Good morning everyone - Happy Friday! It looks like the City has packed up and gone home for the weekend.

All done for today, thank you.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view |

|---|---|---|---|

J D Wetherspoon (LON:JDW) (£752m) | LfLs +5.1%, adj. PBT +10.1% (£81.4m). As previously indicated, higher NICs/labour to cost £60m p.a. “The company currently anticipates a reasonable outcome for the financial year, although government-led cost increases in areas such as energy may have a bearing on the outcome.” | AMBER (Graham) As I have no confidence in EPS forecasts for the current year, I can’t be positive on the stock, but I’m also resistant to being negative on it, due to its inherent balance sheet strength and the resilient performance it has achieved over many years. I’m therefore going to leave our AMBER stance untouched for now. | |

FW Thorpe (LON:TFW) (£357m) | SP -2% Revenue -0.3%, PBT +5.9% (£31.6m). Solid start to 2025/2026, with operating performance in line with prior year. Cash reserves grow to £62m. | AMBER (Graham) [no section below] Mark was AMBER on this in March at a £352m market cap. The market cap after today's movement is £351m. And there is little change at the business, as FY 2026 starts off in line with the prior period. The modest increase in profits has come "primarily" thanks to cost reductions, as revenue decreases slightly. It's a conservatively-run family business and so I'm inclined to take a positive view, but I struggle to find anything in today's results to light up some excitement for investors. We are at least told that management teams are "targeted with finding growth" despite having similar revenues and a similar order book at this stage of the new financial year. I am left with the conclusion that it's fairly valued at this level (P/E ratio 14.6x, ValueRank 53). | |

RWS Holdings (LON:RWS) (£350m) | CFO has decided to step down. It has been agreed she will stay until end of 2025. | ||

Headlam (LON:HEAD) (£44m) | CEO steps down with immediate effect. The Chair becomes Exec Chair while the Board runs a formal CEO succession process. “This leadership change positions us to move forward with greater pace and focus.” | AMBER/RED (Graham) [no section below] The outgoing CEO is thanked for his efforts but it sounds very much like the Board at Headlam have grown impatient for progress. Half-year results published in September showed a large underlying loss (£17m), compared to a £12m loss in H1 of the prior year. The statutory pre-tax loss was enormous at £32m. Meanwhile the outlook could only reassure investors in relation to the medium-term; short-term market indicators were poor with "a slight deterioration" in the previous three months. Earnings estimates are negative here for the foreseeable future, and accordingly I'm downgrading our stance on this stock by one notch. |

Graham's section

Market comment: "pleasant conditions in which to invest"

After the webinar by Ed and myself, and the webinar review in which I suggested that these were very pleasant investing conditions, it was noted in the comments that not everybody agreed. In particular, Alex Brummer (City Editor, Daily Mail) had written an article with the following totally reasonable headline:

In 50 years as a City writer, I’ve almost never felt so worried a terrible crash is coming. Warning sings are EVERYWHERE.

He began the article by noting that a NYSE-listed company, that owns stakes in small football clubs, announced an intention to buy crypto tokens last week. Its share price subsequently increased by 225%, after peaking at a 600% increase.

As another example, he notes Nvdia’s $100 billion investment into OpenAI,

Given the extent of the mania, he writes:

We are very possibly heading for a historic crash, one that could presage all manner of impoverishment, ruined careers, decimated retirement prospects and more.

Other observations from Mr. Brummer:

Almost all stock market indexes are at or close to all-time peaks (even including the FTSE)

Gold price up 44% this year

Bitcoin has no intrinsic value, and is just below its $124k all-time high

Economically, he notes that UK government bond yields are at their highest level since 1998, with debt to GDP at close to 100% (highest ever level in peacetime), and that the number of unemployed is on the rise since the last Budget.

And he draws parallels between Trump’s tariffs and the tariff wars of the 1930s, contributing to the Great Depression.

