Good morning!

I'm hoping to catch up on some company news that slipped through the cracks over the last few days.

I'm afraid I've run out of time - have a great weekend all.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Mitchells & Butlers (LON:MAB) (£1.53bn | SR83) | SP +10.5% Strong trading ahead of the wider market, like-for-like sales +4.3%. Adj. operating profit +5.8% (£330m). Solid start to FY26, like-for-like sales +3.8%. | AMBER (Graham) [no section below] | |

Metals Exploration (LON:MTL) (£324m | SR98) | Channel sampling has outlined an extension to the initial Phase 1 North pit at La India of a minimum of 100 metres up to potentially 300 metres. High-priority drill programme planned. | ||

Quadrise (LON:QED) (£60m | SR9) | SP -8% “Whilst progress during 2025 overall has not proceeded as expected, the Company closes the year in a stronger position, with a clearer path towards commercialisation and the resources in place to achieve this.” | RED = (Graham) [no section below] This is an "energy transition technology company focused on the decarbonisation of shipping and heavy industry through deployment of low carbon fuels and biofuels". Their technology is supposed to produce a synthetic fuel oil or biofuel by mixing residuals oils with a specialist chemicals. I've had to be RED on this due to the lack of meaningful revenues and the resultant consistent losses. Today's update describes progress at various projects: trials in the marine sector, and a timetable for the payment of $1.5m to QED for licensing and equipment it provided in Utah, etc. Unfortunately it remains at a very early stage of its development and so I must remain RED. | |

Serabi Gold (LON:SRB) (£201m | SR99) | Unaudited interim results for the three and nine-month periods ended 30 September 2025 | Gold production for the first 9 months of 2025 of 32,634 oz (same period in 2024: 27,499 oz), positioning Company on track for full year guidance. Post-tax profit for the 9-month period of $34.9m (same period in 2024: $17.8m). | AMBER/GREEN = (Graham) I'm a sceptic here when it comes to valuation, and I do have some questions about rising administrative costs where I'd love to hear an explanation from the company. However, I am going to leave our moderately positive stance unchanged as the stock does enjoy strong momentum and a very high StockRank, and I'd be more comfortable if someone who covers the stock more regularly was the one who gave it the downgrade! |

Facilities by ADF (LON:ADF) (£17m | SR39) | New CEO appointed, starting in January. She was CEO of Picnik Entertainment. | ||

B90 Holdings (LON:B90) (£17m | SR37) | All current revenue is derived from partners and customers located outside the UK. As such, these duty changes have no impact on B90's business model, financial guidance or operations. The company continues to trade in line and full-year results are to be “consistent with, or ahead of expectations”. | ||

Caffyns (LON:CFYN) (£13m | SR50) | SP -10% Revenue falls 2.7% to £134m (2024: £138m). Underlying pre-tax loss £0.81m (2024: profit £0.45m). CEO: "The motor retail market was particularly challenging in the half year to 30 September. We have responded by making a number of operational changes to improve performance." | AMBER (Graham) [no section below] This share has been knocking around for a long time, but it has been tough to make money in motor retail. Profits have been minimal (or non-existent) since 2023, despite over a quarter of a billion pounds of annual revenue. Gross margin fell and then labour costs rose from April 2025: with a low-margin business, small changes in costs have an outsized effect on profits. It could be argued that the additional £0.5m expense from minimum wage and higher NICs is responsible for the majority of the £0.8m H1 loss. The primary attraction of this share is probably £30m of balance sheet net assets, which is almost fully tangible amd includes freehold premises. But the stock is controlled by the Caffyns family through 2,000,000 preference shares, each of which has a vote (there are only 2.7 million ordinary shares). Value could get unlocked here some day but it's anybody's guess when that might happen. | |

essensys (LON:ESYS) (£10m | SR23) | SP -9% | BLACK (profit warning) (RED =) and PINK (takeover situation!) |

Graham's Section

Serabi Gold (LON:SRB)

Up 5% to 277.8p (£209m / $276m) - Unaudited interim results - Graham - AMBER/GREEN =

Most days, I avoid talking about the gold sector, but let’s try it today.

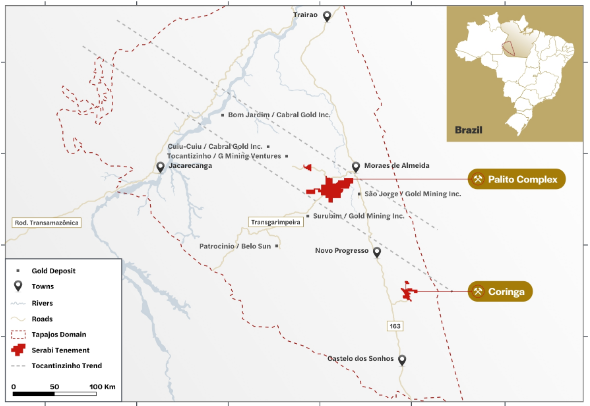

Serabi is a Brazilian gold miner: here’s a map of its operations in the Tapajós region in Northern Brazil:

The share price has nearly trebled over the past year; and it’s a ten-bagger since 2023:

So let’s check out these interim results:

Q3 production 12,090 ounces, year-to-date production 32,634 ounces (up 19% over the corresponding nine-month period last year).

