Good morning! I hope everyone is doing well. Wrapping it up there, thanks everyone!

Spreadsheet accompanying this report: link (last updated to: 5th September).

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£198bn) | Voluntarily agrees to measures enabling US patients to access medicines at prices equalized with those available in wealthy countries. | ||

Lloyds Banking (LON:LLOY) (£49bn) | Based on the FCA proposals in their current form, intends to take an additional charge of £800 million. | AMBER/GREEN (Graham) Upgrading our stance on this by one notch as clarity approaches on the motor finance topic. There's still a range of possible outcomes, but the FCA's suggested compensation scheme is now possibly the worst-case scenario. With Lloyds being able to easily afford the additional charge announced today, I'm happy to take a mildly positive stance. It still trades in the ballpark of book value, and (just) at a single digit forward earnings multiple. | |

| Big Yellow (LON:BYG) (£1.9bn) | Response to Press Speculation | SP +18% Board notes announcement by Blackstone that one or more of its funds may be considering a possible offer for BYG and confirms it has held meetings “with a small number of parties”. However, BYG says it is not in receipt of an approach and is not currently in discussions with any parties regarding a potential sale. | PINK (Graham) [no section below] It’s a little vague - no mention of any price, and nothing is yet on the table. But the news is out now that Blackstone is thinking about it. For those who think the UK market is overvalued - Blackstone at least are still pondering the value on offer. We don’t typically cover BYG due to its size and the sector, with self-storage being categorised as property/REITs. However, the shares were and still are trading at a discount to tangible book value. According to the most recent full-year results, adjusted net asset value per share was £13.56 (using EPRA methodology). On the balance sheet, net assets were £2.57 billion (almost fully tangible). Maybe these numbers mean something, after all! Even after today’s gains, the share price is still just £11.34 with a market cap of £2.2 billion. |

Oxford Instruments (LON:OXIG) (£1.1bn) | SP -7% “...we expect H2 revenue to be marginally up versus H2 of the prior year… on an organic constant currency basis we now expect… full year revenue, adjusted operating profit and AOP margin to be similar to the prior year.” | AMBER (Graham) [no section below] Oxford Instruments is in the FTSE-350 and is well-covered by City brokers, but the downside of that is it doesn't feel obliged to put this trading update in plain English. Anyone who wants to know if the company is trading ahead of, in line with, or below expectations will have to look at the share price reaction rather than this trading update, in order to get a black-and-white answer. H1 revenues are down around 8% (organic constant currency basis), and the full year result (FY March 26) is expected to be similar to FY25. The CEO says "we are now assuming that we will not recover the H1 revenue shortfall". Checking the archives, I criticised the company's full-year results in June for its vague outlook statement and for including multiple layers of adjustments. Meagre organic growth remains a cause for concern. Putting it all together, I'm inclined to downgrade this by one notch to neutral, which is as much for the the clarity of its investor communications as it is for the company's performance. Checking the StockReport, I find a Falling Star with weakness in both its value and its momentum scores. It might very well be undervalued, but I don't think it's making it easy for investors to understand why. | |

Renew Holdings (LON:RNWH) (£727m) | £12m consideration. Emerald is “a specialist in overhead lines, focused on the maintenance and upgrade of electricity networks for Distribution Network Operators (DNOs) in the North West”. | ||

Serica Energy (LON:SQZ) (£699m) | Agreement to acquire the entirety of BP's stake in the P111 and P2544 licences located in the UK Central North Sea. Upfront cash consideration $232m. | AMBER/GREEN (Roland) This acquisition is subject to pre-emption rights over the next 30 days, so it may not go ahead. But assuming it does, it looks like a good deal to me. Although my sums suggest the original Culzean discovery may only have c.3.5 years of production left, it looks like there is scope for further exploration and development. Meanwhile, Serica will benefit from owning a stake in a field being operated by a world-class major with modern infrastructure. This should reduce the chance of a recurrence of the issues it’s faced elsewhere over the last year. I’m leaving our moderately positive view unchanged today. | |

