Good morning!

The US inflation rate came in at 2.7% yesterday, as expected.

Today we have a few pieces of macro news but the most important is probably the ECB rate decision at 13:15 GMT.

However, a 25 basis point cut is expected with near-certainty and almost nobody will be surprised if or when that is announced.

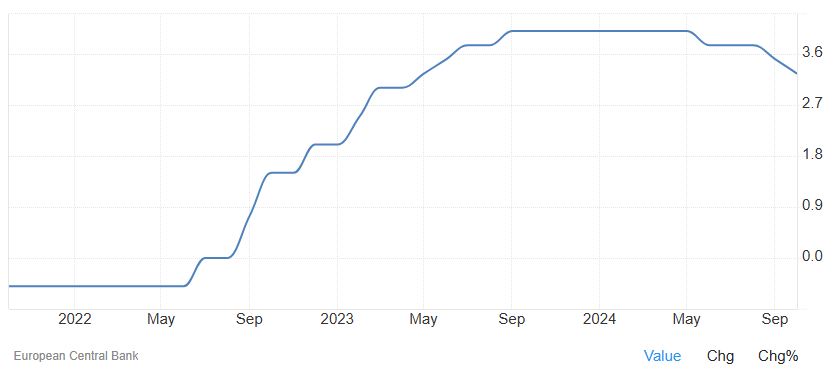

The rate is expected to fall from 3.25% to 3%, which will be the fourth cut of the year. Here is a 3-year chart of this rate:

(Source of economic charts: TradingEconomics.com)

Cuts are expected to continue in 2025, taking the deposit facility all the way down to 1.75% by the end of next year.

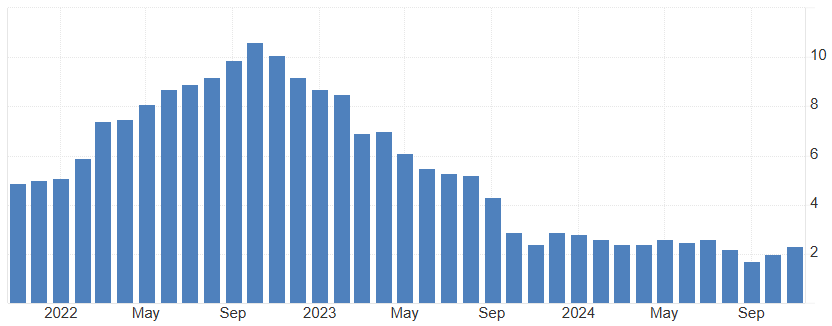

The ECB targets an inflation rate of 2% over the medium term. It's currently on target:

Eurozone equities may not enjoy the prestige or the performance of their US counterparts, but I don't think that low rates can be blamed for this: the ECB has been very supportive, and it's likely to remain supportive for the foreseeable future.

1pm: We've wrapped up the report now, enjoy the rest of your day!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet). Updated to 10/12/2024.

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Currys (LON:CURY) (£907m) | H1 Results | Guidance unchanged. | AMBER/GREEN (Graham) |

RWS Holdings (LON:RWS) (£590m) | Final Results | Trading in early months of FY25 is in line with expectations set out in October TU. | GREEN (Mark) |

Volex (LON:VLX) (£520m) re: TT electronics (LON:TTG) (£211m) | Statement re: TTG | No intention to bid. | GREEN on VLX, AMBER on TTG (Mark) |

Serica Energy (LON:SQZ) (£513m) | Acquisition of Assets | £5m paid + £9m deferred for 50% WI in Skerryvore + Fynn Beauly | AMBER/GREEN (Mark) |

SThree (LON:STEM) | TU | In line FY24. Net fees down 9%, challenging conditions. Net cash £70m. PW for FY25, PBT £25m. | AMBER/GREEN (Graham) |

Pollen Street (LON:POLN) (£446m) | TU | AUM £5bn (Sep 2024), up year-on-year from £4.2bn. | |

Benchmark Holdings (LON:BMK) (£254m) | Q4 Results | Soft start to the new year in Advanced Nutrition. Good start to the year for Health. | |

