Good morning! I don't know about you, but I'm still trying to get accustomed to the FTSE having a "9" handle (that means having a 9 as its first digit!).

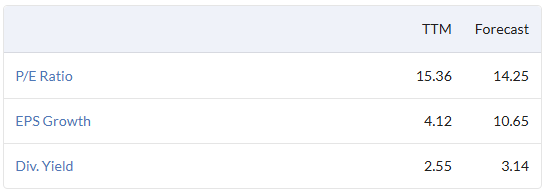

Stockopedia provides this table of median ratios - I'm relieved to see that they aren't particularly stretched:

12:45pm: wrapping it up there, thanks for all the comments and interaction! Graham

Spreadsheet accompanying this report: link (last updated: 30th June).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

GSK (LON:GSK) (£56.8bn) | Will co-develop 12 medicines across respiratory, immunology and inflammation/oncology. | ||

Cranswick (LON:CWK) (£2.9bn) | Rev +7.9% LFL w/ volume growth and outperformance of premium ranges. | AMBER/GREEN (Roland) [no section below] Today’s update from this food producer seems strong to me and has prompted house broker Shore Capital to nudge its forecasts slightly higher. Cranswick doesn’t generate high margins, but it does deliver quite high returns on capital. I see this as being driven by good scale and strong management. I don’t see any reason for this to change in the near future. An independent investigation remains underway relating to alleged mistreatment of animals at one plant, but the company says it has already strengthened its processes. Investment is also underway to add capacity and improve efficiency. Notably, £14m of investment has been committed at the Lincoln pet site to support new business wins. The StockRanks view Cranswick as a High Flyer, with strong Quality and Momentum scores. I’m inclined to agree and have left Graham’s moderately positive view from May unchanged today. | |

Computacenter (LON:CCC) (£2.4bn) | SP: unchanged | AMBER/GREEN (Roland holds) [no section below] The market appears to have accepted today’s update as in line, although my first instinct at 7am was that it might be seen as slightly below. I think the saving grace here is continued “excellent” growth in North America, helping to offset weakness in Germany, which remains the group’s largest market by profit. Looking ahead, I see the investment case being driven by continued growth in the US, driven by high volume deals with hyperscalers (large AI/data centre players). While the outlook is relatively flat right now, Computacenter has an excellent record of creating value for shareholders and remains under the effective voting control of its founders. On a P/E of 13 with net cash of £278m, I think the valuation looks undemanding and remain broadly positive. | |

Firstgroup (LON:FGP) (£1.3bn) | Acquired Leeds firm Tetley’s w/55 vehicles and strong contract portfolio. FY24 EBIT £1.4m. | ||

Adriatic Metals (LON:ADT1) (£988m) | Q2 +23% to 1.7Moz AgEq Tailings below exps. FY exps cut to 9.5-10.5Moz AgEq (prev. 12-13Moz). | ||

Smarter Web (OFEX:SWC) (£592m) | 6.1m new shares from 14m tranche sold at 325p per share from 7-25 July. Current SP 218p. | ||

Ocean Wilsons Holdings (LON:OCN) (£413m) | OCN SP -14% Combination with Hansa Investment (LON:HAN). OCN shareholders will receive 1.4925 new Hansa share units (each “unit” is one HAN share and two non-voting HANA shares) in exchange for every OCN share. | PINK (Graham) [no section below] | |

Oxford BioMedica (LON:OXB) (£407m) | H1 rev £70-73m (+38-44% vs 1H24). £149m new orders in H1. FY25 exps unch; £160-170m rev. | ||

Griffin Mining (LON:GFM) (£334m) | Rec’d $30.3m of dividends from its Chinese operating subsidiary re. FY24/5. Ex-China cash $53.7m. | ||

Kenmare Resources (LON:KMR) (£285m) | This equipment forms part of the upgrade to Wet Concentrator Plant A. Progress remains on track. | ||

SolGold (LON:SOLG) (£263m) | First 3 holes confirm high-grade resource. Fourth drill rig being added to expedite results. | ||

