Good morning! As September draws to a close, we should see news flow return to a more normal pace over the next few days.

All finished now, thank you.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

GSK (LON:GSK) (£60.4bn) | Internal appointment: currently Chief Commercial Officer. Starting January 2026. | ||

Berkeley group (LON:BKG) (£3.53bn) | Internal appointment: currently Divisional FD of Berkeley Capital, a London division. | ||

Alphawave IP (LON:AWE) (£1.49bn) | Since announcing… acquisition of the Group by Qualcomm… we have continued to deliver against our strategy. | ||

Pets at Home (LON:PETS) (£923m) | CFO decides to retire after nine years. CFO of PZ Cussons to replace him. | AMBER/RED (Graham) [no section below] A nasty profit warning was announced on Sep 18th (during market hours), coinciding with news that the CEO was leaving “with immediate effect” (and the RNS did not thank her for her efforts). Today we learn that the CEO is also moving on. It’s unfortunate timing, coming on the back of some poor company performance, but this departure looks and feels very different to the loss of the company’s CEO. The CFO moves on after a long tenure in the position - nearly a decade - and it appears that he is doing so voluntarily. He receives high praise from the Exec Chair in today’s RNS. Furthermore, the company already has a replacement CFO lined up from another listed company (PZC). So as far as CFO departures go, they don’t get much better than this. I’m leaving our AMBER/RED stance untouched given the recentness of the profit warning here. | |

Genuit (LON:GEN) (£850m) | Leading brands in the plumbing and heating sectors bought for £49m. Expected to deliver £32.8m of full-year revenues in 2025. | ||

CMC Markets (LON:CMCX) (£625m) | CMC Stockbroking the preferred vendor for Westpac’s online share trading services. | AMBER (Mark) [no section below] | |

Hilton Food (LON:HFG) (£589m) | Gross cash proceeds of £54m. Earnings dilutive. Further step in aligning HFG more closely with its core strength. | ||

Rockhopper Exploration (LON:RKH) (£472m) | Funded for Final Investment Decision re: Sea Lion, based on financing plan. $54m cash (August 2025). FID targeted by end-2025. | ||

IP (LON:IPO) (£469m) | Funding to accelerate OXCCU’s commercialisation efforts, expand operations, and advance the next stage of technology scale-up. | ||

PZ Cussons (LON:PZC) (£345m) | CFO leaves to take up a new role (details elsewhere in this table!) Her replacement at PZC will be announced “in due course”. | ||

Puretech Health (LON:PRTC) (£302m) | Switchers from to deupirfenidone achieved stabilization of lung function. Update on Phase 3 trial design expected in Q4 2025. | ||

Guardian Metal Resources (LON:GMET) (£178m) | CEO: “high tenor and consistency of the results… is very encouraging…”. The project is 100% owned, royalty free. | ||

Epwin (LON:EPWN) (£162m) | Trading is “resilient despite subdued market conditions”. Q3 following a similar trend to H1, in line with Board’s expectations. | PINK (takeover at £1.20 is already approved by shareholders) | |

Mkango Resources (LON:MKA) (£151m) | MKA subsidiary enters agreement with US Development Finance Corporation to secure $4.6m for Malawi rare earth project. | ||

Helios Underwriting (LON:HUW) (£149m) | 2024 year of account profit forecast is tracking towards a strong result. 2025 year of account developing in line with exps. | ||

