Good morning! It's a quiet end to the week - I'm hoping to update our spreadsheet after finishing today's report.

All done for today - quite an interesting set of results and profit warnings in the end! Have a great weekend everyone.

Spreadsheet accompanying this report: link (last updated to: 31st October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

| Vodafone (LON:VOD) (£20.8bn | SR96) | Vodafone and AST SpaceMobile announcement | VOD and AST SpaceMobile announce a new EU satellite constellation and select Germany for Satellite Operations Centre. | |

| Rightmove (LON:RMV) (£5.0bn | SR38) | Trading Statement | SP -13% Reaffirms 2025 guidance: revenue growth 9%, 70% underlying operating margin. New 2026 guidance: revenue growth 8-10%, underlying operating profit growth 3-5%. This is lower than current market forecasts. | BLACK (AMBER/GREEN) (Graham) |

ITV (LON:ITV) (£2.5bn | SR82) | Confirms that it is in preliminary discussions regarding a possible sale of its M&E business to Sky for an enterprise value of £1.6bn. |

PINK (AMBER/GREEN) (Graham) | |

Coats (LON:COA) (£1.52bn | SR59) | 4-month period: market conditions remained subdued but performance was “in line with our expectations”. Outlook unchanged. | ||

Wizz Air Holdings (LON:WIZZ) (£1.03bn | SR28) | The orderbook of 273 total aircraft remains intact, but the delivery schedule is adjusted “to align with a more sustainable and profitable capacity growth trajectory.” | ||

ME International (LON:MEGP) (£716m | SR68) | SP -7% Revenue £311-£318m, PBT £76-79m. (2024: revenue £308m, PBT £73m.) Still exploring strategic options including potential offerors for the company. Laundry revenue +10% and continuing to roll out to new geographies although unusually warm weather impacted demand. A more serious problem in the photo business where German regulations require passport photos to be taken in the citizens’ office or by certified photographers. Outlook: uncertain macro backdrop, but group well-position to deliver growth. | BLACK (AMBER) (Graham) (also PINK) This is a weak update compared to existing revenue expectations for 2025 (£329m) and the new PBT guidance of £76-79m looks set to miss the prior estimate, too. We learned in June that the company was looking for a buyer, with the important context being that we have an 83-year-old CEO who owns 36% of the company. Probably he wishes to sell just to diversify his wealth and crystallise the value of a life’s work, although news that Germany won’t allow Photo-me photos to be used in passports is very unfortunate and makes me wonder if there is a risk that this could happen in other jurisdictions? The photo business has always been treated suspiciously by investors with the previous concern being that people would take passport photos on their phone - although the German law is a step further away from that scenario. ME Group is a high-quality business (QualityRank 97) that has been an important holding in many portfolios for years, and I respect it very much, but let’s temporarily put it on AMBER after this mild profit warning. I’ll happily upgrade it again at the next “in-line” trading update. | |

Idox (LON:IDOX) (£327m | SR66) | Idox Shares which are subject to irrevocable undertakings/ non-binding letters of intent to support the takeover have increased from 22.97% of Idox Shares to c.29.51%. | PINK (Graham) [no section below] | |

Record (LON:REC) (£117m | SR84) | SP -4% H1 FY26 revenue -9% (loss of a client with schemes across multiple products in late FY25). Net income £3.7m (H1 last year: £5.0m). “The outlook for the current financial year relative to market expectations is highly dependent on timing of closing certain projects.” Estimates: with thanks to Panmure Liberum, the FY26 revenue forecast is £40m (previously £42m), and the new PBT forecast is £9.7m (previously £11.2m). Following years also get a PBT cut of about £1m each. | BLACK (AMBER) (Graham) [no section below] This announcement doesn’t officially include a profit warning but the company’s broker confirms that forecasts for the current year (FY March 2026) need to be adjusted lower, and the new PBT forecast is 13% than the old one. In that sense it’s surprising that Record’s share price only fell by 4% today, but that might be to do with the fact the the miss is largely due to reduced performance fees - these are inherently unpredictable and so it’s possible that investors are willing to look past a weaker six-month innings when it comes to these fees (£800k vs. £1.6m in H1 last year). I’ve been a long-term fan of this business and I continue to find it interesting and worthy of research: AUM is at record highs ($110.3bn) and net flows were at breakeven in H1, which is an achievement in itself. Also, the new Record Infrastructure Equity Fund promises to generate a new long-term stream of management fee. They are also launching a Sharia-compliant Deep Tier Supply Finance Fund. Overall, then I remain a fan of this highly cash-generative, financially strong and reputable currency manager. However, to reflect that we have just witnessed a profit warning and with potential further vulnerability depending on the timing of customer agreements, I am going to downgrade our stance on it to neutral. | |

