Good morning!

Have a great weekend! Cheers.

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

GSK (LON:GSK) (£71.8bn | SR94) | Action contends that recent conduct by AnaptysBio is in material breach of the existing license agreement with GSK subsidiary TESARO. | ||

Babcock International (LON:BAB) (£5.6bn | SR61) | Organic revenue growth 7%. Underlying operating profit +19%. Net debt reduced to £56m. Expectations for FY26 are unchanged | ||

HgCapital Trust (LON:HGT) (£2.13bn | SR N/A) | Transaction values HgT's investment in Intelerad at approximately £52 million: an uplift of £20 million over the carrying value in the pro-forma NAV of HgT. | ||

Hammerson (LON:HMSO) (£1.53bn | SR77) | Acquires the remaining 50% interest in The Oracle, Reading from its JV partner, at a headline price of £104.5m. FY25 like-for-like gross and net rental income growth expected to be around 3%. Total gross rental income growth raised to 19% (from the 17% previously guided). | ||

Sirius Real Estate (LON:SRE) (£1.44bn | SR82) | Completes the acquisition of a business park in Feldkirchen, Munich, Germany, for €43.7 million (including acquisition costs). | ||

Bodycote (LON:BOY) (£1.05bn | SR81) | Sites based in France. Cash consideration €22m. | ||

Craneware (LON:CRW) (£751m | SR57) | SP +3% The start of FY26 has seen positive momentum continue. Continues to trade in line with market expectations. Senior NED retires as previously announced. | AMBER/GREEN (Graham) [no section below] Roland has been covering this one in detail (see here for his most recent comment) and I won't attempt to reinvent the wheel on the back of this AGM statement. The main takeaway is that this is a reassuring update which goes some way towards justifying the aggressive valuation of the stock (albeit less aggressive now than it was in September). The company has a "leading position in the 340B market", a regulated drug purchasing programme in the US, with its customers including over 12,000 US hospitals, pharmacies and clinics. This interaction with US regulation has been a source of opportunity but I would also see it as a potential source of risk, as who knows how the company might be affected by future changes in the rules? However, regulated entities do at least tend to be sticky customers when it comes to software. I continue to find Craneware's achievements highly impressive and if you're willing to value them on a multiple of sales (5x), taking a software perspective, rather than focusing too heavily on the P/E (22x), you might not find the current market cap excessive. | |

PPHE Hotel (LON:PPH) (£741m | SR35) | Board to consider options including introducing growth capital, or a potential sale of all or part of PPHE. | PINK (AMBER/GREEN) (Graham) [no section below] Exactly a week ago, we had a similar announcement from PPHE, noting that their two major shareholders - the founder and the CEO - were having discussions with potential investors with a view to PPHE receiving growth capital and/or achieving a "partial monetisation" of their stakes in PPH. I said at the time that my assumption was that the two individuals were hoping to liquidate their positions. Today's announcement makes the situation more official, although we already had an FSP (formal sales process) under stock market rules. The difference now is that the PLC board, not just the two individuals, are exploring options that include a sale of the entire company. I've covered this stock in some detail, noting the wide disparity between its stock price and its officially stated NAV. I'm inclined to think that the search for a buyer is good news, with a distinct possibility being that the company finds someone who is willing to accept a narrower discount to NAV (£28) than the current share price (£17.80). The worst-case scenario is probably that they don't find a buyer and carry on as they were before, with a slight risk being that the two largest shareholders might be perceived as creating a stock overhang. | |

ITM Power (LON:ITM) (£442m | SR40) | CEO comment: "Partnering with Stablegrid on these landmark grid balancing projects in Germany reinforces ITM's position at the forefront of the energy transition in Europe's largest economy." | ||

Frp Advisory (LON:FRP) (£364m | SR70) | H1 revenue +12%, underlying adj. EBITDA +3% (£23m). Net cash £16.5m. “The client pipeline remains encouraging, and assuming current activity levels continue, the Board remains confident of achieving full year expectations.” | AMBER/GREEN (Graham) [no section below] Forecasts at broker Cavendish are unchanged (except for the impact of a small strategic investment by the company) and I'm similarly inclined to leave our AMBER/GREEN stance unchanged since our last comment. The EPS forecast for FY April 2026 is 11.7p, and for FY April 2027 is 12.2p. So if you're willing to look ahead to next year, the stock is trading on 11.6x earnings. That's probably about as high as I'd be willing to pay for a professional services business but the company does enjoy a healthy balance sheet (with net cash) and a tailwind in the form of strong demand for restructuring services. I'd personally be in no rush to buy here but I can see it as a strong "hold", and therefore AMBER/GREEN is fair. FRP is quite acquisitive but so far, it's hard to fault them on the results they've achieved with this strategy. | |

