Good morning!

We are all done for today, thank you.

Spreadsheet accompanying this report (updated to 24th November): link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BP (LON:BP.). (£66.5bn | SR87) | The existing CEO has decided to step down, effective today. Meg O’Neill, CEO of Woodside Energy, appointed BP’s next CEO, effective April 2026. | ||

Big Yellow (LON:BYG) (£1.99bn | SR42) | Planning consent obtained for a 58,000 sq ft storage centre on its site in Leicester. | ||

Currys (LON:CURY) (£1.41bn | SR98) | Performance continues to strengthen (H1 results) | SP +8% H1 adjusted PBT £22m, +144% YOY. Group trading since the period end has been consistent with the Board's expectations, full year guidance maintained. | GREEN = (Graham) Happy to leave our positive stance unchanged. There is no change to expectations which is great news for a stock which the market corrects treats as high-risk and puts on a PER of 10x. The peak trading period is all-important and if the CEO is happy with performance so far, then the company should be in great shape to hit expectations for the full-year. The balance sheet isn't overly strong but it does have a buyback-enabling net cash position, along with a modest dividend yield. The StockRank is 98 and we've previously been positive on this one - let's hope for more of the same! |

Workspace (LON:WKP) (£746m | SR46) | New CFO designate has been CEO of Hibernia Real Estate Group since 2022. | ||

Harworth (LON:HWG) (£534m | SR50) | Industrial & logistics lettings are secured on previously vacant space. Vacancy falls to 1% (H1 2025: 4.9%), £2.5m in additional annualised rental income. | ||

ITM Power (LON:ITM) (£388m | SR39) | Contract with a project managed by Octopus Energy Generation to deploy its NEPTUNE V containerised green hydrogen systems at Kimberly-Clark's Northfleet manufacturing plant in Gravesend, Kent. | ||

Frp Advisory (LON:FRP) (£356m | SR70) | Revenue +12%, adjusted PBT +4% (£21.1m), actual PBT +3% (£18.3m). The Board remains confident of achieving full year expectations (adjusted EBITDA £44.8m). | ||

Avacta (LON:AVCT) (£314m | SR33) | CEO: “These data are key to support the clinical development of FAP-Exd (AVA6103) and the profile of this second pre|CISION medicine in the preclinical setting is tremendous.” | ||

Puretech Health (LON:PRTC) (£292m | SR51) | New CEO has served as Interim CEO since July 2025 and joined PureTech in January 2024 as Chief Portfolio Officer. | ||

Synthomer (LON:SYNT) (£97.6m | SR45) | Trade receivables purchasing arrangement with a subsidiary of its largest shareholder, “to provide additional short-term financial flexibility and ensure a prudent level of banking covenant headroom at year end”. | AMBER/RED = (Mark) [No section below] | |

Ilika (LON:IKA) (£69.1m | SR27) | Has commenced shipping prototype Stereax M300s to customers, meeting an important commercial milestone. | ||

Aminex (LON:AEX) (£67m | SR16) | Pipe for the Pipeline has been manufactured and is scheduled to arrive in Tanzania in late January 2026, completion and commissioning in Q3 2026. “Ntorya gas development is progressing well and on track for first gas next year.” | ||

Nexteq (LON:NXQ) (£49.7m | SR80) | FY26 outlook: short-term revenue challenge, reductions in volumes. Revenue for FY26 to be not less than $85m with a consequential impact on profitability (StockReport revenue forecast for FY26: $94m). | BLACK (AMBER/RED =) (Mark) While 2025 may have been in line, the accompanying broker’s note reveals a huge downgrade to future EPS forecasts, with estimates for FY27 halving. This means the company now looks expensive on a 2027 EV/EBIT of 10x, despite a large cash pile. In light of this, the current share price fall looks like a huge under-reaction. Only the presence of a large cash pile, which means solvency isn’t an issue, and some asset backing stops me reducing our view further. | |

Naked Wines (LON:WINE) (£47.6m | SR85) | FY26: Revenue at lower end of guidance, adjusted EBITDA is expected to be towards the top end of published guidance. | ||

First Tin (LON:1SN) (£47.4m | SR47) | CEO: “We are very pleased with the results from this infill and extension drilling programme, which has identified higher-grades and additional mineralisation both within and adjacent to the current pit designs.” | ||

