Good morning! This is a tanned, insect-bitten Graham with slightly more knowledge of the Spanish language than I had two weeks ago. I hope everyone is doing well!

3.20pm: we've run out of time for today, see you tomorrow!

Spreadsheet accompanying this report: link (last updated to: 5th September).

Today's Agenda is now complete.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Smiths (LON:SMIN) (£7.78bn) | Strong performance ahead of twice-raised growth guidance. Confidence in positive outlook. | ||

Kingfisher (LON:KGF) (£4.41bn) | SP +14% Upgrading full year guidance, targeting the upper end of adj. PBT £480-540m. | GREEN (Graham) Well done to Roland for going GREEN on this in May: his confidence is rewarded with a nice upgrade to profit and cash flow guidance. I am compelled to stay GREEN on this as I have no major concerns: I would only flag that today’s share price rise could be partly to do with news that the company is accelerating its share buyback plans. But overall I don’t see any current reason to change stance on this Super Stock. | |

Serco (LON:SRP) (£2.27bn) | Sole awardee under the contract. Ceiling value £720m over 5 years. £45m expected during 2026. | ||

Raspberry PI Holdings (LON:RPI) (£777m) | H1 PBT -43% (£6.2m). H2 has started well. Volumes expected higher. Profit exps unchanged. | ||

Oxford BioMedica (LON:OXB) (£757m) | Full year guidance confirmed: £160-170m revenues, low single digit £m op. EBITDA profitability. | ||

ZIGUP (LON:ZIG) (£719m) | Positive start to the year, on track to achieve market expectations. Leverage in line with target 1-2x. | ||

Mortgage Advice Bureau (Holdings) (LON:MAB1) (£394m) | SP +9% Rev +19.6%, adj. PBT +18.4% (£14.5m). Continues to trade in line with Board’s exps for 2025. | GREEN (Graham) [no section below] The bull thesis continues to play out here, which is a relief as this stock remains on my watchlist. The share price reaction today is interesting when we consider that the outlook today is merely “in line”, supplemented by adjectives such as “strong”. I note that statutory H1 PBT (i.e. PBT without adjustments) grew by 55% to £9.6m, while adjusted PBT grew to 18% to £14.5m. It’s a cleaner set of accounts with less influence from the complicated agreement to purchase the mortgage broker Fluent. More broadly, the mortgage market had a very active H1 (new lending up 22%) and it is this sort of environment I was hoping would turbo-charge MAB’s performance. Refinancing is also set to pick up in H2 as fixed rate mortgages mature. I continue to view this as a high-quality operation that is worthy of investigation. | |

Frp Advisory (LON:FRP) (£379m) | Continues to trade positively, in line with exps. Integrating acquired businesses as planned. | ||

Origin Enterprises (LON:OGN) (£362m) | Adj. EPS +12.8%, ahead of guidance. Well-positioned to execute medium-term strategy. | ||

Ocean Wilsons Holdings (LON:OCN) (£334m) | Court adjourned to allow objecting shareholder to present objections and exchange of evidence. | PINK (Graham) [no section below] It's noteworthy that the court is taking the objections of Arnhold LLC seriously. They had promised to show up at the Court Sanction Hearing to object to the merger with Hansa, and they will be given their chance to present their arguments. The independent NEDs at Ocean Wilsons say they are still confident that the merger go through, and I guess that it probably will, but I did not expect this speedbump. As I said recently, I do have sympathy with Arnhold's position, but I think the Board at Ocean Wilsons will be within their rights to go through with the planned merger. | |

Ab Dynamics (LON:ABDP) (£325m) | Confident of achieving target margin >20%. FY25 adj. op. profit to be slightly ahead of exps. | ||

Henry Boot (LON:BOOT) (£295m) | “Solid” first half in uncertain markets. PBT £7.8m (last year: £3.7m). On course to meet exps. | GREEN (Mark) This company is a mix of a property developer and a land banker. While it is good to see strong PBT in difficult conditions, the real value here is in the assets. NAV is down slightly (excluding a likely inaccessible pension surplus) to 304p. However, there has been around 8p of dividends in the year so including this there has been a slight rise in NAV. This means that the shares trade on around 0.7xTBV which looks good value. The real NAV may be significantly higher as the company only marks up the book value of their plots when they are sold, not when planning consent is achieved. Given the government's push for housebuilding they are accelerating their planning permission applications and if those are successful, increased sales will no doubt follow, boosting profits and NAV. As such, I see no reason to change our positive view here. | |

Yu (LON:YU.). (£259m) | H1 rev +9%, PBT +14% (£22.6m). On target for EBITDA/adjusted EPS in line with exps. | ||

