Good morning!

To kick off the discussion this morning, I thought I'd mention the proposed IPO of Shein in London.

Over the last few days, reports in mainstream media have suggested that the FCA might allow this IPO to go ahead, despite human rights concerns. Shein is said to have filed initial paperwork back in June.

From MorningStar:

Financial Conduct Authority Chief Executive Nikhil Rathi told the FT that it was “not unusual” for UK-listed companies to carry legal risks globally. However, a priority is ensuring risks are disclosed, so investors can make informed decisions.

“What parliament has not asked us to do is to be a broad regulator around every aspect of corporate behaviour,” Rathi said, but declined to comment on Shein specifically.

In a market that has been starved of IPOs for some time, a £50 billion IPO would be of great benefit to many in the City.

And from an investor point of view, it would be fascinating to see the successor to Boohoo (LON:BOO) and Asos (LON:ASC) exposed to the limelight. Readers will remember that Boohoo has in the past faced accusations over working conditions.

How would you feel about investing in Shein?

1pm: we're all done for today, cheers!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

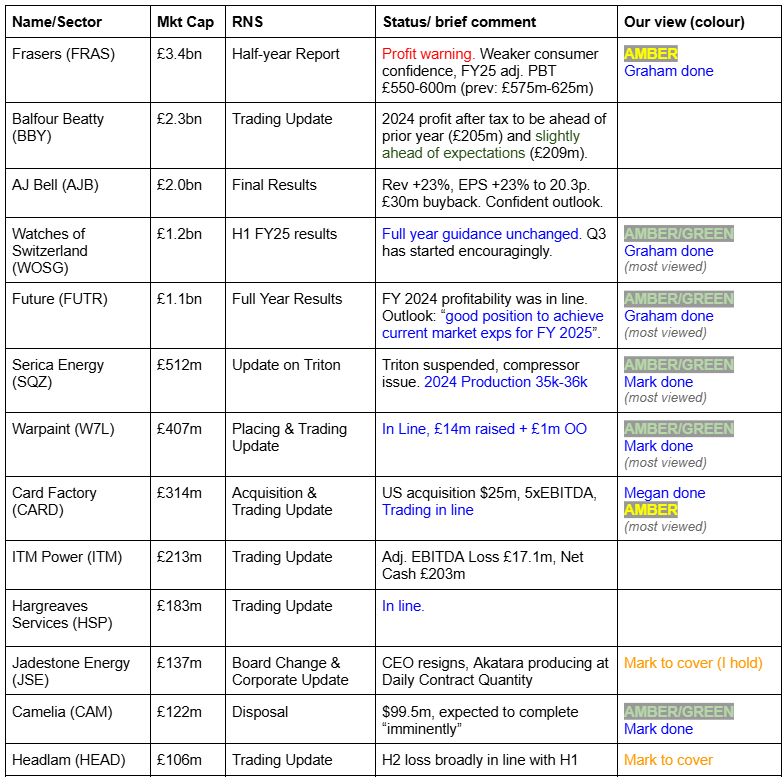

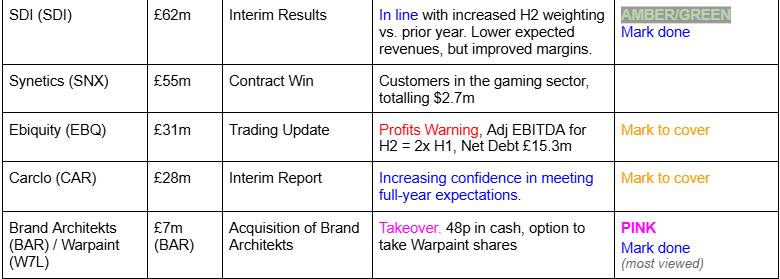

Companies Reporting

Summaries

Frasers (LON:FRAS) - down 12% to 649p (£2.9 billion) - Half-year Report - Graham - AMBER

It’s a slight profit warning from Frasers due to weak consumer confidence before and after the recent Budget announcement. H1 revenues are down 8% which includes the effect of planned decline at low margin businesses. Profits have been protected thanks to automation and synergies.