Duke Capital (LON:DUKE) (£148m) | Expects recurring cash revenue of £6.6m in Q2 FY2025, in line with prior quarter (+3% year-on-year). CEO pleased to see base rate cut. | AMBER/GREEN (Graham) [no section below] No change this quarter, as recurring cash revenue stays where it was. The CEO’s view on the direction of base rates doesn’t surprise me: DUKE’s share price has been unable to recover since H2 2021, when the rate tightening cycle saw the DUKE share price fall from 43p to about 30p. That's roughly where it remains today, offering a dividend yield of almost 10%.The company previously talked about deploying third-party capital, but admitted in its most recent full-year results that “current geopolitical and market conditions have made it challenging to secure such partnerships on acceptable terms”. There is no mention of any further progress on this in today’s update, which would lead me to assume that it is not going to happen in the near-term. I continue to think that this is an interesting income stock, although I’m not currently invested in it and have no plans to get back into it. Its own balance sheet is significantly leveraged: as of March 2025 it owed £88m to Fairfax Financial, a facility on which it pays 5% over the benchmark rate. But my main reason to stay away is their continuing desire to raise additional funds, which I view as a pretty significant source of uncertainty. For purely income-oriented investors I do think this is worthy of research, as it has a good track record of paying its dividend for the best part of a decade now. | |

Devolver Digital (LON:DEVO) (£115m) | On track to meet guidance. “Resilient revenue in line with expectations against a strong prior year comparator”. H1 revenues down 25%. Pre-tax loss $4.1m. | AMBER/GREEN (Graham) "On track to meet guidance" comes with an asterisk, as joint broker Panmure Liberum has shaved revenue forecasts and this year's EBITDA forecast. I like this stock but there are a few reasons for caution outlined in more detail below - revenue volatility, a declining cash balance due to development spend (hopefully this will reverse in H2), and some modest cuts to forecasts. And this year's EPS is going to be a casualty of a tax asset write-off. | |

Solid State (LON:SOLI) (£93.8m) | Steatite is awarded a £1.65m contract by MoD agency to design, develop, qualify & supply complex integrated systems. | ||

Spectra Systems (LON:SPSY) (£93.2m) | SP -20% H1 Revenue +54% to $35.0m, Adj EBITDA +101% to $15.8m, Adj. EPS +85% to 20.8c, Net debt $1.2m (24H1: $0.36m) excluding $5m restricted cash. “...on track to achieve record earnings and meet market expectations for the full year." | BLACK (AMBER/GREEN) (Mark holds) | |

Orosur Mining (LON:OMI) (£79.3m) | Given the recent acquisition of Monte Aguila; the spectacular results at Pepas; and the encouraging results at El Pantano in Argentina, the Company will focus on these areas. | ||

Quadrise (LON:QED) (£78.2m) | Loss after tax £3.1m. FY June 2025 “a pivotal point for Quadrise as we laid the groundwork for commercialisation”. Cash £5.9m. | ||

ICFG (LON:ICFG) (£63.2m) | Reverse takeover/admission to trading in February. Has 80% share of a non-bank financial institution in Mongolia. | ||

Seascape Energy Asia (LON:SEA) (£50.5m) | Pre-revenue. Cash reserves £8.6m (£2m restricted). Focused on maximising value in existing portfolio, selectively adding to it. | ||

Water Intelligence (LON:WATR) (£46.5m) | Rev +8%, adj. PBT +8% ($5.7m). H1 results are in line. Momentum for H2 from a strong Q2. | AMBER/GREEN (Mark) | |

| Ariana Resources (LON:AAU) (£39.2m) | Interim Results | H1 PBT -71% to £0.2m. Revised PFS received at Dokwe North. Dual listing on ASX raised A$11m. | |

Aurrigo International (LON:AURR) (£37.1m) | H1 Revenue -10% to £3.5m, Adj LBITDA £1.6m (24H1: LBITDA £1.2m), Net cash £1.8m (24H1: £1.8m) prior to £14.1m fundraise. | ||

Touchstone Exploration (LON:TXP) (£36.3m) | Well circulation was lost, leading the Company to conclude drilling operations earlier than planned. Will complete the well for production using a combination of casing and the drill string, enabling access to the gas-charged intervals identified while drilling. | ||

Pulsar Helium (LON:PLSR) (£35.8m) | Independent PFS indicates subsurface reservoir temperatures of 80-130°C. Helium recovery 350 thousand cubic feet (Mcf) per day, capital expenditures of USD $20-30m. | ||

Metals One (LON:MET1) (£31.6m) | Small scale sampling yields up to 4.17% Uranium from from historic waste material, Vanadium 2.46%, Copper 1.14%, Silver 99g/t. | ||

