Good morning!

1pm: we're all done! Have a great weekend.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

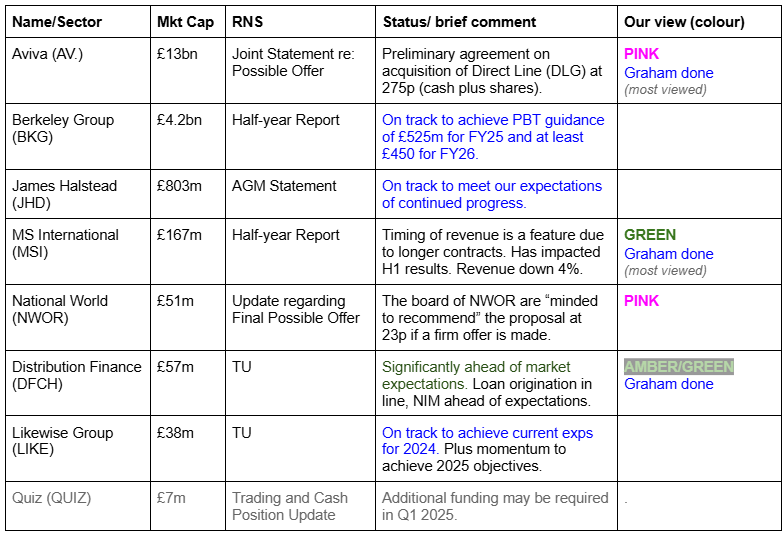

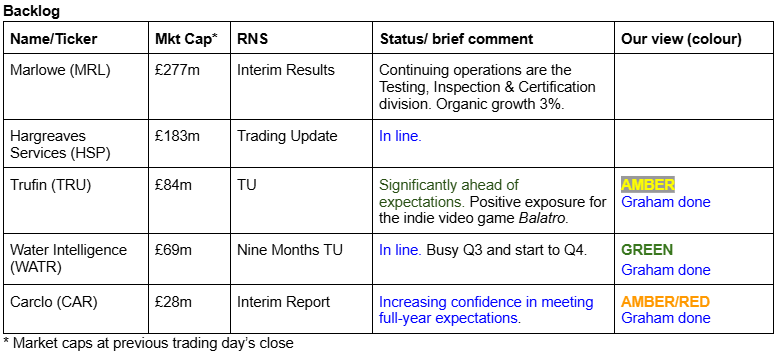

Companies Reporting

Summaries

MS International (LON:MSI) - down 5% to 975p (£157m) - Half-year Report - Graham - GREEN

These results don’t yet show the progress that I believe is widely expected by shareholders (though I acknowledge that there are no official forecasts). The Chairman points out that accounting rules prevent the recognition of revenue until delivery, and this will be an important feature of MSI’s long-term contracts. My own view is that these results are perfectly fine and that the £20m+ increase in inventories signals future success.

Short Sections

Jadestone Energy (LON:JSE)

Up 4% to 26.4p - Board Change & Corporate Update - Mark (I hold) - AMBER

This accident-prone Asian oil & gas producer loses its CEO:

A. Paul Blakeley has elected to step down as Executive Director, President and Chief Executive Officer of the Company.

Unlike Serica, the production problems at their Montara and Stag fields appear to be mostly their own fault. The lack of maintenance may have been due to a previous operator. However, the length of time that it took to do repairs and the costs associated are down to the company. As such, the CEO appears to have fallen on his sword. He recently bought shares in the company, so this appears to have been unexpected:

Blakely is thanked, but pointedly, the Chairman says:

A priority for the new management team will be ensuring operational excellence across the portfolio.

The Chair becomes Executive Chair, and a NED becomes COO, so they presumably are not in a rush to appoint another CEO. Not everything has gone badly during Blakely’s tenure. CWLH has proven to be an excellent acquisition so far:

Production also continues to run ahead of expectations at the CWLH asset and the Sinphuhorm field, with the latter recently benefitting from strong gas demand in northern Thailand.

