Good morning!

08:17 - Agenda is complete

14:03- Report is complete

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

Name (Mkt Cap) | RNS | Summary | Our view (Author) | |

AstraZeneca (LON:AZN) (£175bn) | Phase III trial results showing Tezspire reduced nasal polyp severity and nasal congestion, nearly eliminated the need for surgery and significantly reduced systemic corticosteroid use vs. placebo | |||

ITM Power (LON:ITM) (£431m) | RWE reserves 30 units for call-off by 2027. | |||

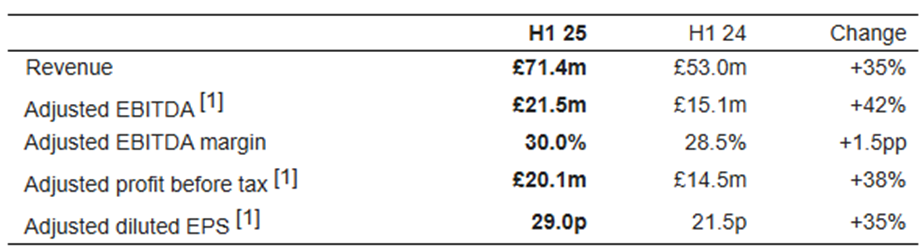

Elixirr International (LON:ELIX) (£401m) | Acquisition of TRC Advisory, LLC | H1 Revenue +35% to £71.4m (17% organic), Adj. EBITDA +42% to £21.5m, EPS +35% to 29.0p. Net debt £6.8m (24H1: Net cash £22.1m). Confident in delivering organic FY 25 trading results in line with market expectations. Acquires TRC Advisory, US-based challenger consultancy, for $57m, $16m in shares at £8.20, which is 4.2-7.8x EV/EBITDA based on contingent consideration of up to $68m. Acquisition is debt funded and immediately earnings-enhancing | AMBER/GREEN (Mark)

Although there are some of my usual concerns about people businesess and acquistion costs, the rating here looks modest compared to organic growth rates. With acquistions on top, and with a pattern of EPS upgrades, this continues to look good value. | |

Wilmington (LON:WIL) (£299m) | Ongoing revenue +11% to £99.5m, Adj. PBT +18% to £28.4m, Adj. EPS +20% to 23.7p. Net cash excl. lease liabilities £42.2m (FY24: £67.8m). “We have had a good start to the current financial year, with revenues and profits in line with expectations and look forward to Conversia joining the Group later this year.” |

| ||

Riverstone Energy (LON:RSE) (£226m) | All shares in Solid Power Inc, a Louisville, Colorado based producer of all solid-state batteries for electric vehicles, sold for $25.9m. | |||

Beeks Financial Cloud (LON:BKS) | TMX Datalinx, the information services division of TMX Group, which operates primarily Canadian markets, such as the TSE, to offer Beeks' Exchange Cloud® platform to its clients. Revenue share deal to help meet FY26 expectations. | AMBER (Mark) [no section below] This is another deal with a well-known exchange continuing the trend for positive newsflow. It is a revenue share deal, and while no figures are given, my assumption would be that Beeks will fund the capex involved. The typical 30-something per cent gross margins of this business suggest it is either one of the worst software businesses in the UK or one of the best equipment lessors, depending on your view. While it is always likely to be a capital-intensive business, it has shown the ability to grow rapidly when it has the capital, which the interim results suggest it has plenty of to fund deals such as this. This agreement is said to help it meet current FY26 expectations, which at around 26x forward earnings already price in significant growth. The StockRank of just 28 also suggests some caution is warranted, so I am in no rush to change our neutral view on this one. | ||

Rainbow Rare Earths (LON:RBW) | Successful optimisation of the feed stream to the final separation circuit via the incorporation of a Ce depletion step benefitting quality and operating costs. | |||

Ilika (LON:IKA) (£65.1m) | Commencement of its PRIMED programme, a step towards commercialising Ilika's innovative solid-state battery technology. | |||

