Good morning! It's been a hectic week, let's see what Friday has in store for us.

Wrapping it up at 1pm. Thanks for all the interesting comments! Graham.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

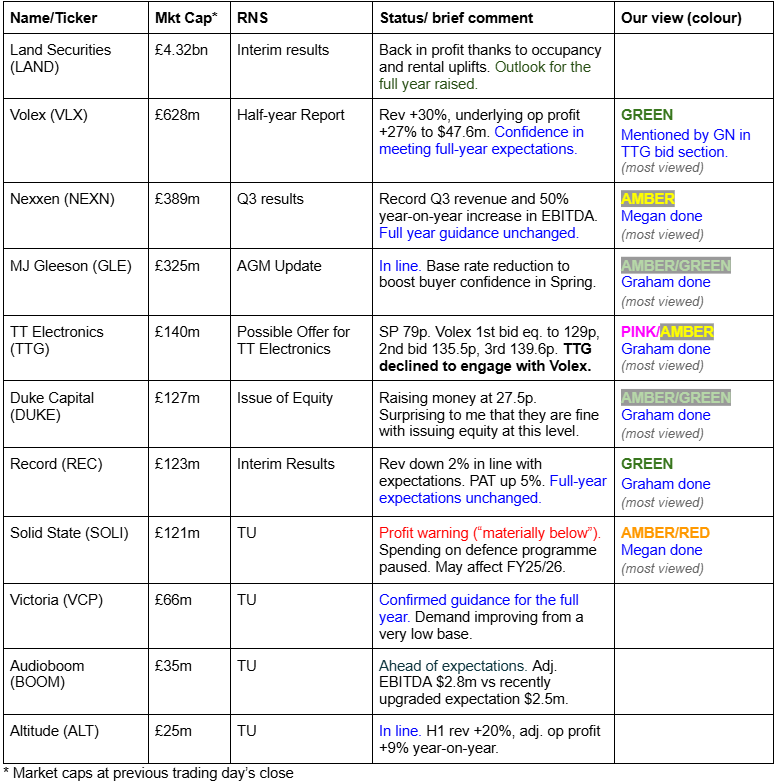

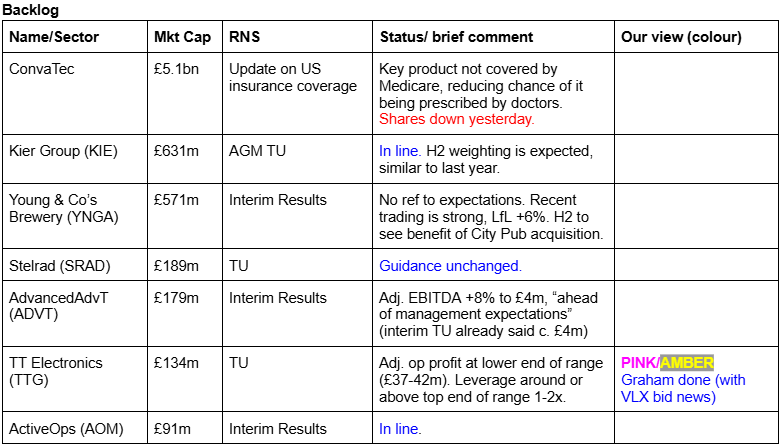

Companies Reporting

Summaries

Solid State (LON:SOLI) - down 48% to 110p (£121m) - Trading Update (profit warning) - Megan - AMBER/RED

A delay in orders from defence customers has forced the company to issue a major profit warning for the year to March 2025. Sales are now expected to be “materially below” consensus expectations. The delay, which management think has been caused by the government’s strategic defence review scheduled for next summer, could also impact orders into the new financial year as well. Shares have fallen a whopping 48% in early trading.

Duke Capital (LON:DUKE) - down 5% to 28.4p (£121m) - Issue of Equity - Graham - AMBER/GREEN

I’m disappointed to see DUKE raising funds at a price of just 27.5p. NAV is around 40p and I hoped that management would wait for the share price to recover closer to that level before raising. However, they could not wait any longer and for me this is a blow to the investment case. I downgrade this from GREEN.