De La Rue (LON:DLAR) (£214m) | HY Results | H1 ahead of guidance but reiterates full-year guidance, adj. op profit mid to high £20 millions. | AMBER (Graham) |

Carr's (LON:CARR) (£110m) | FY Results | Prospects for Ag Division enhanced. Sale of Eng division to drive optimal shareholder value. | |

NWF (LON:NWF) (£77m) | TU | H1 in line and full-year expectations unchanged. | |

Dewhurst (LON:DWHA) (£61m) | Final Results | Sales start the year in line with exps. Growth outlook in UK has worsened. Risk of US tariffs. | |

Van Elle Holdings (LON:VANL) (£41m) | TU | H1 revenue down 5%. In line for FYwith H2 weighting. | GREEN (Mark) |

Velocity Composites (LON:VEL) (£12m) | TU | Full-year revenue +40% slightly ahead. Positive EBITDA. Further growth expected in FY25. |

Summaries

SThree (LON:STEM) - down 27% to 263p (£358m) - Trading Update - Graham - AMBER/GREEN

It’s a major profit warning as the adj. PBT forecast gets cut to only £25m, including £7m of one-off costs to improve efficiencies. The FY24 result is in line (adj. PBT c. £67.4m) and FY25 had been forecast to see a similar result. I have to downgrade this to AMBER/GREEN as it’s now a recovery story and the timing of recovery is always uncertain. At least the balance sheet remains very strong, and a £20m buyback will help to mop up shares at prices that will hopefully prove to be cheap in the long run.

RWS Holdings (LON:RWS) - Up 4% to 167p - Final Results - Mark (I hold) - GREEN

Revenue is flat, and earnings are down 11% as weak end markets continue to weigh on the business. However, there is continued strong operating cash flow, which combined with a decent balance sheet, means that the company has its 21st year of increasing dividends. The risk of AI disruption remains, but this is an opportunity for the company as well. The outlook is a little vague, and individual investors can’t see the brokers’ note,s so we are flying a bit blind when it comes to forward valuation. However, the historical dividend yield of 7.5% and trading at less than 5x last year’s OCF before changes in working capital means that the recovery here could have further to run.

De La Rue (LON:DLAR) - down 4% to 105.5p (£207m) - Half Year Results - Graham - AMBER

H1 adj. operating profit is ahead of guidance but the group result is not relevant given that one of DLAR’s divisions is to be sold. The disposal needs to go ahead to clear an expiring RCF and help to pay down DLAR’s pension deficit. The most likely outcome for shareholders seems positive given the attractive price achieved for the Authentication division (£300m). But with the company looking totally reliant on this deal going ahead, I have to take a neutral stance until it completes.

Currys (LON:CURY) - up 10% to 86.55p (£980m) - H1 Results - Graham - AMBER/GREEN

I upgrade this to AMBER/GREEN as the PER is less than 10x. It’s shaping up to be an excellent year for Currys, and shareholders can look forward to the likely resumption of dividends next year. The balance sheet (negative TNAV) and the sector both scare me and personally I wouldn’t want to own this one long-term (5 years+), but I can see the potential for continued gains in the medium-term.

Short Sections

Van Elle Holdings (LON:VANL)

Down 3% to 37p - Trading Update - Mark (I hold) - GREEN

I recently wrote a summary of construction groundwork specialist Van Elle Holdings (LON:VANL) here. Short-term trading conditions remain weak:

The Group expects to report revenue for the Period of approximately £65m (HY2024: £68m), representing a decrease of 5% on the prior year.

There are a number of reasons to think that this is temporary. For example:

Workload has been subdued in Rail, as the sector transitions from CP6 into CP7, and Highways continues to experience project delays.

Housing is starting to see a recovery, and H2 is looking much better. Their Canadian rail subsidiary is winning contracts. However, these are for future work, and they have incurred significant start-up costs here. Hence, overall, they say:

The Board continues to expect results for the full year in line with market consensus1, and as previously communicated, anticipates profitability being second half weighted.