Colefax (LON:CFX) (£50.3m) | Fabric Division sales for 19w to 12 Sep +7.8% (+10.3% CCY). Cautious about prospects due to the end of the pause in additional US import tariffs on 1 Aug and the additional 50% import duty applicable to Indian origin goods from 27 Aug. “Allowing for these factors and budgeted increases in operating costs we are expecting the current year performance to be in line with expectations.” | AMBER/GREEN (Mark - I hold) [no section below] The revenue growth rates in their key Fabric Division are quite impressive at 10% constant-currency, given the current consumer market sentiment. Interestingly, all regions are growing, even the UK (off a low base)! However, they expressed significant caution around the tariff situation in the US in their FY results that were released at the end of July; they felt that demand had been pulled forward to avoid tariffs. That caution remains in this trading statement despite the positive revenue growth so far continuing into this financial year. Today they also quantify how much extra they will need to charge US customers in future to maintan margins at $6m in total. This is likely to reduce demand in this core market. All of this means that they are unlikely to repeat the 108p of EPS that they delivered in FY25. Instead, they guide in line with forecasts for 76.7p EPS, which puts them on a forward P/E of 11. This doesn’t look particularly cheap, until you realise around half the current market cap is in cash. They have a rather strange way of returning capital periodically, and are quite illiquid. However, their bullet-proof balance sheet, long-term focus and outperformance in difficult market conditions will no doubt appeal to certain investors. Hence, I think it makes sense to have a broadly positive view (and a small holding). | ||

Creo Medical (LON:CREO) (£50m) | Revenue +40% to £2.2m, u/l Loss £9.1m (24H1: £12.8m loss), Cash £20.5m (31 Dec: £8.7m) after sale of 51% of Creo Medical Europe for £24.9m. Continued implementation of operational efficiencies and cost reductions. Management reiterates 40% to 60% full year revenue growth, in-line with guidance. | |||

Fiinu (LON:BANK) (£49.4m) | £2m loan from Manx Financial at a 10% interest rate + convertible at 10p per Fiinu share. | |||

Aoti (LON:AOTI) (£47.9m) | H1 Revenue +21% to $31.8m, Adh EBITDA -10% to $3.07m, Net debt $5.4m (24H1: Net cash $5.5m). “As indicated in the July trading statement, revenue growth for FY 2025 is expected to be in the mid-teens and adjusted EBITDA margin is expected to be low double digit. Trading post period in July and August has been consistent with this revenue growth guidance.” | |||

Ondo InsurTech (LON:ONDO) (£45m) | Continued to achieve meaningful progress, particularly in the US, with US customers of 185k (30% of customers & 50% of recurring revenue). | |||

Manx Financial (LON:MFX) (£43.2m) |

& £2m CLN | H1 net interest income flat at £17.7m, PBT +16% to £4.1m, loan book +5% to £392.6m. CET1 12.2% (31 Dec: 12.5%). £2m loan made to Fiinu at a 10% interest rate + convertible at 10p per Fiinu share. | AMBER (Mark) [no section below] The CLN here seems to be a good deal for Manx, as they negotiated it when Fiinu was trading below the conversion price. They get a 10% annual coupon and are already £350k into the money on the convert. However, things may not be as good as they seem, as Fiinu itself only has a StockRank of 19, and its only positive characteristic is Momentum. A lot is riding on the future success of their Plugin Overdraft® product, and the shares may well be below the convert price by the time they can be converted. If I were Manx, I’d be looking to hedge that position as soon as possible, which may put pressure on the Fiinu share price. The results themselves look ok, but as a non-bank analyst I have little insight apart from that I’m not sure I’d pay 2xTBV for a small bank with a 12% CET1 ratio, when something probably safer and more diversified, such as Barclays, still trades below TBV. However, I don’t have enough conviction either way to change Graham’s previously neutral view. | |

Van Elle Holdings (LON:VANL) (£39.6m) | “…full year trading and profitability is expected to be materially below market expectations, and below the prior year.” Medium-term outlook positive due to strong Jul 31st order book of £47.3m (30 Apr: £41.5m) SP -10% Zeus cut FY26/27/28 EPS by 50%/30%/17% |

BLACK/AMBER/RED (Mark) They say that profits warnings come in threes, so this downgrade should perhaps not be a surprise. However, the scale of the miss is significant, with broker, Zeus, cutting FY26 EPS in half. The company's claim of a positive medium-term outlook doesn’t stop Zeus also making significant cuts to future years and the dividend forecast. This suggests that there is no easy fix here, and while the discount to TBV highlights that there may be value here eventually, there is no sign of all of these assets being made productive anytime soon. As such, I reluctantly reduce our view one notch further, until there are signs that current downward trends are actually reversing. | ||

