Good morning!

I've finally managed to publish my interview with the CFO of PPHE Hotel (LON:PPH) in article format, which I hope you'll find interesting.

Was Treatt successful?

Congratulations to Lord Lee on his successful Treatt (LON:TET) investment over many years, where he has now crystallised the profits.

There is a good question in the comments, asking how Lord Lee's Treatt investment was successful.

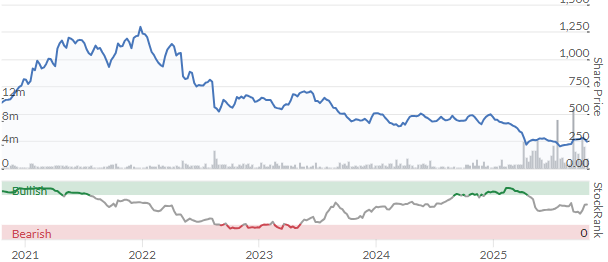

It does look like a rubbish investment, to be fair:

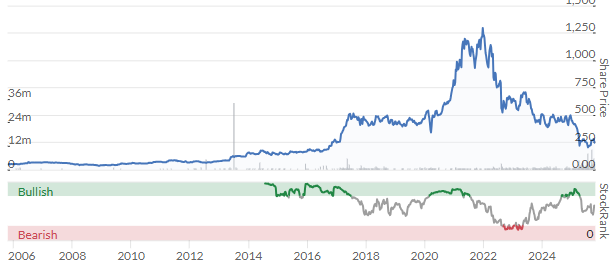

That is, until you zoom out:

This chart does not even capture Lord Lee's entire timeframe. He said that he first invested in it in 1999, when the share price was £1.50 - and that was before a 5:1 stock split (each old share was "split" into five new shares). On an equivalent basis, the share price in 1999 was only 30p.

The annual dividend alone is now worth 8p, and the takeover offer is 290p.

I accept that 26 years is a long time in investing. I accept that Lord Lee will have paid more than 30p per share for his follow-on investments in Treatt. And I accept that the S&P 500 has also done very well over this timeframe. But there is no universe in which this share has been an unsuccessful investment since 1999.

To me, this is what extremely successful investing can look like: when dividends are a double-digit (even better, a triple-digit) return on your initial investment. When the stock moves in a month (or even in a day) by as much as your initial investment. When you can sell a tiny portion of your stake and get all of your initial investment back.

This might sound fantastical, but I've seen plenty of people do it. Lord Lee did it with Treatt. The Tesla believers, for all their faults, have done it. I'd be shocked if Ian Cassel hadn't done it on multiple occasions. Holding onto shares for very long periods of time is not the only way to invest - but it's not bad! And it's working out pretty well for me, where my own current portfolio is worth about twice what I paid for it.

Spreadsheet accompanying this report: link (last updated to: 7th October).

All finished for the day and for the week. Thanks everyone.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

GSK (LON:GSK) (£66.9bn | SR88) | DREAMM-7 showed a 51% reduction in the risk of death and tripled median progression-free survival. | ||

Natwest (LON:NWG) (£48.2bn | SR81) | “We have upgraded our income and returns guidance for 2025… We now expect income excluding notable items to be around £16.3 billion for 2025 and to achieve a Return on Tangible Equity of greater than 18.0%.” | ||

CVS (LON:CVSG) (£1.02bn | SR65) | Intends to move from AIM to Main Market. Rationale: access deeper pools of capital, index inclusion, etc. £20m share buyback. | ||

Treatt (LON:TET) (£145m | SR59) | Lord Lee said he had an intention to vote for the takeover, but has now sold all of his Treatt shares. The number of shares which have been promised to vote for the takeover reduces from 8.1% to 6.9%. | PINK | |

Alumasc (LON:ALU) (£123m | SR78) | Conditions have become more challenging in Q1, exacerbated by uncertainty re: Autumn Budget. The board believes it prudent to adopt a cautious approach for H1; still expects a second-half weighting. | BLACK (AMBER) (Graham) Downgrading our stance to neutral, to be consistent with our normal procedure after a profit warning and also consistent with Alumasc’s declining StockRank. The earnings multiple on next year’s EPS forecast (FY June 2027) is 9x and I would struggle to argue that it deserves to be rated more highly than that. | |