B.P. Marsh & Partners (LON:BPM) (£250m) | Continued strong performance from portfolio. £52.6m funds (July 2025). Robust pipeline. Insurance market outlook: “parts of the market are softening, however, the Group's portfolio remains concentrated in specialist risk classes, where pricing is typically more resilient supporting confidence that our investee businesses are well positioned to deliver sustainable growth through the cycle. Industry consolidation shows no signs of slowing in 2025, creating attractive opportunities for the Group to realise investments, deploy capital into new vehicles, and support expansion within the existing portfolio.” | GREEN (Graham) [no section below] Conditions remain very pleasant for insurance investor BPM and its shareholders with the company enjoying large funds of £52.6m (July 2025 figure) as it continues to reinvest following a very large disposal. The “robust pipeline” speaks to the continued opportunities found by the company and another investment was announced only yesterday: a small £2m injection (debt plus equity) into a start-up insurance intermediary. Given BPM’s increased asset base these days, it has to work harder to move the needle: perhaps this new investee (“Salus”) will be a good place to invest further capital over time? BPM is taking it seriously, taking two board seats. Turning back to today’s announcement, we do not yet get an update on NAV, which was last seen at 890p (Jan 2025). With the shares trading at 690.5p, I continue to see plenty of value here. | |

Fonix (LON:FNX) (£217m) | Adj. PBT +2.1% (£14.3m), in line with expectations. Enters FY26 with strong momentum. | ||

Keystone Law (LON:KEYS) (£198m) | FY26 rev, adj. PBIT to be ahead. Adj. PBT comfortably ahead of exps (those exps being £12.9m). | ||

Smiths News (LON:SNWS) (£146m) | Adj. op profit for FY25 to be slightly ahead (exps: £37.2m). Received final £2m from McColl’s. | GREEN (Mark) [no section below] | |

Life Science Reit (LON:LABS) (£136m) | Contracted rent rises to £17.2m. Adj. earnings stable at £3.4m. Higher debt and finance costs. | PINK (managed wind-down) | |

Kistos Holdings (LON:KIST) (£136m) | Total production rate -26% (6,200 boepd). Rev -22%. On track to meet production guidance. | ||

Diaceutics (LON:DXRX) (£129m) | Rev +22%. Adj. EBITDA £0.1m. LBT £3.0m (last year: -£3.3m). On track for full year “profitability”. | ||

MPAC (LON:MPAC) (£88m) | Order intake +7.5%, rev +41.2% (thanks to acquisitions). Full year guidance unchanged. | AMBER (Mark) | |

Carr's (LON:CARR) (£77.1m) | FY25 revenue £78m slightly below £80 m consensus, adj. Operating profit in line with expectations of £3.6m. Net cash £3.4m. During the peak seasonal trading period, all markets are trading in line with management expectations. | ||

Iqe (LON:IQE) (£76.1m) | Revenue -31% to £45.3m, LBITDA £0.4m (24H1: EBITDA £6.6m), adj. net debt £23.5m (24H1: £17m). Outlook: FY25 revenue £90.0-100.0m, adjusted EBITDA between £(5.0m) to £2.0m, as previously announced. Sale of Taiwan operations received early-stage expressions of interest. | ||

Amcomri (LON:AMCO) (£74.5m) | H1 Revenue +17% to £31.8m, Adj EBITDA +15% to £4.3m, PBT +11% to £2.1m, Net Debt £11m (31 Dec: £6.2m). Outlook: “Confident in full year 2025 performance and well-positioned heading into 2026, supported by recent acquisitions, diversified and robust end markets and solid underlying commercial development prospects in operating companies.” | ||

hVIVO (LON:HVO) (£61.8m) | H1 Revenue -32% to £24.2m, Adj. EBITDA -66% to £3.0m, Adj EPS -64% to 0.29p, Cash £23.3m (24H1: £37.1m), Orderbook -44% to £40m. Outlook: “Trading remains in line with market expectations for the full year with the Company expecting to deliver revenues of £47 million and low-single digit EBITDA loss (pre-exceptional items) for the full year.” | ||

Real Estate Investors (LON:RLE) (£56m) | H1Revenue -14% to £4.8m due to property sales, u/l PBT -16% to £1.5m. EPRA NTA/share 50.6p (FY24: 51.3p), Q2 dividend 0.4p (24Q2: 0.5p). £5.3m sales post period end for c.96% of book value. Total debt £34.9m. | ||

Kooth (LON:KOO) (£54m) | H1 Revenue -1% to £32.1m (+1% CCY), Adj. EBITDA -79% due to accelerated investment. LBT £1.3m (24H1: PBT £3.9m) Net cash £15.3m (24H1: £14.9m). Revenue and adjusted EBITDA in line with expectations on a CCY basis. (revenue 2-3% below and EBITDA 6-8% below at current FX rates.) | ||

System1 (LON:SYS1) (£50.8m) | Revenue in H1 FY26 is expected to be 5% lower than in H1 FY25 due to the continued reduction in non-platform business. Expects full year financial performance to be materially below current market expectations. | BLACK (AMBER) (Mark - I hold) | |

