Good morning!

Wrapping it up there, thank you.

Spreadsheet accompanying this report: link (last updated to: 5th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

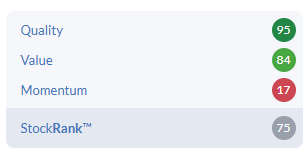

Vodafone (LON:VOD) (£21bn | SR96) | Expecting to deliver at the upper end of guidance range for both profit and cash flow. New progressive dividend policy. Revenue rose by 7.3% to €19,609m in H1 while adjusted EBITDAaL rose by 5.9% to €5.7bn. Pre-tax profit flat at €2.1bn due to increased depreciation and amortisation charges following Three merger. | AMBER/GREEN (Roland) [no section below] Happy Days for long-suffering Vodafone shareholders! In The Week Ahead on Friday, I commented on the group’s encouraging turnaround progress and noted that Vodafone was currently the second-highest ranked stock in the FTSE 100. Today’s upward nudge to guidance suggests to me the stock should at least retain its strong MomentumRank when the latest accounts are digested by the algorithms. Turning to the numbers, a fair chunk of H1 growth was driven by the consolidation of the Three network into Vodafone’s accounts, but one key achievement is a return to revenue growth (+0.5%!) in Germany, the group’s largest market. However, in my view the most useful measure for this business is free cash flow, as this is what’s required to support the dividend and buybacks. Today’s results indicate surplus cash should be at the top end of the guidance range, potentially giving the stock a 10% forecast free cash flow yield. This appears to have provided enough confidence for Vodafone to pencil in a return to a progressive dividend payout alongside a further €500m share buyback. The proposed 2.5% dividend increase would be the first rise in seven years. If this new policy proves sustainable, it could drive a gradual re-rating of the stock. While overall profitability remains fairly low, things do seem to be moving in the right direction. I’m going to lift our view by one notch to AMBER/GREEN, reflecting today’s positive guidance and the company’s Super Stock status. | |

Informa (LON:INF) (£12.5bn | SR75) | Full year guidance reaffirmed on Underlying Revenue Growth (6%±), Group Revenues (£4bn±) and Adjusted Earnings per Share Growth (10%+). | ||

DCC (LON:DCC) (£4.6bn | SR87) | “Continuing adjusted operating profit declined by 5.4% in the seasonally less significant first half… We continue to expect good profit growth for the full year in line with market expectations.” | ||

Greencoat UK Wind (LON:UKW) (£2.2bn | SR n/a) | Potential changes to the inflation indexation in the Renewables Obligation scheme could reduce NAV per share by 2.4p or 10.6p. | ||

Princes (LON:PRN) (£1.2bn | SR N/A) | Continues to trade in line with expectations and remains confident in the delivery of full-year performance in line with management's internal budget. | ||

Dowlais (LON:DWL) (£1.09bn | SR43) | Full-year performance now expected towards the top end of guidance range of flat to a mid-single digit adjusted revenue decline and adjusted operating margin of 6.5% to 7.0%. | ||

Oxford Instruments (LON:OXIG) (£1.01bn | SR35) | Challenging conditions in H1; positive momentum returning. H1 actions and order recovery are expected to lead to a full-year performance consistent with the October trading update. | ||

4imprint (LON:FOUR) (£959m | SR77) | Resilient performance. Full year revenue ≥ $1.32bn, at the high end of analyst forecasts. PBT ≥ $142m, above upper end of analyst forecast range. | AMBER/GREEN (Roland) Today’s update is encouraging and suggests to me management is executing well and controlling what it can. The underlying story hasn’t changed, though – revenue and order volumes are down, while expected product cost increases have been postponed rather than avoided. Broker forecasts for next year remain unchanged today, suggesting profits could fall further before a recovery starts. In contrarian and cyclical situations such as this, there’s always a risk of buying too soon. I think that could still apply here. However, 4Imprint’s valuation has already de-rated sharply, while its balance sheet remains very strong. I’m inclined to think the risk-reward balance is probably favourable on a medium-term view, given the group’s strong profitability and track record. | |

Vesuvius (LON:VSVS) (£928m | SR83) | Revenue “broadly” in line. Trading profit for the full year to be “broadly” in line. The medium term outlook is more positive. | ||

