Good morning.

It has been a tough week in the markets - the FTSE down 2.2% and the AIM down 4.5%. At least stocks can't go down any further tomorrow!

As the fallout continues from Trump's tariff announcement, I'm still hopeful that this will be a temporary rather than a semi-permanent obstacle to global trade. This quote stood out to me, reported in the last few hours:

That’s the beauty of what we do. We put ourselves in the driver’s seat. If we would have asked some of these countries, most of these countries, to do us a favour, they would have said now they’ll do anything for us," Trump said.

“If somebody said they are ready to give you something phenomenal, it’s good," Trump added, on being asked if he would make a deal with countries.

Therefore I'm still hopeful that despite what Trump's aides have said, this is in fact an enormous negotiating tactic. And that in six months, perhaps many of the tariffs will be reduced if not eliminated completely, with Trump able to point to various concessions he has achieved for the United States.

But I acknowledge that in the short-term, this prospect is cold comfort. We'll have to assume these tariffs are here to stay for the time being.

12pm: I see that China is hitting back with a 34% tariff on all US goods from April 10th. Index movements:

- Dow futures down 2.6% overnight after falling 4% yesterday.

- The FTSE is down nearly 4% today (down 6% in total this week).

- The AIM All-Share is down 3% (down 7% in total this week).

These are the days when a brisk walk outside, or a relaxing swim, can be the best response. Those with cash may consider buying quality merchandise when it is marked down. As usual, I am not hitting the sell button on anything today!

(This report is done for today, please enjoy your weekend!)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

THG (LON:THG) (£434m) | Completion of Debt refinancing | Leverage reduces from 3.2x to 2.2x, pre fees, based on 2024 adj. EBITDA excluding Ingenuity. | RED (Graham) I'm unconvinced that this is a financially sound business. It remains leveraged despite raising nearly £200m of fresh equity since October. |

Jpmorgan Global Emerging Markets Income Trust (LON:JEMI) (£354m) | Half-year Report | H1 (to January) NAV return +5.9% vs. benchmark +4.9%. Share price discount widened. Commentary does not reflect the latest tariffs. | AMBER/GREEN (Graham) Very nice conditional tender offer promised although it is five years away. Discount to NAV possibly still over 10%, last seen c. 12%. |

Science (LON:SAG) (£191m) | Increased shareholding in Ricardo (LON:RCDO) | Science now owns 19.1% of Ricardo. | AMBER/GREEN (Graham) Please see my comments earlier this week. I’m starting to suspect that SAG are aiming for a 29.9% stake. |

Global Opportunities Trust (LON:GOT) (£85m) | Annual Results | NAV return including dividends +4.1%. Share price fell as discount widened. Commentary does not reflect the latest tariffs. | GREEN (Graham) |

Kodal Minerals (LON:KOD) (£81m) | Mining Licence Transfer and Project Update | Licence transfer awaiting final approval and signing by the President of Mali. | AMBER (Graham) [no section below] The President has already been involved in two successful coups and so this licence transfer is unlikely to be very stressful for him. |

Cavendish (LON:CAV) (£33m) | TU | FY March 2025 revenues to be in line with FY24 on a like-for-like basis. Profitable in H1 and H2. | GREEN (Graham) I'm hoping that the high cash balance, covering most of the market cap here, might put a floor on the share price soon. Cavendish is profitable and its cash balance has grown, despite these woeful conditions. |

Quantum Base Holdings plc (QUBE) (£15m) | First Day of Dealings on AIM | Quantum science company focused on authentication. Raised £4.8m in a placing. | AMBER (Graham) It's great to see any IPO happening in this environment. |

Graham's Section

THG (LON:THG)

Unchanged at 30p (£434m) - Completion of Debt Refinancing - Graham - RED

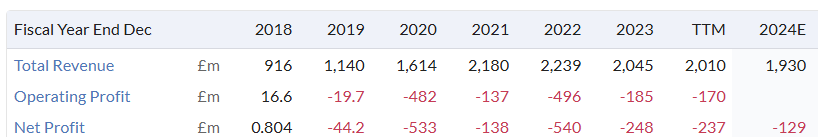

This company tends to produce terrible results dressed up with EBITDA and a wide range of adjustments.

It looks like we are still waiting for 2024's numbers - for 2023, they were published on 10th April.

Interim results for last year showed “continuing adjusted EBITDA” of +£42m, while the actual operating loss was £84m.

Continued real losses have taken their toll on the balance sheet and THG have raise new equity twice in recent times.

