Good morning!

The Budget is coming up on Wednesday - always an exciting day for UK markets.

Wrapping it up for today, thanks everyone.

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£214bn | SR75) | Plans to invest $2bn to expand its existing Frederick and Gaithersburg facilities, adding manufacturing and development capacity. | ||

BHP (LON:BHP) (£101bn | SR95) | BHP confirms it is no longer considering a combination of the two companies. | ||

IMI (LON:IMI) (£5.9bn | SR73) | Sold Truflo Marine business to Fairbanks Morse Defense for an enterprise value of £225m. Expect completion mid-2026. | ||

| ROSEBANK INDUSTRIES (LON:ROSE) (£1.4bn | SR4) | Trading Update | Highly confident full year expectations will be achieved. Expects net debt to be below expectations of $500m, leverage to be approx 2.5x. | |

Cerillion (LON:CER) (£400m | SR34) | Rev +4%, pre-tax profit +10% to £21.7m. New orders +25%, order backlog +21% to £56.9m. 2026 outlook positive, broker forecasts broadly unchanged. | AMBER (Roland) Today’s results appear to be in line and highlight an impressive 45% operating margin – a new high. However, there’s no upgrade to the outlook and growth is at the lower end of the rate I’d want to see to justify the current valuation. A review of the balance sheet also flags up the complexity of the company’s multi-year contracts and suggests to me that net cash may not all be surplus to requirements. I’m open to the possibility of upgrading my view here and believe this business might be worthy of more in-depth research. For now though, I’m staying neutral to reflect indifferent momentum and a weak StockRank. | |

TT electronics (LON:TTG) (£241m | SR76) | Jul-Oct revenue was £150m, “broadly flat” versus H1 2025. FY25 guidance unchanged (adj op profit £33.7m) but this outcome will require “significant step up in” Nov/Dec, with c.£12m of op profit needed during this period. FY26 outlook “broadly in line with 2025” | PINK (under offer) / BLACK (Roland) [no section below] | |

Tristel (LON:TSTL) (£170m | SR62) | American Institute of Ultrasound in Medicine has issued updated guidelines, for the first time accepting chlorine dioxide as an option for high-level disinfection. Leaves conditions “well-aligned” for greater adoption of Tristel ULT. | ||

Microlise (LON:SAAS) (£162m | SR74) | H2 trading “mixed” due to a slower recovery in the automotive and construction sectors. FY25 revenue and EBITDA to be below expectations at >£84m and >£8.3m respectively (previously £91.3m, £12.7m). FY26 outlook also downgraded. Canaccord Genuity estimates: - FY25E EPS 3.1p (prev. 5.5p) - FY26E EPS 4.9p (prev. 6.6p) | BLACK (AMBER/RED) (Roland) Today’s profit warning is quite a big one. I cannot help feeling that the company has left it as long as possible before admitting that it won’t meet previous expectations. More broadly, this 2021 IPO is not a business I’ve looked at before, but appears to have some intriguing characteristics – while it has a big share of the telematics market for UK HGV fleets, profitability is markedly weak. The CEO also controls more than half the shares. I’m intrigued, but plan to wait for the full-year accounts before conducting a more detailed assessment. | |

M&C Saatchi (LON:SAA) (£154m | SR49) | US government shutdown had a material impact on Q4 revenue and profit. FY25 results to be below expectations, with LFL net revenue -7% and op profit of £26-28m (PanLib previously: £31.4m). | BLACK (AMBER) (Graham) The broker forecast for next year's profit result gets cut by 25%, but I think there's enough value here to keep me neutral rather than negative. It had net cash (prior to a small acquisition in October), is still profitable according to forecasts, is embarking on a reasonably-sized (£5m) share buyback, and recently received a £50m bid for its Enterprise division. On a forward PER of less than 8x, I think this could be an interesting contrarian idea. | |