Scancell Holdings (LON:SCLP) (£102m | SR9) | Presented positive data (first reported in July) from the ongoing Phase 2 SCOPE trial of its active immunotherapy at the Society for Immunotherapy of Cancer (SITC) annual meeting. | ||

| Rentguarantor Holdings (LON:RGG) (£28m | SR10) | Conditional Subscription for approximately £2.5m | SP -42% Has conditionally raised £2.5m at 12.5p “to support the Company's growth and facilitate a wider marketing campaign, to be strategically timed with the passage of the Renters' Rights Act.” Each new share is accompanied by a warrant with strike price 17.5p. Secondary share sale: the CEO, founder and largest shareholder conditionally sells 2.2 million shares at 12.5p (his holding before the announcement was 46.8 million shares).. | RED (Graham) I’m relieved to see that I was AMBER/RED on this in August even though I was glad to see it join AIM. Invesors will probably have to vote this fundraise through as the alternative is to potentially see the company’s cash balance run thin. Accordingly I am going to downgrade my stance on this to fully RED as this runs the risk of becoming just another cash-guzzler on AIM. |

Medpal AI (LON:MPAL) (£28m | SR10) | Launches MedPal.clinic, its retail pharmacy website. | ||

| Cyanconnode Holdings (LON:CYAN) (£22m | SR9) | $5.25m Loan Note to support AMISP Tenders | Lender is a Middle Eastern climate technology company. Funds will be used as “Earnest Money Deposits” when tendering for smart metering contracts. | |

CAP-XX (LON:CPX) (£18m | SR22) | Revenue of A$4.94m (+7.6%), loss after tax A$3.93 (last year: A$6.14m loss). Four months since year end: bookings +25.4%, billings +12.1%. | ||

Argo Blockchain (LON:ARB) (£15m | SR7) | SP -10% High Court of Justice in London has approved the convening of creditor and member meetings. The Restructuring Plan is expected to be implemented on or shortly after 8 December 2025. As previously announced, existing shareholders will have their interest diluted to 2.5%. | RED (Graham) [no section below] Unless I'm mistaken, Argo's current market cap (£13.7m) suggests that the recapitalised company - with existing shareholders owning 2.5% of it - will be worth £550m . I don't know how this can possibly make sense. 2024 results showed the company mining 2.1 bitcoin per day, generating revenues of $47m, adjusted EBITDA of $5.7m, and a net loss of $55m. |

Graham's Section

ITV (LON:ITV)

Up 14% to 77.28p (£2.91bn) - Year-end Trading Update - Graham - PINK (AMBER/GREEN)

This is a tiny RNS in word count, but it has resulted in a c. £360m change to the ITV market cap today:

ITV plc ("ITV") notes the recent press speculation and confirms that it is in preliminary discussions regarding a possible sale of its M&E business to Sky for an enterprise value of £1.6bn.

There can be no certainty as to the terms upon which any potential sale may be agreed or whether any transaction will take place. A further announcement will be made in due course if appropriate.

ITV published a Q3 update which we covered briefly in yesterday's update.

Let’s explore that update in a little bit more detail now.

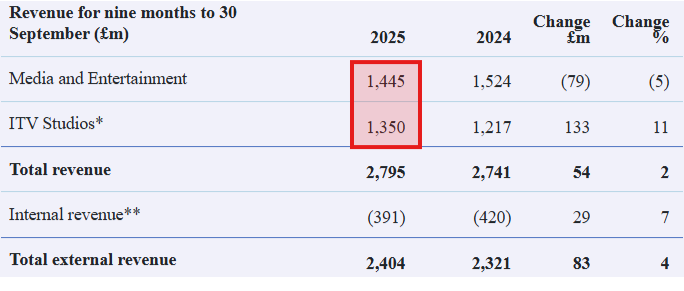

The tables in the update shows that Media and Entertainment division was responsible for the majority of revenues in the year-to-date, but not by much:

M&E is the broadcaster/streamer that includes the company’s linear TV channels and ITVX, and also their YouTube channels.

ITV Studios is the large media production and distribution group responsible for a wide range of familiar content - The Voice, Love Island, The Chase, I’m a Celebrity, etc.

