Good morning! The rush of news has rather suddenly died down.

Calling it a day there, thank you.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view |

|---|---|---|---|

Tesco (LON:TSCO) (£28bn) | Now expects FY26 adjusted operating profit £2.9bn to £3.1bn, up from previous range £2.7bn to £3.0bn. | AMBER/GREEN (Graham) I’m going to upgrade this to AMBER/GREEN, consistent with Stockopedia’s findings that upgrades tend, on average, to be followed by more upgrades (while profit warnings tend to be followed by more profit warnings). I’m happy enough with that as I can see that the stock may offer some value around these levels, although I also think there are some pretty hard limits in terms of what such a capital-intensive business can do for its shareholders. | |

Pennon (LON:PNN) (£2.22bn) | He has been CEO of Affinity Water and is expected to join Pennon in 2026, following his notice period. | ||

Morgan Sindall (LON:MGNS) (£2.1bn) | FY 2025 to be significantly ahead of expectations. Continuation of the strengthening performance from the Fit Out division. | GREEN (Graham) We've flitted between GREEN and AMBER/GREEN here. After what looks like the fourth consecutive upgrade, I'm back in the GREEN camp: the trend is your friend, after all. Just be careful: the earnings multiple is in the mid-teens, which is unusually high for this stock and for the construction sector. I would be very quick to downgrade this several notches on foot of bad news. At least the strong net cash position (expected to be £350m as a daily average this year, ahead of guidance) provides plenty of reassurance around its financial stability. | |

Dr Martens (LON:DOCS) (£944m) | New agreement with Beside Group in UAE, entering UAE for the first time. Has also partnered with Crosby in Latin America. | ||

Workspace (LON:WKP) (£762m) | Sold Morie Street in Wandsworth and Castle Lane in Victoria for £22.4m, 3% below the March 2025 valuation. | ||

AdvancedAdvT (LON:ADVT) (£252m) | H1 Revenue not less than £25m, Adj. EBITDA £7m+, Net cash £96.9m & investments £19.2m of M&C Saatchi plc. | AMBER (Graham) [no section below] This is primarily a bet on Chairman Vin Murria’s capital allocation skills, and news this year has been positive with a “materially above” update back in February (that update related to FY Feb 2025). As we get deeper into FY Feb 2026, shareholders can look forward to the positive impact of two acquisitions that have already taken place this year. These two deals cost roughly £12.5m in the aggregate (net of cash acquired), comprising a mixture of upfront cash, deferred payments, and ADVT shares. ADVT now has seven software businesses. With nearly £100m still in cash, plus another £19m held in M&C Saatchi (LON:SAA) shares, it’s important to adjust the valuation metrics here for the financial strength: It seems to me that despite the rising share price, the EV/EBITDA multiple is still only around 10x (it was about 11x when I checked earlier this year). In a software context, this is unlikely to be overvalued. However, I’m leaving our AMBER stance unchanged due to the odd (and to my eyes, somewhat off-putting) structure which sees this software group continue to own about 10% of a major advertising agency. | |

ACG Metals (LON:ACG) (£204m) | Oxide royalty rate reduced from 10% to 2.25%, sulphide royalty rate increased from 2% to 2.25%. Should result in a significant reduction in all in sustaining costs (AISC) on the remaining oxide ore produced at the Gediktepe mine from 2026 | ||

Gaming Realms (LON:GMR) (£127m) | Light & Wonder will create Slingo titles of hugely popular games including 88 FORTUNES™ and HUFF N' MORE PUFF™. | AMBER (Mark) [no section below] | |

Avation (LON:AVAP) (£108m) | Revenue +19% to $110.1m, EBITDA +20% to $107.1m, LBT $7.7m, (FY24: PBT $19.7m), Net debt -7% to $604.2m. Dividend 1c. NAV/share $3.66. Well positioned to achieve a successful refinancing of the Oct 26 Notes. | AMBER (Mark) | |

Ondine Biomedical (LON:OBI) (£75.2m) | The Royal Papworth pilot will integrate Steriwave into cardiac surgical care pathways as part of a broader strategy to reduce patient microbial burden-specifically in the nose-prior to surgery to help prevent infections. | ||