IP (LON:IPO) (£474m) | “We are encouraged by Metsera's Phase 2b results for MET‑097i and its plans to initiate Phase 3 in 2025.” | ||

SolGold (LON:SOLG) (£457m) | “We continue to see a strong run of near-surface results at Tandayama América, reinforcing the importance of this deposit within the Cascabel concession.” | ||

Metals Exploration (LON:MTL) (£407m) | Q3 2025 gold revenue of US$25.5 million (Q2 2025: US$70.5 million). No change required to FY2025 production guidance. | ||

Costain (LON:COST) (£374m) | Selected to refurbish and replace utility distribution systems and services for Sellafield. Worth up to £1bn. An initial term of nine years with an option to extend. | AMBER/GREEN (Roland) [no section below] Today’s update looks like a material win for Costain. Averaging over the nine year initial term, I estimate this programme could be worth up to c.£110m/yr in revenue and perhaps £7-£8m in operating profit, based on this year’s H1 margins. What we don’t know is how much of this, if any, was already priced into consensus forecasts. I don’t have access to any updated broker notes today, but the market reaction suggests to me that at least some of today’s win is being seen as an upgrade to forecasts. Costain’s Natural Resources division generates significantly higher margins than its Transportation business, so growth in this area is potentially more attractive. Costain’s shares fell sharply in August, when its half-year results showed expected HS2 rail revenue being pushed back. Forecasts were left unchanged at the time and the broker’s suggestion was that growth in Natural Resources could help to offset a shortfall in Transportation. Today’s win seems to provide some support for that view, while the share price remains below its August highs. For these reasons, I’m going to move up one notch to AMBER/GREEN. | |

Public Policy Holding (LON:PPHC) (£270m) | The Company has applied to list on Nasdaq; will be dual-listed on Nasdaq and AIM. | ||

Science (LON:SAG) (£245m) | “While business confidence remains subdued… SAG has continued to perform as anticipated.” FY26 AOP in line or slightly ahead of expectations. | GREEN (Graham) [no science below] Martyn Radcliffe proved my scepticism misplaced with his foray this year into Ricardo shares, on behalf of Science Group. After that well-timed and astute investment, Science Group is now sitting on an enormous cash pile of £77.6m (net funds £66m). Even better, the underlying business is apparently doing fine. Regardless of any reservations I might have when it comes to investing in the consultancy sector, I’ll be reluctant to downgrade my stance on this share again - once bitten, twice shy. Consistent with my positive stance, this is a Super Stock with a StockRank of 93, and qualifies for five bullish stock screens. I’ll be fascinated to see what moves Mr. Radcliffe might make next. He is an 18% shareholder in this company. | |

Tristel (LON:TSTL) (£171m) | Rev +11%, adj PBT +23% to £10.1m. Results in line with exps. Confident outlook. | AMBER/GREEN (Roland) Today’s results look fine to me and showcase the group’s high margins and good cash generation. However, growth in North America – the main opportunity for a transformative expansion – remains at the early stages and is generating minimal income. The opportunity is clearly large, but I have no idea how likely it is that Tristel will succeed in displacing various incumbent competitors. Today’s updated forecasts from Cavendish suggest to me that the expected cost and time required to penetrate the US market could be greater than expected. To reflect the range of outcomes here and the company’s attractive core UK/EU business, I am going to maintain our AMBER/GREEN view today. | |

KEFI Gold and Copper (LON:KEFI) (£114m) | $240m debt offering is now expected to take place this week following the resolution of a procedural issue. | ||

Avation (LON:AVAP) (£105m) | Eight-year lease with European ACMI provider for eight-year-old ATR 72-600. | ||

Software Circle (LON:SFT) (£87m) | Total consideration of €8.25m, 9x EBIT. Acquired business has 50% EBIT margin and 90% recurring revenue. | ||

Ferro-Alloy Resources (LON:FAR) (£76m) | Phase 1 feasibility of Balasausqandiq vanadium deposit in Kazakhstan. Project NPV of $748m. Require $520m funding. | ||