Time Out (LON:TMO) (£41.1m | SR19) | Revenue -7% (same accounting policy) to £73.2m, Adj EBITDA -42% to £7.1m, Operating loss £49.7m after £35.1 non-cash impairment and £9.2m exceptionals (FY24: £0.4m operating loss). Net debt excl leases of £44.3m (FY24 £33.0m). £8m raised at 8.0p, a 30% discount to last night’s close. Requires refinancing of €34.4m loan facility due for repayment on 24 November 2026, to be a going concern. | RED = (Mark) | |

Arrow Exploration (LON:AXL) (£33.3m | SR44) | M-HZ7 well on production in the Carbonera C9 formation, which has approximately 4,053 feet of horizontal oil pay, at 1,694bobpd gross, on a heavily restricted choke. | ||

Clean Power Hydrogen (LON:CPH2) (£30.1m | SR4) | Company's next generation MFE220 1MW successfully completing its internal Level 1 Factory Acceptance Test. To commence the Front-End Engineering Design for a 5MW unit. | ||

Atome (LON:ATOM) (£28.5m | SR8) | Proposed equity club consortium for the funding of ATOME's landmark US$630 million, 260,000 tonne-per-year low-carbon fertiliser plant at Villeta, Paraguay waiting on final structuring and execution of definitive documentation at FID, the negotiations of which are at an advanced stage. | ||

Blencowe Resources (LON:BRES) (£27.6m | SR14) | Two further deep holes confirm continuous, thick graphite mineralisation from or near surface to ~100 metres, with all deep holes ending in graphite. | ||

Poolbeg Pharma (LON:POLB) (£27.5m | SR15) | Expecting to deliver on a series of exciting clinical milestones in 2026. Well-funded…with a cash runway into 2027. | ||

Cyanconnode Holdings (LON:CYAN) (£26m | SR13) | Revenue +32% to £7.4m, Operating Loss £3.0m (25H1: £2.1m loss), Cash £1.6m (FY25: £3.7m), $5.25m raised post-period end through a convertible loan note. “Key operational metrics remain positive” | AMBER/RED = (Mark) [no section below] | |

Capital Metals (LON:CMET) (£21.6m | SR11) | H1 LBT $1.07m (25H1:$0.45m loss), Cash $4.8m (31 Mar: $1.4m), following $5.3m equity raise. “Company is well funded to complete the approvals and planning required to take FID to enable the commencement of construction in Q1 next year.” | ||

Abingdon Health (LON:ABDX) (£16.9m | SR9) | New European patent "Assay Reading Method" has been granted and follows the recent granting of a similar patent in USA, with other patents already granted in UK. | ||

Chesterfield Special Cylinders Holdings (LON:CSC) (£15.1m | SR27) | FY Revenue +12% to £16.6m, Adj. EBITDA £0.9m (FY24: LBITDA £0.9m), Adj EPS 0p, (FY24: LPS 4.7p), Net cash £2.1m (FY24: £0.1m) following disposal of PMC division for £4.4m. Order book £16.3m (FY24:£9.3m). | AMBER/RED = (Mark) The company scrapes back into profitability on an adjusted basis, and the sale of one of their divisions rebuilds the balance sheet. However, FY26 is only forecast to be break-even again, and perhaps worryingly, H2-weighted. The investment thesis here is based on their aspirations to generate £30m revenue in 2028, with a 15% EBITDA margin before central costs. If they achieve this, then it will look cheap. However, that seems far too far in the future to base a view on. They may be in some growth areas of defence and hydrogen, but these are subject to significant political whims. There is a strong shareholder register, and Rockwood Strategic’s Richard Stavely is on the board. However, he comes up against a company with a history of destroying shareholder value for decades. So I can’t bring myself to change our previously mostly negative view, especially on a relatively poor set of results released today. | |

GSTechnologies (LON:GST) (£14.2m | SR0) | H1 Revenue -37% to $1.4m, Net loss $437k (25H1: $69k loss), Net cash & bitcoin $3.91m (25H1: $2.91m) after £1.9m equity raise. | ||

Blackbird (LON:BIRD) (£13.3m | SR5) | £500k before £30k expenses raised at 2.25p/shar, a 22% discount to last night’s close, to strengthen balance sheet. | ||

Eden Research (LON:EDEN) (£12.8m | SR21) | Distribution Agreement will see Syngenta register and develop the market for Eden's novel fungicide product, to be marketed by Syngenta as "Evelta™", for uses such as cut flowers, pot plants, trees, shrubs, and bulbs. | ||