Kooth (LON:KOO) (£50.8m) | Additional year at $1.45m per annum to provide Soluna platform to four school districts within New Jersey. | AMBER/GREEN (Mark - I hold) [no section below] | |

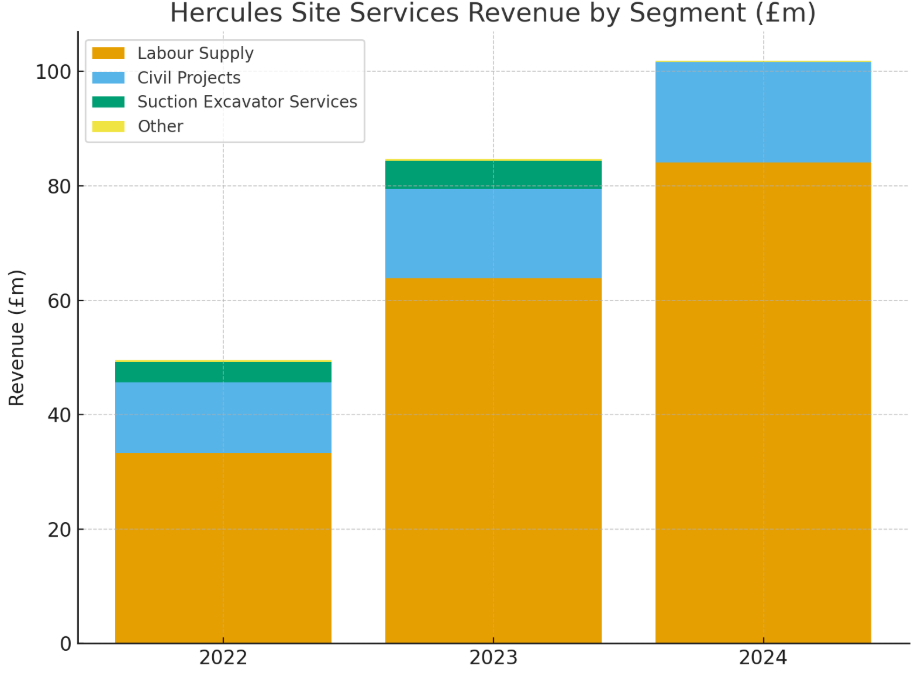

Hercules (LON:HERC) (£28.3m) | Adj EBITDA and Ad. PBT for FY25 in line with market expectations (£6.1m, and £3.3m, respectively). Revenue +16% to £118m+. | AMBER/GREEN (Mark) | |

Tavistock Investments (LON:TAVI) (£24.6m) | A Court hearing has now been listed for December 2025 to determine both parties' applications. The Board remains confident in the strength of its case and continues to defend Titan's claim and pursue its own counterclaims vigorously. | ||

Zinc Media (LON:ZIN) (£14.2m) | “By centralising the group's distribution activity, Zinc Distribution will strengthen relationships with existing distribution partners, forge new partnerships with broadcasters and digital platforms, and drive programme sales and revenue streams across digital content, format licences and merchandising opportunities.” |

Graham's Section

Tesco (LON:TSCO)

Interim Results - Graham - AMBER/GREEN

We tend not to cover the major supermarkets in very much detail, as our efforts are probably better directed at smaller companies.

But this is a pretty impressive piece of news:

We now expect FY 25/26 Group adjusted operating profit between £2.9bn and £3.1bn, an increase from the previous range of between £2.7bn and £3.0bn. We continue to expect free cash flow within our medium-term guidance range of £1.4bn to £1.8bn.

At the midpoint, it’s an upgrade of 5%.

Although it's also fair to say that I would probably not value the company as a multiple of adjusted operating profit, instead choosing net income, EPS or free cash flow as the basis of valuation. And the free cash flow forecast is not getting an upgrade today.

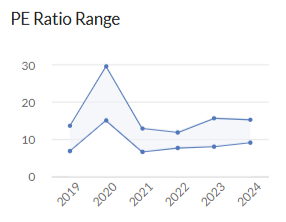

Hopefully the EPS result comes in strong: if I nudge up the existing EPS forecast by 5% to get a sense of what’s possible, I get something very close to 29p.