Fevara (LON:FVA) (£69m) | Company formerly known as Carr’s Group. | ||

1Spatial (LON:SPA) (£61m) | Rev +9%, adj EBITDA +5% to £2.1m, pre-tax loss £300k. Expect H2 weighting, FY26 to be in line. | ||

Colefax (LON:CFX) (£52m) | Will purchase up to 15% of shares at the lower of 880p or 105% of avg closing mid-price over five days to Take-Up announcement. | ||

First Tin (LON:1SN) (£33m) | Finalised MRE estimate. Total Indicated & Inferred resources now 90,900t, taking First Tin’s total resource base to 367,600t. | ||

Aptamer (LON:APTA) (£28m) | New fee-for-services contract valued at £112k, is repeat business with existing client. FY26 contract value now £1.14m. | ||

Cirata (LON:CRTA) (£24m) | Largest direct contract in Cirata’s history, encompasses deployment of Data Migrator, with focus on disaster recovery. | ||

Power Metal Resources (LON:POW) (£15m) | In advanced discussions for licensing of its core metals extraction technology. Recently completed an initial commission. | ||

Cordel (LON:CRDL) (£15m) | 6-month follow-on contract awarded to cover “double the amount of track mileage capture and analysis” |

Graham's Section

Lloyds Banking (LON:LLOY)

Up 1% to 84p (£49.8bn) - Motor Finance Update - Graham - AMBER/GREEN

We have a reassuring share price reaction in response to news of an additional £800m charge.

Further to the recent FCA announcement and consultation paper on an industry wide redress scheme for motor finance, following the Supreme Court judgment handed down on 1 August 2025, the Group has now undertaken an assessment of the implications and impact of the proposed redress scheme.

The FCA made an announcement last week, with news that they are consulting on a motor finance compensation scheme.

The FCA’s point of view:

“Many firm broke laws and regulations in force at the time by failing to disclose important information. Our extensive review, covering data from 32m agreements, found widespread failures to adequately disclose the existence and nature of commission and contractual ties between lenders and brokers.

Of the agreements reviewed involving a discretionary commission arrangement (DCA) - where the broker could adjust the interest rate offered to a customer to obtain a higher commission - there was no evidence that the customer had been told about the DCA.

They estimate that 44% of all agreements made since 2007 will be considered “unfair” (and therefore unlawful), with total estimated redress of £8.2 billion, including interest.

Impact on Lloyds: they had an existing provision of £1.15 billion, and are now taking an additional £800m charge.

Based on the FCA proposals in their current form, the potential impact is at the adverse end of the range of previous expected outcomes. The proposals are subject to consultation and there remain a number of uncertainties.

Lloyds also make it clear that they do not agree with the FCA’s proposals, and will be arguing their case - this could yet drag on for some time. The FCA’s consultation closes on 18th November.

Graham’s view

The new £800m charge is only a fraction of the group’s forecast after-tax net income this year (£4.6bn).. And so while the FCA’s initial proposed compensation scheme might not be what the company wanted to hear, the big picture is that any amounts paid out are likely to be easily affordable.

Looking at it another way, Lloyds Bank Plc has a book value of £42 billion, within the larger Group that has equity of £47bn.

And the market has had plenty of time in recent months to digest the various announcements from the Supreme Court and then the FCA. The final outcome is becoming clearer: compensation for DCA customers (i.e. those who paid variable commissions), with some wrangling to take place now over the formula used. The FCA may demand that customers receive back the entire commission paid, plus whatever interest they may have overpaid on their car loan, plus interest on this amount. The exact calculation will be debated.

I’m happy to upgrade our stance on this by one notch, to AMBER/GREEN. It’s always risky taking any sort of a view on large banks, but I tend to like them when they’re available around book value and at single-digit earnings multiples. Lloyds is still roughly in that ballpark.

Roland's Section

Serica Energy (LON:SQZ)

Up 8% at 194p (£750m) - Proposed acquisition of UK North Sea assets from BP - Roland - AMBER/GREEN

Should this transaction complete, it would deliver a step-change for Serica, adding material production and cash flows from the largest producing gas field in the UK.