OPG Power Ventures (LON:OPG) (£28.9m) | Tax rate on coal in India will be increased from 5% to 18%. Expects £2.5m cost increase due to these GST changes. | BLACK | ||

Helium One Global (LON:HE1) (£23.8m) | Electrical Submersible Pump (ESP) purchased. On track to commence ESP operations at ITW-1 in Q4 2025 | |||

B90 Holdings (LON:B90) (£16.3m) | Revenue +75% to €2.41m, EBITDA +65% to €303k, Net loss €39k (24H1: €322k loss), Net Cash €401k (24H1:302k). “With market expectations reaffirmed in our July 2025 trading update, we remain confident in delivering a strong full-year result at both revenue and EBITDA level.” | |||

Rockfire Resources (LON:ROCK) (£15.7m) | H1 LBT £536k (24H1: LBT £888k), Cash £140k (24H1: £515k). £2m gross raised in July post period end. | |||

Oriole Resources (LON:ORR) (£15.4m) | 59 mineralised intersections, including 13.7m at 1.36g/t from 116.9m. | |||

EMV Capital (LON:EMVC) (£11.7m) | Novel, ultra-rapid mechanism that reduces the chance of bacteria becoming resistance to its action and has advantages over traditional antibiotics acquired for £2.475m from Destiny Pharma. | |||

New Frontier Minerals (LON:NFM) (£10.7m) | FY LBT $2.5m (FY24: LBT $15m), Cash $1.8m (FY24: $1.1m) |

* Market caps at previous trading day’s close

Mark’s Section:

Van Elle Holdings (LON:VANL)

Down 8% at 34p - Trading Update - Mark - AMBER/RED

This is now the third clear profits warning. This is the recent history:

In March 2025, their broker Zeus took 6% out of revenue for FY25 and reduced PBT by 33% when the company said that they no longer expected a recovery in 25H2 due to delays in their Canadian business.

There was a small positive in May as they received a cash injection from outsourcing heavy haulage operations to specialist company, transferring their assets.

In early June, we got a further profits warning with Zeus reducing EPS by a further 14% to 2.4p for FY25. The company’s narrative suggested that this was a delay of work from FY25 to FY26, but given, that Zeus took similar amounts out of FY26 and FY27 PBT forecasts, this didn’t hold a lot of water, in my opinion, and I downgraded our view to AMBER (it would have been lower apart from the discount to TBV, and presence of an activist shareholder on the register.)

The consensus trend shows a deterioration in outlook that goes even further back:

Today’s further warning is based on a continuation of previously given trends:

As commented on in its results announcement on 23 July 2025, challenging trading conditions experienced throughout FY2025 continued into the new financial year. The expected improvement across the Group's core sectors is yet to materialise, attributable to spending constraints and delays to contract starts across all sectors, particularly related to Building Safety Act ('BSA') approvals for high-rise residential buildings.

Which has led to:

Due to these factors, year to date revenues have not increased as anticipated and consequently, full year trading and profitability is expected to be materially below market expectations, and below the prior year.

This looks to have caught their broker on the hop as there was no updated coverage first thing, but I can now see the Zeus’s updated note in Research Tree, which quantifies the miss:

With FY26 results expected to be significantly below market expectations and below the prior year, we reduce FY26 forecast underlying PBT by c. 50% to £3.0m, primarily driven by a 6.3% reduction in our revenue estimate to £140.0m.

This is a huge downgrade for FY26. However, the company remain positive about the medium term, saying:

The medium-term outlook remains very positive, with significant opportunities in the growing energy and water sectors, where good early progress is being made. The Group continues to maintain a strong order book of £47.3m at 31 July 2025 (30 April 2025: £41.5m).

However, Zeus throw shade on that view by saying:

Zeus FY27 and FY28 revenue forecasts are reduced by 6.4% and 6.5%, respectively, and underlying PBT forecasts are reduced by 31.7% to £5.5m in FY27 and by 16.7% to £7.5m in FY28. The profit downgrade in FY26 reduces our net cash (ex. IFRS 16 leases) forecast from £5.8m to £3.1m, with the Group’s banking facility remaining undrawn.

So again, far from being a short-term shift of demand into the future, this seems to be a permanent downgrade of prospects for the business.

