Good morning!

Ed and I presented a webinar yesterday with our thoughts on results season - here's the link. There was too much to discuss but we did our best!

As for today, I'd like to catch up on some stories we missed during this busy week, so I'll be looking again at all the comments under the reports.

Hanging up the pen now, cheers!

Webinar Overview

Macro (from Ed):

- End of September is one of the major annual spikes in results announcements.

- Companies in January with "ahead" statements and big jumps have, in aggregate continued to do well since then.

- This is consistent with the lesson to buy/hold when companies are ahead of expectations or see big price jumps.

- Rates are falling but are still 1% higher than expected (4% vs 3%). Inflation has been sticky, nudging higher (close to 4%).

- FTSE All Share index still significantly cheaper than international peers despite performing well this year, matching the S&P 500 year-to-date

- "Don't fight the tape. Don't fight the Fed." - Martin Zweig.

- Gold price rocketing.

Core Discussion Themes:

1. Investing: brokers, funds and platforms.

- Peel Hunt/Cavendish. Not many IPOs yet. Cash-rich investment banks waiting for activity to pick up again.

- Jupiter Fund Management: their CCLA acquisition looks promising (good value). Shares have recovered well but could have more to go (StockRank 99, MomentumRank 99).

- Polar, Impax (I own), Mercia all interesting in their own ways.

- IG Group (I own): volatility has calmed down since Trump tariff panic, still like it as a long-term hold.

2. Retailers.

- Currys: LfL revenue growth 3%, gaining market share - general market not strong.

- DFS: finely balanced outlook statement. Consumer strength is not strong or weak.

- Jet 2/OTB: consumers delaying holiday purchases until they are sure they can afford it.

3. Video game companies.

- Frontier Developments: huge post-Covid fall. Primed for recovery? Big release coming out in October.

- Everplay: indie developer and publisher. Maker of Worms. Lower risk due to back catalogue revenues, more diversified.

4. Defence

- Goodwin: amazing RNS, big contract with Northrup Grumman. Family business, not interested in the City. No forecasts.

- Rolls-Royce: big upgrade back in July. Valuation worrying at these levels. High Flyers can quickly become Falling Stars.

- Babcock/Cohort: very pleasant conditions for companies to benefit from government spending in the sector.

5. Government contractors (Ed)

- Morgan Sindell/Galliford Try/Kier. New "frameworks" guarantee revenue and allow the companies to share in gains and losses, less risky than Cerillion days.

- Made Tech: IPO failure, now on recovery with government spending on digitisation.

6. Gold sector (Ed).

- Producers: Serabi (Brazil), Altyngold (Kazakhstan). Improving the amount of recoverable resources as they mine out.

- Explorers: Metals Exploration, Thor Exploration.

- Operational gearing and balance sheet healing thanks to the high gold price. Net debt moving to net cash.

- Junior Gold Miner ETF has doubled.

7. Lenders

- International Personal Finance: Graham still not entirely satisfied by bid from New York buyer.

- DFCH: discount to net assets, big increase in EPS estimates, expanding to new loan types.

- ASAI: microfinance in Africa and Asia, average loan only $210, millions of customers.

- MAB1: benefiting from increase in new mortgage lending, refinancings also to pick up.

Case study from Ed: high-rank shares have an uncanny ability to outperform profit estimates, driving momentum. Can check this by clicking on "Print" on a company's StockReport and downloading the report from a year ago. Look for companies with high StockRanks and surprisingly low profit growth forecasts! Morgan Sindall is a good example.

My thoughts post-Webinar: I have to say that I think these are very nice conditions in which to be investing. We all suffered the small-cap bear market for a long time, but it now looks like we have possibly turned a corner as many sectors (not all by any means!) have recovered well. And yet overall valuations aren't excessive. There are still plenty of cheap P/E multiples out there for those focused purely on value.

If you look at the sectors we covered in the webinar, I think it would be hard to argue that many of them are in bubble territory. Some of them (gold, defence, government contractors) have performed extremely well, but the reasons for that strong performance are logical (high gold price, government spending). So I don't think that the market as a whole has become irrationally optimistic yet - far from it!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Pennon (LON:PNN) (£2.1bn) | On track against expectations in 2025/26. Target RORE (return on regulated equity) 7%. | ||

Ceres Power Holdings (LON:CWR) (£274m) | SP -14% Most probable revenue c. £32m (StockReport: £53.5m estimate!). Uncertain timing of revenue recognition from new agreement. | BLACK (RED) (Graham) [no section below] We've been cautious on this one, e.g. Roland in July. More recently, Megan provided a preview for us in The Week Ahead. Today's results to June 2025 start off with the good news: cash and short-term investments of £104m. The pre-tax result is a less promising £19m loss - worse than £11m loss seen in H1 last year. The company has been cutting costs. I can't claim to understand the technology at play here but I know a revenue warning when I see one; CWR was supposed to generate far more revenues this year than the £32m they have guided for today. I'm going to give this a RED today on the back of this negative surprise. Material losses are forecast for the foreseeable future, but I could still upgrade it to AMBER/RED if it meets forecasts over the next 6-12 months, as it should at least have enough cash to survive the next few years. | |