Watches of Switzerland (LON:WOSG) - up 11% to 553.5p (£1.2 billion) - H1 FY25 Results - Graham - AMBER/GREEN

Full year guidance is unchanged and the market breathes another sigh of relief. Organic revenue is still on the retreat but WOSG has shored up its numbers with acquisitions and has a growing exposure to the US consumer (45% of H1 revenues). I’m happy to maintain a mildly positive stance on this one, seeing it as an interesting recovery and growth story, not a sleep-sound type of stock.

Brand Architekts (LON:BAR) - up 88% to 45p - Takeover - Mark - PINK

100% premium. While this is only just above tangible book value, this looks a good deal for both shareholders here, given the ongoing losses, and the acquirer Warpaint.

Warpaint London (LON:W7L) - Up 3% to 540p - Placing and Trading Update - Mark - AMBER/GREEN

As part of the acquisition documents, Warpaint provides a trading update which re-iterates the in line statement from September. Some investors will be reassured by this, but many will be expecting (and the market rating implies) that the company will beat, not just hit forecasts.

The placing of £15m at 510p to fund a £13.9m acquisition of a company with £7m net cash, raises questions as to whether the management of this £400m market cap business are just being extremely cautious or whether their willingness to pay fees to issue shares at this price reflects their unstated opinion on the current valuation.

Serica Energy (LON:SQZ) - Down 3% to 128p - Update on Triton FPSO - Mark (I hold) - AMBER/GREEN

Further production problems at the non-operated Triton field hub hit production estimates for FY2024. However, plans remain in place to improve the robustness of this platform in 25Q1, and in the medium term, this doesn’t impact the very cash-generating nature of this business nor the 18% forecast dividend yield.

SDI (LON:SDI) - Up 5% to 62p - Interim Results - Mark - AMBER/GREEN

The results themselves are weak, and leave a lot to do in H2. However, the detailed narrative reveals a positive outlook. New management appears to be following the right strategy of driving organic growth and improving synergies and best-practice sharing between the subsidiaries. With this strategy in place, this is a decent business; it just isn’t particularly cheap based on current forecasts.

Future (LON:FUTR) - up 12% to £11 (£1.2bn) - Full Year Results - Graham - AMBER/GREEN

This media group says it’s in a good position to achieve current market expectations for the new financial year. The results for 2024 show very modest organic growth which is at least an improvement on 2023. I’m downgrading this to AMBER/GREEN as the only part of the business I have investment conviction in is Go.Compare, and the shares have enjoyed a very strong run higher over the past year.

Camellia (LON:CAM) - up 15% to 5082p - Disposal - Mark (I hold) - AMBER/GREEN

A bonkers corporate structure is slowly being rationalised, with the $100m sale of an insurance subsidiary comparing favourably to the £141m market cap, even after a share price rise today. Some doubts remain as to how much of the cash will be returned via buybacks, but given the ongoing discount to tangible book value, any buybacks would likely add shareholder value.

Short Sections

Card Factory (LON:CARD)

Up 7% to 96p (£314m) - Trading update and acquisition announcement - Megan - AMBER

In September, Card Factory (LON:CARD) shares sold off hard after H1 results were hit by higher wage costs. At the time, the company said it was still on track to meet full year expectations and analysts only trimmed their forecasts by a small amount.

The sell off, which took the share price down to a low of 80p and trading on a forecast PER of 5.5x at the start of November, perhaps seemed a little overdone.

This morning the company has once again reiterated its full year guidance, although management does concede that the peak Christmas trading period is still to come. Investors only sent the shares up 7% in early trading following the announcement - suggesting that the market is waiting for more clarity on Christmas sales (a trading announcement is due on 14 January) before they leap back in.

This morning’s trading announcement also contains details of its acquisition of a gifting wholesaler based in Minnesota. This marks the company’s first entry into physical retail space in the US, a market which management say is worth £70bn.

