Good morning!

Wrapping this up at 1pm. Thanks everyone!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

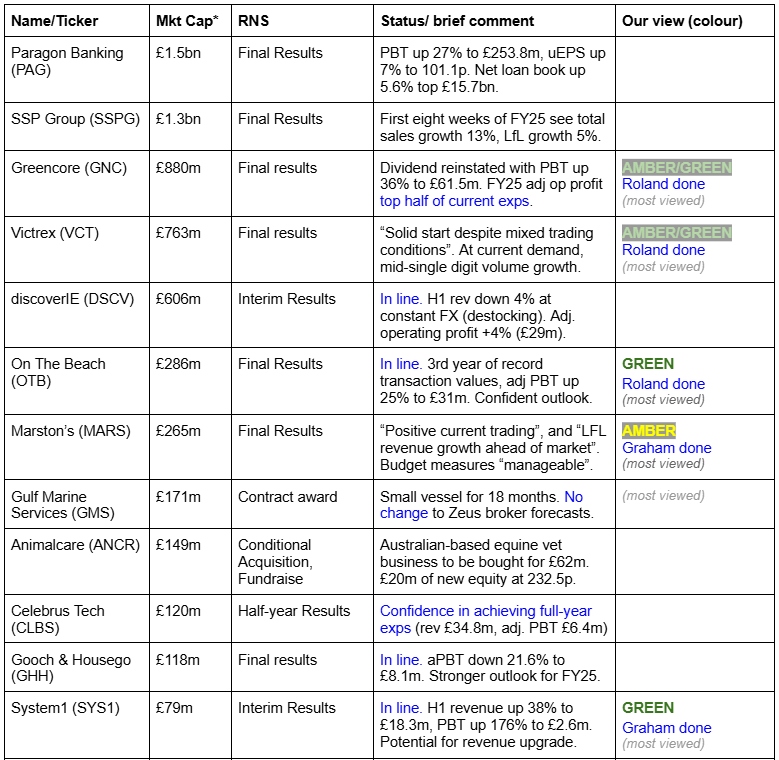

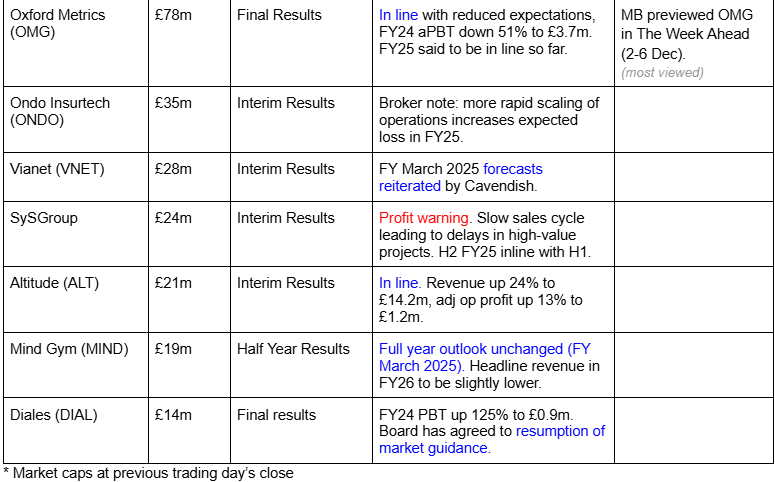

Companies Reporting

Summaries

Impax Asset Management (LON:IPX) - 328.5p (£442m) - Final Results - Graham - GREEN

Last week’s final results showed stable AUM (around £37bn) despite substantial outflows, thanks to market performance plus a small acquisition. Another acquisition is set to complete shortly. I remain positive on this due to a cheap valuation of c. 11x and credibility in its niche of sustainability.

On Beach group (LON:OTB) - up 13% to 194p (£317m) - Final Results - Roland - GREEN

The online travel agent has reported revenue up 14% and a 25% rise in adjusted PBT. Trading remains strong and management are confident of a similar increase in profitability for FY25. A £25m share buyback should further bolster earnings and unwind pandemic-era dilution. I remain positive at this level.