Science (LON:SAG) (£244m) | H1 rev +6.5%, PBT +8% to £8.2m (exc. £24m gain on Ricardo (LON:RCDO)). Outlook: “well positioned” for FY. | GREEN (Graham) Some weakness in professional services is offset by strength in the two "Systems" businesses. Given the strength of the balance sheet and management's glowing M&A track record now, I think it's worth staying positive on this. | |

dotDigital (LON:DOTD) (£221m) | Revenue +6% w/ 94% recurring revenue. Average revenue per customer +8% to £1,923, and adjusted PBT expected to grow in line with expectations. Forecasts at Cavendish reiterated “bar a small FX-related revenue adjustment” (£0.2-0.3m per annum). FY25 adjusted PBT forecast unchanged at £18.3m, FY26 £19.6m, FY27 £22.4m. Continues to assess further strategic M&A. | AMBER/GREEN (Graham) [no section below] It’s been a while since I last looked at this one (November 2024); since then, its earnings estimates have wobbled a little but have now recovered and the stock is trading on a forward P/E of c. 14x, which I think is cheap by historical standards. It made a $35m acquisition last month, comprising a $20m upfront payment and a potential $15m earnout. Despite this, the company's cash balance remains strong at £36.2m (Dec 2024: £45.7m). Overall, I can find little for shareholders to complain about other than a share price that hasn’t been able to break out of its range of the past three years. One slightly underwhelming feature of current performance, given the high-growth sector in which the company operates, is single-digit revenue growth. There are pockets of higher growth within the company, and it notes “strong double-digit percentages” internationally. Perhaps I should upgrade this already but I’ll conservatively leave it at AMBER/GREEN. The StockRank is improving but still only 57 for now. | |

Sovereign Metals (LON:SVML) (£211m) | Graphite tariff highlights Kasiya’s potential to be world’s lowest-cost non-China producer ($241/t) | ||

Aquila European Renewables (LON:AERS) (£205m) | Revised offer from preferred bidder. Sales process paused, bidder no longer in exclusivity. | ||

| Ceres Power Holdings (LON:CWR) (£195m) | Doosan Fuel Cell and Ceres joint announcement | SP +45% South Korean firm Doosan begins mass production of fuel cells using Ceres’ solid oxide tech. First sales expected in 2025, targeting AI and commercial applications, such as renewable microgrids. This is the first time the company’s technology has been brought into mass production by one of its strategic partners. | AMBER/RED (Roland) [no section below] Today’s news has met with a rapturous reception. Is this justified? It’s certainly positive that Ceres’ technology is in commercial production. But today’s update gives no clue as to the likely revenue impact and shouldn’t really be a surprise – the company confirmed in March that Doosan was on track for commercial product launch in 2025. More broadly, I think it’s worth remembering that Ceres has lost money continuously for 20 years, since listing on the LSE in 2004. Forecasts for 2025 prior to today showed revenue of £53m and a c.£20m annual loss, with similar in 2026. The company seems to have some good technology, but can it find a route to operating profitability? I don’t know, so I am going to maintain our previous cautious view. |

Life Science Reit (LON:LABS) (£153m) | Significant interest from a range of sources. NTA £232.1m/66.3p per share. Minor banking cov breach. | ||

John Wood (LON:WG.) (£128m) (suspended) | Commercial alignment on headline terms of proposed refinancing in connection with possible offer. | PINK | |

EKF Diagnostics Holdings (LON:EKF) (£119m) | H1 in line. Revenues unch. at £25.2m. Adj. EBITDA +9% (cc). Full-year outlook in line. | ||

STV (LON:STVG) (£89m) | SP -23% Deterioration in commissioning and advertising markets: results materially below consensus. Revised FY25 EPS estimates: - Shore Capital: 9.1p (prev. 21.2p) - Panmure Liberum: 11.7p (prev. 21.1p) | BLACK (AMBER/RED) (Roland) This is a bad profit warning, with EPS estimates cut by c.50% due to a weaker outlook for both advertising and programme commissioning for the remainder of 2025. These issues highlight STV’s heavy dependence on the UK market and consequent exposure to the UK economy. With single-digit margins and rising leverage, I think it makes sense to take a cautious view here until some signs of stability emerge. | |