Card Factory has been pursuing an international growth strategy based on locating partners for domestic sales. Today’s acquisition is a bit of a departure from this partnership strategy, but it reiterates the company’s commitment to international expansion.

Megan’s view

Card Factory shares look cheap. The EV to EBITDA ratio is just 4.2x, which is less than the acquisition multiple of the US company it has just bought. Trading on 5x EV/EBITDA would give a share price of more than 120p - over 25% up on the price today.

This is certainly a tempting price for value investors, but I share the market’s hesitancy. If the company misses earnings expectations (currently 14.4p) investors might have longer to wait for the recovery.

And that 14.4p forecast looks a little ambitious given first half adjusted EPS of just 3.1p. Last year Card Factory made 8.5p per share in the second half. To hit this year’s expectations the company is going to need a 32% increase in earnings in the second half.

At this price, I am perhaps being overly cautious and maybe a value investor might be more tempted. But I would rather wait for clarity on 14 January. AMBER

Serica Energy (LON:SQZ)

Down 3% to 128p - Update on Triton FPSO - Mark (I hold) - AMBER/GREEN

Serica have had a number of operational issues recently on their Triton hub. In May they had an unplanned shutdown due to a compressor failure. Then, the planned shutdown in July lasted three weeks longer than expected. At the end of October there was a further shutdown due to a seal failure. Production was anticipated to start again at the start of December. Today we find out that:

…after a limited resumption of production at the Triton FPSO last week, an issue with one of the compressor seals has been discovered which has resulted in production being suspended.

This has had quite a big effect on production:

H1 actual - 43,700 boepd

2nd Oct FY guidance - towards the bottom of the 41,000 to 46,000 boepd range

29th Oct FY guidance - expected to be slightly below this previous guidance (41,000 boepd)

Today's FY guidance - 35,000-36,0000

The reason is that the Bruce hub and other assets only produce around 28,000 boepd, around half of their anticipated production. However, the company highlight that they have plans in place to improve the resilience of their operations:

As previously stated, the operational vulnerability will remain until the ongoing works to restore two-compressor operations are completed, expected in Q1 2025.

There is also some good news on gas prices:

October price per therm - 97.9p

Current price per therm - 115-120p/therm

Given the majority of their current production is gas and that costs are largely fixed, a 20% rise in short-term gas prices will help offset the impact of the missed production.

Mark’s View

While it is disappointing to have further production issues in 2024, these don’t impact the reserves of the company, or its medium-term production. Serica is not the operator of the assets that have had issues, so I don’t think we can fully blame them for the miss. In the last results presentation, the company highlighted their ability to generate the current market cap in cash over the next four years or so. I see nothing in today’s announcement that changes that. The budget was negative for the company but not as bad as it could have been. So it is a AMBER/GREEN for me, and I remain happy to hold for the 18% dividend yield.

Graham's Section

Frasers (LON:FRAS)

Down 12% to 649p (£2.9 billion) - Half-year Report - Graham - AMBER

This serial acquirer of retail shares has published its own interim results this morning.

However, this does include a mild profit warning:

We are set to deliver another year of profitable growth but, given recent weaker consumer confidence leading up to and following the Budget, FY25 APBT is now expected to be in the range of £550m to £600m."

Guidance given at the full-year results was for APBT of £575-625m. So from midpoint to midpoint, this is a 4% cut in the estimate.

As for H1 itself, here are the key facts:

Revenue down 8.3% (to £2.5 billion)

“Group profit from trading” - similar to adj. EBITDA - down 2.9% (to £400.6m)

The unadjusted profit figures are badly impacted by foreign exchange (there is a headwind in H1 this year, vs. a tailwind in H1 last year). So unadjusted H1 operating profit is down 10.5% year-on-year. I’m happy to look past this, as it’s something entirely beyond the company’s control.

