Good morning! And welcome back to Roland from his holiday.

Apologies for the lateness of today's report - I lost internet connection this afternoon for the first time in years! Will add a few more sections to finish off. All finished for today.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view |

|---|---|---|---|

Mondi (LON:MNDI) (£4.6bn) | Adj EBITDA -19% to €223m vs Q2. “Challenging trading” with oversupply. Current prices below Q3 average prices. | ||

Sirius Real Estate (LON:SRE) (£1.47bn) | YoY rent roll +15.2% (+5.2% LFL), with €300m acquisitions YTD. On track to deliver FY results in line with exps. | ||

Aston Martin Lagonda Global Holdings (LON:AML) (£823m) | PW: FY vols to decline by “mid-high single digit” %. FY25 adj EBIT to be below bottom end of exps (<£110m). | BLACK (RED) (Graham) [no section below] Some may argue that there is no point in my covering this, as I am only ever going to be RED on it. However, I think that in order to fully appreciate what makes good companies “good”, it helps to be aware of what makes bad companies “bad”. In the case of AML, the investment case hasn’t matched the elegance of the cars, as the company has been consistently loss-making ever since it floated, and earnings forecasts have a strong tendency to be downgraded. Car manufacturing is a highly capital-intensive process at the best of times, where the largest operators struggle to generate an attractive profit margin, and where small brands such as AML require very strong margins to turn a profit at all. AML has been unable to do this and has also (consequently) suffered from a very weak balance sheet, requiring regular fundraisings. The most recent interim results to June showed net debt of £1.4 billion; the company is rated B- by Fitch, which is at the lower end of “highly speculative”, and its outlook was changed to negative earlier this year. Of course I’ll keep our RED on this stock after today’s latest profit warning. | |

ITM Power (LON:ITM) (£488m) | Project shortlisted in UK HAR2 round, expects to be operational in 2028. No value provided. | ||

Ferrexpo (LON:FXPO) (£316m) | Commercial production +3% to 1.51mt vs Q2, but -29% vs Q1. Withheld VAT now $47m, production down to one line. | ||

Treatt (LON:TET) (£161m) | Final cash offer from Natara of 290p per share; 29.5% premium to 5/9 close. (Previous offer was 260p.) | PINK (under offer) (Graham) [no section below] | |

Beeks Financial Cloud (LON:BKS) (£148m) | Rev +26%, adj PBT +41% to £5.5m. Recurring revenue +5% to £29.5m. FY26 outlook in line with exps. | AMBER (Roland) | |

Quartix Technologies (LON:QTX) (£138m) | Q3 “very strong”. FY25 rev and profit to “slightly exceed” latest market forecasts. FY26 outlook “improved”. | GREEN (Roland) Today’s Q3 update reads well and contains the sixth upgrade to guidance since July 2024. Founder Andrew Walters has done an excellent job since returning to the business two years ago and it’s hard to fault recent performance, in my view. International growth is encouraging with nearly half the group’s revenue now generated outside its core UK market. I can see some risk that pricing power or growth could falter as Quartix competes against rivals backed by big corporate owners. But I’m happy to remain positive given excellent quality metrics and strong cash generation. While the P/E of 22 isn’t cheap, I don’t think it’s unreasonable given expected double-digit EPS growth. | |

Speedy Hire (LON:SDY) (£111m) | Agreed supply deal with HSS ProService, will take 10% equity stake and purchase some assets for £35m. | AMBER (Roland) [no section below] The market has reacted well to today’s news that Speedy will become the first-choice supplier to ProService (HSS’s digital sales channel). Speedy will also take a 10% stake in the restructured ProService business and acquire certain assets, listed as “three distribution centres, motor vehicles and hire equipment”. Without any details it’s hard for us to gauge if this is likely to represent an attractive investment for £35m. Speedy expects “a full payback” through operating cash flow in “two to three years”. However, today’s note from Panmure Liberum suggests leverage will rise to 2.1x by March 26 as a result of this deal (FY25: 1.9x). To support deleveraging over the next two years, Speedy’s dividend is being cut by 61% to 1p for FY26, although management hopes to reinstate the payout to current levels in FY29. The obvious attraction here is that Speedy Hire will gain additional volumes and market share in a competitive and somewhat commoditised sector. That’s not a bad thing and today’s broker note suggests it could drive a meaningful recovery in earnings. However, Speedy Hire warned on profits in February and has historically generated low returns. It’s also been somewhat accident prone. I would like to see concrete evidence of the benefits of this deal with HSS (also a poor quality business, in my view) before turning positive, so I’m going to mirror the StockRanks and leave Graham’s previous neutral view unchanged today. | |