TT electronics (LON:TTG) and Volex (LON:VLX) - TTG up 36% today to 107.8p (£192m) - VLX down 12% today to 301p (£546m) - Possible Offer for TT Electronics - Graham - AMBER on TTG, GREEN on VLX

Exciting news for shareholders in both companies as VLX reveals it made two bids for TTG, neither of which have been entertained yet by TTG management. A mix of cash and shares is proposed. If it goes ahead, VLX would pay the price of higher debt and substantial share count dilution for their most adventurous acquisition to date. It looks like a reasonable offer to me and if I held TTG, I’d be inclined to accept.

Nexxen International (LON:NEXN) - up 7% to 313p (£389m) - Q3 2024 Results - Megan - AMBER

Upgraded adjusted EBITDA guidance for the full year, alongside the confirmation of another $50m buyback scheme. Management has also proposed the cancellation of the AIM-traded shares in favour of Nasdaq and shareholders will be given a vote on this at the AGM in December. Nasdaq feels like a more appropriate market.

Record (LON:REC) - down 0.6% to 62p (£123m) - Interim Results - Graham - GREEN

The outlook for the full year is in line with expectations so perhaps the biggest news here is the launch of a €1.1 billion infrastructure equity fund. Revenues from this source should help to offset the loss of a client from Record’s “custom solutions” business, who switched over to their Passive Hedging product.

Short Sections

MJ GLEESON (LON:GLE)

Down 2% to 546p (£319m) - AGM Trading Update - Graham - AMBER/GREEN

It’s a brief AGM update from this homebuilder.

Key points:

Full year results (for June 2025) at this early stage are still expected to be in line with expectations.

However, the results will be “more weighted to the second half than usual”. This can be interpreted as an amber flag.

Gleeson Homes:

As anticipated, the lack of conviction in the market continued through the Autumn. Last week's base rate reduction was welcome and is expected to bolster buyer confidence into the important Spring selling season.

There’s an increase in net reservation rates but also continuing margin pressure.

And confusingly, they “will be selling overall on a lower average number of sites than last year”, despite opening 27 new sales sites during the year.

Gleeson Land: this should deliver a full year result materially ahead of last year.

Graham’s view: after reading this update, I think there’s an elevated risk of a profit warning this year, but it’s still early days and there is all to play for. My overall positive view is unchanged and so I will leave our AMBER/GREEN stance unchanged.

Graham's Section

Duke Capital (LON:DUKE)

30p (£127m) - Issue of Equity - Graham - AMBER/GREEN

We had news at 5pm last night from Duke Capital, “a leading provider of hybrid capital solutions for SME business owners in Europe and North America”.

I’ve been GREEN on this stock, on the basis that it was trading at a discount to balance sheet NAV. My plan was to switch to AMBER/GREEN or AMBER if the stock made it to net asset value, c. 40p.

The reason for this strategy was twofold. Firstly, as an investment vehicle, I think it’s fair to value it relative to NAV.

Secondly, I believe that Duke will become more valuable the more diversified it is, and I’m aware that management are keen to raise money. My working assumption was that management would raise money as soon as they could do so in the region of 40p.

For context, the last time that Duke raised money was at 35p in May 2022. NAV per share was 37p at the time.

So I’m a little disappointed by last night’s announcement.

Duke are looking to raise at least £15m from a Placing, plus another £3m in a Retail Offer.

The price is the disappointing bit: they are looking to raise at only 27.5p.

Is this all they think existing shares are worth?

In one sense it’s fair enough: I’m the one who has focused on balance sheet NAV; management themselves haven’t talked about it much and instead tend to focus on recurring cash revenue as their main KPI, e.g. £6.3m of quarterly recurring cash revenue in Q1 FY 2025.

While cash revenue is a very important number, you do need to apply some sort of theoretical interest rate/capitalisation rate to it, if you are trying to value Duke as a whole. I prefer the objectivity of NAV.

