Happy Friday!

This is at risk of becoming a weekly "What has Michael Burry done next?" column, but I can't help noticing that Burry has deregistered his hedge fund.

A letter dated October 27th to his investors said that he is returning capital. The reason given: "My estimation of value in securities is not now, and has not been for some time, in sync with the markets".

On October 31st, he said "Sometimes, we see bubbles. Sometimes, there is something to do about it. Sometimes, the only winning move is not to play."

On November 10th, he accused the "hyperscalers" (tech mega-caps META, GOOG, ORCL, MSFT, AMZN) of understating depreciation by extending the useful life of their Nvidia chips and servers, which in turn inflates their earnings.

He very recently disclosed a large bet against Palantir, although the size was not as large as the media originally reported: he spent $9.2 million on 50,000 Palantir options, each of which is for 100 Palantir shares, these options having a strike price of $50. The maximum profits on the bet are therefore $250m if Palantir goes to zero in 2027. That would not be bad for a fund with AUM of c. $155m earlier this year.

Perhaps he and his investors are unhappy with his recent performance? Perhaps he's not sure what the best strategy is to short the AI/tech bubble, and so he prefers "not to play" the game of shorting it with other people's money? Or perhaps he simply prefers investing away from the limelight of having a registered fund. Either way, I very much doubt that this is the last we've heard of him.

Mello London is next week, and several of us will be there! If you are thinking of going, they have given us a 25% discount code: STOCKOPEDIA25. This will make a 1 day ticket £74.25 (instead of £99) or a 2 day ticket £126.75 (instead of £169).

Tickets can be bought here and the programme is here.

Have a great weekend everyone.

Spreadsheet accompanying this report: link (last updated to: 5th November)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Melrose Industries (LON:MRO) (£7.9bn) | Our guidance for the full year remains unchanged: revenue £3.425 - 3.575 billion. Adjusted operating profit of £620-650m. | ||

Land Securities (LON:LAND) (£4.8bn) | Increase in guidance. FY26 EPRA EPS growth expected to be at the top end of c. 2-4% guidance, before the impact of a disposal. | ||

| Goodwin (LON:GDWN) | Placing of shares in Goodwin Plc | The family sell 1.6% of the company to a limited number of institutional investors. | AMBER/GREEN (Graham) I’m inclined to leave our moderately positive stance unchanged here. The sale by the Goodwin family doesn’t change very much. It does let us know that the stock’s valuation is rather full - but we knew that already. |

Supermarket Income REIT (LON:SUPR) (£1.0bn) | Acquires 20 Carrefour supermarkets in France through sale and leaseback transaction. €123m invested at a net initial yield of 6.6%. | ||

PPHE Hotel (LON:PPH) (£628m) | Eli Papouchado and Boris Ivesha (owning 44% collectively) “intend to hold a small handful of meetings with financial investors in relation to a range of potential options, from contributing growth capital to PPHE, to a potential partial monetisation of their stakes in PPHE.” | PINK (AMBER/GREEN) (Graham) I'm inclined to view this as Papouchado and/or Ivesha looking to crystallise the work they've done and the value they've built over many years. It could be good or bad for the stock price (although the market has interpreted it positively). The downside risk is that it creates a large overhang, with up to 44% of the company’s stock being perceived as (or actually) up for sale. The upside risk is that the company ends up going private, and existing shareholders get to cash out at a number closer to EPRA NAV. EPRA value per share was £28.07, according to the interim results: that's 66% higher than the current share price. It’s a very speculative possibility, but the talks that are about to take place could be the catalyst. | |

DFS Furniture (LON:DFS) (£371m) | “Whilst it is still relatively early in our financial year and we are mindful of the broader macroeconomic environment and the uncertainty created by the upcoming Autumn budget, we remain comfortable with the range of consensus profit expectations.” | AMBER/RED (Graham) Another reassuring in-line update. Perhaps I'm too cautious on it; I just think it's worthwhile to be very careful in this sector, especially when large leases and other debts are involved. For now at least, the company is performing well and I can understand why the market is putting it on a respectable PER of c. 11x. I may be forced to revert to neutral if it continues to pump out positive updates and clean profits. | |