I’m writing this pre-open; based on last night’s close, that puts the shares on an earnings multiple of just below 15x.

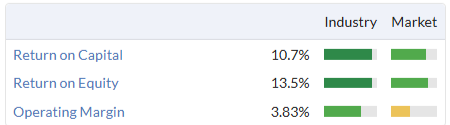

Is Tesco worth more than that? That’s for you to decide. Personally, I think the best counter-argument is a relatively simple one: supermarkets are extremely capital-intensive and low-margin, and even Tesco struggles to generate very impressive returns:

But according to the StockReport, it has at least been doing better than Sainsbury’s (and it's twice the size of Sainsbury’s):

Perhaps the best argument in Tesco’s favour is that it’s utterly entrenched as the market leader, and that its sheer size offers it some protection from the competition?

Here are some more headlines from today’s interim results:

Sales +5.1%

Free cash flow £1.3bn (up 2.9%)

Adjusted EPS 15.43p (up 6.8%)

Net debt is £9.9bn but this is mostly leases, it’s £2.1bn excluding leases (up from £1.7bn six months previously). There was nearly £800m of share buybacks during the period, which goes a long way towards explaining why net debt increased.

Net debt to EBITDA is 2x, below the company’s target range of 2.3x - 2.8x.

CEO comment:

"I am pleased with our first half performance, which builds on already strong momentum. Our market share gains in the UK are a particular highlight and reflect the decisive action we took at the start of the year to further invest in value, quality and service. The extension of our savings programme is helping offset new operating cost inflation, including increased National Insurance and other regulatory costs. Sales have grown across all our businesses, with customer satisfaction scores improving once again.”

Graham’s view

I’m going to upgrade this to AMBER/GREEN, consistent with Stockopedia’s findings that upgrades tend, on average, to be followed by more upgrades (while profit warnings tend to be followed by more profit warnings).

I’m happy enough with that as I can see that the stock may offer some value around these levels, although I also think there are some pretty hard limits in terms of what such a capital-intensive business can do for its shareholders.

Morgan Sindall (LON:MGNS)

Up 11% to £48.71 (£2.3bn) - Trading Update and Outlook - Graham - GREEN

Morgan Sindall Group plc, the Partnerships, Fit Out and Construction Services Group, today announces an update on trading and the outlook for the 2025 financial year.

Well done to Ed who has been highlighting this one: an example where good news has been followed by more good news, and following momentum rules could have led someone to take a long position here:

I’ve found the valuation multiple (in the teens) to be a little off-putting, and I shared Roland’s view that AMBER/GREEN was most appropriate - see Roland in June, and then myself in July.

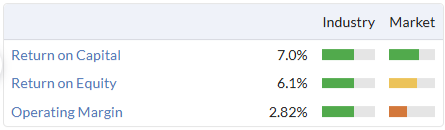

Valuation is at the top end of the normal range, and unusually high for the construction sector:

(The P/E in 2020 isn’t relevant due to depressed profits at that time.)

But the good news just keeps coming.

Since its Half Year Trading Announcement on 29th July 2025 the Group now anticipates that its full year results for 2025 will be significantly ahead of its previous expectations, following a continuation of the strengthening performance from the Fit Out division.

Let’s get a quick overview of the divisions:

Partnership Housing: profits in line with previous guidance. Agreements with Birmingham City Council, Cardiff and Vale of Glamorgan.

Mixed Use Partnership: still loss-making and losses in H2 to be almost double the £1.5m loss seen in H1 (I think these numbers are immaterial, and not a concern).

Construction and Infrastructure, Property Services: all trading in line.

Fit Out: this is the highlight.

Fit Out's performance has continued to strengthen significantly due to a combination of strong trading and operational execution. As a result, profits are now expected to significantly exceed the Group's previous expectations. Its secured order book as of 31st August 2025 was £1.6bn (of which £900m relates to 2026 and beyond) representing an increase of 8% on both the half-year 2025 and year-end 2024 position, underpinning the Group's confidence for 2025 and beyond. The Group's medium-term target for Fit Out remains unchanged.

Order book: £12.2 billion, up 2% since the half-year (June) and up 7% on year end (Dec 2024).