And the Akatara gas project is performing as planned, after fairly normal start-up teething problems:

The Akatara project has achieved sustained gas sales at contractual rates of c.20 MMscf/d (the "Daily Contract Quantity", or DCQ), with overall Akatara production benefitting from associated condensate and LPG streams.

The focus of the new executive management team seems to be avoiding high-risk or capital-intensive development projects. Instead, dividends and buybacks should be back on the cards:

A stronger balance sheet will facilitate the next phase of growth for Jadestone, and allow for a resumption of shareholder returns, which remains a priority for the Board. Capital will be allocated efficiently by investing in projects and acquisitions that deliver the greatest value; we will continue to play to our core strengths of establishing material operated positions in existing upstream assets and creating value through efficient operations and selective reinvestment.

If broker forecasts are to be believed, this puts them on a P/E of less than 4. Given this broker trend, it may be too soon to put too much faith in this:

Mark’s view

This remains one of the most hated oil & gas stocks on the UK market. Yet, being Asian-focused it suffers from none of the problems with UK taxation. Instead, it is operational problems that have caused the issues. With the company drawing a line under those and refocusing on strong cash generation from its assets and shareholder returns, this could mark the nadir. It will be a while yet before trust is restored that they have a handle on things operationally, so I am rating it AMBER for the moment. However, £140m market buys a lot of production in favourable tax jurisdictions, so the potential upside is high if that confidence can be built by the new executive team.

Ebiquity (LON:EBQ)

Down 15% to 19p - Trading Update - Mark - BLACK/AMBER

This sounds like a profits warning:

As indicated in the Group's Earnings Release in September, the Board anticipated a stronger H2 than H1; that is proving to be the case with expected H2 revenue still representing a mid-single digit improvement on the revenues of H1 2024. However, the very final months of the financial year are not meeting those high expectations in all respects.

Which is confirmed by the CEO narrative:

H2 2024 performance has been stronger than H1 2024 albeit below previous expectations.

Assuming “mid-single digit” is 5%, this means £77.7m revenue and the guidance of 10% EBIT margin means £7.8m EBIT. They had about £1m of net finance costs in H1, so annualising that gives me £5.8m PBT and £4.3m PAT on a standard tax charge. This is quite a big gap to the £7.7m Stockopedia has for consensus Net Profit. In light of this, the 15% fall in response looks light. Although, it seems that given the forecast P/E, investors may already have been expecting this. The market cap is only 6xPAT on my calculations after the fall.

However, this is another acquisitive company that likes its adjusted figures, so things are undoubtedly worse than their preferred measure would have you believe:

Net debt is also significant:

Net debt as at 30 June 2024 was £15.3 million. As expected, given the normal seasonality of the Group's cash flows, net debt increased somewhat during the third quarter but is expected to reduce again by year end, following working capital management actions. Stronger seasonal cash collections will continue through Q1 2025 and the Group has ample liquidity and headroom against its banking covenants.

While it may be comforting to know that this increased net debt isn’t causing problems with banking covenants, it is another nail in the coffin of the current valuation, as it is now at least half the market cap.

On the plus side, they do generate decent revenue and have blue-chip clients. They also have a new CEO, who was head of the best-performing part of the business and one they acquired a few years ago. So this may well be the start of a turnaround. However, with a rather patchy history of profitability, it is hard to point to where they may get to if the new CEO does manage to improve things.

Mark’s view

The shares aren’t on a high P/E multiple, even after this profits warning is taken into account. However, the presence of significant net debt and a penchant for adjusted numbers means this isn’t as cheap as it may first appear. Paul rated this AMBER after the last profits warning, and I see no reason to change that.

Headlam (LON:HEAD)

Down 4% to 126p - Trading Update - Mark - AMBER

Yesterday’s news from Brand Architekts and Camelia shows that often good things happen to investors who buy stocks on a significant discount to tangible book value and simply wait.