Hilton Food (LON:HFG) (£576m | SR75) | “Resilient performance”. Subdued underlying demand. Adjusted PBT to be in the range of £72m to £75m (interim results range of expectations: £76.8 - £81m). | BLACK (AMBER/RED) (Roland) This is a fairly severe profit warning. While profit forecasts for FY25 have only been trimmed slightly, house broker Shore Capital has cut its forecasts for 2026 and 2027 by nearly 20%. The problem seems to be that Hilton is being squeezed on both sides, with input cost inflation and more cautious consumer spending. The company will no doubt also be under pressure from its (much larger) customers to keep its prices as low as possible. It all adds up to an uncomfortable situation that’s not helped by a persistent debt balance – net bank debt has only been kept flat with the help of disposal proceeds. While I think there’s a decent, viable business here, I think it makes sense to be cautious until there’s some sign of more positive momentum. | |

Forterra (LON:FORT) (£386m | SR68) | H2 despatches and revenues to be at similar levels to H1. H2 adjusted EBITDA to be modestly ahead of H1, as previously guided. Full year guidance maintained. | ||

Ab Dynamics (LON:ABDP) (£298m | SR35) |

| AMBER (Roland) [no section below] Today’s results from this automotive test and verification specialist seem to present a slightly mixed picture. On the one hand, there’s a useful improvement in operating margin to 13.5% (FY24: 11.4%). Encouragingly, adjusted net profit of £18.7m converted into free cash flow of £20m, giving a free cash flow margin of over 17%. This strong performance appears to justify some of the expense on past acquisitions, albeit profitability remains well below historic levels. Despite this progress, I’m a little concerned by management commentary on trading conditions. Revenue growth was minimal last year and AB says the timing of simulator orders for automotive testing has been “impacted by macroeconomic disruption”. This affected trading in H2 and may continue into the first half of the current year. As a result, FY26 profits are expected to be weighted to the second half of the year. My feeling is that the confidence level on today’s outlook statement is a little lower than I’d really like to see. On balance, I think this is an interesting specialist business, with some attractive IP and industry relationships. But the shares are still trading on 16x forecast earnings and have earned a Falling Star style from the algorithms. I’m going to maintain Megan’s previous neutral view today. | |

Luceco (LON:LUCE) (£215m | SR72) | SP +7% Q3 rev +19.5%, with LFL +c.10%. EV charging key driver. Strong order book for Q4, FY adj op profit towards upper end of exps (range: £30.5m-£32.5m). | AMBER/GREEN (Graham) [no section below] I thought I might have to grudgingly raise our stance on this after a positive update. Longspur Research (sponsored by the company) have upgraded their EPS forecast for this year from 12.6p to 13p, and I'm going to make the judgement call that this is not significant enough to force me to take a more positive stance on the stock. I'm inherently wary of lighting companies, as they often appear to suffer from commoditisation and volatile demand, but let's give Luceco credit for strong performance including double-digit like-for-like growth in Q3 (just!). Year-to-date like-for-like growth is c. 5%. The company carries a meaningful amount of net debt (£68m) which is another reason for me to want to moderate our positive stance here, although the leverage multiple of 1.6x is by no means extreme. The stock trades at an earnings multiple of 10x which is towards the upper end of what I'd want to pay for a leveraged lighting business, although I do accept that Luceco's track record is better than average for this industry (the QualityRank is an impressive 79, for example). | |

FDM (Holdings) (LON:FDM) (£138m | SR69) | Macro conditions remain difficult, lengthening decision cycles. Some pick-up since summer. 2,003 consultants assigned @ 31 Oct (30 Jun: 2,173). Expect 2025 results to be in line with expectations. | ||

Team Internet (LON:TIG) (£106m | SR57) | Considering a potential breakup; in active discussions regarding divestment or strategic partnerships for “substantially all parts of the business”. PW: FY25 adj EBITDA now exp $40-45m (Zeus prev. $62.0m). | BLACK (AMBER/RED) (Graham) Leaving this on AMBER/RED despite the potential for the company to simplify its structure and receive large cash inflows from divestments. I'm afraid I can't look past the fact that today's profit warning is very large in percentage terms, and the company's weak balance sheet may itself form part of the explanation for the strategic review. | |

Dialight (LON:DIA) (£105m | SR70) | Rev -3.9%, adj op profit +4.6% to £5.5m. Net debt reduced to £10.2m, agreement reached to accelerate remaining Sanmina payments. FY outlook unchanged. | ||