Balance Sheet: MGNS reports daily average net cash, which I consider to be best practice. Daily average net cash was £361m, down from £372m for the same period last year. Daily average net cash for the full year is expected to be greater than £350m, ahead of guidance.

Graham’s view

It would be churlish of me not to be GREEN on this after yet another upgrade:

I’ve just been checking over a note from Panmure Liberum, discussing June’s spending review - an extra £14bn was allocated to the Affordable Homes programme (£39bn instead of £25bn, over ten years). Annual spending on Affordable Homes is set to almost double to £4bn by 2029-2030, compared to its average annual spending in recent years.

We’ve written plenty on the impact of higher NICs and the potential casualties it has created in certain sectors.

The flipside of that coin is that government spending is also set to be higher than previously forecast.

For profitable companies that are locked into this spending, this is creating a wonderful opportunity.

But today’s trading update is about the success of MGNS’s Fit Out division specifically (Morgan Lovell and Overbury). In this division, there is a mix of private commercial clients along with some public sector work. It would be wrong to imply that MGNS is entirely reliant on government spending - it isn’t.

I won’t fight against momentum: I’m GREEN on this. It’s a Super Stock with a StockRank of 93, after all.

Mark's Section

Avation (LON:AVAP)

Up 1% at x164p - Annual Financial Report - Mark - AMBER

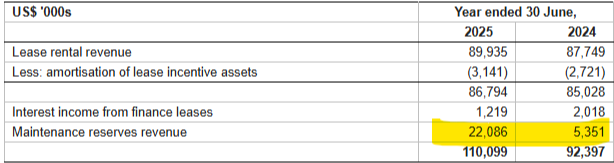

Revenue is up 19% here on a lease yield improvement from 10.7% to 11.3%, meaning that EBITDA rises 20% to $107m. Positive moves in operating cash flow mean that net debt is reducing, although at a level that would be considered very high if this wasn’t an aircraft lessor:

· Operating cashflow increased by 12.2% to $91.5 million (2024: $81.6 million);

· Net indebtedness reduced by 7.3% to $604.2 million (2023: $651.5 million);

· Net debt: EBITDA reduced to 5.6x (2024: 7.3x);

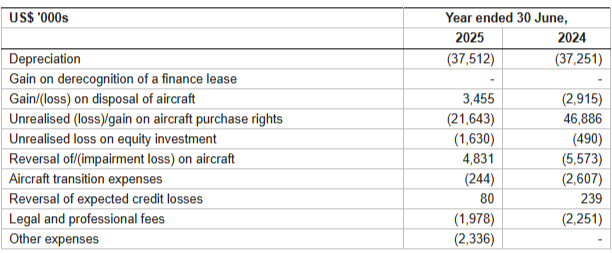

However, depreciation is a real cost when you own aircraft, so it is a little disappointing to see much reduced operating profit and a PT loss:

· Operating profit was $46.4 million (2024: $83.2 million);

· Loss after tax was $7.7 million (2024: profit $19.7 million);

Income statement:

However, looking at the details this is one company that probably should be producing adjusted EPS:

Large unrealised gains on aircraft purchase rights last year become large losses this year. These are explained:

The Company's 24 aircraft purchase rights were revalued at 30 June 2025 using a Black-Scholes option pricing model. The principal factors leading to the recognition of a loss of US$21.6 million (2024: US$ 46.9 million gain) were a decrease in risk-free interest rates and a reduction in the time to expiry of the purchase rights.