Kooth (LON:KOO) (£65m) | SP -9% California in line with mgmt exps. Marketing spend to moderate in H2. GBP/USD impacting EBITDA. Net cash £15.1m (Dec 24: £21.8m) due to £1.5m buyback and investment in marketing and service delivery in California. | AMBER (Roland) [no section below] Today’s update has received a poor reception. Reading the company’s commentary, I am inclined to attribute this to comments about the uncertain outlook for Medicaid spending, due to US federal cuts. Medicaid was previously seen as a potential source of growth to help reduce dependence on the California project, which is only a four-year contract. Another possible negative today is the unspecified FX impact on revenue and profits from the stronger dollar. When I looked at Kooth’s results in April I took a moderately positive view, citing the modest valuation and good progress last year. Although the group’s cash balance remains impressive and provides a useful safety net, earnings are expected to be lower this year leaving the stock on a P/E of 19. To justify further growth from this valuation. I think Kooth may need a) a California renewal and b) further diversification of its revenue sources. While a positive outcome is certainly possible, I’m not sure how likely it is. For this reason, I’ve taken my view down one notch to neutral today. | |

Frenkel Topping (LON:FEN) (£61m) | Discussions with Harwood remain ongoing. Extension of deadline to 25th August 2025. | PINK | |

Kromek (LON:KMK) (£37m) | 2nd payment after delivery of milestones by Kromek. $30m recovered so far, $7.5m remaining. | ||

Everyman Media (LON:EMAN) (£37m) | Admissions +15%, revenue +21%. Net debt falls to £24m. Trading in line with expectations. | RED (Graham) [no section below] I’ve been negative on this one due to a lack of meaningful profits and concern that increased scale isn’t going to radically improve this picture. Today’s update shows growing top-line figures but it’s essential to bear in mind that they aren’t like-for-like, as the number of venues has increased from 41 to 48 over the past year. The two like-for-like figures provided are average ticket prices and average food and beverage spend. The company’s pace of expansion may slow down now with no further openings planned for 2025, and only two next year, so it will be interesting to see if the cash flow and profit performance can improve. They say “net debt repayment from operational cash flow expected in H2 2025”. According to forecasts, the company’s losses will reduce but it will remain loss-making through 2026. Nothing fundamental has changed after this in-line update and so I think that a negative stance remains justified. StockRanks identify this as a Value Trap. | |

Cordel (LON:CRDL) (£14m) | Uses AI to detect/locate trackside assets with unprecedented automation and accuracy. | ||

Capital Metals (LON:CMET) (£13m) | Potential for many multiples of existing resource to be achievable in the initial mining area. | ||

OptiBiotix Health (LON:OPTI) (£12m) | Rev +102% to £557k. Cash £1.3m. Will see the effect of cost reductions in H2 2025. | ||

RTC (LON:RTC) (£12m) | Profit from operations maintained at £1.3m. Optimistic about short, medium, long-term prospects. |

Graham's Section

Science (LON:SAG)

Up 3% to 569p (£252m) - Interim Results - Graham - GREEN

I was a bit concerned about how long it would take, and how complicated it might be, for Science Group to generate a return on their investment in Ricardo (RCDO).

But as it happened, they made a very quick turn on this investment: £24m of pre-tax profit.

That boosts H1 PBT to £32.2m (H1 last year: £7.6m).

Their net funds have shot up from £26.4m to £70m, although this is before a £3.6m dividend and a £5.1m tax payment on Ricardo profits. So the current net funds figure is presumably around £61m.

Excluding their profits from Ricardo, Science Group’s overall H1 adjusted operating profit was £11.3m (H1 last year: £11m). “A strong performance in the Systems businesses offset the weaker market conditions within Professional Services.”