So that is the dreaded H2-weighting, which often precedes a full-year warning. However, I am less concerned with short-term trading here, as the main attraction is the discount to tangible book value:

This is around a third of the current rating that larger UK groundworker Keller trades on. Investors will either see a business that is struggling to compete with larger peers or an opportunity to take advantage of that discount. This trading update is unlikely to change investors’ minds on this.

Mark’s view

I think there are genuine reasons to believe the current mediocre trading performance is due to specific headwinds that will become tailwinds in the future and that the assets here will prove to be productive over the full cycle. Given the discount to TBV, the market clearly doesn’t believe this. Rockwood Strategic/Harwood is involved here, and a new management team is in place. This gives me confidence that this won’t just be allowed to languish. Hence, I am happy to retain Paul’s GREEN rating from July, despite no immediate sign of improved asset productivity in this trading update.

Serica Energy (LON:SQZ)

Up 3% to 135p - Acquisition of assets from Parkmead Group - Mark (I hold) - AMBER/GREEN

…acquire 100% of the shares in Parkmead (E&P) Limited ('PUK') from Parkmead Group Plc ('Parkmead'), which includes a 50% working interest in licence P2400 (Skerryvore) and a 50% working interest in licence P2634 (Fynn Beauly)

The amounts here are de minimis for a company with a £500m+market cap at £5m initial + £9m deferred consideration. However, there are some strategic reasons for doing this deal:

The transaction provides optionality regarding future projects, simplifies decision making, and provides strategic flexibility relating to the existing position in Skerryvore through consolidating the interests in the P2400 licence, in which Serica Energy (UK) Limited, a wholly owned subsidiary of Serica, already holds a 20% interest. Following completion of the transaction, Serica will hold 70% and become the operator.

And this may be the most attractive part, given the current fiscal regime:

PUK has carried forward tax loss balances which as at the transaction economic date of 30 June 2024 amounted to £197 million of ring-fence corporation tax losses, £181 million of supplementary charge tax losses, £1 million of Energy Profits Levy losses and £12 million of activated investment allowances. PUK has no employees.

The market perhaps believes that Parkmead got the better deal here, as their share price is up 65% in response! However, in reality, this just reflects that their market cap was just £16m, so receiving £5m +£9m deferred is far more material to them, and this may well be a win-win as Parkmead clearly don’t have the financial flexibility to develop these assets.

Mark’s view

This shows the kind of deals that can be done with Serica's financial strength. However, I can’t help feeling that shareholders (of which I am one) would prefer them to use their UK reserve-based lending capacity to diversify into kinder fiscal regimes. A debt-based acquisition of Asian assets would make them less reliant on UK tax whims while reducing corporation tax as debt interest would be tax deductible. Overall, this deal reinforces why I view this as a very cheap, conservatively-financed business with the ability to do good deals and I retain the AMBER/GREEN rating.

Volex (LON:VLX) / TT electronics (LON:TTG)

VLX up 8%, TTG down 13% - No intention to bid - Mark - GREEN on VLX, AMBER on TTG

Breaking news mid-morning as Volex say:

Further to its announcement on 15 November 2024, Volex confirms that it does not intend to make an offer for TT Electronics.

This perhaps should not come as a surprise, as when Volex tabled their bid, TT Electronics had already said that they had rejected a higher offer in cash. The market clearly feared that Volex were going to come back with a higher offer, which would make the deal less compelling for Volex, and the price had been weak over the last month:

As it happens, Volex Exec Chair, Nat Rothschild mentions their disciplined approach in the commentary:

Volex remains resolutely disciplined in how it allocates capital and, applying that principle, we will not proceed with an offer for TT Electronics as it is now clear that the Board of TT Electronics is not willing to recommend an offer at a valuation that is also acceptable to Volex.

Volex is up around 8% in response. This looks like it could be a good entry point for those who like the long-term strategy here. After all, it is not expensive:

Matters are complicated because Volex released results on the same day they revealed their bid. However, I saw nothing in the results to justify a share price fall, so this could represent an opportunity. Volex confirm that they are trading in line today and, equally importantly, have shown that they are not just empire-building at any cost.

