Good morning! I'm hoping to get a chance to update our spreadsheet later today.

We have what looks like two profit warnings, an upgrade and a takeover in today's news - slightly more dramatic than your typical Friday!

Today's report is complete. Have a wonderful weekend - and thanks for all the comments and the thumbs up!

Companies Reporting

| Name (Mkt Cap) | |||

|---|---|---|---|

GSK (LON:GSK) (£74bn | SR91) | European Medicines Agency's Committee for Medicinal Products for Human Use has recommended expanding the indication of GKS’s RSV vaccine to all adults aged 18 years and older. The European Commission's final decision is expected in February 2026. | ||

Aberdeen (LON:ABDN) (£3.6bn | SR90) | Aberdeen has reached agreement with MFS to acquire the management of closed end fund (CEF) assets totalling £1.5bn. | ||

Harbour Energy (LON:HBR) (£2.8bn | SR67) | Agreement to acquire substantially all the subsidiaries of Waldorf Energy Partners Ltd and Waldorf Production Ltd, currently in administration, for $170 million. Adds oil-weighted production of 20 kboepd and 2P reserves of 35 mmboe. | ||

Capita (LON:CPI) (£453m | SR79) | Trading Statement & Statement re closed book Life & Pensions | Update for 11 months to 30th November: adjusted revenue performance “broadly consistent with” H1. Full-year revenue guidance reduced (compared to guidance at the half-year results) at Capita Public Service, Contact Centre and Pension Solutions. | BLACK? AMBER (Graham) Revenue guidance is reduced in three divisions but this is offset by a strong pipeline figure and news that the company has managed to strike a deal to get out of legacy Life and Pensions contracts. That exit could cost shareholders dilution of 5% if it is settled in shares, and both Capita and Royal can choose to settle it in shares if they wish. Short-term momentum is very strong and Capita is trading on a cheap multiple (7x): if the revenue guidance hadn't been rather weak-sounding, I might have been obliged to upgrade our stance on this share today. |

ITM Power (LON:ITM) (£385m | SR40) | Basic Design Engineering Package contract for a project in Australia, and Front-End Engineering Design contract for a project in Canada. Combined capacity 70MW. Value not given. | ||

Card Factory (LON:CARD) (£336m | SR79) | SP -23% UK store sales performance is lower than expectations. Adj. PBT for the year is now expected at £55-60m. Previously guided for mid-to-high single digit % growth in adjusted PBT from FY25’s result £66m. | BLACK (AMBER ↓) (Graham) Downgrading to neutral seems fair given the severity of this profit warning. At least the company is still profitable, and management remain confident enough to pay a progressive full-year dividend - either that, or they are justifying the continuation of a buyback to fund employee bonuses. Overall, I do think these shares offer good scope for recovery and upside potential if the consumer recovers soon, but it's not a bet I'd personally be interested in making. Card shops are a danger zone for investors when it comes to the retail sector, which is already a fairly treacherous sector. | |

Filtronic (LON:FTC) (£312m | SR63) | “Enters the second half with a robust order book, strong customer engagement and growing pipeline, providing the Board with confidence in a strong H2 and a full-year performance in line with market expectations.” | AMBER = (Graham) [no section below] This is a designer and manufacturer of communication products for the space, defence and telecoms sectors. We've been cautious on it, seeing as it has been an expensive "High Flyer" with falling momentum - although that's not true currently, with the MomentumRank apparently on the mend after a period of share price consolidation. Today's H1 update sees broker Cavendish leaving forecasts unchanged, including adjusted EPS of 3.2p in the current year (FY May 2026) and then 3.9p in FY May 2027. It's great to read that the customer base is diversifying away from SpaceX, with "a broader pipeline of opportunities", and net cash is fine at c. £8.5m (depending on how it is calculated). Following today's "in line" update, I'll leave our neutral stance unchanged. | |

Tribal (LON:TRB) (£134m | SR88) | SP +8% “Tribal expects to deliver FY25 revenue comfortably in line with, and adjusted EBITDA ahead of, current market expectations.” Movement from net debt (£3m) to net cash (£5m), allowing a special dividend of 1.5p to be paid in January. | GREEN ↑ (Graham) [no section below] Roland was AMBER/GREEN on this educational software and services provider in August when the company raised expectations. It raises expectations yet again today and the market cap is now, as I type this, some £144m: 40%+ higher than it was when Roland looked at it in August. The net debt to net cash movement for the year is £8m which is consistent with a net income forecast of over £9m. With EPS forecasts in a rising uptrend, I'm content to nudge this up to fully GREEN seeing as the valuation here doesn't yet strike me as excessive. Tribal's customers are likely to be "sticky" (universities, further education colleges and schools), and I calculate that the Enterprise Value to Sales multiple for the current year is only 1.5x (quite low if this is valued as successful software business). | |

Audioboom (LON:BOOM) (£110m | SR50) | November 2025: “Revenue of US$9.1 million, gearing strongly to adjusted EBITDA profit, representing the highest monthly results for both key financial metrics.” | ||