Headlam has many similar characteristics. A big discount to tangible book value:

The freehold property on the balance sheet is almost certainly undervaluing it and making the real discount wider. They say:

The last valuation of the property portfolio was undertaken in January 2023; the most recent property sale (in June 2024) was at a premium to this valuation

However, these assets are currently very unproductive:

This is a situation that isn’t expected to change any time soon and this trading update to 30th November, moves things further into the future:

As has been widely reported, UK consumer confidence declined in the run-up to the UK government's budget announcement, and this resulted in a further deterioration in the rate of decline in consumer spending on home improvements1. Consequently, there has been no sign of improvement in the flooring market during the second half of the 2024 and we estimate that the market continued to decline at 10-15% year-on-year, in line with H1.

Costs are increasing too:

Whilst the Board anticipated some of the changes that were announced such as the increase in the national minimum wage, the reduction in the national insurance threshold was not anticipated. When combined with the rise in the employers' national insurance rate to 15% the overall effect of these changes will be to add c.£2 million to the Group's annual operating costs, effective from April 2025.

Mark’s view

Ultimately, this is a cyclical industry, and this company will have its day in the sun again. The big question is when? The current discount to freehold property suggests a significant upside to the shares when that upswing does come. However, the time it will take and the presence of better opportunities means that it is hard to think that now is a great time to jump in, and I retain the AMBER rating. However, there is a risk that a Brand Architekts-style scenario makes me look stupid here before the turnaround begins.

Direct Line Insurance (LON:DLG)

Up 7% to 252p (£3.3 billion) - Joint Statement Regarding Possible Offer - Graham - AMBER

I have no strong opinion on DLG or Aviva shares but just wanted to mention in passing the big news of the day for the FTSE 100:

…the Board of Direct Line has carefully considered the Proposal with its advisers and consulted with Direct Line shareholders during the offer period, and has concluded that the Proposal is at a value that it would be minded to recommend to Direct Line shareholders should a firm intention to make an offer pursuant to Rule 2.7 of the Code be announced…

The offer is for 275p per Direct Line share, comprising 129.7p in cash, dividend payments of up to 5p, plus new Aviva shares.

It strikes me as surprising news because as recently as November 27th (Wednesday of last week), Direct Line said that the initial offer of 250p was “highly opportunistic and substantially undervalued the company”. It came to this original conclusion after consulting with its advisors.

I can only assume that DLG’s shareholders, when they were asked, took a different view. DLG shares don’t seem particularly expensive but then neither do Aviva’s. So swapping out one for the other (plus cash) could make sense.

Distribution Finance Capital Holdings (LON:DFCH)

Up 14% to 37p (£66m) - Trading Update - Graham - AMBER/GREEN

This specialist lender caught my eye this morning with a “significantly ahead of expectations” trading update.

Key points:

Loan origination is in line. End-of-year loan book c. £650-700m.

Net interest margin (NIM) remains ahead of expectations. “Cost of risk running well below the Group’s target of 1%”.

Result: underlying PBT to be significantly ahead of expectations at not less than £14m (2023: £4.6m).

Additionally, DFCH can now reverse £3m of provisions relating to the collapse of the caravan park Royale Life. In total, £4.7m is being recovered from a bad debt of £10m.

Graham’s view: Paul provided a nice overview of this in July. It provides inventory finance to a range of sectors: agricultural,industrial, transportation, motorhomes and caravans (which produced the large impairment), etc.

Tangible net assets at the interims (published in September) were £107m, with TNAV per share of 59.6p. It is currently applying for consumer lending permissions, with the goal of becoming a multi-product lender.

Given the strong trading, discount to book value, derisory P/E multiple, and growth ambitions, I’m happy to upgrade this to AMBER/GREEN.

Of course as a lender it will be exposed to obvious and not-so-obvious risks. I still shudder every time I think of what happened with PCF Bank, a specialist lender that we covered in this report and that abruptly collapsed and shut down, giving investors no explanation for their sudden capitulation.