These figures are presumably on a continuing basis as well. In the FY25 results, the company classified their Canadian Rail Operations as discontinued as they expect to sell or close this subsidiary. However, as far as we know this is still operating and the company will still be funding the ongoing losses here. Given that these totalled £1.3m last year, they are material to the reported PBT, which will be lower than the headline figures, at least for FY26.

Valuation:

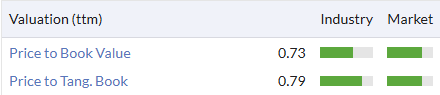

The original bull case here was that a strong cyclical recovery in trading would put this company on a very cheap multiple. This was backed up by the discount to TBV:

If these assets can be made productive again, then the company should be re-rated. Much larger ground-work contractor, Keller, trades on 2xTBV. However, there is little sign that Van Elle's assets can be made productive in the near-term. Indeed, we now need to go out to Zeus’s FY28 forecasts of 5.1p EPS to make this look good value. The company does trade on a low EV/EBITDA of less than 4, but this is not the sort of business where we can ignore depreciation as a cost. Zeus point out that such metrics are merely in line with peers.

Zeus prefer to utilise a DCF as their valuation methodology and the changes to forecasts today, reduce their valuation from 53p to 44p. This still represents some 30% upside from today’s buy price. However, I really struggle to place much confidence in the forecasts. As such, investors may want to demand a higher discount rate that the 11.5% that Zeus use.

The company highlights their balance sheet strength, and the asset-backing and net cash does give them time to wait for a recovery. However, I also not that Zeus have cut their dividend expectations in line with EPS. The company has been paying 1.2p out each year for the last few years, but are only forecast to pay 0.7p in FY26. There are cyclical companies on the UK market that pay a much better yield while investors wait for a recovery in trading.

Mark’s view

I am torn on this one, and it seems the market often is as well. Despite repeated profit warnings, the share price always seems to bounce from current levels as investors get over the initial disappointment, and focus again on the discount to TBV and chance of a medium-term recovery.

A sale or closure of their loss-making Canadian subsidiary may help remove management distraction even if the losses here are now excluded from these figures. Equally, further intervention by Harwood in forcing a turnaround or other corporate action may give a positive catalyst. The increasing order book suggests that momentum may now be swinging the other way after the third warning.

However, I don’t tend to invest on such possibilities, and the only metric the company is really cheap on is now the discount to TBV. One could argue it looks good value on 2028 EPS estimates, but given that forward earnings keep being cut by the brokers I don’t put much weight on this. The StockRank has been declining, and I expect the FY26 results, when they arrive next year, will see further deterioration in most of these metrics:

Everytime the company has warned in the past, and the share price has dropped to these levels, I’ve been tempted to buy, expecting a medium-term recovery. However, the scale of today’s downgrades, including cuts to the dividend payout, and that these forecasts now exclude the large losses from Canada, means that that temptation has disappeared this morning. Hence it is a further reluctant downgrade of my view to AMBER/RED.

Wilmington (LON:WIL)

Unch. 336p - Financial results for the year ended 30 June 2025 - Mark - AMBER

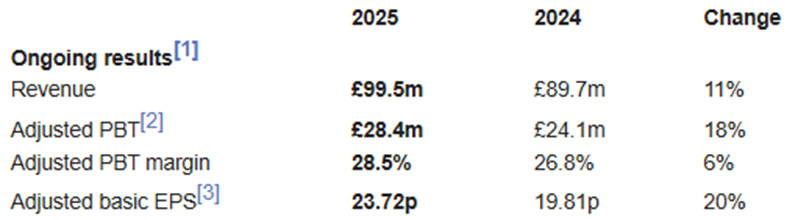

Wilmington describe themselves as a “provider of data, information, education and training services in the global Governance, Risk and Compliance (GRC) markets”. You’d expect this to be a growth area in the market, and the headline figures read well here, with double-digit revenue growth, and operational gearing leading to a 20% rise in EPS:

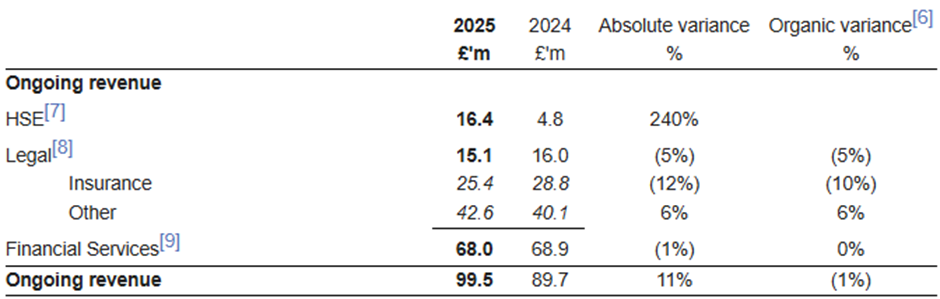

However, you quickly realise that there are three factors to untangle which add to the complexity: Acquisitions, disposals and adjustments. Let’s take these one at a time:

Acquisitions:

They acquired Phoenix Health and Safety in Oct 2024 and this appears to be responsible for all of the revenue growth:

It is largely this acquisition that means that net cash has declined by £25.5m to £42.2m.

They are proposing to buy Spanish business Conversia for £105m for 13xEBITDA, and their debt leverage ratio will go to 2x. While there are strategic reasons for this acquisition, this is not a cheap price (3.3x sales) and adds to the risk here.

Disposals:

They sold Compliance Week in Feb 2025, and are marketing their US events business, FRA. The £662k loss from sold and closed businesses is excluded, although it seems they have yet to classify FRA amongst this.

Adjustments

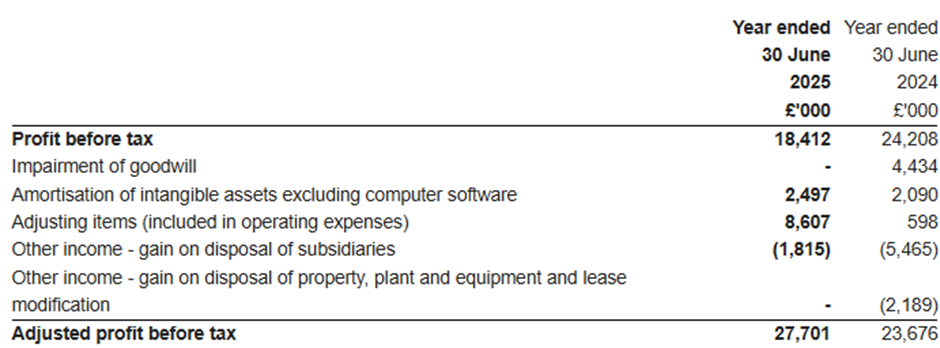

While adjusted EPS has grown, statutory results are down, mainly due to a big increase in adjusting items:

They say:

Strategic activities represent acquisition costs comprising earnouts in relation to the acquisitions of Astutis and Phoenix of £5.9m (2024: £nil) and strategic transaction costs relating to acquisitions and disposals of £2.7m (2024: 0.6m).

So this is another company that wants shareholders to give them the benefit of the acquisitions and disposals they make, but not count the costs against them. For wilmington, such costs seems to be an ongoing expense, as they say:

Alongside streamlining the Group since 2020 by selling or closing eight of the 15 businesses, we have consistently delivered notable profit growth over the five-year period.

Outlook:

They say that in the current quarter revenues and profits are in line with expectations. Presumably, current forecasts don’t include any impact of the Conversia acquisition, but even then the high multiple paid isn’t going to have an immediate material positive impact on earnings.

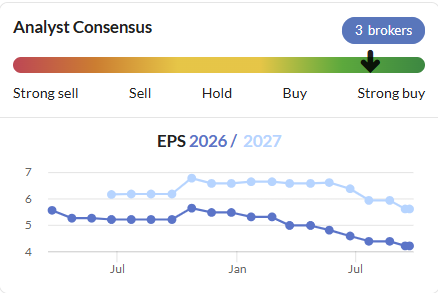

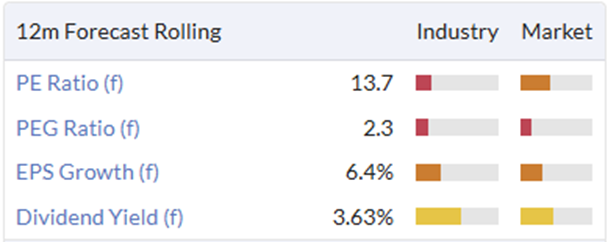

This means that the current forecasts, while not bonkers, don’t look appealing compared to single-digit percentage growth in revenues and profits:

Given the continued sale and purchase on businesses, you can almost guarantee that these figures will include significant adjusting items.