Where I agree

Firstly, I respect anyone who’s been in the City for 50 years. You get less than that for murder, as the saying goes…

And I do agree with Alex on numerous points - except where he describes ARK Invest founder Cathie Wood as “serious and respectable”. She is extremely successful, yes, but her funds have not consistently outperformed the S&P 500 over the long run. She has proudly and confidently invested in some of the most speculative US stocks of the past decade, and due to the publicity and following she achieved during market bull runs, I would argue that she is personally responsible for more value destruction in the stock market than almost anyone else during this period.

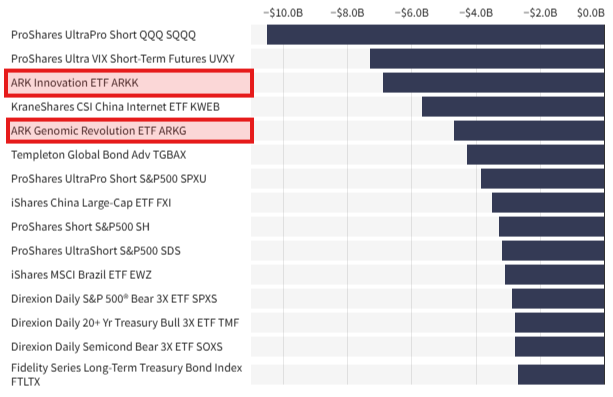

Here is a list of the biggest ETF losers over the past decade, from Investopedia. If someone bought the ARK Innovation ETF at inception (2014) and held it, they would have enjoyed returns similar to the S&P. But due to the nature of markets, most retail investors buy into this sort of ETF when it’s horribly overvalued:

But let’s turn back to where I agree with Mr. Brummer!

Readers will know that I completely share his opinion that Bitcoin Treasury Policy companies are a speculative bubble - here is my article on the topic. Many of these companies are close to worthless, if not actually worthless, in my view.

AI is also a bubble: for years, I’ve been quick to point out whenever I’ve found a company dubiously claiming to be involved in AI, in order to attract investor interest. I’ve been instinctively cautious whenever I find a micro-cap that claims to have the next big idea in crypto, machine learning or AI.

I’ve also been fairly sceptical of Nvidia’s valuation (wrongly, so far).

And when it comes to the economy, the UK’s debt to GDP is of course a very legitimate cause of concern, and international tariff wars are still a major source of risk. At least we are no longer in a "ZIRP" environment - the era of zero interest rates forced investors to take on excessive risk, whereas now there are some fixed income alternatives that do offer a reasonable return.

But I agree substantially with nearly all of Mr. Brummer’s points: there are many warnings signs, and many potential causes of concern.

Where I disagree

I think the danger with a view like Mr. Brummer’s is that it could tempt (or scare) some people to sit in cash, earning little, in an attempt to avoid the inevitable crash.

The problem with predicting crashes is that you never know when they are going to happen. It may be perfectly obvious that a stock, a market or a commodity is overvalued - but it can take years for the bubble to pop.

So from a portfolio management point of view, it’s not enough to say “markets are overvalued” - you still need a reasonable choice for what to do with your money.

Why I said that these are pleasant conditions in which to invest

My day-to-day focus is on UK small-caps, and I believe that we are very far from being in a speculative bubble in this niche.

Ed showed us a slide at last week’s webinar which showed the UK market as a whole being the cheapest (relative to earnings) against a set of comparable national indices.

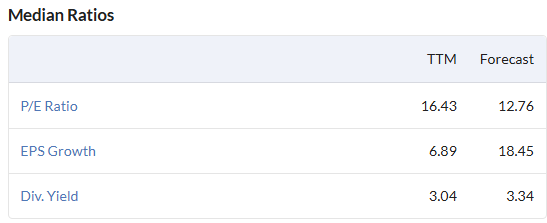

If we focus specifically on the AIM All-Share Index, we find a forward P/E ratio of 12.76 - hardly in bubble territory.

Note also that its PEG ratio (P/E ratio divided by EPS growth) is less than 1x, on a forward basis:

The FTSE Smallcap Index, which is higher-quality than AIM, offers even more value (forward P/E 10.5x), a lower PEG ratio, and a higher forecast dividend yield (4.5%).