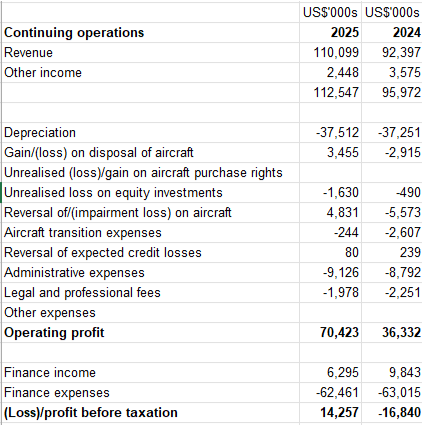

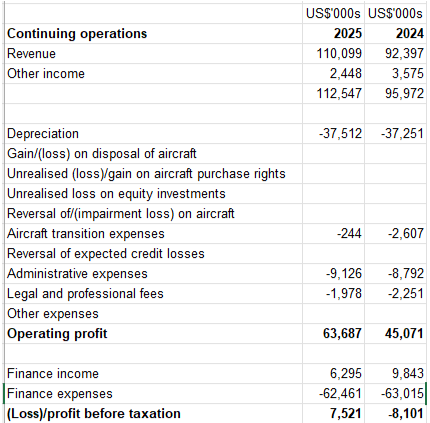

These are not really factors they can control (and may not even reflect reality as they are model-based). This looks more like the comparison we should be looking at, removing these costs and FX losses:

Excluding other one-off factors, the income statement would look like this:

Both of these show a decent turnaround for the year. But even the revenue here is not simple, much of the increase in revenue is a higher release of maintenance reserves:

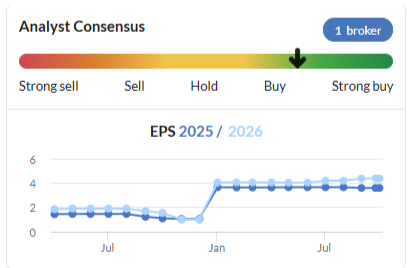

Broker forecasts:

How one treats this is open for debate. Often we turn to brokers to help us out and Zeus calculates this as 22c, which is a huge beat on their 1.9c forecast. However, given that revenue beat their $102.3m forecast almost entirely due to changes in maintenance reserves, the adjusted EPS is largely about the adjustments they choose to make rather than the EPS!

Looking forward, Zeus raise their FY26 EPS estimate by 18% to 14.2c and introduce a FY27 forecast of 11.9c. However, given the difference between FY25E and FY25A EPS, the 95% confidence intervals on those has to be +-40c!

That aside, the overall income statement, adjusted or not, highlights two things: 1. They are doing a lot of work for minimal reward. 2. Finance costs are eating most of the accounting profits.

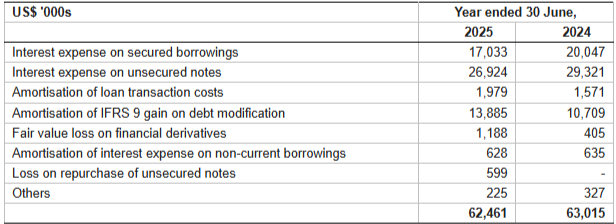

Finance costs:

Again, there is a lot going on with finance costs, and I won’t go into all of it, but the biggest costs are the interest on secured borrowings and on the unsecured notes:

The weighted cost of secured debt is actually quite reasonable at 5.2%, up slightly from the 4.8% of last year. The unsecured notes are at 9%. And this to me looks like an issue. When your average lease yield is 11.3%, then paying 9% on your debt doesn’t leave much to pay your admin expenses and other costs. This is why they have been actively buying back their own bonds:

We have made significant repurchases of the Avation Capital S.A. 8.25% October 2026 unsecured notes issue, reducing the outstanding amount to US$310.0 million at 30 June 2025 and to US$298.0 million as of today's date.

However, they won’t be able to fully repay these notes before they become due in October 2026, so they will need to refinance. They say they are “are now well positioned to achieve a successful refinancing of the Notes”. Presumably they have been building up their cash pile, now standing at around $130m, in order to provide flexibility over this refinancing. However, the bulk of this cash is still restricted and set aside for pre-delivery payments or to meet secured loan covenants.

I understand their desire to have the flexibility that having a mix of secured and unsecured debt provides, but in my opinion, it comes at a too high cost at the moment. If they were paying their average secured debt rate on the unsecured debt, they would save $11.3m over the next year. This would fund a further 17c of dividends if they chose to pay it out in that way versus the 1c declared, giving a 0.5% yield.