Metals Exploration (LON:MTL) (£366m) | SP -2% Operations at Runruno were impacted by the Super-typhoon Uwan. The Company is revising its annual gold production guidance from 70-75k oz to 65-70k oz. | BLACK (Graham) [no section below] I'm no expert when it comes to this share but the moderate share price reaction and the text of the RNS itself says that the typhoon is not a major problem for the company. From midpoint to midpoint, the reduction in production guidance is 7%, and this results not just from the typhoon but from cyanide contamination in September. Sadly this typhoon has resulted in some deaths and the displacement of over a million people in the Philippines. | |

Frp Advisory (LON:FRP) (£361m) | £6m plus payment for net assets acquired (£650k) and earn-out. Arc is “a renowned FCA-regulated provider of financial advisory services to the real estate sector.” | ||

Idox (LON:IDOX) (£326m) | Shares subject to irrevocable undertakings/letters of intent to support the takeover have increased from 22.97% of shares to 29.47% of shares. | PINK | |

MJ GLEESON (LON:GLE) (£220m) | “The Board, whilst mindful that the Government's Autumn Budget will be announced on 26 November 2025, expects that the results for the financial year ended 30 June 2026 will be in line with current market expectations.” | ||

Crystal Amber Fund (LON:CRS) (£95m) | Crystal Amber Asset Management intends to resign. Strategic proposal from Tarncourt Capital to manage the fund. | GREEN (Graham) [no section below] I mentioned this one very recently, commenting on their interesting portfolio of mostly unlisted equity investments, and their 29% discount to NAV. I also noticed recently that their investment manager Richard Bernstein had turned up as the CEO of Insig Ai (LON:INSG). It didn't seem very plausible that he could continue both roles, and a solution has now been found. CRS shares could very well continue to trade at a discount but surely their new manager will be thinking about how to narrow it? | |

Shield Therapeutics (LON:STX) (£71m) | STX’s partner, MEDLEAP Pharma, has initiated a Phase II trial for ACCRUFER® (ferric maltol), a new drug candidate for Pulmonary Arterial Hypertension (PAH), for patients in Japan. | ||

Steppe Cement (LON:STCM) (£39m) | Proposed capital repayment of approx. 1.5p per share. $4.35m in cash to be paid in GBP. | ||

MicroSalt (LON:SALT) (£30m) | 2025: confident of exceeding its original expectation of full year revenue of $2.0 million. 2026 projection: sales to total $7.0 million based on in-hand volume estimations and its current customer base, rising to more than $15.0 million in 2027. Guidance at the interim results: 2026 revenues of $6.5-7m, and at least $13m in 2027. | RED (Graham) [no section below] A genuinely exciting situation here where the company claims to be on the verge of achieving a massive step-up in revenues. There is no broker coverage so investors who are willing to do the work here and verify the company's claims could get a real edge. However, I'm going to leave my negative stance unchanged from last time when I listed seven reasons for caution. I'd like to wait and see if the promises turn into reality. Checking the interim results, I see that the company's gross margin improved from deeply negative to breakeven. That's a start. Cash was $0.9m. | |

Aptamer (LON:APTA) (£26m) | “With £1.95 million of binding contracts already secured and seven months remaining in the financial year, the Board is confident that full year revenue will materially exceed the prior year's performance.” | ||

Rentguarantor Holdings (LON:RGG) (£18m) | Individual franchised branches of Winkworth Estate & Letting Agents will have the option of introducing the RentGuarantor service to their tenants. | ||

Goldplat (LON:GDP) (£16m) | “A strong operating quarter supported by the high gold price and good supply from South America and once off supply in South Africa.” £200k dividend. |

Graham's Section

Goodwin (LON:GDWN)