FIH (LON:FIH) (£36.9m) | Trading in Falklands Islands Co. continues to be challenging. “Progress is being made.” | ||

Mast Energy Developments (LON:MAST) (£35.4m) | Expected cumulative gross profit c. £6.5m, plus inflation increases, on top of existing £1.7m contract. | ||

Surface Transforms (LON:SCE) (£31.2m) | Rev +72% (£8.1m), loss before tax £5.6m (H1 last year: 7.6m). Cash £1.2m. Self-fund is “attainable”. | ||

First Tin (LON:1SN) (£27.8m) | CEO: “these results… validate our interpretation that additional mineralisation exists…”. | ||

Ebiquity (LON:EBQ) (£25.7m) | US market conditions have proved challenging for longer than previously anticipated. Now expects to report full year revenues of in the region of £75 million, in line with 2024 revenues, and an adjusted operating profit in the region of £5.5 million. | BLACK? | |

Mission (LON:TMG) (£20.9m) | H1 Revenue from Continuing Ops -4% to £33.7m, PBT +97% to £1.1m, EPS +50% to 0.9p, Net Bank Debt £13.7m (24H1: £19.6m). H2 weighting, challenging trading environment but on track to meet full-year headline operating profit and margin expectations. | ||

Transense Technologies (LON:TRT) (£18.7m) | FY Revenue +33% to £5.55m, PBT +12% to £1.41m, Cash £1.14m (FY24: £3.44m). Aim to maintain profitability as Bridgestone royalty income reduces. Confident that this can be achieved with some improvement in revenue visibility. | ||

Vulcan Two (LON:VUL) (£16.6m) | H1 LBT £80k (24H1: LBT £15k), Net Cash £4.5m (24H1: net debt £123k) | ||

Oriole Resources (LON:ORR) (£14.7m) | H1 LBT £0.57m (24H1: PBT £1.15m), Cash at 31 Aug £0.68m (31 Dec: £1.13m) following £0.62m from BCM. | ||

Safestay (LON:SSTY) (£14.6m) | H1 revenue -6% to £10.1m, Adj EBITDA -28% to £2.3m, PBT £0.6m (24H1: LBT £0.1m), Cash £1.7m (24H1: £2.2m), NAV -4% to 47.8p/share. Significant price pressures impacting FY revenue, which is expected to be lower than 2024. (Stockopedia previous consensus 10% revenue growth.) | BLACK (RED) (Graham) [no section below] We’ve been nervous about this one; Roland was AMBER/RED in June and I think the downgrade to fully negative is correct now after a very weak outlook statement. H1 (to June) sees a small PBT from continuing operations of £591k but July and August are the key months for hostels and these months were “impacted” by a “deterioration in market conditions”. Cash at bank as of June was £1.7m, and at the same time there were bank loans of c. £20m. It is yet to show an annual profit. | |

Switch Metals (LON:SWT) (£11.2m) | 400 tonnes of samples collected on schedule and on budget. First resource estimate for Issia on track for early 2026. |

Graham's Section

Trustpilot (LON:TRST) (no RNS: attempted bear raid)

Thanks to f6317 in yesterday’s comments section who noted that Trustpilot had recently attracted the attention of a US-based activist short-seller. I had never heard of this short-seller (“Hithawk Research”) before: it appears to be active only for the past two years, and it is anonymous.

While I’m all for short-sellers exposing wrongdoing by publicly-traded companies, I’m uneasy when they do so behind the mask of anonymity. Unless they are whistleblowers at the risk of losing their jobs - and I don’t believe that’s the case here - then why hide behind anonymity?

If I was ever advising a public company that was the target of a bear raid from an anonymous short-seller, my first advice would be to ignore it. Anonymous traders do not have credibility on the public stage, and so there is no need to respond to them.

As for the claims made by the short-seller, I do agree that the competitive threat from Google is (potentially) a serious long-term challenge for the company, but that is nothing new, and it is only hypothetical.

The primary thrust of the short-seller’s argument is that the business model is inherently fraudulent:

Businesses have no right to not be listed on Trustpilot.

Removing fake/defamatory reviews requires signing up to Trustpilot’s T&Cs.

The alleged removal of positive reviews for businesses without a paid plan, while those who do pay can filter out low-rated reviews.

Fake reviews: the short-seller claims that there are too many 5-star reviews relative to other ratings, and using an AI language model to analyse reviews, says that 5- star reviews are “clearly fabricated”. It’s not clear how extensive this analysis was: three businesses are mentioned.

Etc.

My view: this is not a stock I own, but it is a stock on which I’ve generally had a positive view, and I don’t see any smoking gun here. If Trustpilot was engaged in creating or knowingly allowing fake reviews, that would be an enormous scandal, but there is no proof of this happening.