Headlam (LON:HEAD) (£41m | SR28) | Will refocus on independent retailers and aim to reduce SKUs and improve purchasing efficiency. Targeting return to profitability in 2027 w/ lower inventory and surplus property sales. | ||

Abingdon Health (LON:ABDX) (£21m | SR14) | Several large contracts secured. Rev +38% to £8.4m, FY25 op loss of £(3.5m). Outlook: FY26 started well w/ Q1 revenue ahead of prior period. | ||

Altitude (LON:ALT) (£17m | SR55) | PW: rev +17.5% to $21.6m, adj EBITDA +6% to $1.7m reflecting revenue mix from UGS. Expect FY26 rev to be at least $43m, with adj EBITDA $3.7m (Zeus previous f’cast: $44.2m & $4.5m). | BLACK (AMBER/RED) (Graham) [no section below] We had a CFO departure in June, and then the long-standing CEO left “with immediate effect” in July. She was thanked and was said to have left “in order to pursue other opportunities”, but whenever “immediate effect” is involved, I’m inclined to suspect (without any particular evidence) that the departure is not 100% voluntary. Today’s update refers to “the strengthened management team” at the company now, and says there is “a requirement for the Group to realign current-year expectations, together with hurdle criteria and pricing for future contracts.” The result is a large profit warning (FY25 EBITDA forecast cut by 18%), and house broker Zeus declines to update FY26 and FY27 forecasts until the interims are published - visibility on contract wins doesn't seem particularly strong right now. Altitude was originally pitched by some investors as a “marketplace” type of stock, for promotional products. I, along with others, had high hopes for it at one point. However, it hasn’t lived up to these expectations and has gradually evolved into a service provider: it has a creative design agency and provides e-commerce websites for customers. This is a very different type of business compared to where I thought its aspirations were heading originally. I’m afraid I don’t view this as offering much underlying quality as an investment, and I have to downgrade our stance on it after today’s profit warning. | |

Shearwater (LON:SWG) (£15m | SR77) | Revenue of £39.5m, annualised growth of 29%. Adj PBT £0.6m, net cash £5.1m. Expects revenue and EBITDA growth in FY26. | ||

Tap Global (LON:TAP) (£13m | SR16) | Q1 rev +40% to £991k, with QoQ growth of c.30%. Core B2C offering remained resilient, initial revenue from new B2B product. |

Graham's Section

Team Internet (LON:TIG)

Up 9% to 46.95p (£111m) - Strategic Review to Unlock Shareholder Value - Graham - BLACK (AMBER/RED)

Team Internet Group Plc… the global internet company that generates recurring revenue from creating meaningful and successful connections: businesses to domains, brands to consumers, publishers to advertisers, today announces the initiation of a strategic review to unlock shareholder value and provides an update on market developments in its Search and Comparison segments.

Roland was rightly cautious on this in September with the company issuing fairly mixed interim results (broker earnings forecasts were unchanged but the net debt forecast increased).

The company’s self-description sounds vague and this is because of the wide variety of services it provides: domain management and registration, brand security, product comparison, etc.

Statutory results have been poor, although the company has posted large adjusted EBITDA numbers (e.g. $24.6m in H1 this year, and $92m in 2024).

They are dissatisfied with their share price:

The Board believes that Team Internet's share price does not reflect the intrinsic value of its individual businesses, each of which is a leader in structurally growing digital markets. In recognition of this, and following a number of inbound approaches, the Group has initiated a strategic review to unlock the full value of its portfolio…

“A number of inbound approaches” is interesting, but of course still quite vague. It could mean a highly speculative, opportunistic approach to pick up a part of TIG very cheaply, or it could mean something substantial. We will not be told.

Possible solutions that the company is exploring: divestments of businesses, or entering strategic partnerships.

They are not looking to sell the entire group. Instead, they are looking at each individual business and seeing what could be done with it.

In our Domains, Identity & Software (DIS) segment, where discussions are most advanced, the Group has retained a Tier 1 financial adviser to assist the Board in exploring strategic options, including a divestment of the segment.

“DIS” is one of their three segments, the others being Comparison and Search.

Comparison consists of a French product comparison website and a German product consumer website, both aimed at consumers.

Search consists of six businesses ranging from domain parking services to content creation and publishing.

