Good morning!

07:48 - Agenda complete

13:30 - Report complete

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

Name (Mkt Cap) | RNS | Summary | Our view (Author) |

Lloyds Banking (LON:LLOY) (£51.2bn) | “Uncertainties remain outstanding… but based on our initial analysis… an additional provision is likely to be required which may be material.” | ||

Johnson Matthey (LON:JMAT) (£3.44bn) | Catalyst Technologies (sale agreed in May) now classified as discontinued. TU: outlook at higher end of initial guidance. | ||

Derwent London (LON:DLN) (£1.92bn) | 25 Baker St. “recently reached practical completion. This marks an important milestone… delivering a yield… of 7.5% and an ungeared IRR of 11.3%.” | ||

Hammerson (LON:HMSO) (£1.51bn) | €350m bond priced at 3.5%. 1st stage of early refinancing of €700m 1.75% bond. Results in downgrade to FY25 earnings expectation by £1m to £101m. | ||

Grainger (LON:GRI) (£1.39bn) | Occupancy high at 98.1%. LfL rental growth in line. On track to deliver 50% earnings growth from FY24 to FY29. | ||

SSP (LON:SSPG) (£1.34bn) | £100m buyback announced “reflecting a healthy balance sheet position and highlighting the Board's confidence in the Company's prospects into FY26.” | ||

Volution (LON:FAN) (£1.29bn) | Rev +20.6%, adj. PBT +18.7% (£83.9m). Organic growth 5.7%. “The new year has started well.” | ||

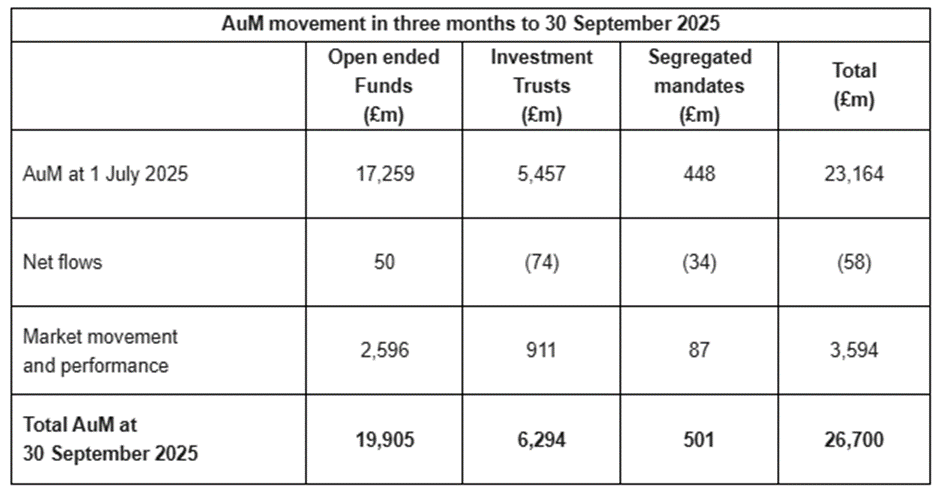

Polar Capital Holdings (LON:POLR) (£551m) | Net outflows £58m. AUM increases 15% q/q to £26.7bn. “Equity markets have delivered robust returns… Our meaningful exposure to technology has enabled us to benefit from this favourable backdrop.” | AMBER/GREEN (Mark)

With very little in the way of outflows, strong fund performance and some big upgrades in EPS from research provider Equity Development, it is tempting to upgrade our view. This now trades on sector averages for earnings but is outperforming its peers. However, it is still on a significant premium to others on metrics such as Market Cap/AUM, meaning it is at risk if its focus on the technology sector goes from a tailwind to a headwind. There are few storm clouds on the horizon at the moment, though, so it makes sense to remain mostly positive. | |

Central Asia Metals (LON:CAML) (£276m) | Production guidance for FY 2025 maintained. | ||

Anglo Asian Mining (LON:AAZ) (£237m) | Revised guidance: copper of 8,100 to 9,000 tonnes, gold of 25k to 28k oz. (Guidance in February: copper 6,500-8,100, gold 28k-33k.) | ||