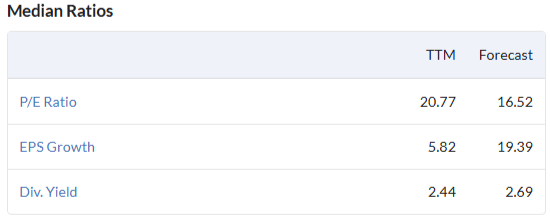

Turning to the United States, the NASDAQ composite is, unsurprisingly, much more expensive. But even there, the forward PEG ratio is less than 1x:

Where I think that the real danger lies - and my solution

For me, there are two main sources of danger in current markets.

The first is the crypto mania, where I think that the proliferation of Bitcoin Treasury companies is a sign of speculative frenzy. Bitcoin itself might be a great investment, but I cannot be convinced that a company is worth something purely because it intends to buy some Bitcoins!

The second main source of danger is the concentration of the S&P 500 into a small number of mega-caps. Note that in the figures above, I was looking at median valuation multiples, because these provide useful yardsticks for stock pickers who are willing to look at companies of all sizes.

For ETF investors, however, the value of an index - or an ETF - is determined by its biggest companies, not by the median.

Index concentration does set the stage for a potentially dramatic collapse, in my view:

Nvidia: 7.6% of the S&P 500 (forward P/E 33x)

Microsoft: 6.3% (32x)

Apple: 6.3% (32x)

Amazon: 3.9% (30x)

Meta: 3.0% (25x)

That’s 20% of the index in the top 3, and 27% in the top 5. And the cheapest one is at a forward earnings multiple of 25x!

This does scare me.

I think the strong performance of these mega-caps is a symptom of the ease with which anyone, globally, can invest in an S&P 500 tracker.

But I also think that their strong performance is a cause of increased interest in buying S&P 500 trackers.

So I think Michael Burry was right when he said:

Passive investments are inflating stock and bond prices in a similar way that collateralized debt obligations did for subprime mortgages … When the massive inflows into passive vehicles reverse, ‘it will be ugly.’

But note that he didn’t say this last week, he said this six years ago. Isn’t there some well-known phrase about markets remaining irrational for a long time?

My solution

As in all things, I think it’s good to have a balanced perspective.

I personally own some of all of these:

UK small-caps and mid-caps: my main focus. I don’t believe that the stocks I own are particularly overvalued.

Berkshire Hathaway: diversified US exposure in a single stock.

Global tracker, including the S&P 500 (in a pension fund, which I can’t access): just in case Michael Burry and Alex Brummer are wrong. I don’t get to touch this money for a few decades anyway.

Global high dividend yield tracker (in a pension fund, which I can’t access): similar to the global tracker, but it excludes companies with a low dividend yield. It doesn’t own any of the Magnificent 7, is much better diversified than the global tracker, and is much less US-weighted.

So I’m going to stand by my words that these are pleasant conditions in which to invest: I’m happy continuing to plough money into the above categories, whenever I can afford to. It’s responsible to hold some cash too, of course, but there is a point at which holding too much cash becomes inefficient. I do not believe that investors with a reasonably long time horizon (5 years+) will face good odds if they avoid market risk at all costs, for fear of a crash.

At the same time, I’m going to agree with Mr. Brummer that there are several worrying signs of speculative mania in the markets, and that there are plenty of economic reasons to be fearful. But there are always things to worry about - the trick is to position your portfolio so that you can sleep at night.

J D Wetherspoon (LON:JDW)

Down 5% to 633.5p (£716m) - Preliminary Results - Graham - AMBER

These are fine results, but do bear in mind that they only go to the end of July, i.e. including three months of higher National Insurance contributions.

We did get a preview of these results with a trading update in July, covered by Roland.

There is a 10% increase in adjusted PBT, and a 4.5% increase in adjusted EPS.

I think this difference between PBT and EPS growth is purely to do with taxes: there was a 29% tax rate on adjusted PBT this year, vs. 21% last year.

The weighted average number of shares is down by 4%, which all else being equal would have meant EPS growing faster than PBT.

Also of note is that “separately disclosed items” are positive, i.e. the statutory numbers are better than the adjusted numbers. In the footnotes, I find mention of £10.3m worth of impairment reversals on pubs, and £12.7m income relating to hedging trades on interest rates.