Tekmar (LON:TGP) (£11.5m | SR77) | €8 million with an existing Engineering, Procurement and Construction customer, for delivery in late 2027, with revenue phased across the Company's FY26 and FY27 financial periods. | AMBER = (Mark) [No section below] | |

Kropz (LON:KRPZ) (£11m | SR27) | H1 Revenue +9% to $15.4m, Loss $74m (24H1: $6.4m loss), Net debt $76.6m (31 Mar: $61m net debt). |

Graham's Section

Currys (LON:CURY)

Up 8% to 136.8p (£1.52bn) - Performance continues to strengthen - Graham - GREEN =

“Performance continues to strengthen” is an odd name for an RNS. More accurate would be “Half-year Report”!

The numbers in this half-year report (to the start of November 2025) are excellent:

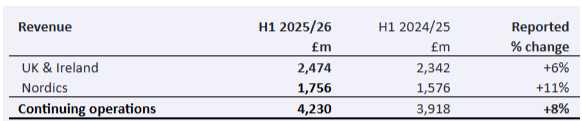

LfL revenue +4%, total revenue +6% at constant currencies, total revenue +8% at actual currencies.

Adjusted EBIT +£13m (+32%) to £54m

Adjusted PBT +144% to £22m.

However, there are some adjusting items and the actual PBT is only £9m.

That might seem very small against a market cap of over £1.5bn, but it’s a H1 result in a seasonal business.

Let’s review last year:

H1 adjusted PBT £9m, H1 actual PBT minus £10m.

Full-year adjusted PBT £162m, actual PBT £124m.

So actually when you consider how profits are weighted, I’m not sure if these H1 results matter at all - what really matters is that they don’t make a large loss in H1, and then go on to have a successful Christmas buying period in H2.

That appears to be the case, so far. Here’s the current year guidance:

Group trading since the period end has been consistent with the Board's expectations

Full year guidance maintained - the Group continues to expect growth in profits and free cash flow for the year

Given that Christmas is only a week away (where did the time go?), I think they should be able to say with a good degree of certainty how they’ve done during their peak season.

Checking the CEO comment specifically for news on recent performance:

We entered Peak well prepared, with strong stock availability and market-leading deals that reflect our unmatched importance to our partners. Trading is in line with expectations.

Expectations for FY April 2026: revenue growth to £8.9 billion, net income of £130m, and earnings per share of 11.7p.

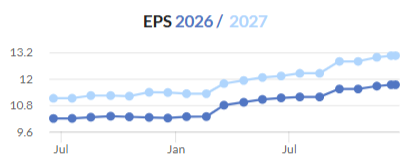

EPS forecasts have been in a rising trend this year:

UK & Ireland vs. Nordics

Currys owns Elkjo, “the market-leading electricals retailers across the Nordic region”. It’s in Norway, Sweden, Denmark and Finland, and even has franchises in Greenland, Iceland and the Faroes.

While not as large as the UK & Ireland segment, it is substantial, and growing faster:

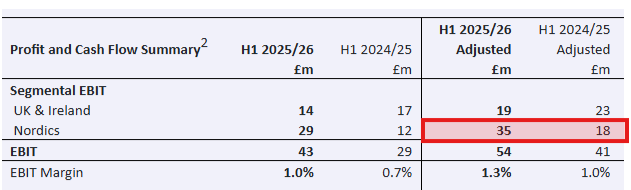

And its H1 profits have nearly doubled - it was far more profitable than UK&I in H1:

Of course I can’t go back and reverse what I said above about the H1 profit result not mattering all that much. We’ll have to wait and see the full-year profit split. But I just wanted to highlight the importance of the Nordic segment, as I don’t think it’s a point that I’ve focused on much before.

Long-term guidance: they are targeting a 3% adjusted EBIT margin in both segments. For context, the result last year was 2.6%, up from 2.4% the prior year. So 3% looks like a very sensible round-number target to aim for.

Cash: they aim to have net cash of at least £100m, pay and grow the dividend, and return any surplus cash left over with buybacks. The latest net cash figure is £133m.

Balance sheet today

The balance sheet today has a tangible net worth of zero, but that doesn’t concern me. I accept that they aren’t ever going to become their own landlord. It’s a lease-based business model. They aren’t going to tie up wealth in property.