Christie (LON:CTG) (£28.8m) | SP +7% | AMBER/GREEN (Graham) [no section below] There's a very nice swing in PBT here, from a £0.9m loss to a £0.9m profit. Checking this morning's research note from Shore Capital, I can find no change to forecasts: EPS this year is still expected to rise to 5.2p (from 4.4p last year), and then an even larger jump to 8.2p is forecast for FY December 2026. If that's achieved, the shares are trading at a forward P/E of about 15x (my calculations match well with the StockReport). As the company is now sitting on net cash, I'd now like to see it earn some interest to offset the notional interest it pays on leases. As for the fundamental driver of the strong H1 performance, Christie tells us that the volume of businesses sold in its PFS division was slightly lower than last year, but the mix included "higher value assets and sectors". That is by no means the only driver of the strong result but I think it's worth highlighting that Christie itself may have little control over the mix of businesses sold by this division. Luckily, PFS provides a range of services and all of them had a strong first half, in contrast to the "Stock & Inventory Systems & Services" division, which saw subdued demand in its stock audit business. I'm happy to take a moderately positive stance here given the strong balance sheet (including healthy pension funds), growth outlook and consistent dividend track record. | |

Poolbeg Pharma (LON:POLB) (£27.2m) | LBT £2.23m (24H1: 2.28m). Cash £10.0m after £4.9m fundraise. | ||

XP Factory (LON:XPF) (£23.6m) | Non-Executive Chairman Richard Rose to stand down after 9 years. | ||

Ebiquity (LON:EBQ) (£19.8m) | H1 Revenue flat at £37.9m, Adj. Operating Profit +11% to £2.6m, PBT -73% to £0.4m, Net debt £15.0m (24H1: £16.2m). FY revenues £75m similar to 2024 & Adj. Op Profit £5.5m. | AMBER/RED (Mark) [no section below] | |

ITIM (LON:ITIM) (£19.5m) | H1 Revenue -9% to £0.8m , Adj. EBITDA -67% to £0.4m, LBT £0.7m (24H1: LBT £0.1m), Net Cash £1.8m, (31 Dec: £3.8m). | ||

Lexington Gold (LON:LEX) (£17.4m) | Net loss $0.4m (24H1: $0.3m), Cash $0.7m (31 Dec: $0.9m), after $680k equity placing. | ||

Alien Metals (LON:UFO) (£16.6m) | H1 Operating Loss $1.245m, (24H1: $579k), Net Cash $93k (31 Dec: $60k) after raising £1m in the period. £411k received post-period end after warrant exercise. | ||

CPPGroup (LON:CPP) (£14m) | H1 revenue from cont. Ops -36% to £0.9m, after selling CPP Turkey for £6.1m and CPP India for £14.4m. LBITDA £2.9m (24H1: LBITDA £3.9m), Cash £8.1m prior to CPP Turkey receipts, (31 Dec: £9.7m). | ||

Petro Matad (LON:MATD) (£13.6m) | Heron-1 well continues to produce with artificial lift at a rate of c. 150 barrels per day (bopd) with water cut stable at c. 3%. | ||

Rockfire Resources (LON:ROCK) (£12.9m) | Binding Farm-in agreement with Eastern Resources, listed on the ASX, to sole fund 3 years of exploration. Rockfire can retain 20% by contributing to explo costs or take a 1.5% smelter royalty. | ||

Energypathways (LON:EPP) (£12.6m) | The MESH project will now follow the priority development authorisation processes under the Planning Act 2008. | ||

Huddled (LON:HUD) (£11.9m) | H1 Revenue +81% (not organic) to £9.48m, Adj LBITDA £1.47m (24H1: £1.34m), Loss £1.99m (24H1: £1.75m), Net debt £0.1m (24H1: £2.8m net cash) partly due to acquisitions, £1.5m equity raised in Q3. Q3 Revenue +43% to £4.9m. Outlook: Q4 2025 revenue expected to be not less than that of Q3 2025 and H2 2025 losses are expected to narrow from those in H1 2025 | ||