Avation (LON:AVAP) (£109m) | Appointed advisors to arrange investor meetings for new $300-400m credit offering. | ||

Jubilee Metals (LON:JLP) (£104m) | Now received first tranche of $15m sale proceeds. Progressing 3-stage plan to develop Zambia copper assets. | ||

Dialight (LON:DIA) (£97m) | Sales are marginally down but margin improvement, cost reduction and cash generation continued to improve. “Expects to significantly exceed Adjusted Operating Profit expectations.” But also: “the Group remains cautious on the sales outlook for the full financial year to 31 March 2026 due to this continuing uncertainty.” | AMBER/RED (Graham) [no section below] My existing RED stance on this - as explained here - is to do with balance sheet safety, and therefore I can give it an upgrade by one notch today on the news that net debt has improved significantly to $10.2m (March 2025: $17.8m), helped by $3m of credits from the IRS. That debt level is less than £8m, i.e. less than 10% of the market cap. Therefore, even if the company still had any risk of breaching covenants, and there was a short-term emergency, one might expect that the company could fill the gap with a small fundraise. So hopefully the balance sheet concerns are no longer valid here - more will undoubtedly be revealed at the interim results. Looking at the company more broadly, I remain very careful when it comes to stocks in the lighting sector, due to volatile demand, and I note that the company’s messages today are very mixed: they are beating operating profit expectations, but accompanying that with an extremely cautious sales outlook. So I’d still be inclined to view this as a high-risk play, and not particularly cheap at a c. £100m market cap. | |

Brave Bison (LON:BBSN) (£91m) | GM convened on behalf of Lord Ashcroft to appoint a new NED. 51% of shares have indicated they support Board’s opposition to this. | AMBER/GREEN (Graham) [no section below] It sounds like Lord Ashcroft's attempt to get the CEO of Impellam, Julia Robertson, onto the board of Brave Bison is now doomed to failure. Shareholders owning the majority of the shares have now indicated they support the Board on this. I do find it a little surprising that the Conservative peer is unable to get a NED appointed, seeing as he owns 24% of the company. The level of opposition is impressive, with two thirds of the entire shareholder register (excluding Lord Ashcroft) providing written indications of support. Incidents like this often lead to escalation of some sort - perhaps we will see him increase his stake further? For our most recent coverage of this stock, please see here (Sep 11th). | |

Batm Advanced Communications (LON:BVC) (£79m) | Sells A.M.S 2000 Trading Impex to Dr. Zvi Marom in exchange for his shareholding in BATM, c. 22% of the company. Transaction values AMS at £17.6m. | ||

Alternative Income REIT (LON:AIRE) (£58m) | NAVps +3.4% (83.64p). Year-end discount falls from 18.4% to 11.5%. Dividend resets lower due to increased financing costs. | ||

Hemogenyx Pharmaceuticals (LON:HEMO) (£58m) | Institutional Review Board at MD Anderson Cancer Center has allowed children and adolescents in Phase 1 trial of HG-CT-1. | ||

1Spatial (LON:SPA) (£53m) | Signed £1m, 15-month contract with UK Power Networks for 1Streetworks platform, with a one-year extension option. | ||

HSS Hire (LON:HSS) (£52m) (suspended) | Final Results & ProService Supply Agreement with Speedy Hire | 15-month period to March 2025: £130m loss, underlying PBT minus £8.4m. Material uncertainty. Suspension is lifted. | |

Skinbiotherapeutics (LON:SBTX) (£38m) | SBTX received a list of participating Superdrug Stores for 1st phase of AxisBiotix™ launch. | ||

Manx Financial (LON:MFX) (£33m) | Neil Jeffery, consultant with subsidiary Payment Assist Limited, has been retained by Manx Ventures Limited until 2023. | ||

Litigation Capital Management (LON:LIT) (£13m) | Funded party unsuccessful in seeking to appeal arbitration loss, Investment held at a value of £1.4 million to be written off. |

Graham's Section

Beauty Tech (LON:TBTG)

Down 2% to 281.55 (£312m) - IPO (Announcement of Pricing and Offer Size) - Graham - AMBER

Last week saw the first major IPO in London of 2025: Beauty Tech (LON:TBTG).