Secure Trust Bank (LON:STB) (£231m) | Q3 Net lending book - 4.1% largely driven by the Vehicle Finance run-off. Core net lending down 2.2% QoQ to £3,202m, but +10.3% YoY. Vehicle Finance -15.8% QoQ to £469m, -12.4% YoY. Deposits -1.7% QoQ to £3,449m, but +9.8% YoY . FY25 underlying profit before tax now expected to be up to £9m below market expectations, due to Vehicle Finance performance. | BLACK | |

S&U (LON:SUS) (£208m) | Revenue -14% to £51.8m, PBT +22% to £15.6m, Basic EPS +21% to 95.5p, interim dividend +17% to 35p, Net borrowing -25% to £180m. Recovery underway. | ||

Mobico (LON:MCG) (£170m) | ALSA JV subsidiary has won an eight-year capital-light contract in the KSA, with a total contract value of €500 million revenue. The contract includes the operation of 156 vehicles, 126 of which will be electric, serving Qiddiya, a new city on the outskirts of Riyadh. | ||

Treatt (LON:TET) (£166m) | Heritage revenue -15%, Premium revenue -13% and New revenue -17%, due to continued headwinds. FY25 financial performance is expected to be within the revised management expectations (£130.6m revenue, PBTE £10.0m). Net debt £5.9m (FY24: £0.7m net debt) | PINK (Mark) [no section below] This is an in line update, following two profit warnings, so that has to be viewed positively in some way. However, I can’t help feeling the mid-teens declining revenue in all their segments makes for rather grim reading. Of course, very little of this matters as the company currently has a recommended offer of 290p per share. Many investors will see this offer as too cheap, especially if they bought some time ago and will be crystallising a loss. However, this trading update highlights that if the bid is voted down, the share price will likely decline precipitously from here. Perhaps that’s the key message management wants to get across? | |

Hostelworld (LON:HSW) (£148m) | Q3 generated revenue +5% (+2% bookings, +3% booking value), Commission rate +16.3%, Direct marketing 47% of revenue (25H1: 51%). YTD net revenue flat at €72.6m, YTD Adj. EBITDA -13% to €15.4m, Net cash €6.6m. FY2025 adjusted EBITDA guidance remains in line with the current market consensus of €19.8m. | GREEN (Graham holds) Upgrading this by one notch as I’m hoping that the risk of a profit warning has receded after this in-line update, with only one quarter left to potentially disappoint investors. The company is now a dividend payer and a buyer of its own shares, and trades at a modest earnings multiple of c. 10x, despite building out its own social network and having what I perceive as a very strong brand in the budget accommodation sector. Growth is not too exciting yet, but I see a lot of potential here. | |

Motorpoint (LON:MOTR) (£131m) | Retail volumes +8.9%, Revenue +15% to £648m, PBT +80% to £3.6m. Net debt £0.5m. Remains confident that the Group will achieve its expectations for the full year. | ||

Intercede (LON:IGP) (£104m) | H1 Revenue -3.9% to £8.21m, due to delays in contract awards. Cash £17.8m (31 March: £18.7m). Full-year financial performance will be in line with current market expectations. | AMBER/RED (Mark) This is an in line update, but one that shows that a higher-than-usual H2-weighting is required to hit the FY numbers. Even if they hit those figures, this is another year of negligible EPS growth. Their transition to SaaS sales is gaining some traction, but the overall figures are tiny, especially considering many software companies made this a priority over a decade ago. All this makes their 30x P/E increasingly hard to justify, even considering their good products and strong balance sheet. We were neutral on the company when it was a “High Flyer”, but now it is a "Falling Star”, it looks the right time to take a slightly more negative stance. | |

Distribution Finance Capital Holdings (LON:DFCH) (£91.7m) | Q3 New loan origination 30% to £460m, Loan Book +26% to £759m, Non-performing loans £10.4m, 1.4% of loan book. Confident of achieving full year results in-line with market expectations. | GREEN (Graham) [no section below] DFCH gave us a very nice upgrade in September and I note that the EPS forecast on the StockReport has increased from 5.9p to 7.3p for the current year. The only thing that was missing was a big upgrade for next year, and that has not materialised yet - perhaps some investors were hoping for this today, given the slight fall in the share price today. It is still up by some 44% year-to-date thanks to strong execution and above all very fast growth at this specialist lender. Today’s update reminds us that growth is not risk-free, as I note a jump in the number of dealers who are in arrears, from 25 a year ago to 42 today. Total arrears and amounts in recovery have increased from 0.9% a year to 1.5% of the loan book. The company reassures us that this is “well within expectations” but of course the company and its shareholders must remain vigilant on these metrics. More positively, asset finance (direct lending to buyers) is rolling out and growing, now with a £10m loan book, and this should be a source of high returns. Overall, I remain comfortable with my positive stance here due to an attractive mix of cheapness and growth. And as Roland noted last time, it has done this with a high CET1 ratio, implying a sturdy balance sheet. | |