Record (LON:REC) (£112m | SR81) | Net flows marginally positive, AUM reaches new high. £0.5m performance fees. Fee rates “broadly unchanged”. | AMBER/GREEN I’m a long-term fan of this one, and my instinct is always to be GREEN on it. But I note Roland moderated our stance to AMBER/GREEN in July. And I can’t really argue with that given that net flows are neutral, fee rates are probably nudging lower long-term, and performance fees are fairly modest. | |

Orosur Mining (LON:OMI) (£87m | SR26) | Latest cash balance $17.2m following private placement. Will focus investment in Columbia and Argentina. Exploration-stage, zero revenues. | ||

Rentguarantor Holdings (LON:RGG) (£28m| SR12) | Winner of the 'Best Professional Guarantor' award at the ESTAS Awards 2025. Award judged off customer satisfaction. | ||

Tap Global (LON:TAP) (£19m | SR16) | Institutional Bitcoin Treasury as a Service ("BTaaS") platform has successfully onboarded London BTC Company Limited (LSE: BTC) ("London BTC Company") as a client for its BTaaS platform. | RED (Graham) [no section below] If Bitcoin Treasury companies are rat poison, then this is rat poison-squared. |

Backlog

Molten Ventures (LON:GROW)

Up 15% yesterday, now at 489p (£868m) - Half Year Trading Update - Graham - GREEN

Thank you to Jim for suggesting we cover this one today. The company formerly known as Draper Esprit put out a strong statement yesterday and saw a very nice share price reaction. It has been on an upward trajectory in recent months:

Molten Ventures is a European tech-focused venture capital firm. If so inclined, you can peruse its investment portfolio here - it includes some names you’ll definitely have heard of.

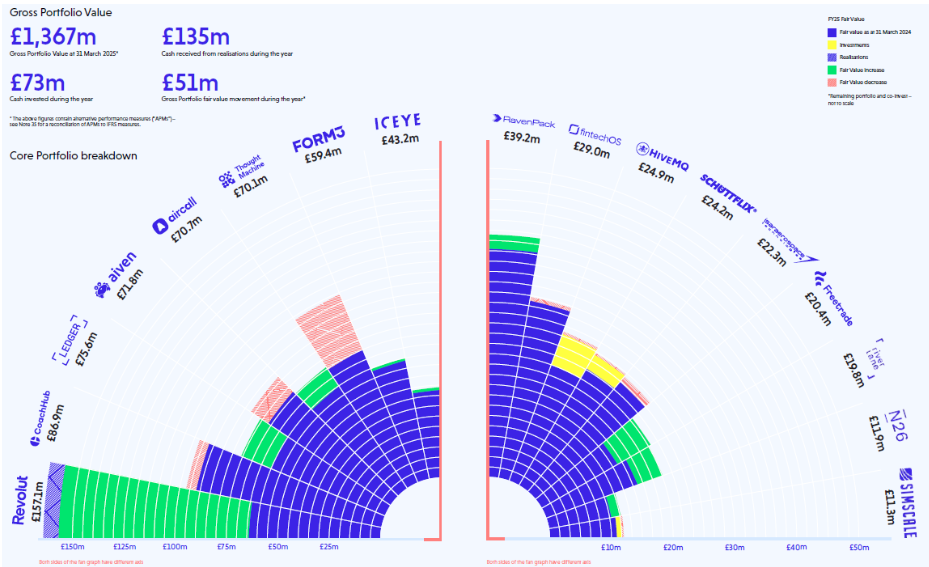

This is what they achieved in H1 (to September):

HY26 demonstrated further growth in both GPV (5.5%) and NAV per share (7.2%), supported by a combination of hands-on portfolio management, improved market comparables, and the ongoing share buyback programme.

(GPV = gross portfolio value.)

NAV is expected at 719p (current share price: 489p, so that’s a 32% discount). That’s up from 671p at the end of the previous financial year (FY March 2025).

Gross portfolio value is £1,425m, benefiting from a £75m uplift. Of course true portfolio value for a business like this is a matter of opinion to some extent, but the valuations of their companies at recent funding rounds can be used to provide reasonable estimates.

The company has an annual target when it comes to realisations: 10% of gross portfolio value. H1 saw 4.5% of the portfolio converting into cash, which is pretty much in line with that target, and there are “further potential realisations during FY26 being actively worked on”.