The Q3 update shows M&E revenue falling by 5% year-on-year, although there were pockets of growth within that - digital advertising revenue up 15%. Market share of commercial viewing on linear TV fell slightly, from 32.3% to 31.8%.

In a difficult advertising environment, the company has been doing ok - there is no doubt that it has been challenged by the conditions.

For example, if I scroll back further, to the interim results, I find that the M&E division produced an adjusted EBITDA of only £35m - less than half of the prior year. That gives an uninspiring EBITDA margin of less than 4%, on £955m of H1 revenue. The absence of a major football tournament in 2025 explains only some of the weakness.

ITV Studios generated much higher margins: £107m of adjusted EBITDA on £893m of revenue (giving an EBITDA margin around 12%).

So the studios business has produced more profits and at higher margins than M&E. This is also true for FY 2024 (ITV studios: £299m adjusted EBITDA, M&E: £260m adjusted EBITDA).

Graham’s view

I’m inclined to upgrade our stance on this by at least one notch - to AMBER/GREEN - to reflect the arrival of a catalyst that could unlock a huge amount of value for shareholders.

Sky’s motivations are pretty obvious - why not add more channels and streaming services and enjoy even bigger scale? Sky News (ironically reporting on the story) says that the goal is to create “a UK-focused streaming giant”. ITVX has become a valuable asset, it seems.

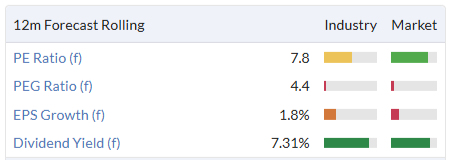

The suggested enterprise value of £1.6 billion would be 6x last year’s adjusted EBITDA. Remember that EBITDA multiples should be much lower than P/E multiples - so 6x EBITDA might actually be a reasonable price for everyone.

ITV reported net debt of £586m at the half-year, with a low leverage multiple of 1.1x. The injection of £1.6bn, if it happens, could eliminate some or all of the debt, expand the Studios business, and still allow for a large surplus to be returned to shareholders.

Exciting times for the company's shareholders - well done to anyone who was contrarian enough to invest in this cheap big-cap.

Rightmove (LON:RMV)

Down 13% to 568p (£4.39bn) - Trading Statement - Graham - BLACK (AMBER/GREEN)

(At the time of publication, Graham has a long position in RMV.)

I’ve been invested here since 2018. It has been an ok investment - paying a small dividend, reducing the share count, and maintaining very high market share in the UK property portal market.

EPS was 17.7p in 2018, versus 28.7p expected this year.

Today’s update has been met with dissatisfaction by the market. The key news is that “Rightmove is accelerating technology investment to build an even stronger platform and to drive sustainable growth over the medium to long term”.

More investment means more spending and lower earnings in the short-term.

Bullet points from the business update:

>80% market share in consumer time per Comscore (nothing new here), and more usage of Rightmove’s home-moving tools.

Estate agents: highest retention in H1 2025 for over 10 years.

Growth areas (Commercial Property, Mortgages, Rentals): 7% of H1 revenues vs. 5% in 2023.

And this is where they will be investing more:

Consumer - the Rightmove App, and AI search capabilities.

AI-powered operations - back-end infrastructure and AI interfaces.

R&D to fast-track new growth opportunities.

The goal: “enhanced network effects, more efficient operations, and sustained double-digit growth.”

Outlook: reaffirming 2025 guidance which is 9% revenue growth (previous guidance range was 8-10%), 70% underlying operating margin.

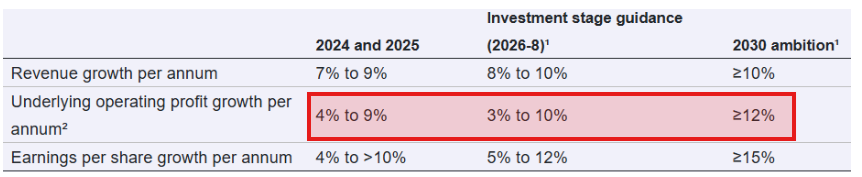

2026 guidance: revenue growth 8-10%, with underlying operating profit growth 3-5%, “reflecting the increased investment outlined above”.

I think this is technically a profit warning, as the market had previously pencilled in profit growth of about 10% for 2026.

The company provides this handy table outlining their guidance and ambitions:

Note that earnings per share can grow faster than operating profit growth due to factors including share buybacks.

Market update: there has been a continuation of existing trends in the property market, e.g. favourable mortgage rates vs. last year (albeit higher now than was expected last year), listings continue to increase, and prices are "broadly flat at a national level compared to last year”. Some uncertainty around the forthcoming Autumn budget.