Blackbird (LON:BIRD) (£10.5m) | H1 Revenue -17% to £577k, LBITDA £1.15m (24H1: £2.03m), Cash burn £1.50m (24H1: £1.90m), Cash £2.27m (24H1: £3.77m), £2.13m placing after period end. |

Graham's Section

Devolver Digital (LON:DEVO)

Up 1% to 27.25p (£123m) - Half Year Results - Graham - AMBER/GREEN

Devolver Digital, the award-winning digital publisher and developer of independent ("indie") video games, announces its unaudited results for the six months ended 30 June 2025. All figures relate to this period unless otherwise stated.

Roland was AMBER/GREEN on this in June as a contrarian play, seeing as cash covers a chunk of the market cap here.

The financial results for H1 aren’t pretty, but are in line with expectations. Important to note that an H2 weighting is forecast: over 60% of full-year revenues are expected in H2.

H1 revenue down 25% to $38.8m

H1 pre-tax loss $4.1m (H1 last year: loss $4.8m)

Net loss for the period $11m

The huge gap between the pre-tax loss ($4.1m) and the after-tax loss ($11m) is worthy of comment.

The company says:

1H included a non-cash write-down of deferred tax assets totalling $6.8 million ($5.9 million related to previous period stock option expense tax losses), given lack of visibility if such deferred tax assets would be utilised.

I’ve dug up last year’s report, where I find a breakdown of DEVO’s deferred tax assets, and there is indeed an item described as “Potential future share option exercises” (page 84), with a value of $5.6m.

That asset has now gone up in smoke, due to uncertainty over whether or not the company will get to use it - perhaps because it isn’t generating sufficient taxable profits quickly enough?

This is a reminder for me that I might want to treat deferred tax assets a bit more carefully when I’m calculating tangible asset value. I often simply deduct the company’s goodwill and other intangibles from balance sheet equity. But maybe I also need to deduct deferred tax assets - especially in cases where the company is unprofitable.

Let’s get into the fundamentals of how DEVO is performing.

There is an “exciting release pipeline” for H2:

Visibility on 2H - currently on track underpinned by:

At least 8 releases in 2H 2025, with pleasing early sales;

Strong current trading on back of recent positive Steam publisher sale held in 2H 2025, vs 1H in 2024;

>65% of signed platform deals for 2025 expected to be recognised in 2H (2H 2024: c. 20% of 2024 platform deals)

CEO comment:

"Our performance in the first half of 2025 was resilient against a tough prior year comparator. We have good visibility on the second half of the year, supported by signed platform deals, Steam publisher and seasonal sales, a healthy release schedule and strong current trading since the half year end. We're delighted with the new titles we've delivered so far in 2025. These exciting new games have been very well received and will bolster the back catalogue in the future.

Estimates: many thanks to Panmure Liberum for publishing a very helpful note on DEVO today.

They emphasise that this is “a year of two halves”. Judging by Roland’s previous comments, this seems to be a message that has been made perfectly clear to the market at this stage.

However, the revenue forecast for the current year does get a 5% cut, revenues next year get an 8% cut, and the year after gets cut, too. This year’s H1 figure is considered “a touch light”.

The EBITDA forecast for this year also gets shaved from $10.3m to $9.6m, but future years are left unchanged thanks to slightly improved margins.

As for diluted EPS, it is also unchanged for future years (2.3p in 2026, 2.6p in 2027). But the estimate for the current year gets smashed by news of the deferred tax asset going away - from 1.9p to only 0.2p.

Graham’s view

This is an indie developer, so the back catalogue is of crucial importance - it relies on steadily monetising a large quantity of titles, rather than hanging its hopes on a small number of blockbusters.

Unfortunately, despite having a large back catalogue, there is still considerable volatility in DEVO’s revenues: it reports a 38% decline in back catalogue revenues in H1, due to the timing of the Steam publisher sale (Stream being a major online games platform).

At least the company still has significant cash resources ($34.7m / £26m as of June 2025), although this is down from $41.6m/£31m at year-end 2024.