Tight cost control has saved the result, with an overall 11% reduction in retail operating costs worth £85m. There has been a planned decline at video game retailer GAME and at Studio Retail (we previously knew this as Findel).

In addition, the company talks about “right-sizing” the brands acquired from JD Sports and points to warehouse automation/rationalisation and synergies from acquisitions.

In the luxury segment, I note with interest the following:

Our long-term ambitions for the luxury business remain unchanged, although it is likely that progress will remain subdued for the short to medium term in the face of a challenging market. However, we continue to view this as an opportunity for consolidation in order to further strengthen our position.

The company remains very much in expansion mode. On top of the stories we’ve spoken about in this report (battles with Boohoo and Mulberry, for example) there are various international adventures for Frasers including:

i. Completed the acquisition of Twinsport in the Netherlands.

ii. Invested in Australia/New Zealand group Accent.

iii. Invested in Maltese/North Africa retailer/Nike distributor Hudson.

iv. After period end, announced the acquisition of Holdsport in South Africa/Namibia.

There is a helpful (but incomplete) list of strategic investments:

With the following note on strategy:

Our strategic investments are intended to allow us to develop relationships and commercial partnerships with the relevant retailers and brands. The Group is actively seeking a board seat at Hugo Boss and has recently had a representative appointed to the board of Accent Group.

Net debt has increased to £831m, or to £725m if you’re willing to exclude loans securitised on assets. The balance sheet has net assets of £2.1 billion.

Relationship with Mike Ashley (73% shareholder):

Mike stepped down as CEO in 2022. He also stepped down from the Board of Directors later in 2022 and has no day-to-day involvement or responsibility for the strategic direction of the Group or any Board matters.

However, given his extensive involvement in leading the business for over forty years, the Board has an agreement with Mr Ashley, through his own company MASH Holdings Limited, which provides for management to seek his expertise in discrete areas where he has specific knowledge, for example in warehousing, logistics or strategic relationships with the supply chain. He does not receive any remuneration for providing this advice to management and has no decision-making powers.

I checked the 2024 Annual Report and can find no mention anywhere that the very young CEO of Frasers, Michael Murray, is Mike Ashley’s son-in-law.

According to the Daily Mail in 2022:

Mr Murray is said to be extremely close to his mentor, with one source previously describing how the pair would 'thrash out business deals over drinks or dinner or on family holidays away from the wider management team'.

Graham’s view

I tend to spend more time looking at the deals done by Frasers than I do looking at Frasers itself.

When it comes to Frasers itself, I must say that I find the CEO appointment off-putting. I’d much prefer if Mike Ashley was Chairman, rather than having a member of his extended family as CEO and telling us that he has no decision-making powers.

The expansion and acquisition strategy has been working well for Frasers. As readers may know, I’m a shareholder in Next and personally I like what Next does: buying up brands out of administration and plugging them into the Next machine.

Frasers takes a more aggressive approach: buying shares on the stock market and then sometimes haranguing the Directors of the companies it owns shares in.

I admit that the Frasers valuation does looks tempting, especially considering the discount to net assets.

It might be a little harsh, but personally I can’t give FRAS anything better than a neutral stance. I don’t like the governance situation, and I prefer an M&A strategy that is seen as friendly and helpful by the companies it targets (in the Warren Buffett tradition), as I think this tends to work out better for everyone in the long-term.

For these reasons, I wouldn’t want to pay a high multiple for FRAS shares. But I acknowledge that FRAS may already be too “cheap” at only six times adjusted PBT, and that my concerns might be unfounded and cause me to miss out on an undervalued stock. I’ll have to think about what conditions would allow me to take a more positive view - perhaps a meaningful reduction of the outstanding debt.

Watches of Switzerland (LON:WOSG)

Up 11% to 553.5p (£1.2 billion) - H1 FY25 Results - Graham - AMBER/GREEN

Full-year guidance is unchanged at Watches of Switzerland and the market is enthused.

It has been a rough year, so I guess that stability of expectations is seen as welcome news:

I covered the in-line trading update in September. Today now have interim results to October.