And the fact that Duke waited two and a half years since the last placing suggests to me that maybe they were waiting for the share price to recover to a better level, before they raised more funds. But perhaps they grew impatient.

Covid, followed shortly afterwards by higher interest rates, have put a dent in Duke’s valuation. In late 2021/early 2022, the share price nearly recovered, but then I guess higher rates starting from Dec 2021 put a stop to that.

It was shortly after rates started rising that Duke carried out its last previous fundraise:

Graham’s view

This fundraise is negative for my GREEN thesis as I was relying on the company to avoid raising funds except at levels where I thought it would be attractive for them to do so.

I therefore have to downgrade my stance here. Perhaps I should go straight to neutral but that might be a little drastic. Let’s go to AMBER/GREEN for now. The shares do still offer a nice yield and as I said at the top, Duke does become more diversified, and therefore more valuable, the larger it grows. So the placing is not all bad news.

TT electronics (LON:TTG) and Volex (LON:VLX)

Possible Offer for TT Electronics - Graham - AMBER on TTG, GREEN on VLX

TTG: up 36% today to 107.8p (£192m)

VLX: down 12% today to 301p (£546m)

TTG is a stock I was positive on, until they issued a horrible profit warning in September, causing a sharp fall in the share price:

Today we learn that VLX has spotted value in it.

They do not say when they submitted their bids, but I’m confident that they all took place after the recent profit warning.

1st bid: 129p (of which 62.9p cash, the rest VLX shares).

2nd bid: 135.5p (of which 62.9p cash).

3rd and latest bid: 139.6p (no change to the terms of the offer, but with a higher VLX share price).

VLX notes that the latest bid is a 76.7% premium to last night’s closing price for TTG.

However, TTG has not engaged with VLX, i.e. the directors of TTG do not seem interested in recommending the bid to their shareholders.

Rationale for the bid

Firstly in terms of each company’s activities, it’s clear that they might be able to work together. TTG is an international designer/manufacturer of electronic components with sites dotted across the UK, the US and Asia. Their products are used in healthcare, aerospace/defence and various submarkets where processes need to be automated/electrified.

Volex, meanwhile, are “global integrated manufacturing specialists”, and they love to acquire: 12 businesses have been acquired since 2018.

Volex, under the leadership of Lord Rothschild, has been the far superior investment over almost any timeframe.

The trend has been maintained over the past year, thanks to TTG’s recent profit warning.

Here’s a 5-year chart with TTG in candlesticks, VLX in red:

VLX aren’t afraid to put the boot into TTG management today (emphasis added):

Despite the resilience of TT Electronics' underlying business, it has faced persistent challenges in recent years, which Volex believes have been exacerbated by execution missteps by the Board, including former and current executive leadership. As a result TT Electronics' shares are trading at a 10 year low.

It’s hard to argue with the view that mistakes have been made at TTG - I said as much in September at the time of the profit warning, which was blamed on “operational efficiency issues” in North America.

Those issues have cost the company c. £18m of operating profit in 2024. A trading update posted only yesterday by TTG confirmed that profits for 2024 would be at the lower end of the range they previously suggested.

Here’s the latest on the problems facing TTG:

There remains a significant management focus on the operational challenges identified in the trading update on 16 September 2024 in two North American sites. The underlying operational efficiency issues relate to an evolution of product mix over the last couple of years in both locations, and we are now dealing with specific productivity issues exacerbated by increased volumes and product complexity.

Graham’s view

I don’t see any response from TTG in relation to the VLX bid yet. Perhaps they will say that the VLX bid is opportunistic, which it is.

But I also think it’s potentially quite a reasonable offer. A 77% premium to the most recent share price is a huge premium, in anyone’s book.

However, the fall in the VLX share price today adjusts things.

As I type this, VLX is down by 12%.

The bid is 62.9 pence in cash plus 0.223 new Volex shares for each TTG share.

That’s £111m in cash plus £119m of value in Volex shares, assuming the Volex share price stays around £3. Total value: £230m.

Net debt was last seen at £127m (June 2024) so let’s call that a £355m enterprise value.