The cash drain is attributed to “continued investment in game development”.

Like many software companies, DEVO capitalises its development spend.

Checking the cash flow statement for H1, I see $15.5m under “purchase of intangible assets”.

I also find that the offsetting charge, “amortisation of intangible assets”, was only $11m.

This says to me that profits were boosted by around $4.5m due to the way that development spending is accounted for.

On balance, I’m going to leave this on AMBER/GREEN as it has a high StockRank (90) that includes rising momentum, a moderate earnings multiple on forecast earnings, and that healthy cash balance (which the earnings multiple doesn’t take into account).

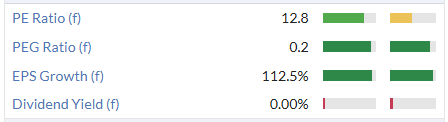

High StockRank:

And a modest P/E multiple that doesn’t take the large cash balance into account.

However, as always with AMBER/GREEN, there are a couple of reasons for caution.

In particular, revenues are lumpier than I would like - I think this is largely due to their reliance on Steam.

And the game catalogue doesn’t speak to me in the same way that the catalogue at Everplay (LON:EVPL) speaks to me, but that is perhaps just due to my age!

I also think that the cuts to the revenue forecasts should be seen as an amber flag.

Overall - an interesting stock in the sector, but I would not be madly keen to invest at this level.

Mark's Section

Spectra Systems (LON:SPSY)

Down 20% at 155p - Interim Results - Mark - BLACK (AMBER/GREEN)

At the time of publication, Market as a long position in SYSY.

The headlines here are very strong:

Revenue of $34,965k (2024: $22,739k) up 54%

Adjusted EBITDA up 101% at $15,764k (2024: $7,847k)

Adjusted PBTA up 130% to $14,346k (2024: $6,225k)

Adjusted earnings per share up 85% to US $20.8 cents (2024: US $11.2 cents)

And it’s an inline statement for the rest of the year. Which leaves around $20m of revenue to book for H2 and 17.4c EPS to meet Zeus FY25 forecasts, which looks achievable even with the one-off sensor contract being completed. However, the price reaction this morning shows that there is a sting in the tail. There are some hints in the RNS, such as this opportunity not being tendered until mid-2026:

In addition, we have submitted another 10,000-sheet sample to our Middle Eastern central bank partner and downstream customer for qualification. With the next tender now expected in Q2-Q3 of 2026, we have been asked to provide another 10,000-sheet sample in October for further testing. As stated previously, the expectation is that once we formally qualify, we will receive a small order which will be followed by an invitation to tender.

Or delays with a tax stamp customer:

With recently announced advances in our smartphone technology, which allow for a larger number of smartphone models and a faster response. These developments have fueled traction with a significant tax stamp customer opportunity. This opportunity has been delayed by the customer, but their interest remains high, and we expect a second trial in H2 following the very successful trial in H1.

However, the overall outlook sounds positive:

The combination of the sensor contract award, the continued strong covert material sales, a boost in optical materials sales, an exceptional performance by the gaming software operation, and the significant advancements in the commercialization of our polymer substrate have positioned us for growing our profitability in the coming years.

It is only when you get to the broker’s note from Zeus that the impact of these is spelled out:

However, challenges impact FY26E, forecasts reduced: SPSY will provide a further 10,000 sheet sample to a Middle Eastern Central Bank in the current month for another round of evaluation. We view this as marking a further level of engagement with a potential client which has been working closely with SPSY for several years. However we note delays both to this programme due to an expected tender shifting to H2 of 2026 and to a major tax stamp customer opportunity that was anticipated based on a highly successful first trial, both of which might have been expected to feed into FY26E. Taking these issues together, we feel that it is prudent to reduce our FY26E forecasts as laid out in Exhibit 3 below, with a further driver being the reorganisation of Security Printing (Cartor) which was announced earlier in the year and mainly impacts on revenues.