While Comparison and Search are still highly diversified, it would at least be much easier for shareholders to understand TIG if it only consisted of those two segments, after the DIS segment was disposed of.

Of course the risk is that DIS is the best part of the business.

Here’s a bold statement in today’s announcement:

The Board is confident that the DIS business alone could command a valuation materially exceeding the Company's current market capitalisation.

For reference, TIG's market cap last night was £106m.

Update on the Search segment: the company is also putting this one up for sale, at least in accounting terms. It expects to classify Search as “an asset held for sale”. Although it sounds like an actual takeover of this segment is not imminent.

Search has been badly hurt by changes to Google ad products - the foundations of this business do not seem very solid to me, as a long-term investment.

Outlook: adjusted EBITDA $40-45m this year, which amounts to a profit warning compared to prior forecasts. They say that they “remain highly profitable and cash-generative” (where “profitable” must refer to adjusted figures, not the statutory numbers which have been terrible!).

Estimates: thanks to Zeus for publishing on this.

2025 forecasts - the adjusted EBITDA forecast was $62m in September, and now reduces to $42.3m. The revenue forecast gets cut by 12%. The adjusted EPS forecast gets cut by nearly 40% to 8.2 cents.

2026 forecasts - the revenue forecast gets cut by 16.7% and the adjusted EPS forecast gets cut by over 40%, to 9.7 cents (previously 16.8 cents).

Graham’s view

I think I’m going to leave this on AMBER/RED.

Reasons why I might upgrade it today:

Selling or partnering off parts of the group will lead to a simpler structure that investors will be better able to understand, and on which they might put a higher valuation.

Selling off DIS could, allegedly, result in more money flowing in than last night’s market cap.

However, there are also reasons why I might downgrade it:

This is an enormous profit warning in terms of the cuts made today to the adjusted EPS forecasts for this year and next year.

The company was carrying net debt of $93m as of June 2025.

Those are two excellent reasons for a downgrade.

Firstly, we know that profit warnings tend to lead to more profit warnings. TIG has form for this:

Perhaps estimates have reached a floor now - but that’s an inherently contrarian position to take.

Secondly, the debt position gives an alternative explanation for the strategic review: that the company wasn’t feeling financially comfortable, and that it needs the cash inflow.

Note that even if they sold DIS for £110m ($145m), that doesn’t mean they would sell their debt off with it. They could pay off the debt with the funds received, and be left with about $50m of cash plus their remaining businesses.

Interestingly, two private equity firms were interested in TIG earlier this year, and they were both considering bids at 125p. Both of them subsequently walked away. Perhaps they saw something they didn’t like?

On balance, I think AMBER/RED remains appropriate here. There is the potential for takeovers of individual businesses or of the entire group that would make the current valuation look very cheap. But there is also the potential for TIG’s “good” businesses to be sold, leaving shareholders only with the “bad” businesses plus whatever cash is left after debt repayment.

And I wonder if buyers might look at TIG’s balance sheet and feel emboldened to offer cheaper bids.

One final point is that TIG has been buying its own shares this year. While I love a good buyback more than most, I don’t consider TIG’s buyback activity to be wise, given its losses and its leverage. So that’s another reason to be wary of getting involved - bad buybacks are a sign of poor decision-making.

Roland's Section

4imprint (LON:FOUR)

Up 15% at 3,930p (£1.1bn) - Trading Statement - Roland - AMBER/GREEN

This morning’s update from FTSE 250 promotional goods supplier 4Imprint is short but sweet. The company provides welcome clarity on trading expectations and has upgraded its 2025 profit guidance:

The Board expects full year Group revenue of not less than $1.32bn, which is at the high end of the current analyst forecast range, and profit before tax of not less than $142m, which is above the upper end of the current analyst forecast range.

(Previous figures from commissioned research provider Edison were for FY25 revenue of $1,320m and adjusted pre-tax profit of $135.4m.)

The market has given this update a warm reception, perhaps aided by yesterday’s news that a deal has been agreed to end the US government shutdown. That could be positive for corporate spending, too.