System1 (LON:SYS1) - down 1% to 616.5p (£77m) - Interim Results - Graham - GREEN

Strong results as expected from this provider of an ad-testing service along with related products and consultancy services. The company should have a strong chance of beating the previous revenue estimate but with £2m of new discretionary spending for growth, next year’s pre-tax profit forecast has been slightly downgraded by its broker to £5.6m.

Greencore (LON:GNC) - up 9% to 215p (£976m) - Final Results - Roland - AMBER/GREEN

This convenience food producer appears to be extending a strong run of improved performance that’s seen the stock double over the last year. Updated guidance today suggests a possible 4% increase to FY25 earnings expectations. I think the valuation is starting to look full, but can’t ignore the potential for further upgrades.

Victrex (LON:VCT) - up 15% to 1,009p (£888m) - Final Results - Roland - AMBER/GREEN

Encouraging results showing a return to volume growth for this specialist plastics business. Pricing power remained relatively weak last year but management expects profits to grow ahead of volumes this year, suggesting improving market conditions. It’s too soon to be sure of the turnaround here, but I’m increasingly positive after a harsh multi-year derating.

Marston's (LON:MARS) - up 7% to 43.2p (£273m) - Preliminary Results - Graham - AMBER

Upgrading this one to AMBER after a set of results showing strong profitability. The main news in the outlook statement is that the company has continued to trade with positive like-for-like growth in the first weeks of the new financial year. They expect to deliver £50m of recurring free cash flow annually in the near-to-medium term and I hope to see the leverage multiple continue to fall from 5.2x (they are not currently paying dividends).

Graham's Section

Impax Asset Management (LON:IPX)

328.5p (£442m) - Final Results - Graham - GREEN

Impax Asset Management Group plc ("Impax" or the "Company"), the specialist investor focused on the transition to a more sustainable global economy, today announces final audited results for the year ending 30 September 2024…

Let’s catch up on another stock that slipped through the net last week.

Assets under management

Impax, like almost all fund managers we follow, has fallen into suffering net outflows. That was true in FY 2024 as clients pulled out a net £5.8 billion.

Positive performance helped to offset the effect of those flows, however, and £300m of fixed income AUM was acquired.

The net effect: AUM was little changed by the end of the financial year at £37.2 billion (end of FY 2023: £37.4 billion).

Profitability

Revenues are earned on average AUM, and IPX’s full-year revenues fell by 4.7% to £170m.

There are knock-on effects on profits, but generally profits have held up ok:

Adjusted operating profit down 9% to £53m

PBT down 6% to £49m

Well done to Impax for managing its adjusted operating costs, which fell by £3m to £117m.

The revenue margin on AUM was stable at 45 basis points - stable is good, as the general trend in revenue margin for the industry is downwards.

Full-year dividend: unchanged at 27.6p, with an implied yield of over 8.4% on the current share price:

Impax is paying out 87% of adjusted profit in the form of the dividend, far above its minimum target of 55%. The reason given is that it’s in “robust financial health”.

Balance sheet: robust financial health can be witnessed on the balance sheet where there is tangible equity of £108m including cash reserves of nearly £91m (includes amounts held in money market funds which I agree are equivalent to cash).

The comment by the Chair highlights resilience in a period of uncertainty:

Impax has continued to show its resilience over the Period. The Company has made material strategic progress and delivered improved investment performance while focusing on operational efficiency and the control of costs.

Also, the Outlook statement is interesting after a US election result that did not favour the environmentalist movement.

Despite President-elect Donald Trump's negative stance on climate policies, experience from the first Trump administration suggests that the next four years are likely to be positive for US-based businesses delivering innovative products and services in the above areas [GN note: healthcare, semiconductors, reinsurance, infrastructure] and in which materials and energy efficiency are significant contributors. Against this backdrop, we are highly confident that our investment portfolios can deliver excellent returns for clients.