Zephyr Energy (LON:ZPHR) (£67.2m) | Zephyr will acquire assets and the Investor will make available up to US$100 million to fund 100% of the capital expenditure related to the drilling, completing and equipping of those assets. | ||

Metals One (LON:MET1) (£30.4m) | CA$500,000 investment Fidelity Minerals Corp via 5m shares in private placement. | ||

Challenger Energy (LON:CEG) (£28.7m) | Offer by Sintana Energy Inc for 0.4705 New Sintana Shares for each Challenger Share. Represents an implied value of 16.61 pence per Challenger Share based on C$0.66 Sinatra share price at close, 44% premium. | PINK | |

Petro Matad (LON:MATD) (£15.3m) | Gazelle-1 Well 16bobd on a ⅛” choke, 300bobp on a ¼” choke, will be completed for production. Gobi Bear-1 well delayed to April 2026. Heron-2 well pump fitted to perform well clean out. | ||

Cloudbreak Discovery (LON:CDL) (£15.1m) | Exclusive option for £10k for a two month option period with 56,000,000 new ordinary shares to be issued no later than 31 January 2026 in the event that the option is exercised. |

* Market caps at previous trading day’s close

Graham’s Section:

Hostelworld (LON:HSW)

Up 5% to 123.6p - Trading Statement - Graham (I hold) - GREEN

At the time of publication, Graham has a long position in HSW.

This is an in line update that has been warmly received by the market, as they say:

Improved Q3 Trading and Solid YTD Performance

It appears that the market generally - and I - were concerned about the company’s ability to meet forecasts, given the extent of the seasonal H2 weighting that was baked into forecasts. (See here for our coverage of the interim results, when the company reported EBITDA of €7.4m vs. full-year forecast €19.9m). Today the company reports that the consensus EBITDA estimate is €19.8m, and it expects to hit this.

Some key points for Q3:

Q3 “generated revenue” +5% (number of bookings up 2%, average booking value up 3%). (NB. like other companies in the holiday sector, Hostelworld takes money in advance from travellers, but doesn’t book the revenue until later. This means that in any given period, actual revenue will depend on bookings made in prior periods. I think that “generated revenue” is supposed to show us the value of bookings made in the period itself, less cancellations.)

Elevate - the tool we discussed last time, that allows hostel operators to pay more for increased visibility - has boosted the commission rate year-on-year from 15.2% to 16.3%.

Another key KPI is direct marketing costs as a percentage of net revenue, and it falls to 47% (vs. 51% in H1 and 49% in Q3 last year).

Turning to year-to-date figures, revenue is broadly flat and EBITDA is down:

YTD Adjusted EBITDA for the period was €15.4m with a 21% margin (YTD 2024: €17.8m and 25%), reflecting planned investments in growth initiatives and the timing of deferred revenue.

So with the summer months out of the way, 78% of the full-year EBITDA forecast is in the bag. I guess there’s still the possibility of a profit warning at this late stage, but at least there are now strong limits on how severe a warning could be!

Net cash is €6.6m, up by half a million since the end of H1.

CEO Gary Morrison notes “the continued popularity of low-cost destinations”, which has been a headwind here for some time. At least hostel travellers are continuing to travel, even if they are remaining extremely budget-conscious! He concludes:

Looking ahead, we are on schedule to launch our social network monetisation and the provision of budget accommodation initiatives in the fourth quarter. The timely delivery of these foundational initiatives is a key step towards delivering our growth strategy, as set out at our Capital Markets Day.

Graham’s view

I think there’s a view among some investors that Hostelworld should be substantially more successful than it already is. From my point of view, having a small stake in this, I do see untapped potential. I definitely see it as a growth opportunity rather than a boring value play (even if it’s rated as a value stock) and I have no real interest in the dividend.

Having said that, I am of course delighted that the company is now in strong enough financial shape to afford dividends and buybacks. But if management could identify more high-return investments in terms of developing its app and its capabilities, I would be even happier!