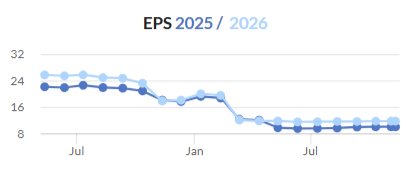

4Imprint business generates almost all of its sales in North America and has suffered a run of downgrades in recent months that have been blamed on macro conditions, depressing its share price:

However, today’s trading update makes it clear that these macro pressures have continued, with revenue and order volumes below 2024:

Revenue for the 10 months to 31 October was down 2%

Order intake was “approximately 3% below prior year” with average order values flat

Existing customer order count was flat, with new customer order count down 13%

For context, H1 revenue fell by 1%, while order intake was down 2.9%. So it looks like these trends were broadly unchanged in Q3.

Profit upgrade - why? It’s worth remembering falling revenue and flat order values have been achieved against a background of cost inflation – so it seems fair to assume volumes are slightly lower than last year too.

Given this, you might be wondering what’s driven today’s profit upgrade.

It seems that the answer relates to US tariffs. 4Imprint doesn’t manufacture products itself, but sources these from suppliers. Inevitably, many products are made in China and thus affected by this year’s tariffs.

Previously, management expected tariff-related price rises on many products to be phased in during H2. When customers reordered stocks, the company was planning to absorb some supplier price rises in order to keep its prices competitive and protect its strong market share.

It seems that input price rises are taking longer to feed through than expected, perhaps because suppliers built up US stocks ahead of the introduction of tariffs.

At the same time, 4Imprint has been able to flex its marketing spend (largely online advertising) in order to reflect lower levels of new customer acquisition.

This combination has had the effect of improving profit margins, leading to today’s upgrade (my bold):

Gross profit margin has remained strong at just below 33%, as product cost increases due to tariffs are being phased in later than anticipated, while the marketing mix is providing the flexibility we anticipated. As a result, a double-digit operating profit margin has been maintained in the 10-month period.

4Imprint has always maintained a conservative balance sheet and today’s update confirms that this remains true. Net cash was $124m at the end of October 2025.

Updated Outlook & Estimates

Edison has published a new note this morning with updated forecasts for FY25. As a commissioned research provider, we can assume its numbers have been accepted by the company, making this particularly useful today.

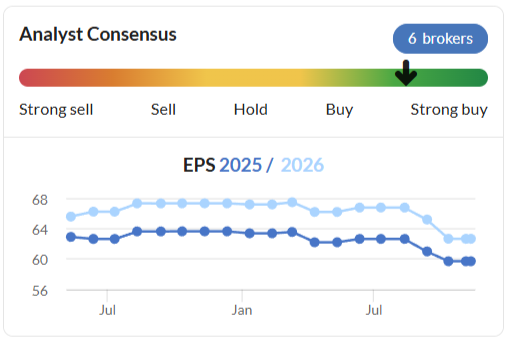

Note that forecasts for next year suggest profits will fall as market headwinds and cost pressures persist:

FY25E EPS: 381.66c (+4.6% vs 364.95c previously)

FY26E EPS: 328.90c (-0.4% vs 330.09c previously)

My feeling from today’s update is that the impact of tariff-related price rises may be postponed rather than avoided. Edison’s analysts echo this view with a quite strongly-worded comment:

However, it is a case of when and not if these tariff-related increases are passed on, and the positive surprise for FY25 profit does not flow through to FY26 forecasts.

After this morning’s gains, my sums suggest 4Imprint is trading on a FY25E P/E of 14, rising to a P/E of 16 in FY26.

Roland’s view

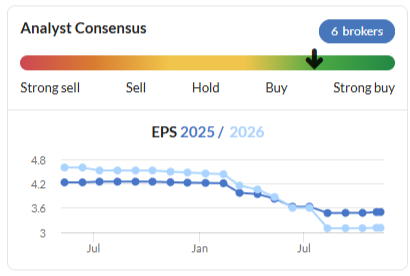

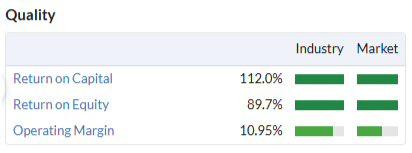

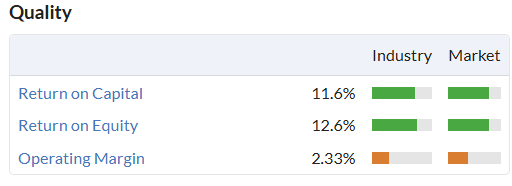

When Graham covered 4Imprint’s 2024 results in March, he suggested that this remains a high quality business, despite short-term headwinds. I share this view – the capital-light business model delivers wonderful profitability and strong cash generation:

I’d argue that the current Contrarian styling is well deserved (in a good way!) and note that the stock currently passes seven of Stockopedia’s Guru screens:

Today’s update seems broadly positive to me. 4Imprint appears to be executing well and optimising its performance to suit the current environment, despite ongoing pressures.

