Good morning!

Today's Agenda is complete.

11.15am: with the long weekend looming, I'm going to hang up my pen there for the day. I'll see you all refreshed next week!

I wrote a fun little article yesterday about a serious topic - Eating the sundae: the continued exodus from the LSE.

Spreadsheet accompanying this report: link (last updated to: 1st August).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Serica Energy (LON:SQZ) (£664m) | Triton production of 20k boepd net to Serica over the last two weeks. Overall guidance for the year unchanged at 33-35k boepd. | ||

Aptamer (LON:APTA) (£17m) | SP +16% 3 licences. Licence 2 is being discussed and APTA’s tech is yet to be evaluated for Licence 3. | RED (Graham) [no section below] My negative stance here is not a comment on the value of Aptamer's technologies. Rather, it's just my interpretation of the risks and probabilities involved here. Of the three licences described in today's announcement, I don't think any of them are actually signed yet. Licence 1 is at "an advanced stage of negotiation", and is forecast to cover 15% of Aptamer's annual overheads over the next three years. So that sounds positive. Licence 2 - Aptamer "continues to advance licensing discussions". Licence 3 - the potential partner still needs to evaluate the technology. So I wish the company well, but it looks and sounds to me as if it's a startup. As noted by Mark recently, the full-year trading update made no reference to profits (or losses). Revenues did at least increase 41% to £1.2m, and the company finished with cash of £1.06m, subsequently raised £1.83m. So let's call that a cash balance of £3m. The pre-tax loss in the previous financial year happened to be £3m. So I don't know how long the cash runway is, but it sounds like it might need another extension before the company achieves takeoff. | |

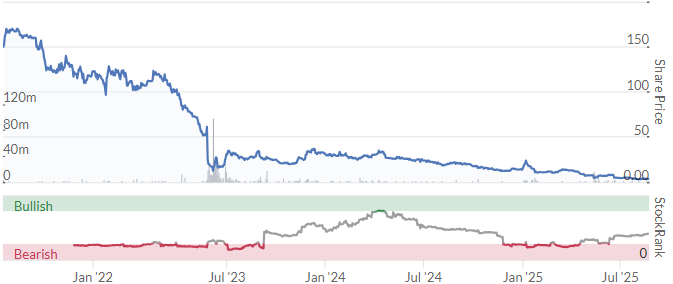

Argo Blockchain (LON:ARB) (£13m) | SP -19% Loan negotiations ongoing. Growler to own ≥ 80% of ARB. Bondholders will also get equity. | RED (Graham) [no section below] Massive dilution incoming. Existing shareholders will be left with scraps, and that's the best-case scenario. We called this one. I'm not going to go into this in further detail: the main point is that the extent of the potential dilution is still unknown, as it depends on the outcome of ongoing negotiations. Existing shares could be left with 10%, 1% or 0.1% of the company, after the recapitalisation. ARB says "there is general recognition that any agreement will include the provision of continuing value to shareholders in the form of their existing shares and, potentially, other forms of equity" but this doesn't provide any real guarantee. The only benefit of this plan (compared to REVB for example) is that it should at least wipe out the company's outstanding debts for good. | |

Revolution Beauty (LON:REVB) (£11m) | £15m fundraise today. FY 2025 rev -25%, pre-tax loss £16.8m. Co-founder returns as CEO. | RED (Graham) Massive dilution incoming. Even £15m of new equity will only allow partial repayment of £26m of net debt. We called this one. And after reading the details of the plan, I'm surprised how little of the fundraise will be applied to debt reduction. It turns out that the company has many other cash needs (and I'm guessing that some of these have been neglected while the company's cash position has been "tight"). Leverage will therefore remain high, even after the placing and subscription. |

Graham's Section

Revolution Beauty (LON:REVB)

Up 6% to 3.7p (£12m) - Preliminary Results - Graham - RED

It’s a busy day at Revolution Beauty; they’ve issued five announcements already.

Let’s get the results out of the way first (FY February 2025).

Revenue -25% (£142.6m)

Gross margin 38% (last year: 46%)

Adj. pre-tax loss: £5.5m

Actual pre-tax loss: £16.8m

Net debt closes at £26m, excluding leases. The £32m RCF was fully drawn.