S4 Capital (LON:SFOR) (£119m | SR43) | SP -9% 2025 like-for-like net revenue to be down by just under 10%. Now targeting operational EBITDA, c. £75m, below the current market consensus of £81.6 million. Lower project-based revenue, continued client caution and a slower ramp up of new business wins than expected. New forecasts from Dowgate: for next year, FY26 revenue is now forecast at £672m (prev: £676m), and adj. EBITDA £85m (prev: £90m). Net debt forecast for 2025 rises to £137m. | BLACK (RED) (Graham) [no section below] This remains in the unenviable position of having net debt higher than its market cap, at a time when corporate marketing budgets have been slashed. Mark was AMBER/RED on this in September as he correctly noted that an earnings miss was likely (revenue expectations had been cut but EBITDA expectations unchanged). SFOR follows through now with an admission that adjusted EBITDA will miss expectations. This is a company where earnings tend to be enormous, with the full complement of depreciation, amortisation, impairment, share-based payments and restructuring charges. Tangible equity value is deeply in the red, which in my view suggests that investors are right to be worried about the leverage involved here (even if the leverage multiple is still well below the level it would need to reach to break covenants). Although the cut to the EBITDA forecast for next year is not huge in percentage terms, I think I'm right to downgrade our stance on this to fully negative given the lack of earnings quality, the downward momentum in forecasts, and the poor balance sheet. | |

ImmuPharma (LON:IMM) (£49m | SR24) | Now aims to complete a partnership deal as soon as practicable in 2026 (previously wanted to complete a deal by the end of 2025). Cash runway now extends into Q4 2026. | ||

Ondo InsurTech (LON:ONDO) (£42m | SR11) | Nationwide has placed a further order for LeakBot devices and services to expand the program into ten additional states. | ||

MTI Wireless Edge (LON:MWE) (£37m | SR72) | Revenues +12%, profit from operations +21% ($4.2m). $4m net cash from operating activity. Outlook: Positioned for a strong full year outturn, driven by all three divisions performing well. | AMBER/GREEN (Roland) [no section below] There are no changes to broker forecasts today after a solid Q3 for this Israeli technology group, which generates much of its revenue from the defence sector. Taking each of the divisions in turn, the antenna business benefited from “rising demand for military antennas globally”, but more mixed demand for its 5G backhaul and ABS antenna solutions (both aimed at mobile operators). The MTI Summit business also enjoyed good demand from defence clients, while in Mottech (which sells electronic water management and irrigation solutions), management reported continued growth from businesses and governments. Segmental profits were fairly evenly split across the business, ranging from $1.1m to $1.5m for each division. The balance sheet remains strong and quality metrics are respectable. I continue to see this as a decent business at a reasonable price. However, it’s family-controlled, overseas-based and has some geopolitical exposure. Full-year forecast EPS growth is also relatively pedestrian, so I’m going to leave my previous moderately positive view unchanged today. | |

EnSilica (LON:ENSI) (£36m | SR23) | Purchase order for the next phase of development of a satellite payload ASIC. Increases company’s contractual coverage against FY26 revenue guidance and will be worth $ millions over FY27 and FY28 if it continues to progress as expected. | ||

Powerhouse Energy (LON:PHE) (£23m | SR3) | PHE’s consulting division has progressed contracts previously announced as well as gained new contracts. Now necessary to grow this team further. | ||

Fusion Antibodies (LON:FAB) (£14m | SR17) | Revenues £0.84m (H1 last year: £1.2m). Loss reduced to £0.51m. Cash £0.25m. Going concern warning. FAB are "specialists in pre-clinical antibody discovery, engineering and supply for both therapeutic drug and diagnostic applications." | RED (Graham) [no section below] This has a paper-thin balance sheet for a listed company, with net assets of only £726k. Thankfully its assets are mostly liquid but it has a major need to get paid: receivables (£868k) are higher than six-monthly revenues, and this includes debtors of £543k. The company's cash balance is only £250k and it continues to post losses as it has done for as long as records show. I'm no expert in the science here but I can read a going concern warning: "Due to the risk that revenues and the related conversion of revenue to cash inflows may not be achieved as forecast over the going concern period, the Directors believe that there exists a material uncertainty that may cast significant doubt on the Company's ability to continue as a going concern without raising additional funds..." This is an automatic RED for me until it raises funds and extends its cash runway. | |