Water Intelligence (LON:WATR)

403p (£70m) - Nine months trading and capital allocation update - Graham - GREEN

The interim results from this primarily US-based company didn’t impress me too much in September, with sales growth across its network of just 2%.

Yesterday’s Q3 update was in line with expectations.

Q3 revenue rose 10% to $63.5m, led by sales at its corporate-owned stores. Franchising royalties and other franchise-related revenues declined.

I think these trends are easily explained by the fact that it has been buying back stores from franchisees.

Q3 PBT was up 7% to $6.1m.

Net debt has spiked up to $11m but the company continues to argue that it is “under-levered” with a leverage multiple of less than 1x. It has been on the acquisition trail and recently started buying back its own shares.

An interesting comment from the very well-aligned Executive Chairman, who seems almost apologetic for the lack of share price progress:

"We have a had a busy Q3 and start to Q4. We continue to grow and our team is executing along all facets of a capital allocation plan that is expected to produce accelerated growth in 2025. Our balance sheet remains strong, enabling us to continue to drive growth from our capital allocation plan. We appreciate the continued support of our shareholders and will be calibrating the delivery of our growth plan with better communication on the value of our shares given the headwinds facing the AIM market."

Graham’s view

I’ve been GREEN on this but at the same time, I’ve been asking that the company find a way to boost growth rates, as 2% sales growth across the network is not, in my view, exciting enough to stay positive on the shares. In fairness, they seem determined to do this and I agree that they should be financially strong enough to make the necessary investments. I’ll leave my GREEN stance unchanged for now.

The StockRanks agree:

Trufin (LON:TRU)

79.6p (£84m) - Trading Statement - Graham - AMBER

Trufin is a collection of businesses in payments, games publishing and invoice financing.

Historically, it has been heavily loss-making but revenues are on the rise and it says it is “fully funded to profitability”.

Yesterday’s positive trading update relates to the success of a game called Balatro. As a result, financial performance for 2024 will be significantly ahead of expectations.

Group revenue is now expected to be more than £46m (FY23: £18.1m), representing year-on-year growth in excess of 150%. TruFin also expects EBITDA to be no less than £4.5m (FY23: £(3.5)m) and Adjusted Loss Before Tax to be no more than £(1.5)m (FY23: £(6.6)m).

Estimates: Panmure notes that this is the fourth upgrade and they increase their year-end cash estimate from £6m to £7m.

Graham’s view: I’m happy to upgrade this from AMBER/RED to AMBER as £7m of cash gives the company more than a few years to work its way to profitability, based on the current loss rate. The only disclaimer I would add to this is that video game performance is inherently unpredictable and in the absence of another Balatro next year, the situation could deteriorate. But according to Panmure, the company is on its way to generate a pre-tax profit in 2025.

Carclo (LON:CAR)

31p (£23m) - Interim Report - Graham - AMBER/RED

I looked at this components manufacturer in some detail in September, choosing AMBER/RED as the immediate risk of insolvency had diminished but I could not justify the valuation. The shares were 33p at the time.

In yesterday’s interim report, we learned that net debt had reduced to £25m (including leases).

Checking Panmure’s note, I see an improvement as they now estimate net debt of £24m for March 2025, then £18m for March 2026 (according to my notes they previously estimated £28m for March 2025 and £26m for March 2026). So that’s a very nice trend of falling net debt and falling estimates of net debt.

Today’s outlook statement is positive:

The markets for our businesses are stable, this along with our solid HY25 performance, provide the Board with increasing confidence in meeting its full-year expectations. The strategic changes underway are building a strong foundation for sustained performance improvement and we are confident that we remain on track to achieve our long-term strategic goals.

Less positively, the company did make a small pre-tax loss in H1, as operating profit was entirely eaten up by interest expense.

The performance looks a little better if you’re willing to exclude exceptional items: it cost £1.3m to refinance their bank facilities.