The year-on-year downturn in EBITDA doesn’t particularly concern me - I’m happy to give management the benefit of the doubt on the investments that they are making in their new social network and in expansion to other types of budget accommodation. As the risk of a profit warning should hopefully have receded, I’ll tentatively upgrade this to GREEN.

Mark’s Section:

Intercede (LON:IGP)

Down 10% at 158p - Trading Update, New Contract awards and Renewals - Mark - AMBER/RED

When Roland looked at the Final Results from this identity verification specialist in June, revenue was down double-digits and adjusted EPS down significantly. However, this was actually slightly ahead of expectations, as FY24 benefitted from a large one-off license sale. The company did communicate that this contract was an exceptional order and deemed 'one-off' at the time, and the broker’s forecasts reflected this. However, looking at the price chart during that reporting period, I’m not sure that message really landed with investors:

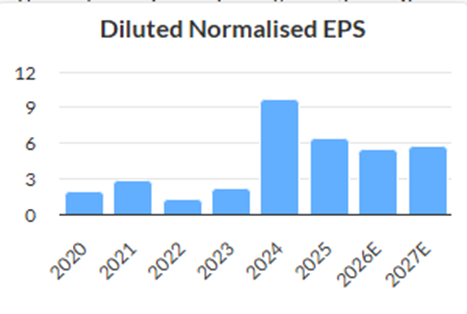

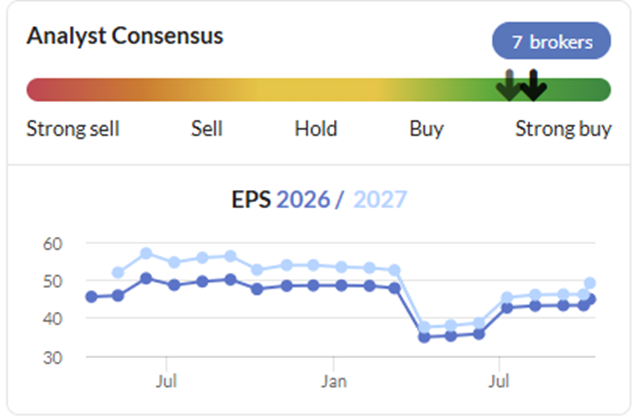

At the time of this year’s Final Results, their broker upgraded FY26 EPS estimates to 5.5p, and today they say:

Given the underlying momentum being seen by the Group, the Board remains confident in the Group's short, medium and long-term growth trajectory and maintains that full-year financial performance will be in line with current market expectations.

However, put into context, the in-line they refer to is another declining EPS figure:

When they refer to “underlying momentum” they presumably want investors to infer some kind of positive movement, rather than a continuation of the overall trend in this H1 update for declining revenue:

The Group expects revenues for H1 FY26 to be approximately £8.21 million (H1 FY25: £8.54 million), representing a year-on-year decrease of 3.9% or a decrease of 4.2% on a constant currency basis.

SaaS Revenue:

As Roland also pointed out in his review of the Final Results, there is some attempt to move to a more subscription-based revenue model, which may dampen short-term revenue, at the benefit of a more sustainable ongoing sales. Today’s trading update shows some sign of this:

Reported revenues includes licence revenue which increased by 65.5% to £1.44 million (H1 FY: £0.87 million) and comprises perpetual licence income of £1.08 million (up 63.6% from H1 FY25: £0.66 million) and subscription licence income of £0.36 million (up 71.4% from H1 FY25: £0.21 million).

But the numbers here are absolutely tiny. That’s an annualised subscription licence income of £0.72m, versus a market cap of over £100m at last night’s close. I also can’t help feeling that 2025 can’t be the first time they realised that there may be some benefit to a SaaS revenue model. Microsoft made the shift to SaaS 14 years ago, in 2011. Many software companies followed this trend and started moving customers to a subscription model a decade ago.

Current trading:

Some of this weakness is put down to:

…temporary delays in some contract awards, primarily attributable to the US federal market. These delays, combined with adverse exchange rate movements and changes in revenue mix, have particularly affected reported US dollar revenues in Q2 of the period.

This is understandable, with the political environment in the US, now is not a good time to be reliant on US government contracts. However, I’m not sure I get the FX point. Most companies with significant dollar revenues but reporting in sterling have nominal movements in revenue greater than constant currency movements. Here constant currency has declined more than reported currency, suggesting that they have actually benefitted from currency movements.

