Good morning! I'm afraid we have some profit warnings to digest today, but we also have an impressive disposal by Strix (LON:KETL).

Today's Agenda is complete. Spreadsheet accompanying this report (updated to 24th November): link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

SSE (LON:SSE) (£26.0bn | SR63) | £1bn,12-year bank facility from a large banking syndicate. Backed by a financial guarantee from the UK Government's National Wealth Fund to support four major grid upgrade projects under way in the north of Scotland. | ||

Atalaya Mining Copper SA (LON:ATYM) (£1.12bn | SR92) | A high number of dissenting votes were recorded at this year’s AGM. A director promises to attend more Board meetings, and the company says its new remuneration policy will have higher shareholder support. | ||

WH Smith (LON:SMWH) (£866m | SR47) | Revenue +5%, headline PBT falls to £108m (previous year: £144m). Dividend reset lower. Expects to deliver FY26 Headline PBT of £100 - 115m. FCA investigation. Profit warning: FY26 PBT guidance of £100-115m PBT seems low, e.g. after-tax net income guidance on the StockReport is £87.8m. Also the FY25 result has slightly missed expectations. The FY25 result is below the company-compiled analyst consensus figure (£110m) but consistent with the guidance they gave in November (£100-110m). | BLACK (RED ↓) (Graham) More bad news for WH Smith shareholders and I'm sadly and reluctantly going to have to be fully RED on this for the time being. In other circumstances, I might have been able to stay AMBER/RED but when you combine a deteriorating earnings outlook, a terrible balance sheet and an FCA investigation, I'm not left with much of a choice. | |

Applied Nutrition (LON:APN) (£618m | SR48) | An exclusive, three-year agreement. Morrisons will formulate, produce and sell Applied Nutrition branded meals and food products. | ||

Capita (LON:CPI) (£452m | SR76) | Four-year contract renewal with a major European telecommunications provider, valued at £62 million, commencing in January 2026. | ||

Caledonia Mining (LON:CMCL) (£346m | SR88) | The revised proposals (not yet enacted in law) should result in no change in the financial outlook for Caledonia's portfolio of assets in Zimbabwe provided the gold price remains below $5,000 per ounce. | ||

VP (LON:VP.). (£213m | SR69) | New CEO to begin in February 2026. Her most recent role was MD at Mitie Group plc. | ||

Strix (LON:KETL) (£93m | SR65) | £110.0 million conditional agreement to sell Billi on a cash free / debt free basis to private equity. £110m is equivalent to 47.8p per KETL share (current share price: 40.65p). Net debt balance will be c.£68 million before disposal. Disposal is “the optimal path to bring the Group back into a net cash position”. | ||

Proservice Building Services Marketplace (LON:PRO) (£66m | SR60) (formerly HSS Hire) | Revenue -14%. Loss before tax £6.2m. Now expects FY26 revenue of c. £260m (continuing operations, excluding THSC), and Underlying EBITDA of around break even. | BLACK | |

Nexteq (LON:NXQ) (£43m | SR77) | Buyback for up to 10% of the company’s shares. Commences today. | ||

Fusion Antibodies (LON:FAB) (£17m | SR14) | NCI has expressed an interest in continuing to use OptiMAL® and provided Fusion with a proposal to extend the collaboration agreement. Negotiations to continue into early 2026. | ||

Plexus Holdings (LON:POS) (£11m | SR36) | Sales £4.48m (2024: £12.7m). Adjusted EBITDA loss £1.1m. Pre-tax loss £3.3m. Cash £2.5m. The loss is “consistent with our strategic decision to reinvest in the rental model and strengthen our rental operations.” |

Graham's Section

WH Smith (LON:SMWH)

Down 4% to 654.39p (£828m) - Preliminary Results Announcement - Graham - RED ↓

This stock has been in the wars. I turned AMBER/RED on it in August when it was revealed that the company had overstated profits in North America.

The stock has been treading water since then:

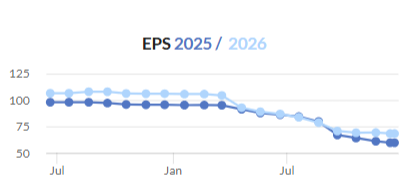

Earnings expectations have continued to slide since August:

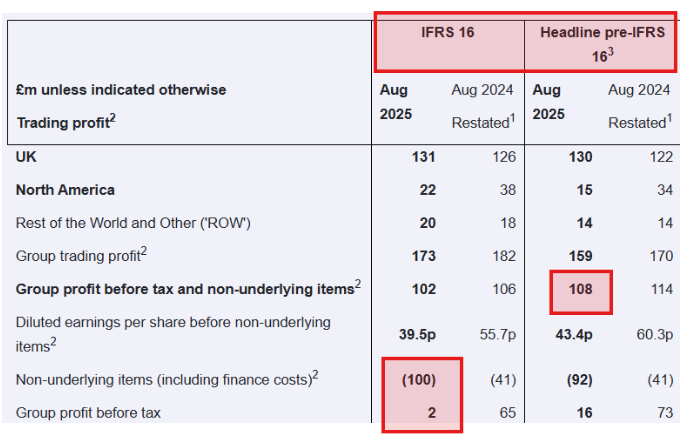

I initially thought (and Reuters reported) that today’s headline adjusted PBT of £108m was below expectations. There is a company-compiled consensus figure of £110m.