TT Electronics are down 13% but still trades some 30% above where they were before the Volex bid was announced. On one level, this makes sense, as industry players clearly see value here. However, they presumably see value under different management, and with the current team rejecting the bids, investors are left with their rather patchy recent operational record. I am less inclined to consider this a good opportunity, at least at the current price.

Mark’s view

I agree with Graham’s previous assessment: AMBER on TTG, GREEN on VLX. If anything, recent newsflow and price moves reinforce these.

Graham's Section

SThree (LON:STEM)

Down 27% to 263p (£358m) - Trading Update - Graham - AMBER/GREEN

This update is a severe profit warning as the company takes a chainsaw to the FY Nov 2025 earnings forecast.

According to a note published by h2Radnor in August, after the H1 results were published, STEM was forecast to generate adj. PBT of £69.3m in FY25.

This was an important downgrade in its own right, as the previous forecast was £80.8m.

Today the company says that it now only expects to earn around £25m, although this does include £7m of one-off costs needed to provide future operational efficiencies.

The reason is simple enough: a continuation of the poor conditions in the recruitment sector. Indeed, STEM says that uncertainty has even increased:

Whilst the Group continues to expect robust contract extensions, new business activity remained weak throughout FY24 driven by the protracted challenging economic conditions, impacting FY25 performance. The latter part of FY24 saw increased political and macro-economic uncertainty, particularly in Europe, further delaying decision making and the anticipated easing of market conditions.

It now assumes that the poor conditions will persist throughout FY25.

For FY24, results are in line and are illustrative of the difficult conditions with net fees down 9% and the contractor order book down 10%.

Buyback: the combination of a profit warning with a buyback is unusual but this is an example, with STEM announcing the planned repurchase of £20m of shares.

It’s a bold move. I have previously asked STEM’s management team if they might need to reduce their cash balance - it had grown to £90m at the time I asked them. Their response was that they needed about £60m on hand in order to fund business as usual and their expected growth in contractors.

Cash is a volatile number for STEM and it had fallen all the way down to £45m by the time of the Q3 trading update.

It now sits at £70m (as of the end of November).

Graham’s view

On the buyback, I trust management’s decision here, and I think it adds up. If they need c. £60m to fund operations, there is at least a £10m surplus currently, plus whatever profits the business earns during the course of buyback (that is expected to take six months).

But their cash needs tend to be counter-cyclical and so in an environment where demand is soft, they need less cash than they do in a growth environment. Therefore it makes sense that if they assume conditions will remain challenging for the duration of the new financial year, then they can also assume that they will need less cash than they previously thought.

The flipside to this is that if recruitment suddenly picked up, providing them with plentiful opportunities to fund new contractors, there is the possibility that they might not have the cash on hand to fund this. But the chances of this happening seem remote, and even if it were to occur, a small amount of very temporary borrowing could fund the difference.

A more difficult question is whether they should be buying their own shares with surplus cash, rather than, say, finding one or two bolt-on acquisitions.

I imagine that management predicted today’s share price reaction would be sharply negative (down 27% as I type).

The market cap of c. £360m implies a very high earnings multiple on FY25 earnings, but if adj. PBT can get back to the “normal” level (FY23/FY24) of £70-80m within a couple of years, then it’s not expensive at all (after-tax earnings multiple only around 6-7x, backed up by a very strong balance sheet).

So if management do see potential for a recovery in the next 2-3 years, then I think the shares still remain good value and the buyback is a reasonable use of cash.

I’m going to have to downgrade this one to AMBER/GREEN today as while I still remain a big fan of the company, and it is my favourite recruitment share, the investment case is now a recovery story.

I fully expect it to recover, but I can’t predict the timing of when the recruitment market, particularly in Europe, is going to pick up again. Perhaps ECB rate cuts will help!