TTG’s 2024 adj. operating profit will be somewhere in the region of £37m.

We therefore get a valuation of less than 10x adj. operating profit.

Maybe that’s a good deal for VLX but I wouldn’t say that it’s a steal. After taxes and other items are accounted for, I think VLX will pay a reasonable multiple for TTG.

The counter-argument is that 2024’s profits are temporarily depressed by the problems in North America, which will be fixed sooner or later. Without those problems, adj. operating profit for 2024 should have been £55m.

TTG’s shareholders will have the final say on this. They may look at VLX’s interim results, published this morning, and feel envious: revenues +30%, underlying operating profit +27% to $47.6m, and full-year expectations unchanged.

Volex does already carry over $150m of net debt (ex. leases) and my calculations suggest that this would almost double if their bid for TTG was accepted. Volex shareholders would also be diluted by over 20%.

In summary: I think the bid is opportunistic but also reasonable.

On TTG itself I was neutral, due to my loss of faith in management. I remain neutral on it now, and I’d be inclined to accept the VLX bid.

As for VLX, this is a stock where Paul has been GREEN. I think the debt and dilution proposed today should be a cause for some concern. And if they succeed in taking over TTG, I expect that improving it will be hard work.

On balance I’m happy to leave the GREEN stance unchanged due to Volex’s track record of successful acquisitions, but I think this could be their most difficult one yet - not just in terms of getting it over the line, but also in terms of making TTG a successful component of their empire.

Record (LON:REC)

Down 0.6% to 62p (£123m) - Interim Results - Graham - GREEN

Record plc… the specialist currency and asset manager, today announces its unaudited results for the six months ended 30 September 2024 ("H1 FY25").

Some decent results here, key points:

Assets under management up 4% during the period.

Revenue down 2% year-on-year to £21.1m, in line with expectations.

PAT (profit after tax) up 5% to £5m

Trading for the full year remains in line with expectations.

Performance fees: an important but volatile contributor to profits, these fees were £1.6m in H1, slightly higher than H1 last year.

Thanks to TB in the comments for pointing out this important line in the commentary: the exceptional performance fees of £4.3 million earned in H2 FY24 are unlikely to be repeated in the second half of this year.

The “revenue by product” table shows increased fees from currency management (up £2m) offset by lower fees from Record’s “custom solutions” within Asset Management. An important client has switched over from Custom Solutions to Passive Hedging, as previously announced.

Net cash is almost unchanged year-on-year at £14m.

Interim dividend unchanged at 2.15p.

The yield here is one of its best features:

On that point, Record passes 5 bullish stock screens, two of which relate to its yield:

And turning back to the interim results, here’s a snippet from the comment by the new CEO:

We have continued to focus on delivering best-in-class solutions to clients in our six core product areas, and we are seeing increased demand for our Hedging for Asset Managers and FX Alpha products in particular. I am especially delighted to announce the launch of our Infrastructure Equity Fund. This is an important milestone in the growth of our Asset Management offering, which will deliver sustainable long-term revenues and where we continue to develop our pipeline.

Graham’s view

Record continues to exhibit the features that initially attracted me to it: namely high profit margins and a strong and very liquid balance sheet (net assets £28m, almost entirely consisting of liquid assets).

Quality metrics are fabulous:

The missing ingredient is growth, and indeed the loss of a client from “Custom Solutions” is a return to the old trend where Record would lose clients from its more profitable products.

A helpful note from Panmure this morning suggested that Record could earn 17 basis points of revenues on its new €1.1 billion infrastructure fund - that’s a couple of million euros in additional revenues, hopefully providing a surplus over its associated costs and with the potential to grow over time, over and above its initial commitments.

I’m going to give this stock the thumbs up with a GREEN stance, as I am a long admirer of the company and I think that even in the absence of rapid growth, it’s a nice stock to own (I’m a former shareholder).

Additionally, I’m intrigued to see what their young new CEO might achieve. He’s an internal hire who has been with the company for his entire career. Perhaps he will bring a fresh approach to an old, respected name?