Graham’s view

I tend to be positive on this share: the last time was at 370p in July, when IPX announced the acquisition of another £1.6 billion in fixed income “assets under management and advice”. It’s yet another US-based acquisition for IPX, and it’s expected to close “around the end of the calendar year”.

It won’t come as a shock to readers that I’m staying positive on this one at a PER of about 11x and even lower than that if you’re willing to adjust the cash out to use an EV-based valuation.

Analyst Paul Bryant at Equity Developments puts it on an FY 2025 PER of 10.9x and cites a number of possible catalysts for inflows to resume at IPX. These include interest rate cuts, growth in US industrials under Trump, a flight back to active management due to concentration risk in the Magnificent 7, and renewed interest in sustainable investing.

For me it’s the last one of these that is the most relevant. IPX has a real niche: its entire mission from day one has been “sustainable” investing, and in my view this makes it one of the most credible names in this field.

Investor interest in this niche will come and go, but that doesn’t mean IPX has to lose any of its long-term competitive advantage.

In terms of valuation, investors currently get £84 of AUM for every £1 they invest in IPX, before the effect of the acquisition which is about to complete.

This compares with only £19 of AUM for every £1 invested at the height of optimism in late 2021:

I believe I was justifiably cautious when these shares were overheated. As they now sit in the doldrums, I think I’m justifiably positive.

System1 (LON:SYS1)

Down 1% to 616.5p (£77m) - Interim Results - Graham - GREEN

It took many years for SYS1, “the marketing decision-making platform”, to reorganise its strategy after an initial run of success that lasted until 2017.

The subsequent run of poor performance has ended at last, and the shares have more than quadrupled since early 2023:

The strategy is now focused on Ad-testing with the flagship “Test Your Ad” product.

In addition to Data products, the company provides “Data-led consultancy” that it also categorises within “Platform revenue”.

Today’s interim results show a 53% increase in SYS1’s “Platform” revenue, while operating costs increased by only 26%. We get a useful PBT result of £2.6m over six months:

The profits have already been earmarked for spending, but I don’t think SYS1’s shareholders will complain:

£2m additional discretionary investment in the next 18 months aimed at building our position in America and revitalising System1's Innovation proposition.

KPIs: System1 is one of the very few companies we cover that uses that “Rule of 40”, a rule that helps investors to determine if software companies are finding an appropriate mix of growth and profitability.

The rule states that revenue growth plus the profit margin should add up to 40.

This implies that investors should be happy with:

40% revenue growth, 0% profit margin.

20% revenue growth, 20% profit margin.

0% revenue growth, 40% profit margin.

Whether investors are in fact happy with each of these outcomes is another matter, but that’s the Rule of 40.

SYS1 says that its Rule of 40 score has improved from 56 to 69, now even higher above the minimum amount:

Another helpful KPI is net revenue retention (NRR), which is revenue (excluding new clients) as a percentage of revenue in the corresponding period last year. It helps to demonstrate customer loyalty, customer satisfaction and the demand for repeat business.

NRR improved to 120% for platform revenue, implying that last year’s clients spent 20% more in H1 this year.

Geographic breakdown: the strategy of US-driven growth is bearing fruit with 79% revenue growth in the US in H1, from £3.6m to £6.4m.

Balance sheet: a nice simple balance sheet with £10.5m of tangible equity including a healthy cash balance of nearly £9m, with no borrowings.

Outlook: in line with full-year expectations for revenue of £36.5m and adj. PBT of £4.4m.

CEO comment:

"The first half has played out in line with our plan with strong platform growth and good progress in the USA, over 160 new client wins and improved net revenue retention with existing clients. System1 has a significant opportunity to increase revenue both in America and within the Innovation market segment and we have already begun a £2m additional discretionary investment programme over the next 18 months to target medium-term revenue growth in these areas".

Later, he says that Q3 has “begun well”, with “potentially some revenue upside compared to current market expectations”.