Revenue from watches is down 2% at constant currencies, despite acquiring 19 Ernest Jones stores a year ago. Revenue from jewellery (excluding the impact of the newly-acquired Roberto Coin Inc.) is down 5% at constant currencies.

I think these should be the headlines, but the company instead leads with the headline of 4% total revenue growth.

PBT is down 39% to £41m, not helped by “exceptional” costs of £16.5m (H1 last year: only £4m of exceptional costs). The main exceptional cost is a £13m impairment caused by “the current macroeconomic environment, high interest rates and inflationary landscape”. The value of PPE and leases have been written down.

Net debt has jumped to £120m following the acquisition of Roberto Coin Inc.

Inventory is up by £77m due to the acquisition of RCI and Ernest Jones stores, and now stands at a remarkable £477m. They say they are well-stocked for the holiday season - I should hope so! For context, the full-year revenue estimate on the StockReport is £1.7 billion.

ROCE according to the company has fallen from nearly 24% to 16.5%.

Guidance: revenue of c. £1.7 billion, with an adj. EBIT margin +0.2 to +0.6 percentage points expansion from FY24.

The adj. EBIT margin in FY24 was 8.8%. At 9.2% (+0.4% expansion), adj. EBIT would be c. £156m.

Graham’s view

I’ve been tentatively positive on this since May, when the share price was 328p. With the shares up by nearly 70% since then, it would be quite reasonable of me to switch back to a neutral stance.

However, I like to let the winners run and so I’ll let this run a little longer before switching back to neutral. The P/E ratio is still at a reasonable level and the festive period is about to begin. The company has significant exposure to the US economy (£355m of revenue in H1), and the market in luxury watches should soon start to rebuild from a new base, after the bursting of its post-Covid bubble.

In short, I think there is still enough potential excitement here to keep my mildly positive stance.

Please note that there are no dividends on offer from WOSG and they seem unlikely for the foreseeable future. Showroom investments and strategic acquisitions come first.

Future (LON:FUTR)

Up 12% to £11 (£1.2bn) - Full Year Results - Graham - AMBER/GREEN

Revenue is up 1% organically at Future, an improvement on last year when it was down 10%!

The same can’t be said for adj. operating profit, which has fallen at a faster rate (11%) than it did last year (9%), using constant currency rates, and comes in at £222m (in line with expectations).

Leverage has reduced to 1.1x (from 1.3x), with net debt falling to £256m despite £65m of buybacks plus a token dividend. This debt level should be manageable.

Management: the CEO is leaving next year and the company is searching for a replacement. A new CFO joined in September.

Outlook:

Our return to revenue growth in H2, driven by the execution of GAS [growth acceleration strategy], puts the Group in a good position to achieve current market expectations for FY 2025. We expect to continue to operate at an adjusted operating profit margin of 28% for the coming year reflecting the planned incremental GAS costs, and to maintain strong cash conversion.

Beyond FY 2025, we now expect to deliver accelerating organic revenue growth, in line with current market expectations.

Graham’s view

As I’ve said before, my favourite part of FUTR is the price comparison business Go.Compare, which generates more than a quarter of its revenues. This is the only part of FUTR where I am fully convinced that it’s a high-quality investment.

In total, the group has about 200 media brands including some well-recognised titles.

An important adjustment to the earnings numbers is the amortisation of intangibles. I’m happy with the principle of allowing this adjustment if we are happy to assume that intangibles on the balance sheet are all worthless: that assumption leads to a net asset value for FUTR of minus £450m. So there is zero balance sheet support and really the company is in the hole for a few hundred million pounds.

I’m going to downgrade this to AMBER/GREEN, even though it might still offer good value at this level. It has had a very good run.