Big Technologies (LON:BIG) (£251m) | Resolutions to remove and replace the Chairman. Supporting shareholders hold 52% of active voting rights in BIG. | ||

Seeing Machines (LON:SEE) (£122m) | Significant 5-year agreement with leading UK bus OEM. OEM manufactures 1,700 units annually. | ||

Quadrise (LON:QED) (£81m) | SP -5% Addendum to June 2023 agreement with Valkor in Utah. $1m due to QED will be rephased over the period to June 2026. | ||

Brave Bison (LON:BBSN) (£75m) | Lord Ashcroft wishes to appoint a new Director to the Board. | ||

Ondine Biomedical (LON:OBI) (£75m) | Continued commercial expansion and clinical progress. Revenues +18% ($1m), loss from operations $12.5m. Cash $5.6m. | ||

Time Out (LON:TMO) (£48m) | TMO’s 13th food and cultural market opens following last week’s Budapest opening. | ||

Carclo (LON:CAR) (£47m) | Performance in line & exps unchanged. D&E revenues to partially recover in H2, strong margins to be maintained. | ||

Tandem (LON:TND) (£11m) | SP -9% | AMBER/GREEN (Graham) [no section below] The share price here has made a little upward progress since I covered it in March. I used to own a large (for me) stake in this business, but lost interest after years of limited progress. With an £11m market cap today, it continues to struggle to take things to the next level. At least the outlook is in line, and Cavendish have issued a note today leaving their forecast unchanged: adjusted EPS of 8.5p in the current year, with an adjusted PBT of £0.5m . Net assets are £23m of which only £5.5m is intangible. It remains objectively cheap in balance sheet terms, and is categorised as a "Super Stock". It just never seems to generate enough real profits to get taken seriously. Historically, there has also been a capital allocation problem in my view - meaningful profits have been generated from time to time, but have not been reinvested successfully. The company has posted a small operating loss and a £400k pre-tax loss for the first six months of the year. I like to think that I'm a patient investor, but personally I don't have the patience for this one. It's still AMBER/GREEN for the potential it has to come good some day. | |

Blackbird (LON:BIRD) (£11m) | Elevate.io will be exhibiting at Chamber’s “Annual Business Expo” today. | ||

Smarttech247 (LON:S247) (£11m) | SP -64% Numerous contract wins but margins to be slightly softer than anticipated: trading EBITDA and profit to be less than guidance. Company is undervalued; a delisting will provide greater strategic flexibility. | RED (Graham) [no section below] Commiserations to anyone holding this overnight. From £10m and below, I tend to be very concerned about delisting risk, but this shows that being just over £10m is no defence against delisting. In fact the risk here was heightened by the presence of a majority shareholder who owns nearly 70% of the company, as I pointed out in January. This share is now only suitable for those who are happy to own a private company, so I'll put it RED today to further emphasise the special risks and complications associated with that. The lesson is that life is easier when we stick to companies that are a little bigger than this, with bigger free floats! |

Backlog

Made Tech (LON:MTEC)

35.35p (£53m) - Final Results - Graham - AMBER/GREEN

Made Tech Group plc, a leading provider of digital, data, and technology services to the UK public sector, is pleased to announce its audited final results for the year ended 31 May 2025 ("FY25" or the "Period").

Let’s catch up on these results.

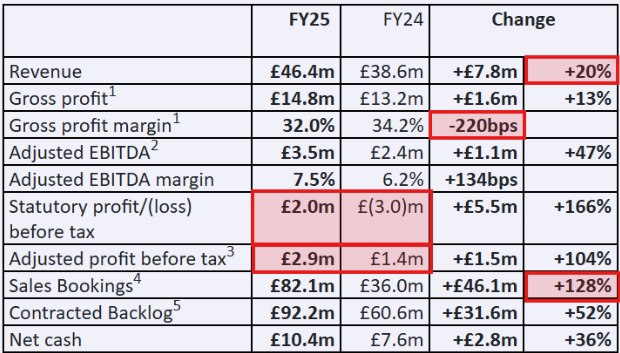

I’ve highlighted some of the numbers that jump out at me from the results highlights:

20% revenue growth is positive, even if it comes at a slightly reduced gross profit margin.

PBT makes a big improvement whether on an adjusted or unadjusted (“statutory”) basis.