Removing fake reviews is an enormous task that would be faced by anyone - e.g. Google - who attempted to take Trustpilot’s market position.

More fundamentally, it seems to me that businesses should not have a right to not be listed on Trustpilot, and should not have a right to prevent themselves from being discussed on Trustpilot. The company’s position has been tested in the UK when it comes to defamation law, and I expect that it will be tested again. The courts have sided with Trustpilot.

It’s true that those who pay Trustpilot for a Premium plan tend to get far better reviews than those who don’t pay - that is a fact, but it’s also very well-known. Businesses with a Premium plan have many benefits, including the ability to conveniently invite their customers to give them positive reviews.

I would like it if Trustpilot made it more obvious which companies have a Premium plan, and which ones don’t (although the review scores themselves are often the best clue!).

Overall, it seems to me that this is a very risky short. I’ve written before about the hallmarks of the best investments, and one of them is having a very high market share. Companies with monopolistic characteristics tend to be incredibly profitable. Think of Google/Alphabet, or in a UK context, think of Rightmove (I am long RMV).

When a company enjoys monopolistic pricing power, this does breed resentment among customers or potential customers who resent dealing with monopolistic power - I don’t deny that. There are always risks of the monopoly being broken up legally or attacked by competitors. Unhappy customers or potential customers may cause reputational damage. But these powerful companies can still often make for the most lucrative investments.

In fact, when I hear that customers are unhappy with the price they are being charged for a service like this, I will often take this as a bullish sign - it implies that customers feel they have little alternative but to pay, which reinforces that we are looking at a very powerful monopoly.

Roland reviewed Trustpilot’s H1 results last week: revenues were up 21%, adj. EBITDA up 70%, and the company continues to enjoy a large cash pile ($67m). Little wonder that the short-seller said “it is not Trustpilot’s financial position that raises our greatest concerns” (!).

I do think that the stock may be fully valued at this level. The ValueRank is only 3, and there is a risk of the stock underperforming. But if that happens, I expect that it will be for valuation reasons, not because there is something inherently shaky with the business model - from an investment standpoint, the business model is terrific.

The short-seller report was published last Wednesday. TRST’s share price has not reacted very much:

Kingfisher (LON:KGF)

Up 14% to 287.8p (£5.03bn) - Half Year Results - Graham - GREEN

Roland took a positive view on the owner of B&Q/Screwfix in May, consistent with the company’s StockRank of 99.

Today it publishes decent half year results but more importantly they are accompanied by upgrades to full year profit and free cash flow guidance.

Some headlines:

“Retail profit” - a measure of store profits excluding head office costs - rose 7.1% at constant currencies.

Adjusted PBT is up by 10.2% to £368m. Actual PBT is up by 4.1% (£338m)

Net debt reduces to £1.7bn and very importantly this includes £2.25bn of lease liabilities. Exclude them and the company is in a net cash position.

And in terms of outlook:

Upgrading full year guidance now targeting the "upper end" of FY 25/26 adjusted PBT of c.£480m to £540m, and free cash flow of c.£480m to £520m (previously £420m to £480m)

CEO comment:

"We delivered a strong first half with high quality underlying like-for-like sales growth of 1.9%, driven by increased volumes and transactions. Our teams continue to execute at a high level, delivering double-digit growth in our strategic initiatives, trade and e-commerce, which supported our market share gains…

"In a higher cost environment, we remain disciplined on managing costs and cash. Our margin and operating cost initiatives combined with the positive impact of our strategic drivers enabled us to deliver 10.2% growth in adjusted PBT and 16.5% growth in adjusted EPS…

"Our expectations for our markets for the year remain consistent with what we outlined in March, whilst mindful of mixed consumer sentiment and political uncertainty. Combined with our H1 performance, this gives us the confidence to upgrade our full year profit and free cash flow guidance and to accelerate our share buyback programme…

Graham’s view

I’m going to have to stay positive on this considering that we were already positive, and it has now issued an ahead-of-expectations update.

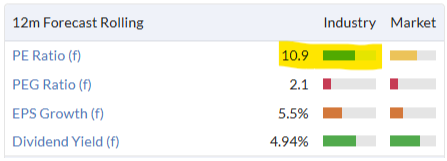

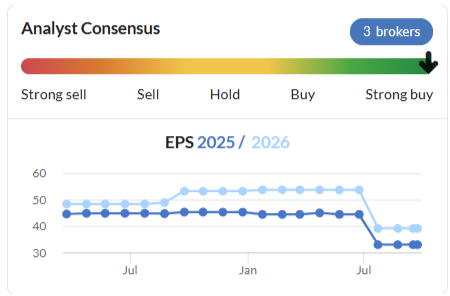

Fortunately, it does not appear that the valuation has overheated yet. The metrics as of last night:

Now personally I would not be inclined to put retailers on high multiples, but you can see from the above that KGF is not coming out as expensive even within its industry (specialty retail).

