Good morning!

Wrapping it up at 1pm. Cheers!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

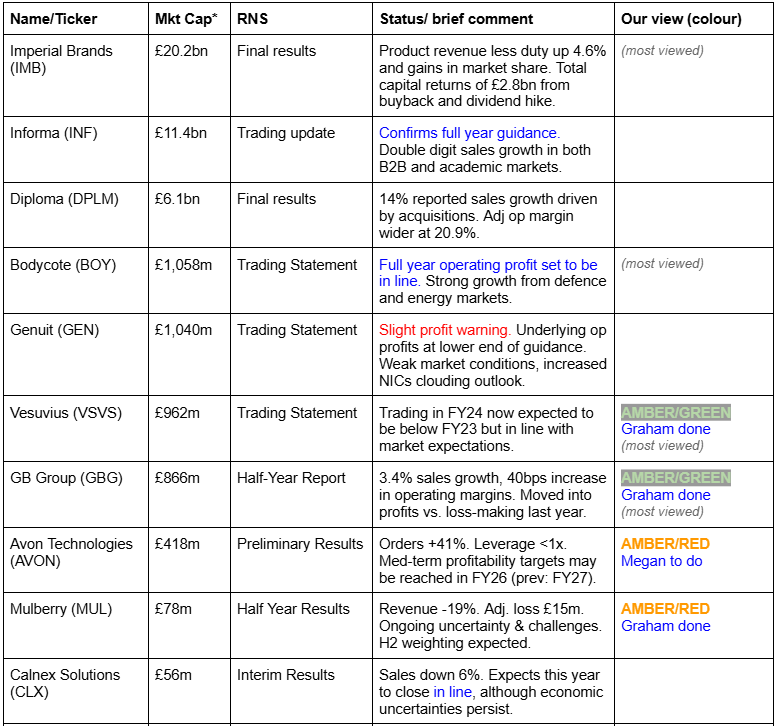

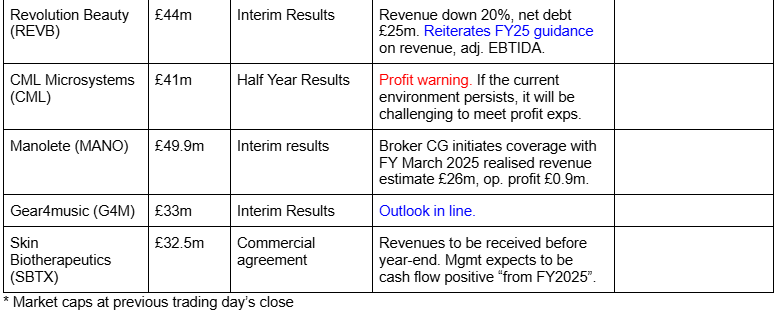

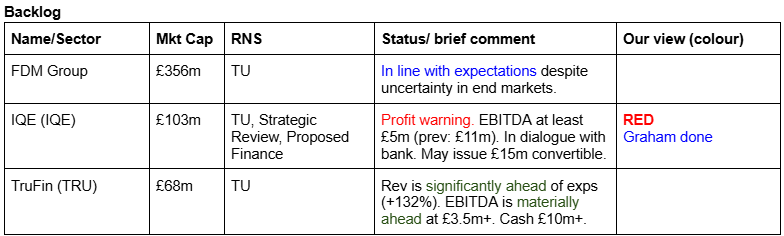

Companies Reporting

Summaries

Iqe (LON:IQE) - down 2% to 10.5p (£102m) - Trading Update (profit warning) - Graham - RED

Adj. EBITDA is now expected at £5m+ but real earnings will be much lower and can be expected firmly in the red. Net debt last seen at £17m. The company is in talks with its bank while at the same time negotiating a possible loan note and conducting a strategic review. I’d vigorously avoid this share.

Mulberry (LON:MUL) - down 7% to 110p (£77m) - Half Year Results - Graham - AMBER/RED

Poor results, as expected, with revenues down 19% and the underlying loss before tax widens to £15m. The outlook statement offers little solace, with ongoing uncertainty and challenges. The solution to MUL’s problems is probably a takeover but its majority owner does not seem at all interested in that outcome.