It looks to be the biggest IPO since Applied Nutrition (LON:APN) and Raspberry PI Holdings (LON:RPI), which both took place last year.

Some of the key facts:

39 million shares sold at 271p

Implied gross proceeds: £106.5m

Net proceeds: £101m, of which £28m is receivable by the company, while £73m goes to selling shareholders.

As a general rule of thumb, I like to see IPOs where more money is being raised by the company (presumably to fund growth) rather than by selling shareholders.

On Friday, the shares closed at 288p, up 6%: a sign of a well-run IPO where there was more demand than supply at the IPO price.

Berenberg and Rothschild managed the IPO with the help of RetailBook (owned by Peel Hunt, Hargreaves Lansdown and others).

What it does:

What began in 2009 with the launch of CurrentBody has since evolved into a portfolio of category-leading brands, including CurrentBody Skin, ZIIP Beauty and Tria Laser. Together, they give us product excellence across the four core clinic based technologies of LED, radio-frequency, microcurrent and laser.

The “signature devices” from CurrentBody are an LED Red Light Therapy Mask (costs £499) and a Radio Frequency Skin Tightening Device (costs £299).

Red Light Therapy Mask:

I’m not familiar with this technology - and I would not presume that any of our readers need any of these devices!

The Therapy Mask provides “advanced skin brightening, clearing and anti-ageing”.

Historical financial information - FY December 2024

Digging through documents on the IPO website, I find the following information:

FY 2024 revenue: £101m

Gross profit £57m

Operating profit £12.6m before the impact of IPO-related costs of £7.2m.

Firstly, I would say that the high gross profit/gross margin of over 50% is a good start - an initial indicator that we are looking at a high-quality business, with pricing power.

Secondly, I agree with excluding IPO-related costs, so I am happy to use the £12.6m operating profit figure.

Moving further down the income statement, there was a large interest bill (“finance costs” are £8.6m).

But the footnotes tell us that using the IPO proceeds, the company is to pay off £22.5m of bank loans. They are also converting loan notes and preference shares into shares, and will have a “debt-free position at IPO”.

With bank loans, loan notes and preference shares all eliminated, £8.6m of finance costs would have been drastically reduced.

So in summary: 2024 saw over £100m of revenue, a >50% gross profit margin, and an operating profit of £12.6m.

Interim financials to June 2025

We also get interim results to June 2025.

Key points:

Revenue £55m (up 27%)

Gross profit £33.6m (61% gross margin)

Operating profit £9.3m, up more than 100% against the previous H1.

Finance costs are £4m but this includes interest on loan notes and preference shares - and as we just mentioned, these costs should not be continuing.

I note also that the operating profit figure is after charging “exceptional administrative expenses” of £1.5m, with “deal fees” (relating to exploring a private equity acquisition, and IPO-related costs) of over £1m.

27% revenue growth in H1 is very impressive, but dig beneath the surface and there are a lot of moving parts. The main driver was 56% growth in the main brand Currentbody, while at the same time the company discontinued reselling Third Party products, which resulted in a loss of revenue.

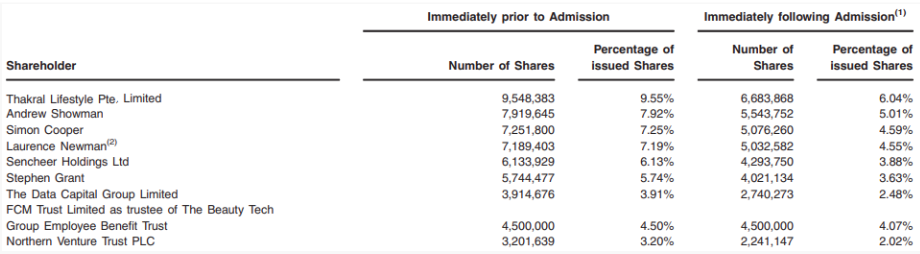

Shareholders after IPO

Some key points here: this is clearly a liquidity event for existing shareholders, but it looks like they are all keeping most of their existing stakes.