After last week’s disappointing downgrade to production guidance, today brings some more positive news from North Sea oil and gas producer Serica.

The company has agreed a fairly large deal to buy BP’s stake in the P111 and P2544 licences in the North Sea for $232m, plus two further contingent payments that are dependent on future exploration and tax events.

It’s worth noting that this deal is currently only provisional. BP’s existing partners in the Culzean field, TotalEnergies and NEO NEXT, have pre-emption rights. These give them a 30-day option to acquire BP’s stake in the licences on the same terms as those agreed by Serica. So the deal isn’t guaranteed, at this stage.

What is Serica hoping to buy? The main asset being acquired is BP’s 32% stake in the Culzean gas condensate field (P111). Culzean is the largest single gas producing field in the UK North Sea and generated production net to BP of c.25,500 boepd during the first half of this year.

P2544 is an exploration licence adjacent to P111.

Culzean is operated by French major TotalEnergies and only came onstream in 2019. Unlike some of Serica’s assets, it benefits from modern infrastructure run by a highly-respected operator:

Culzean is a world-class asset, delivering gas from a modern platform with exceptionally high uptime and low emissions."

Culzean has attractive operating economics with a production cost of just $10.7/boe. An updated note on Research Tree today from Auctus Advisors (many thanks) suggests this could translate to annual pre-tax operating cash flow of c.$490m at recent gas prices/production levels.

How will Serica fund the deal? The company says it hopes to offset some of the compensation costs using cash flows that would be accumulated between the economic date of the transaction (1 Sept 25) and its expected completion “around the end of 2025”.

The remaining costs would be funded from current cash and using its existing $525m reserve based lending facility. However, the company says it’s also considering putting in place a new, larger acquisition facility to reflect its growing asset base.

Is Culzean as cheap as it seems? We don’t know why BP is selling. One answer may simply be that while Culzean is a big field for today’s North Sea, a minority stake of this type isn’t really a very big project for BP.

However, the numbers provided today also suggest to me another possible reason for selling, and might also explain the seemingly cheap price:

Production net to BP of 25,500 boepd, i.e. c.9.3 million boe/year

Remaining 2P reserves net to BP of 33mmboe (million boe)

These figures suggest remaining production life of the current field could be just 3.5 years

I still think this looks like a good buy for Serica – it could be highly cash generative. But having invested heavily in modern infrastructure for Culzean, I imagine operator TotalEnergies will be interested in extending its life through active exploration of the P2544 licence.

A quick Google suggests one such project may already be underway, targeting a further 67mmboe. I would guess more such work is planned over the coming years, for which Serica would presumably need to fund its share of costs. Ultimately, of course, Serica would probably also have to fund its share of decommissioning costs.

Roland’s view

Today’s RNS is a little light on detail, presumably because Serica is not yet certain if the deal will go ahead.

Based on what we know today, I can’t really see anything to dislike here. It looks like Culzean should be highly cash generative for Serica, without the reliability issues that have plagued the group’s non-operated production through the Triton FPSO.

Culzean’s H1 production (net to BP) exceeded Serica’s entire H1 production this year, due to the extended Triton outage. Even if all of Serica’s current assets were producing at full potential, the Culzean output would add around 50% to the group’s current production capacity.

I am not sure I have the knowledge required to try and estimate the likely post-tax cash flow from Culzean to Serica. However, I think it’s reasonable to assume this deal would pay for itself well within the current reserve life of the field and leave a comfortable margin.

The only caveat I’d add – as usual with this business and other similar operators – is that I think a modest valuation for Serica shares is appropriate, given the short lifespan and uncertain future costs of its asset base.

It’s also worth remembering that this deal may not go ahead, if NEO NEXT or TotalEnergies decide to buy out BP’s stake.

I’m going to leave our AMBER/GREEN view unchanged today.