The current valuation is well below historic norms and I don’t see any reason why 4Imprint shouldn’t recover over time, when US market economic conditions become more favourable.

Perhaps my main reservation is that profits are still expected to fall next year. This raises the risk that it could still be too soon to buy – the business could face a more prolonged slump.

Buying too early is an error I’ve often made with cyclical and turnaround situations. But on balance, I can’t help feeling that the risk-reward balance is probably favourable, at least on a medium-term view.

I’m going to leave Graham’s moderately positive view unchanged today and stay at AMBER/GREEN.

Note: we’ll be publishing a more in-depth look at 4Imprint on Thursday in a new Stock Pitch. Look out for this if you’d like to learn more about this impressive business.

Hilton Food (LON:HFG)

Down 24% at 488p (£437m) - Trading Statement - Roland - BLACK (AMBER/RED)

Markets have reacted badly to today’s profit warning from this meat-packing multi-protein food business:

Arguably, this is a good example of the downside risk that can come from investing in Contrarian situations where momentum is very weak:

I’m relieved to see I flagged some risks here in September, when the company guided for FY25 results to be “within the range of expectations” despite some inflationary pressures.

It’s since become apparent that those expectations weren’t achievable after all. In today’s statement, the company has cut its guidance for both FY25 and FY26, citing inflationary pressures and disruption to US imports.

Here are the main points from today’s statement:

Red meat and convenience volumes “remain solid”, but price inflation is weighing on underlying demand – (I’d guess shoppers may also be downgrading to cheaper cuts of meat, potentially weighing on margins);

Salmon should benefit from festive demand, but overall UK seafood performance is being affected by soft demand for white fish which has become too expensive for some shoppers;

Hilton’s Foppen smoked salmon business is currently facing regulatory restrictions on exports to the US that have led to a production shutdown in Greece. The US government shutdown has made this situation worse and production is not expected to resume this year.

Balance sheet: year-end net debt is expected to be “marginally higher” than at the end of FY24. Today’s note from Shore Capital forecasts net bank debt (exc. leases) of c.£135m, versus £131.4m at the end of 2024.

However, it’s worth noting that Hilton has received £71m of cash proceeds from two recent divestments during the quarter (at least one of which is expected to be dilutive to earnings). So it seems fair to assume year-end net debt would probably have been c.£200m without these sales.

This makes me wonder if the recent disposals may have been motivated primarily by a desire to raise some cash.

Outlook & Updated Estimates

Underlying demand is said to be subdued, but Hilton is confident (or at least hopeful) that the usual Q4 seasonal demand will help to support full-year results.

Despite this, profit expectations for both this year and 2026 have been cut:

FY25: adj pre-tax profit: £72m to £75m (previous consensus range: £76.8m to £81m)

FY26: “the Board has become more cautious on the trading outlook for 2026 and as such expects profit progression in the next financial year to be difficult.”

With thanks to house broker Shore Capital, revised forecasts are available on Research Tree today – note the much larger cuts to the outer year forecasts:

FY25E adj EPS: 56.3p (-4.1% vs prev. 58.7p)

FY26E adj EPS: 51.4p (-17.5% vs prev. 62.3p)

FY27E adj EPS: 56.1p (-18.7% vs prev. 69.0p)

Roland’s view

Today’s downgrades leave Hilton Foods trading on less than 10 times forecast earnings, but I’m not sure this would be cheap enough to tempt me in until there’s some improvement in the outlook.

Earnings forecasts have already been cut on multiple occasions this year. My feeling is that visibility remains quite poor:

Debt levels remain material too, in my view, especially given the wafer-thin margins and somewhat average profitability of this business:

Hilton typically sells products to much larger buyers, such as supermarkets and big foodservice companies. As a result, I’d imagine its pricing power is very limited, especially given the semi-commoditised nature of its products.

While I think Hilton Foods does have a viable, scaled business, the combination of macro headwinds and an indifferent balance sheet means that I’m inclined to be cautious. To reflect this view (and today’s profit warning), I’m downgrading my view on this stock to AMBER/RED.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.