I guess you could argue that a stronger working capital position might add comfort, but is it necessary? The company runs on payables (£2.5 billion as early November 2025) and therefore has negative working capital.

As this payables figure is so enormous, let me just spend another moment on it.

Trade payables: increased from £1.63 billion last year to £1.85 billion this year, “in line with higher inventory levels”.

Other payables: increased from £720m to £780m due to higher VAT payable on increased sales, and the timing of monthly payroll in this year’s figure compared to last year’s figure.

I’ll reiterate that none of this particularly concerns me, but it does mean that this is a situation where there is zero balance sheet support for the Currys share price. It’s 100% about earnings.

Pension: Currys paid £82m into its pension deficit in H1 and has agreed to pay £13m annually for five years, after which it should be fully funded. The pension is therefore not a concern.

Buybacks: £30m has been bought back out of a £50m programme. The purchased shares will be cancelled. This entire buyback is only going to reduce the share count by about 3%, but as the company seems able to afford it then I wouldn’t object.

The buybacks for employee share options is a separate programme. £13m was bought back for that purpose in H1.

Graham’s view

This is an interesting report in the sense that the absolute amount of earnings are almost irrelevant to me, but the general direction of travel, the commentary and the balance sheet do have meaningful information.

And the meaning I’m taking from it is that this is still worth backing with a GREEN stance.

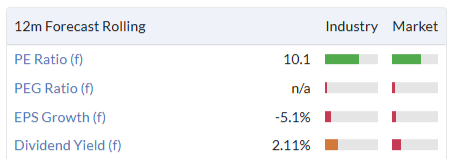

It probably doesn’t deserve a premium P/E multiple, but it doesn’t have one:

And it’s ticking all the boxes in terms of StockRanks:

As there is no major reason to not be GREEN, I’m happy to leave this stance unchanged today.

I will add one small word of warning: all retailers are very risky. We saw the major profit warning at Card Factory recently. Similarly, while Currys has navigated this period of weak consumer sentiment extremely well, it doesn’t actually have a “moat” to protect it from economic downturns or from competitors. It’s not a brand owner.

So, as with Card Factory, I wouldn’t treat this as a sleep-soundly, buy-and-hold-forever type of stock (the type of stock with a long-term moat). Instead, this is the type of stock where shareholders can do very well for a while, but where it is likely to overheat at some stage, and where profits will come and go. So I would want to cash in my gains here at some point in the future - but hopefully these gains can last for several years to come?

Mark's Section

Chesterfield Special Cylinders Holdings (LON:CSC)

Up 5% at 41p - 2025 Final Results - Mark - AMBER/RED

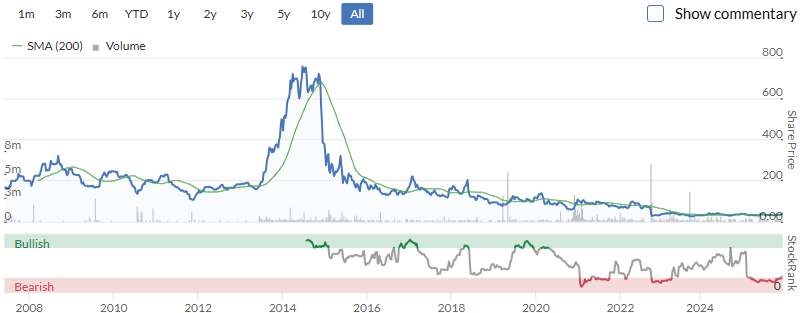

This company has gone through a transition of late. Originally listed as Pressure Technologies in 2007, it has failed to generate any shareholder value since listing:

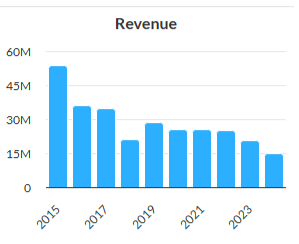

It had two core divisions, the Cylinders business and Precision Machined Components. Shareholders, including Harwood/Rockwood Strategic, with Richard Stavely holding a non-exec position here, have been encouraging management to pursue a change of strategy. PMC was sold off to focus of the cylinder business. However, for a while it looked like they’d backed the wrong horse. The FY24 results showed PMC revenue rising 52% and generating £1.5m EBITDA, whereas CSC revenue fell 29% and generated a LBITDA of £0.9m.