1Spatial (LON:SPA) (£52m | SR27) | Possible Offer at 73 pence per share, 57% premium. Potential buyer has "completed commercial due diligence, has a clear understanding of the 1Spatial business and requires only limited confirmatory diligence to proceed to an announcement of a firm intention to make an offer". Board of 1Spatial "intends to unanimously recommend the Possible Offer". | PINK (Graham) | |

Tekcapital (LON:TEK) (£23m | SR90) | Innovative Eyewear has launched two new, light-adaptive sport smartglasses in its cutting-edge Reebok Powered by Lucyd collection. These new variants of the Octane and Nitrous frames are designed for use in the gym and for outdoor sport. | AMBER =(Graham) [no section below] This is a non-regulatory press release and it can be safely ignored if investors wish to ignore it. But Tekcapital already published a similar press release on December 1st, and it's back again with another one today - why? Do investors really need to know every time its subsidiary Innovative Eyewear launches a new product? The frequency of these releases is overly promotional for my liking. According to the Q3 update, Innovative Eyewear made a loss of $5.7m for the nine months ending September 2025. |

Card Factory (LON:CARD)

Down 23% to 73.8p (£257m) - Trading Statement - Graham - BLACK (AMBER ↓)

A short but highly consequential trading update from CARD factory:

Over recent months, the pressures facing the UK consumer have been well publicised. It is an inescapable fact that these pressures have impacted consumer confidence and shopping behaviour, contributing to soft high street footfall. Those conditions have persisted as we moved into our most important trading period, leading to a UK store sales performance which is lower than our previous expectations.

More positively, the company’s Irish and American businesses continue to trade in line, and the integration of Funky Pigeon is “on track”.

New guidance: if current trading trends persist, FY January 2026 is expected to see an adjusted PBT of £55-60m.

Estimates: A note from Edison Research in October suggested that FY26 adjusted PBT would be £70.7m, a 7% increase on the £66m result for FY25.

At the midpoint, new guidance is therefore a 19% cut to adjusted PBT.

Graham’s view

We’ve been GREEN on this one, which obviously doesn’t look too smart in the light of this profit warning:

I’m inclined to downgrade our stance all the way to neutral today.

In my previous comments (e.g. September), I’ve made it clear that I view card shops as a particularly dangerous niche in the retail space, as they are essentially selling commodities. But I was happy to stay GREEN on the stock with that disclaimer attached, given the cheap multiple attached to earnings expectations at the time.

Back in 2012, I witnessed CARD’s rival, Clinton Cards, going into administration and shareholders losing everything. That episode stuck with me, and I’ve never wanted to get involved in a card shop since then. Clinton Cards, incidentally, has suffered financial distress on multiple occasions since then, under different owners.

It’s an unfortunate reality that most retailers seem to get into trouble sooner or later. And card shops seem to be more accident-prone than most.

The good news is that CARD is still profitable: with over 1,000 stores, it does enjoy scale benefits and should not suffer negative operating leverage as quickly as a smaller chain would.

And management, in a sign of confidence, have announced today that they still intend to announce a progressive full-year dividend. So they don’t seem to be panicking.

They also announce that their ongoing share buyback will continue, but I wouldn’t read too much into this. The buyback announcement in October noted that “the shares acquired are intended to be used to satisfy awards under the Company's employee share plans.” So the point of this buyback is to fund bonuses, not to return cash to shareholders.

Balance sheet: as I noted in September at the half-year results, CARD does have a leveraged balance sheet with £78.9m of net debt excluding leases, plus another £121m of lease liabilities.

The non-lease leverage multiple at the time was 0.6x - a modest figure. But I certainly wouldn’t ignore the lease liabilities.

Conclusion: if after-tax net income is £43m this year, that puts the shares on a current-year PER of 6x at the current market cap. However, if the weak consumer trends of recent months continue throughout FY January 2027, then we will certainly see a decline in profitability next year, and the forward multiple is therefore materially higher than 6x.

That being the case, I think a neutral stance makes sense here at the current level: if the true PER is, for example, 8-10x (based on current trends continuing for most of FY27), then it wouldn’t surprise me if the shares were fairly valued at this level. There’s scope for an upside surprise if the consumer makes a swift recovery, but you’re smarter than me if you can predict when that might happen!

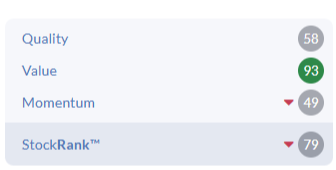

The StockRanks did well, noticing the declining share price momentum and dropping the overall score in advance of this profit warning:

Capita (LON:CPI)

Up 1.5% to 402.5p (£460m) - Trading Statement and Statement re closed book Life & Pensions - Graham - AMBER =

The market has shrugged off what appears to be a downgrade in revenue guidance from support services provider Capita.

Key points:

Adjusted revenue in the 11 months to November “broadly consistent with the first half performance”.

Public Service (largest division, majority of total revenues) +4% with H2 revenue growth moderating slightly

Contact Centre (2nd largest division) down 18.3%, “reflecting the impact of previously announced contract losses and volume reductions”.