Tristel (LON:TSTL)

Unch at 358p (£172m) - Final Results - Roland - AMBER/GREEN

Another year of double-digit revenue growth, 23% growth in adj. pre-tax profits and strong cash generation

Checking back in the archives, I took an AMBER/GREEN view on this medical device disinfectant specialist at the time of its interim results in February. Graham then left this unchanged when he reviewed April’s update on the company’s US operations – the group’s main priority for growth.

Stocklopedia has adopted a High Flyer styling for this stock and the share price has been relatively unchanged this year, aside from a nasty dip at the time of April’s US tariff announcements:

Today’s full-year results have also left the share price relatively unmoved, despite double-digit earnings growth.

Has the market lost sight of an attractive long-term growth opportunity, or is the share price up with events? The big uncertainty remains the scale and pace at which US hospitals might adopt Tristel products. Unfortunately, today’s results suggest investors may need to remain patient.

FY25 results summary (y/e 30 June)

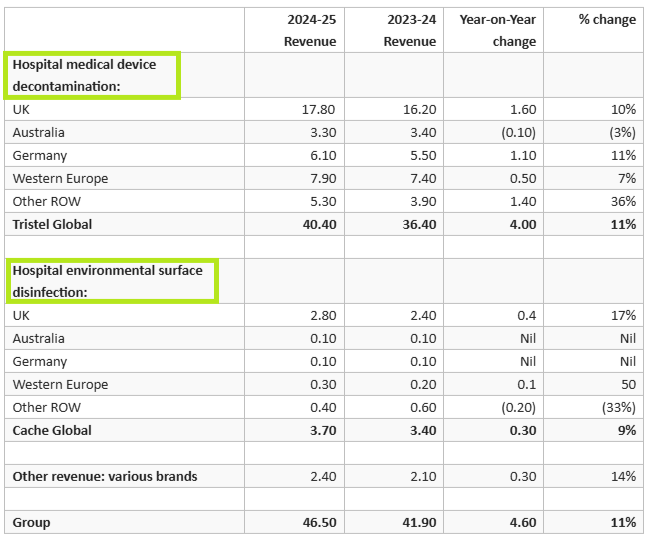

The headline numbers from today’s results look pretty healthy and appear to be in line with expectations based on July’s trading update:

Revenue up 11% to £46.5m

Gross margin: 81% (FY24: 80%)

Adjusted pre-tax profit up 23% to £10.1m

Reported pre-tax profit up 18% to £8.4m*

Adjusted EPS up 12% to 17.15p

Dividend up 5% to 14.20p per share

Net cash exc leases of £12.8m

*The difference between reported and adjusted profits was almost entirely accounted for by a £1.4m exceptional charge relating to retirement payments to the outgoing and longserving CEO and CFO, and the recruitment of their replacements. In this case I’m happy to ignore these as they should be one-offs.

Highlights from last year include receiving US FDA clearance for Tristel OPH (a disinfectant foam) and insourcing the manufacturing of Trio Wipes, which is said to have generated annualised savings of £0.8m.

In addition, updated USA standards are now recognising chlorine dioxide foam (Tristel’s core IP) as “a recommended means of high-level disinfectant for medical devices”. Reinforcing this, the company says it completed a 90-day study in partnership with the Mayo Clinic that concluded Tristel ULT is “an effective and efficient method for HLD”.

Of course, the fact that Tristel’s US-related headlines relate to trials and regulatory approvals rather than commercial achievements tells a story in itself. Actual revenue generated through the company’s royalty deal with its US partner Parker Laboratories remained very limited last year, at just £108k (FY24: £74k).

Let’s see what the company has to say about each of its regions.

Revenue by channel: the bulk of the company’s revenue continued to come from its core UK (NHS) market, together with Germany and other countries in Western Europe:

UK: the FY24 results received a one-off boost from the agreement of a new six-year contract with NHS Supply Chain. The FY25 figures are said to reflect 6% growth in the UK business, with “steady, underlying growth across all product lines”.

N.B. I think the mismatch between 6% UK growth in the commentary and the 10% in the table above reflects the inclusion of UK sales to overseas distributors in the table above.