If I had one concern, it would be that the market’s reaction today might involve some element of people front-running the share-buyback, as the company has committed to buying back the next £200m+ of its £300m share buyback by the end of March 2026, i.e. over the next 5 months.

But please don’t interpret this as a major criticism of the £300m. buyback. Given its existing healthy finances, I think it can afford it.

Free cash flow guidance for the year is £480-520m, which is approximately enough to fund both its regular dividend and the £300m buyback.

Having said that, the company is also planning for c. £350m of capex this year. So it is going to take on a slightly riskier financial profile when all is said and done.

I personally don’t find this share to be all that tempting, but that’s purely because of the cyclical nature of the retail sector in which it operates. When it comes to its present valuation, balance sheet, current trading, outlook and international profile (UK/Ire, France, Poland and others), it offers plenty of attractions.

Mark's Section

System1 (LON:SYS1)

Down 33% at 267p - Trading Update - Mark (I hold) - BLACK (AMBER)

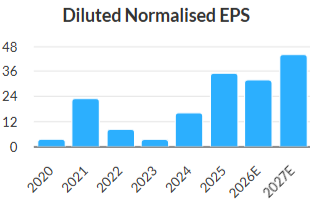

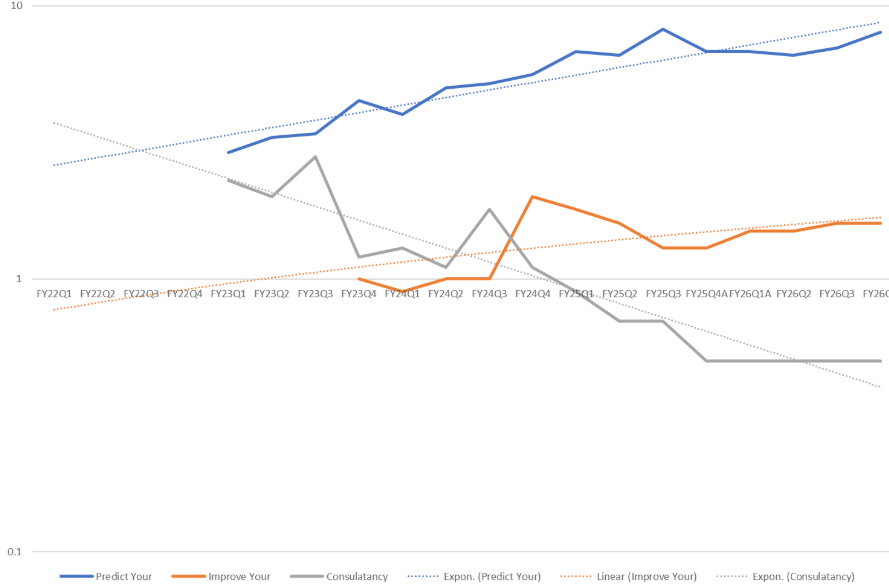

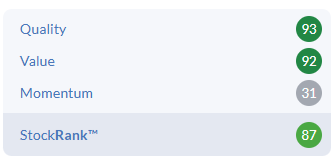

It’s been quite the two years for this marketing platform provider. At the end of 2023 it looked expensive on the market forecasts of around 5.8p EPS for FY24 and 10p for FY25. However, FY24 EPS came in at 16p in the end, and by mid-2024, FY25 forecasts had risen to 23.5p and the share price was touching £8:

When FY25 results were released a year later EPS came in at 35p:

Yet the share price had fallen back below £4, on concerns that FY26 EPS was going to be lower than FY25, despite the company guiding that revenues would continue to grow 15% in tough market conditions. The cause of the drop was due to “continued investments as previously noted in US growth, innovation and go to market”. Their broker kept a 44p EPS estimate on a further 16% growth in revenue into FY27 which would have made them look cheap, especially with around a fifth of their market cap in cash. However, today, we get this shocker:

As a result of H1 trading, the Board expects full year financial performance to be materially below current market expectations. Revenue for FY26 is expected to be broadly in line with the £37m achieved in FY25 and full year Adjusted PBT in a range between £2.0 to £2.5 million, reflecting the Company's increased investment in medium term growth opportunities.

They helpfully quantify the miss:

For the purpose of this announcement, the Group believes market expectations for FY26 to be revenue of £42.1m and adjusted profit before taxation of £5.8m.

With PBT now expected to be around a third of previous levels, this is a huge miss. The share price is almost back to where it began this journey at the end of 2023. This case study, underlines three market tendencies:

Investors tend to over-react to short term news and over-extrapolate recent trends. The System1 share price peaked at £8 before the EPS trend peaked.

Operational gearing goes both ways. This is a company with around 80% gross margins, and while I think this may be partly due to how they account for costs, the impact of a slight decline in revenue leads to a big miss on EPS.