In October, they raised £95m.

In March, they raised £22m and issued an equity-like convertible loan for £68m, for a total raise of £90m.

Today’s announcement outlines their recent achievements when it comes to financing:

“Amend and Extend” of a €445m loan to Dec 20209

Partial repayment of loans using their own cash and the equity raise

Extended their £150m RCF to May 2029

Result:

As a result of the proposed refinancing, net total leverage (excl. leases) decreases from 3.2x to 2.2x pre deal fees based on FY 2024 continuing Adjusted EBITDA (excluding Ingenuity) of £92m. THG is a fundamentally cash generative business and the refinancing underlines the Company's target to progress towards a neutral net cash / net debt position.

Graham’s view

I’m afraid that the financials here have always lacked credibility to me. They say that they are cash generative and profitable, and yet they’ve had to raise nearly £200m of fresh equity in the last six months. I think I can rest my case there!

They said that the first placing was to put their e-commerce platform Ingenuity on a sound financial footing, so that it could operate on a standalone basis after being demerged.

The purpose of the second placing was “to establish a long-term capital structure”.

While their finances have been strengthened by the addition of fresh equity, and the THG market cap is now far more modest than it was before, I’m afraid that I’m still yet to see evidence of a financially sustainable business here. So I’m staying RED on this.

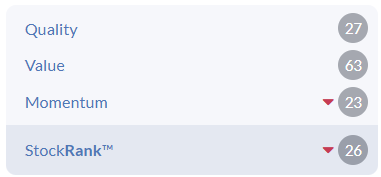

The StockReport says it's a Value Trap:

Jpmorgan Global Emerging Markets Income Trust (LON:JEMI)

Unch. at 128.25p (£354m) - Graham - AMBER

This trust seems to be in the crosshairs of Trump's tariffs. Here is the regional breakdown on its website:

It outperformed its benchmark by 1% in H1, helped by buying back its own shares at a discount.

Although the entire benefit of that did not show up in JEMI’s share price, as its discount to NAV widened during the period.

Net asset value per share as of 2nd April was 151.47p.

JEMI’s share price fell 4% yesterday and is now around 128.25p. I’m not sure what the exact discount to NAV is today, given that JEMI’s underlying assets will have fallen hard yesterday. It had been trading at a discount of c. 12%.

Today’s commentary does mention tariff risk a number of times, but it was written before the major announcement this week:

…at the time of writing, the US policy around tariffs is fast changing and therefore the longer term impacts are more difficult to predict

Shareholders will have been expecting this report to be published on time, and rewriting it the day before publication would not have been feasible. So I don’t blame JEMI for publishing it based on their views prior to Liberation Day.

Conditional tender offer

This is an interesting concept. In addition to its ordinary buybacks (£12.7m repurchased in H1), the trust announces a new conditional tender offer that it will make in five years.

It will work like this: if they don’t outperform their benchmark over the next five years (beginning in August), they’ll make a tender offer for up to 25% of their shares, at a price that is 2% below NAV.

I really like this. Either the company outperforms its benchmark over five years (which should result in pleasant shareholder returns), or shareholders will be able to sell a chunk of shares back to the company at a small discount to NAV. From a shareholder perspective, given the current discount to NAV, it lessens the risk. And from the perspective of the trust, they are bravely offering to reduce their AUM by a significant amount, if they can’t beat their benchmark.

Graham’s view

I’m going to give this an AMBER/GREEN because I think it’s still trading at a discount to NAV of over 10%, and I like the mechanism of their conditional tender offer.

As trusts go, I do think it is quite high-risk. Here are the top 5 holdings:

Global Opportunities Trust (LON:GOT)

Up 2% at 296.5p (£87m) - Annual Results - Graham - GREEN

This trust reports a NAV total return for H1 of 4.1%.

It trades at an enormous discount to NAV. Based on the figures for 2nd April, it was trading then at a discount of nearly 24% against the 389.05p NAV (including income).

That might have something to do with its small size, lack of any benchmark and modest returns:

Shareholders should note however that the Company has no stated benchmark against which it seeks to outperform. Its objective is to achieve real long-term total return through investing in undervalued global securities. In this regard the Company’s NAV Total Return over the past three years has averaged 6.8% despite the Company retaining a defensive investment posture, achieved through a combination of high cash levels and the nature of the equity holdings.

Its extraordinarily high cash balance of £37m (34% of assets) should come in handy now.