Avon Technologies (LON:AVON) - Up 3.4% to 1354p (£406m) - Preliminary Results - Megan - AMBER/RED

Strong financial results with a record order book and new order intake boosted from additional spending from the US department of defence. The company is coming to the end of a multi-year transformation project which should see margins back in line with historic figures.

GB (LON:GBG) - up 4% to 354p (£861m) - Half-year Report - Graham - AMBER/GREEN

Fine results from GBG with the growth in adj. operating profit (+21%) standing out, although that’s based on a one-time cost reduction programme that occurred during the previous financial year. More broadly, I have a positive impression of GBG and the PER of 18x seems like it could be worth paying.

Short Sections

Letter from Retailers to Chancellor (Megan)

A group of retailers has written a letter to Chancellor Rachel Reeves, warning of the potential fallout from the increase in employer National Insurance contributions and the National Living Wage, proposed in last month’s budget. Both changes are due to come into effect in April next year and will add an estimated £7bn of costs across the sector.

We’ve seen a handful of companies estimate the cost of the increased NI contributions. For example, yesterday Begbies Traynor (LON:BEG) (which employs 991 people) said it would be taking a £1.25m hit. But so far, companies in the retail and hospitality sectors have steered clear of directly forecasting the additional costs.

But investors should expect some cuts to profit forecasts. Retail and hospitality businesses are most on the hook for rising costs because, in addition to the rising NI contribution per employee, the threshold for paying national insurance is set to be reduced meaning companies that employ a lot of part time staff on entry level salaries should expect to see a big leap in costs from April.

The retail and leisure sectors have been among the worst performing in the UK since the budget, down roughly 5% in just one month. Revolution Beauty (LON:REVB) (which reported a 20% decline in sales in its first half this morning), JD Sports Fashion (LON:JD.) and Mothercare (LON:MTC) are among the worst performers - these are all companies that operate in the budget section of the retail market and might struggle to pass rising costs onto their customers.

But the companies to be most wary of are those with the tightest of operating margins. Tortilla Mexican Grill (LON:MEX) (restaurants), Currys (LON:CURY) and J Sainsbury (LON:SBRY), for example all reported operating margins of less than 2% last year. Rising costs might wipe out any scrap of operating profit these companies once had.

Vesuvius (LON:VSVS)

Up 7% to 396.5p (£962m) - Trading Statement - Graham - AMBER/GREEN

It’s a reasonable update from the “global leader in molten metal flow engineering and technology”. It covers the period from July to October, inclusive.

The company performed “robustly”.

The unusually-named “Trading Profit” is expected this year to be slightly below the corresponding result for FY23 (£200m). This metric is defined as EBITA: EBITDA minus depreciation!

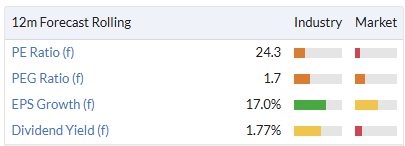

The stock trades at a cheap multiple:

The company itself must see a lot of value in its shares as it launches a second buyback for £50m, “supported by our strong balance sheet”.

At the interim results to June, net debt was £315m, which does seem on the high side to me.

The company would point to its leverage multiple (net debt/EBITDA) which was only 1.2x in June, a low-ish figure.

Outlook:

We expect both Steel and Foundry markets to remain subdued for the remainder of the year and remain cautious on the timing of a recovery. We are mitigating this temporary end market weakness with further actions, including higher in-year cost savings. We now anticipate trading profit for FY24 to be slightly below FY23 on a constant currency basis and in line with current market expectations.

I haven’t got a strong view on this one so I’ll leave our stance unchanged at AMBER/GREEN for now.

Graham's Section

Iqe (LON:IQE)

Down 2% yesterday to 10.5p (£102m) - Trading Update (profit warning) - Graham - RED

This manufacturer of semiconductor wafers issued a trading update that contained little by the way of good news:

Revenue for the Full Year 2024 is expected to be broadly flat year-on-year, resulting in around £115m. In line with the rest of the industry, we are continuing to see a slower than anticipated recovery in key sectors driven by weak consumer demand in end markets. The group expects this to result in an Adjusted EBITDA of at least £5m.

At the interim results, the company said it was heading for adj. EBITDA at the lower end of the range of analyst expectations. Those expectations were £11.1 - 16.6m. So it’s now well below that range.