DSW Capital (LON:DSW) (£13m | SR63) | Trading “resilient” and in line with management expectations. Results are typically H2-weighted. “The business continues to trade well but the Board remains mindful of… uncertainties, particularly regarding the forthcoming Budget”. | AMBER (Graham) [no section below] Mark was AMBER on this in May and the share price/market cap are unchanged since then. Perhaps AMBER was the right call, then! EPS forecasts have increased only marginally since then. Today’s broker update from ShoreCap leaves EBIT forecasts unchanged for now (£2.5m this year, £2.7m next) with a small adjustment needed to correct a previous mistake in their analysis, leading to a 6% reduction in the PBT forecast (to £2.4m). This isn’t very important when it comes to the investment case, in my view. My view is that small professional services businesses should trade at low earnings multiples, and DSW is trading at 7x. That’s probably about right, with plenty of upside available if their M&A franchise takes off. I’m staying neutral. |

Graham's Section

M&C Saatchi (LON:SAA)

Down 12% to 111p (£137m) - Graham - BLACK (AMBER)

Some unfortunate timing from me recently, as on 3rd November I upgraded our stance on M&C Saatchi from neutral to AMBER/GREEN.

The reason for that decision was takeover interest in Saatchi’s “Performance” division, at an enterprise value of £50m.

However, it looks like I’m going to have to take our stance on Saatchi today back to neutral, at best.

Full-year trading update:

Trading in the second half of the year has been adversely impacted by the unprecedented US Government shutdown, the longest in history, affecting our Issues specialism which is a significant contributor to the Company's fourth quarter revenue and profit.

This must be the “Global and Social Issues” service, listed on their website. “Our clients include governments, NGOs, multilaterals, foundations, philanthropies and consumer brands.”

They say there is no impact to ongoing contract agreements or long-term growth prospects, but:

…the Company now expects a LFL net revenue decline of around 7% (or a decline of around 1.5% excluding Australia) with operating profit in the range of £26m to £28m, indicating an operating profit margin of around 12.5% - 13.0%, which is below the expectation set out in the Company's interim results announcement.

Estimates: my thanks to Panmure Liberum for publishing on this today.

They note that the “Issues” business is worth about 30% of SAA’s total revenue, and at a higher than average margin - that’s huge.

FY 2026 revenue forecast £210m (previously £212.7m), adj. EBIT forecast £26m (previously £31.4m).

FY 2026 revenue forecast £218.6m (previously £227.2m), adj. EBIT forecast £28m (previously £37.3m).

I note that although the company says the long-term prospects are unaffected, that doesn’t spare 2026 from seeing a major cut to its profit forecast, as Panmure pencils in more damage arising from the US government shutdown.

More positively, the company says it’s on track for its £12m cost saving programme.

Australia: this business has been restructured, including a “reset of the overhead cost base”. This business is set to be a big drag on Saatchi’s overall LfL revenue growth for the year, considering that the company is guiding for a decline of 7% including Australia, or only 1.5% excluding. But hopefully that sets it up for better performance moving forward.

£5m share buyback:

The Company believes that its strong balance sheet provides the opportunity to repurchase shares given the current market position.

At the most recent interim results, the company had £11m of net cash. Given that it is still profitable, it should be able to afford this buyback and it is a meaningful figure, given the current market cap of just £137m.

So rather than viewing it as an unnecessary sop to shareholders, I find myself agreeing with this buyback.

Graham’s view

In a situation where I could be neutral or negative on a stock, I like to let the balance sheet decide for me.

Again turning to the interim balance sheet: it’s not as bad as I’d typically expect from companies in this sector, with positive tangible net worth and the net cash figure I’ve previously mentioned.

Admittedly the positive tangible net worth relies on items whose real value might be difficult to fully realise in an emergency (things like deferred tax assets and PPE), but I think the overall list of positive factors is compelling enough:

Net cash (prior to a small acquisition in October)

Still profitable according to forecasts, with a double digit operating profit margin.

Reasonably-sized share buyback to take advantage of the shares hitting mult-year lows.