Asos (LON:ASC) (£295m | SR35) | SP -7% Gross merchandise value -12%, revenue -14%. Adjusted pre-tax loss £98m (previous year: £126m). FY26 outlook: GMV to show an improving trajectory, further gross margin expansion, adjusted EBITDA growth to £150m to £180m. Free cash flow broadly neutral. | RED (Graham) [no section below] We reported on an ASOS profit warning in September. Today's full-year results make it official with adj. EBITDA coming in at £131.6m, which is indeed at the low end of the £130-150m range that had previously been expected for the year. The EBITDA number seems to be a fantasy, however, as the adjusted loss before tax is £98m, and the actually loss before tax is an enormous £282m. When annual loss figures are higher than the currrent market cap, it's a sign that this is an extreme situation. Net debt is £185m, and it would have been much higher if not for the sale of the Tophop/Topman brands, although ASOS does retain an exclusive licence to design, distribute and sell these brands. The outlook is cheery enough but I don't trust EBITDA figures. Depreciation alone is £50m+ and is a real cost. I wish the turnaround every success and detailed research might reveal that it can succeed, but it's too early in the turnaround for me to be anything but RED on this stock. They have an entirely new commercial model - it's in startup mode again, which is appropriate after everything it has been through. | |

Aew UK Reit (LON:AEWU) (£166m | SR79) | NAV £172.82 million and 109.09 pence per share (31 March 2025: £174.44 million and 110.11 pps). | AMBER (Graham) [no section below] It's slightly cheeky for the company to lead with their "total shareholder return" of 11.44% in H1, when this is primarily driven by the company's share price. The underlying NAV return was a far more modest 2.7%. The result is that the discount to NAV has largely closed here - the Chairman points out that the stock has even occasionally traded at a premium to NAV in reecnt times (AEWU responded to this by reissuing 150,000 shares from Treasury). Roland was moderately positive in June although he acknowledged that the shares "may be trading closing to fair value". For me, small REITs should trade more cheaply than larger ones, and I am inclined to think that this is fully valued at such a small (c. 4%) discount to official NAV. The company's willingness to reissue shares underlines this view. I am therefore putting us on neutral here. | |

Knights group (LON:KGH) (£147m | SR84) | “Strong” H1, with 30% revenue growth including a return to organic growth. "We expect the second half to benefit from recent hires and a full period contribution from the recent acquisitions, underpinning our confidence in delivering a full year performance in line with market expectations.” | ||

Tullow Oil (LON:TLW) (£126m | SR26) | 2025 production guidance is expected to be at the lower end of the 40-45 kboepd range, as previously guided. Capital expenditure and decommissioning expenditure guidance for 2025 remains c.$185m and c.$20m. | ||

NWF (LON:NWF) (£79m | SR83) | SP -29% Trading “mixed”, solid performances in Food and Feeds more than off-set by a disappointing trading period for Fuels. Lower volumes in heating oil, and lower demand for commercial diesel and gas oil. Results for FY26 to be significantly below current market expectations. | BLACK (AMBER) (Graham) This could be an interesting contrarian investment, but I'm neutral on it for now until it's clear that trading has stabilised, and until I get my hands on the new profit forecasts. NWF's fuels division is its most important one. Hopefully it will trade normally through the Winter, after an unusually warm Autumn. | |

Inspecs (LON:SPEC) (£74m | SR81) | SP +3% | PINK (AMBER) (Graham) [no section below] | |