Post-tax profit for the nine-month period of $34.9m (nearly double the result for the corresponding period last year: $17.8m).

The figure given for “net cash inflow from operations” ($34.3m) matches well with the post-tax profit figure. That’s after spending $4m on mine development.

The average gold price on sales ($3,244 per ounce) is up 39%, with a leveraged impact on profits.

The All-In Sustaining cost was $1,816 per ounce, only slightly higher than the same period last year.

If I naively take the difference between the average sale price and the AISC, I get $1,428 of profit per ounce, versus only $548 of profit per ounce last year.

Serabi’s Net cash improves to $33m. There is a $5m loan with Santander in Brazil, charging 6.16% (sounds impressively low to me).

CEO comment:

“The nine months to 30 September 2025 have delivered strong financial and operational performance for the Company placing us firmly on track to meet full-year guidance…

On exploration:

In parallel, exploration and resource development drilling continued across both the Palito Complex and Coringa, with approximately 27,937 metres completed year to date. Early results are encouraging, supporting the Company’s objective of increasing resources to the 1.5-2.0Moz range in the oncoming years as part of Phase 2 of our growth strategy.

Graham’s view

I’m bringing a fresh set of eyes to this company, and don’t claim to have any particular expertise.

One thing that jumps out to me is that quarterly administrative expenses have risen 60% year-on-year. On a 9-month view, they are up 50% (to $8.2m).

This is much faster than the growth in AISC per ounce (cost to produce an ounce), and it’s also much faster than the growth in ounces produced. Of course, given the rise in the gold price, you could argue that it’s not too relevant. But clearly the central cost overhead is rising rapidly.

Looking for an explanation in the commentary, I don’t find anything too specific, although the company does refer to “inflationary cost pressures”, and they also say that “Reported revenues and costs reflect the ounces sold in each period”. I’d like to have a better understanding of this $8.2m spend - does it include exploration spending, for example?

It might seem odd that I’m honing in on this item, but I think it makes sense to focus on costs rather than revenues - miners don’t control the gold price, they can only control their costs and how much they produce in a given period.

When it comes to production, I would assume that Serabi is faultless: there’s been a very pleasing trend of increased production.

When it comes to cost, the AISC looks great, but I do think that the admin costs deserve more details when the annual report is published.

And the other big question is longevity - how long will the company’s assets continue profitably producing?

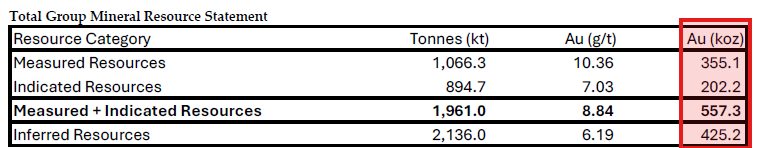

I find the following table in the 2024 annual report:

With 12,000 ounces being produced in the most recent quarter, this suggests an impressive number of years of life left, e.g. production at 50,000 ounces per year would take 7 years to deplete the company’s measured resources.

Of course I would assume that the cost profile is likely to change (increase further) over time, and that production will slow down at some point.

But I think that this table implies Serabi has above-average longevity for junior miners.

Mark was AMBER/GREEN on this in August, and he also had some questions about costs.

I’m happy to leave this on AMBER/GREEN: I don’t have enough conviction to change our stance on my first write-up of the stock.

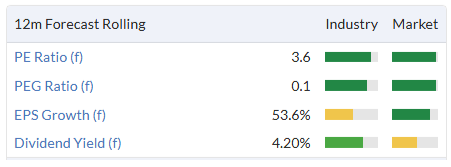

It does enjoy a StockRank of 99:

And a cheap earnings multiple - although personally I don’t think that any wasting assets, such as mines, should be valued on the basis of an earnings multiple. Earnings multiples should be reserved for companies with long-term earning power:

In an ideal world, I’d value a stock like this based on its book value, but that doesn’t make sense either, seeing as the gold price has surged higher.

If I tried to stick to something objective like free cash flow, I don’t get a massively impressive answer: year-to-date there has been $38m of net cash inflow from operations, offset then by $4.1m of mine development expenditure, $6m of PPE, $6m of exploration, and $7m of pre-operational project costs.

In the end, there’s a $16m cash inflow for the 9-month period, which doesn’t seem all that high to me, compared to a market cap that’s equivalent to $276m.

So I guess that makes me a sceptic when it comes to valuation here. I could see myself cashing in gains if I was a shareholder - but that same instinct would have prevented me from enjoying the gains that the stock has already achieved. It still enjoys very strong momentum, and a rising gold price can keep it going. So who knows?

When I did invest in gold miners (I owned Orosur Mining (LON:OMI) a very long time ago, also a South American gold miner), I quickly learned that cash profits were not being delivered to shareholders. Cash profits were instead being spent on development and exploration: this are perfectly logical activities for a gold miner to spend money on, but from a shareholder perspective, it felt like my winnings were being reinvested into more lottery tickets, and eventually I would lose. This is why I abandoned the sector all those years ago, and it's one of the reasons I've missed out on a 10-bagger here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.