Recent £50m bid for its Performance division, which was rejected on the grounds that it was too low.

Putting all of this together, I’m happy to stick to neutral on SAA. I'd even want to upgrade it to AMBER/GREEN again, if it was clear that trading had stabilised.

The latest P/E multiple for 2026, using the share price as of writing this (111p) and the new Panmure forecast (£14.5p) is only 7.7x.

Not bad value for a profitable business with a net cash position, although of course there’s going to be a wide range of possible outcomes for 2026.

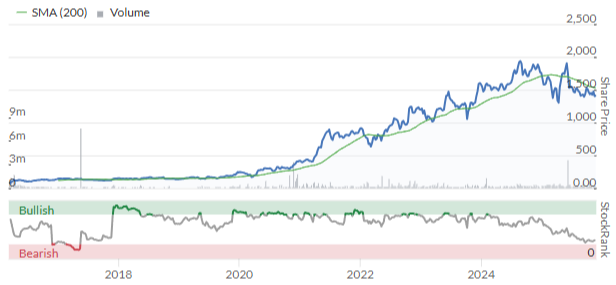

In Stockopedia terms I acknowledge that it’s a Falling Star, which is a losing StockRank style:

The profit forecast for next year has just been cut by 25%, which is a serious financial event no matter which way you look at it.

On the other hand, the US government shutdown has ended, as of a few days ago. Perhaps we could even get a positive earnings surprise from this stock next year?

Roland's Section

Microlise (LON:SAAS)

Down 29% to 99p (£115m) - FY25 Trading Update - Roland - BLACK (AMBER/RED)

Commiserations to anyone holding shares in Microlise this morning. The company has issued what looks like a fairly serious profit warning to me, including cuts to both 2025 and 2026 expectations.

We haven’t covered this 2021 IPO in any depth previously, but I am loosely aware that it’s a telematics business. Checking the website, I see Microlise describes itself as a “leading provider of transport management software to fleet operators” .

According to AI, Microlise has a 58% market share among large UK HGV fleets (>500 vehicles). It also offers additional functionality such as route and schedule management for haulage fleets. Sales include hardware, software and support services.

Some well-known names are highlighted on its website:

What’s gone wrong?

Today’s statement highlights two main areas of weakness that have prompted today’s downgrade to FY25 expectations.

Global OEM customers: lower order volumes from global OEM customers in the automotive and construction sectors mean that OEM revenues are expected to be lower than in FY24. This is said to be mainly due to tariff disruption, along with “general weakness” in the macro environment.

The company says global OEM customers are expected to deliver 27% of FY25 revenue, down from 33% in FY24. My sums suggest this could equate to a drop in global OEM revenues from £26.2m in 2024 to c.£23m in 2025.

Worryingly, this trend is expected to continue in 2026 – current expectations are for FY26 revenue from OEM customers to be below FY25 levels.

Softer UK sales: direct sales to UK customers have been weaker this year, impacted by delays in a “a small number of customer projects”. One project in particular is mentioned, “a British multinational retailer which was hit by a cyber-attack earlier this year”. I’d speculate this might be Marks & Spencer.

Revenue from these delayed customer projects is now expected to be recognised in 2026.

Cost savings are now underway – the company expects to reduce headcount by approximately 10% by the year end. This is expected to generate annualised savings of “at least £4.0m” at an upfront cost of c.£1.5m.

Outlook & Estimates

Helpfully, Microlise has provided details of both its revised expectations and previous consensus forecasts in today’s RNS.

FY25 revised outlook: revenue of at least £84m, with EBITDA of at least £8.3m (previous consensus was £91.3m and £12.7m, respectively)

This equates to an 8% reduction in revenue guidance and a 35% cut to EBITDA expectations. This appears to be a nasty case of reverse operating leverage. With the prospect of further weakness next year, it’s easy to see why the company is cutting headcount quite significantly.

Broker forecasts: with thanks to Canaccord Genuity on Research Tree, we have updated earnings forecasts for both 2025 and 2026 – big cuts have been made:

FY25E adj EPS: 3.1p (-43% vs 5.5p previously)

FY26E adj EPS: 4.9p (-25% versus 6.6p previously)

Notably, CG has withdrawn its 2027 forecasts – an unusual step at this stage, suggesting a lack of confidence in the outlook.