Estimates: Canaccord have not waited around. They have touched up their FY25 revenue forecast to £37m (from £36.5m). As £18.3m has already been delivered in H1, I think it makes absolute sense to start getting the upgrades in.

For FY26, they increase the revenue forecast by £2m (to £44m) but also reduce the adj. PBT forecast by £0.4m (to £5.6m), due to SYS1’s planned investment spending.

Graham’s view

When it was first explained, I wasn’t a fan of SYS’1 new strategy - and I wasn’t alone. In April 2023, frustration with the lack of progress led to a battle for control of the Boardroom. I thought the strategy relied on success with the biggest advertisers, which wasn’t guaranteed, and preferred the concept of selling more broadly to anyone who wanted to advertise.

However, I cannot complain about the company’s financial progress over the past year and a half.

Valuation has soared and the stock now trades on a current-year PER of 26x, falling to 19x based on FY26 forecasts.

My instincts are to downgrade this to AMBER/GREEN on valuation grounds but it’s important to let winners run and so I’ll leave this on GREEN while it continues to hoover up new clients.

Marston's (LON:MARS)

Up 7% to 43.2p (£273m) - Preliminary Results - Graham - AMBER

Marston's, a leading local pub business with an estate of 1,339 pubs across the UK, today announces its Preliminary Results for the 52 weeks ended 28 September 2024.

I was nervous on this one in October at the time of the full-year trading update. MARS has a freehold property estate but has borrowed heavily against this, leaving it in a complicated financial position.

Today’s full-year results show strong profitability: the PBT result is £42m, up 64% year-on-year.

Pub operating profit is an impressive £147m, but then finance costs of £106.5m eat up most of that.

Finance costs are hopefully on the retreat: net debt (excluding leases) fell by £300m during the year, to £884m, as we discussed in October.

The leverage multiple falls from an entirely unreasonable 8x down to a still uncomfortable 5.2x.

Outlook is positive:

Positive current trading with continued momentum and early progress in embedding strategy across the business

Like-for-like sales in the first six weeks grew by 3.9% marking a strong start to the year and demonstrating continued growth ahead of the market

The recent Budget “puts some additional pressure on costs, but the overall package of measures is considered manageable”.

Balance sheet: the CEO points to balance sheet asset value of £2.1 billion. Net assets have changed little year-on-year: they are now £655m, or 103p per share.

The big difference on the balance sheet is the sale of the company’s interest in its brewing business, Carlsberg Marston’s, to enable a reduction in borrowings.

Going concern: the going concern statement reads quite well this year. The directors have concluded that the company could withstand a reduction in sales of 10% vs. base case scenario. This would only result in a breach of banking covenants in the quarter after the next financial year, and that’s assuming there are no management actions taken to mitigate the impact.

Outlook: LfL sales growth is running at 2.1% in the first eight weeks of the new financial year, with recent weeks affected by snow and storms.

In the near-to-medium term, their targets include revenue growth ahead of the market and £50m recurring free cash flow.

Graham’s view

I’m going to give this an upgrade to AMBER.

I said in October that I wanted to see strong numbers from MARS and signs of solvency.

The much-improved going concern statement today gives me the confidence to switch to a neutral stance as financial distress now seems to be off the table - of course there is never any guarantee, but the company has a fully-tangible, positive NAV of more than double the current share price, and its going concern statement is clean. I believe that if trading were to suddenly collapse, management would probably have actions that they could take to defend the company.

The main indicator that needs to be improved now is the leverage multiple. At 5.2x, this is still too high in my view (I never want to see this over 3x). Remember also that it’s based on EBITDA, i.e. it excludes depreciation which is a significant expense for a capital-intensive business such as pubs (MARS took a £40m depreciation charge during FY 2024).