CEO comment:

“AI is now becoming absolutely central to how we run our business and plan for the future. We are already working on a wide range of exciting AI-enabled innovations for the benefit of our partners and consumers, and see vast potential utilising our leading reach and connected data. We are investing to accelerate our capabilities, which we are confident will create an even stronger platform and higher-growth business over time. We aim to further advance our leading digital position in the UK property ecosystem.”

Graham’s view

The share price reaction is perhaps a little harsh in my view, but I can see why investors might not like today’s update.

Firstly, it is technically a profit warning, albeit one that has been dressed up in the best possible way: as a voluntary decision to invest for the medium- to long-term.

The most common criticism of Rightmove as an investment is that it doesn’t grow fast enough - that it’s a high-quality business but that the funds it earns can’t be profitably invested.

In that context, I don’t mind the company using more cash for investment for a few years, to see if it can turbo-charge growth. I think it’s fair to say that the possibilities of digital investment are probably more exciting now than they were a couple of years ago, and so the timing of this decision does make some sense to me.

The negatives?

Well, a sceptic could argue that the company could be starting to feel the heat of competition from Onthemarket (and others). It could be argued that the decision to “accelerate growth” is not as voluntary as Rightmove are making out, but is instead required in order to stay ahead of determined competition.

Personally, I’m a little uneasy when I hear Rightmove say that “AI is and will continue to be central to all that we do”. I never thought of this as an AI stock before, and I don’t think of it as one now. It’s a marketplace platform and while it will certainly use AI in various ways - dealing with search requests, user queries - I don’t see this as being core to the investment case.

So I am a little worried that the company might be getting distracted by investor euphoria around AI. It must be difficult to ignore the extreme valuations attached to AI businesses, and tempting to try to get involved in some way.

I was AMBER/GREEN on this last time. Given that it is still profitable, and that profits are still growing, and that it remains a fundamentally high-quality business (QualityRank 95), I’m reluctant to downgrade our stance on this. The P/E multiple is now less than 20x which historically I have viewed as a sign of a potential buying opportunity here.

Therefore, I am perhaps controversially not going to downgrade our stance on this one today, despite the cuts that analysts will be making to their profit forecasts for the next few years. As before, the debate around this stock is to do with merely how fast profits will grow - and the range of possible outcomes doesn’t seem very wide to me. Either profits will grow at 12%+ by 2030 as planned or perhaps growth will get stuck in the single digits.

This is a luxury problem to have in business and so I do think a moderately positive stance remains justified. But do bear in mind that I am talking up my own book here!

The chart is not encouraging in the short-term and in StockRank terms this is a Falling Star, which is considered to be a losing style:

Putting on my technical analyst goggles, I would see long-term support above 500p and I’d also bear in mind that the rejected takeover offer last year was at 775p. I don’t think the business has changed all that much since then!

Rentguarantor Holdings (LON:RGG)

Down 42% to 12.95p (£16m) - Conditional subscription for approximately £2.5m - Graham - RED

This is an illiquid share with 69% of shares held by its top holders according to the StockReport, so dramatic moves are always possible, but even so - this is a stunning fall today.

I’m relieved to see that I was AMBER/RED on it in August even though I was glad to see it join AIM.

The valuation at £40m seemed rather high to me, and the company apparently agrees as it is happy to raise money at an enormous 44% discount to last night’s close (12.5p vs. 22.5p). Worse, the new shares each come with a warrant that can be exercised at 17.5p, which means more dilution if the share price recovers.

If the warrants aren’t exercised, the amount of dilution is admittedly not huge: only 20 million new shares on top of 125 million existing shares. However, it’s the extremely low pricing of the fundraise, compared to the existing share price, which indicates just how out of line that prior share price was.

Also, this debacle is combined with news of the founder-CEO looking to trim his holding a little, at 12.5p. I guess he must agree that it was radically overvalued at 22.5p.

Graham’s view

While the company trumpets growth and marketing as the reasons for the fundraise, they also say:

The net proceeds will also, to a lesser degree, be utilised towards maintaining the Company's working capital position as it grows.

Interim results showed the company earning H1 revenues of just under £1m, an operating loss of £400k+ for the six months, and finishing up with cash of just over £700k.

I think investors will have to vote this fundraising through as the alternative is to potentially see the company’s cash balance run thin. Accordingly I am going to downgrade my stance on this to fully RED as this runs the risk of becoming just another cash-guzzler on AIM.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.