The other factor mentioned, a restructuring of Cartor to reduce minimally profitable printing contracts has a big impact on revenue but not profitability. I already pointed out when I reviewed the FY results that Cantor was much lower margin than the core business. This is what the company say about this change:

Repeatable and growing profits from the Cartor security printing group will require the elimination of unpredictable earnings from small jobs that do not financially support their staffing requirements. As previously referenced, there is an executable plan for restructuring the business, which will refocus management on the goal of producing polymer banknote substrate while defraying labour and infrastructure costs through multi-year postal and tax stamp contracts with technologically leveraged margins. We plan to restructure the security printing operations by Q2 of 2026. Modeling predicts that this will generate repeatable and significant profitability even in the absence of Fusion sales while having the capability to produce substrate for over 2.5 billion notes per annum.

This makes sense, there is no point in the company being busy fools. Cartor was largely bought for its assets, an underutilised printing machine capable of producing polymer banknotes. However, the short term revenue impact is significant, with Zeus taking 43% out of their FY26 revenue forecast. Profitability estimates are reduced by 34% as a result of the delays. Zeus do say:

It is possible that we are being over-cautious given that the company is actively bidding on many opportunities across the whole range of its activities; and also there is a history of orders from major clients as we approach the end of the year. However, our forecasts for this company are generally based on predictable or highly visible revenue streams; and these adjustments are consistent with this approach.

These changes appear to be largely timing on contracts, the company is confident that they will be included in the next print run for the MECB customer, it is just that the bulk of that revenue will land in FY27 not FY26. Given the impact that this has had on next year’s forecasts I have some sympathy for the view that the company should be spelling this out more clearly. After all, these delays have had a material impact on the medium term forecasts. Anyone who bought shares this morning without reading the broker’s note has the right to feel a little aggrieved. I am more forgiving of this sort of thing when the note is publicly available to all investors who register for free.

No doubt, the company would argue that they have always had lumpy results and have no control over customer timings so are delivering on what they can control. I suspect the company don’t see today’s update changing the valuation of the business in any meaningful way. However, I think the company should have spelled out the impact of the delays on the FY26 results more clearly to avoid possible accusations of allowing a false market on the open.

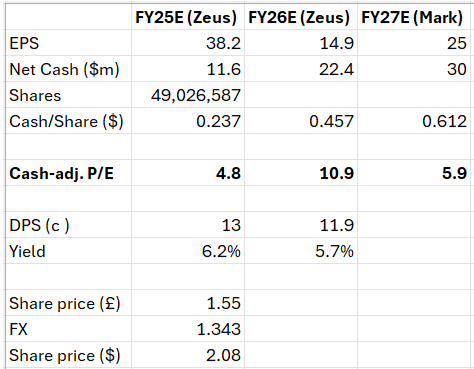

Valuation:

Given the flux in forecasts and share price, I need to do my own calculations for valuation metrics. Zeus provides their unchanged FY25 and updated FY26 estimates. No estimate is provided for FY27. However, I guesstimate that this could be around 25c EPS as the delayed FY26 revenue largely hits FY27, plus Cartor will be more profitable, having culled unprofitable revenue. In addition, the currently low revenue but high margin software side of the business looks to be on a growth trajectory.

Zeus see net cash largely unchanged by today’s update, and I estimate that FY27 will see further modest cash generation. The upshot is that none of these metrics look particularly demanding for a technology led business:

However, they do highlight that the lumpiness makes this a very hard business to apply any real valuation methodologies to. This is probably the reality of many businesses. Investors love a smooth revenue and profits growth as they can extrapolate out into future years and apply multiples to those. The reality is that is at best a false precision, at worst a management team actively managing results via inappropriate adjustments and other gimmicks. (The adjustments in these results are very minor and restricted to a small amount of amortisation and SBP). That Spectra will never have smooth financial results means that it will never have a particularly high rating, and investors need to make peace with that, even if it may not be as logical as it sounds.

Of course, using a cash-adjusted multiple assumes that the company will do something good with that cash. Given this statement, I doubt they will just sit on it:

With the expected cash build-up commencing in H2 2025 and continuing through 2026, we continue to evaluate acquisitions of synergistic, strategic and profitable businesses.