Investors hate anything where short term investment negatively impacts earnings. I fall for this trap myself, as I tend to be an investor who focuses primarily on the numbers. Investors often choose to ignore the impact of investment when it comes as capitalised costs, such as money spent on new equipment, acquiring other businesses or internal development that is capitalised. However, if a company expenses increased investment the usual response is a share price sell-off. It is no wonder many companies prefer a strategy of repeated acquisitions (despite evidence that most acquisitions destroy shareholder value), rather than internal investment.

None of these mean that today’s 33% fall in share price is an over-reaction. Indeed, it may well be an under-reaction, given that their broker Canaccord have cut 2026 EPS from 31.3p to 11.6p and FY27 EPS from 43.2p to 14.8p.

Backing the numbers out of the RNS and broker’s note, the implied revenue trends would mean that “Predict Your” would likely return to trend, but from a lower level given the weak 25Q4-26Q2:

The risk is that this is a H2-weighting that may not materialise, leading to a further profits warning.

Valuation:

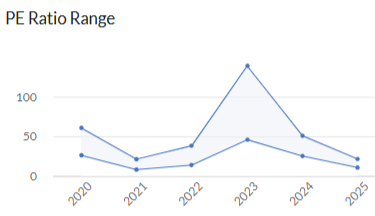

Taking into account the EPS cuts and share price drop today, and adjusting for the cash balance, I get that the underlying cash-adjusted forward P/E is now around 14, dropping to 11 for FY27. This is reasonable compared to historical averages, but no where near as cheap as it appeared to be before today's major warning:

If one believes that the current investment that the company is making will drive medium-term growth and that this is a hiccup, then this sort of rating isn’t crazy. The biggest risk is that this is an underlying change in the business, perhaps driven by competition, rather than just a macro weakness. It is my lack of understanding around their competitive position that means I (thankfully) only had a relatively small position here.

One thing that perhaps give confidence that this may just be macro conditions is that they are still winning new customers, they say the issue is that “The Company is continuing to see lower, but ongoing, spend from many of its largest clients, due to the wider macroeconomic uncertainty.” It is also clear that the huge drop in EPS is due to higher admin costs, part of which is described as investment. If this doesn’t pay back, they have the option to cut back admin costs which would have a positive impact on short term profitability (possibly at the expense of long-term growth).

The dividend forecasts have been cut along with EPS so while investors who hold on Thursday this week will receive an 11p dividend (5.5p Final + 5.5p Special), going forward the dividend yield is only expected to be around 2% at the current share price.

Mark’s view

I have a small holding here, making today’s fall painful, especially since the immediate valuation multiples are now above what I would normally consider cheap. These show the impact of a relatively modest revenue miss on a company with high operational gearing, where costs have been ramping up due to planned investment. The risk is that this miss is a sign of not just weak customer spend, but increased competition or a more serious change in customer behaviour. That they are still winning new customers and the issue is that existing customers are spending less, partly assuages that concern. This means I am torn over what action to take here; selling a subscale position or adding to bring it up to size. The reality is that I will probably take no action in the short term. At the current price, and given the cash balance and ability to cut costs if current investment fails to deliver, it would seem a mistake to sell purely on a near-term EPS cut. Yet the uncertainty around whether a H2-weighting can actually be delivered means I am reluctant to add in the short term until there is a clear upward trend in platform revenue again. I guess that makes it an AMBER for me.

Kooth (LON:KOO)

Down 9% at 137p - Unaudited Half Year Results - Mark (I hold) - AMBER/GREEN

This is another one of my holdings that report today where the market remains unconvinced by its long-term growth strategy. At least this one says:

The Group expects to deliver revenue and adjusted EBITDA in line with expectations for the year before accounting for the potential impact of foreign exchange movements. At current rates the expected impact would be to reduce full year consensus median revenue of £66.8m by c.2-3% and consensus median adjusted EBITDA of £10.2m by c.6-8%.

Of course, for many UK companies with large US operations, in line on a constant currency basis is actually slightly below. Perhaps more worrying is that these H1 results leave a lot to do in H2:

Reported revenue fell marginally by £0.4m to £32.1m (2024: £32.5m). This was due to the impact of a £0.8m negative foreign exchange (FX) movement together with contract changes, largely in the UK, that reduced revenue by £0.6m, offset by a £0.6m New Jersey contract win and £0.4m of additional revenue recognition in California.

Adjusted EBITDA of £1.6m (2024: £7.8m) decreased in line with the accelerated investment in key areas of focus including user marketing in California as noted above.