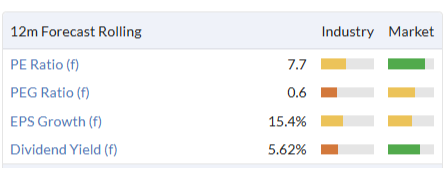

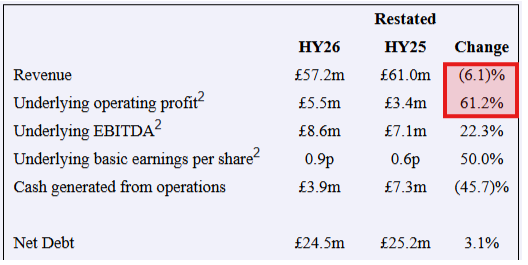

Carclo (LON:CAR) (£52m | SR95) | SP -11% Revenue -6%, underlying operating profit +61% (£5.5m). Net debt £24.5m. Expectations for the full year remain unchanged. | AMBER/RED (Graham) I'm staying negative on this due to the weak balance sheet., although the news here is not all bad. If it weren't for the outstanding financial debt and the pension deficit, I'd have a completely different view, but as it stands, I think the equity is a little shaky here. | |

Argo Blockchain (LON:ARB) (£12m | SR8) | One ADS (American Depositary Share) will represent 2,160 ordinary shares. Ordinary shares will have a JP Jenkins matched bargain facility for six months. | RED (Graham) [no section below] It continues to baffle me that this stock maintains a market cap in excess of £12m, when the planned restructuring will see existing shareholders left with only a 2.5% stake. At the new share count, the current share price would equate to a market cap of £500m, which doesn't seem at all realistic. However, the stock is also trading on the NASDAQ (ticker ARBK) and it seems that between the UK and the US, there is enough speculative interest to keep this at a double-digit market cap. |

Graham's Section

NWF (LON:NWF)

Down 20% to 126.5p (£63m) - Trading Update - Graham - AMBER

NWF Group plc ('NWF' the 'Company' or the 'Group'), the specialist distributor today provides a trading update for the half-year ending 30 November 2025 (the "Period").

Commiserations to anyone holding this overnight, let’s find out what’s the problem.

Trading since the AGM statement in September has been “mixed, with solid performances in Food and Feeds more than off-set by a disappointing trading period for Fuels”.

Fuels: industry data shows heating oil volume in the 3-month period to August 2025 were 25% below the prior year.

These lower volumes have continued to be experienced, largely attributable to temperatures through the Autumn being warmer than historical averages. With the seasonally busier winter months still to come, the Group expects that heating oil demand will return to normal levels, but this will not compensate for the unusually lower volumes in the first half of the year.

In addition, there has been lower demand for commercial diesel and gas oil. Again, industry data shows quarterly volumes down by nearly 30% year-on-year.

And to top it all off, NWF has been rolling out a new regional operating model for this division, which “has created some short term challenges”.

The other divisions are fine:

Food: financial performance ahead of the comparative.

Feeds: volumes in line with the prior year, with healthy margins.

Outlook:

The Group expects the performance of Fuels to improve in the second half as demand for domestic heating oil increases through the colder months. Despite the anticipated recovery, the Board does not believe this will offset the shortfall experienced in the first half, and accordingly, the Group results for the financial year ending 31 May 2026 are now expected to be significantly below current market expectations.

Prior to this update, expectations were for headline operating profit of £17.9m and headline PBT of £13.2m.

“Significantly below”, in my view, typically means over 10%, and a 20% fall in the share price is not out-of-the-ordinary as a response.

Peel Hunt is the Nomad; the stock also receives occasional coverage from Panmure Liberum, and I hope to get my hands on their new forecasts before too long.

Graham’s view

Well done to Roland for expressing a little caution on this share in June, although he was still moderately positive.

This profit warning is just another everyday example of the danger of dealing in commodities and weather-related shares - events beyond NWF’s control leave it vulnerable to reduced trading.

That being said, NWF was not priced aggressively; I would have thought that it was priced fairly for an investment of average to below-average quality:

It’s 20% lower today with a new profit outlook for the year that will be sharply lower, considering that this is a low-margin business and that the under-performing fuels division was responsible for half of its profits.

If I took a longer-term view, I could probably remain mildly positive. Because if I wanted to make a contrarian long-term investment, bad weather-related news is the type of thing that sometimes makes for nice entry point.

The balance sheet is key when making a contrarian investment: NWF’s most recent full-year results (to May) showed the company having net cash of £6.3m. This was after making some acquisitions for the fuels division, acquisitions that were said to be “immediately profitable and cash generative”. Even with a lower profit result for FY26 than previously forecast, I would still expect the group as a whole to generate cash this year.