This is also a contract update. They list 11 contract wins or renewals but the average contract value is just $240k. Q2 contract wins and renewals work out to be just 13% of FY26 forecast revenue. This might be quite reasonable if these are all subscription licence income, but the above figures suggest that very few of them will be. Their broker, Cavendish, also points out that a higher H2-weighting is required:

Revenue of £8.2m for 1H26 represents 44% of FY expectations (1H25: 48%), leading to free cash generation of £0.9m, representing 42% (1H25: £-0.7m; 2H25 £+2.9m) of the £2.2m forecast for FY26E, excluding settlement of £1.8m cash relating to the growth scheme award, which vested in July.

Share awards:

Just looking at that share award briefly, it seems the Group CEO received:

· The payment of £1.8 million gross in cash; and

· The issue to Mr Van de Leest of 743,095 ordinary shares in Intercede Group plc, based on the closing share price of an Intercede Share of 173.5p on 7 July 2025, being the day before receipt of the put option (the "New Ordinary Shares").

The criterion for this award appears to have been entirely based on share price, so he was the big winner from shareholders’ exuberance around the one-off $6.6m order in 2024, as it made him £3.09m!

Forecasts:

Looking further out, Cavendish see revenue growth finally being reflected in an EPS forecast rising to 7.4p in FY28, but I rarely put much faith in forecasts that far in the future. All the academic evidence suggests that they are little better than guesswork out that far.

Balance sheet:

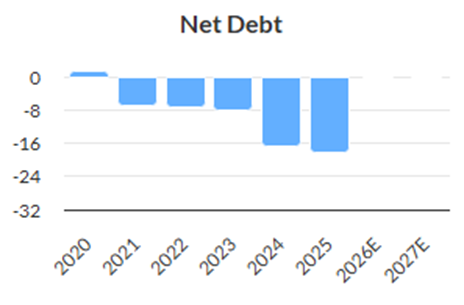

When it comes to the balance sheet, things look better:

As at 30 September 2025, gross cash balances stood at £17.8 million (30 September 2024: £16.2 million), which includes the payment of £1.8 million on the vesting of a share award as announced on 22 July 2025. Cash balances were £18.7 million as at 31 March 2025. The Group continues to operate with no debt.

Like many software companies, they run with negative working capital, but not exceptionally so. At the year end, there was around £8m of deferred revenue, but as long as revenue doesn’t decline too quickly, this is likely to remain around this level, meaning this cash is available for acquisitions that may improve their growth credentials. However, they have not been short of cash in the past, and have not found something that is the right fit:

Valuation:

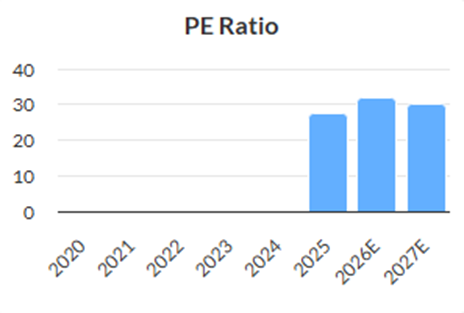

A forward P/E of 30 on 2027 EPS would be punchy for any company, let alone one reporting declining H1 revenue:

Taking account of today’s 10% fall in share price and if I adjust the c.20% of the market cap in cash, this comes out as an adjusted P/E of around 21. However, this still looks materially overvalued for a company with negligible forecast EPS growth. They need to be significantly exceeding market expectations to justify this rating, and in-line with a higher-than usual H2 weighting just doesn’t cut it.

Mark’s view

What starts as an in line trading update gets worse as you go through it, and I can see why the shares are down 10% today. This is not a terrible company; it has genuinely good products in an in-demand area, and a strong balance sheet. It is no surprise that this is a top-quartile Quality Rank stock. However, it appears to be struggling to generate enough contract wins or ongoing SaaS revenue to generate bottom-line growth. As such, it looks to be overvalued on a forward P/E of around 30. Investors appear to have got a little carried away after a big one-off deal in 2024 generated exceptional profits and this has yet to meaningfully revert to a valuation based on the underlying trend. Something the very low Value Rank confirms:

When Roland looked at this in June, it had a Momentum Rank of 69 and was classified as a “High Flyer”. However, with that Momentum Rank dropping to 45, and likely to drop further after today’s price action is assimilated, and now classified a “Falling Star” it makes sense to take a more negative view of AMBER/RED.