Canaccord reduce their EBITDA forecasts for the currency effects to £9.4m, but that still leaves £7.8m to do in H2. However there are some reasons to think that this is reasonable:

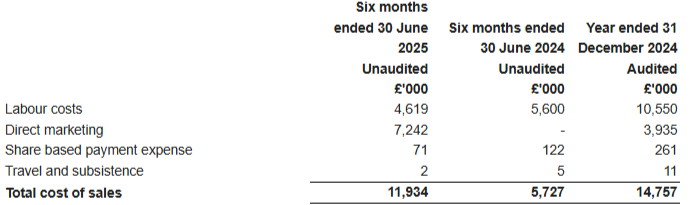

1. They say that the one-off investment in increased marketing is now complete. This is backed up by the accounts where direct marketing is the only part of COGS that has increased:

2. Other administration costs look to be well-controlled:

3. Users in California continue to grow and they expect to exceed targets for 2025 here.

Longer term, their next generation “Soluna” platform is due to launch in the UK in 2026, and in the US, states continue to want to target more cost-effective early intervention for mental health. Canaccord forecasts modest revenue growth for FY26, but a 20% increase in EBITDA to £11.3m (although again, this is tempered by currency effects.)

Valuation:

Canaccord are also forecasting around £20m of net cash (working capital flows are responsible for the lower figure at the half year). Therefore the company is on 3.2x FY25 EV/EBITDA, falling to 2.6x for FY26. Of course, EBITDA is not always a great measure for companies that capitalise intangible development. However, this is now running below D&A, meaning cash flow will benefit going forward.

These multiples are pretty cheap for a company with plenty of growth runway ahead of it. Canaccord moderate their price target today, again reflecting the currency impacts, but note that this is still almost 3x the current share price, saying:

Kooth trades on an FY26E EV/Sales and EV/EBIT of 0.5x and 6.3x, a considerable discount to peers (>80% and ~70%, respectively) and, in our view, looks too cheap given Kooth's profitable growth outlook. We update our target to 430p (from 490p), based on a CY25E EV/Sales of 2.2x and EV/EBIT of 20x on our revised estimates, both in line with peers.

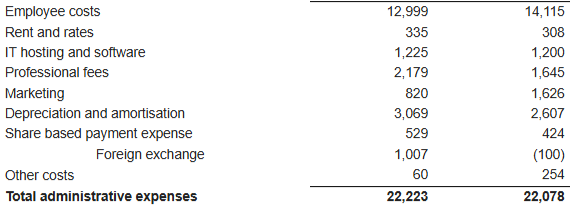

This is reflected in the very strong QV-rank (although these may fall in the short term when these H1 results are assimilated):

There is no dividend here, with the company preferring to retain capital for growth. There was a buyback earlier this year, but no sign of anything similar in today’s results. This makes sense if the company can grow as rapidly as they have in the past. However, if that growth has now slowed, I would want them to look to return some of that cash balance to shareholders in the form of dividends or buybacks.

Risks:

The major risk remains that this is a business highly exposed to government funding in one large market, namely California. Indeed, the last time the shares traded at the current levels was in the run up to the California budget statement, when investors worried that financial pressures may reduce the willingness of this state to fund digital mental health services. As it happens, those fears proved unfounded. However, the company's other territories have yet to deliver revenue anywhere near that scale.

Like many topics these days, there seems to be an increasing polarisation along political lines. It seems that in the US digital mental health services is one of those topics. Democratic voters seem to believe in the role of external services in improving teen mental health, whereas Republicans tend to prefer everything to be kept in family units. This means that, realistically, Kooth can only target Blue states for contracts to grow their business.

Mark’s view

I can see why the market has not been convinced by the headlines here. Negative currency impacts and a large H2-weighting add to the risks that there are deeper issues than the company is letting on. However, looking at the detailed cost breakdown in the accounts, this matches the narrative that the company has engaged in a one-off marketing campaign in order to grow its user base in the key Californian market. Given this, I don’t see why the (reduced due to currency impact) forecasts are not achievable. This puts the company on a modest 2.6x 2026 EV/EBITDA, which seems low for the long-term growth potential for digital mental health services. Roland downgraded this in July on contract renewal and valuation concerns, but with the share price now some 30% lower, and the net cash magnifying the effect on a EV basis, I’m going to nudge it back up to AMBER/GREEN.

MPAC (LON:MPAC)

Up 7% at 315p - Half Year Results - Mark - AMBER

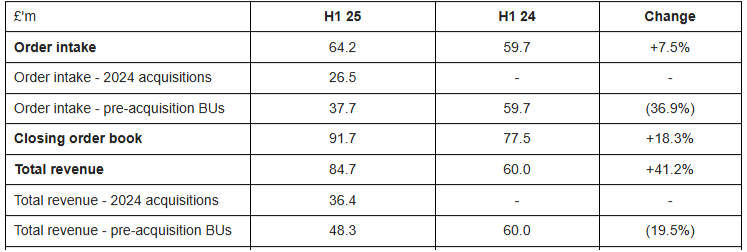

The market has liked these results this morning, presumably since there was no further deterioration since the July 1st trading update when a weak order book led to them saying:

…due to the expected impact from slower orders in Q2 the Board now expects FY 2025 revenue to fall significantly below the Board's previous expectations.