I am going to go neutral on this for now, but I do think that a c. £60m market cap is interesting for a distributor with over £1 billion of turnover, on a long-term view.

The company has a new CEO since March 2024. He should be a safe pair of hands seeing as he was CFO since 2017: I would not assume that he deserves any blame for this profit warning. Sometimes, events are simply beyond management’s control.

Let’s go AMBER on this for now. I’ll hope to turn positive on it again when there are signs of stabilisation, and once we have clarity on the new profit forecasts.

Carclo (LON:CAR)

Down 11% to 62.65p (£46m) - Half-year Report - Graham - AMBER/RED

Carclo plc ("Carclo" or the "Group"), a global precision engineering group with comprehensive, end-to-end manufacturing capabilities is pleased to announce results for the six months ended 30 September 2025 ('HY26').

Panmure have published on this one today, with the surprising headline “significant opportunities in all sectors”.

The H1 results are a mixed bag: falling revenues but much higher profitability vs. H1 last year:

The company is happy with the figures, noting that it hit its “Return on sales” and “Return on Capital Employed” targets, on a trailing 12-month basis.

So what’s the catch?

Skipping ahead to the outlook statement:

The Board's expectations for the full year performance remain unchanged as the Group maintains the positive momentum established in HY26 throughout the remainder of FY26, with D&E [Design & Engineering] revenues expected to slightly increase in the second half, continued margin expansion and positive cash generation.

“Profitable growth” - a rather vague description of the outlook - is mentioned three times in today’s report.

Continuing the positive theme, the CEO says he is “delighted” with the progress made by the company.

Estimates: the note from Panmure is key to understanding the news today, with a new adj. PBT estimate for FY March 2026 of £5m (previously: £6.5m).

The reason? £2.3m of costs which include refinancing fees on the company’s new banking facility, and also the costs of the company’s pension deficit.

Panmure notes that these costs are “non-cash”, as they are charged to the company’s P&L in a different period than the period in which they are actually paid by Carclo.

However, despite these costs being non-cash, I do not think it is correct to adjust them out of the results.

Bank facility: Carclose uses a lender called BZ Commercial Finance. Most of the £38m of total facilities are secured on company assets.

Pension scheme: the latest actuarial analysis was completed in April 2025, and reported a deficit of £64.5m. However, that figure is already out of date. The latest figure given is £52.7m as of September 2025, after the company made a lump sum contribution.

Carclo’s annual contributions into the scheme are currently set at £3.5m until March 2029.

Dividends: it has been nearly a decade since the company paid a dividend, and there is no change on that front today.

Balance sheet: unfortunately the balance sheet has negative equity of some £9.5m, and negative equity of over £30m if intangible assets are excluded. Working capital is positive (current assets minus current liabilities), but the financial debt and pension deficit pull the company deep into the red.

Graham’s view

I feel bad that I haven’t spent much time looking at the company’s operations, which are fairly interesting. There is a Carclo Technical Plastics division with core competencies in drug delivery, precision tech components, and in vitro diagnostics. There’s also a Speciality division providing aerospace components, speciality optics and passive infrared sensor lenses.

The strategy sounds good. They say they are evolving “from being a volume provider to a focused engineering business providing value solutions”.

They have an international footprint - they “can manufacture and supply in-region across EMEA, APAC, USA”.

And I’m impressed by their focus on KPIs that can improve the quality of the business as an investment, namely Return on Sales (roughly speaking, that’s their operating margin) and ROCE.

However, I was AMBER/RED on this last time, arguing that they had “many mouths to feed”.

That comment noted that the company had failed to get its full-year results published by the deadline in order to avoid suspension. This is a main market stock, so they only have four months.

The results did get published a few weeks later, and trading in the shares was duly restored. The company also changed its auditor. So hopefully that was just a one-off problem, not to be repeated.

Overall, I’m inclined to leave this on AMBER/RED for the time being.

It’s true that the downgrade to estimates seen today has very little to do with underlying business performance.

However, balance sheet weakness was one of the main reasons I was cautious on this stock last time, and that weakness is what has caused this downgrade.

The market cap might be less than £50m, but it’s about £100m if you choose to add on the pension deficit. It’s over £120m in terms of enterprise value, if you also add on the latest net debt figure.

EBIT is forecast at £12.1m this year, rising to £13.9m the following year.

Therefore, against its enterprise value, I do not yet view this stock as a bargain.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.