Mark's Section

Brand Architekts (LON:BAR)

Up 88% to 45p - Takeover - Mark - PINK

This is below the normal market cap size for the DSMR, but given that the acquirer is the well-known Warpaint, it is worth covering. Warpaint are offering 48p in cash for the company, and it represents a significant premium to last night's close:

· 100 per cent. to the Closing Price of 24 pence per Brand Architekts Share on 4 December 2024 (being the last Business Day before the date of this announcement);

· 85.42 per cent. to the average price of 25.89 pence per Brand Architekts Share for the 3-month period ended 4 December 2024 (being the last Business Day before the date of this announcement); and

· 95.78 per cent. to the average price of 24.52 pence per Brand Architekts Share for the 12-month period ended 4 December 2024 (being the last Business Day before the date of this announcement).

There is also the option for shareholders to take Warpaint shares equal to the same 48p value.

Brand Architekts has been one of the few net nets on the UK market recently. (Net nets are companies trading at a discount to their liquid assets, netting off all liabilities.) The company sold off their manufacturing operations for a large cash sum to focus on the brand side of their business. However, they were continuously loss-making:

And the cash pile was dwindling:

This, plus extreme illiquidity, put off many value investors, such as myself. The market didn’t get wind of any offer, and whoever the keen seller at the end of November will no doubt be kicking themselves:

The reality is that Warpaint appear to have got a good deal here. They are paying only a small premium to tangible book value, which is mainly cash and inventory. These are the figures from last night’s close:

They are getting the brands, which are not the most high-quality but probably worth something, for free. They will be able to rationalise costs, and without the overhead of the additional listing this will no doubt make them money. Long-term, Brand Architekts shareholders may not be happy to sell out given how far the shares have fallen over the years:

But objectively, the future is much brighter under Warpaint’s stewardship. This looks like a win-win for all.

The offer will be implemented via a scheme of arrangement. Warpaint has received around 31% irrevocable undertakings, including the largest shareholder, Peter Gyllenhammar. While this isn’t a slam dunk, given the premium, I can’t see a higher offer coming from elsewhere. Brand Architekts also has a pension deficit, which may put off smaller potential acquirers. Given his value-bent, it is perhaps unsurprising that Gyllenhammar has opted for the cash option, not shares.

Warpaint London (LON:W7L)

Up 3% to 540p - Placing and Trading Update - Mark - AMBER/GREEN

As part of the Brand Achitekts takeover, Warpaint has announced a £15m capital raise, consisting of a placing:

It is expected that the Fundraising will result in the Company raising total gross proceeds (before fees and expenses) of up to £15 million. Warpaint proposes to use the net proceeds of the Placing to repay the bridging loans which have been used to fund the maximum cash consideration payable by the Company pursuant to the Acquisition.

The dilution is small:

The Placing Shares will represent approximately 3.53 per cent. of the existing issued ordinary share capital of the Company

And given this, the discount is minor:

…the Issue Price represents a discount of approximately 2.67 per cent. to the closing mid-market price of 524 pence per Existing Ordinary Share on 4 December 2024

It is worth noting that companies often pay 5-10% fees on placings such as this, so there is a genuine cost to shareholders, even if the discount is small.

It does raise questions as to why they needed a placing at all. They are paying £13.9m for Brand Architeckts, but will be getting £7m of cash which is on their balance sheet, minus any losses since 30th June. Some Brand Architekts shareholders will probably opt for Warpaint equity, and the company had £5.5m in cash at the last balance sheet date and no bank debt. This may reflect a high level of caution by management and the fact that this takeover comes at the point of peak working capital for the business. However, surely no bank would worry about lending a £400m market cap company £5-10m for an acquisition. The alternative view is that management view their equity as fully priced at current levels.

As part of the announcement, the company has provided a trading statement. However, this is just a re-iteration of what they said on September 17th, when the crux of the matter was:

…the board expects the results for the year ended 31 December 2024 to be in line with its expectations.

This will be reassuring to many investors as we head into the Christmas trading period. However, many expect this company to not just meet but beat expectations and will be looking for upgrades in the FY trading update.