The update continues with two other pieces of major news.

Strategic Review:

The Board believes there is significant value in IQE that is not currently reflected in its market capitalisation. Consequently, IQE announces today that it will be conducting a comprehensive strategic review of its asset base to ensure that it has a strong capital position to further invest in its core operations (the "Strategic Review").

In plainer English, it sounds like disposals are being considered to strengthen the balance sheet.

Consistent with this interpretation, we learn the company’s Taiwan operations are now being considered for a full sale rather than an IPO.

Proposed Financing

This section is two-pronged.

Firstly, IQE is in discussions with its largest shareholder to borrow up to £15m in the form of a convertible loan note.

Abd secondly:

The Group also continues to have a constructive dialogue with HSBC, and the Directors do not foresee the need to raise further equity should these ongoing discussions progress as expected.

Comment by the Executive Chair:

The impact of the slow pace of recovery in the semiconductor industry can be seen across the sector and is reflected in our revenue expectations for FY24. Looking ahead, the strategic review, including the broader assessment of options for our Taiwan operations, will ensure we have a strong capital base to continue investing in our core business and support IQE's long-term strategy. We remain committed to delivering maximum value for our shareholders and serving our customers. We are confident in IQE's long-term prospects and inherent value.

There is no CEO comment as the CEO abruptly left the company at the end of October, and was not thanked for his efforts over three years in the announcement of that news.

Graham’s view

This RNS strikes me as incredibly grim. It seems that anything considered “non-core” is potentially up for sale. A loan note from a shareholder is up for consideration to plug the gap, and the bank is also taking a keen interest in the situation.

At the interims, net debt was £17m while the company posted an adj. operating loss of £7m (despite having positive adj. EBITDA).

With only HSBC’s attitude preventing another equity raise, I have little choice but to take a negative stance on this one.

I’ve long seen this as a capital-intensive, low-margin manufacturer. Its financial results are very poor even for companies in this category.

And we’ve been here before. The last fundraise was at 20p in 2023, when it raised £30m.

Mulberry (LON:MUL)

Down 7% to 110p (£77m) - Half Year Results - Graham - AMBER/RED

I was wrong on this one in 2023, staying positive on it as late as Nov 2023 (share price at the time: 140p).

As discussed by Paul recently, its financial results have been awful over the past year and the company has had to raise fresh equity (£10m) to stay afloat.

One very interesting feature of the story is that this is another stock where Frasers (LON:FRAS) have been trying to take control. They first suggested a price of 130p per share, and then later upped that to 150p, expressing indignation that their first offer was turned down shortly after the company had been happy to raise fresh equity at 100p.

As recently as last month, Frasers said that “there is no current commercial plan, turnaround or otherwise” at Mulberry, and doubted that £10m would be enough to keep the business going in the near to medium term.

But the majority owner of Mulberry - a Singaporean billionaire family - don't seem to care too much about Mike Ashley’s opinion, and they can’t be forced to sell to him.

All of which brings us to today's interim results:

Revenue down 19% to £56m

Gross margin falls from 70% to 67% (“principally due to stock optimisation to manage inventory and working capital levels”)

Underlying loss before tax £15m (H1 LY: £12.3m) as lower operating costs prevented the losses from rising more rapidly.

Frasers do seem to have a point that a £10m equity raise doesn’t look like much in the face of these losses.

Current trading:

The wider macro-economic environment, including ongoing inflationary pressures, continues to present uncertainty and challenges.

Key points of focus are: inventory levels, operational efficiency, margin and cash position

There is an expected H2 weighting “given the important festive trading period” - same as last year.

Comment by the new CEO, who joined recently from the affordable luxury brand Ganni:

"There is no question that our industry is facing a period of significant uncertainty, driven by a challenging and volatile macroeconomic environment that is impacting consumer confidence in several markets, particularly in our home country. However, with the teams' efforts on cost-cutting, a strengthened balance sheet, a renewed brand-first approach and a refreshed business strategy-details of which I'll share in due course-I am confident we are making the right moves to bring Mulberry back to profitability."

Cash flow in H1 was not as bad as the losses might suggest, as the company decisively crushed its inventories balance by £20m (from £45m to £25m). This meant that they were able to generate positive cash from operations.