Outlook for the full year:

From a full year perspective, we now expect growth in Capita Public Service to be slightly below mid single digit, a high teen digit reduction in Contact Centre and low single digit growth in our Pension Solutions business. Our guidance on margin improvement, free cash flow (including the £14m previously announced Information Commissioner’s Office (ICO) settlement) and debt, together with our medium-term targets, remain unchanged.

This divisional revenue guidance is below what the company said at the half-year results. Here is what they said in August:

Capita Public Service guidance upgraded to mid single digit revenue growth, Contact Centre now expected to deliver a mid teen revenue reduction.

In Pension Solutions we expect a mid single digit revenue increase…

So Public Service is now “slightly below” August guidance, Contact Centre is seeing a larger decline than anticipated, and Pension Solutions has grown less than anticipated.

But the market doesn’t seem to mind, as the more forward-looking business pipeline has grown considerably:

In the second half of 2025, we’ve seen a significant increase in the Group’s unweighted contract pipeline, with total contract opportunities across all divisions now valued at £16.5bn, up 41% from the half year. This represents the highest level the Group’s unweighted pipeline has been for several years. Of this, £3.5bn relates to opportunities which have a strong technology component.

And there's some nice jargon re: AI which reads like it could have been composed by AI:

In recent months, we also launched our AI Catalyst Stack for customers which leverages our operational expertise and hyperscaler partnerships to embed AI in mission-critical services, driving faster transformation, reducing costs, and improving outcomes for citizens and customers.

CEO comment: “While some challenges remain, we are making good progress and continue to work hard to build a Better Capita.”

Life and Pensions contracts: part of the “Regulated Services” division, the “Life and Pensions” business is shutting down. The last contracts with Royal London are being exited at an initial cost of £22.5m (which might be settled in shares), plus another £30m to be paid in three equal instalments.

This is a very expensive deal that could result in 5% dilution to shareholders, but it sounds like it’s necessary. Capita CEO again:

“This marks the completion of a key element of our ‘manage for value’ strategy, eliminating a significant future annual cash outflow from the Group and enabling us to focus fully on areas where we can deliver sustainable value.”

Graham’s view

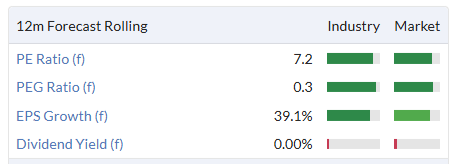

This is not a sleep-soundly type of stock, but it is cheap:

Given the public sector focus, shouldn’t it be a winner in an era of increased government spending? That new pipeline figure does sound very promising.

Although the balance sheet gets me less enthused.

Net debt at the half-year results, excluding leases, was £87m.

Operating profit is forecast to be higher than that, so it should be a very manageable debt pile.

However, the overall structure has a few issues. There are over £300m of lease liabilities for a start. More importantly, tangible net assets are minus £280m.

This is a case where customers are funding the company with upfront payments, so it’s probably nothing to worry about, but I’m going to stand by my view that the balance sheet is not supporting any bullish arguments here.

This is all about earnings, and profit at a company like Capita is the difference between two large numbers. For now at least, it is getting the equation right:

Putting it all together: if the recent revenue performance had been stronger I might have been compelled to upgrade our stance, but I think that I can justifiably stay neutral on Capital today.

Momentum is 89 and rising, and technically it is breaking out to new highs - so it’s looking great in the short-term. Longer-term, I'm not convinced.

1Spatial (LON:SPA)

Up 45% to 67.5p (£75m) - Possible Offer for 1 Spatial plc - Graham - PINK

Is it just me, or has takeover news gone a little quiet lately?

That changes today with news of a “possible” offer:

The Possible Offer at 73 pence per 1Spatial share values the entire issued and to be issued ordinary share capital of 1Spatial at approximately £87.1 million

1Spatial is “a global leader in providing software, solutions and business applications for managing location and geospatial data.”

We haven’t covered it too much, because it has been barely profitable and difficult to assess:

The largest shareholders here seem happy with the prospect of getting out at 73p. Threadneedle and Canaccord Genuity have both pledged to support the offer, if it materialises.

And we have a brief trading update:

The Board re-iterates the outlook statement made in the Company's interim results, noting that the final out-turn for the year is dependent on the timing of delivery of key contracts.

The possible buyer: a very similar company called VertiGIS that provides “Enterprise Geospatial Mapping Software” and is present in nine countries including the US, Canada and Australia.

Rationale for the Board's recommendation to accept the possible offer: besides providing “certain and fair value” to existing shareholders, the Board says that the takeover will "accelerate" their strategy under private ownership, and “create a compelling strategic combination”.

Graham’s view: this appears to make sense for the company, for its current shareholders and for the buyer. I don’t know if the price paid is fair but the suggested valuation is over 2x revenues for a business that has been listed for a long time and never generated much profit. It seems reasonable now to let it evolve under new owners who are willing to pay a strong premium (it is hard to turn down a takeover offer at a 50-60% premium).

So let’s hope that the offer materialises and goes through as planned. All that’s left now is “limited confirmatory diligence.”

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.