Laurence Newman is the founder and CEO: his stake reduces from 7.2% to 4.6%.

As an aside, I note that Northern Venture Trust PLC is managed by Mercia Asset Management (LON:MERC). Beauty Tech’s headquarters are in Manchester.

Comment by Laurence Newman:

"I am incredibly proud of everything The Beauty Tech Group has achieved since we launched CurrentBody in 2009. From establishing ourselves as a global leader in the fast growing at-home beauty technology market to successfully completing this milestone listing on the London Stock Exchange, the Group continues to go from strength to strength.

"As we enter the next stage of our growth journey, this IPO provides the perfect platform to increase awareness of our three distinct, premium brands and take the Group to the next level, while delivering sustained and profitable growth. The continued momentum within the business and strong support from investors during our roadshow, gives us the confidence and financial firepower to fully capitalise on the significant opportunities that lie before us.”

Graham’s view

I’m still getting familiar with this company, so I’m not going to express a very strong opinion on this today.

Some positive points:

Founder-led, and the founder-CEO still has a position in the shares after the IPO.

The balance sheet should be fine - not cash-rich, but not carrying excessive debt either.

While I don’t know much about the company’s products, it seems that this sector - beauty technology at home - ought to be a growth sector for the foreseeable future, due to the technology involved becoming gradually more affordable and effective.

Some risks and negative points:

While some of the IPO money has gone to the company, most of it has gone to selling shareholders.

The money that has been received by the company is mostly being used to repair the balance sheet, rather than directly funding growth.

Is there a risk of LEDs/laser products becoming more strictly regulated? And do these products actually work? I don’t know!

As usual, I’ll apply my IPO rule, which says that the stock is likely to remain overvalued after IPO for at least two years, or until the share price has fallen by 50%.

A price to sales multiple of 6x is certainly quite adventurous, although with strong margins the P/E multiple for the current year might actually turn out to be reasonable for a high-growth consumer-facing company.

For example, operating profit should be well over £20m, considering that the seasonally most important Q4 period has not happened yet. Then adjusted net income after 25% tax should be over £15m, which would put the P/E on less than 20x.

On seasonality:

The Group experiences a significant degree of seasonality, with a substantial portion of its annual revenue generated during the fourth quarter of the year. In particular, sales volumes peak in November and December, driven primarily by increased consumer spending associated with Black Friday, Cyber Monday, and the holiday shopping season leading up to Christmas.

A cynic might argue that it’s suspicious that the company would get its IPO away just before sales volumes are forecast to peak for the year. Will this become one of those IPOs that issues a disgraceful profit warning very shortly after listing - I hope not!

Overall, I’m going AMBER on this. I’m delighted to have a big IPO to look at, as they are necessary for the long-term health of the market. And it will be a bonus if these shares turn out to be a decent investment.

Roland's Section

Quartix Technologies (LON:QTX)

+12% at 318p (£154m) - Trading Statement - Roland - GREEN

The Company now expects to slightly exceed the most-recently updated market estimates for revenue and profit for the full year.

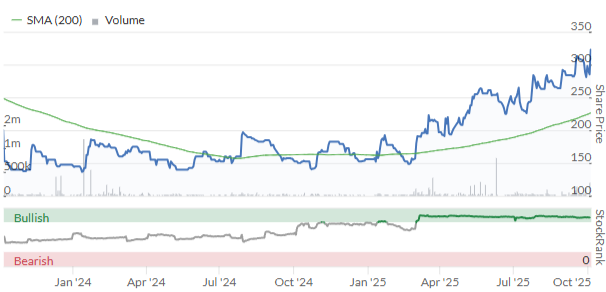

This fleet telematics specialist has staged a strong recovery over the last year. The stock has double-bagged since founder Andrew Walters returned to take charge of the business in October 2023.

This has been mirrored by a series of broker upgrades – today’s upgrade is the sixth since July 2024, according to today’s note from house broker Cavendish. This is reflected by the broker trend chart on the StockReport:

Let’s take a look at today’s update to see what’s changed.

Q3 trading - FY upgrade: financial performance during the most recent quarter is described as “very strong”.