Roland’s view

The shares are down sharply today, reversing recent momentum. It looks like investor sentiment has got out of kilter with reality:

In fairness, earnings expectations for 2025 had been edging lower for some time:

However, I can’t help feeling that Microlise’s management may have left today’s warning as late as possible – after all, weaker trends in the automotive and construction sectors have been reported for some time.

Stepping back to take a broader look at this business, I have mixed feelings. Microlise floated in 2021 and has so far proved an unrewarding investment for shareholders:

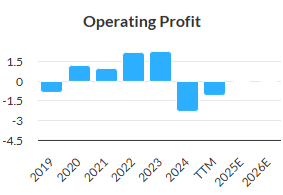

Profitability has been weak and inconsistent in recent years:

However, even after today’s fall the shares still seem to be priced for growth, on a FY26E P/E of 20. Despite this, the company’s quality metrics don’t seem consistent with its presentation as a growing software-focused company:

In fairness, Microlise does have some attractions. The balance sheet looks fine with no drawn debt and expected net cash of c.£11m at the end of 2025.

CEO Nadeem Raza also remains a 50.05% shareholder in the business, according to our data. The downside of this is that he retains almost sole control of the company – minority shareholders are unlikely to have a strong voice. However, the value of his shareholding has fallen from c. £80 million to around £58 million today. I would imagine he is now well-incentivised to find ways of returning the business to growth..

On balance, I’m intrigued by Microlise, but would like to wait for the next set of accounts to form a more detailed assessment. In the meantime, I’m going to take an AMBER/RED view to reflect the declining earnings forecast trend, weak profitability and our knowledge that companies often underperform for a time after warning on profits.

Cerillion (LON:CER)

Up 3% to 1,400p (£413m) - Final Results - Roland - AMBER

Over the last year, this provider of telco billing and CRM software has made the uncomfortable transition from High Flyer to Falling Star.

While we’ve admired the high-quality growth generated by this business in the past, Graham and I have both been neutral on Cerillion this year.

Do today’s results for the year ending 30 September provide enough good news for us to turn positive again?

FY25 results summary

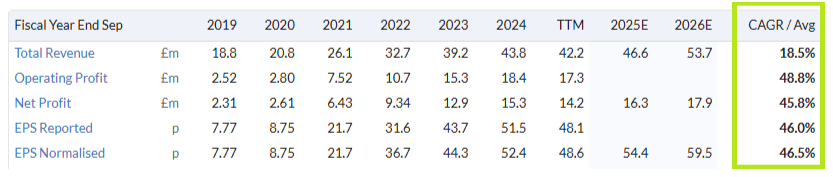

Today’s results are in line with broker forecasts and show a relatively slow year for revenue growth, but with improved margins and a strong pipeline of new opportunities.

Revenue up 4% to £45.4m

Recurring revenue (e.g. support & maintenance) up 3% to £15.9m

Pre-tax profit up 10% to £21.8m

Adjusted earnings up 8% to 56.5p per share

Dividend up 17% to 15.4p per share

Net cash up 15% to £34.4m

Trading commentary

The company completed two new implementations last year, for Virgin Media (Ireland) and Paratus, a South African business. CEO Louis Hall reports a “significant increase in R&D” to support product development – the company recently launched a new version of its software.

Inevitably, AI gets a mention – Mr Hall says that Cerillion’s developers are “focusing further on AI”.

Away from software development, sales and marketing resources were also increased last year. New contracts signed included £25.3m of agreements “with an existing European customer” and an £8.5m contract with Ucom, a leading telecommunications provider in Armenia.

These deals helped to support a 21% increase in order backlog to £56.9m, which includes £47.4m of sales contracted but not yet recognised. (The balance is from annualised support and maintenance revenue.).

Looking further ahead, the new customer sales pipeline expanded by 5% to “a new high” of £275m at the end of September. I’d imagine that executing well on this pipeline will be key to returning the business to stronger rates of growth.