These results show a partial recovery, but revenue at the remaining business is still significantly below FY23 levels. They are profitable, but negligibly so, and on an adjusted basis-only:

● Revenue increased 12% to £16.6 million (2024: £14.8 million)

● Adjusted operating profit of £43,000 (2024: Adjusted loss of £1.7 million)

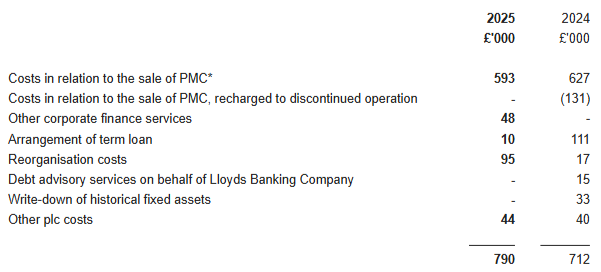

Here are those adjustments:

Obviously, the sale of PMC is a one-off. However, what stands out here, is that it cost them £1.1m to sell a business generating £1.5m EBITDA for £4.4m. What looked like a sale for an already cheap 2.9x Adj. EBITDA, turned out to be just 2.2x when the costs of selling it were included. All I can say is that they must have really needed the cash! Something the cash flow statement backs up:

Cash balance of £2.1 million (2024: £0.1 million)

When you add back the £4.4m received, they have had £2.4m cash outflow in this supposedly profitable period.

Balance Sheet:

Overall the balance sheet doesn’t look too bad following receipt of those sale proceeds. The current ratio is 1.8. Net assets are £10.8m, of which nothing is intangible, and only £0.25m is net tax assets. This provides some downside protection, but it is clearly not an asset play at the current share price.

Outlook:

While the past may look like a litany of failures, the outlook is positive based on their expectations for growth in defence and hydrogen markets:

Robust defence order book and significant opportunities in the UK hydrogen market underpin a positive outlook for significant earnings growth in FY26, with contract revenues weighted heavily towards the second half of the year

That H2-weighting will probably worry investors, as it typically indicates short-term weakness. However, this is a long lead-time industry, and they say the FY26 outlook is underpinned by defence orders received in 2024. They expect FY27 to show further improvement, and have an aspiration to hit £30m revenue with 15% EBITDA margins, before central costs. Order intake in FY25 has been strong, but it is worth noting that the order book is still less than 1 year’s revenue, meaning they have to win a number of near-term orders each year to hit their targets:

Strong order intake during FY25 of £23.4 million (2024: £13.1 million) underpinned an order book of £16.3 million at the end of the period (2024: £9.5 million)

I can’t see any update in forecasts from their broker Singer, but the previous update in October had breakeven for FY26 and £2m PBT for FY27. If they hit their 2028 aspirations, then this would look good value.

Mark’s view

It would be a brave man to bet against harwood/Rockwood, given their track record. However, it would also seem brave to bet against the long-term performance of this business, which is cyclical on top of a secular decline:

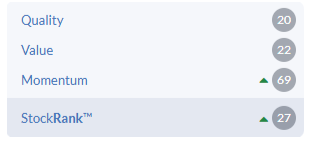

And while the Momentum may be good here, the poor QV ranks mean this is classified as a Momentum trap:

While I get that they are now operating in parts of the market that are likely to be growing, international defence orders and hydrogen power generation are subject to significant political whim. So much of the investment case here is dependent on them hitting their aspirations for a financial year that will end in three years' time. This seems too far in the future, in an uncertain political climate, to be basing an investment thesis on, so I remain broadly negative. AMBER/RED

Nexteq (LON:NXQ)

Down 13% at 72.5p - Trading Update - Mark - AMBER/RED

It’s a good news, bad news update here. First the good:

The Board is pleased to confirm that trading has remained robust across both divisions and is expected to report Group revenue and adjusted PBT in line with 2025 market expectations.

Helpfully quantified:

The current consensus forecasts for the year ended 31 December 2025 are $86.5m revenue, $6.0m adjusted EBITDA and $3.6m adjusted profit before tax.

However, they seem less keen to provide previous forecasts when it comes to the bad news:

As a result of the above factors, the Board now expects revenue for FY26 to be not less than $85m with a consequential impact on profitability.