Former management left this business in a mess, and that includes a £9m liability that is still on the balance sheet - this is a leftover from REVB’s acquisition of its manufacturing business (purchased from its own former Exec Chairman/co-founder).

It has suffered from various accounting issues over the years, and undisclosed loans, and today’s results include some further restatements.

Management changes: the former Chairman, who sold the company its manufacturing business, is returning as CEO.

The former CEO, who admitted no liability after the loan scandal, is also returning, as a consultant. At least one positive is that he has a decent stake in the company (15% before the fundraise).

Current trading and outlook

Q1 sales fell 29%, and Q2 is thought to be down c. 25%.

Action has been taken to address the declines in revenues by: resurrecting profitable stock keeping units that have been discontinued; re-launching the Relove value brand with new retail distribution partners; and establishing a profitable discount outlet channel. The pipeline on new product development has been enhanced, with more digital first product launches planned. Commercial discipline has been improved, to focus on more profitable product lines, customers and channels… the Company expects year-on-year revenue decline rates to reduce significantly in the second half of the year.

The returning co-founders seem primarily focused on cost-cutting:

At the heart of this plan is a return to Revolution Beauty's original formula for success - fast, trend-driven innovation combined with a product-led strategy. A key element of the plan will be reducing the Company's cost base, which will provide financial stability in the near term and will also encourage operational alignment across all business functions. In addition to cost savings already realised, the Founders estimate that an additional £7.5m of annual staff cost savings can be realised by FY27 as a result of a material reduction of headcount across the Group's geographies and business functions….

New guidance for FY26:

Revenues £110-120m

Adjusted EBITDA of low single digit millions will be achieved after staff costing measures have been implemented.

Annual adjusted EBITDA run-rate of £8-10m by the end of FY26.

Use of proceeds

I’m surprised to see how little of the £15m gross proceeds will be applied to debt reduction. There are many other cash needs:

£4m to repay debt

£2.5m capex

£2.5m working capital

£2m set aside as a working capital contingency (let’s call it an emergency fund)

£1.9m restructuring costs

£2.1m transaction costs

HSBC and NatWest have extended the company's RCF to July 2028 and agreed a covenant “holiday” until May 2026, but they have also reduced the size of the facility by £4m (to £28m) and adjusted the interest rate, so that it now varies with the company’s EBITDA performance.

Risk warnings: these risks may seem obvious, but I’d like to highlight them (emphasis added).

…there is no certainty that the additional capital will be sufficient to meet future requirements or to respond to unforeseen events or business needs… As such, the Company is currently not in a position to determine how much additional capital may be required (if it is required at all) or when it might be required;

Furthermore:

…even with a lower level of net debt following the Fundraise, the Company currently maintains a relatively high level of debt with its two lenders. While the Founders anticipate that the measures they intend to implement to drive growth and profitability will enhance Revolution Beauty's long term value, the high debt levels still pose a substantial risk to the ongoing solvency of Revolution Beauty. In the event of a material deterioration in financial conditions, there is a consequential risk that the Company breaches the covenants contained in Revolution Beauty's banking facilities, which could accelerate repayment.

Dilution: there is a placing for 345m shares, and a subscription for 155m shares, so I make that 500 million new shares, plus whatever the Retail Offer raises.

The existing share count is 319m. So existing shares will only own about 37% of the company after the fundraise, with further dilution from the Retail Offer.

Graham’s view

I’m staying RED on this for a number of reasons. Firstly, I don’t think the previous management team covered themselves in glory, so I don’t see their return as a reason to change my negative stance.

Secondly, the fundraise is only going to partially resolve the company’s financial problems. It will remain heavily indebted.

At the current share price of 3.7p, I think the implied market cap based on the new share count is £30m. We could add on £28m of outstanding debt to make for an enterprise value of £58m. If the corporate makeover is successful and the company hits its £10m run-rate EBITDA target next year, that makes for an EBITDA multiple of about 6x. Is that cheap? Maybe, maybe not. Its leverage multiple (net debt/EBITDA) could still be pretty high, and I’d see it as a risky bet.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.