It looks like Molten Ventures must have been a fairly late investor at Freetrade, as they only made 1.5x their money on that one (it was bought by IG group (LON:IGG), in which I have a long position).

They made 20x their money on Revolut.

Buyback: £38m has been returned through buybacks since July 2024.

Cash: still very substantial at £76m, and they have access to a £60m RCF.

CEO comment: very positive.

“We have had a strong first half of the financial year continuing the recent upward trends in portfolio value and NAV per share, supported by our focus on portfolio management and development, and our balanced capital allocation policy.

“We are also pleased that we have been able to deliver an ongoing strong level of realisations following on from last year, which reflects the maturity, depth and breadth of our portfolio.

“We invest at the forefront of a generational shift in technology, with Molten’s portfolio covering key subsectors such as Fintech, Space, Cyber, AI, Climate, Quantum, Digital Health, and Crypto & Blockchain. The portfolio offers considerable potential to deliver some of the category winners of the future.

Graham’s view

I like listed investment vehicles with good track records, and Draper Esprit has done ok for investors over the years - although given the risk involved in VC investing, you might have expected more capital appreciation than what the long-term chart shows below. They have never paid a dividend.

Checking the presentation at their full-year results, I see that they claim to have delivered a 15% average return since IPO.

I can't verify that figure but I can see that their NAV per share has grown from 343p (March 2017) to its current level of 719p.

I guess they don’t have that much control over their share price: they couldn’t stop it trading at a massive premium to NAV in 2021, and I’m sure they wish it wasn’t trading at a discount now.

Here’s a snapshot of their “Core portfolio”, which includes their largest, most mature holdings. It might be tricky to read but it does show Revolut, Freetrade (now sold) and N26.

I’m inclined to put a GREEN on this: I like the risk:reward of reputable investment vehicles at a 30%+ discount to NAV. Of course, there is some risk, but I'd wager that a 30%+ discount prices in plenty of bad news, and the company is addressing the discount with buybacks (these buybacks themselves being a further boost to NAV, on top of the company’s own investment returns).

Portfolio diversification could be a little better, but I note that they have been selling off bits of their Revolut position, to open up new positions elsewhere. Sounds sensible.

So I'm GREEN on this - I'd definitely be up for researching this in more detail, and putting it on a "buy" watchlist.

Graham's Section

Alumasc (LON:ALU)

Down 11% to 302p (£123m) - AGM Trading Update - Graham - AMBER

A pretty poor AGM update from this “premium sustainable building products, systems and solutions Group”.

The situation has worsened in the Q1 period (July to September), with the blame going to pre-Budget uncertainty:

As announced at the FY24/25 full year results, conditions in the Group's core UK residential and commercial markets have been volatile, with demand in a number of sub-sectors at subdued levels. Conditions in a number of these markets have become more challenging through the period, exacerbated by short-term uncertainty surrounding the UK Government's upcoming Autumn Budget. While the Housebuilding Products division has continued its positive momentum over the period, a number of delays in larger new build and RMI projects have constrained UK revenues in the Building Envelope and Water Management divisions, despite a healthy order book and a growing pipeline of opportunities.

Alumasc says it is outperforming the wider market, and still sees “encouraging demand in its export markets”, although export revenues this year will not match last year’s success.

Looking ahead to a possible recovery in UK construction activity:

The timing and pace of this recovery remains difficult to predict, and consequently the Board believes it prudent to adopt a cautious approach for the first half of FY25/26, as conditions remain uncertain. The Board still expects a second-half weighting to FY25/26, as announced at the FY24/25 full year results.

Estimates: as is typical, the job of providing fresh forecasts goes to the Nomad (in this case Cavendish), and forecasts are not shown in the RNS.

So let’s switch over to this morning’s Cavendish report to find the new estimates.

FY June 2026: revenue forecast cut by £4m to £113.4m, adj. PBT forecast cut by £0.9m to £14.4m. Adj. EPS forecast cut by 5.9% to 29.1p.

FY June 2027: revenue forecast cut by £1m to £119m, adj. PBT forecast cut by £0.3m to £16.2m. Adj. EPS forecast cut by 1.9% to 32.8p.