Balance sheet: the losses do still show up in the form of lower net worth on the balance sheet. Net assets fall from £11m (March 2024) to minus £5m (Sep 2024), and if we deduct intangibles then it’s lower again. So I’m afraid there is zero balance sheet support for Mulberry’s valuation.

Net debt as of Sep 2024 was £16m, just before the equity raise.

Graham’s view

As readers may recall, I’ve been a shareholder (long-suffering) at Burberry (LON:BRBY) for many years. See Roland’s recent coverage of its interim results here. Its H1 revenues fell by 22%, even faster than Mulberry’s, and it also posted a loss.

At the risk of inadvertently rhyming, the inventory problem at Burberry is also worse than the inventory problem at Mulberry.

But despite Burberry’s terrible performance, I still prefer it over Mulberry, for one major reason: Burberry is not sub-scale. When Burberry gets its product and pricing formula right, and economic conditions allow, it is a proven cash cow.

The same is not true at Mulberry, where results tend to be hit-and-miss. I think this is because Mulberry is just too small to be able to effectively spread out its costs effectively.

Consider that the H1 operating margin at Mulberry is minus 23% (Burberry: minus 5%), despite apparently doing everything it could to cut operating costs.

The reason I stayed positive on Mulberry last year, while acknowledging that it was high-risk, was my suspicion that an industry player would want to buy it to get the brand ownership, to strip out costs and integrate it into a larger group. I thought that this buyer might even have been Burberry.

However, it turns out that Frasers is the most enthusiastic potential buyer.

The suggested (and rejected) takeover price of 150p per share is very cheap from the point of view of the price/sales multiple (only about 0.8x), but the stock is currently only trading at 0.54x.

BRBY trades at 1.2x, which is already a depressed level.

In conclusion: I do think that Mulberry is very cheap, and that it would make sense for a larger group to buy it here.

I also think that the billionaire majority owners can probably afford to keep funding its losses for the foreseeable future, if they wish.

However, in light of the “going concern” warning published in last year’s results and my belief that in its current form it is sub-scale, I’m now obliged to take a negative view. I could go RED but as I still believe in the fundamental value I’ll moderate this to AMBER/RED.

GB (LON:GBG)

Up 4% to 354p (£861m) - Half-year Report - Graham - AMBER/GREEN

GB Group plc, (AIM: GBG), the experts in global identity fraud and location software, today announces its unaudited results for the six months ended 30 September 2024.

Paul covered the H1 trading update in lots of detail in October. Today we have the full report.

Instead of going over ground that’s already been covered, I’ll try to find relevant new information from this announcement

Outlook: reiterated.

Trading remains in line with expectations for the full year:

We continue to expect mid-single-digit revenue growth on a constant currency basis for FY25, which will drive high single-digit growth in adjusted operating profit, given the operational efficiency gains achieved in FY24.

In H1, these growth targets were met or exceeded:

Revenue growth: +4.5% to £137m.

Adj. op profit growth: +21% to £29m, thanks to cost and simplification initiatives that were executed during the prior year.

CEO comment:

"I'm pleased to report on a first half where we have made positive progress against my initial focus areas; removing complexity, being globally aligned, driving a performance culture and differentiating through innovation…

There is more to be done to drive our reacceleration in organic growth, but I am highly encouraged with our progress to date, and I thank the entire team who have responded with energy and positivity to this challenge…

Financial review

On the profit calculation:

If we are happy to treat intangibles as worthless then we might look past the amortisation figure.

The share-based payments of £2m should not be ignored but at least in this case they are less than 10% of adj. operating profit (at smaller companies than GBG they can be a much larger %).

It’s nice to see zero exceptional items in this six-month reporting period.

Turning to the balance sheet, we have net debt of £72m as of Sep 2024, down by £9m in six months. That seems a reasonable rate of deleveraging for anyone concerned about their balance sheet.

They could have reduced debt much faster, but paid out £10m in dividends during the period.

Balance sheet as a whole: when Paul checked it last time, it had a tangible NAV of minus £118m.

Today that figure works out at minus £102m. So while it’s still deeply in the red, the deficit has reduced by 13.5% in six months.

Checking out some of the specific line items, we are reminded again of some of the features described in Paul’s last report.