Megan's Section

Solid State (LON:SOLI)

Down 48% to 110p (£121m) - Trading Update (profit warning) - Megan - AMBER/RED

It’s never a good sign when a company is forced to issue a trading update just 9 days after the last one. This morning, Solid State (LON:SOLI) has announced that revenue from a major defence programme has been delayed. Financial results in the year to March 2025 are therefore expected to be materially below current expectations.

Solid State supplies electronic components to industries with complex demands. In 2024, the defence sector contributed 44% of sales, with 20% generated directly from NATO sales.

Today management has suggested the order delay is a result of the UK government’s strategic defence review, that has forced customers to pause orders pending completion of the review, which is due next summer. As a result, management cannot currently be confident that the order delays won’t impact sales in the 2026 financial year.

Chief executive Gary Marsh commented:

"While the current delays in receiving orders are frustrating, our relationships with the Forces and key defence prime contractors underpins our confidence in the Group's position within this sector. The Board remains optimistic about the medium and long-term outlook for defence spending given the current geopolitical climate.”

Megan’s view:

When Graham covered the company’s trading statement last week, he downgraded his view from green to amber/green. His rationale was that earnings momentum had stalled slightly, and shares were starting to look prohibitively expensive.

I agree with that view. Although Solid State has been a phenomenally high performer since it listed on AIM in 1996, a weakening of momentum is definitely a reason for concern.

The company’s over-exposure to sectors highly impacted by geopolitics also merits some caution. Customers in hard-to-access sectors like defence are reliable and sticky in good times, but one-off events (like today’s one) can cause material disruption. Management had flagged this in 2024 financial results and continue to aim to balance out defence sales from private industrial sectors, most noticeably medical.

It’s likely that the revenue from key defence programmes has only been delayed and Solid State will recoup that in subsequent years, but for now it is unclear how long the lower demand will last.

While today’s whopping share price fall might look tempting, given the quality of this company, we have written before about the perils of buying on a profit warning. This feels like a prime example of a company whose troubles might not yet be behind it.

I am minded to downgrade our view further awaiting more clarity when the company issues its interim results in December. AMBER/RED

Nexxen International (LON:NEXN)

Up 7% to 313p (£389m) - Q3 2024 Results - Megan - AMBER

Last week I covered digital advertising agency S4 Capital (LON:SFOR), whose results pointed to the challenging market conditions facing companies in the sector. Analysing numbers from Nexxen International (LON:NEXN) this morning is like night and day. This is also a digital advertising platform, but its specialist field is CTV (“Connected TV”) where its expertise means demand is soaring.

Revenue in the third quarter was 13% higher than the same period last year at $90.2m. The company has also swung back into an operating profit and reported net margins of 23%.

On an adjusted EBITDA basis, management has raised its guidance for the full year from $100m to $107m and has announced an acceleration in spending plans in the world of data and AI.

The company’s performance in the last year has not gone unnoticed by shareholders. The shares have outperformed the wider market by 76% and are currently trading well above their 200 day moving average.

However, long-term holders are still not back in the black. The share price fell off a cliff in late 2021 after acquisitions widened the net debt position and revenue growth disappointed, but numbers today bring reassurance that, operationally, things are on the right track.

And it’s not just the operational performance that has supported shares this year. Management initiated a $50m share repurchase scheme in May and followed this up with another $50m repurchase scheme in October. The average number of shares in issue has fallen to 141m from 153m at the end of 2022.

There are still some red marks though. Receivables remain worryingly high at $201m - more than the revenue reported in the period. That suggests the company’s customers are not good at paying bills in a timely manner.

The company also insists on heavy adjustments in its own reporting. On an underlying basis, profits have been far from consistent.

Megan’s view

Today’s numbers are encouraging and the approval of another buyback scheme should give further support to the shares for the next few months.

In December, shareholders will be given a vote on a proposed delisting from AIM in favour of the more tech-savvy Nasdaq market. This feels like a more appropriate market for the Israel-based company.

For long-term investors, there are too many unknowns. For those looking for a short uptick in momentum, the trend of the last few months looks like it has further to go. AMBER

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.