Mark’s View

When Paul looked at this in September, he highlighted that the forecasts looked too low, and that upgrades would make the valuation look much more reasonable. However, with only in-line trading confirmed today and perhaps a few signs that management aren’t shy about issuing equity at the 510p level, this is an AMBER/GREEN for me. However, if that upgrade does arrive, this may well be back to GREEN.

SDI (LON:SDI)

Up 5% to 62p - Interim Results - Mark - AMBER/GREEN

It is a weak half for this roll-up of scientific instruments businesses:

Revenues of £30.9m (H1 FY24: £32.2m) reflecting reduced activity in the life sciences and biomedical markets

Gross margins (on materials only) improved to 65.4% (H1 FY24: 63.0%)

Adjusted operating profit* of £3.9m ( H1 FY24 : £4.4m) and reported operating profit of £2.4m ( H1 FY24 : £3.4m)

Adjusted profit before tax* of £3.2m ( H1 FY24: £3.7m) and reported profit before tax of £1.7m ( H1 FY24: £2.7m)

However, these results are not terrible. An increase in an already strong gross margin means that adjusted operating profit is only down 11%. There is a big gap to statutory profits, though, and in such cases, it is worth looking into the details. This is what they say they exclude:

…share based payments, acquisition costs, reorganisation costs, divestment of subsidiary undertaking (in FY24) and amortisation of acquired intangible assets.

And here is the breakdown:

I think excluding share-based payments is fair as long as investors use the fully diluted share count. Amortisation of acquired intangibles is normal these days. However, I am less convinced about acquisition costs and reorganisation costs. These are real cash costs and not one-off for this company. Indeed, they say:

…we continue to drive our active M&A pipeline to expand our portfolio across key markets.

It seems to me that many companies want to have their cake and eat it. They want investors to price the growth that comes from acquisitions but not the cost of doing so. They want investors to report a profit improvement from headcount reductions but exclude the costs of making employees redundant. Acquisitive companies are always going to have reorganisation costs, as the rationale for making acquisitions is that they have synergies to unlock.

Adding back these costs, we would have an operating profit of £3.38m in H1 versus £4.37m for H1 last year, meaning operating profit would be down a more substantial 23%.

It is not all about the past, and H2 is looking better:

Increased activity towards the end of the half, following the previously reported slower start to the financial year. Positive momentum continuing into H2 FY25

…Order intake significantly up on a like for like basis compared to the second half of FY24

This still leaves a lot to do in H2 to go from adjusted diluted EPS of 2.37p in H1 to the 6.2p their broker, Cavendish, is forecasting. There seems to be some confidence that they will do it, though, with Cavendish saying:

We make no changes to FY25 profit forecasts. We introduce FY26 forecasts with revenue growth of 9.2%, with improving organic growth of 6.5% and the drive to improve internal efficiencies continuing. This drives adj PBT growth of 12% to £9.4m resulting in EPS of 6.8p, up 9%. We forecast stronger cash generation reducing net bank debt to £6.1m, offering greater scope to make accretive acquisitions.

Personally, I like this strategy change:

From an organic growth perspective, we have made progress in actively fostering synergies between portfolio companies operating in overlapping markets and/or offering similar products. The senior management at Safelab Systems ('Safelab') and Monmouth Scientific ('Monmouth') have been combined, and the two individual businesses are now working closely together. Furthermore, businesses within the laboratory equipment segment are increasingly engaging in white-label partnerships to secure larger contracts.

The previous SDI management appeared to follow the Judges Scientific strategy of leaving acquisitions alone. However, they appear to have lacked Judges' skill in finding suitable quality acquisitions at bargain prices. A COVID boom in the demand for certain imaging products hid the issues for a number of years, before the current situation came to light. That new management are now pushing the synergies and best practices that should be present between similar businesses seems to me to be exactly the kind of thing the board of this sort of business should be doing.