During the first nine months of 2025, Quartix’s annualised recurring revenue (ARR) rose by £3.5m (+11%) to £36.1m. In value terms, that’s equal to the ARR growth achieved during the whole of last year.

As a result, both sales and profits for the full year are now expected to be ahead of previous market forecasts for revenue of £36m and adjusted PBT of £7.1m:

One factor driving these gains was the implementation of the company’s second annual price increase earlier this year. I think this is important. Telematics services are relatively cheap on a per-vehicle basis and costs have come down in cost over the years, as might be expected. For these reasons I’m encouraged to see that Quartix’s services have sufficient appeal to support both price increases and growth.

A greater focus on subscriptions should also help support visibility and margins. The company says hardware now accounts for under 3% of sales, with 94% of revenue coming from subscriptions.

Cash generation was further boosted in Q3 as production of the company’s latest, lower-cost tracking system TCSV17 reached full production, allowing stocks of the previous TCSV15 to be run down. Going forward, this transition is expected to support higher gross margins. Cash costs from 4G upgrades are also expected to taper.

Management says free cash flow for the first nine months of 2025 was £4.3m, exceeding previous full-year forecasts of £4.1m.

Outlook & Updated Estimates

Executive chairman Walters sounds confident about the prospects for the next 15 months:

"We have made substantial progress in many key aspects of our business during the first 9 months of 2025. Over the past 12 months our annualised subscription revenues have risen by a record £4.3m, or 14%, to £36.0m; we look forward to the remainder of the year and 2026 with confidence."

With thanks to broker Cavendish, we have access to updated forecasts today showing the scale of today’s upgrade:

Revenue | EPS | |

FY25E | £36.1m (prev. £36.0m) | 11.5p (prev. 11.2p) |

FY26E | £40.3m (prev. £39.9m) | 14.6p (prev. 13.8p) |

While changes to revenue growth forecasts are minimal, these new forecasts increase FY25 EPS by 2.7% and FY26E EPS by 5.8% – useful increases.

Taking into account this morning’s double-digit share price gain, I estimate this leaves Quartix on a FY26E P/E of 22.

Roland’s view

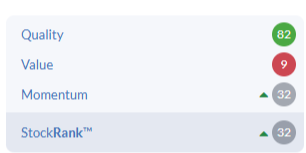

Quartix has been a good example of a turnaround with good fundamentals where investors have been able to ride the momentum and benefit from a significant re-rating. Momentum remains strong but the stock’s value rating has declined, leaving it in High Flyer territory.

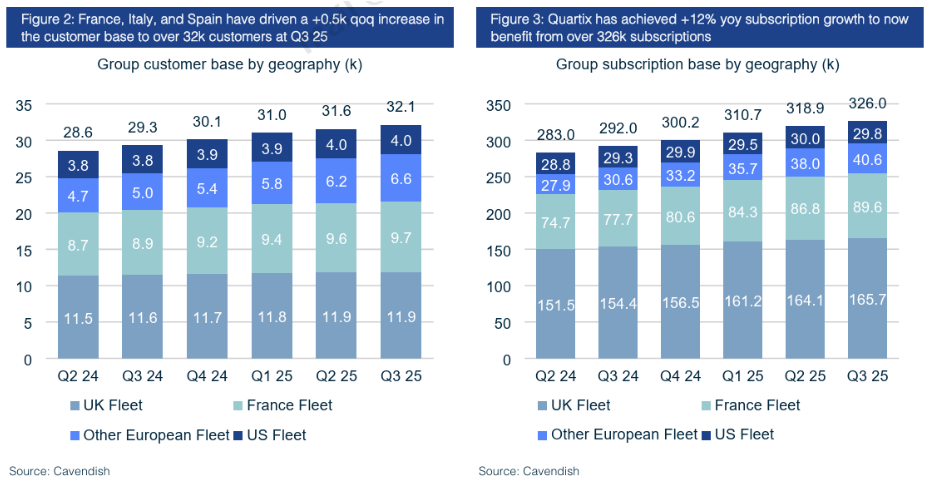

The company’s focus on expanding its fleet and international businesses is paying off and seems to be allowing it to gain scale outside its core UK market. I’ve reproduced the charts below from today’s Cavendish note:

Around 46% of recurring revenue now comes from customers outside the UK, suggesting there could be significant further growth potential.