Valuation:

The good news is that if they manage to refinance at much lower rates, lower interest charges will have a positive impact on profitability, when we can actually untangle the details. This may highlight perhaps the most important aspect of valuation here is that they trade at a significant discount to net assets:

We have to be a little cautious here as this is the difference between two large numbers, fleet valuation and debt. While the debt value is certain, the fleet valuation is opinion, and can vary significantly. Market conditions are generally supportive of fleet values at the moment. The company says:

This market backdrop has continued to support aircraft valuations and lease rates over the last year with Avation seeing increases in values and lease rates for both new and second-hand commercial aircraft.

Plus, they have taken delivery of ATR-72 aircraft this year and immediately sold it at a profit, which suggests there is currently a high demand for their 24 purchase rights, either to be placed with customers or sold on. Of course, market conditions may change between now and when these aircraft are delivered, but for the moment, things look broadly positive on that front.

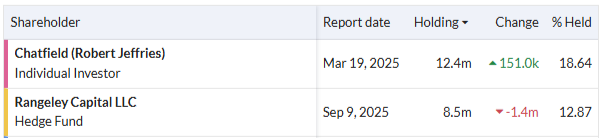

While net assets have increased slightly in dollar terms, the FX moves mean they have declined 6% in sterling. On the surface, trading at 0.63xTBV looks like a bargain, and indeed it may well be. However, again there is a flip side. In recent years the company had typically traded on 0.5xTBV and their largest shareholder Rangely Capital (togther with their associate, the unfortunately-named Jeremy Raper) have been selling down. Indeed, they sold a 10% stake in the company. My understanding is Rangely took their 25.78% stake in Aviation in order to attempt to unlock value by narrowing the discount to NAV, encouraging a sale or liquidation of assets. That they are now selling down their stake in the market and at a significant discount to NAV suggests they have unsuccessful in this. Exec Chairman Jeff Chatfield’s stake in the business still gives him significant influence:

Takeover target?

In contrast to Avation, a big competitor like Aercap is paying between 4-5% for unsecured debt. This seems to make it a no-brainer for a company like this to buy Avation, refinance the debt at much lower levels and reap the benefit. There have been rumours in the past but on the last results call the company denies that they have received any approaches. I think one of the stumbling blocks may be that Chatfield would want to receive NAV in order to let the business go, whereas most independent shareholders would presumably be happy with a modest discount, as this would still be a premium to the current market price. This leaves the company stuck in a bit of a no man's land - undervalued compared to its assets, but with no clear route for that discount to narrow. After the refinancing, there may be the financial flexibility for the company to narrow the discount via on market buybacks. However, they have resisted this in the past, choosing only to buy large off-market blocks from the likes of Rangeley. This may be good for increasing the discount to NAV, but does little for the share price, which given that the yield is less than 1% is the only reason to hold Avation shares. The downside is that once the refinancing is in place, the attraction of the company to an acquirer who has a lower cost of capital goes away.

Mark’s view

I rated this AMBER/GREEN back in December 2024 when I held the shares. The attraction was the purchase of a large chunk of shares from Rangeley made the P/TBV around 0.5x and this seemed too cheap. Since then, the discount has narrowed due to a modest price rise and negative FX impacts on sterling NAV. This makes it more like 0.63x TBV today. In the big picture this still looks too cheap, as recent trends back up the fleet valuation. However, I sold because I lost faith that there will be any near-term catalyst to reduce that discount. If the company successfully refinances their notes at a lower rate this will free up cash flow, but there is little sign that this will be used for higher dividends or on market purchases of shares that might help narrow the discount. However, a refinancing removes one of the major reasons a larger competitor may want to acquire the company in the short-term: access to cheaper debt. In the meantime Rangely seem happy to keep selling down their 13% stake in the market, having presumably lost the battle to precipitate major changes in strategy. So much as it loathes me to do so, given the discount to TBV, I feel it may be time for a more neutral view of AMBER (cue takeover tomorrow!).

Hercules (LON:HERC)

Up 2% at 36p - Trading Update - Mark - AMBER/GREEN

Graham was AMBER on this business at the start of the year after a fundraise in 2024 strengthened their balance sheet. The balance sheet was further bolstered by the subsequent sale of its vehicle rental business, Suction Excavator Services, which was responsible for only 5% of HERC’s overall revenues, but 88% of its debt. By May, an in line trading update had seen him raise his view to AMBER/GREEN.