Currys (LON:CURY)

Up 10% to 86.55p (£980m) - H1 Results - Graham - AMBER/GREEN

The share price is noticeably up here despite an “in line” current year outlook for FY April 2025:

Trading since the period end has been consistent with the Board's expectations

Full year guidance unchanged - the Group continues to expect growth in profits and free cash flow for the year

The driver of the positive reaction is instead the outlook for FY April 26.

At Panmure, they have upgraded PBT estimates by 5% (to £154m for FY26) due to lower interest rates.

Panmure have also upgraded the FY26 free cash flow forecast significantly (>20%), expecting boosts from working capital, lower capex and lower pension contributions.

This is what CURY itself has to say about future prospects, in summary:

Budget-related costs to increase £32m (living wage, National Insurance, supplier cost increases, business rates).

Half of these were anticipated, with plans in place to offset them. The remainder will be mitigated as much as possible with a variety of measures, including some price rises.

And continuing:

Despite these unexpected headwinds, the Group expects the P&L to benefit from lower interest costs, and is continuing to target at least 3% adjusted EBIT margin.

Alongside this, the Group will remain focused on free cash flow generation. The Group expects to keep annual capital expenditure below £100m, for exceptional cash costs to fall and to be below £10m by 2026/27, and to keep working capital at least neutral despite continued growth of the Mobile business.

Pension deficit: £143m on an accounting basis. On an actuarial basis, the next valuation date is March 2025. Scheduled contributions add up to £277m by FY 2029, but Panmure are suggesting that CURY may only need to pay £50m p.a. for four years.

Net cash: a big swing upwards here and a net cash balance of £107m as of October 2024 (this is before taking the pension deficit or lease liabilities into consideration).

With a rising net cash balance and a reducing pension deficit, CURY says “this… is by far the strongest balance sheet the Group has had in the decade since the merger”.

Dividends are coming:

As we announced on 27 June 2024, providing trading continues to be in line with expectations, the strengthened balance sheet and the improving cashflow dynamics underpin the Board's intention to announce a recommencement of shareholder returns no later than the full year results on 3 July 2025.

H1 result: adj. EBIT £41m, up 52% year-on-year. Free cash flow £50m. Like-for-like revenue +2%.

Remember that this is a business that works on the tiniest of net profit margins, so small changes in gross margins and operating costs have an oversized impact on the bottom line.

We can see sharp increases in profitability when gross margins are stronger and when costs are under control, such as in the latest H1 period, but there remains an inherent vulnerability to cost increases - such as the recent tax changes..

The company’s strategy to achieve higher margin, recurring revenue is as follows:

Our aim is to continue growing sources of higher margin, recurring revenue such as credit, protection plans and connectivity so that over time our business mixes away from single product purchases to the more predictable, recurring and higher margin revenue streams of solution sales.

Balance sheet: there are nominal net assets of £2 billion but it’s minus £400m after you strip out intangibles. There is a nice year-on-year reduction in inventories (to £1.33 billion) that will have helped to boost the cash position. Lease liabilities of over £900m need to be considered as a risk factor, separate to the net debt position.

Adjusting items: the impressive adj. EBIT figure of £41m is before £12m of amortisation which I am happy to ignore in this case.

I am less willing to ignore finance costs, which wipe out a significant chunk of EBIT whether you are using adjusted or unadjusted figures.

The company argues that interest on the pension scheme liabilities should be ignored, for example. It presents “adjusted net finance costs” of £32m.

On balance, I’m inclined to trust the adjusted PBT figure of £9m as being a meaningful reflection of the company’s performance, but do bear in mind that the actual accounting result for H1 is a pre-tax loss of £10m.

Graham’s view

Looking at these results turned out to be more work than I expected it to be, which is often the case when you look at a larger company. I still feel that I have only scratched the surface.

I’ll tentatively upgrade our stance here to AMBER/GREEN as I can see the case for it offering some value at this market cap. The PER is in the region of 9x.

The negatives are mainly to do with the type of company it is, rather than management’s performance or its current trends.

And while the strategy of prioritising products such as credit and protection makes sense, it’s not enough to dissuade me from the view that this is a fundamentally poor-quality sector, from an investment point of view.