The background to the factors mentioned are that in 2024 one of their largest customers, Everi, merged with the gaming and betting divisions of International Game Technology, this was then acquired by Apollo in July 2025. In the Interim Results they had revealed that they “continue to supply and support Everi, but our volumes are significantly down as they prepare for their new future.” My understanding is their gaming division, Quixant, faces significant competition from advantech in this space.

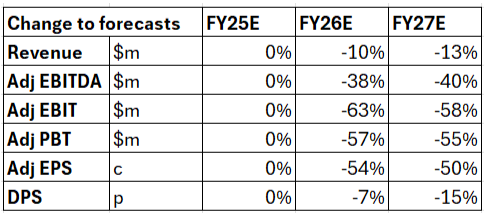

When I calculate the changes to forecasts, from their broker Cavendish, this reveals a huge downgrade to future EPS estimates:

On the surface, only a 13% decline in share price looks like a huge under-reaction. However, the company also holds significant net cash. While forecasts are for this to decline slightly in 2026, it is still forecast to be $28.3m, or £21.1m, just less than half the current market cap after today’s fall. This means the current fall still looks a big under-reaction, especially as the shares appear to have risen since the Summer on no change to broker forecasts:

Backing up the fact that this now looks significantly overvalued is that the FY27 forecast for $3.0m puts them on an EV/EBIT of around 10. However, the cash balance and their willingness to pay this out as a dividend (although, again at a slightly reduced rate forecast today) means that the share price should start to receive support from net assets if it falls below the 50p or so level.

Mark’s view

I rated this AMBER/RED in September, with the share price at 80p, following what looked like weak interim results. While the company managed to deliver against FY25 expectations, the scale of the downgrade to future years makes this look much more expensive on earnings than it has in recent times. Only the presence of a large cash pile which means solvency isn’t an issue, and some asset backing that may start to kick in if/when the shares fall stops me reducing our view further.

Time Out (LON:TMO)

Down 23% at 8.8p - Preliminary results & announcement of £8m placing - Mark - RED =

The revenue decline isn’t severe, at least on a comparable basis:

Revenue of £73.2 million (FY24: £103.1 million, comparative using current accounting policy: £78.7 million)

However, in a rising cost environment, this is enough to cause a big drop in Adj. EBITDA, with Media particularly badly hit, whereas Markets has held up reasonably well:

Adjusted EBITDA of £7.1 million (FY24: £12.4 million):

o Markets £10.7 million (FY24 £12.0 million)

o Media (£1.1 million) EBITDA loss (FY24 £5.3 million EBITDA profit)

In terms of adjustments, there is a big impairment of intangibles and goodwill, plus £9.2m of exceptionals. As far as I can see, they don’t actually tell us what these are apart from being split between the two BUs and “were incurred in relation to restructuring exercises and other non-cash items.”

I doubt those restructuring charges are non-cash as they also reveal the following reasons for raising £8m from an equity placing today:

Today, the Company also announces an £8m placing and an additional retail offer for:

o £3.6 million growth capital for Markets and Media technology

o £4.4 million working capital, including for one-off restructuring costs which are expected to generate a further £3.5 million per annum savings

This gives the impression that they needed to make more cost-savings but their financial situation was so dire, they couldn’t afford to make anyone redundant without raising equity to pay the redundancy costs! And you can see why with £44.3m net debt excluding lease liabilities, up £11.3m in the year.

These results also tell us that they have been unable to meet the cash interest payments on this loan recently:

During the year, it was agreed the interest would revert to PIK for the quarters ended 30 June 2025, 30 September 2025 and 31 December 2025 at a rate of 9.5% plus three-month EURIBOR after which time interest will be paid in cash at a rate of 8.5% plus three-month EURIBOR.

The qualified going concern statement reveals what should be obvious, that they will not be able to repay this when it is due in November 2026, and it will need refinancing. The going concern also requires the full £8m to be raised in the placing. What also seems obvious is that the “severe but plausible downside scenario” that the going concern statement relies on is plausible but not severe, at just 10% decline from the base case scenario. This base case doesn’t appear to be given, but I assume it is around current trading. The reality seems to be that they needed to raise much more equity than this, but having to take a 30% haircut to an all-time low share price, to get the £8m away, there simply wasn’t more capital available.

Mark’s view

When Graham looked at this following their profits warning in August, he viewed it as RED, saying “I fear that the existing equity here may turn out to be worthless.”. If anything, these results and placing strengthen that view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.