Let’s check out the always-colourful commentary by Tim Martin.

On recent trading:

"In the last nine weeks, to 28 September 2025, like-for-like sales increased by 3.2%. The latest 'CGA RSM Hospitality Business Tracker', for August 2025, said industry like-for-like sales were +0.5%. During this period, Wetherspoon like-for-like sales were +3.7%. This was the 36th month in a row that Wetherspoon has outperformed the tracker.

Great news, but the impact of NICs on profitability is what I’m most worried about when it comes to this stock. Tim Martin addresses it in a similar manner to before:

"As previously indicated, increases in national insurance and labour rates will result in cost increases of approximately £60 million per annum, and non-commodity energy costs will add £7 million… Cost increases such as these will undoubtedly add to underlying inflation in the UK economy, although Wetherspoon, as always, will endeavour to keep price increases to a minimum….

"The company currently anticipates a reasonable outcome for the financial year, although government-led cost increases in areas such as energy may have a bearing on the outcome."

This mirrors what the company said about FY 2025, e.g. in March they said:

"The company currently anticipates a reasonable outcome for the financial year, subject to our future sales performance."

And back in January they said:E

"The company is confident of a reasonable outcome for the year, although forecasting is more difficult, given the extent of the increased costs."

So this is what they do: they tell us there will be a “reasonable” outcome, usually with some form of basic disclaimer.

In this case, the warning that “government-led cost increases… may have a bearing on the outcome” is already known. So unfortunately the outlook sheds little light.

But it’s clear that cost increases of £60m (NICs/labour), energy (£7m) and packaging (£2.4m) are significant in an industry with small margins, and where adjusted PBT for the year just gone was £81m.

The £7m energy charge is new:

Wetherspoon has just been informed that the "non-commodity" elements of our electricity charges (in effect, taxes or "levies" which are added to electricity bills) will rise by an annualised £7 million, starting this month, so that the non-commodity element will be approximately 62% of our overall electricity costs.

The increased cost is partly due to two new levies: one is a nuclear power subsidy, the other is a subsidy, as we understand it, for energy intensive industries.

As indicated, this substantial increase in levies, applicable to most consumers and businesses, will inevitably add to inflation in coming months.

Balance sheet: I’ve noticed some excellent comments under this article re: JDW’s use of cash and buybacks.

As per the cash flow statements, these are the major cash movements for FY July 2025::

£193m cash inflow from operating activities (arguably we should deduct from this £38m of lease-related payments that are classified elsewhere).

£108m cash outflow for investing activities (includes £24m of growth capex).

£67m outflow for buybacks.

£23m outflow to buy shares for share-based payments (staff bonuses).

£19m outflow for dividends.

£19m outflow for freeholds/investment properties.

Net debt increases from £660m to £724m.

Including leases, debt increases from £1.07 billion to £1.13 billion.

Net assets (almost fully tangible) are £361m.

Graham’s view

I don’t have any real objection to the company’s use of cash this year, although it's fair to question the buyback is profits subsequently come under pressure. To my eyes, using the figures shown above, they made a cash income of £48m (operating activities minus investing activities, adding back growth capex and deducting share purchases for SBPs).

The company's own calculation comes up with a free cash flow figure of £57m.

In that context, spending £86m on buybacks and dividends combined might seem excessive, but they are starting from a strong position in terms of freehold properties and tangible net assets. I note “the company's freehold assets have not been revalued for over 25 years.”

The bigger question to is what is going to happen with profits, and on that front I remain deeply concerned about the impact of higher NICs, and other costs.

There are winners under the current government, but there are also losers, and JDW stands in the firing line.

As I have no confidence in EPS forecasts for the current year, I can’t be positive on the stock, but I’m also resistant to being negative on it, due to its inherent balance sheet strength and the resilient performance it has achieved over many years.

I’m therefore going to leave our AMBER stance untouched for now.

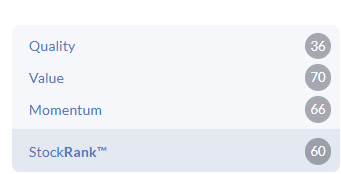

I’m in good company with my neutral stance:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.