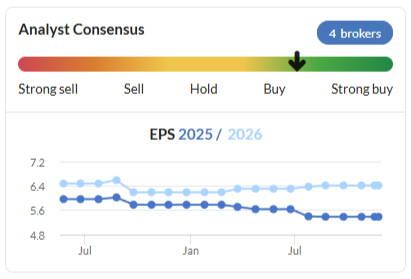

While this year’s 10% pre-tax profit growth is respectable, it’s well below the double-digit growth rates seen in the past:

To some extent, I think slower growth is probably inevitable as the company gets larger. But I’d like to think there’s scope for some improvement in revenue growth from the rate seen last year, which seems to barely reflect inflation.

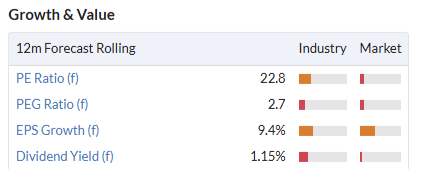

Certainly, I’d argue that the valuation still implies decent growth expectations:

Accounting review

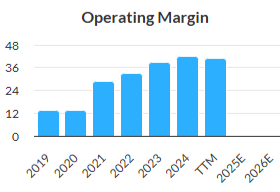

Profitability: it’s good to see Cerillion’s ability to generate positive operating leverage seems to remain intact. Operating expenses only rose by 1.2% last year, despite a 4% increase in revenue. This supported a 12% rise in operating profit to £20.6m – equivalent to a very impressive 45.4% operating margin.

This continues a trend of margin growth as the business has expanded:

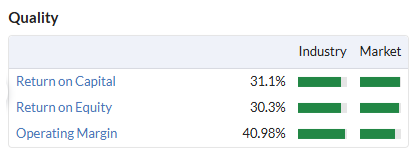

More broadly, this business has fantastic quality metrics, reflecting its apparent pricing power and capital-light business model:

These numbers are reflected in the QualityRank of 88.

Balance sheet: my sums suggest net profit of £16.6m converted into free cash flow of £14.1m last year, before working capital movements. When paired with the £34m net cash position (8% of the market cap), I don’t have any serious concerns about the balance sheet or quality of earnings for this business.

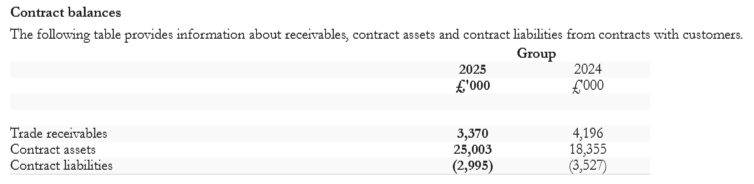

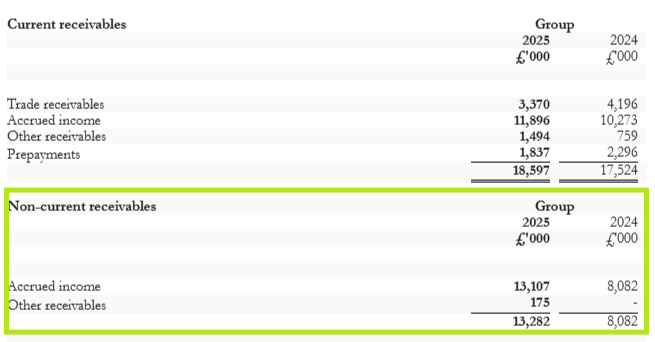

The only caveat to that is that the company’s multi-year contracts and backlog mean that revenue recognition is quite complex: the accounts show £25m of contract assets or accrued income – revenue earned but not yet invoiced.

Of the current £47.4m order backlog (“unsatisfied performance obligations”), the company expects c.33% to be recognised in the next 12 months, with the remainder to be recognised over following years. This reflects the average contract length of five years.

The company also comments that payment terms vary widely:

In some cases, customers pay in advance of the delivery of solutions or services; in other cases, payment is due as services are performed or in arrears following the delivery of the solutions or services.