The high-performing “Systems” businesses are CMS2 (critical maritime systems and support) and Frontier Smart Technologies (a provider of radio chips and modules). FST was an AIM-listed company until it was acquired by Science back in 2019.

“Professional Services” have been unified under the Sagentia brand, and are under some pressure due to “the international political/economic volatility causing customers to defer, descope or cancel projects”. H1 revenue fell from £36.5m last year to £33.2m this year, while adj. operating profit fell from £8.8m to £7.9m, “a respectable performance in a period of exceptional volatility”.

Ricardo: Science invested £32.4m from Feb to May, and received £58m back from this investment in June after Ricardo received a takeover offer. I will be a bit more open-minded the next time Science starts investing in the stock market!

Borrowings: Science has £12m of term loans expiring in 2035, secured against freehold property. The rate on these has been fixed at 7.3%. There is also an undrawn £30m RCF that can be extended by another £10m. Given that Science Group has a large net funds position rather than net debt, this implies that it has a tremendous amount of liquidity available to it currently.

Indeed, they acknowledge that they have more cash than they need - I would say they have vastly more cash than they need. But given the success they’ve just had with Ricardo, perhaps there is no harm in keeping some dry powder? They say that they might not be able to find another suitable opportunity:

The Board recognises that the Group's cash resources exceed the Group's operating requirements, particularly for a business that is highly cash generative. Furthermore, with a limited UK-centred population of potential acquisitions and/or investments, there may or may not be suitable opportunities to deploy the capital in accordance with the Board's investment criteria. Accordingly, and taking into account the buy-back programme constraints, the Board shall keep under review the possibility of a return of capital to shareholders via a tender offer.

Estimates: Panmure Liberum have increased their PBT estimates by 4-5% for FY25 and FY26, thanks to higher interest receivable. Their new PBT estimates are £22.7m (FY25) and £23.5m (FY26), with corresponding EPS estimates of 37.7p and 39.2p.

Graham’s view

I went back to a fully positive stance on Science Group in June when news of the Ricardo takeover emerged.

I see little need to change that stance today, although the shares are more expensive now than they were then:

Professional services/consulting is not a sector that I think should trade very richly, and it’s not a sector I’m inclined to be GREEN on very often, due to what I perceive as lower quality compared to other sectors. Most of Science’s operating profits are generated by this type of business.

However, the reasons I’m happy to be GREEN are:

Ricardo’s margins in Professional Services strike me as very good (23.9%), with management focused on maintaining these even in difficult conditions.

The cash balance covers about a quarter of the market cap, implying a high level of safety.

Adjusting for cash reduces the P/E multiple, e.g. it’s trading at about 14.5x next year’s EPS estimate, but this reduces to <11x on an enterprise value basis.

The Ricardo investment was remarkably successful, adding strong credibility to the company’s M&A track record.

Exec Chairman Martyn Ratcliffe is well-aligned to keep the success going, as the largest shareholder in the company.

Access to debt gives management additional flexibility, on top of the cash balance, to either return cash to shareholders or make new investments.

As a result, I’m staying GREEN on this one.

Roland's Section

STV (LON:STVG)

Down 23% to 147p (£69m) - FY25 Trading Update - Roland - BLACK (AMBER/RED)

As a long-suffering ITV shareholder, I’m familiar with the challenges being faced by traditional broadcasters as they navigate an ad slump and transition to a streaming-based world.

Unfortunately it’s ITV’s smaller, Scottish rival STV that appears to be suffering today. STV has issued a big profit warning that’s seen brokers cut their earnings forecasts for this year by around 50%. Commiserations to holders here.

Let’s take a look at what’s gone wrong.

Advertising slowdown

STV says H1 total advertising advertising revenue is in line with guidance, albeit 10% below the figure achieved last year. This largely relates to the boost provided by the men’s Euro 2024 football in June 2024.