There is virtually no PPE. Long-term assets are close to zero if you ignore intangibles.

Working capital (current assets minus current liabilities) is slightly negative, with little change in the net figure over the past six months. The standout item here is £50m of deferred revenue (some of which is considered long-term in nature), where customers have paid in advance for GBG’s products.

Deferred revenue is usually a very nice feature of a balance sheet, as it means that customers are financing the business and not charging any interest for the privilege of doing so.

It’s not a panacea: airlines and travel companies frequently go bust despite enjoying this fantastic free customer financing (much to the chagrin of their generous customers). But if used responsibly, deferred revenue can greatly boost the returns achieved by a business for its shareholders.

That seems to be happening at GBG.

Graham’s view

I’m happy to leave the AMBER/GREEN stance unchanged here. I don’t see any reason why the demand for customer identity verification and similar services should decline in the years ahead, and GBG seem to be very good at it. Many blue-chip financial and banking customers are shown on its website, in addition to other names with which readers of this report will be very familiar.

The shares aren’t cheap by any means, but could be worth paying up for:

Megan's Section

Avon Technologies (LON:AVON) - Up 3.4% to 1354p (£406m) - Preliminary Results - Megan - AMBER/RED

Last week I covered Solid State after a delay in a material order from the defence sector resulted in a massive profit warning, which sent shares down 40% in one day.

Protective gear company, Avon Technologies (LON:AVON) is no stranger to such a fate. In 2021 a delay in product approval for a defence contract wiped off 12% of annual sales in one go. After an uninspiring year, the share price dropped even further off its lofty pre-covid highs and is still some way from the valuation it once commanded.

But recent momentum means the share price is now up almost 50% in the last year and the market has liked what it has seen in final results for the year to September.

But with Avon still exposed to the defence sector that gave Solid State so much trouble last week, should investors be too enthusiastic, especially as recent strength means shares are now trading on almost 25 times forecast earnings?

Not enough diversification

Just like Solid State, Avon generates a huge chunk of its sales from one key customer: in this case, the US department of defence. In FY24, sales from this customer rose 12% to $123m (44% of total sales) thanks to major orders in the protective headgear division of the business, known as Team Wendy. But the performance of the respirator division of the business (which houses the original British business and is known as Avon Protection) reveals the dangers from such over-exposure to a single customer. US DOD respiratory sales dropped 41% sending the whole division’s revenue down 7% to $146m.

The US as a whole (including the private sector) contributed 70% of group sales with the remainder coming from a division known as ‘UK and International’. It’s a geographic split that’s improved since 2021 (when the company generated 91% of its £168m of revenue from the US), but it’s still not as balanced as I would like.

That said, exposure to the US has benefited the company in 2024. Overall sales rose 12.2% at constant currencies and the closing order book has risen 64% to $225m (a record high). In total, the company received $364m of orders in the year, including two DOD contracts worth a combined $76m. The company is also seeing strong demand from West Coast police forces ahead of the 2026 FIFA World Cup and 2028 Los Angeles Olympics.

A return to profitable growth

Gross margins recovered slightly to 38%, from 35% last year, back in line with the type of margins the company was reporting before the pandemic. At the operating level, the company has swung back into a reported profit. Adjusted operating profits are up 49% to $31.6m.

But I don’t particularly like the level of adjustments Avon’s management use in their reporting. Amortisation of acquired intangibles isn’t a one-off cost. It has hovered around the $6m mark since the company’s acquisition of Team Wendy. The company has also booked $10.8m of ‘transformational, restructuring and transition costs’ among its adjustments, which includes the multi-year consolidation of the company’s helmet manufacturing sites.

Next year the cost of this transformation is expected to fall rapidly which should have a more permanent positive impact on profits, but until that happens I don’t fully trust the level of adjustments going on here.

Megan’s view

There is no doubt that Avon Protection operates in a hot sector right now. After some cooling off in recent months, its share price has definitely benefited from the re-election of Donald Trump.

The company boasts a market leading position and is showing signs that its ‘transformation initiative’ (which began 18 months ago) is bearing fruit.

But the level of exposure to a single customer makes me nervous. And with a PE ratio of almost 25 times there really shouldn’t be any nerves. AMBER/RED

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.