Perhaps I shouldn’t let this influence me, but personally I would never buy credit or protection from a retailer. They are higher-margin products for a reason - they are terrible value for the customer. There are few good reasons to pay a retailer an APR of 30% (admittedly one of my personal holdings, Next (LON:NXT) does charge customers an APR of 29.9%). The insurance products are also overpriced and unnecessary, in my view.

That’s just an aside. I’m happy to leave this at AMBER/GREEN as the picture has improved, the earnings multiple is cheap, and the announcement of a dividend is another catalyst to look forward to (assuming it is not already fully priced in). It’s not a stock I would sleep soundly at night owning, but the risk:reward might be reasonably attractive here.

De La Rue (LON:DLAR)

Down 4% to 105.5p (£207m) - Half Year Results - Graham - AMBER

In October we had the impressive news that DLAR was selling its authentication business for £300m, transforming its balance sheet and leaving behind the banknote printing business only.

Today’s interim results to September combine both the Currency and Authentication business, which isn’t very helpful.

Looking at the Currency business alone, we have:

H1 revenue falls 16% to £94.9m as some deliveries slipped into H2.

Order book picks up to £252m (six months previously: £239m), which accounts for a large part of the revenue decline, as orders not yet delivered stay in the order book.

H1 adj. operating profit £1.1m (H1 last year: £1.4m), “in its traditionally weaker first half”. The full-year result last year was £6.4m.

As of Nov 2024, the order book has increased further to £338m. It “includes significant increase in polymer orders, securing good manufacturing loads into FY26 and beyond.”

Net debt as of September is irrelevant as the company will move into a net cash position assuming that the proposed sale of the Authentication division goes ahead.

There is a warning that higher volumes in the Currency division will require more working capital than usual, as the company will receive less in advance payments from customers. This in turn is caused by the company being unable to provide the usual long-term performance guarantees to customers - which I think is a red flag in its own right. There are also c. £12m of costs to separate the Authentication business.

The above has prompted me to check the going concern statement, and it isn’t pretty. In short, there is a possibility that the company is insolvent if the planned disposal does not go ahead. The directors have noted that “the probability and timing of completion [of the deal] are subject to factors outside of the Board’s control”.

DLAR’s credit facility is expiring in July 2025. There are “severe but plausible” scenarios in which DLAR has “relatively low headroom” on the covenants attached to this facility.

This section includes the dreaded material uncertainty phrase.

Outlook: in line. The reiterate guidance for group adj. operating profit but this is again not relevant as only the Currency result should matter now.

Looking ahead further:

In FY26 conversion of Currency order book into sales will accelerate to produce strong double-digit growth in Currency EBITDA before central costs.

CEO comment concludes with the statement that the Currency division should see “a substantial upward step change in activity in 2025 and beyond”.

Progress on the disposal: it sounds like a complicated (and expensive) process to fully separate employees and customers between the two divisions, but DLAR says it is on track to complete the sale in the first half of the calendar year 2025.

Graham’s view

I was planning to reiterate the AMBER/GREEN stance that Paul took here last time, but the going concern statement has shaken my nerves. Hopefully the disposal goes ahead on time and completion is only a formality. But personally I’d be wary of making any significant investment where if a deal failed to go through on time, the consequences could be calamitous.

Therefore, I’m only going to take a neutral stance on this one for now. When the deal completes, there is a chance I can take it back up to AMBER/GREEN.

Mark's Section

RWS Holdings (LON:RWS)

Up 4% to 167p - Final Results - Mark (I hold) - GREEN

I wrote up RWS as a Stock Pitch here for background. These are the final results to 30 September, and show some stabilisation in revenue:

This is flat excluding the effects of currency movements. Here is the breakdown between the different business units:

Gross margin improves slightly but increased admin costs:

Adjusted administrative expenses (gross profit less adjusted operating profit) increased by £8.5m to £224.2m, with cost control measures not quite offsetting cost of inflation, the additional overheads costs associated with Propylon, incremental investments in growth initiatives and reduced foreign exchange gains.