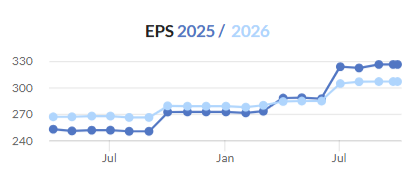

During this period forecasts have been largely flat:

But that hasn’t stopped the share price going up and back down in this time:

This is perhaps not surprising given that results for groundworks and site services businesses have been quite mixed in the UK. However, today’s trading update show some brightness:

The Company expects another record year, with Hercules' revenue, adjusted EBITDA and adjusted Profit Before Tax (PBT) for FY25 in line with market expectations*. Revenue is expected to be more than £118m, representing an increase of c. 16% on the prior year ended 30 September 2024 (£101.9m), as Hercules continues to benefit from increased investment in UK infrastructure.

So this is a 5% beat on revenue, but in line with adjusted EBITDA of £6.1m, and adjusted PBT of £3.3m forecasts. Interim results released in June had £2.6m Adj. EBITDA and £1.7m PTP, so this means H2 delivered £3.5m EBITDA and £1.6m PTP. It is a bit of a mystery which of ITDA has gone up in H2 for a rising EBITDA to lead to reduced PTP, as they have reduced tangible assets so presumably D is smaller, as should I be on lower net debt at the half year. The difference may be that they bought Advantage NRG in June for an initial cash consideration of £10.2 million, funded by a £6m loan from a non-exec at 8% interest.

H2 will also benefit from 3 months of NRG’s trading, so perhaps the lack of upgrades from this, or a belief that they overpaid at 6xEBIT + earnout for this business may be behind the recent weaker share price. Understanding all of this is not helped by them not breaking out their adjustments in the half year results, which seems a big oversight to me.

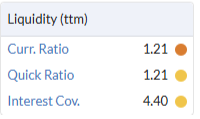

Balance sheet:

One of the things that changed Graham’s view here was the strengthening of the balance sheet, and they had £0.9m net cash excl. Leases at the half year. I did think that there may be some window dressing as they had £9.8m cash and £8.9m debt. However, I think this could also be explained by them preparing for a large acquisition. The current ratio was reasonable for this sort of business, but not outstanding:

This may change in the full year, depending on how the debt taken on to fund the NRG acquisition is accounted for. There isn’t a lot of asset backing, but this isn’t a major concern:

Segmental reporting:

I also can’t see any segmental reporting in the HY results, which is another major miss IMO. Here are the full-year breakdowns:

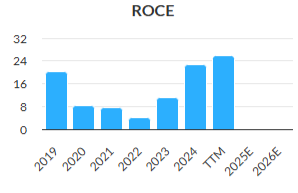

It seems almost all of the growth here is in the labour supply part of the business. The reality may be that this is becoming increasingly like a recruiter rather than a civil engineering business. While it is a rare recruiter that is performing well, that may impact the valuation investors are willing to give it.

The benefit of this increasing shift is that it is asset light, and this is evident in an improving ROCE over time:

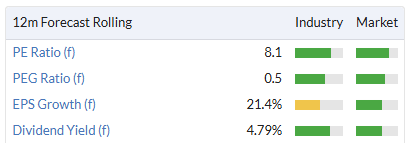

Valuation:

This seems very modestly rated now we have confirmation that it is trading in line:

The further growth in EPS into FY26 looks largely baked in due to their acquisition, making the PEG ratio look particularly interesting, but it also raises some questions. Why haven’t we seen a greater increase in forecasts following the acquisition of NRG, did they overpay or is there a weakness in their core business that is being masked?

Mark’s view

This doesn’t look the greatest quality of business and I don’t think its moat is the strongest. However, that doesn’t seem to stop it growing at a reasonable pace without requiring lots of additional capital, putting them on a modest earnings multiple. I think their disclosures could do with a big upgrade; not including a breakdown of their adjustments or segmental reporting at the half year looks remiss to me. Hence, I’d like to see their final results, including the initial impact of their recent acquisition on profitability and their balance sheet. But I’m happy to keep our broadly positive view of AMBER/GREEN for the moment, as the in line statement looks at odds with the recent share price movement.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.