Graham’s view: perhaps a little harsh, but I’ll leave this at AMBER/RED. I don’t like the balance sheet with net assets of c. zero and negative tangible asset value. In addition to the bank situation, there’s a retirement benefit obligation of nearly £38m.

This one is cheap, but maybe for good reasons:

Graham's Section

MS International (LON:MSI)

Down 5% to 975p (£157m) - Half-year Report - Graham - GREEN

There has been a lot of excitement around this stock relating to new defence contracts. Paul and I were consistently GREEN on it over the past two years (see last update in June).

As far as listed companies go, it's an eccentric with no broker forecasts and much less commentary and fanfare than other companies.

A large part of the reason for that is heavy insider ownership. Michael Bell is Chairman:

In addition to the top two names, there are other names with holdings of 10% and 7%.

In today’s interim results, Michael Bell seems a little disappointed with the financial outcome. He notes that modern accounting rules to do with revenue recognition for long-term Defence & Security contracts have impacted the figures:

As a result of winning these larger contracts, a substantial amount of ongoing work in the first half will not be recognised as revenue until either later this year or in following years, when the goods and services have transferred to the customer.

Timing of revenue will, therefore, be an increasingly significant feature going forward and, indeed, it has impacted the results for the first half. Nevertheless, the Company is making remarkable advances, even if the half year results do not fully reflect this.

The headline numbers are as follows:

Revenue down 4% to £54.7m

PBT up 14% to £8.8m

Defence & Security: MS International is “a top-quality designer and producer of naval weapon systems”, and is now gaining “a similar reputation in the much larger international land-based equipment section of the defence market”.

The facility in Norwich is being upgraded in anticipation of future business, and the property in South Carolina is also being prepared “to accommodate our projected growth”.

Forgings: there is reduced global demand for fork-arms; MSI are maintaining their market share.

Petrol Station Superstructures: UK activity remains high. Times are more challenging for the Poland-based business.

Corporate Branding: the UK operation prospers, while Netherlands/Germany business “restructures to meet subdued market conditions in the petroleum business sector”.

Outlook:

I am most encouraged with the considerable progress that we continue to make across all the divisions. This is particularly pleasing in a year of uncertainty, in terms of the political change in many of the countries we serve and, of course, movements in both interest and exchange rates.

There are some management changes - new MD and FD (internal hires).

A strategic review is nearly complete, with an update to come before the end of the financial year (April).

Graham’s view

I tend to like this company because it’s understated and clearly not trying to promote itself, while at the same time having a very long history of profits and dividends, a strong balance sheet, and a stable (even declining) share count.

While there are no official forecasts to compare with, today’s results do feel like a miss in the sense that investors have been keenly looking forward to bumper results from the Defence & Security division, and these have not materialised yet.

On the other hand, I wouldn’t dare to downgrade MSI as the results are still perfectly good in their own right: the accounts are perfectly clean and the profit margin is up on lower revenues. After-tax net income is £6.4m (H1 last year: £5.8m).

On the balance sheet there are net assets of £51m, almost fully tangible, including cash of almost £28m (H1 last year: £43m).

As pointed out in the comments section below, there is a large increase in inventories, up by over £20m year-on-year to £37.5m. This alone can account for the reduction in MSI’s cash.

The good news is that if these inventories are soon to be sold, future income statements should be very impressive indeed. The gross profit margin is currently running at 34%. So an extra £20m of inventories could in theory be sold for £30m+, leaving an additional £10m+ of gross profit behind (before the deduction of distribution/admin costs).

There are a lot of assumptions involved - who knows what the margin might be on new contracts - but I’m definitely inclined to see this inventory movement as a positive. As I’ve said before, it’s very often a good thing to see cash on the decline at growing businesses.

More generally, I reviewed the defence sector not long ago for a Stockopedia webinar with Megan, and came to the conclusion that the outlook for the sector was quite good.

MSI, while not yet producing the type of numbers we’ve been hoping for, seems to remain on a good track. So I’m staying positive on it.

This historical PER does not adjust for the strength of the balance sheet or cash position:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.