Mark’s view

When Graham looked at this in February, he said:

At 15x earnings it’s not particularly cheap, and that is likely to be before the adjustments are accounted for. Actual reported earnings per share were only 2.88p in H1. I may need to downgrade this further to AMBER, the next time I look at it.

It is a little bit cheaper today, but the risk looks to be ramping up with a strategic, but expensive-looking global acquisition, and no end in sight for the type of adjustments that do impact the company’s cash flow. I am going to cement my reputation as the cynical one and complete Graham’s potential reduction in view to AMBER.

Elixirr International (LON:ELIX)

Unch. at 830p - Interim Results & Acquisition of TRC Advisory, LLC - Mark - AMBER/GREEN

Decent growth in revenue here. Although around half of it comes from acquisitions and hence there isn’t any obvious operational gearing:

29p doesn’t leave much to do to hit the original FY forecast of 49.6p, although there was a seasonal bias to H1 last year. Having upgraded forecasts recently, their broker, Cavendish make further upgrades today, saying:

We have upgraded FY25E EPS by +12% (+8% organic, +4% from TRC), FY26E EPS by +18% (+2% organic, +16% from TRC) and our target price from 1100p to 1240p.

Helpfully, they have split out the impact of trading and from today’s acquisition. The acquisition itself seems reasonable, but not amazing value for a people business on an EV/EBITDA of 4.2x-7.8x dependent on contingent consideration earned during the top-up and earnout period. The initial payment is met by debt facilities and issuing shares:

The headline initial consideration payable under the Acquisition is US$57 million …The cash component of the initial consideration of US$41 million will be funded through the Company's increased revolving credit facility with National Westminster Bank PLCof £65 million and a US$20.25 million term loan with NatWest. The balance of the initial consideration of US$16 million will be satisfied by the allotment and issue of 1,428,526 new Ordinary Shares to the TRC Seller.

The size of the contingent consideration is significant, and adds to the leverage, if we consider this similar to debt, or dilution if they issue shares for this:

Deferred consideration of up to US$68 million, comprised of:

o A post-Completion contingent top-up payment, capped at US$32 million, to be determined by 30 April 2026 and based on the achievement of agreed FY 25 Adjusted EBITDA performance targets for TRC, will, if earned, be payable up to US$24 million in cash and up to US$8 million to be satisfied by the allotment and issue of further new Ordinary Shares (the "Deferred Elixirr Shares") to the TRC Seller.

o A further deferred performance-based payment of up to US$36 million, payable over three years (2026, 2027 and 2028) in three instalments, at the Company's discretion, either in cash or through the allotment and issue of further new Ordinary Shares (the "Performance Elixirr Shares" and together with the initial Consideration Shares and the Deferred Elixirr Shares, the "Transaction Shares") to the TRC Seller.

Back to the results, there are some large adjustments:

SBP is always a debate, and the size of these suggests we should definitely be using fully diluted share count in any valuation, as a minimum. Costs associated with their move from AIM to the main market should be one-off, but given that they have already announced another acquisition today, M&A maybe should be treated as recurring.

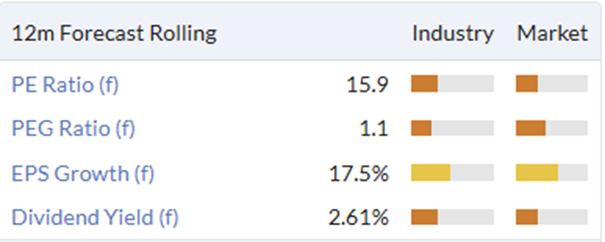

Valuation:

Today’s upgrades by Cavendish mean that the valuation metrics look a bit better than we have in the StockReport:

Now we have 14.9x FY25 EPS and 13.1x FY26. Seems reasonable value given the organic revenue growth rates, although some caution is probably required as this is largely a people business, which adds to the risk that the bulk of the returns go to staff not shareholders in the long term. Plus they now have modest net debt forecast, whereas they previously had net cash.

Mark’s view

The organic growth rates in today’s results are probably sufficient to justify the current valuation. When you add in the growth from acquisitions and history of upgrades, this may well be good value, even if one is more conservative than the company about what are really one-off costs. Roland had this is AMBER/GREEN following the H1 trading update and with a further acquisition and EPS upgrades, I am happy to take the same view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.