Polar Capital Holdings (LON:POLR)

Up 5% at 567p - AuM Update - Mark - AMBER/GREEN

With both of this week’s quarterly updates from Impax and Liontrust (see DSMRs here & here) not being particularly well-received by the market, lots of eyes were on this morning’s Polar Capital AUM update:

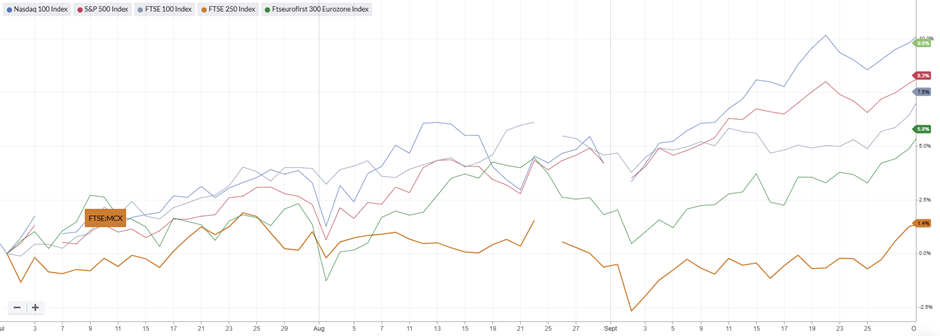

With net outflows of just £58m at Polar, versus £1.09bn for Liontrust and £1.4bn for Impax (both around 5% of AUM), investors have certainly maintained a higher view of Polar’s funds. And you can certainly see why. Whereas Impax offset the outflows with a roughly 4% investment performance, and Liontrust 5%, Polar generated almost double that at 9%.

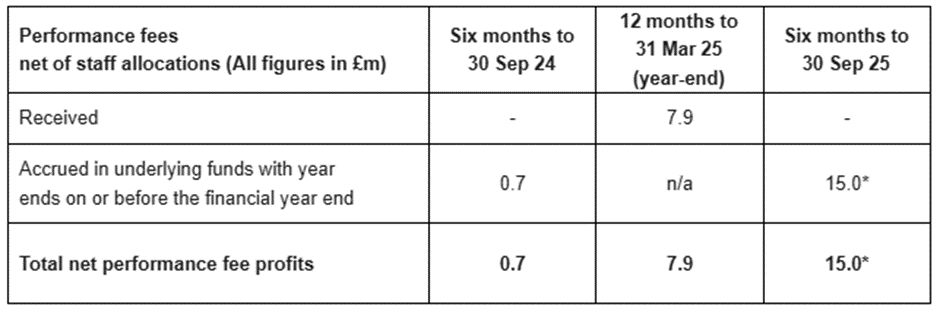

Short-term performance isn’t just important for AUM flows (despite much evidence that it damages long-term returns, fund investors continue to largely invest on short-term performance), it generates performance fees. These make asset managers geared plays on the underlying assets, and it is good news for shareholders that performance fees are rising strongly:

It is Polar’s technology focus that is again leading to these strong returns, with the NASDAQ being the strongest index in the last quarter by some margin:

Research provider, Equity Development update their forecasts in response to this, saying:

We upgrade our FY26 and fY27 forecasts due to:

• The jump in AUM over H1-26 being higher than originally forecast, and

• Mark to market performance fee profits being higher than originally forecast.

They increase their FY26 EPS estimate by a whopping 40% to 57.2p, and lift their FY27E EPS by 24% to 55.6p. To be fair, they appear to be a little behind the consensus:

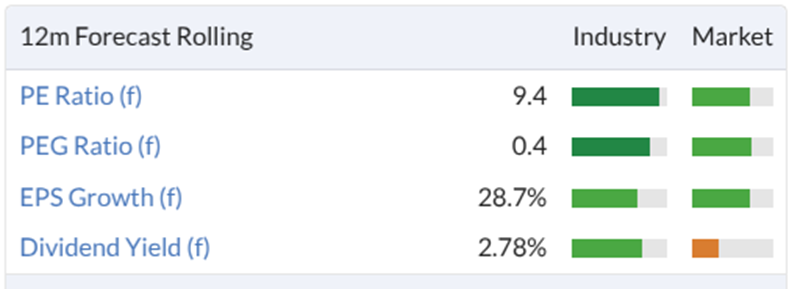

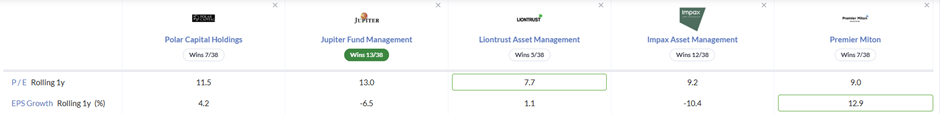

But this is still a big upgrade and means the P/E here is now around 10. This makes them look more favourable on a sector comparison