One point I’ve noticed when I’ve looked at this business before is that Quartix’s customers tend to have small fleets. Or at least, they use telematics on relatively small numbers of vehicles. Crunching the numbers from the Cavendish graphics above give me the following average number of subscriptions [vehicles] per customer:

UK 13.9

France: 9.2

Other European: 6.2

US: 7.5

I guess these averages may mask a small number of larger customers and a long tail of small operators. But I’d see this both as a growth opportunity and perhaps a constraint on long-term growth, depending on whether Quartix can win business from more larger customers or not.

When I looked at this business in depth elsewhere a few years ago, my impression was that a number of key competitors were owned by larger companies. For example, tyre giant Michelin and US mobile operator Verizon both own telematics providers.

At the time I wondered if competitive pressures could limit Quartix’s pricing power and growth potential. I can’t help feeling this remains a medium-term risk, but it certainly doesn’t seem to be a significant problem at the moment.

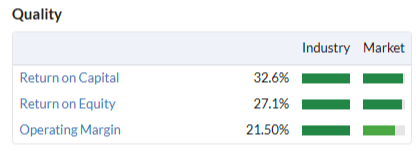

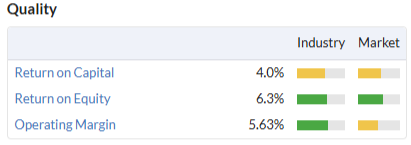

While the stock’s ValueRank of 16 is now at a level that might suggest some caution, quality metrics are excellent here:

As we’ve seen today, momentum also appears to remain strong. Based on today’s forecasts from Cavendish, adjusted earnings are expected to rise by 17% in 2025 and by 27% in 2026.

I took a GREEN view on Quartix in April, but the shares have risen by nearly 50% since then.

I might normally moderate my view to AMBER/GREEN at this point, but I’ve decided to stay positive.

On balance, I don’t think the stock looks too expensive for a business with this level of quality and momentum. Quartix’s strong balance sheet and excellent quality metrics also suggest to me that cash generation could remain very strong as various one-off costs recede, perhaps supporting additional shareholder returns. GREEN

Beeks Financial Cloud (LON:BKS)

Down 9% at 200p (£148m) - Final Results for y/e 30 June 2025 - Roland - AMBER

Our tracking spreadsheet shows that we have been consistently neutral on Beeks this year, most recently in September when Mark reviewed a recent contract announcement.

Beeks provides low-latency computing and connectivity for financial sector customers. For me, the problem is that this business is priced like a high-flying software company but seems to have more of the characteristics of an equipment leasing business. Beeks has consistently reported low profitability and must often fund new customer deployments upfront before receiving ongoing revenue. As a result, strong revenue growth has not been matched by profit growth and profitability has been poor, at least on a statutory basis.

I’m open to the idea that this situation could improve over time as Beeks scales up and transitions to new revenue models. But the shares are down again today, extending a trend that’s seen the shares fall by over 25% so far in 2025:

FY25 results summary

Turning to today’s results, revenue of £35.9m and adjusted earnings of 7.6p per share both appear to be in line with consensus expectations, according to the StockReport.

The company is one of the more talkative members of the market and has kept investors updated with regular RNS releases covering contract wins and other developments. Here are some of the highlights from the past year:

Exchange Cloud contract wins secured with clients including the Australian and Mexican stock exchanges, crypto group Kraken and post-period end, a division of the TMX Group (which owns the Toronto Stock Exchange);

Continued expansion with existing customers, including an Exchange Cloud contract extension with the Johannesburg Stock Exchange;

Proximity Cloud contracts signed including renewals and wins “across brokerage and fintech firms”, including “a leading global FX broker”.

Turning to the accounts, there are some fairly large movements reported for both revenue and profit:

Revenue up 26% to £35.9m

Gross profit up 30% to £14.7m

Gross margin: 40.9% (FY24: 39.8%)

Underlying pre-tax profit up 41% to £5.5m

Reported pre-tax profit up 91% to £2.8m

Net cash of £7.9m (FY24: £6.6m)

Revenue: the company is keen to flag up growth in its newer Exchange and Proximity Cloud services, but these still only account for a minority of revenue. The core Public/Private Cloud business still generates the majority of sales, albeit with minimal growth last year:

Public/Private Cloud revenue up 2.4% to £25.6m

Proximity/Exchange Cloud revenue up 196% to £10.3m

Note: as I understand it, Public/Private Cloud respectively allow customers access to shared or dedicated infrastructure located in Beeks’ own data centres.

