possible spinout.

Business update: a strategy update will be provided with the FY24 results in March. For now, the company confirms it's continuing to investigate “strategic options” in relation to Parameta Solutions, including a possible IPO. This might be in the US, although nothing has been decided yet.

Roland’s view

TP ICAP’s performance appears to have gained momentum this year:

H1 revenue +3%

9 month revenue +5%

Q3 revenue +10%

This appears to support management’s claim that strong Q2 momentum continued into Q3.

The reality is that some elements of this business, notably the broking business, are somewhat mature and will always be exposed to external market conditions. But I’m comfortable that this group is performing well, probably better than for some years.

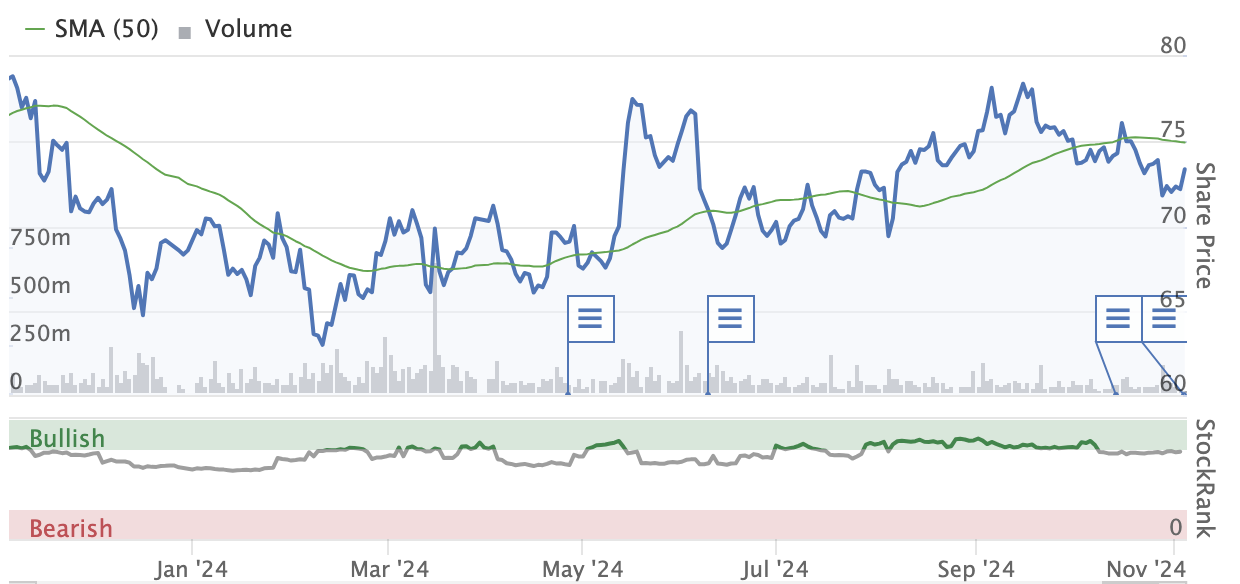

The shares have also done well over the last year, gaining around 40% and remaining highly ranked:

One point worth making may be that while TP ICAP is cash generative, historical profitability has been somewhat average:

Low profitability might help explain the low valuation and supports the argument that Parameta could be more valuable if spun out.

However, consensus estimates suggest to me that TP ICAP’s adjusted operating margin could rise to a low-teens level in 2024, with a corresponding increase in return on equity. This might help to support a higher valuation, in my view.

Outlook: Today’s update confirms FY24 adjusted EBIT guidance, subject to any outsized FX movements (TP ICAP is heavily exposed to the USD).

Broker notes aren’t available to me, but I’d imagine it’s reasonable to continue relying on Stockopedia’s consensus earnings estimate of 29.5p per share. This prices the stock on a FY24 P/E of 8 with a 6.5% dividend yield – still very modest, in my view.

While the shares aren’t quite as cheap as they were, TP ICAP still appears to be on a positive trajectory. I remain positive about the outlook here.

Schroders (LON:SDR)

Down 14% to 314p (£5.1bn) - Q3 2024 update - Roland - AMBER/GREEN

Total assets under management (AUM) reached a new high of £777.4 billion and the Group's net flows for the nine months to 30 September 2024 totalled £1.6 billion.

This morning’s third-quarter update from FTSE 100 asset manager Schroders has triggered a moderate sell off. Shares in this family-controlled business are down by 14% as I write, extending a multi–year decline that’s seen the stock fall by nearly 50%:

Let’s take a look at the news that has prompted this slump.

AUM: Total assets under management rose by £3.7bn (0.5%) to £777.4bn during the third quarter, but this was driven by market movements (+£6bn) offsetting net outflows (-£2.3bn). I’ve pasted in the table showing AUM movements below to highlight the scale and complexity of this business:

While I’m reassured to see positive market performance, ultimately net inflows are required to drive a recovery in profitability.

Unfortunately, the company’s comments suggest that Q4 2024 could be a dire period for outflows:

£2bn of losses from three institutional clients

£8bn of outflows on the legacy Scottish Widows mandate (although this will see regular outflows by its nature)

The company expects to report more positive progress in 2025, when management says “there are good mandates funding across Asset Management”.

Time will tell. But I would argue that today’s news is only more of the same from Schroders, highlighting a persistent underperformance and erosion of profitability.

We can see this readily using the data presented on the StockReport. Profitability has declined steadily for years, as revenue growth has failed to keep pace with cost growth and acquisition spending.

Since 2018, revenue has risen at a compound average rate of 2.3% per year, while operating profit has fallen by 7% per year:

The increase in costs can be seen explicitly by clicking through to the Accounts/Income Statement tab.

This process has resulted in a steady decline in Schroders’ operating margins (and a corresponding decline in return on equity to under 10%):

Roland’s view

Schroders is not the only asset manager to be suffering from declining profitability and a hefty cost base. I covered rival Abrdn (LON:ABDN) in a piece last week, for example.

However, as with Abrdn, the recent promotion of the CFO into the CEO position suggests to me that Schroders may start to pay closer attention to its cost base.

I’d hope that CEO Richard Oldfield will also use this period to take a closer look at the group’s (broad) range of activities. Could the focus be tightened on areas where Schroders has more well-defined competitive advantages?

Having said this, I think Schroders’ valuation may have come down to a level where it’s starting to look reasonably priced. Assuming consensus remains broadly unchanged, the shares are now trading on less than 11 times forecast earnings with a 6% dividend yield.

Although dividend cover has thinned in recent years, this payout has not been cut for over 30 years. I don't think there's much risk of a cut as things stand today.

On balance, I feel broadly positive about Schroders’ business and current valuation. However, I do think a measure of caution is prudent to reflect near-term risks, so I’ve opted for AMBER/GREEN here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.