Good morning! I hope you've been enjoying the festive season. It's wonderful to see how active the forum has been over the past week.

Let's see what today's RNS has for us... these end of year reports can be quite fun, as they often turn into a policing exercise, i.e. studying companies who have tried to sneak out bad results when few are watching, or simply to avoid suspension!

I don't see anything else where I can make a sensible comment today, so I'll leave it there. If I don't speak to you again before 2026, then I hope you enjoy the New Year's Celebrations - unless you are one of those people who goes to bed early on New Year's Eve, in which case I wish you a good night's sleep!

Spreadsheet accompanying this report: link (updated to 24/11).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

International Personal Finance (LON:IPF) (£484m | SR97) | Offer at 235p plus 9p dividend (as previously suggested). The Acquisition is expected to complete during Q3 2026. | PINK (Graham holds) | |

Invinity Energy Systems (LON:IES) (£105m | SR10) | A 3.5 MWh Endurium Enterprise system will be deployed at Charles Murgat, an aquaculture business in France. Delivery of the batteries expected during H2 2026. | AMBER/RED ↑ (Graham) [no section below] I do not claim to understand battery technology but staying somewhat cautious on this seems to be prudent. We haven’t looked at IES since September 2024 (when I was RED) and results have not been pretty since then, with a £23m loss last year and a similar loss pencilled in for the current year. More positively, revenues are set to quadruple from £5m (2024) to £20m+ (2025): Longspur Research forecast turnover of £20.7m for 2025 and then £51.3m for 2026, although the company is not expected to reach breakeven until 2027. And when it comes to balance sheet safety, I note that the company is forecast to have net cash of £33m at the end of this year, thanks to a large fundraise that occurred in September. On balance, therefore, I’m inclined to give this a small upgrade, while staying cautious. It’s undoubtedly a blue-sky share but the combination of soaring revenues and a cash-rich balance sheet provides hope that it can succeed. | |

Batm Advanced Communications (LON:BVC) (£73m | SR65) | Recently appointed NED becomes Chairman. Former Chairman (for the past ten years) will step down from the Board on New Year’s Day. | ||

Panthera Resources (LON:PAT) (£59m | SR33) | H1 net loss $1.4m, “reflecting continued arbitration activities and investment in exploration activities”. Arbitration proceedings advanced, including a damages claim for $1.58 billion. Cash balance $1.9m as of Sep 2025, and has since raised $1.2m. | ||

Corero Network Security (LON:CNS) (£49m | SR12) | SP +5% A short letter to shareholders. “We enter 2026 with a stronger platform, and a strategy sharpened by the realities of the past year.” | RED = (Graham) [no section below] This stock sold off badly in July on a profit warning. The price has been firm since then, and the interim results (published in September) maintained full-year guidance at revenues of $24-25.5m (previous year: $24.6m) and EBITDA of between a $1.5m loss and breakeven. One rule that has served me well is to take a strict line on companies that are loss-making at the EBITDA level: that measure tends to be highly adjusted and very forgiving, so it's right to be sceptical of companies that can't make a profit by that measure. In the case of CNS, given that it's unprofitable at the EBITDA level and it has failed to grow much in 2025, I'm inclined to leave our RED stance unchanged. Today's letter provides a nice overview of the industry and of the evolution of CNS's product, but it doesn't change the overall picture. | |

Everyman Media (LON:EMAN) (£25m | SR37) | CEO steps down with immediate effect. He is thanked. | RED = (Graham) This isn't a share where I'd be tempted to bottom-fish. Net debt of £24m looks like a significant burden, given its generally poor performance and economic vulnerability. | |

Metals One (LON:MET1) (£21m | SR6) | MET1 owns 19% of a mining finance company (“Lions Bay Capital”) and has agreed to lend it C$4m to help it try to carry out an acquisition. |

Graham's Section

International Personal Finance (LON:IPF)

Up 6% to 233.5p (£513m) - Recommended Cash Acquisition - Graham - PINK

(At the time of publication, Graham has a long position in IPF.) (Update at 12 noon: I no longer have a position in IPF.)

Significant news here as the potential offer has finally materialised and become a real offer.

The terms are the same as previously announced: 235p plus a 9p dividend.

As noted by today’s announcement, this is a 31% premium to the share price before news of a potential offer came out.

Looking for the official rationale from IPF, we find:

The IPF Board believes that the Acquisition represents an attractive opportunity for IPF Shareholders to realise the full value of their investment set against the inherent uncertainty of realising the value that could be generated by IPF's business in the future, given current global macroeconomic uncertainty, competitive forces, an ever-changing regulatory landscape and the risks of operating in emerging markets undergoing rapid, and often unpredictable, economic and political development.

There are also “risks associated with IPF executing on its strategy and delivering value to IPF Shareholders as an independent listed company, notably when set against shareholders' wishes to see growth opportunities, conservative financial leverage and balance sheet management, a progressive dividend policy and a share buyback programme.” This reads to me like it’s a clue that satisfying the many wishes of IPF’s various shareholders was difficult?