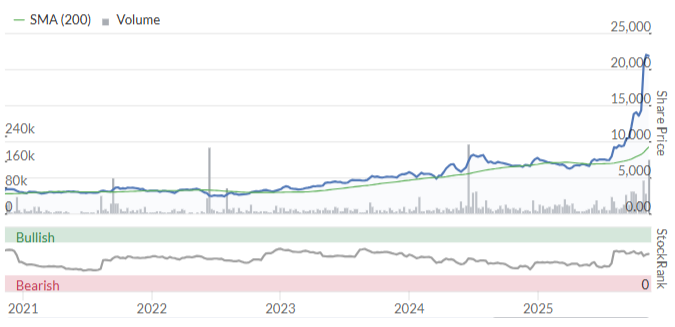

Down 8% to £205.76 (£1.55bn) - Placing of shares in Goodwin Plc - Graham - AMBER/GREEN

A brief RNS this morning that discloses the sale of 1.6% of Goodwin Plc by the Goodwin family.

The buyers are “a limited number of institutional investors”.

GDWN shares have had an incredible multi-bagging run:

122,000 shares have been sold - these were worth £4m five years ago, £8m a year ago, and c. £25m today.

Whenever an insider sells out, it’s important to put it in context.

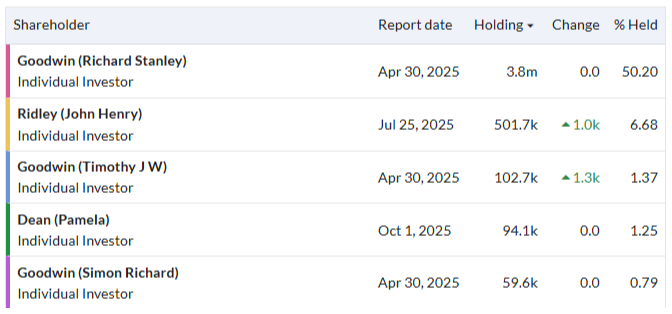

The Goodwin family are still very heavily invested in their company. At the moment, the shareholder list consists only of individuals, and I think that pretty much all of them are family members. Their combined holdings are 63%, with Richard Goodwin having 50%. The top 5:

In this context, the sale of 1.6% doesn’t change all that much. The family remains in control of the business and they are still highly motivated to see it succeed.

However the sale of c. £25m of stock should, I think, be seen as a signal that the stock’s valuation is reasonably full.

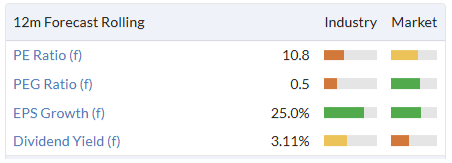

The ValueRank is only 6:

However, please bear in mind that the valuation metrics involved here are unusually backward-looking, as the company generally doesn’t get involved in the City’s usual routine of attempting to meet market forecasts. I don’t blame them for that - my own largest holdings take a similar approach.

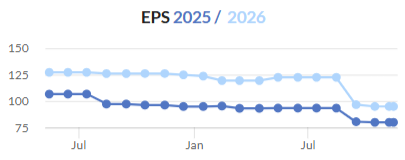

But this does mean that the P/E ratio you’ll find on Goodwin’s StockReport is a trailing PE, not a forward-looking PE. All other metrics are also trailing metrics.

It wouldn’t matter so much if Goodwin’s EPS wasn’t growing so quickly.

At the October update, they told us to expect a trading PBT for FY April 2025 of over £71m - that’s double the result for the prior year.

The ValueRank can’t take that into account yet, so I do think the ValueRank is a little understated.

But at a £1.55bn market cap, it is arguably expensive even if you take the new PBT forecast into account. I estimate the current-year P/E multiple at 29x.

Putting it all together, I’m inclined to leave our moderately positive stance unchanged here. The sale by the Goodwin family doesn’t change very much. It does let us know that the stock’s valuation is rather full - but we knew that already.

PPHE Hotel (LON:PPH)

Up 13% to £16.90 (£707m) - Graham - AMBER/GREEN

I’m putting a PINK on this as PPHE is now officially considered to be in an “offer period”, as a result of this announcement:

Eli Papouchado and Boris Ivesha (the "Shareholders"), who collectively own c.44% of the voting rights of PPHE Hotel Group Limited ("PPHE"), note the recent media speculation and confirm that they intend to hold a small handful of meetings with financial investors in relation to a range of potential options, from contributing growth capital to PPHE, to a potential partial monetisation of their stakes in PPHE.