Finally, we see a very impressive more than doubling of sales bookings.

The CEO is of course pleased:

"I'm delighted by the progress we've achieved this year, with strong revenue growth, improved profitability, and solid free cash flow. Our focus on sales and bidding has paid off, driving a marked increase in Sales Bookings and a materially larger Contracted Backlog.

This is one of those government spending stocks:

The UK Government's emphasis on digital transformation, highlighted in the State of Digital Government report, the UK's Modern Industrial Strategy, and the Strategic Defence Review, continues to underline the scale of the long-term opportunity. With the Spending Review now concluded, the demand for modern digital services is clearer than ever, offering the potential for sustained growth.

Outlook

There’s been a “strong start” to FY May 2026. Revenue, adj. EBITDA and cash conversion are all in line.

Solid Contracted Backlog underpinning expectations for FY26

UK Government emphasising the significant role technology will play in delivering its priorities supports confidence for long term growth

Reading through the Chair’s statement, she notes that the “political clarity” after the General Election and Spending Review will “drive significant investment in digital initiatives”.

Perhaps an overview of the group would be helpful.

Service Division: when organised by industry, this covers Health & Life Sciences (includes NHS modernisation), Public Safety & Defence (Ministry of Justice), and Central & Devolved Government (the largest group, “delivering a wide range of nationally important programs”. 41% growth in the year).

The company is also organised along service lines - a wide range of services provided such as Technology, Data & AI, etc.

Finances

No dividend is anticipated “in the near term”, as the company prioritises growth. That’s totally reasonable, but many income-oriented investors are likely to give it a pass for now.

Balance sheet: £14.5m of equity, almost fully tangible and mostly consisting of cash. There’s a £10.4m cash balance with zero borrowings. Not bad at all for a £50m market cap company.

As usual, I investigate the differences between adj. EBITDA, adj. PBT and actual PBT.

It’s nice to see that there are zero exceptional items.

There were also no impairments.

It therefore seems that the main - indeed, the only - adjusting item is share-based payments of £0.9m.

I do not permit this to be adjusted out, as it’s a cost borne by shareholders in the form of dilution.

Therefore, I prefer the actual PBT figure (£2m) rather than the adjusted figure (£2.9m).

Adjusted EBITDA is £3.5m. I still think £2m is the most accurate profit figure. .

Estimates

Thanks to the company and its advisors for including this:

Based on the latest published equity research, the company understands current market consensus for the year ended 31 May 2026 (FY26), as at 23 September 2025 being the day prior to the publication of this announcement, to be revenue of £50.1m, Adjusted EBITDA of £3.9m and cash of £13.0m, and for the year ended 31 May 2027 (FY27) to be revenue of £55.1m, Adjusted EBITDA of £4.4m and cash of £16.1m.

Graham’s view

The success of government-linked companies is an interesting dynamic considering that higher taxes (especially NICs) are seen as dragging on the consumer. Every cloud has a silver lining, I suppose?

The revenue forecast suggests top-line growth of 8% this year (FY May 2026), and then 10% the following year.

Adjusted EBITDA is expected to increase by about half a million pounds each year.

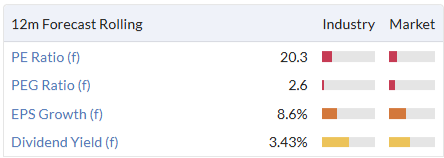

Based on these numbers, I have to say that this look fully valued to me.

Research from h2Radnor acknowledges that (at 38p per share) it’s trading at a 2% premium to its UK Software Service peer group, but argues that the premium is merited given its public sector prospects.

I’m willing to concede that point, noting the very strong growth in bookings and order backlog. But at the same time, the financial forecasts - revenue and EBITDA - suggest that actual financial results will be more limited.

We’ve been GREEN on this - see Roland’s June coverage. I can keep a positive stance on this, but I’m not sure if a fully GREEN position can be maintained.

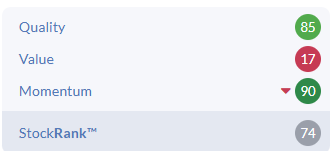

In StockRank terms, it’s a High Flyer but with declining momentum:

In simple Value terms, it’s not offering that much.

On balance I think that AMBER/GREEN is most reasonable at this point.

Keystone Law (LON:KEYS)

674p (£214m) - Half-year Report - Graham - AMBER/GREEN

We’ve been AMBER/GREEN on this national law firm for a while - most recently in February. It issued interim results on Wednesday which caught the eye of some readers.

Company description: “a highly scalable, premier tech-enabled platform law firm”.

Key points from Keystone:

Revenue +16.5%

Revenue per Principal +9.9% (£116.8k)

Adjusted PBT +20.4% to £7.3m

All very impressive progress. It’s an altogether pleasant update:

Positive recruitment market conditions - 30 new Principals added.