However, today’s result is actually consistent with the guidance given in November of £100-110m of headline adjusted PBT, and is closer to the top of that range. So I don’t think the FY25 figure is a miss.

But there are other reasons for concern.

For a start, there are £100m of “non-underlying” items, resulting in a statutory PBT of only £2m. That’s compared to only £41m of non-underlying items last year.

It’s all rather complicated due to the company’s presentation of IFRS vs. “Headline Pre-IFRS 16” figures (treating leases as a debt vs. treating leases as an expense), along with other very heavy adjustments.

They continue to manage the business on the basis of pre-IFRS 16 analysis:

But given that the company has admitted that prior years were not recorded correctly, it’s clear that it has had trouble managing its own figures. So naturally, outsiders like us are going to struggle to get a grip on them..

FCA: the Financial Conduct Authority has started an investigation into WH Smith’s compliance with listing rules.

On 19th November, the findings of an independent Deloitte review were published, and the CEO offered his resignation on the same day.

The review confirmed that profits in North America had been overstated due to the company’s early recognition of supplier incentives. It was “a timing rather than an existence issue”, but still a serious one. It was blamed on “a target-driven performance culture”, “a limited level of Group oversight”, “weaknesses in the composition of the finance team”, and “insufficient systems, controls and review procedures”.

I wonder if there’s a risk of a large fine here?

FY26 outlook

Let’s pick out some of the key points surrounding the outlook.

13 weeks to August (roughly speaking, the final quarter of FY25): LfL revenue growth was 3%.

FY26: total revenue growth of 4-6% expected (not like-for-like).

FY26 Headline trading profit margin expected at 14-15% (UK), 7-8% (US), 5% (Rest of World). This suggests a small deterioration in margin in the UK, from 15.6% in FY26.

Recent like-for-like sales trends: +3% including +2% in the UK (“largely reflecting a softening in rail”), North America +1%, Rest of World +6%.

It sounds like the challenged UK consumer is having an effect here, with Rail passengers in particular not raising their spending in line with inflation.

The Group expects to deliver FY26 Headline Group profit before tax and non-underlying items of £100m - £115m.

This looks like a downgrade to me, considering that the StockReport suggests an after-tax net income figure of £87.8m for FY26 (which would require closer to £120m pre-tax).

Balance sheet

Finance costs are impactful with £26m of interest during the year charged on bank loans, overdrafts and convertible bonds, and that’s before we get into the notional interest charged on lease liabilities.

Net debt was £390m as of August 2025, mostly consisting of convertible bonds. That’s up from £371m the prior year.

If you include leases, net debt was £874m.

Funky Pigeon was sold for £25m, not really making a huge difference to the debt picture.

Non-underlying items: these are huge and they arise primarily due to £138m of impairments charged to PPE, leases, goodwill and other intangibles, offset by the sale of Funk Pigeon and a few other small items.

Putting it all together the balance sheet has net assets of £188m but this includes a frightening £447m of goodwill and other intangibles. Strip them out and the balance sheet is worth minus £259m.

Due to lease liabilities being higher than lease assets (after leases were impaired), modern accounting rules contribute to the size of this deficit. Under old accounting rules, net assets would be £290m and only minus £159m after excluding intangibles.

Graham’s view

I’m going to downgrade our stance on this to a deeper shade of red, considering:

The FY25 result is technically a miss against analyst consensus, although it is consistent with recent guidance.

FY26 guidance is weak against existing estimates.

The balance sheet is horrific and they carry significant debts.

It’s difficult to predict what the FCA might do after their investigation.

No permanent CEO: searching for a new one.

This all suggests that WH Smith is very high risk right now. Of course it could be good value here, but there is clearly the potential for more bad news, and momentum is against it - both in a business sense and in terms of share price momentum.

It’s a shame because this has been such a successful, profitable and cash-generative business in the past, and I’ve done well with this share before (a long time ago). I’d personally like to own it at some point, but the balance sheet and other problems mentioned above will keep me away for the foreseeable future.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.