Good morning!

I'm very impressed with how you're looking after the markets in my absence - my portfolio keeps going up, so we celebrated with rib-eye steaks last night, overlooking the Mediterranean, courtesy of some strong performers in my portfolio. No mosquitoes here in Spain either, so that's a big plus compared with Greece last year. Eating & drinking are good value, given the strength of sterling versus the Euro.

A good start to today too, with a positive update from Flybe. Let's start with that one.

Flybe (LON:FLYB)

Share price: 77.4p (up 9% today)

No. shares: 216.7m

Market cap: £167.7m

(at the time of writing, I hold a long position in this share)

Trading update - the market has responded positively to today's update, with the shares rising 9%, so they have now recouped about half the losses incurred with the profit warning in Jan 2015. It confirms my belief that when a fundamentally sound company with a strong balance sheet warns on profit, the shares usually recover within about a year. Although general rules are dangerous, because each situation is unique, and hence has to be carefully weighed up.

Today's update covers Q1, which for this company is Apr-Jun inclusive (since it's a Mar year-end).

Revenue for Q1 is up 9.8% to £152.7m, although the load factor has fallen from 75.8% to 74.1%. Costs seem under control, and are reported as down 3.4% per seat. A table is presented on fuel hedging, showing that cheaper fuel will be coming through increasingly over the next year, further helping profit margins.

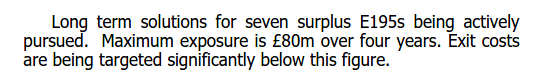

The one significant remaining legacy issue is the 7 surplus planes, which are the wrong type of plane for Flybe's routes, but Flybe is locked into expensive leases which have about 4 years left to run. The company today updates on this issue:

My opinion - I like the turnaround here, which admittedly is taking longer than anticipated to happen, but the disposal of the surplus planes referred to above could well be the catalyst for a useful re-rating of these shares. Although the market is doing a fairly good job of anticipating that outcome, with the shares already rising nicely.

Note that based on forecasts for 2016/17, the shares would be on a PER of 5, if those figures are met. The balance sheet here is very strong too. Although personally I'm taking broker forecasts with a pinch of salt, as they missed by a mile in the past.

New management inherited a near basket case of a business, but they've done a good job turning it around in my view. Flybe's business model means it has little (if any) competition on most routes, so once the surplus planes are disposed of, there should be a decent, profitable business here. The valuation seems undemanding to me, so I'm hoping there's more upside to be had here.

Norcros (LON:NXR)

Share price: 20.3p (down 5% today)

No. shares: 610.0m

Market cap: £123.8m

(at the time of writing, I hold a long position in this share)

Trading update - this covers Q1, being the 3 months to end Jun 2015. The key sentence says:

The Group's overall trading for the first quarter was in line with the Board's expectations.

I suppose they say "the Board's expectations" because brokers don't give forecasts for individual quarters. Although they could have said that the company is trading in line with market expectations for the full year.

Oh hang on, I've just seen the last paragraph, and it does indeed confirm full year market expectations, as follows:

My opinion - The weakness of the S.African Rand doesn't matter at all, as we saw in the last set of results, because when revenue & costs are in the same currency, then it's only the translation of the profit into sterling that matters, and S.Africa showed a big improvement in profits last time.

Broker expectations are for 2.15p EPS this year, and 2.4p next year, as acquisitions kick in. So the shares should probably be valued at about 30p, which would be a fairly modest PER of about 12.5. Actually the shares are about a third cheaper, at just over 20p, which seems an unjustified discount. The divi yield of 3% is useful too - it's nice to be paid to wait for the shares to re-rate.

I like the strategy of sensibly-priced bolt-on acquisitions, using debt initially, but then using the acquired companies' own cashflows to repay the debt. That's a sensible strategy when borrowing costs are low.

The group says that UK retail sales "remain sluggish". Since consumers are actually spending, this must mean that Norcros doesn't have the right products/pricing to appeal to the retail chains which buy their products. So I hope they are taking remedial action, to bring in ranges which are more appealing to the retail chains.

Overall though, the company's trading in line with expectations, which is all that really matters, so personally I am looking at today's drop as a potential opportunity to top up. Note that the StockRank is very high at 95, and the chart looks good too - with the down trend stopping in Oct-Nov last year, then forming a base over the next six months, and now apparently in a strong up-trend. The low valuation suggests to me that there is scope for this up-trend to continue, but we'll have to wait and see. The company dropped hints that more acquisitions are in the pipeline too, which should be a catalyst for a further move up potentially.

MyCelx Technologies (LON:MYX)

Share price: 47.7p (down 64% today)

No. shares: 18.6m

Market cap: £8.9m

Trading update - commiserations to any holders of this water filtering company focussed on the oil sector. The shares have been brutally sold off today, down by almost two thirds at the time of writing.

This company seems to have interesting technology, but looks to be a victim of cost-cutting in the oil services sector. So today's update is really all about contract delays & cancellations. Revenue guidance is revised to $15-16.5m for 2015, which compares badly with $23.5m which brokers are currently estimating.

Whilst there have been some cost cuts - 10% reduction for the full year is mentioned today, this must surely point towards 2015 being another year of hefty losses. That in turn raises the question of whether the company needs to raise fresh funding, and whether they will be able to secure any more funding? The company raised $12.4m in fresh equity in Q4 of 2014, but already had some debt, so I reckon that net cash is possibly starting to get a bit tight now.

The savage drop in share price today also suggests that the market fears another fundraising may be coming. I would have been tempted to have a punt on this if the company had given an indication of the likely losses for this year, and had specified what the current cash position & cash burn are, but seeing as that vital info was not forthcoming today, it looks too uncertain to risk catching this particular falling knife.

Tungsten (LON:TUNG)

Results y/e 30 Apr 2015 - these figures look grim to me. The cash burn is far greater than originally planned, and given that the share price has collapsed over 80% from recent highs, the apparently inevitable future fund raises could end up being at a large discount again, thus diluting existing holders considerably.

On the other hand, the Edi Truell share promotion roadshow might get back on track, and excite people again with the potential. It's certainly a great story, which sucked in many investors, including me, a while ago. Sadly the execution has not been anything like what was planned. It seems to be costing a huge amount to build up the business, and link up customers and their supplier bases into Tungsten's e-invoicing and early payment system.

It will be interesting to see how this pans out, but having reviewed today's figures, it looks too risky for me. One for the gamblers only, methinks!

Correction re Galasys (LON:GLS)

Newgate have contacted us to point out that Galasys (LON:GLS) is actually a Malaysian company, not Chinese as I mistakenly stated in yesterday's report. I've corrected yesterday's report. Apologies for this error.

As I'm a shareholder in Porta Communications (LON:PTCM) the holding company of Newgate, I'm very pleased to see they're on the ball!

That's it for today, I'm off for dinner, and more disco dancing in Sitges tonight, great fun!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in FLYB and NXR, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only. They should not be taken as recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.