Excess cash will almost certainly be returned to shareholders. Zeus maintains their forecasts for DPS, ie. a slight decline in payout in FY26. With today’s lower share price this works out to be a yield of around 6%.

Mark’s view

I view this company a bit like a cheap option. They clearly have products with a significant competitive advantage and some of the highest prestige customers in the world. Yet, the type of customers they have means that orders will always be lumpy and timing out of their control. Today we see both sides of that dynamic - very strong interim results built on the revenue recognition of a large sensor contract, but a reduction of FY26 estimates due to delays with a couple of key contract awards. The share price reaction today reflects that the former was known and the latter new news. However, these contracts don’t seem to be lost but merely delayed, meaning that there is significant scope for a bounce back in earnings in 2027, although it is outside the forecast window. In the meantime, investors get a c6% dividend yield and there are multiple opportunities for them to win additional business, or acquire interesting bolt-on companies.

So while this is clearly a downgrade in FY26 forecast so should be BLACK, I also think today’s share price reaction looks like a potential over-reaction. One of the reasons that investors are often better off selling on profits warnings is that they may indicate the start of a trend; companies will already have pulled every lever to try to avoid it, so if they are warning it means worse may be on its way. However, with Spectra, this is already so lumpy on revenue recognition that delays to contracts initial forecast to deliver in FY26 are more likely to be positive for FY27 than negative. This view takes a certain amount of confidence in management that may have been eroded by today’s broker update. Personally, I have tentatively added on the drop, as I don’t see the FY26 downgrade here changing our long-term broadly positive view of AMBER/GREEN.

Water Intelligence (LON:WATR)

Up 1% at 274p - Interim Results - Mark - AMBER/GREEN

There is always quite a lot of flux here as the company has a tendency to both buy and sell their own franchises. This time it is the owned business doing well and offsetting weakness in royalty income due to fewer franchises:

· Revenue increased by 8% to $45 million (1H 2024: $41.5 million)

o Franchise Royalty income decreased by 10% to $3.21 million (1H 2024: $3.55 million) as a result of franchise reacquisitions reducing the pool of royalty income

o Franchise Related sales decreased 15% to $4.7 million (1H 2024: $5.5 million) as a result of fewer franchisees

o Group Corporate Store sales increased 13% to $37.1 million (1H 2024: $32.4 million)

§ US Corporate sales grew 7% to $30.3 million (1H 2024: $28.3 million)

§ International Corporate sales grew 64% to $6.8 million (1H 2024: $4.1 million)

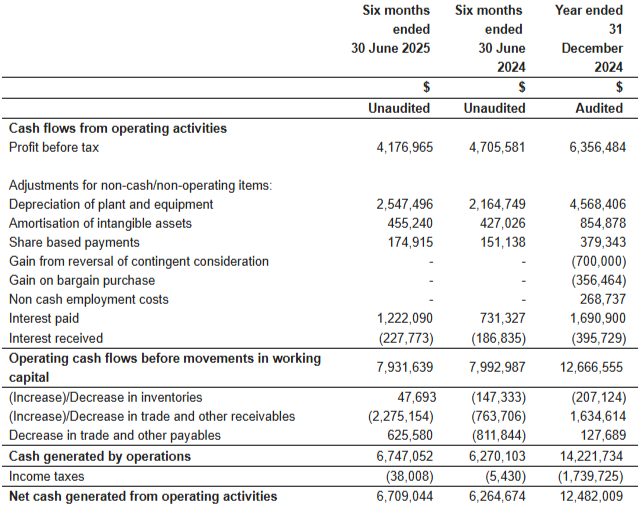

Their international operations have grown well, although the growth in revenue is less impressive compared to a H2 last year where they did $6.2m revenue. The overall result is adjusted EBITDA rising 16%, but profitability measures rising around 8% on an adjusted basis. They say these are adjusted for “amortisation, share based payments and non-core costs/gains including IFRS treatment of earn-out gains).” While these sound reasonable, I can’t see the details of these broken out in these results. As such, it seems to be prudent to focus on the cash flow statement:

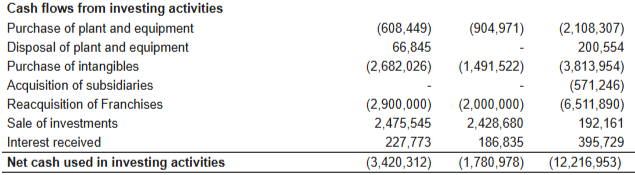

So there is decent operating cash flow here, up around 7% which is in line with the PBT. However, investing cash flows are dominated by increasing purchase of intangibles and acquisition and sales of franchises:

I really dislike this dynamic. There is always a good reason for these strategic moves, such as:

Reacquisition of West Georgia franchise to create regional corporate hub after integration with prior franchise reacquisitions in area.

And the executive Chairman has a large holding here, which should align interests:

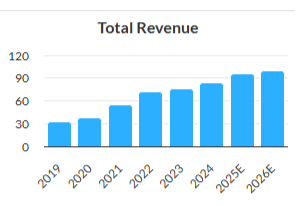

However, there is absolutely no way for investors to confirm that the company is getting a good deal on these transactions. The strategy of both being an operator and franchisor just seems strange to me. Surely one of these business models should be better; either greater control from being the operator, or higher margin from being a franchisor. It would make more sense to me if they were moving in one direction, but acquiring and selling their own franchises just raises questions over what their long term aim is. So far, they have generated very good revenue growth:

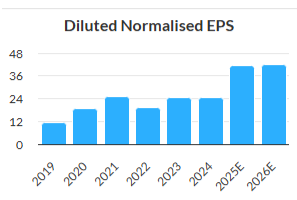

Which has been reflected in EPS growth, although without any real operational gearing so far. However, 2025 is forecast to see a big step up in EPS:

It is this dynamic that meant I picked it as my “growth” stock to watch in 2025, as part of the 12 days of Christmas series. If the company delivers on these expectations it look cheap on a P/E of less than 9. So far, the market has been unconvinced:

And these HY results don’t do much to change that view. They need to do $50.5m revenue. However, EPS only needs to be 18.5c in H2 vs the 22.9c in H1. Today they say:

While building out our multinational platform and continuing to meet expectations in terms of profitability, we have preserved a strong balance sheet and credit capacity.

So that leaves some wriggle room on the revenue, but at least suggests EPS is in line. In terms of balance sheet, the 1.2x leverage they report seems reasonable. But there is £9.6m of deferred consideration on top of this. Overall, goodwill and intangibles make up the vast majority of the book value. These are more reasons why I just don’t like the strategy of re-acquiring franchises at a premium to the price they were sold for.

One interesting part is an upcoming new technology release:

Moreover, with our latest proprietary leak detection equipment to be unveiled at our forthcoming annual ALD Convention 22-25th of October, we will be unmatched and this positions us well for a strong 2026.

They seem to have some patented products such as Versaliner, but I think overall, the technology aspect of what they do isn’t completely unique. Anything that adds to the uniqueness of their product suite could help grow franchises and add to margins.

Mark’s view

I regularly flip flop on this one. The multiples for a company growing revenue at these rates are very low. If they do have a technology advantage which can be grown with new products and quickly rolled out to franchisees in a highly fragmented market things are only going to get better. This would make investing in the equity a compelling proposition. However, I really dislike the strategy of buying and selling their own franchisees. While I have no evidence that anything is untoward here, it is so open to abuse that to invest here you really need to completely trust the management and products. I struggle to work out how investors sitting at a computer in a different continent to the bulk of their operations can build that confidence. There is no dividend to back up the cash flow and the buyback has been relatively minor. However that isn’t unusual for a company pursuing growth. We took a broadly positive view last time it was reviewed on the DSMR. Today’s update is an inline one, at least on profitability, so I see no reason to change that in the short term. AMBER/GREEN

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.