In some ways this resembles the Goodwin announcement above, but the market has responded very differently.

In the case of PPHE, Eli Papouchado (age 88) is the founder, while Boris Ivesha (age 72) is the President and CEO.

Mr. Papouchado was Chairman from 1989 until the beginning of this year.

Mr. Ivesha shares his CEO duties with a Co-CEO.

I have spoken to management here a couple of times - my notes after my most recent meeting with CFO Daniel Kos were written up for Stockopedia here. He made good arguments as to why the valuation of the company using real estate principles (the “EPRA” valuation, £1,188m) is more realistic than the balance sheet value, and much higher than the current market cap.

Today’s announcement mentions the potential for the company to receive growth capital. While Mr. Kos also expressed to me that the company wished to raise growth capital, I think investors will rightly focus instead on the possibility of a “monetisation” of the Papouchado/Ivesha shares.

In practice this could mean a large placing, as we had with Goodwin.

Another possibility - however speculative - is that an investor might be found who would be interested to buy the entire group. Not just the Papouchado/Ivesha shares, but all of them.

Graham’s view

I’ve been reluctant to upgrade my stance on PPHE for a couple of reasons. Firstly, it issued a profit warning in August and I don’t want to upgrade my stance on a company where estimates are under pressure.

Secondly, I try to avoid being unduly swayed by persuasive management teams - top executives are always very convincing!

In the case of PPH, I was AMBER/GREEN on it prior to the August profit warning, and I’m happy to return to that stance today.

There haven’t been any further downward revisions to earnings forecasts since August:

When it comes to interpreting today's news, I'm inclined to view it as Papouchado and/or Ivesha looking to crystallise the work they've done and the value they've built over many years.

it could be good or bad for the stock price (although the market has interpreted it positively). The downside risk is that it creates a large overhang, with up to 44% of the company’s stock being perceived as (or actually) up for sale.

The upside risk, as I’ve mentioned, is that the company ends up going private, and existing shareholders get to cash out at a number closer to EPRA NAV. EPRA value per share was £28.07, according to the interim results: that's 66% higher than the current share price. It’s a very speculative possibility, but the talks that are about to take place could be the catalyst.

DFS Furniture (LON:DFS)

Up 0.6% to 159.44p (£373m) - AGM Trading Statement - Graham - AMBER/RED

DFS Furniture plc (the 'Group'), the market leading retailer of upholstered furniture in the United Kingdom, provides the following update in advance of its Annual General Meeting later today.

It’s a nice little update from DFS. Key points:

Order intake growth in line with expectations

Outperformed the market according to Lloyds Bank data (external link outlining the Lloyds-DFS relationship).

Expects to deliver strong year on year profit growth in H1 (period to December).

Key sentence:

Whilst it is still relatively early in our financial year and we are mindful of the broader macroeconomic environment and the uncertainty created by the upcoming Autumn budget, we remain comfortable with the range of consensus profit expectations.

Expectations: profit before tax and brand amortisation £37.6 to £43m, with a consensus figure £40.6m.

Graham’s view

I upgraded our stance on this (from RED to AMBER/RED) in September, after an in-line trading update accompanied the full-year results.

The question for me today is whether it deserves another upgrade after another in-line update.

My instincts say no, because we aren’t cautious on this stock due to concerns that it won’t hit earnings.

We are cautious on it due to a) the sector, which demands a low valuation, and b) the DFS balance sheet, which isn’t very strong.

Net debt was last seen at £107m, which is on top of lease debt.

I tend to think about stocks in terms of how many large risks are involved. Roughly speaking, if there is one large risk, I can live with that. If there are two, I am cautious. If there are three, I tend to avoid it altogether.

At DFS, the risks are:

The sector, which is both cyclical and highly competitive. No moat.

Large lease liabilities. It’s normal, but it is a risk.

Financial net debt, last seen at £107m.

I wish them well but I’d rather stay cautious on this share until the balance sheet improves further and/or the valuation becomes even more obviously cheap.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.