Shore now have £165m revenue forecast for FY25 and 33.5p adjusted EPS. These H1 results have £84.7m of revenue and 12.1p adjusted EPS, leaving £80.3m and 21.4p of EPS left to do. Despite the weakening order book, the revenue looks achievable, as they say:

We held a £91.7m order book going into the second half of 2025, providing good coverage of updated revenue expectations for FY 2025. The full year revenue expectation is based upon £19.0m (11%) of revenue coming from orders still to be won in H2 2025, primarily from short-cycle service business.

However, they will be reliant on cost savings to make that EPS figure. These are the actions that Shore say will contribute to this:

Mpac has consolidated its US operational footprint with Cleveland closed, moving production to BCA in Boston (i.e. two of the smallest/less efficient business into a single larger efficient site), with Mississauga operations in Canada downsized. So, capacity has been reduced, contractors released, and a lower headcount achieved. Capex and discretionary spend has been restricted. A lower cost engineering hub has been opened in Malaysia supporting global activities. Manufacturing capability in Romania is now supporting wider UK and European projects across the Group.

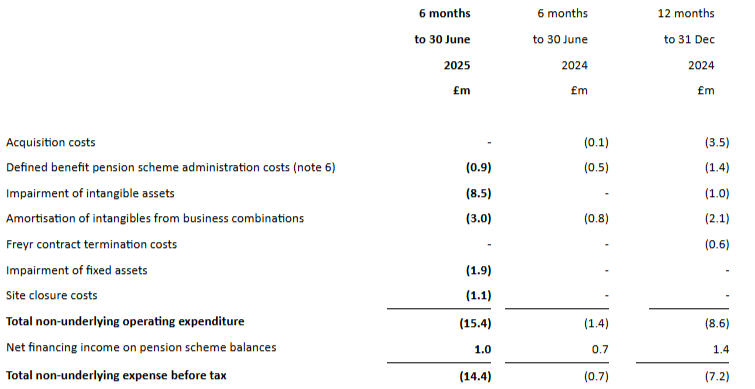

I have been critical of the adjustments MPAC have made in the past. Here are today’s figures:

The underlying results are stated before pension-related credits/charges of £0.1m (H1 2024: £0.2m), comprising charges in respect of administering the Group's defined benefit pension schemes of £0.9m (H1 2024: £0.5m) and finance income on pension scheme balances of £1.0m (H1 2024: £0.7m), amortisation of acquired intangible assets of £3.0m (H1 2024: £0.8m) and acquisition costs of £nil (H1 2024: £0.1m). In H1 2025 the Group incurred a non-cash charge of £11.5m related to the consolidation of the Cleveland and Boston sites.

The cash contributions to the pension scheme look to go away with the possible buy-in from Aviva. However, it is worth noting that this doesn’t mean that the admin costs go away,as they would with a buy out. In this period, finance income has covered these costs. However, presumably these income generating assets will go to Aviva. So it is not clear to me that these admin costs won’t be an ongoing burden to the company. The good news is that as the group has grown, they have become a lower proportion of profits.

The other thing that springs to mind reading these adjustments is that if they could consolidate sites, generate significant savings and all the costs were non-cash write downs, why didn’t they do this earlier? The answer seems to be that there are cash costs associated with the re-organisation that they haven’t mentioned above:

Still, this should be one-offs and will generate ongoing savings that should help them meet forecasts. They have been saved from a significant order book and revenue decline by those acquisitions:

But the cost is that net debt now stands at £43.2m, excluding £11.8m of lease liabilities. This is around half the current market cap. So while the current 9x Adj. EPS looks potentially good value, we really should be using EV measures here. The forward EV/EBITDA is around 6. This isn’t crazy, but we have to remember that this is a company that capitalises intangibles, and where some of the adjustments may be a little aggressive. On this basis it's probably priced about right.

Mark’s view

When I first saw these results, I was a little sceptical that the company would be able to make up what looks like a big H2-weighting to hit their FY EPS figure. However, looking at the details, I think the potential cost savings may get them over the line, despite the weak order book. Our usual concerns around their questionable adjustments remain, but with the pension scheme liability potentially going away, this may look a bit better in the future. The business has been rather saved from significantly declining sales by the acquisitions they made last year. However, this has come at a price of increased debt, adding to the risk and making the relatively low earnings multiples a misguided way to value the business. Roland viewed this as AMBER/RED following the profits warning due to the risk of a further warning and what that may mean for their financial strength. On more realistic EV measures, this looks priced about right for this sort of business, so with today’s in line statement, I am tentatively updating our view to a more neutral AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.