In summary: MARS has made good progress and deserves an upgrade, in my view. But there is more to do. I’m curious to see how they will manage the recent Budget changes to employment costs. If they succeed in mitigating the impact and paying down debt, there is an opportunity for shareholders to do very well from this level:

Roland's Section

On Beach group (LON:OTB)

Up 13% to 194p (£317m) - Final Results - Roland - GREEN

When I looked at On The Beach’s full-year trading update in September, I took a positive view. This stance seemed to have been justified by a strong set of results today. Management at this online travel agent certainly sound bullish, potentially with good reason:

Another record-breaking year of TTV, with adjusted PBT +25% YOY, addressable market expansion and enhanced customer proposition

OTB’s profits have now surpassed their pre-pandemic highs, but the share price remains subdued, even allowing for the dilution that took place in 2020/21.

Let’s take a look at today’s results.

23/24 results summary: today’s numbers cover the year to 30 September 2024, so include peak summer trading.

Total transaction value (TTV) rose by 15% to £1.2bn last year, while revenue climbed 14% to £128.2m. I would guess some of this is inflationary rather than volume related, but I can’t argue with the 25% increase in adjusted pre-tax profit to £31m.

On a clean, statutory basis the increase is even more impressive – OTB’s pre-tax profit rose by 84% to £26.5m, a new record high for the business.

The company ended the year with cash excluding amounts held in trust of £96.2m (Sept 23: £75.8m). This is presumably a post-summer seasonal high, but is still quite striking for a company with a c.£290m market cap.

Shareholder returns: management clearly feels that at least some of this cash is surplus to requirements.

OTB’s dividend has been reinstated with a full-year payout of 3p per share, in line with the company’s policy of paying out 25% of net earnings.

My sums suggest the dividend will total c.£5m. This amount looks somewhat modest when seen alongside today’s other surprise news – a £25m share buyback.

At the current share price I estimate this could see the company cancel around 12m shares, roughly equivalent to an 8% increase in earnings per share.

That’s only equivalent to a £1m increase in last year’s profit, equating to a 4% return on a buyback spend of £25m. However, if profits continue to perform strongly I guess the effective return achieved from this spending could increase in the future.

Trading commentary: passenger numbers in summer '24 were 13% higher than in summer 23. The company once again flags up the “transformational” nature of its partnership agreement with Ryanair, which allows customers to book Ryanair flights as part of an OTB package.

Upgrades to technology are said to be increasing addressable markets and OTB began expanding into city breaks from the final quarter of FY24, supporting the next stage of revenue growth.

OTB has also launched the first stage of its international expansion in Ireland, with onthebeach.ie.

Winter ‘24 bookings are currently said to be 25% ahead of the same period last year. TTV for the year to date (1 Oct-2 Dec) is said to be up by 14%, with bookings up 15%. This seems to suggest inflation has dropped out of the numbers – or else that customers are booking cheaper packages.

Outlook: management are confident that Summer '25 will be “significantly ahead” of Summer '24.

Profit guidance is unchanged and the company reiterates its support for consensus of £37.9m.

I don’t have access to any broker notes this morning, but this looks broadly consistent with the consensus estimates shown on the StockReport.

Looking further ahead, On The Beach says it is targeting TTV of £2.5bn and adjusted PBT of £85m. Achieving those medium-term targets would comfortably double the size of the business relative to FY25 forecasts.

Roland’s view

Today’s results show an operating margin of 16% and return on capital employed (ROCE) of 11.5%. These figures have been much higher in the past and I would hope there’s scope for further recovery:

One significant cost for the business is marketing spend in what is a competitive sector. However, I’d expect this to become more efficient as the company scales. This seems to be supported by last year’s results – marketing costs rose by 4.4% to £42.4m, supporting a 9.5% increase in gross profit after marketing costs.

On The Beach looks in decent health to me and appears to be enjoying strong trading momentum. Consumer demand appears to remain strong and as the group scales I would expect its brand to become a more effective asset driving customer acquisition, potentially lowering marketing costs per booking.

The shares have responded strongly to today’s news and are up 13% to 194p at the time of writing. Assuming consensus forecasts remain unchanged, that prices OTB on around 13x FY25 forecast earnings.

Given the group’s positive momentum and improving profitability, I think I can maintain my previous GREEN stance at this level.