…and a slightly higher finance charge sees adjusted PBT down 11%. There is a huge gap between adjusted PBT and the statutory figures so this requires further analysis. Here is the breakdown:

Excluding the amortisation of acquired intangibles is fairly normal these days, and you have to wonder if the accounting standards around this still make sense. If companies and investors simply ignore these figures does it add value to have them accounted for in this way?

There is a further impairment of intangibles, but not as big as the previous year. I am not particularly concerned about this, as the major acquisition was SDL, which was paid for with overpriced (with hindsight) equity. This explains why the ROCE has never been impressive here, despite being a relatively capital-light business:

Strangely, impairing intangibles will probably improve ROCE going forward.

This is a bit worrying:

The Group recorded a £10.5m impairment charge on its revalued freehold building at 1-3 Chalfont St Peter after a recent revaluation lowered its value from £14.0m to £3.5m. The revaluation took place as part of a Group property portfolio review.

That’s a huge write-down on a single building. Which is presumably this office here:

A google drive-by from June 2023 doesn’t show obvious signs of dilapidation. The location seems reasonable, just a few miles from junctions with either the M25 or M40. So, being out by so much seems like a big miss. However, this was never going to be a tangible asset play, so this is probably irrelevant in the big picture:

Here is how the performance breaks down between the different business units:

Nothing stands out as a major change. Although, it is worth noting that the unadjusted figures show a recovery, since large intangible write-downs were taken in 2023.

When a company has significant adjustments, it often makes sense just to focus on the cash flow. Operating cash flow remains steady:

With a £600m market cap, this trades at less than 5x OCF. This is less impressive after working capital flows:

These appear to be mainly timing-related, and the overall figures for working capital seem in line with a company with this level of turnover:

The rest of the balance sheet looks conservative, with a small amount of net debt, although with no tangible asset backing to fall back on.

That cash flow makes its way back to shareholders, too. While a £30m buyback appears to have been badly timed having occurred at a much higher price, the dividend remains the cornerstone:

The Group continues to deliver against its progressive dividend policy and this marks the 21st year in succession that we have increased the dividend.

There aren’t many companies with this sort of record. Although it feels like this year’s increase at 2% is more nominal than usual, it still exceeds broker expectations, where at least one broker must have expected them to be unable to maintain the dividend:

The Board therefore recommends a final dividend of 10p per share. Together with the interim dividend of 2.45p per share, this will result in a total dividend of 12.45p for the year, an increase of 2% compared with FY23.

A 7.5% yield is not to be sneezed at, even in the current UK market. However, that is only of value if they can maintain it, and here the outlook is important:

The Group's FY24 results reflect good progress in a number of key areas and demonstrate that we are well positioned for clients' increased appetite to harness AI to meet their language and content needs. Our successes with TrainAI, Language Weaver and Evolve demonstrate that our AI-enabled solutions are resonating with clients at this transitional moment for our industry.

That is a little vague for my liking. Especially as the broker consensus looks like this:

Sadly, this is the sort of mid-cap company that doesn’t have any research available to individual investors, so we have to wait and see if this is the end of the downtrend. A new CEO joins in January, so this may add both an element of risk and an opportunity for a change of strategy.

Mark’s view

Disruption by AI solutions remains a risk for RWS. However, like all tech disruptions, large companies tend to be slow and cautious in their adoption. In the translation space, you can see why they would be. No one wants to put their reputation at risk by implementing translation services from an unknown AI model. This means that incumbent suppliers, such as RWS, can either develop, copy or buy solutions and sell them more effectively to their existing customer base. As such, it is far from obvious that RWS will be an AI loser. Trading at 5x OCF this doesn’t need to be a huge AI winner; just stay with the times and offer some AI solutions. Something the company appears to be doing.

At the end of October, Paul rated this GREEN due to the recovery potential. Since then, the shares have recovered some 20% or so. However, looking at the long-term chart, this could just be the start of any re-rating:

Especially as the huge fall in share price is not reflected in the operating cash flow the company generates:

I’m happy to both hold and retain the GREEN rating.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.