Current top holdings don’t seem to have any clear theme, besides being defensive in nature:

Dr Sandy Nairn, Executive Director, says that the portfolio will be “restructured into one with significantly higher upside” when cracks appear in equity valuations. Surely that is happening now - the Dow fell 4% yesterday!

Tariffs are mentioned in today’s report only as a component of “geopolitical risk”. So as with JEMI, this report will have been written prior to the events of this week.

Graham’s view

I’ll tentatively give this a GREEN due to its very high discount to NAV, liquid and easily valued portfolio, and dry powder available to make investments in an environment that offers better value. Hopefully they will be tempted to put their money to work now!

Although there are currently no buybacks in place, they say they are thinking about how they might close the discount to NAV:

The Board is very conscious of the level of the discount and will look closely at a range of options for improving the marketability of the Company. To this end Cavendish have been appointed as company broker with effect from 3 February 2025 to assist with efforts to improve demand for the Company’s shares.

Cavendish (LON:CAV)

Down 1% to 8.5p (£33m) - Full Year Trading Update - Graham - GREEN

This is an update for FY March 2025. Key points:

FY25 revenues c. £55m, in line with FY March 2024 on a like-for-like basis (combining finnCap and Cenkos).

Profitable in both halves of the year.

Net cash £21m as of March 2025.

I see that the cash balance is up from £17m as of Sep 2024 - very good.

Cavendish are pleased with it, too:

The Board believes that a strong cash-rich balance sheet provides financial resilience for the Group and allows us to continue to build our business for the benefit of all our stakeholders.

Looking forward, they say “the solid pipeline of transactions in train includes further IPOs”.

New offices have opened in both Manchester and Birmingham.

The outlook section highlights the opportunities for Cavendish in private markets:

The private markets pipeline remains encouraging, underpinned by a growing number of entrepreneurs considering exit opportunities and increasing engagement from private equity firms seeking to realise value from their portfolios of companies. Cavendish maintains active relationships with approximately 150 UK private equity firms. These investors are currently deploying over £50 billion of committed capital from their latest funds. Notably, 20 of these firms have raised a combined £7 billion over the past 18 months to invest in sectors that align closely with Cavendish's core focus. Encouragingly, the UK Budget last September did not have a material impact on business owner sentiment.

Graham’s view

I do regret putting both Cavendish (LON:CAV) and Peel Hunt (LON:PEEL) on my watchlist for the year. One would have been enough. But it’s hard to know which one I like the most.

For raw potential, it’s hard to argue against Cavendish: the enterprise value is only £12m. finnCap alone earned after-tax profits of c. £7m p.a. in the boom years of 2021 and 2022. It previously earned about £2m p.a.

Similarly, CNKS earned £6.5m in the boom year FY 2022, and previously earned c. £2m.

The combination of these two businesses should be more profitable than that in a healthy market, due to the fact that they aren’t competing with each other, and thanks to cost synergies.

So I have to remain GREEN on this even though the timing of any recovery is uncertain.

Stockopedia rates it as “Contrarian”, offering both Quality and Value, but very poor Momentum. That sounds about right! But hopefully its high cash balance will help to put a floor on the share price soon.

Quantum Base Holdings (LON:QUBE)

Up 4% to 24p (£15m) - Graham - AMBER

Yet another Cavendish-related announcement as they are acting as broker for this new stock. Strand Hanson is the Nomad.

We don’t get IPOs very often these days. Let’s take a look.

£4.8m has been raised through the issue of new shares at a price of 23.1p.

What they do:

Quantum Base is focused on creating a new global standard in authentication through its patented Q-ID solution; a near unbreakable and non-replicable authenticity tags that can be applied to a vast array of products, significantly mitigating counterfeiting.

The technology underpinning Q-ID harnesses the randomness that is inherent at a nanometre length scale. The sheer volume and variation of the interactions between molecules that occur at nanoscale means that there is virtually an infinite number of combinations that can be created. The Q-ID is practically impossible to replicate using even the most advanced available technology.

Use of proceeds: to fund commercial development and sales initiatives.

CEO comment:

I am thrilled to commence trading on AIM today, marking a key step in our decade long journey from a Lancaster University spin-out to a British scientific success story. Floating on AIM gives us direct access to a large, sophisticated pool of investors, and provides further independence and credibility for our business.

I’m glad he thinks that we are sophisticated - as long as he stays off some of the message boards, he may continue to think that!

Graham’s view

There’s no way I’m taking a negative stance on this company today. We need more IPOs. So I’m taking a neutral stance and giving QUBE a chance to develop a track record as a publicly-listed company, before I take a stance on it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.