We can see a breakdown of the impact of this situation in the footnotes. I’ve highlighted a relatively unusual level of non-current receivables:

I can’t be sure, but I would guess the high level of accrued income probably means that not all of Cerillion’s cash balance is truly surplus to requirements. Some of it may represent cash received upfront for work yet to be delivered.

[Correction 25/11/25: I've been contacted by Cerillion's advisors who have pointed out that my original comment above suggests that Cerillion's cash balance may include accrued income. This is incorrect, of course. Cash received in advance of invoicing is deferred income, not accrued. Accrued income represents revenue recognised but not yet received. Apologies for any confusion this caused - my thanks to the company's advisors for flagging this up.

The point I intended to make was that the staged profile of billing on Cerillion's multi-year projects (reflected in its accrued income) may mean that having adequate cash on hand to fund work in progress is an important element of the business model. Thus it's possible, in my view, that not all of the group's net cash is necessarily surplus to requirements.]

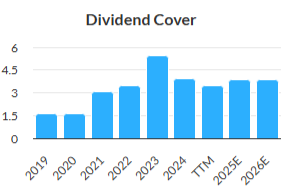

If I’m right, this might also explain the company’s very low dividend payout ratio (seen as a high level of dividend cover):

Working in this way appears to be a natural element of Cerillion’s business model and I’m not suggesting any problems – the company seems to have worked successfully in this way for years. But this kind of complex long-term contract does mean that revenue recognition is much more complex than in other types of business – and harder for outside investors to understand.

Outlook & EPS Estimates

Today’s management outlook commentary is positive but perhaps a little vague, in my view. Here’s an extract:

We expect to make very good progress over the new financial year and will continue to invest in the business to support growth.

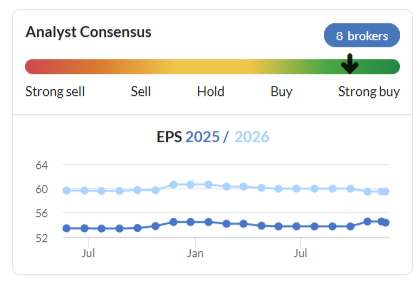

Fortunately, I’m able to access a new note from broker Panmure Liberum. This confirms that today’s guidance is effectively in line; PanLib’s analysts have made only very slight changes to forecasts, which they say reflect an assumption that margins will remain at the top end of the company’s guidance range:

FY26E EPS: 58.4p (+1.2% vs 57.7p previously)

FY27E EPS: 64.1p (new forecast)

These estimates price the stock on a FY26E P/E of 24, falling to a P/E of 22 in FY27.

Roland’s view

Today’s results give Cerillion and EBIT/EV yield (see here) of around 6%. For a company with this level of profitability, I don’t think that’s necessarily too expensive.

If the business can maintain 10%+ earnings growth for a few years, then I think the shares could deliver some upside from current levels.

The risk is that from my perspective as an outsider, visibility on growth prospects is poor and revenue recognition from long-term contracts is complex and somewhat opaque.

Today’s results and outlook are also only in line, not ahead of expectations, extending an 18-month run of broadly flat expectations:

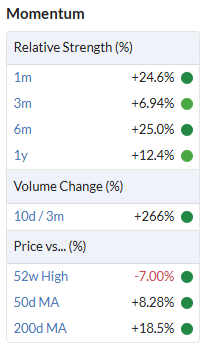

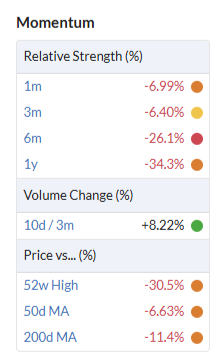

Technical momentum is also weak here:

The decision I need to make today is whether to maintain my previous neutral view, or move up one notch to AMBER/GREEN.

It’s possible that I’m being too conservative, but I’m going to stay at AMBER to reflect the lack of upgrades, Falling Star styling and low StockRank.

I’m certainly open to upgrading my view, and would hope to have the chance to do so over the coming months. Indeed, I think that this business might reward more in-depth research into the product and competitive landscape than we are able to do here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.