Europe: sales growth was positive last year, up 11% in Germany and 7% elsewhere in Western Europe.

UK & Europe sales growth was respectable last year, but these markets are relatively mature for Tristel and seem unlikely to deliver transformative growth.

North America: Tristel first started operating commercially in the US in FY24. Last year (FY25) was the first full year of commercial operations.

The company operates through a manufacturing and distribution partner, Parker Laboratories in the US. Royalty revenue remained very limited last year, at £108k, but the company says awareness and adoption is building steadily:

To date, we have engaged with around 200 health systems, and adoption is steadily building as Parker leverages its nationwide sales force and distribution network.

Last year’s FDA clearance for the US launch of Tristel OPH (for ophthalmic devices) is said to have been a major milestone, addressing “a long-standing unmet need” for a safe alternative to “outdated and hazardous open-tray methods”.

With 16m ophthalmic procedures annually in North America, the opportunity seems significant and the company says “early customer interest has been strong”.

I think today’s commentary highlights the scale and complexity of this opportunity, when compared to European markets. Here in the UK, the company generates most of its revenue through a single contract with NHS Supply Chain.

In North America, Tristel has already engaged with 200 health systems – and presumably there are others it has not yet reached.

Predicting the eventual level of adoption and the likely timescale for this seems difficult, if not impossible. Understandable, CEO Matt Sassone, who has an extensive background in marketing medical technology in the USA, remains bullish:

We view North America as a substantial long-term growth driver for the Group. With regulatory approvals secured, two FDA-cleared products in the portfolio, and a growing pipeline of hospital engagements, we are confident that the region will make a meaningful contribution to Group revenues over the coming years.

Outlook

Today’s outlook commentary is heavy on words but light on numbers. In essence, Sassone says that he’s confident of incremental growth in the UK and Europe and hopeful of transformative growth in North America. However, he avoids making any specific comment about market forecasts for FY26, instead settling for this generic remark:

We look forward to 2026 and beyond with significant confidence in the prospects for Tristel and its market leading products.

Fortunately for us, house broker Cavendish has provided an updated note on Research Tree today – many thanks.

Cavendish has left its FY26 revenue growth estimate of c.10% unchanged, but has cut earnings forecasts for the current year. The main reason for this is that the broker expects Tristel to increase its US spending in an effort to drive additional sales growth in this market:

FY26E adj EPS: 17.56p (prev. 19.58p)

FY27E EPS: 19.39p (new forecast)

These forecasts put Tristel on a FY26E P/E of about 20 at the time of writing, with a useful 4.2% dividend yield that’s reflective of the company’s strong profitability and cash generation.

One side note regarding revenue growth – as US sales are recognised as royalties only, they won’t have much impact on revenue but should feed through quite directly to profits and drive margins higher. So that’s something to watch for in future results, I think.

Roland’s view

I share Tristtel’s view that the US represents an exciting long-term growth opportunity. If Tristel can achieve the kind of market penetration it has in the UK or even some other European markets, then it would surely become a significantly more valuable business than it is today.

However, today’s revised forecast from Cavendish suggests to me that the expected costs and timeframe for US adoption are both expanding.

Gaining a foothold in the world’s largest healthcare market is never going to be easy. In most cases (if not all) I believe Tristel will have to displace incumbent suppliers. Even if its products are both superior and equally cost effective, winning market share in this way will take time.

I think investors have to recognise some risk that Tristel could ultimately fail in North America.

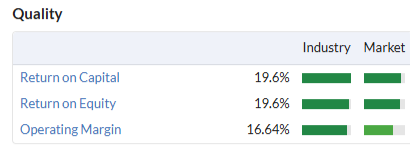

Fortunately, the group’s UK and European operations are scaled and highly profitable in their own right. Today’s results show quality metrics very similar to those on the StockReport:

If we look at Tristel as a UK/Europe business alone, I’d say it was probably fairly priced. Add in the possibility of US success and it could be cheap, in my view. To reflect this range of outcomes – and the group’s strong financial profile – I am going to leave our AMBER/GREEN view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.