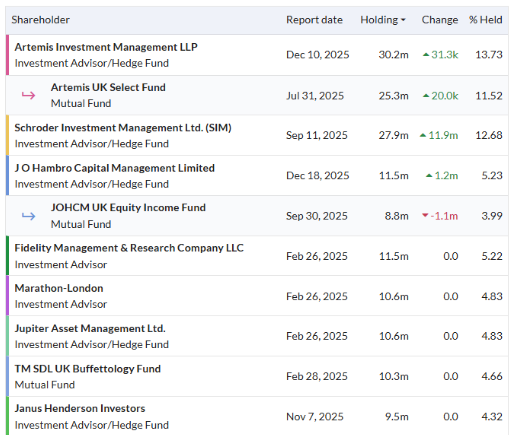

IPF’s major shareholders are various mainstream fund managers - a category of investor that is often amenable to a takeover offer.

Information on the buyer: we’ve discussed before that there is little public information about the buyer. A basic profile is provided today that’s consistent with what is publicly available:

BasePoint is a leading provider in the United States of asset-based financing and liquidity to select specialty finance companies. BasePoint's borrowers primarily comprise originators of unsecured consumer receivables and originators of small business loans and providers of merchant cash advance solutions.

BasePoint Vehicles have extended over $13 billion in committed financings since 2011.

Timetable: regulatory clearance is needed, and a shareholder vote, but the acquisition is expected to complete in Q3 2026.

Irrevocable undertakings: I don’t see any pledges or promises to support the deal from anyone apart from the IPF Board, who have 1.2% of the company (including 0.9% held by the CEO). But I still very much expect the deal to go through, given the length of time that the Board has had to discuss it with their major shareholders.

Graham’s view

This morning I’ve published a separate article, the review of my 2025 watchlist. In that article, I’ve said that the watchlist is banking the theoretical gains it made from IPF last year, and picking something new for 2026.

I’m inclined to do the same with my personal portfolio - my finger is hovering over the “sell” button today. I did extremely well with my small IPF investment iun 2025, and with the share price now around 233p, I can sell out with a clear conscience.

If I do that, it will mean giving up on the 9p dividend and the full 235p payout. So I haven’t made the final decision yet, but I’m currently inclined to cash out.

This is a share that I was happy to hold for the long-term, and I wanted this takeover offer to fail. But I can accept when things don’t go exactly the way I wanted them to. And losing shares to a takeover offer is definitely a first world problem! So I won’t complain: I’ll thank the IPF management team for doing a fine job, wish them the very best, and move along.

Everyman Media (LON:EMAN)

Unch. at 27p (£25m) - Board change - Graham - RED

We’ve already looked at Everyman twice this month.

On 10th December, there was a profit warning late in the financial year (FY December 2025) which saw EBITDA guidance cut by 15%.

Making the profit morning more serious than just a 15% cut, both Canaccord Genuity (the Nomad) and Cavendish withdrew all of their forecasts, recommendations price targets for the stock, including for 2025. So the market was left to “fly blind” without broker coverage until the January trading update.

Five days later, the Finance Director fell on his sword, “to pursue another opportunity”.

Today we’ve learned that the CEO is also leaving, after nearly five full years in the role. Unlike the FD, who is staying around to help with the transition, the CEO is leaving immediately. A recently appointed NED will take the reins.

[It doesn’t matter very much, but it’s very unusual that Everyman’s website hasn’t been updated yet - neither for the CEO departure, nor for the FD departure, nor for the NED who joined back in September!]

The outgoing CEO is thanked:

We would like to thank Alex for his commitment to Everyman throughout his tenure. He has played a pivotal role in the team that successfully led the business through its recovery from COVID, more than doubling revenue and delivering significant EBITDA growth. He has also built a strong and capable operational team.

Graham’s view

We were already RED on this, and I’m not inclined to change my stance on the news that both the CEO and FD are leaving. While a sudden change in management can be the catalyst for positive change, I think it’s more likely to be followed by an admission that the existing strategy simply hasn’t worked.

For example, if you look back at the profit warning earlier this month, the “challenging economic environment” was blamed, and the company still tried to persuade the market that their 2025 performance had been ok.

While consumer sentiment is certainly a factor, I think it’s far from being the only one. What we might get from a new CEO/FD team is an acknowledgement that the current situation is unsustainable, and perhaps that they need fresh equity.

Net debt of £24m looks to me like a significant burden for a company that:

Hasn’t made a profit since pre-Covid

Has significant operating leases (lease liability >£100m)

Is capital-intensive (H1 adj. EBITDA £8.2m before depreciation and amortisation of £7.4m)

Is sensitive to both consumer sentiment and the movie release cycle, over which it has no control.

While net debt to EBITDA might only be around 1.5x, after taking into account all of the above, this isn’t a share where I’d be tempted to bottom-fish.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.