Greencore (LON:GNC)

Up 9% to 215p (£976m) - Final Results - Roland - AMBER/GREEN

Today’s results from this sandwich maker and convenience food producer looks strong, with the firm flagging up volume growth ahead of the wider market.

Investors have responded positively: Greencore has notched up its guidance for the current year, despite the looming impact of higher national insurance costs in 2025.

...the Group anticipates FY25 Adjusted Operating Profit to be within the top half of the range of current market expectations

Greencore shares have now doubled over the last year. Is there more to come, or is the price now up with events?

When I last looked at Greencore in July, I took an AMBER/GREEN stance at 187p and commented that moves by CEO Dalton Phillips to improve profitability appeared to be delivering results. My view was tempered by caution due to the mix of low margins and a high-teens P/E rating.

I reckon today’s results support this view, even if I was arguably a little too cautious.

Revenue fell by 5.6% to £1,807m last year as Greencore exited some low margin contracts and made a disposal. These changes helped to support a 3.5% increase in gross margin to 33.2%, supported by price growth of 1.8% and volume growth of 1.6%.That seems a decent result to me.

Improved profitability has been helped by efficiency measures and new contract wins. For example, the company’s soup factories have been consolidated to a single facility, while growth in ready meals is highlighted by contract renewals and a “large ready meal contract successfully onboarded” in late Q4.

As a result, Greencore’s operating profit rose by 27.7% to £84.3m, giving an improved operating margin of 4.7% (FY23: 3.4%).

Looking at the income statement, costs also seem to have been well controlled. Total operating costs rose by 2.6% (£13m) to £511.1m, which seems good to me given the six-month impact of last year’s minimum wage increase – Greencore is a fairly labour-intensive business.

This result supports a 12.1% ROCE (FY23: 11.8%). While not high, I would say this is probably a decent result for this business.

Next year’s increase in National Insurance is expected to add a further £7.5m to Greencore’s costs. However, the company expects to offset these through a variety of measures, including “contractual protections” and “further efficiency initiatives”.

Cash flow & balance sheet: I welcome management’s use of free cash flow in the results, although my calculation of £64.5m is slightly lower than the company’s figure of £70m. Even so, £64.5m (before buybacks) represents a very healthy 139% conversion from net profit of £46.3m.

Net debt excluding lease liabilities fell by £5.9m to £148m. This represents 3x net profit, or 1x trailing EBITDA. That looks comfortable to me, if not as low as I might prefer, for a low-margin business like this.

It’s worth noting Greencore spent £20.9m on interest payments last year, nearly a quarter of operating profit.

There was also some additional good news on cash flow. Greencore expects its pension scheme to be fully funded at the end of September 2025, at which point it will be able to cease making £10m annual deficit reduction payments.

Dividend & shares buybacks: management do not appear to feel any urgency to reduce debt. Last year saw a £50m buyback.

Today the company has reinstated the dividend at 2p per share and announced a further £10m buyback.

Outlook: Greencore says that its “leaner, more agile and efficient operating platform” is helping to drive new product innovations and has enhanced profitability.

Despite the significant cost headwind imposed by October’s Budget, management now expects FY25 adjusted operating profit to be “within the top half of the current range of market expectations”. This is available on Greencore’s website and suggests a range of £98.1m to £107.1m.

With thanks to house broker Shore Capital, we can see that this is expected to translate into a 4% eps upgrade, suggesting FY25 earnings of 13.9p per share.

Roland’s view

I don’t see much in today’s results to change my view from July. Greencore is an established market leader in the UK convenience food market and appears to be trading well. Last year’s operating profit of £84m appears to represent a new 10-year high for the business, according to Stockopedia data:

At the same time, Greencore is fundamentally a low margin business, with a moderate amount of debt and a history of cyclicality:

The shares did not look obviously good value to me, even prior to today’s gains:

On balance, I’m going to maintain my AMBER/GREEN view here. I think there could be more to come in the short term, but I don’t view this as a quality compounder to continue holding indefinitely.