AI strategy “focused on delivering real value and real-life solutions”.

Marketing brand refresh

Current trending and outlook: ahead of expectations.

The Group has made a positive start to H2 2026

The Board are confident in the ongoing success of Keystone and expect revenue and adjusted PBIT for the year ending 31 January 2026 ("FY 2026") to be ahead of current market expectations, whilst the newly renegotiated interest rates mean that adjusted PBT is expected to be comfortably ahead.

They helpfully let us know that market expectations were for revenues of £103.6m and adjusted PBT of £12.9m.

“PBIT” is presumably the same thing as EBIT (earnings before interest and taxes).

With higher interest income, PBT is doing even better than EBIT against expectations (higher interest income benefits PBT, but not EBIT).

Some readers focused on the AI element of the report, so let’s take a look at that:

I’m very wary of non-AI companies describing themselves as AI companies, but that’s not what’s happening here. AI seems to be having a very real impact on how this law firm does business. As always, the challenge will be to stay ahead of the competition who are presumably doing the same:

During the Period, we have rolled out a number of generative AI tools, which are available as extensions to the market leading products we already provide to our lawyers. These include the ability for our lawyers to produce file notes of Teams meetings in seconds and for our lawyers to use generative AI solutions across any documents held within NetDocuments (our secure cloud-based document management system). We have developed an internal tool using generative AI as well as an element of agentic AI. This enables our lawyers to interrogate our voluminous Operating Manual using basic English language queries providing them with logical answers as well as links to the relevant sections of the manual; taking only seconds…

It goes on, but I think you get the drift.

Balance sheet: there is some (not much) tangible equity, about about £12m.

Net cash is £6.5m. There are no financial borrowings, and it’s nice to hear that the company has worked to maximise the interest on this cash pile.

Graham’s view

I’m happy to leave our AMBER/GREEN on this.

It’s another High Flyer but in this case momentum is rising and we’ve just had an “ahead of expectations” update, so it would be wrong of me to change stance at this time.

It’s certainly very expensive for a law firm:

The AI revolution is worth reflecting on - will it ultimately be a good thing for law firms? I would say yes, in the same way that every major technological improvement is a good thing (the internet, etc.). Customers get more productivity, and the firms themselves can spend more time on their higher-value work.

But is it necessarily a good thing for investors? Personally, I doubt that it will translate to significantly higher returns for investors, because every law firm will likely get access to similar AI tools before too long. But perhaps Keystone can prove me wrong, and be the law firm that uses AI most intelligently and profitably! We shall see.

ZIGUP (LON:ZIG)

315.5p (£716m) - AGM Statement - Graham - AMBER/GREEN

This is “the leading integrated mobility solutions platform providing services across the vehicle lifecycle”.

I would prefer if they said “we provide van rental and related services”.

They used to have the rather serious name Redde Northgate.

Roland was cautious on it in July, noting a high degree of leverage and heavily adjusted profits.

This AGM statement was pretty good:

The Group has performed well over the first four months of the financial year. VoH (GN note: “Vehicles on Hire”) is ahead of the prior year and good vehicle supply has supported our fleet replacement plans. Activity levels in Claims & Services are as expected, alongside continued stable hire durations and it is now entering the traditionally busier autumn and winter period.

In addition to positive news on contract extensions, they have a new “Operations Control Centre” for roadside assistance, along with upgraded UK call-centre infrastructure.

Leverage is “in line with our target range of 1.-2x”. In the absence of further information, I’ll assume it’s still at the higher end of this wide range. It was at 1.8x when Roland looked at it.

Outlook: unchanged.

Graham’s view

I note that some readers are positive on this, while Roland has been moving between AMBER and AMBER/GREEN.

On the back of an in-line AGM statement, and considering the StockRank of 80, I’ll give this the boost to AMBER/GREEN.

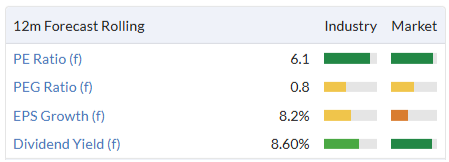

The cheapness is pretty clear:

But the quality is also average, as you’d expect for a rental business. ROCE/ROE of c. 7-8%, and a QualityRank of 54.

Net debt was last seen at over £800m, bigger than the market cap. Rental companies often need to borrow heavily, in order to achieve acceptable returns.

I’m leaning towards the conclusion that everyone is right: the company is right to borrow heavily, Roland is right to be careful, and yet there is an opportunity if nothing goes wrong. So let’s give this an upgrade by one notch, a nice way to end a nice week! Have a great weekend all.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.