Exchange and Proximity Clouds provide customers with similar connectivity stacks deployed into customers’ own data centres. Exchange Cloud is a reseller package designed to allow exchanges to offer white-label services to their own clients, while Proximity Cloud provides dedicated cloud computing infrastructure directly to a single end-user.

These different services have different revenue recognition/payment structures. I’m not familiar with all of the details but Proximity/Exchange Cloud are said to have an upfront revenue element, resulting in a lower level of recurring revenue. Growth in these newer services led to a fall in the proportion of recurring revenue last year:

Annualised Committed Monthly Recurring Revenue up 5% to £29.5m;

Recurring revenue fell to 71% of the total, from 84% in FY24

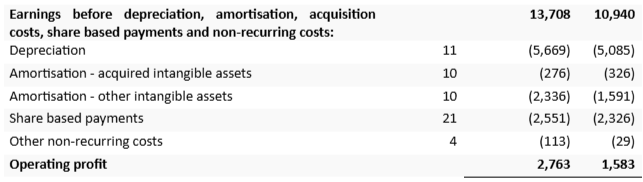

Profits & margins: depreciation and amortisation charges (on hardware and software) are significant and recurring for a business of this type, due to the need for regular upgrades.

Beeks’ FY25 underlying EBITDA of £13.7m drops down to a reported operating profit of £2.8m when these costs are included.

For this reason I am inclined to ignore EBITDA and focus on operating profit (EBIT).

Last year’s increase shows a welcome increase in operating margin at 7.7%, from 5.6% in FY24.

Return on capital employed: this useful improvement in margins translates into a FY25 return on capital employed (ROCE) of 5.9%, according to my sums. That’s better than the 4.1% achieved in FY24, but is of course still a very poor figure that is likely to be below the group’s cost of capital.

In fairness, using average assets over the year lifts ROCE a little higher, as capital employed rose by 20% to £46.7m last year. Last year’s new assets will presumably generate higher returns when they contribute a full year of income (i.e. over the coming year).

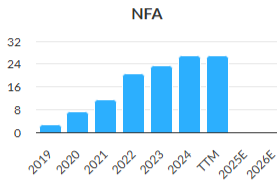

However, this continual growth in capital employed is par for the course with this business, as highlighted on the StockReport by long-term growth in fixed assets:

A review of the historic accounts in Stockopedia suggests to me that there’s limited evidence so far that Beeks’ growth is generating attractive returns:

Capital employed rose by £37.8m to £43.1m between FY18 and FY24;

Over the same period, operating profit rose by 78% to £1.6m;

Thus, the additional capital employed only generated £0.7m of additional operating profit – equivalent to a 1.9% return on the additional capital employed.

Cash generation: net cash rose by £400k to £7m last year, suggesting the group roughly broke even in terms of free cash flow.

Checking the free cash flow statement confirms this, showing that additional cash generated last year was absorbed by working capital outflows and higher capex, both needed to support new business.

Outlook

CEO Gordon McArthur describes FY25 as “another landmark year”. He says that after “two years of market education”, the company is now a “well-established and highly regarded player” in its sector.

Growth prospects are said to be positive, but today’s outlook statement appears to be in line or even slightly below – broker Canaccord Genuity has trimmed its FY26 EPS estimates slightly today, while also introducing FY27 forecasts:

FY26E EPS: 8.9p (prev. 9.1p)

FY27E EPS: 10.5p (new forecast)

These estimates put Beeks on a FY26E P/E of 22.5, falling to 19.0x for FY27.

Roland’s view

Today’s results don’t really change my view on Beeks. While I can see the potential for greater scale and consistent high utilisation to drive improved profitability, the reality is that this remains a relatively low margin and low ROCE business.

Even after today’s share price drop, the shares still look too expensive to me, on a P/E of c.20.

Ahead of today’s results, the Stocko algorithms were rating Beeks as a Falling Star with a low StockRank.

I think this is probably fair. If there was any more leverage here I would probably turn negative, but the group’s net cash position is just about enough for me to leave our neutral view unchanged today. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.