Victrex (LON:VCT)

Up 15% to 1,009p (£888m) - Final Results - Roland - AMBER/GREEN

Shares in this FTSE 250 chemicals group have seen a remarkable 15% bounce today. I believe the positive reaction to today’s results is driven by this bit of news (my bold):

Full year volume growth of 4% reflects a good finish to FY 2024, with our first 1,000 tonne quarter since Q4 FY 2022

The average selling price for Victrex’s proprietary PEEK polymer (a specialist plastic used in aerospace and other sectors) still fell by 9% to £78/kg last year.

But a return to volume growth might finally signify the end of a cycle of downgrades that has left Victrex’s share price more than 60% below its 10-year high…

… and had a similar impact on profits:

2023/24 results summary: today’s numbers do not yet show a recovery in profit to match volume increases.

While sales volumes climbed 4% to 3,731 tonnes, revenue fell by 5% to £291m due to the fall in the average selling price.

Trading performance was mixed across the group’s sectors:

Transport (aero & automotive) up 8%

Value-added resellers up 14%

Electronics down 12%

Energy and industrial down 5%

Medical down 19% to £53m due to destocking

Underlying pre-tax profit dropped 26% to £59.1m, while underlying earnings fell by 33% to 51.7p per share.

The dividend was held unchanged at 59.6p per share, leaving it uncovered by earnings. This isn’t ideal, but cover is expected to be restored in FY25 and Victrex’s minimal net debt of £21m suggests the company can just afford to maintain the payout.

One reason for the company’s profit slump may be that last year’s average selling price (ASP) of £78/kg was exactly the same as that achieved in the FY19 financial year. In contrast, the group’s FY24 cost of sales of £161.9m were 45% higher than the £112m reported for FY19.

I think investors need to consider whether Victrex’s competitive edge remains strong enough to support the pricing power it enjoyed in the past. The company says its mega programmes – R&D efforts to sell more manufactured parts and less raw PEEK – are making progress, but I’m not sure how much they contribute to the bottom line yet.

Outlook: Victrex admits that the timing of a recovery in its key medical market will be an important factor in any profit recovery.

“The Group has seen a solid start to FY 2025 - ahead of the prior year - despite mixed trading conditions. Our expectations for profit growth are based on robust demand continuing across the end markets of Sustainable Solutions, together with Medical improvement as we progress through 2025”

However, the company thinks it may be able to achieve run-rate volumes of around 1,000 tonnes per quarter over the full year, supporting “mid-single digit volume growth”, with underlying PBT growth ahead of volume growth.

I don’t have access to any updated broker notes, but consensus estimates on Stockopedia for FY25 earnings of 72p per share already appear to price in a positive outcome of this kind.

We’ll have to see if consensus estimates are updated after today’s results. But for now, these numbers price the stock on a FY25e P/E of 14 with a dividend yield of 5.7% after today’s gains.

Roland’s view

Today’s results from Victrex definitely seem a step in the right direction. However, I don’t think Victrex’s turnaround is a done deal quite yet.

Last year’s operating margin of 15.7% and ROCE of 8% are a far cry from the figures of 36% and 21.5% respectively reported in the 2019 financial year. While the company clearly still has some pricing power, this appears to be weaker than it used tobe.

Some of this may simply be due to cyclical factors. The last couple of years have also been dire for many other companies in the chemicals sector, with slumps in demand and some brutal destocking.

On the other hand, I think Victrex is facing increased competition from other PEEK manufacturers, hence its R&D investment in the mega programmes. This attempt at moving up the value chain will be key to a return to long-term, high-margin growth, in my view.

I’ve followed Victrex with interest for a while as a potential investment, but I’ve been wary about buying in too soon. The company’s return to volume growth suggests to me that this could be a good time to take a fresh look – I think this business certainly justifies more through research after today’s results.

I’m going to open our coverage of this interesting business by taking an AMBER/GREEN stance, to reflect the potential I believe exists here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.