Graham’s view

For those who don’t study this company regularly (like me), this is what Alumasc provides: water management solutions, building envelopes and house building products (vents, access panels, etc.).

Roland struck a cautious tone on this one in September (share price at the time: 337p). He kept our AMBER/GREEN positioning, but noted that an H2 weighting for the company was unusual.

There are good reasons to be careful about unplanned or unusual H2 weightings. They often come after a poor first half where management are unwilling to admit defeat yet and allow full-year forecasts to get cut. Clearly, this means there is an elevated risk of a profit warning.

At least today’s profit warning is not all that bad: EPS cuts of less than 6% for the current year, and less than 2% for the next year.

But I’m not going to trust that the 2% cut to next year’s forecast is sufficient - it seems to price in a turnaround that is far from certain. There is no order book figure provided, for example, to give us confidence that FY27 will see higher revenues and profits. We can only hope that construction activity picks up soon, perhaps after the Autumn Budget.

CEO - some important context that the CEO is retiring in March 2026, after 25 years with the company and 23 years as CEO. According to the announcement last month, the search for his replacement is “well progressed”. Whoever they are, it seems that they will walk into a challenging environment.

Conclusion - I don't have any desire to be especially critical of this company. It’s still profitable, it’s still paying a dividend, and it’s not financially levered. When dealing with mature micro-caps, that’s already impressive.

However, I am going to downgrade our stance to neutral, to be consistent with our normal procedure after a profit warning and also consistent with Alumasc’s declining StockRank. The earnings multiple on next year’s EPS forecast (FY June 2027) is 9x and I would struggle to argue that it deserves to be rated more highly than that.

Record (LON:REC)

Up 4% to 58.4p (£116m) - Second Quarter Trading Update - Graham - GREEN

The market likes this. Let’s pick out some bullet points:

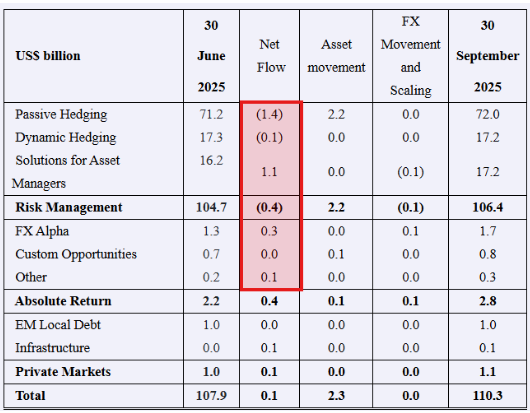

Q2 net inflows of $0.1 billion: a rounding error, but positive!

Positive market movements $2.3 billion, so AUM rises to $110.3 billion.

An important but highly unpredictable number is performance fees: these come in at £0.5m (Q2 last year: zero). A helpful profit boost and it means that performance fees so far this year (£0.9m, after adding in the Q1 result) are meaningful, although it looks like they will struggle to match the £3.2m achieved in FY25. Those in turn were lower than FY24’s performance fees.

Average fee rates are “broadly unchanged” (i.e. slightly lower). I would expect continued gradual downward pressure on fees that can be charged for passive hedging services, but Record also provides value to customers with “Dynamic Hedging”, “Solutions for Asset Managers”, and return-seeking products.

The table shows clients taking a little money out of Passive Hedging, but adding to several other categories:

Infrastructure Equity Fund: this gets off the ground, with €100 million deployed. There were previously said to be €1.1 billion of commitments to this fund, so plenty more to go.

Graham’s view

I’m a long-term fan of this one, and my instinct is always to be GREEN on it. But I note Roland moderated our stance to AMBER/GREEN in July. And I can’t really argue with that given that net flows are neutral, fee rates are probably nudging lower long-term, and performance fees are fairly modest.

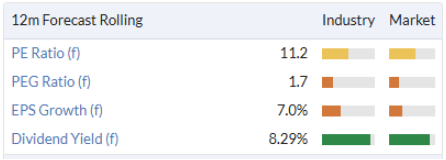

It still has wonderful investment characteristics, in my view - including an enormous yield - but I should accept that when growth is limited, I should also limit my enthusiasm a little.

Stockopedia captures this nicely with the PEG ratio: growth is lower than the P/E ratio, making for an expensive PEG.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.