In terms of valuation, Cavendish forecasts are for an adjusted EPS of 6.8p in FY26, which means they are on a P/E of around 10 for this year, falling to 9 the year after. That’s a PEG of around 1, suggesting that the shares are fully valued at the moment. However, if management initiatives start to bear fruit, this could easily see broker upgrades make it look better value.

Mark’s view

I was a fan of SDI in the early days. However, more recently, I’ve been critical of the company. They appeared to be making acquisitions of poorer-quality businesses at higher multiples yet doing little to improve their prospects. A new management team appears to have grasped the nettle and are making the necessary changes to drive organic growth as well as cut costs and drive synergies between businesses. There is little sign of these changes in these H1 numbers, and their adjustments look a little aggressive to me. However, it takes time for strategy to be reflected in results. Roland rated this AMBER following the last trading update, and not a lot has changed numbers-wise since then. However, I feel this was a little harsh. Under new management, this is a decent business; it just isn’t particularly cheap based on current forecasts. Hence, an AMBER/GREEN rating seems best.

Camellia (LON:CAM)

Up 15% to 5082p - Disposal - Mark (I hold) - AMBER/GREEN

This is a short statement, but one with a lot of history behind it:

…is pleased to announce that the regulatory and tax approvals required in connection with the proposed sale of its shares in BF&M Limited …have been received, and the sale is anticipated to be completed imminently.

This sale was previously known about, but the regulatory approvals were making it a long process. When you include the context, an even longer process!

Camelia has been a value trap for many years. It is a strange conglomerate of agricultural, insurance and banking assets, plus listed and unlisted investments across the globe. The sort of business that could only exist after many decades of empire-building. It almost always traded at a discount to tangible book value, but it is liquid and a family trust owns 50%, making any attempt by external shareholders to shake things up futile.

In this case, either the family trust or management decided enough was enough and have been slowly rationalising the business. They have been selling off non-core holdings and closing down loss-making subsidiaries such as their UK apple farms.

Last month, they sold their “Bangledesh associate companies” for £7.9m having to take a haircut to the £9.5m book value. However, the sale of their stake in an insurance business has been much more lucrative:

At Completion, the Company expects to receive the full gross consideration of $100 million in cash. Net proceeds are expected to be c.$99.5 million (c.£78.7 million) and the transaction will crystalise a net profit of c.£10.7 million including accumulated exchange gains and losses.

£78.7m is clearly material to a business with £123m market cap at last night’s close. The shares are up 15%, adding about £18m to the market cap. A £141m market cap remains a material discount to TBV of £328m minus any losses since last balance sheet date, adjusting for recent losses and gains on disposal.

Originally, the company had to take a loan note for half of the $100m proceeds from BF&M but with today’s announcement, it seems it will all be paid in cash. This means the company will have over £100m in cash,

They say:

The Company will update shareholders on the use of funds upon receipt of the net proceeds from the sale.

So that is quite vague. Previously they said:

…the receipt of the funds realised by this sale, together with funds raised from the disposal of other non-core assets, will enable the Company to accelerate its development programme and continue to diversify its agricultural production by crop and geographic location. The Board considers Camellia's shares to be significantly undervalued and, in the event of any surplus funds arising, will also therefore consider the merit of returning these to shareholders by means of a share buy-back.

So not all that cash will be returned, but it seems likely that some kind of buyback will be implemented. Investing further in agricultural production is a risk. After all the current business goes through wild swings in profitability based on crop pricing and yield. Balancing this is the possibility of further asset divestments. A £30m stately home is being actively marketed, and their “heritage assets”, old manuscripts etc. are also for sale. These may provide further cash for buybacks, but also highlight how bonkers this company structure still is!

Mark’s View

Having been an obvious value trap for many years, today’s announcement highlights that things here appear to have changed. Management are committed to simplifying and rationalising the business. The assets they are divesting are real, and have a value that still appears to be significantly in excess of the current market cap. It is not without risks, though. A currently loss-making agricultural business and a lack of clarity on buybacks remain. The bonkers factor remains high, but the discount to TBV is enough for me to hold, and consider this AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.