However, “the recent further deterioration in the advertising market” means that the third quarter is now likely to be weaker than expected, with total ad revenue down by c.8% vs H2 24.

Audience outlook: as a result, revenue from the newly-formed audience division (broadcast & digital) is expected to be £90-95m this year, with an adjusted operating margin of 13-15%. From what I can see, previous estimates were for a margin of at least 15% and slightly higher revenue.

Studio slump

In my view, the narrative seems worse for the Studios division, which produces programmes for in-house use and for other broadcast and streaming platforms. Some well-known titles include Antiques Road Trip, Catchphrase and drama series Screw and Blue Lights.

STV Studios does serve clients such as Netflix, but its business is still mainly in the UK – and this seems to be a problem at the moment:

There has been significant commissioning market deterioration in late H1 and early H2 as the UK macroeconomic backdrop has worsened. This has impacted our unscripted labels with some projects in advanced development not being green-lit and some commissions being delayed to 2026.

The forward order book for Studios was £76m at the end of February, but has since fallen to £54m.

When last year’s results were published in March, STV said that the majority of the £76m order book was due for delivery in 2025.

The shrinkage since February tells me that the business is not winning new commissions to replace the programmes that are being delivered. This suggests to me that the current weakness could extend into 2026, as it will take time to rebuild the order backlog.

Studios outlook: the group’s programme-making division is now expected to generate revenue of £75-85m this year, at an adjusted operating margin of c.4% (FY24: 7.3%).

Outlook & Revised Estimates

Full credit to STV for being fairly transparent with its guidance today. But the company’s revised outlook is described as “materially below consensus” and represents a big setback versus 2024:

2025 revenue to be £165-180m, with the range largely depending on Studios commissioning results (previously consensus £187m)

2025 adjusted operating margin to be c.7% (previously 9.4% at Panmure Liberum)

Using the mid-point of the new revenue estimate suggests to me that adjusted operating profit could fall to £12.1m this year. Brokers Shore Capital and Panmure Liberum both have updated adjusted EBIT figures of just over £11m today, so are being even more conservative than me.

This new estimate is about 37% below previous estimates and would represent a drop of more than 50% relative to 2024 adjusted operating profit of £25.4m.

With thanks to three brokers who have provided updated estimates today, here are the latest EPS estimates for STV – they have all been cut by c.50%:

Shore Capital FY25E EPS: 9.1p (prev. 21.2p)

Panmure Liberum FY25E EPS: 11.7p (prev. 21.1p)

Progressive FY25E EPS: 11.4p (prev. 25.1p)

Roland’s view

This is a bad profit warning. The fall in STV’s margins continues a deteriorating trend that’s seen the group’s profitability collapse since the advertising market slump got underway in 2023. A partial respite last year has proved not to be sustainable:

A further short-term concern is that from what I can see, this revised outlook is likely to leave STV with a net debt/EBITDA leverage ratio of 2.0-2.5x at the end of 2025. While this is within the company’s covenant limit of 3.0x and may be manageable, it’s above my comfort level for a cyclical small cap with single-digit margins.

Although dividend forecasts are unchanged today at c.11.3p (implying a near-8% yield). I wouldn’t be surprised to see a dividend cut later this year if trading doesn’t improve.

Looking further ahead, this is a cyclical business and conditions may well improve as they have done in the past. STV is not in financial distress and remains profitable, with some useful programme franchises and a profitable broadcast/digital business that enjoys strong viewership share in Scotland.

My main concern is that STV may lack the scale and diversification in its Studios customer base that it needs to deliver sustainable and attractive margins.

Although the Studios unit might be attractive to other television production companies, its linkage with the broader STV business could make such a split more complicated. I wouldn’t bank on a rescue takeover bid, although it’s certainly a possibility.

The StockReport trend chart shows that today’s profit warning is the second cut to guidance in the last six months:

Given STV’s near-total exposure to the UK economy and the tendency of companies to underperform after issuing profit warnings, I’m inclined to take a more cautious view after today’s update. AMBER/RED

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.