Their P/E is in line with the sector but they have better growth and profitability metrics.

There are a couple of reasons for caution. The first is that both the market cap and EV appear large compared to the AUM:

Firm | Mkt Cap (£m) | EV (£m) | AUM (£bn) | Mkt Cap/AUM | EV/AUM |

Liontrust | 206.6 | 129.4 | 22.6 | 0.009 | 0.006 |

Polar Capital | 550.5 | 370 | 23.2 | 0.024 | 0.016 |

Impax | 238.8 | 163.5 | 26.1 | 0.009 | 0.006 |

At around 2.5x higher than Liontrust and Impax, this means they are more reliant on performance fees or higher management fees as they are on roughly the same P/E ratio. This may be a fair reflection of their better recent underlying performance. Although, it must be noted that until recently, Impax was the stock market darling that was at a premium to the sector on these types of metrics.

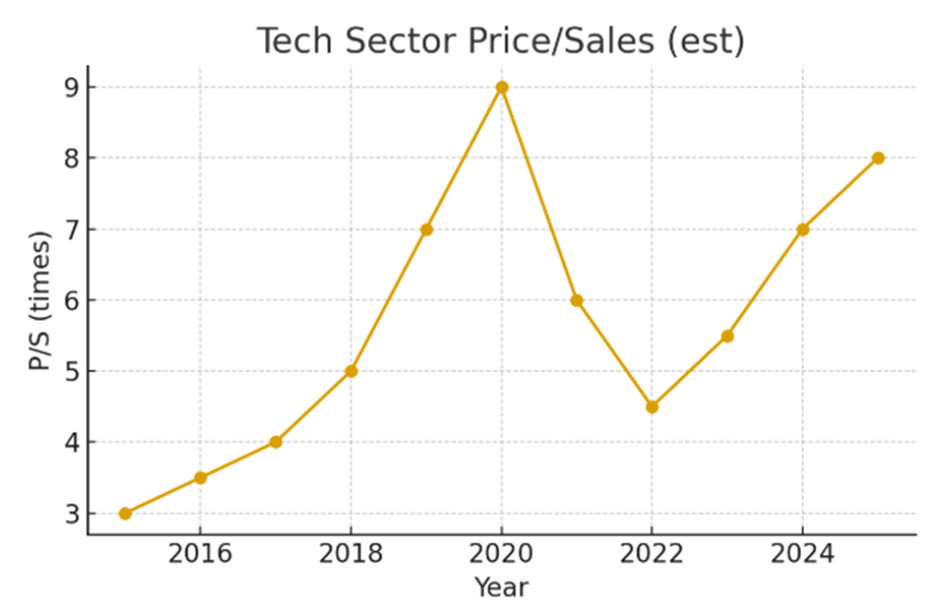

Which brings us to the second bear point, which is that markets tend to be cyclical, and the current outperformance of large-cap tech is by no means guaranteed in the future. The tech sector P/S is looking pretty punchy at the moment on 8x sales:

If this reverts to the recent mean, it will mean a painful performance period for Polar’s funds, no matter how well run they are. But for the moment, momentum is with the sector and as former Citigroup CEO Chuck Prince said in 2007 "While the music plays, keep dancing". Today’s AUM update suggests that Polar will still be dancing for some time yet.

Mark’s view

The strength of the EPS upgrade today makes it tempting to upgrade our view here. After all, it is now trading on a sector average rating but with what seem much better near-term prospects. What moderates my view is the nagging thought that the performance here is as much about the sector their funds find themselves in rather than any endogenous characteristics. The AUM/Market Cap metrics suggest that it won’t all be as rosy, if (when) tech stocks face any moderation in valuation. There are few signs of any storm clouds on the horizon, though, so it makes sense to remain mostly positive. AMBER/GREEN

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.